Published as part of the ECB Economic Bulletin, Issue 3/2023.

Housing investment in the euro area and the United States fell significantly in 2022, with the fall being particularly pronounced in the United States. In the euro area, housing investment started to decline in the second quarter of 2022 and recorded a cumulative fall of about 4% by the fourth quarter of 2022 (Chart A, panel a). By contrast, the decline in the United States started as early as the second quarter of 2021. Since then, US housing investment has fallen by around 21% cumulatively, with a particularly sharp decline in the second half of 2022 when the rise in US mortgage rates led to a sharp drop in affordability for homebuyers (Chart A, panel b). These declines have taken place against the backdrop of monetary policy tightening on both sides of the Atlantic, with policy interest rates in the United States being raised earlier and reaching higher levels than euro area policy rates. Against this background, this box analyses the dynamics of housing investment in the euro area and the United States and discusses the impact of the recent monetary policy tightening on future housing investment in the euro area.

Chart A

Housing investment, short-term interest rates and mortgage rates

(quarter-on-quarter percentage changes and percentages per annum)

Sources: Eurostat, ECB, US Bureau of Economic Analysis, Wall Street Journal and ECB staff calculations.

Notes: Short-term interest rates for the euro area refer to the three-month EURIBOR and for the United States to the effective federal funds rate. Euro area mortgage rates refer to the composite indicator of household borrowing costs for house purchase, while mortgage rates for the United States refer to the 30-year fixed mortgage rate. All interest rates are quarterly averages.

While housing investment is one of the most interest rate-sensitive components of economic activity, it is generally much less volatile in the euro area than in the United States. The volatility of quarterly housing investment growth in the euro area is about half that in the United States (Table A). Moreover, housing investment is only about three times more volatile than aggregate output in the euro area, while it is about six times more volatile in the United States. In spite of its smaller contribution to GDP, US housing investment accounts for a larger share of the fluctuations in aggregate output in the United States than in the euro area (see Table A). In both the euro area and the United States, however, housing investment is strongly procyclical and tends to lead the business cycle, underscoring the important role of the housing market in the economy.[1]

Table A

Properties of quarterly housing investment

(quarter-on-quarter percentage changes, percentage shares of GDP and percentages of variance explained)

Sources: Eurostat, US Bureau of Economic Analysis and ECB staff calculations.

Notes: The table shows the standard deviations of quarterly housing investment growth as well as the shares of GDP and percentages of GDP variance explained by housing investment in the period from the first quarter of 1995 to the fourth quarter of 2019. The shares of GDP are expressed in nominal terms, while the shares of variance explained are expressed in real terms. The GDP variance explained by housing investment accounts also for the covariance of housing investment with the sum of the other demand components of GDP.

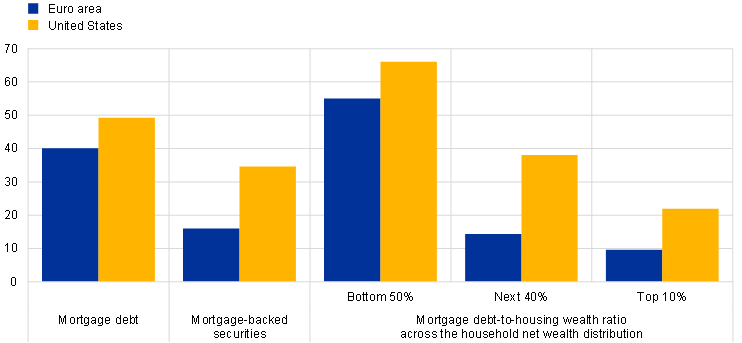

Mortgage markets in the euro area are less deep than in the United States, although there are some cross-country differences in the euro area.[2] Compared with the euro area, banks in the United States can more easily offload housing loans from their balance sheets, making it easier for these banks to shift the associated risks to third parties, with the government acting as the ultimate guarantor through several government-sponsored enterprises.[3] In addition, borrowers in the United States can withdraw mortgage equity and face only limited fees for early repayments and renegotiations and limited personal liability in the event of insolvency.[4] In terms of the typical maturity of mortgage loans, fixed rate 30-year mortgage contracts predominate in the United States, while shorter fixed maturities of 15-25 years are common in some euro area countries and adjustable rate mortgages prevail in others.[5] Looking at various indicators of mortgage market development, reflecting the differences between mortgage markets in the euro area and the United States, these suggest that the US mortgage market is generally deeper than the euro area market. This is shown by the higher household mortgage indebtedness in the United States (as measured by the mortgage debt-to-GDP ratio), higher securitisation (measured by the mortgage-backed securities-to-GDP ratio) and higher leverage (measured by the mortgage debt-to-housing wealth ratio) across the household net wealth distribution (Chart B).

Chart B

Indicators of mortgage market development

(percentage of nominal GDP and percentage of housing wealth)

Sources: ECB, ECB Experimental Distributional Wealth Accounts, Eurostat, US Bureau of Economic Analysis, US Federal Reserve Board, US Federal Reserve Board Distributional Financial Accounts and ECB staff calculations.

Notes: Mortgage debt and mortgage-backed securities are measured as a percentage of nominal GDP. The mortgage debt-to-housing wealth ratio is measured as the ratio between mortgage debt and housing wealth across the household net wealth distribution. The chart reports average values for the period from the first quarter of 2017 to the fourth quarter of 2022. Mortgage debt refers to loans to households for house purchase. Mortgage-backed securities refer to loans for house purchase held by monetary and financial institutions (excluding the European System of Central Banks) in the euro area and securitised household mortgages for issuers of asset-backed securities, government-sponsored enterprises (GSEs), and agency and GSE-backed mortgage pools in the United States.

The lesser depth of euro area mortgage markets tempers the transmission of monetary policy shocks to housing investment. Empirical evidence typically finds that monetary policy shocks, i.e. unexpected changes in monetary policy interest rates, have stronger effects on housing investment in countries with deeper mortgage markets, such as the United States.[6] Indeed, the characteristics of the mortgage market in the United States reinforce the interaction between interest rate changes and credit access: easier terms for mortgage refinancing and equity release strengthen the incentives for households to buy houses when interest rates fall, while the resultant greater indebtedness means that households are more sensitive to interest rate changes when interest rates rise.[7] However, this higher sensitivity is also influenced by the shares of fixed rate and adjustable rate mortgages, with the greater prevalence of fixed rate mortgages in the United States suggesting a more muted transmission of monetary policy.[8] Countering this, however, is the fact that the higher level of mortgage securitisation in the United States causes the mortgage market to be more closely linked to the broader capital markets, as the pricing of mortgage-backed securities has a direct influence on mortgage rates. This leads to a more direct transmission of changes in monetary policy interest rates to mortgage rates and thus housing investment.[9]

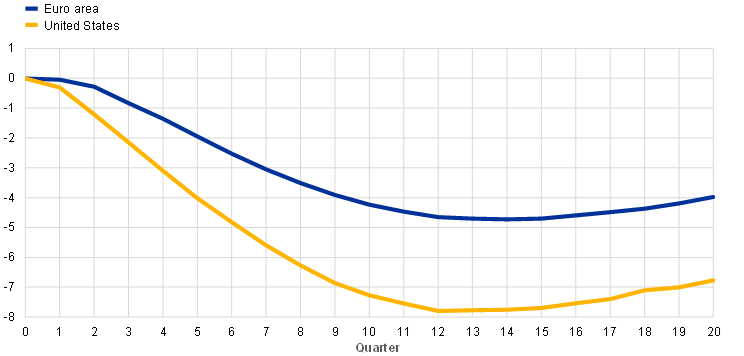

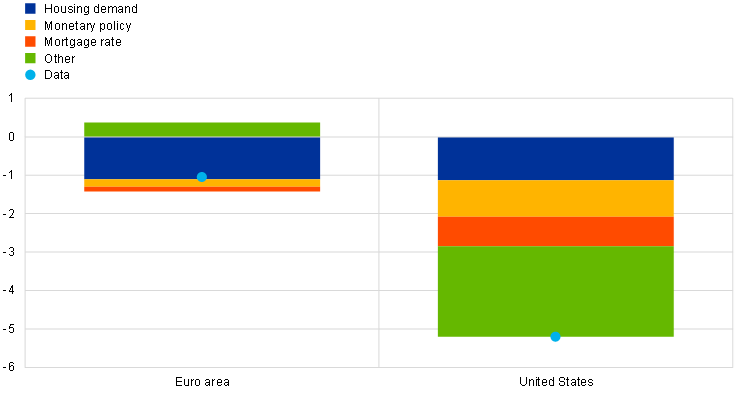

Housing investment in the euro area has been more sheltered from recent monetary policy shocks than in the United States. A Bayesian vector autoregression (BVAR) model is estimated for both the euro area and the United States for the period from the first quarter of 1995 to the fourth quarter of 2022.[10] The model includes real private consumption, the consumption deflator, housing investment, real house prices and short-term interest rates, as well as mortgage rates. It identifies three structural drivers for housing investment, namely monetary policy, the mortgage rate and housing demand shocks.[11] According to the results of the estimation, a temporary monetary policy shock that increases the short-term interest rate by 1 percentage point on impact leads, all else being equal, to a decline in housing investment in the euro area of around 5% after about three years (Chart C, panel a). However, in the United States, the same shock has a greater impact on housing investment, leading to a drop of around 8% after about three years.[12] Consistent with these much more pronounced effects in the United States, especially in the first year after the shock, and partly owing to the larger size of the monetary policy shocks, the recent monetary policy tightening in the United States is estimated to have had a larger impact on housing investment growth in 2022 than seen in the euro area (Chart C, panel b). In addition, the estimation results show that mortgage rate shocks also had a greater impact on housing investment in the United States compared with the euro area, while housing demand shocks weighed on housing investment to broadly the same extent in the two jurisdictions.[13]

Chart C

Housing investment and its drivers

a) Impact on housing investment of a 1 percentage point increase in the short-term interest rate owing to a monetary policy shock

b) Changes in average quarterly housing investment growth between 2021 and 2022

(percentage points and percentage point contributions)

Sources: Eurostat, ECB, US Bureau of Economic Analysis, Wall Street Journal, Wu and Xia (2017) op. cit. and ECB staff calculations.

Notes: Panel a) shows the estimated effect on the housing investment level of a 1 percentage point increase in the short-term interest rate owing to a monetary policy shock. Panel b) shows the change in average quarterly housing investment growth between 2021 and 2022 and estimated drivers. The results are based on a separately estimated BVAR model for the euro area and the United States, with the shocks being identified with zero and sign restrictions. The effects shown in panel a) are significantly different from zero at the 90% confidence level.

The outlook for housing investment in the euro area is weak, despite the recent resilience. While housing investment is generally less volatile and was less affected by the recent tightening of monetary policy than housing investment in the United States, the negative effects of the increase in monetary policy interest rates in the euro area are likely to intensify over time, given the estimated lagged effects of monetary policy. Indeed, the March 2023 ECB staff macroeconomic projections for the euro area forecast a protracted and substantial decline in euro area housing investment this year and next year.

For a comparison of the cyclical properties of housing investment dynamics in the euro area and the United States, see Musso, A., Neri, S. and Stracca, L., “Housing, consumption and monetary policy: How different are the US and the euro area?”, Journal of Banking and Finance, Vol. 35, Issue 11, November 2011, pp. 3019-3041. For the role of housing investment in the business cycle, see, among others, Leamer, E., “Housing is the business cycle”, Proceedings – Economic Policy Symposium – Jackson Hole, Federal Reserve Bank of Kansas City, 2007, pp. 149-233; and Leamer, E., “Housing Really Is the Business Cycle: What Survives the Lessons of 2008–09?”, Journal of Money, Credit and Banking, Vol. 47, Issue s1, March/April 2015, pp. 43-50.

For a comparison of the institutional differences between mortgage markets in the euro area and the United States, see, among others, Musso et al. op. cit. and Calza, A., Monacelli, T. and Stracca, L., “Housing finance and monetary policy”, Journal of the European Economic Association, Vol. 11, Issue s1, January 2013, pp. 101-122. For a more recent overview of the characteristics of mortgage markets in euro area countries, see, for example, Albertazzi, U., Fringuellotti, F. and Ongena, S., “Fixed rate versus adjustable rate mortgages: evidence from the euro area banks”, Working Paper Series, ECB, No 2322, October 2019; Corsetti, G., Duarte, J. and Mann, S., “One money, many markets”, Journal of the European Economic Association, Vol. 20, Issue 1, February 2022, pp. 513-548; and Battistini, N., Falagiarda, M., Hackmann, A. and Roma, M., “Navigating the housing channel of monetary policy across euro area regions”, Working Paper Series, ECB, No 2752, November 2022.

There are two government-sponsored enterprises (GSEs) operating in the mortgage market in the United States. These are the Federal National Mortgage Association (Fannie Mac) and the Federal Home Loan Mortgage Corporation (Freddie Mac). For the emergence of these GSEs and their role in the mortgage market in the United States in a historical context, see, among others, Green, R. and Wachter, S., “The American Mortgage in Historical and International Context”, Journal of Economic Perspectives, Vol. 19, No 4, 2005, pp. 93-114.

See the box entitled “Institutional differences between mortgage markets in the euro area and the United States”, Monthly Bulletin, ECB, August 2009.

Among the largest euro area countries, Italy and Spain have traditionally had a relatively high share of adjustable rate mortgages. Looking at recent developments, in Italy the share of variable rate loans in total housing loans increased significantly to an average of around 55% in the second half of 2022, while in Spain it remained at a relatively low level of 26%. By comparison, the share of variable rate mortgages in Germany and France averaged 15% and 4% respectively in the same period. The data for the individual euro area countries on the share of adjustable rate mortgages in total housing loans can be found in the Risk Assessment Indicators database in the ECB’s Statistical Data Warehouse and are available at a monthly frequency.

See, for example, Musso et al. op. cit., Calza et al. op. cit., Corsetti et al. op. cit., and Battistini et al. op. cit.

See Youngju, K. and Lim, H., “Transmission of monetary policy in times of high household debt”, Journal of Macroeconomics, Vol. 63, March 2022. Deeper mortgage markets can also account for higher volatility in housing investment in response to exogenous changes in productivity, see Nguyen, Q., “Housing investment: What makes it so volatile? Theory and evidence from OECD countries”, Journal of Housing Economics, Vol. 22, Issue 3, September 2013, pp. 163-178.

For the euro area, Corsetti et al. op. cit. and Battistini et al. op. cit. show that the strength of monetary policy transmission to the broader economy is greater in economies with larger shares of adjustable rate mortgages.

See Estrella, A., “Securitisation and the efficacy of monetary policy”, FRBNY Economic Policy Review, Vol. 8, No 1, May 2022.

To avoid any impact of the extraordinary macroeconomic fluctuations during the coronavirus (COVID-19) pandemic on the estimated model parameters, the model is estimated following the approach of Lenza, M. and Primiceri, G., “How to estimate a vector autoregression after March 2020”, Journal of Applied Econometrics, Vol. 37, Issue 4, June/July 2022, pp. 688-699.

The selection of model variable largely follows Musso et al. op. cit. and the shocks are identified with zero and sign restrictions. In particular, a monetary policy shock has an immediate impact on the short-term interest rate but is assumed to affect economic activity (i.e. private consumption and housing investment) and prices (i.e. consumer prices and house prices) only with a lag of one quarter. It is also assumed that a mortgage rate shock has an immediate impact on the mortgage rate but only lagged effects on economic activity and prices, as well as no contemporaneous effects on the short-term interest rate. The housing demand shock is a shock that affects housing investment and house prices contemporaneously and in the same direction but has no contemporaneous effect on private consumption and consumer prices. For both economies, the short-term interest rate is temporarily measured by a shadow short-term interest rate to avoid the binding zero lower bound problem in determining the impact of monetary policy. For the shock identification scheme, see Jarociński, M. and Smets, F., “House Prices and the Stance of Monetary Policy”, Federal Reserve Bank of St. Louis Review, July/August 2008, Vol. 90(4), pp. 339-65. The shadow short-term rates are taken from Wu, J.C. and Xia, F.D., “Time-Varying Lower Bound of Interest Rates in Europe”, Chicago Booth Research Paper, No 17-06, 2017.

As with housing investment, the model results suggests that the impact of a monetary policy shock on real house prices is less pronounced in the euro area than in the United States, although the relative difference is smaller. The stronger effects on the housing market in the United States compared with the euro area also hold for the mortgage rate shock.

According to the model results, other unidentified factors also play a non-negligible role in explaining the recent decline in housing investment in the United States, which could be related, for example, to supply-side factors, broader financial factors, risk aversion or possible changes in preferences. A general drawback of the model is that it does not take non-linearities into account. Recent evidence shows that these could play a role in the current context, as interest rates rose from a very low level. See the box entitled “The impact of rising mortgage rates on the euro area housing market”, Economic Bulletin, Issue 6, ECB, 2022, which examines for the euro area the impact of a 1 percentage point increase in the mortgage rate owing to a mortgage spread shock, using linear and non-linear local projection models.