Liquidity conditions and monetary policy operations in the period from 22 July to 3 November 2020

Published as part of the ECB Economic Bulletin, Issue 8/2020.

This box describes the ECB’s monetary policy operations and liquidity developments during the fifth and sixth reserve maintenance periods of 2020, which ran from 22 July to 15 September and from 16 September to 3 November 2020, respectively. During this period, there was a stabilisation of the market volatility associated with the coronavirus (COVID-19) crisis earlier in the year. Measures announced by central banks continued to underpin market functioning over the summer.

The levels of central bank liquidity in the banking system continued to rise during the fifth and sixth maintenance periods of 2020. This was largely due to the settlement of the third series of targeted longer-term refinancing operations (TLTRO III) and asset purchases conducted under the asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP).

Liquidity needs

The banking system’s average daily liquidity needs, defined as the sum of net autonomous factors and reserve requirements, stood at €2,044.5 billion in the period under review. This was €109.8 billion higher than the average in the third and fourth maintenance periods of 2020 (see the section of Table A entitled “Other liquidity-based information”). Net autonomous factors increased by €107.3 billion to €1,901.6 billion, while minimum reserve requirements increased by €2.6 billion to €142.9 billion.

In the period under review, government deposits remained by far the main liquidity absorbing factor. Government deposits continued their upward trend, although the pace of increase slowed compared with the previous period. They increased on average by €146.7 billion to €727.9 billion. Euro area government deposits stood at record highs, making up more than 11% of the Eurosystem’s balance sheet on average during the review period, compared with around 9% during the previous review period and 6% in the first two maintenance periods of the year. Liquidity providing factors increased by €41.6 billion, offsetting only partially the effect of increased government deposits. In particular, net assets denominated in euro increased by €83.7 billion, which was partly offset by a €42.1 billion reduction in net foreign assets (see the section of Table A entitled “Assets”).

On the whole, during the period under review, the overall supply of liquidity through monetary policy operations continued to be well in excess of the liquidity absorption induced by net autonomous factors.

Table A

Eurosystem liquidity conditions

Assets

(averages; EUR billions)

Other liquidity-based information

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period.

1) Computed as the sum of net autonomous factors and minimum reserve requirements.

2) Computed as the difference between autonomous liquidity factors on the liability side and autonomous liquidity factors on the asset side. For the purpose of this table, items in course of settlement are also added to net autonomous factors.

3) Computed as the sum of current accounts above minimum reserve requirements and the recourse to the deposit facility minus the recourse to the marginal lending facility.

Interest rate developments

(averages; percentages)

Source: ECB.

Notes: Figures in brackets denote the change from the previous review or maintenance period.

1) Computed as the euro short-term rate (€STR) plus 8.5 basis points since 1 October 2019. Differences in the changes shown for the euro overnight index average (EONIA) and the €STR are due to rounding.

Liquidity provided through monetary policy instruments

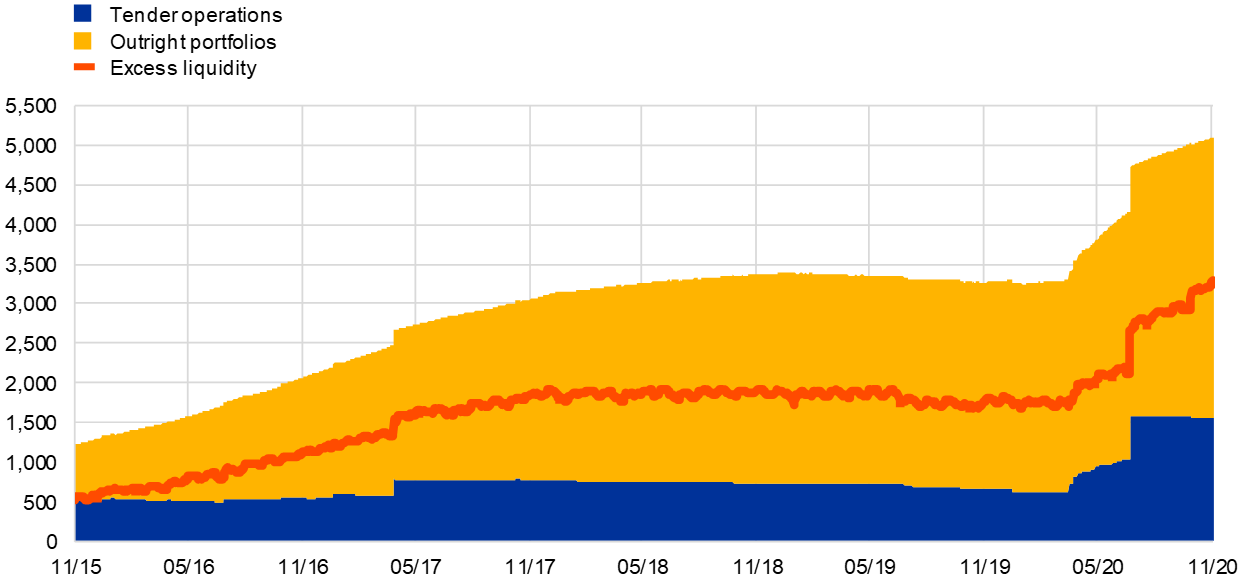

The average amount of liquidity provided through monetary policy instruments increased by €728.6 billion to €5,050.5 billion (see Chart A). More than half (58%) of this increase in liquidity was the result of credit operations in connection with the allotment of TLTRO III; the remaining 42% was the effect of outright asset purchases.

Chart A

Evolution of liquidity provided through open market operations and excess liquidity

(EUR billions)

Source: ECB.

Note: The latest observation is for 3 November 2020.

The average amount of liquidity provided through Eurosystem credit operations increased by €419.8 billion during the review period, largely as a result of the settlement of the fourth and fifth operations in TLTRO III. The average increase of €890.8 billion provided through TLTRO III was partially offset by maturity and/or voluntary repayments under TLTRO II, as counterparties shifted to TLTRO III, the terms of which are more financially convenient, and the maturing of the bridge longer-term refinancing operations (LTROs). On average, repayments under the TLTRO II programme amounted to €242.4 billion. The bridge LTROs, introduced on 12 March 2020 as a transition instrument to provide immediate access to funding at particularly favourable conditions, while allowing for a smoother rollover of funds into TLTRO III, also matured as counterparties transitioned to TLTRO III, contributing an overall amount of €228.6 billion. During the review period, the ECB also conducted the third, fourth and fifth (out of a total of seven) new pandemic emergency longer-term refinancing operations (PELTROs), which were announced in April 2020. These operations are aimed at supporting the smooth functioning of money markets by providing an effective backstop to money market rates. The PELTROs added €7.5 billion in liquidity. The main refinancing operations (MROs) and three-month LTROs played only a marginal role, recording an average aggregate increase of €0.1 billion compared with the previous review period.

At the same time, outright portfolios increased by €308.8 billion to €3,394.6 billion, owing to the continuation of net purchases under the APP and the PEPP. Average holdings in the PEPP amounted to €527.3 billion, representing an increase of €242.0 billion relative to the previous review period. Purchases under the PEPP represented the largest increase by far across all asset purchase programmes, followed by the public sector purchase programme (PSPP) and the corporate sector purchase programme (CSPP), with average increases of €53.1 billion to €2,283.2 billion and €15.3 billion to €232.3 billion, respectively.

Excess liquidity

Average excess liquidity increased by €634.5 billion to €2,998.0 billion (see Chart A). Banks’ current account holdings in excess of minimum reserve requirements grew by €529.6 billion to €2,562.7 billion, while the average recourse to the deposit facility grew by €104.8 billion to €435.4 billion. The partial exemption of excess liquidity holdings from negative remuneration at the deposit facility rate applies only to balances held in the current accounts. Banks therefore have an economic incentive to hold reserves in their current account instead of the deposit facility.

Interest rate developments

The €STR fell on average by 0.8 basis points (bps) compared with the previous review period owing to rising excess liquidity. The €STR stood on average at -55.3 bps during the review period, compared with an average of -54.5 bps during the previous review period.[1] The ECB’s key policy rates, including the rates on the deposit facility, the main refinancing operation and the marginal lending facility, were unchanged during the review period.

- The EONIA, which since October 2019 has been calculated as the €STR plus a fixed spread of 8.5 bps, moved in parallel with the €STR.