Published as part of the Macroprudential Bulletin 15, October 2021.

The transition to a low-carbon economy could lead to climate-related financial stability risks which might need to be incorporated in the capital framework for banks. While climate risks encompass both physical and transition risks[1], a lot of attention is now focused on transition risks which might play a larger role in the short-term. This publication shows that banks take excessive risk when they don’t identify transition risks in their capital requirement calculations. This finding provides a theoretical justification for the introduction of climate prudential policies to address transition risks.

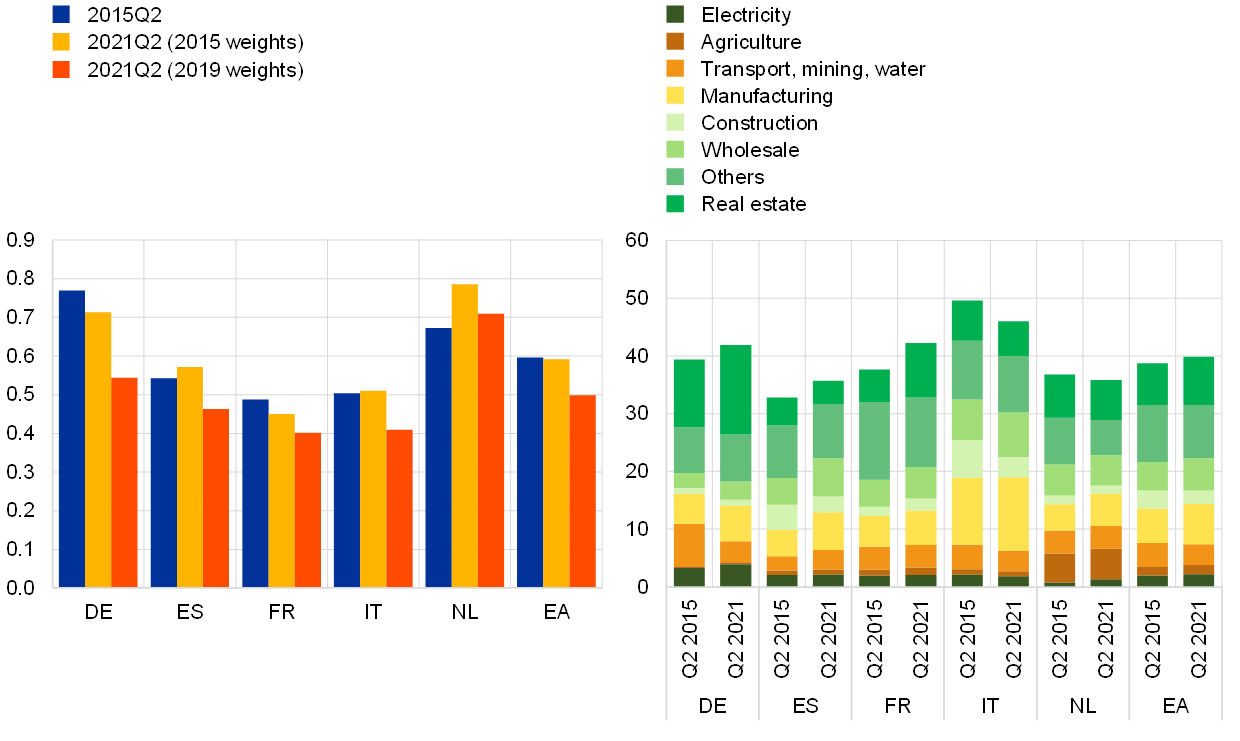

Despite the increasing attention on climate risks, banks’ exposures to assets particularly exposed to climate risk have not substantially changed in recent years, raising the question as to whether banks are sufficiently taking these risks into account. The EU commitment to reduce carbon emissions by 55% by 2030 and its currently discussed measures[2] to ensure that these targets will be met may imply significant and abrupt changes in production activities, with potentially adverse consequences for the euro area banking system. Recent stress test results[3] point towards transition risk having a significant but concentrated impact on the banking system, despite credit exposures to non-financial corporates in sectors potentially affected by transition risk accounting for about 50% of total euro area loans to non-financial corporates.[4] Additionally, banks’ exposures to these sectors have not substantially decreased over time and seem far from compliant with EU emission reduction targets (see Chart A): although the emission intensity of banks has decreased in the main euro area countries, in most of the countries this was only partially driven by a reallocation of exposures across sectors rather than a reduction in the emission intensity of their exposures (left panel). Exposures to the real estate sector increased, while exposures to the sectors most likely to be affected by transition risk have remained stable (right panel), suggesting that financial institutions are not actively greening their portfolios but are rather passively reflecting the carbon footprint of their borrowers.

There is growing evidence that the current banking capital framework may not sufficiently capture these risks owing to the special features of climate risks. A range of initiatives to incentivise appropriate changes to banks’ risk management and increase supervisory scrutiny are already well underway.[5] In addition, as highlighted in Busies et al. (2021), the policy debate is now also focusing on the potential need to close regulatory gaps in the existing capital framework.

Chart A

Banks’ exposures towards high-emitting sectors have not substantially decreased over time

Average emission intensity of banks’ exposures and exposures to different sectors of the economy

(Left: kg per EUR. Right: percentages of loans to the non-financial private sector)

Sources: Eurostat (emission intensity per sector), ECB and ECB data calculations (sectoral exposures).

Notes: The bank sample includes the 167 largest euro area banks. The aggregation by country is done according to the country of the ultimate parent of each bank. The countries shown are (from left to right) Germany, Spain, France, Italy and the Netherlands; “EA” represents the overall sample average. The emission intensity is measured as the ratio between greenhouse gas emissions (CO2, N2O in CO2 equivalent, CH4 in CO2 equivalent, HFC in CO2 equivalent, PFC in CO2 equivalent, SF6 in CO2 equivalent, and NF3 in CO2 equivalent) and the value added. The left panel shows the average emission intensity using as weight the share of credit exposures to firms in each sector of the economy over the total loan book. The chart reports the average emission intensity of the exposures for 2015Q2 (blue bars), the average emission intensity of 2021Q2 exposures using the 2015Q2 emission intensity (yellow bars) and emission intensity of the exposures for 2021Q2 (red bars). The difference between the yellow and blue bars shows the impact of the exposure changes and the difference between the yellow and red bars shows the impact of the emission intensity change.

Our analysis aims to contribute to this debate by providing a theoretical foundation for explicitly incorporating climate risks in the capital framework for banks. Recent studies have shown that climate risks may pose material risks to the financial system, either in the event of an abrupt and sudden transition or if no climate policies are introduced to mitigate climate change.[6] However, to the best of our knowledge there is limited evidence of the need to enhance the current policy toolkit with prudential measures to tackle climate risks. To fill this gap and complement the ongoing conceptual analysis in European and international policy fora on potential gaps in the current regulatory framework, we develop a theoretical model to analyse the possible need for additional capital requirements to directly address climate-related risks. Overall, our findings support the notion that the current regulatory framework may not sufficiently address climate-related risks.

Our theoretical framework shows that transition risk can lead to excessive risk-taking by banks in the absence of climate prudential policies. To conduct our analysis, we employ a dynamic stochastic general equilibrium (DSGE) model which allows us to investigate the efficiency of the portfolio allocation in terms of risk-taking by the banking sector. The economy in our model is composed of households, banks, a tax authority, a monetary policy authority and a corporate sector (see Figure A). Without loss of generality, firms are categorised in the model as either green or carbon intensive according to the emission intensity of the goods that they produce. The production of green products requires more expensive capital investments, while the production of carbon intensive goods is subject to the payment of taxes on emissions. Both types of firms are subject to standard idiosyncratic shocks determining credit risk (as in the literature starting from Bernanke, Gertler and Gilchrist, 1999), but the default probability is higher at aggregate level for firms producing carbon intensive goods, as they are also subject to emission taxes which increase their expenses (see Benmir and Roman, 2020). Banks allocate their loan book to maximise their profits, subject to risk-sensitive capital requirements.

Figure A

Schematic overview of the model economy

Source: ECB.

Note: The grey box indicates that without green prudential policies banks would not distinguish between green and brown firms.

A key assumption of the framework is that transition risk is not the main source of credit risk. This assumption is broadly realistic for most of the banking system and implies that the incentives for banks to internalise transition risk are low. Indeed, transition risk originates from extra taxes or regulation on emissions, which cannot be raised to a very high level owing to the high costs this would impose on consumers and firms. In addition, the identification of credit risk driven by transition risk would imply a number of additional costs for banks, such as investment in databases, the re-estimation or development of new credit risk models or the recruitment of specialised staff. Therefore, in the absence of prudential policies, banks do not distinguish between carbon intensive and green firms to calculate their capital requirements. In our framework, we model this by assuming that banks estimate credit risk on the pool of green and carbon intensive firms without identifying the impact of transition risk separately on green and carbon intensive firms.

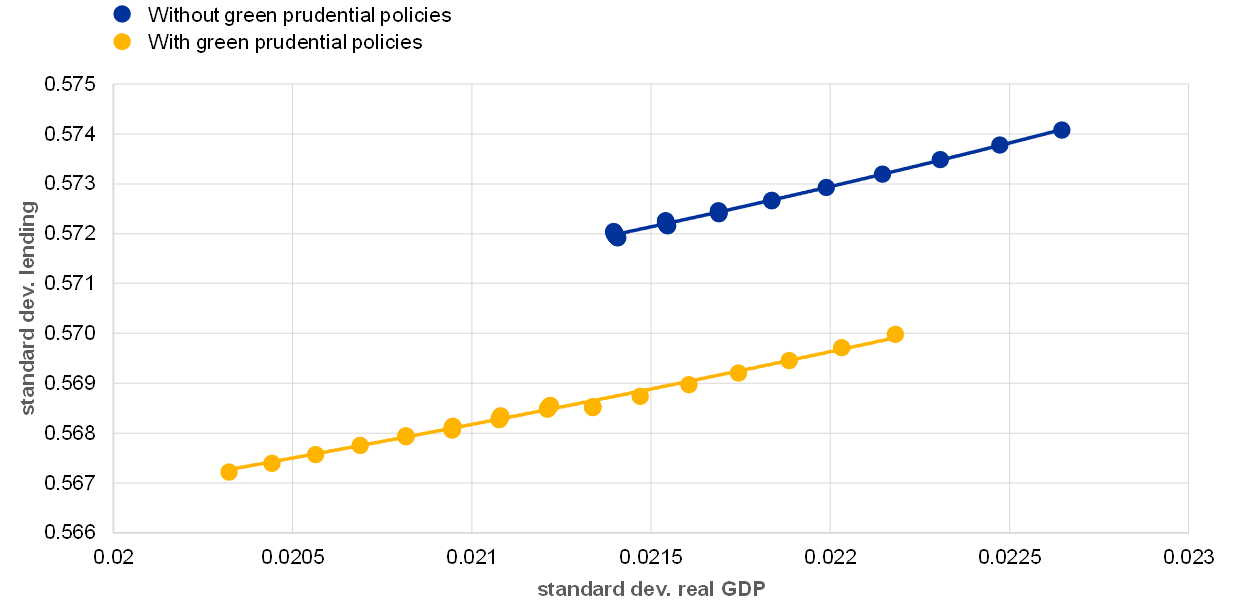

We find that without policy intervention, transition risk generates excessive risk-taking, which in turn increases the volatility of lending and GDP. We compare the allocation of the credit portfolio and the implied credit volatility in the presence of shocks with and without policy intervention[7]. We find that without policy intervention, the aggregate capital requirements do not cover all credit risk. This generates excessive risk-taking and additional lending volatility relative to the case where banks have to identify sector-specific transition risk. For example, if the credit risk of borrowers increases by 1 percentage point, total lending would decrease by an additional 0.2 percentage point when banks do not identify sector-specific transition risk. More generally, in Chart B, we compare the volatility of output and lending with and without climate prudential policy intervention in the presence of unexpected shocks to borrower riskiness for optimised prudential and monetary policy rules. The application of green prudential policies allows to achieve a more efficient policy frontier characterized by lower credit and output volatility.

Chart B

Climate prudential policies decrease financial stability risks

Efficiency frontier between output-lending policy outcomes

Notes: The charts represent the efficiency policy frontier for given shocks to borrower riskiness. The efficiency frontier portrays, for all sets of policymaker preferences, the lending, output and inflation volatilities implied by the corresponding optimised rules.

The framework presented here not only provides a justification for explicitly incorporating climate risk in the prudential framework but can also be used to discuss the optimal design of climate prudential policies and, eventually, the need for climate macroprudential policies. The framework presented in this publication can be used also to compare of the optimality of different policy designs (e.g. to evaluate and compare the impact of sectoral risk weights and sectoral systemic risk buffers to address climate risks). Moreover, it can be used to explore potential systemic effects of transition risk (e.g. via feedback loops from the demand side) which would call for the implementation of macroprudential policies.

References

Alogoskoufis, S., Carbone, S., Coussens, W., Fahr, S., Giuzio, M., Kuik, F., Parisi, L., Salakhova D. and Spaggiari, M. (2021) “Climate-related risks to financial stability”, Financial Stability Review, ECB, May.

Bernanke, B., Gertler, M. and Gilchrist, S. (1998), “The Financial Accelerator in a Quantitative Business Cycle Framework”, NBER Working Papers, No 6455, National Bureau of Economic Research.

Benmir, G. and Roman, J. (2020), “Policy Interactions and the Transition to Clean Technology”, Working Paper, No 368, Centre for Climate Change Economics and Policy.

Baranović, I., Busies, I., Coussens, W., Grill, M. and Hempell, H. (2021), “The challenge of capturing climate risks in the banking regulatory framework: is there a need for a macroprudential response?”, Macroprudential Bulletin, Issue 15, ECB.

ECB/ESRB Project Team on climate risk monitoring (2021), Climate-related risk and financial stability, ECB/European Systemic Risk Board, July.

European Commission (2021), Delivering the European Green Deal, July

Physical risks arise from the changes in weather and climate that impact the economy. Transition risks from the transition to a low-carbon economy.

See European Commission (2021), Delivering the European Green Deal, July

See Alogoskoufis, S. et al. (2021). “ECB economy-wide climate stress-test: methodology and results”, ECB Occasional Paper Nr 281, September.

See ECB/ESRB Project Team on climate risk monitoring (2021), “Climate-related risk and financial stability”, ECB/European Systemic Risk Board, July. See also Alogoskoufis, S., Carbone, S., Coussens, W., Fahr, S., Giuzio, M., Kuik, F., Parisi, L., Salakhova D. and Spaggiari, M. (2021), “Climate-related risks to financial stability”, Financial Stability Review, ECB, May.

The recently published ECB regulatory expectations for banks is a first step by a prudential authority to increase these incentives, while the ongoing climate stress test will try to quantify the materiality of some of those risks.

See Alogoskoufis, S. et al. (2021). “ECB economy-wide climate stress-test: methodology and results”, ECB Occasional Paper Nr XX, September.

The case with policy intervention assumes that banks will be able to fully account sector-specific transition risk in their credit risk calculations.