Liquidity conditions and monetary policy operations in the period from 30 January to 16 April 2019

Published as part of the ECB Economic Bulletin, Issue 4/2019.

This box describes the ECB’s monetary policy operations during the first and second reserve maintenance periods of 2019, which ran from 30 January to 12 March 2019 and from 13 March to 16 April 2019 respectively. Throughout this period the interest rates on the main refinancing operations (MROs), the marginal lending facility and the deposit facility remained unchanged at 0.00%, 0.25% and −0.40% respectively. In parallel, the Eurosystem continued the reinvestment phase of its asset purchase programme (APP), reinvesting principal payments from maturing public sector securities, covered bonds, asset-backed securities and corporate sector securities.

Liquidity needs

In the period under review, the average daily liquidity needs of the banking system, defined as the sum of net autonomous factors and reserve requirements, stood at €1,496.4 billion, a decrease of €15.1 billion compared with the previous review period (i.e. the seventh and eighth maintenance periods of 2018). This slight reduction in liquidity needs was largely the result of a decrease in net autonomous factors, which declined by €16.2 billion to €1,368.3 billion during the review period.

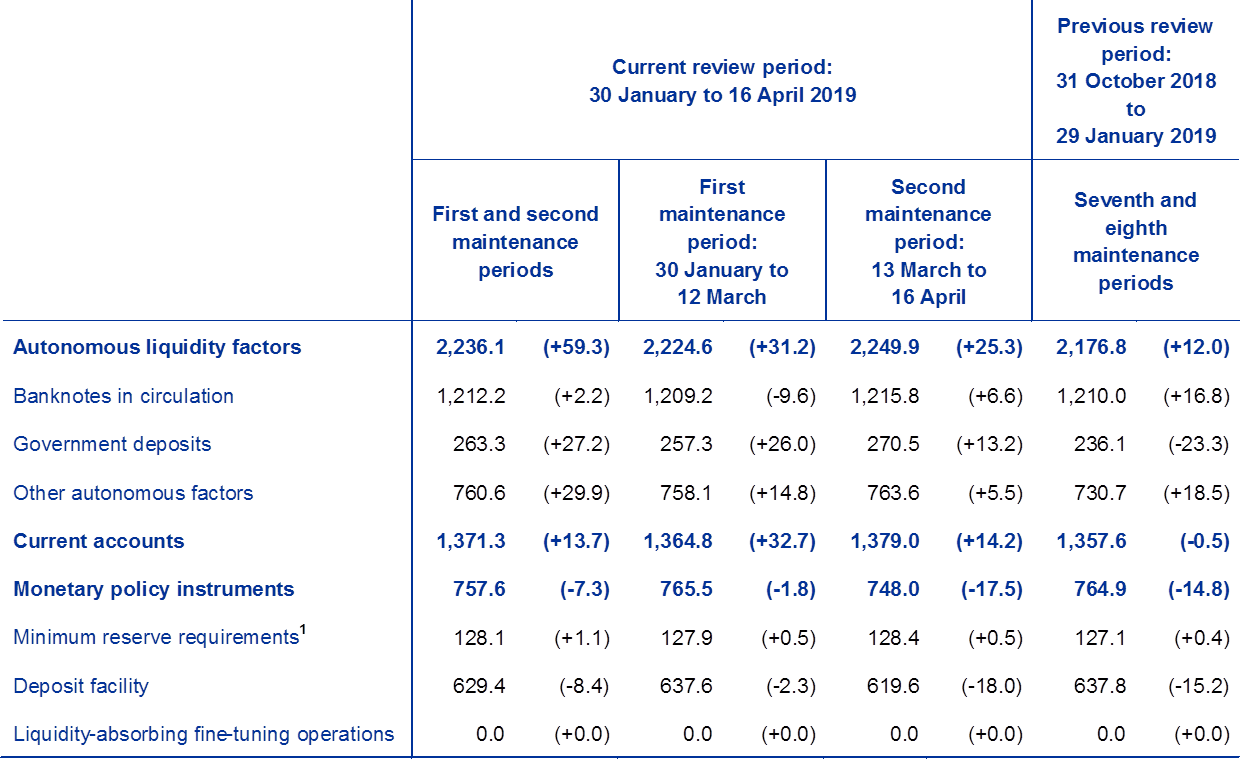

The decline in net autonomous factors was due to an increase in liquidity-providing factors, which was stronger than the growth in liquidity-absorbing factors. The most significant contribution to the increase on the liquidity-providing side came from net assets denominated in euro, which grew on average by €43.2 billion to €196.6 billion. This means that net assets denominated in euro almost fully reversed their decline in the previous review period as a result of the seasonal pattern at year-end, when they decreased by €46.7 billion. The higher level of liquidity-providing factors was also caused by an increase in the value of net foreign assets, which grew on average by €32.2 billion. Among liquidity-absorbing factors, banknotes in circulation, government deposits and other autonomous factors rose on average by €2.2 billion to €1,212.2 billion, by €27.2 billion to €263.3 billion and by €29.9 billion to €760.6 billion respectively.

Table A

Eurosystem liquidity conditions

Liabilities – liquidity needs (averages; EUR billions) Source: ECB. 1) “Minimum reserve requirements” is a memo item that does not appear on the Eurosystem balance sheet and therefore should not be included in the calculation of total liabilities.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period.

2) The overall value of autonomous factors also includes “items in course of settlement”.

Assets – liquidity supply

(averages; EUR billions)

Other liquidity-based information

(averages; EUR billions)

Interest rate developments

(averages; percentages)

Liquidity provided through monetary policy instruments

The average amount of liquidity provided through open market operations – including both tender operations and monetary policy portfolios – decreased by €10.8 billion to €3,369.1 billion (see Chart A). This decrease was driven by lower demand in tender operations as well as a smaller liquidity injection stemming from monetary policy portfolios, due in particular to redemptions of securities purchased under the Securities Markets Programme.

Chart A

Evolution of liquidity provided through open market operations and excess liquidity

(EUR billions)

Source: ECB.

The average amount of liquidity provided through tender operations declined slightly over the review period, by €4.9 billion to €727.7 billion. This decrease was mainly attributable to lower liquidity provided through targeted longer-term refinancing operations (TLTROs), which decreased on average by €2.7 billion as a result of voluntary early repayments. Lower demand also resulted in the provision of liquidity via MROs falling by €1.5 billion to €5.9 billion on average and the provision of liquidity via three-month longer-term refinancing operations (LTROs) falling by €0.7 billion to €3.9 billion on average.

Liquidity provided through the Eurosystem’s monetary policy portfolios decreased by €5.9 billion to €2,641.3 billion on average, mainly owing to redemptions of bonds held under the Securities Market Programme. Redemptions of bonds held under the Securities Markets Programme and the first two covered bond purchase programmes totalled €8.0 billion. Regarding the APP portfolios, since 1 January 2019 the programme has been in the reinvestment phase. While net asset purchases have come to an end, reinvestments of principal payments from maturing securities purchased under the APP are intended to continue for an extended period of time past the date when the Governing Council starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation. The reinvestments adhere to the principle of market neutrality, via smooth and flexible implementation. Limited temporary deviations in the overall size and composition of the APP may occur during the reinvestment phase for operational reasons.[1] The nominal value of the APP portfolio remains stable – in the review period it increased by only €2.1 billion to €2,567.9 billion on average.

Excess liquidity

As a consequence of the developments detailed above, average excess liquidity increased slightly compared with the previous review period, by €4.3 billion to €1,872.5 billion (see Chart A). This increase reflects lower net autonomous factors, which were partially offset by slightly lower liquidity provided through the Eurosystem’s tender operations and monetary policy portfolios. The APP portfolio remained stable as a consequence of the programme having entered the reinvestment phase on 1 January. Regarding the allocation of excess liquidity holdings between current accounts and the deposit facility, average current account holdings marginally increased, by €13.7 billion to €1,371.3 billion, while average recourse to the deposit facility declined by €8.4 billion to €629.4 billion.

Interest rate developments

Overnight unsecured and secured money market rates remained close to the ECB deposit facility rate. In the unsecured market, the euro overnight index average (EONIA) averaged −0.367%, slightly lower than in the previous review period. It fluctuated between a low of −0.372%, observed on 26 February and on 5 March, and a high of −0.356%, observed on 29 March (the end of the quarter). Regarding the secured money market, the spread between the average overnight repo rates for the standard and the extended collateral basket in the general collateral (GC) pooling market[2] widened slightly. Compared with the previous period, the average overnight repo rate for the standard collateral basket decreased by around 1 basis point to −0.425%, while the average overnight repo rate for the extended collateral basket remained broadly stable at −0.408%.

- See the article entitled “Taking stock of the Eurosystem’s asset purchase programme after the end of net asset purchases”, Economic Bulletin, Issue 2, ECB, 2019.

- The GC Pooling market allows repurchase agreements to be traded on the Eurex platform against standardised baskets of collateral.