- Press release

- 28 March 2019

Monetary developments in the euro area: February 2019

- Annual growth rate of broad monetary aggregate M3 increased to 4.3% in February 2019 from 3.8% in January

- Annual growth rate of narrower monetary aggregate M1comprising currency in circulation and overnight deposits, increased to 6.6% in February from 6.2% in January

- Annual growth rate of adjusted loans to households stood at 3.3% in February, compared with 3.2% in January

- Annual growth rate of adjusted loans to non-financial corporations increased to 3.7% in February from 3.4% in January

Components of the broad monetary aggregate M3

The annual growth rate of the broad monetary aggregate M3 increased to 4.3% in February 2019 from 3.8% in January, averaging 4.1% in the three months up to February. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate M1, which comprises currency in circulation and overnight deposits, increased to 6.6% in February from 6.2% in January. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) was -0.2% in February, compared with -0.8% in January. The annual growth rate of marketable instruments (M3-M2) was -0.4% in February, compared with -0.1% in January.

Monetary aggregates

(annual growth rates)

Looking at the components' contributions to the annual growth rate of M3, the narrower aggregate M1 contributed 4.3 percentage points (up from 4.0 percentage points in January), short-term deposits other than overnight deposits (M2-M1) contributed -0.1 percentage point (up from -0.2 percentage point) and marketable instruments (M3-M2) contributed 0.0 percentage point (as in the previous month).From the perspective of the holding sectors of deposits in M3, the annual growth rate of deposits placed by households increased to 5.6% in February from 5.3% in January, while the annual growth rate of deposits placed by non-financial corporations increased to 4.3% in February from 2.5% in January. Finally, the annual growth rate of deposits placed by non-monetary financial corporations (excluding insurance corporations and pension funds) was -3.6% in February, compared with -1.7% in January.

Counterparts of the broad monetary aggregate M3

As a reflection of changes in the items on the monetary financial institution (MFI) consolidated balance sheet other than M3 (counterparts of M3), the annual growth rate of M3 in February 2019 can be broken down as follows: credit to the private sector contributed 3.1 percentage points (up from 2.8 percentage points in January), net external assets contributed 1.3 percentage points (up from 1.0 percentage point), credit to general government contributed 1.0 percentage point (up from 0.9 percentage point), longer-term financial liabilities contributed -0.8 percentage point (down from -0.5 percentage point), and the remaining counterparts of M3 contributed -0.3 percentage point (up from -0.4 percentage point).

Contribution of the M3 counterparts to the annual growth rate of M3

(percentage points)

Credit to euro area residents

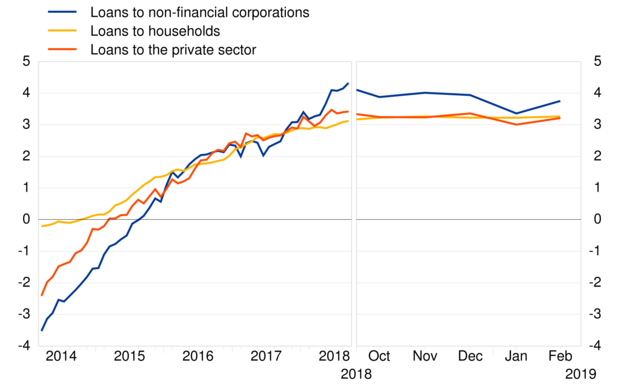

As regards the dynamics of credit, the annual growth rate of total credit to euro area residents increased to 2.7% in February 2019 from 2.5% in the previous month. The annual growth rate of credit to general government stood at 2.5% in February, compared with 2.4% in January, while the annual growth rate of credit to the private sector increased to 2.8% in February from 2.5% in January.The annual growth rate of adjusted loans to the private sector (i.e. adjusted for loan sales, securitisation and notional cash pooling) increased to 3.2% in February from 3.0% in January. Among the borrowing sectors, the annual growth rate of adjusted loans to households stood at 3.3% in February, compared with 3.2% in January, while the annual growth rate of adjusted loans to non-financial corporations increased to 3.7% in February from 3.4% in January.

Adjusted loans to the private sector

(annual growth rates)

Annex

Table: Annex to the press release on monetary developments in the euro areaNotes:

- Data in this press release are adjusted for seasonal and end-of-month calendar effects, unless stated otherwise.

- "Private sector" refers to euro area non-MFIs excluding general government.

- Hyperlinks in the main body of the press release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.

Evropska centralna banka

Generalni direktorat Stiki z javnostjo

- Sonnemannstrasse 20

- 60314 Frankfurt na Majni, Nemčija

- +49 69 1344 7455

- media@ecb.europa.eu

Razmnoževanje je dovoljeno pod pogojem, da je naveden vir.

Kontakti za medije