ECB releases new money market statistics

- First ECB statistics on unsecured euro money market derived from individual transactions

- Statistics enhance transparency and help to improve money market functioning

- The daily average borrowing turnover in the unsecured segment stands at €109 billion

- The weighted average overnight rate on borrowing transactions stands at -0.40% for the wholesale sector and at -0.38% for the interbank sector

The European Central Bank (ECB) is today publishing, for the first time, statistics on the euro money market based on money market statistical reporting (MMSR). These statistics cover the unsecured segment of the market and include information on the total turnover and average rate for the previous maintenance period, broken down by transaction type and maturity. By publishing these figures, the ECB aims to enhance market transparency and therefore improve money market functioning. The statistics will complement the ECB’s initiative to develop a euro unsecured overnight interest rate by 2020.

The Eurosystem collects transaction-by-transaction information from the 52 largest euro area banks in terms of banks’ total main balance sheet assets, broken down by their borrowing from and lending to other counterparties. The data will be published every six to seven weeks, after each of the Eurosystem’s reserve maintenance periods.

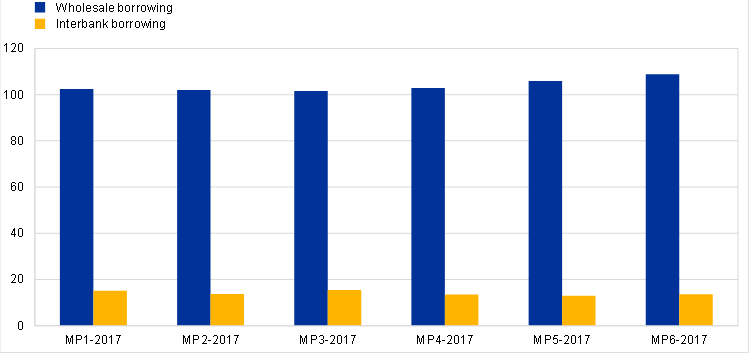

Daily average nominal borrowing amount in the unsecured segment for the wholesale and interbank sectors, by maintenance period

(EUR Billions)

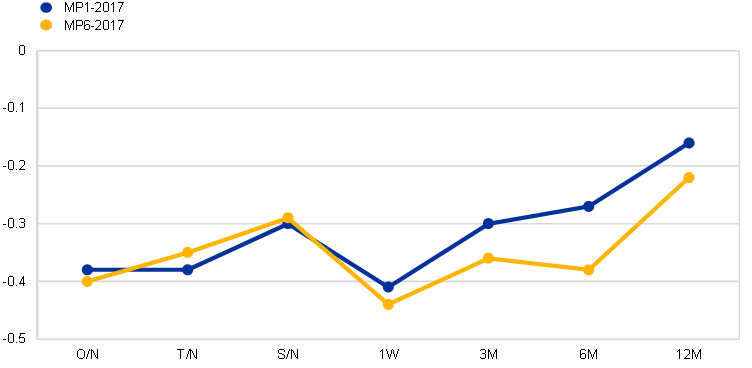

Weighted average rate for wholesale sector borrowing in the unsecured segment by tenor and maintenance period

(Percentage)

In the last maintenance period, which started on 13 September 2017 and ended on 31 October 2017, the borrowing turnover in the unsecured segment averaged €109 billion per day, while the total for the period as a whole was €3,811 billion. Borrowing from other credit institutions, i.e. on the interbank market, represented a turnover of €476 billion, or 12% of the total turnover, and lending to other credit institutions amounted to €440 billion. Most of the borrowing transactions were overnight transactions, representing around 50% of the total nominal amount. The weighted average overnight rate for borrowing transactions was -0.38% for the interbank sector and -0.40% for the wholesale sector (which includes the government sector, corporations and banks).

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes:

- The money market statistics are available in the ECB’s Statistical Data Warehouse.

- More information on the methodology applied, including the list of reporting agents, is available on the ECB’s website.

- The first data release refers to the sixth maintenance period of 2017 (13 September to 31 October 2017) and also includes data for the first five maintenance periods of the year. Data will be published 15 working days after the end of each maintenance period.

- The weighted average rate is calculated as the rates weighted by the respective nominal amount over the maintenance period.

- The tenors O/N, T/N, S/N, 1W, 3M, 6M and 12M refer to, respectively, overnight, tomorrow/next, spot/next, one week, three months, six months and twelve months.

- The indicative calendars for the Eurosystem’s reserve maintenance periods are available on the ECB’s website.

- The next press release on euro money market statistics will be published on 12 January 2018.

Den Europæiske Centralbank

Generaldirektoratet Kommunikation

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Tyskland

- +49 69 1344 7455

- media@ecb.europa.eu

Eftertryk tilladt med kildeangivelse.

Pressekontakt