Derivatives transactions data and their use in central bank analysis

Published as part of the ECB Economic Bulletin, Issue 6/2019.

Data on derivatives transactions have recently become available at a number of central banks, including the ECB, and have opened up new avenues for analysis. Collected as a result of reforms of the over-the-counter (OTC) derivatives market, which were primarily designed to counter systemic risk, the data have numerous applications beyond the domain of financial stability.

This article presents two such applications. It demonstrates how data gathered under the European Market Infrastructure Regulation (EMIR) can be used to better understand two types of derivatives market that are of particular importance for central bank analysis, namely the interest rate derivatives and inflation-linked swap markets.

For the interest rate derivatives market, the article shows how investor expectations for interest rates may be inferred through “positioning indicators” that track how a set of “informed investors” take positions in the market in anticipation of future interest rate movements. Such quantity-based indicators can complement other, more established indicators of interest rate expectations, such as forward rates or survey-based measures.

For euro area inflation-linked swap markets, the article exploits the fact that EMIR data allow a first systematic look at trading activity in these markets, which can provide valuable and timely information on investors’ inflation expectations. It highlights a number of structural features of activity in these markets and discusses their possible implications for the monitoring of market-based measures of inflation compensation.

1 Introduction

Since the collapse of Lehman Brothers and near-failure of AIG in 2008, OTC derivatives have been recognised as one of the amplifiers of the global financial crisis. In response, G20 leaders pledged at the Pittsburgh summit in September 2009 to reform OTC derivatives markets to improve their transparency, prevent market abuse and reduce systemic risks. In Europe, this initiative was formalised in 2012 in the European Market Infrastructure Regulation (EMIR). EMIR imposes several requirements on entities that enter into a derivatives contract, such as the implementation of risk management standards, clearing of certain contracts through central counterparties (CCPs) and reporting obligations.[1]

While the OTC derivative reforms were primarily designed with the aim of reducing systemic risk, data from EMIR have applications in central bank analysis beyond the financial stability domain.[2] Following a brief introduction to the EMIR data (see Section 2), this article presents two examples of such uses. First, it shows how EMIR data on interest rate derivatives can be used to gauge the expectations of investors regarding the future evolution of key interest rates (see Section 3). This is based on the premise that investors expecting lower interest rates in the future position themselves by buying more contracts (than they sell) that benefit from lower interest rates. “Positioning indicators” calculated on this basis can thus be seen as capturing the strength of informed investors’ expectations and have the potential to complement other indicators of interest rate expectations such as forward rates or survey-based measures. Second, the article looks at structural activity patterns in euro area inflation-linked swap markets (see Section 4). It provides an overview of the most relevant contracts and the counterparties that trade in those markets, and draws some conclusions for the ECB’s monitoring of market-based measures of inflation compensation, in particular regarding the information content at various maturities. Both applications demonstrate the wide potential for the use of EMIR data in central bank analysis.

2 The EMIR data

In February 2014 EMIR introduced mandatory reporting of all individual derivatives contracts. This reporting obligation applies to both OTC and exchange-traded derivatives in all five main asset classes, i.e. commodity, equity, foreign exchange, credit and interest rate derivatives. Trades cleared via CCPs are also included. The reporting covers information on both the counterparties involved and the characteristics of the contract, which may change over the life cycle of a derivative trade and are submitted daily.[3]

All EU-located entities that enter a derivatives contract are subject to the reporting obligation. They must report to one of the seven trade repositories currently authorised by the European Securities and Markets Authority (ESMA). Daily transaction-by-transaction derivatives data are then made available to over 100 authorities in the EU, depending on their mandate and jurisdiction. For example, the ECB obtains a subset of the data reported by euro area counterparties.[4] One important implication of this is that transactions between two counterparties domiciled outside the euro area (e.g. between two UK banks or between UK and US banks) are typically not available to the ECB.

Owing to their volume, velocity and variety, the EMIR data can be classified as “big data”, which poses many challenges for using them. In cooperation with the European Systemic Risk Board (ESRB), the ECB has developed an EMIR-dedicated IT infrastructure to store and access the data received from all trade repositories. Despite the significant improvement in data quality since the launch of EMIR reporting in 2014, a careful data cleaning procedure has to be applied before the data can be used for policy analysis; for example, observations are deleted when both the market and notional values are missing or when the notional value is considered an outlier.[5] This article focuses on data between 2 May 2018 and 12 June 2019, as the cleaned data – even as a time-series – are of sufficiently good quality and easily accessible through the EMIR IT infrastructure.

3 Inferring market expectations for future interest rates from EMIR data

The interest rate derivatives market allows market participants to trade financial products linked to future interest rates. The market value of these contracts changes as interest rates move, and investors can use them to hedge against movements in interest rates or for speculative purposes. By analysing the positioning of participants in the market, some inference can be made about their views on the outlook for interest rates.

The market positioning indicators based on EMIR data help to inform central bank analysis. Information on the positioning of certain groups of investors in interest rate derivatives can complement price-based indicators and surveys, which are both commonly used to infer financial market expectations for monetary policy or the macroeconomic outlook.[6]

Positioning indicators rely on three main building blocks: (i) the assessment of an investor’s “net long” (or “net short”) position in a certain contract, (ii) the identification of a specific set of “informed investors”, and (iii) the choice of appropriate interest rate derivative contracts.

An investor’s net long (or net short) position captures how and to what extent they may profit from future interest rate movements. In the case of a fixed-income futures contract – say, a bond futures contract – a buyer, or an investor holding a long position, gains from a decline in interest rates owing to the inverse relationship between interest rates and the value of the underlying bond. The opposite is true for a seller, or the investor who holds a short position. Where an investor simultaneously holds long and short positions, exposure to future interest rate movements is determined by netting all positions. As a result, investors with a “dovish” interest rate outlook (i.e., expecting interest rate declines) are likely to be positioned net long, while those with a “hawkish” view would position themselves net short.

Any meaningful positioning indicator needs to single out a particular subset of investors since the market overall is positioned neither net long nor net short. This follows from the fact that, if one investor takes a long position, another investor has to take an equivalent short position in the same derivative. As a consequence, the net long (and net short) position of all investors combined must be equal to zero, barring reporting errors and/or sample limitations. An informative positioning indicator therefore has to focus on a particular, meaningful set of investors.[7]

The positioning indicator constructed here aims to single out “informed investors” who actively take positions in interest rate derivatives on the basis of their expectations for future interest rates. Their identification is challenging, however. Box 1 explains how EMIR data are enriched to obtain a detailed sector classification which facilitates this task. But even a granular sector classification cannot fully capture the heterogeneity of individual investors’ trading strategies in interest rate derivatives.[8] To address these challenges, “informed sectors” are chosen according to the following criteria: (i) they form a view on future interest rates on the basis of monetary policy and macroeconomic developments, (ii) they react quickly to a change in the outlook, (iii) they trade actively in derivatives contracts, primarily to generate a profit from them, and (iv) they pursue a strategy that is neither very short-term (e.g. arbitrageurs trading to exploit intraday volatility) nor very long-term (e.g. insurance companies or banks hedging their balance sheet duration gaps). The sector referred to as “hedge funds” can satisfy all these criteria, in particular as it is normally identified as comprising entities which take positions on the basis of their expectations for the future evolution of financial market prices in a relatively unconstrained way. However, there are many difficulties in correctly identifying such funds[9] and there may be other classes of investors acting in a similar manner.

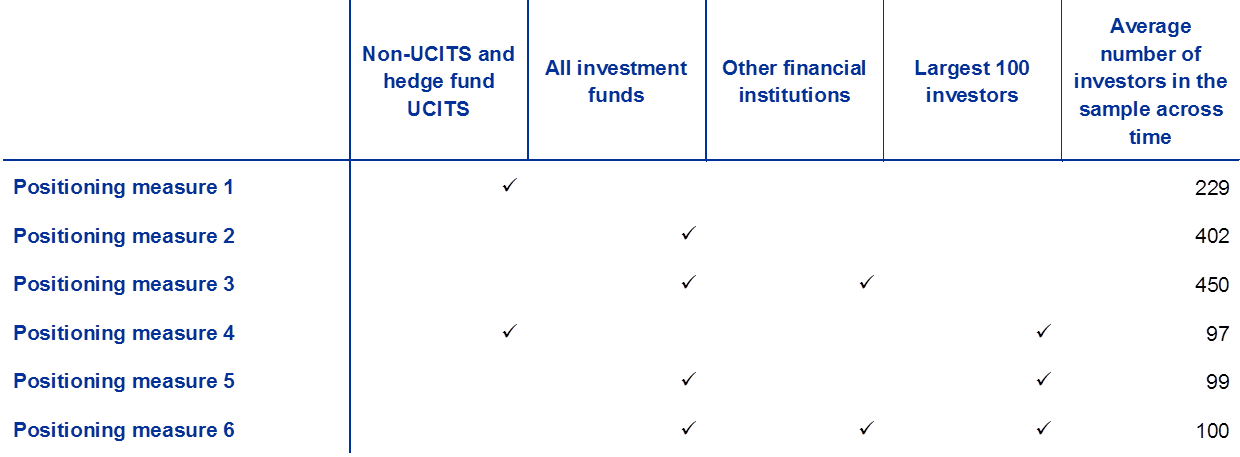

Therefore, we report a range of positioning indicators based on different investor categories (Table 1). The first sample follows the definition of hedge funds in the ECB’s Manual on investment fund statistics[10] and includes all non-UCITS funds, as well as UCITS funds[11] with a hedge fund strategy (see Box 1). The second sample is broader as it includes all investment funds. One rationale for broadening the category is that an asset manager would have only one view on the short-term interest rate outlook, but would typically control several funds, some of them falling into the category of hedge funds and others not. The third sample also includes other financial institutions – which are not banks, insurance companies or pension funds – to control for misclassification and to capture other types of active investor such as systematic trading firms. Finally, to capture only large and active[12] investors, all previous samples are restricted to the counterparties that hold the largest 100 portfolios in terms of gross notional amount on average over time.

Table 1

Defining informed investors

Note: The average number of investors included in positioning measures 4-6 is not always 100 as some of the 100 counterparties with the largest portfolios are not active over the full period.

Finally, a class of interest rate derivatives needs to be chosen. A basic choice is between derivatives with linear payoffs (e.g., swaps, forwards or futures) and derivatives with non-linear payoffs (most notably options). Since the positioning indicators are intended to capture exposure to general interest rate movements rather than unusual developments, this suggests a preference for derivatives with linear payoffs. In addition, the market segment has to be sufficiently liquid, which is not always the case for options markets.

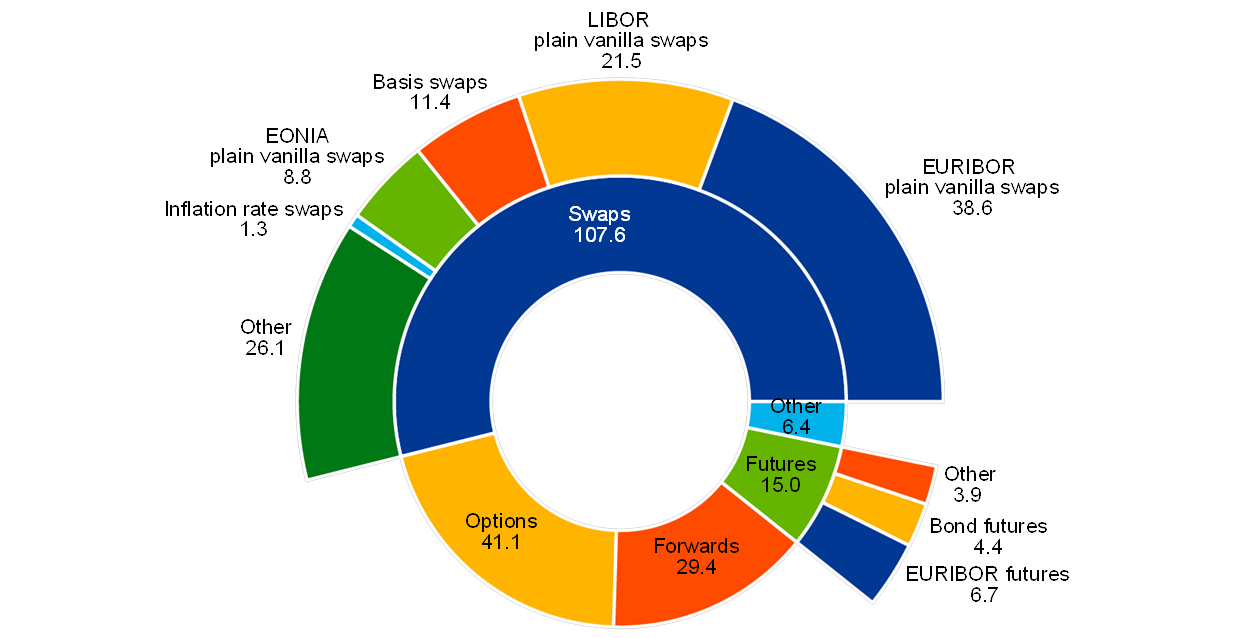

The full interest rate derivatives market in the euro area is very large in terms of both volume and the number of instruments it contains (Chart 1). As of June 2019 the total outstanding notional amount in interest rate derivatives was around €200 trillion, which accounted for two-thirds of the total euro area derivatives market.[13] Interest rate swaps and futures are key instruments in the interest rate derivatives market. Swaps are the most prominent contracts, covering about 54% of the notional value of outstanding contracts. Swaps (including those based on EONIA) are traded “over the counter” and are used for a wide range of purposes, including the hedging of interest rate risks on banks and insurers’ balance sheets (e.g. risks arising from positive and negative duration gaps respectively). The futures market is smaller than the swaps market, but is exchange-traded and hence much more standardised and extremely liquid. Among futures, three-month EURIBOR futures have the largest notional amount outstanding (around €7 trillion out of €15 trillion in June 2019), followed by eurodollar and Bund futures.

Chart 1

The euro area interest rate derivatives market

(EUR trillions)

Sources: EMIR data available to the ECB.

Notes: Figures show notional amounts outstanding as at 12 June 2019. The sample includes both cleared and uncleared outstanding contracts for which the direction (i.e. buyer or seller side) is known. “Forwards” includes forward rate agreements; “Options” includes swaptions. “Other” (€6.4 trillion) includes less common and unclassified contracts. For swaps, “LIBOR plain vanilla swaps” comprises contracts referenced to pound sterling LIBOR, US dollar LIBOR, Japanese yen LIBOR and Swiss franc LIBOR. “Basis swaps” includes all contracts which exchange two floating rates. “Other” comprises contracts exchanging two fixed rates and fixed-for-floating rate swaps not indexed to EURIBOR, EONIA or LIBOR, as well as other less common or unclassified contracts. For futures, “Bonds” includes all bond futures (both government and corporate, of any maturity and any country), while “Other” includes eurodollar futures and unclassified contracts. The notional amounts reported should be interpreted as an upper bound because transactions could be counted more than once as a result of transactions that could not be paired. In addition, if a clearing member clears a trade on behalf of a client, two transactions (a transaction between the client and the clearing member and a transaction between the clearing member and the CCP) are counted.

The positioning indicators are based on EURIBOR futures contracts, owing to their significant information content as regards euro area interest rate developments. As suggested by market intelligence, informed investors make extensive use of EURIBOR futures, primarily on account of their substantial liquidity and high degree of standardisation. Investors that need to adjust their positions may often prefer futures contracts to interest rate swaps, since it is easier to close out existing positions. Moreover, futures on the three-month EURIBOR are attractive because of their direct link to euro area short-term interest rate developments at specific horizons. The basis risk of tracking EONIA through a EURIBOR futures contract is fairly limited at present given the stable spreads between the two. The focus of the positioning indicators is on EURIBOR futures with a residual maturity of above one year to facilitate comparison with gauges of interest rate expectations commonly used by central banks, for instance the one-year EONIA, one year ahead.[14]

The positioning measure is the ratio of informed investors’ net long positions to their gross positions.[15] The net long position (long minus short) of each investor is normalised by their gross position (long plus short). This measure has at least two advantages. First, because the measure is normalised by the gross position, it allows the views expressed by all informed investors to be considered, including smaller investors that may have strong views but are unable to take sizeable absolute positions. A simple sum of net long positions across all informed investors without any normalisation would give significant weight to very large investors and idiosyncrasies of individual players. Second, the sum across all informed investors and the normalisation also make the indicator more robust against misreporting.

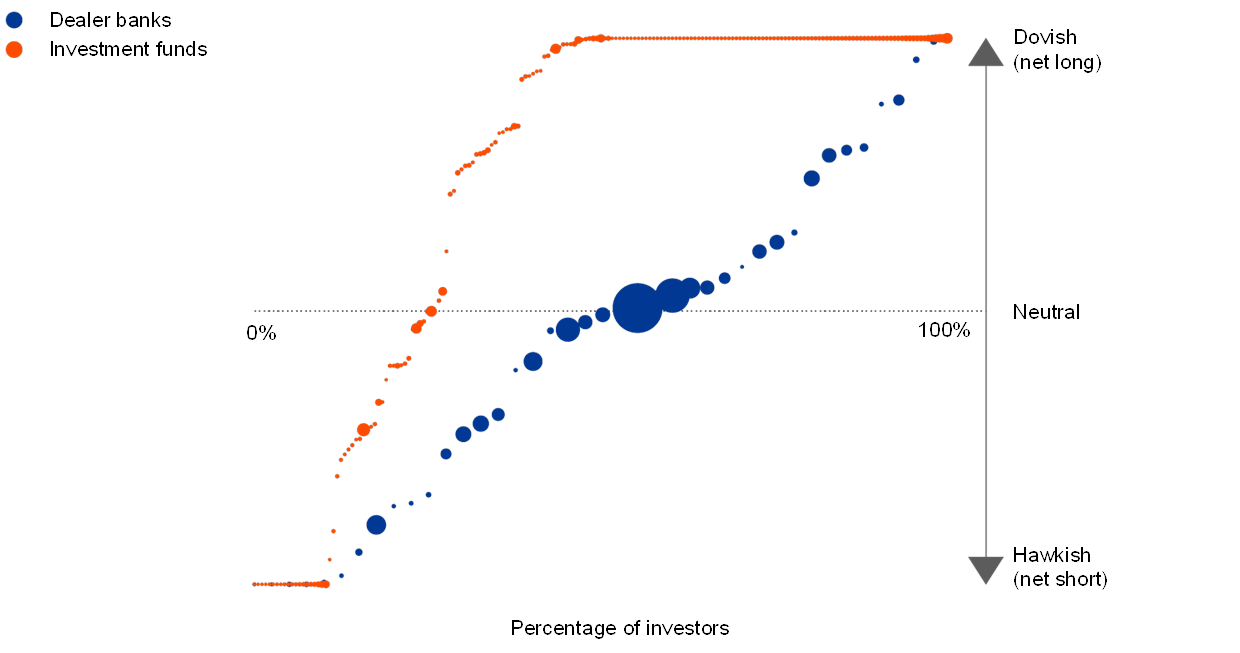

The measure reveals that the positioning of investment funds is relatively polarised, suggesting that a focus on this investor category is indeed warranted since investment funds appear more inclined to express a view on future interest rates than other types of investor. Using all investment funds (positioning measure 2) as the category representative of informed investors, Chart 2 shows that around 60% of these investors take an either extreme hawkish or extreme dovish view, with the extreme dovish view clearly predominating on the date in question (12 June 2019). This pattern is different from that for dealer banks, for example, which tend to be positioned in a more neutral way, as they typically act as market makers. This does not imply that dealer banks do not have views on monetary policy or the macroeconomic outlook, but their dealing activity generally outweighs the proprietary risk-taking motive. Since dealing activity also implies that many of their positions offset each other, their portfolios tend to be large in terms of gross notional amount (as indicated by the size of the bubbles) but less so in terms of the net notional amount.

Chart 2

Empirical quantiles of the net-over-gross positioning of investment funds and dealer banks

(notional amounts)

Sources: EMIR data available to the ECB.

Note: Data are as at 12 June 2019 and show net-over-gross positions of individual investors in the market for EURIBOR futures with a residual maturity of more than one year. The size of the bubbles is proportional to the size of individual portfolios in terms of gross notional amount.

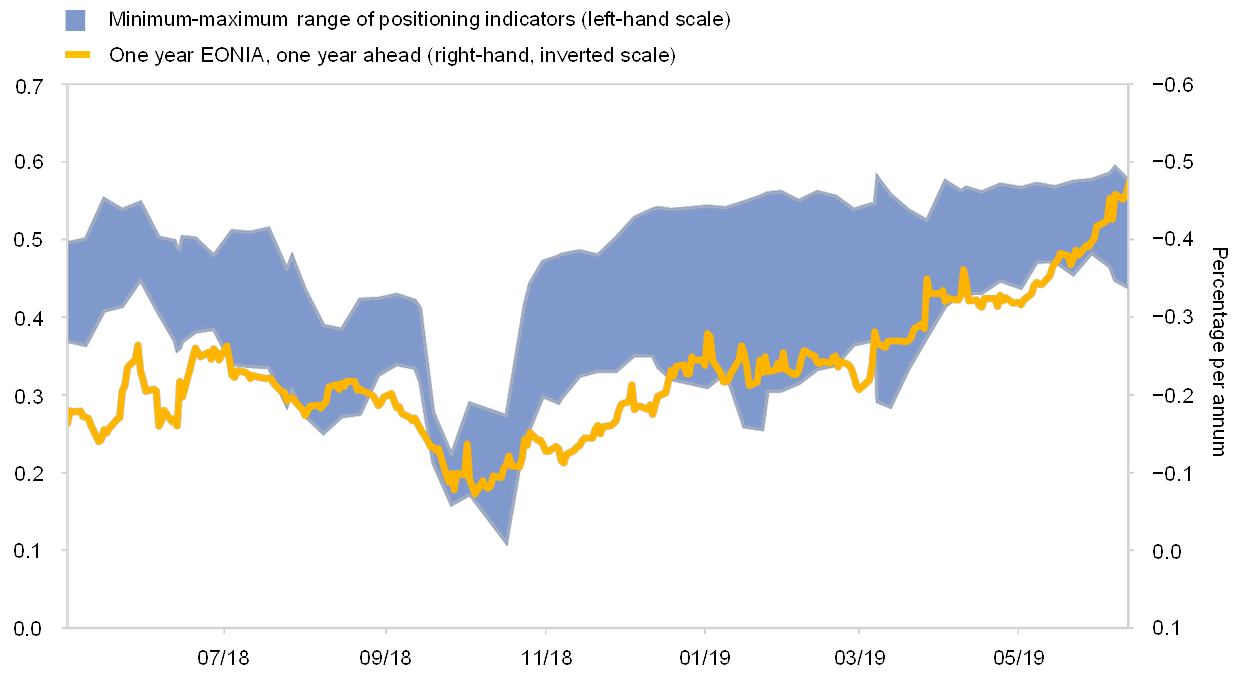

Net long positioning has trended upwards since the start of 2019, consistent with market expectations of a more accommodative monetary policy (Chart 3). The one-year EONIA forward rate one year ahead provides another approximation of how interest rate expectations have evolved over the period under consideration. It shows a downward trend starting in late 2018 as investors started pricing in a more accommodative monetary policy and became less sanguine about the global economic outlook. Consistent with these developments, informed investors have increased their net long positions over the same period. The results shown here thus suggest that the positioning indicators – as a quantity, or volume-based, proxy for expectations about monetary policy and the general economic outlook – can provide signals comparable to price, or rate-based, proxies. Further data analysis may also help identify sectors whose positioning, on average, appears to be the most indicative of the market’s price formation mechanism. Ideally, such analysis would also shed new light on the information embedded in forward interest rates, in particular in situations where the signals from the positioning and price-based indicators are not entirely consistent.

Chart 3

Positioning of informed investors in three-month EURIBOR futures and one-year EONIA, one year ahead

Source: EMIR data available to the ECB.

Note: The range is calculated from positioning indicators based on six different samples of informed investors as detailed in Table 1. A positioning indicator is calculated as the mean of the ratio of net to gross notional amount across individual investors in a sample. A smoothing correction has been applied for an outlier observation on 5 June 2019.

Box 1 Identifying counterparty sector in EMIR data

A prerequisite for the definition of “informed investors” is comprehensive and detailed information on sector classification. This box explains how EMIR data are enriched to obtain such a classification.

While EMIR data contain a field with information on the sector of a reporting counterparty, this information suffers from some limitations. The first relates to data quality: the sector reported by some counterparties varies over time, and in some cases the sector is missing. The second limitation is conceptual: the EMIR sector classification is not sufficiently detailed for many central bank purposes and does not single out entities with key roles in the derivatives market. In particular, CCPs, their clearing members and banks which are subsidiaries of the 16 largest dealers (G16) are not directly identifiable.[16] Furthermore, the EMIR sector breakdown[17] does not always overlap with the widely used ESA 2010 classification.[18]

To overcome these limitations, EMIR data are enriched with eight data sources to obtain a sector classification. The classification is performed using one source at a time, thereby establishing a hierarchy among sources. In the first step, counterparties are classified using four official lists: the ECB’s lists of monetary financial institutions and investment funds, the list of insurance undertakings compiled by the European Insurance and Occupational Authority (EIOPA) and ESMA’s list of CCPs. As these lists cover only a limited set of entities located in the EU/euro area, four more data sources are used in the second step: the European System of Central Banks’ Register of Institutions and Affiliates Data (RIAD) and three commercial data sources (BankFocus, Lipper and Orbis). As a last source in the hierarchy, the sector given in the EMIR data is used, but only if reported consistently.

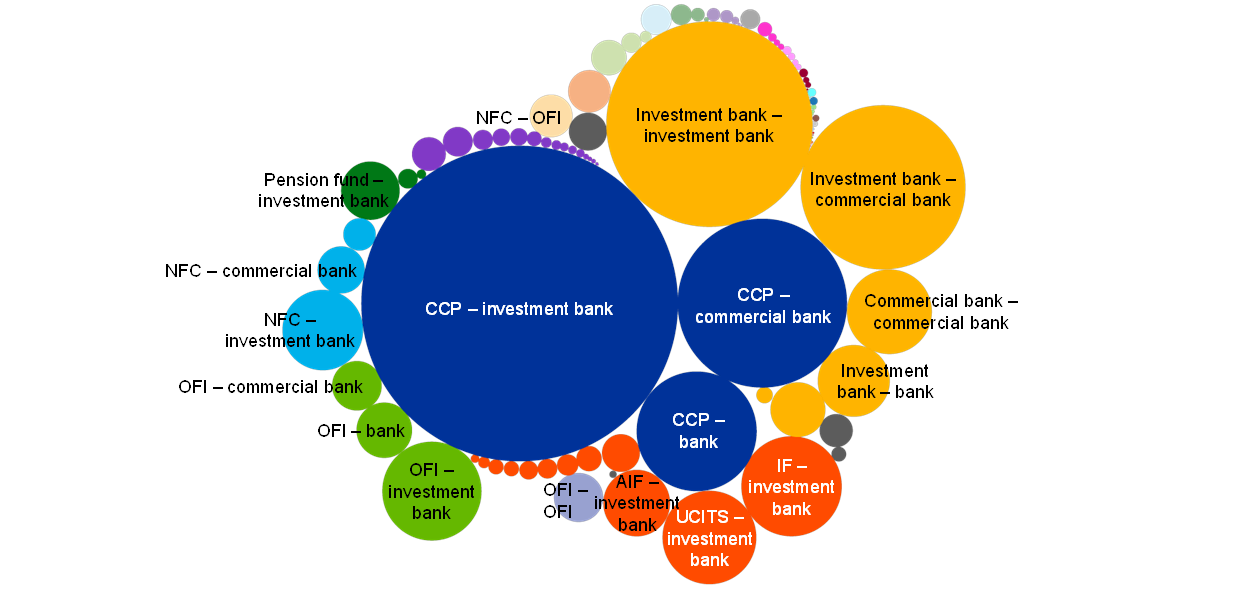

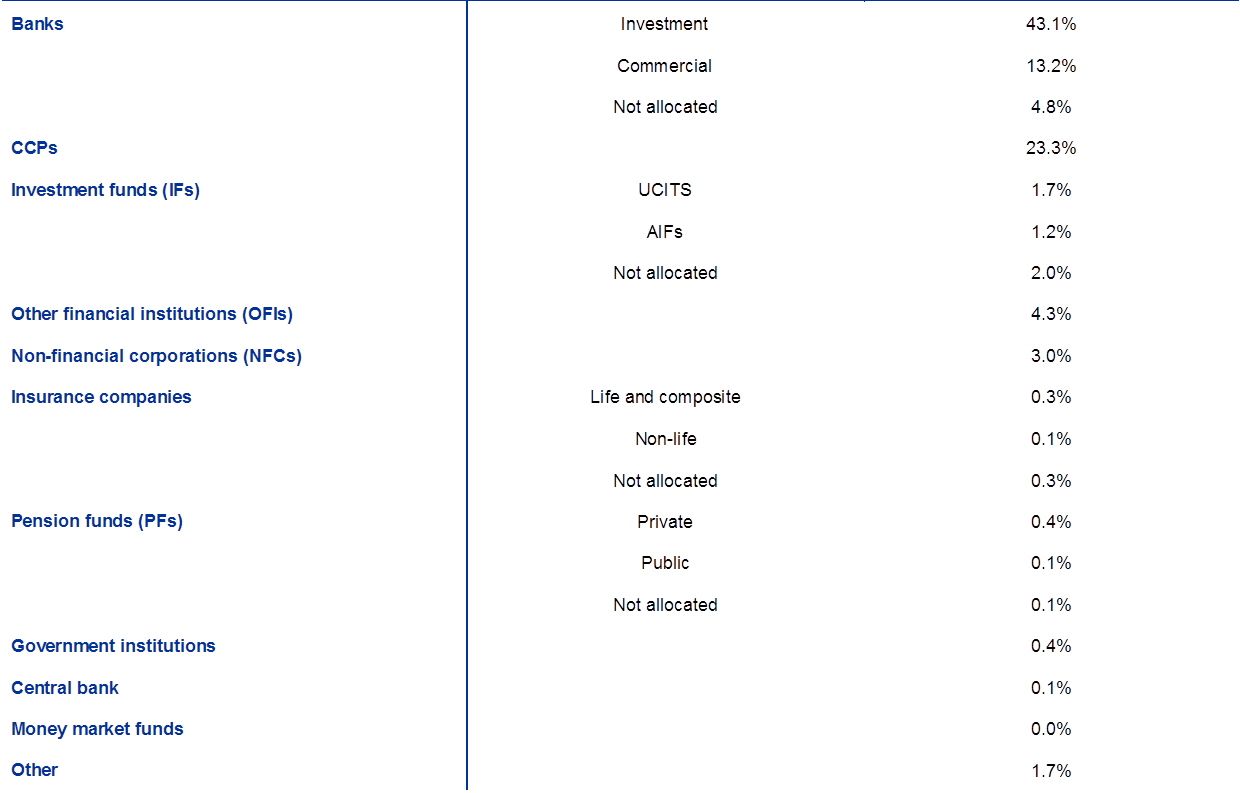

The resulting sector classification has a good coverage, is detailed and shows whether an entity plays a key role in the derivatives market. As of mid-2019, the counterparty sector has been identified for more than 98% of the notional value of outstanding trades in EMIR data (Chart A).[19] Granular information on subsectors is often also available. For instance, banks are further split into investment and commercial banks, and investment funds into UCITS and alternative investment funds. Information on investment funds’ strategy (e.g. bond, equity, hedge fund) is also at hand. Moreover, entities with key roles in the derivatives market, such as clearing members and banks belonging to the G16 dealers, are flagged as such.

Chart A

Identifying counterparty sector in EMIR data: breakdown by notional value

(percentages of gross notional value of outstanding contracts)

Sources: EMIR data, ECB, EIOPA, ESMA, BankFocus, Lipper, Orbis and ECB calculations.

Notes: Data are as at mid-June 2019. The table shows the new sector classification sorted by percentage of gross notional value of all outstanding contracts (“Not allocated” indicates that the notional amount has not been allocated to one of the subsector categories). The chart shows pairs of counterparty sectors, where the bubbles are proportional to the gross notional value of all outstanding contracts. Investment banks include G16 dealers (and relevant banking subsidiaries) and banks performing both commercial and investment banking activity. AIF stands for alternative investment fund. “Other” is a residual category for when the sector is not known.

4 Examining euro area inflation-linked swap markets

Another promising application of the EMIR data lies in providing a more thorough understanding of euro area inflation-linked derivatives markets, which contain important information on the inflation expectations of investors. Inflation expectations play a central role for the ECB, since its primary objective is to maintain price stability in the euro area. In the conduct of monetary policy, such expectations are relevant in their own right, since they influence economic decisions in areas such as consumption and investment, as well as wage and price setting, and thus inflation. Moreover, they serve as a cross-check on the inflation outlook in the Eurosystem/ECB staff macroeconomic projections, which in turn inform the ECB’s monetary policy decisions. In addition to survey-based measures, which capture inflation expectations as expressed directly in regular expert surveys, there are market-based measures of inflation compensation, reflecting the information derivable from the prices of financial instruments. These include inflation-linked swaps, inflation-linked bonds and inflation options, all of which are linked to future inflation outcomes. Since these financial instruments are traded continuously, market-based measures not only provide additional valuable information on the inflation expectations of investors, but can also give more timely indications of potential shifts in the inflation outlook.[20]

EMIR data allow a first quantitative look at the structure of the euro area inflation-linked swap (ILS) market. To date the ECB has relied heavily on market intelligence regarding the activity underlying developments in, for instance, ILS rates. Such market intelligence – while useful – is generally qualitative in nature, and challenging to gather in a consistent fashion across counterparties in practice. The EMIR data complement this type of information and allow it to be cross-checked by offering a quantitative, more systematic look at trading activity in euro area ILS markets. This section uses the EMIR data to demonstrate some structural features of these markets.[21]

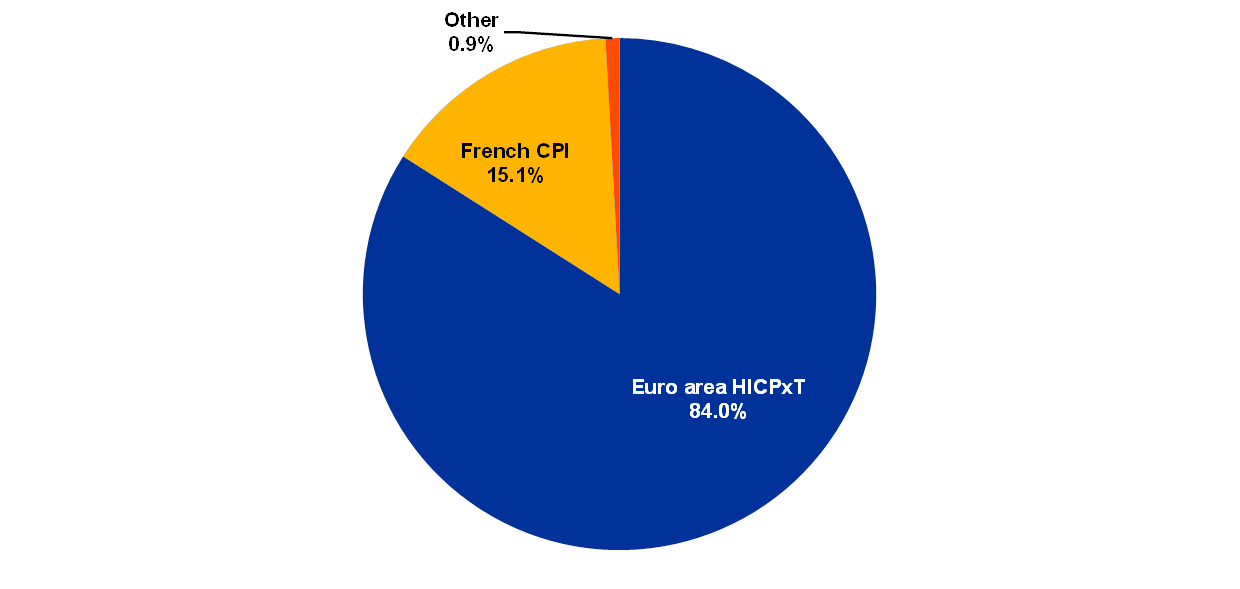

The data suggest that activity in the euro area ILS market is dominated by swaps linked to aggregate euro area inflation rather than national consumer price indices. Chart 4 shows that, on average, swaps linked to the euro area Harmonised Index of Consumer Prices excluding tobacco (HICPxT) account for more than 80% of both the number of transactions and the notional amount involved. The remaining euro area ILS market is almost exclusively linked to the French consumer price index (CPI). Activity in swaps linked to other countries’ CPIs is very limited, even Italian CPI-linked swaps, despite the existence of a sizeable Italian CPI-linked bond market.[22] Since the monitoring of investors’ inflation expectations relies on market quotes (as ILSs are traded “over the counter”), it appears reasonable to assign a higher information content to those ILSs for which quotes are more firmly supported by underlying activity.[23] On that basis and in light of the above observations, monitoring aggregate euro area inflation expectations in ILS markets seems most reliable. However, this does not preclude the monitoring of individual countries’ CPI-linked ILS rates to detect expectations of possible deviations from the aggregate at the national level.

Chart 4

Euro area inflation-linked swap market activity, by underlying reference index

Sources: EMIR data and ECB calculations.

Notes: Data are as at mid-2019. The shares are based on the average of two activity measures, namely the number of transactions and the notional amount involved in these transactions.

EMIR data also show that activity is relatively concentrated in the ten-year, five-year, two-year and one-year maturity segments. These results relate to spot rates of zero coupon swaps – that is, swaps that exchange fixed rate payments for variable payments on the basis of realised inflation between now and a given future date. Chart 5 shows that the four most active points on the curve account for around 50% of all activity in euro area HICPxT-linked swaps. The fact that almost a quarter of activity is clustered at the ten-year spot point, with the second-largest share at the five-year spot point, has an interesting corollary. It suggests that among forward ILS rates, the five-year rate five years ahead – which commands considerable attention in the marketplace – is also the rate most supported by underlying activity. Moreover, rather than declining mechanically with maturity, activity is still notable at a number of longer-dated points along the spot curve, for example at the 15, 20, and 30-year maturities. In the context of central bank analysis, this is reassuring since longer-term ILS rates are less affected by short-term transitory shocks and may thus provide a cleaner guide to investors’ “steady state” inflation expectations.

Chart 5

Activity in euro area HICPxT-linked inflation swaps, by maturity

Sources: EMIR data and ECB calculations.

Notes: Data are as at mid-2019. The activity shares are based on the average of four measures that (i) consider the number of transactions or the notional amount involved and (ii) define maturity either as maturity date minus effective date or as maturity date minus execution date. “Other” refers to maturities not shown in the chart.

There are important differences in sectoral activity across maturities: hedge funds are quite active at the very short end of the curve, while pension funds show above-average activity in the long to ultra-long segments. Chart 6 sorts transactions into different maturity buckets instead of focusing on individual maturity points. It further shows sector pairs involving banks on at least one side of the transaction. This is due to the dominant role played by banks in the ILS market and because activity accounted for by other sector pairs is negligible. Apart from highlighting the dominance of bank-bank and bank-investment fund transactions across maturity buckets, Chart 6 shows notable activity of hedge funds at short maturities. This observation is consistent with market intelligence, according to which some hedge funds have in recent years stepped up their efforts to forecast near-term inflation and then trade on the basis of those forecasts in ILS markets. Moreover, the fact that pension funds are over-proportionally represented in maturities of 20 years and above is in line with the notion that these actors use the ILS market to hedge inflation-linked liabilities, in particular those incurred as part of defined-benefit plans.

Chart 6

Shares of euro area HICPxT-linked swap transactions for selected sector pairs, by maturity

Sources: EMIR data and ECB calculations.

Notes: Sectors are identified using the classification reported in the EMIR database, enriched by a more granular classification and following a thorough data quality check. For example, inflation funds are identified as investment funds whose names and descriptions suggest a strong focus on inflation-adjusted or real returns. Shares are based on the average of the share of the number of transactions between June 2016 and January 2018 and the share of the notional amount involved in these transactions. Percentages add up to 100% for each maturity bucket across the six sector pairs shown. Data are based on reports from DTCC, which is one of the seven trade repositories reporting under EMIR currently authorised by ESMA.

The results show that it is important for the ECB, in assessing investors’ inflation expectations, to consider not only overall activity patterns across the ILS curve but also the sectoral composition of activity in different segments of the curve. More precisely, while the article has shown that activity in longer-dated euro area ILSs of 15 years and beyond is not negligible compared with shorter-dated maturities, the sectoral analysis indicates that a relatively large share of that activity stems from pension funds. Since the latter often use the ILS market to hedge against developments in inflation, they tend to act more as price takers, certainly when compared with hedge funds active at the short end of the ILS curve, which are more likely to express particular views on future inflation. Thus, when price sensitivity is also factored in, the information content of longer-dated ILS rates may be lower than suggested by overall activity in that maturity bucket.

Overall, EMIR data help uncover a number of interesting structural features of euro area ILS markets, suggesting that further EMIR-based analysis can help the ECB better assess future developments in these markets. The findings presented in this section are consistent with market intelligence received. This supports the notion that the EMIR data can indeed serve as a complement to and cross-check other information by offering a quantitative, more systematic view. Natural extensions of the more structural analysis presented here are tracking overall activity or the activity of different investor groups over time as well as across maturities. Moreover, the richness of the data extends beyond the information touched upon in this article, most notably to the prices at which counterparties transact with each other. EMIR data are thus an important addition to the ECB’s toolbox for analysis of euro area ILS markets.

5 Conclusions

This article has shown how EMIR data can be used for analysis beyond the domain of financial stability. This article presents examples based on two classes of derivatives market that are of particular importance for central bank analysis: the interest rate and inflation-linked derivatives markets.

The first example illustrates how EMIR data can help infer investor expectations for future interest rates. The positioning indicators developed track how a group of “informed investors” position themselves in the futures market in anticipation of future interest rate movements. Such quantity-based indicators can act as a complement to other, more established indicators of interest rate expectations, such as forward rates or survey-based measures. While this article provides first insights from such quantity-based indicators, further data analysis may help refine the indicators and also shed new light on the information embedded in forward interest rates, particularly in situations where the signals from the positioning and price-based indicators are not entirely consistent.

The second example shows how EMIR data allow a first systematic look at trading activity in euro area inflation-linked swap markets. This example highlights a number of structural features of these markets, which can provide valuable and timely information on the inflation outlook of investors. Overall, the results support the notion that EMIR data can complement and help to cross-check more qualitative market intelligence on activity in these markets. For example, the data can help assess the information content of inflation-linked swap rates, both across different maturities and on the basis of the relative activity of different types of investors. The data can thus be seen as an important addition to the analytical toolbox of the ECB.

Despite the many challenges in using these “big data”, the use of EMIR data at the ECB and at central banks more generally is on the rise. The increasing scale of analysis based on these data underlines the benefits for policymakers of the reporting of EMIR data as part of the measures to increase transparency in the OTC derivatives market.

- For a comprehensive overview of the elements of the OTC derivative reforms, see the article entitled “Looking back at OTC derivative reforms – objectives, progress and gaps”, Economic Bulletin, Issue 8, ECB, 2016.

- For examples of how EMIR data are used in the financial stability context, see e.g. Abad, J. et al., “Shedding light on dark markets: First insights from the new EU-wide OTC derivatives dataset”, ESRB Occasional Paper Series, No 11, European Systemic Risk Board, 2016; Hoffmann, P., Langfield, S., Pierobon, F. and Vuillemey, G., “Who bears interest rate risk”, Working Paper Series, No 2176, ECB, 2018; Dalla Fontana, S., Holz auf der Heide, M., Pelizzon, L. and Scheicher, M., “The anatomy of the euro area interest rate swap market”, Working Paper Series, No 2242, ECB, September 2018; Rosati, S., Vacirca, F., “Interdependencies in the euro area derivatives clearing network: A multi-layer network approach”, forthcoming in the Journal of Network Theory in Finance; Benos, E., Payne, R. and Vasios, M., “Centralized Trading, Transparency and Interest Rate Swap Market Liquidity: Evidence from the Implementation of the Dodd-Frank Act”, forthcoming in the Journal of Financial and Quantitative Analysis.

- For each derivative transaction more than 120 data fields have to be reported. The information includes the type of derivative, the underlying, the price, the amount outstanding, the execution and clearing venues of the contract, the valuation, the collateral and life-cycle events. For more details, see “Commission Delegated Regulation (EU) No 148/2013”.

- In fact, the ECB’s access is somewhat wider than this. See Article 2 of “Commission Delegated Regulation (EU) No 151/2013”.

- This is when the value exceeds a fixed threshold. The thresholds differ across asset classes and have been set on the basis of ECB market intelligence activity.

- Price-based indicators include, in particular, those calculated on the basis of forward contracts on key euro area interest rates such as EONIA and EURIBOR, either for a given forward horizon (e.g. a one-year rate, one year ahead) or for reserve maintenance periods that are tied to specific ECB Governing Council meetings. Surveys considered by the ECB include those from private providers commonly referenced in the marketplace as well as the ECB’s own, recently introduced Survey of Monetary Analysts.

- The frequently cited (disaggregated) Commitments of Traders report published by the US Commodity Futures Trading Commission provides such subsets. Some market observers use it to follow the evolution of the long and short positions of commercial and non-commercial counterparties in futures contracts on, for instance, currencies and commodities.

- Other approaches, complementary to the one employed here, can be more data-driven, e.g. focusing on investors that change their position often or whose activity in the market is particularly intense. Such approaches will be explored in further extension of this work.

- The main difficulty is limited data coverage and disclosure, as many hedge funds are domiciled in off-shore centres.

- The Manual on investment fund statistics defines hedge funds as funds “which apply relatively unconstrained investment strategies to achieve positive absolute returns, and whose managers, in addition to management fees, are remunerated in relation to the fund’s performance”, but it is acknowledged that a generally accepted definition of hedge funds does not exist.

- The classification of funds into UCITS and non-UCITS depends on whether they fall under the EU Directive on undertakings for collective investment in transferable securities (UCITS). UCITS funds are mutual funds which can be sold to retail investors and are perceived as non-speculative, diversified and well-regulated investments.

- Classifying funds on the basis of their description as active or passive shows that the sample is not dominated by passive funds.

- The aggregates of gross notional values derived from EMIR data tend to be different from those obtained from the Bank for International Settlements semi-annual surveys, owing to various conceptual and measurement differences between the two data sources. For more details, see Abad, J. et al., op. cit.; ESMA Annual Statistical Report, EU Derivatives Markets, 2018, European Securities and Markets Authority, October 2018.

- In addition, for maturities of over one year the mechanical roll-over effect in the nearest-dated futures is removed.

- Positioning at the sector level is computed as the average of individual positions.

- The G16 are: Bank of America, Barclays, BNP Paribas, Citigroup, Crédit Agricole, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, JPMorgan Chase, Morgan Stanley, Nomura, Royal Bank of Scotland, Société Générale, UBS and Wells Fargo.

- The EMIR sector classification distinguishes eight types of financial entity: alternative investment funds, assurance undertakings, credit institutions, insurance undertakings, investment firms, institutions for occupational retirement provision, reinsurance undertakings, undertakings for collective investment in transferable securities (UCITS) and their management companies, and a residual category. Non-financial corporations report one letter codes from the NACE statistical classification.

- The European System of Accounts (ESA 2010) is a statistical classification system used to group institutional units with the same primary activity. The sector code divides the economy into six sectors: non-financial corporations, financial corporations, general government, households, non-profit institutions serving households and the rest of the world.

- For the remaining 2%, the domicile of the counterparty is either not available or outside Europe.

- For more information see the article entitled “Interpreting recent developments in market-based indicators of longer-term inflation expectations”, Economic Bulletin, Issue 6, ECB, 2018.

- The portion of euro area ILS markets covered by the data available at the ECB has an outstanding notional amount of close to €1 trillion. However, since these data represent a subset of the market (see Section 2), the actual size of the market is larger, and potentially significantly so. In any case, the subset reveals that, in the euro area, the ILS market is substantially smaller than the interest rate derivatives market. For instance, the outstanding notional amount of EURIBOR futures contracts is roughly ten times as high as that of euro area HICP-linked swaps.

- Inflation-linked bonds are also primarily indexed to the aggregate euro area HICPxT, but both France and Italy have substantial – and comparable – amounts of bonds outstanding that are linked to their respective national CPIs.

- Note that these quotes are “created” in large data warehouses of global banks and probably also include some information derived from the inflation-linked bond and other markets. Nonetheless, underlying activity is useful in judging the information content of quotes in OTC markets. This is because, while the actual price (or rate) at which two counterparties transact remains confidential, a sizeable amount of activity in these markets is intermediated by dealers that take (at least) one side of the transaction and simultaneously provide quotes for the product in question. Hence, published dealer quotes are informed by – and adjusted in response to – the trades conducted between dealers and other investors. This suggests that the more sizeable the underlying activity in an OTC market, the more likely it is that quoted prices (or rates) provide a reliable guide to where investors are willing to transact.