Euro area balance of payments (November 2014)

In November 2014, the current account of the euro area recorded a surplus of €18.1 billion [1].

In the financial account, combined direct and portfolio investment recorded increases of €72 billion in assets and €32 billion in liabilities.

Current account

The current account of the euro area recorded a surplus of €18.1 billion in November 2014 (see Table 1). This reflected surpluses for goods (€18.7 billion), services (€7.8 billion) and primary income (€4.8 billion), which were partly offset by a deficit for secondary income (€13.2 billion).

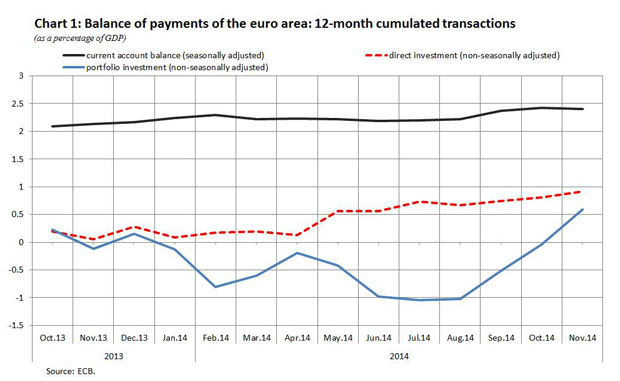

The 12-month cumulated current account for the period ending in November 2014 recorded a surplus of €241.6 billion (2.4% of euro area GDP), compared with one of €211.4 billion (2.1% of euro area GDP) for the 12 months to November 2013 (see Table 1 and Chart 1). The increase in the current account surplus was due mainly to increases in the surpluses for goods (from €214.6 billion to €231.7 billion) and services (from €69.2 billion to €81.6 billion) as well as to a decrease in the deficit for secondary income (from €142.7 to €140.9 billion); these effects were marginally offset by a decrease in the surplus for primary income (from €70.4 billion to €69.2 billion).

Financial account

In the financial account (see Table 2), combined direct and portfolio investment recorded increases of respectively €72 billion in assets and €32 billion in liabilities in November 2014.

Euro area residents recorded an increase in direct investment assets of €26 billion, by means of both debt instruments (€14 billion) and equity (€12 billion). Direct investment liabilities decreased by €3 billion, due to a decrease in debt instruments (€7 billion) which was partly offset by an increase in e quity (€5 billion). As regards portfolio investment, euro area residents made net acquisitions of foreign securities of €47 billion, mostly of debt securities (€36 billion) but also equity (€10 billion). Regarding euro area portfolio investment liabilities, non-euro area residents made net acquisitions of euro area securities of €35 billion, mainly debt securities (€31 billion).

The euro area net financial derivatives account (assets minus liabilities) recorded net flows of +€4 billion. Other investment recorded increases of €80 billion in assets and €46 billion in liabilities. These increases were largely explained by developments in the MFIs excluding the Eurosystem sector (€68 billion in assets and €36 billion in liabilities).

The Eurosystem’s stock of reserve assets increased by €6 billion in November 2014 (to €592 billion), which was explained by positive revaluations of €8 billion. Net disposals of reserve assets amounted to €2 billion.

In the 12 months to November 2014, combined direct and portfolio investment recorded cumulated increases of €531 billion in assets and of €380 billion in liabilities, compared with increases of €811 billion in assets and of €818 billion in liabilities in the 12 months to November 2013. This development resulted from a significant decrease in direct investment activity both by euro area residents abroad and by non-residents in the euro area.

The net external assets of euro area MFIs increased by €255 billion in the 12 months to November 2014, compared with an increase of €253 billion in the preceding 12-month period. This increase in MFIs’ net external assets mirrored primarily an increase in the current account surplus of €254 billion.

Data revisions

This press release incorporates revisions to the October 2014 data. These revisions have not significantly altered the figures previously published.

Additional information

Time series data: ECB’s Statistical Data Warehouse (SDW).

Methodological information: ECB’s website.

Monetary presentation of the balance of payments Next press releases:Monthly balance of payments: 19 February 2015 (reference data up to December 2014).

Quarterly balance of payments and international investment position: 9 April 2015 (reference data up to the fourth quarter of 2014)

Annexes

Table 1: Current account of the euro area

Table 2: Balance of payments of the euro area

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

-

[1]References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are neither seasonally nor working day-adjusted.

Evropska centralna banka

Generalni direktorat Stiki z javnostjo

- Sonnemannstrasse 20

- 60314 Frankfurt na Majni, Nemčija

- +49 69 1344 7455

- media@ecb.europa.eu

Razmnoževanje je dovoljeno pod pogojem, da je naveden vir.

Kontakti za medije