Fintech for the people

Keynote speech by Benoît Cœuré, Chair of the CPMI and Member of the Executive Board of the ECB, at the 14th BCBS-FSI high-level meeting for Africa on strengthening financial sector supervision and current regulatory priorities, Cape Town, 31 January 2019

Introduction[1]

Thank you for the kind invitation to speak at this event. The Basel Committee on Banking Supervision (BCBS) and the Financial Stability Institute (FSI) are critical partners for the Committee on Payments and Market Infrastructures (CPMI). I am very supportive of initiatives such as this high-level meeting to further our shared mission to strengthen financial stability in Africa and elsewhere.

That said, Bill Cohen and Fernando Restoy have given me the difficult task of speaking after my friend, Governor Lesetja Kganyago. He is always a dynamic speaker and few can match his charm and wit. Hence, it was with some trepidation that I accepted this invitation, but who would refuse an opportunity to come back to beautiful Cape Town? The South African Reserve Bank, as a key member of the CPMI, graciously hosted us here a couple of years ago and it was one of the most memorable occasions in my time as committee chair.

As the global standard-setter for payment, clearing and settlement activity, the CPMI works to support financial stability by enhancing the risk management and supervision of financial market infrastructures. In my remarks this morning, I would like to focus on an often overlooked objective for the committee and many of our members – enhancing financial inclusion. Expanding access to payment services is an integral part of our work and a key regulatory priority.

I will discuss fintech’s potential for achieving greater access, and the role that central banks and other authorities can play to help fulfil this potential. I will argue that, over the past decade, significant progress has been made in expanding access to payment services. A number of innovative solutions – many from this continent – have helped increase access for underserved populations in Africa and around the world.

But I will also argue that there is still much work to do. A significant number of people still lack the means to make fast, secure and trustworthy payments and to conduct other financial activities that would integrate them into the broader formal economy. In many cases, this burden is unfortunately often carried by those who are most in need.

We therefore need to strengthen our efforts to expand access to everyone and to effectively regulate and supervise new payments activity. I will argue that a failure to do so may lead to highly undesirable outcomes. It may push people into using unregulated and potentially unsafe “shadow payments” that include the likes of bitcoin and other cryptocurrencies. These types of “shadow payments” may expose people to large financial risks. It is our duty to protect consumers and ensure that the benefits of innovation reach everyone, and not just a portion of the population.

Financial inclusion in payments: progress made but more work ahead

Five years ago, the CPMI and the World Bank established a joint Task Force on Payment Aspects of Financial Inclusion, affectionately known as PAFI, to help countries expand access to payment services.[2]

The 2016 PAFI report outlines actions that countries can take, including explicitly committing themselves to financial inclusion objectives, establishing sound legal and regulatory frameworks in support of financial inclusion, providing basic transaction accounts at little or no cost, having strong information and communications technology infrastructures that underpin transaction accounts, increasing financial literacy, and shifting government payments from cash to electronic payments.

As we mark the PAFI report’s third anniversary, it seems like a good time to review the progress made in expanding access to payment services. The World Bank estimates that, in 2017, 69% of the global population, or 3.8 billion people, had an account at a financial institution or mobile money provider. This represents an increase of 7 percentage points since 2014. Over this period, more than half a billion people opened an account. This is certainly good news.

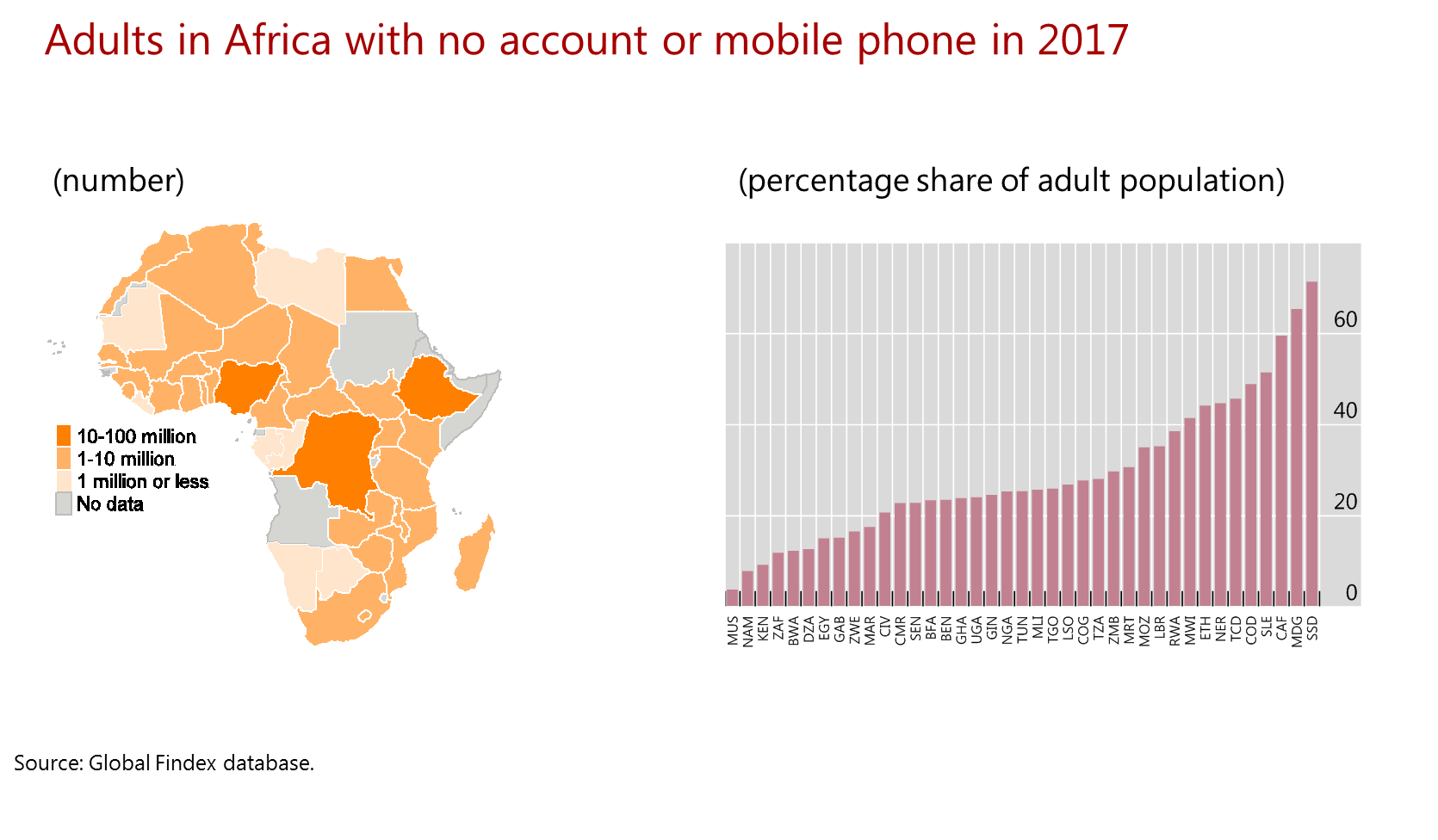

Chart 1 illustrates the progress made in Africa alone. Between 2014 and 2017, more than 70 million adults in Africa opened a transaction account. Much of this progress is due to the rapidly increasing pace of adoption of new technologies that help reduce transaction costs for users, simplify the process of setting up an account and offer new delivery methods, among other benefits.[3] According to one study, Africa is home to more digital financial services than any other region in the world.[4] The use of such services is now second nature for millions of Africans.

Chart 1

Consider M-Pesa. It revolutionised payments by making it possible to settle low-value transactions without a bank account. It cleverly turned sim cards and a mobile service account into a virtual wallet for peer-to-peer and customer-to-business payments. I believe Kenya has served as an inspiration for the payments industry worldwide. Since then we have seen the rise of new payment services in both emerging and advanced economies – some by bigtech firms, some by fintech start-ups and some by incumbent banks.

These new payment schemes not only increase access but also improve competition and drive down transaction costs. Before the recent fintech revolution, the cost of financial services remained astonishingly stable and surprisingly expensive.[5] In other words, improvements in technology have often not been passed on to households and firms. There are clear signs that this is changing.

But Chart 1 also highlights another important point – that more work is needed. Only seven African countries have achieved a 60% penetration rate. In many African countries, less than half the population has access to basic payment services. Chart 2 highlights the number of people who have neither a transaction account nor a mobile phone. Expanding payment access through solutions that require a mobile phone is limited to people who have one.

Chart 2

Financial exclusion of this type threatens the cohesion of our societies. It often forms part of a much wider social exclusion faced by individuals who lack access to education, insurance or healthcare.

Also, without access to basic payment services, people are unlikely to have access to credit markets. And without credit, there is less trade, less investment, less education and fewer jobs. The empirical evidence is overwhelming: developing and emerging market economies with deeper credit markets tend to grow faster than others.[6] A material number of micro, small and medium-sized enterprises in developing economies still lack access to affordable financial services and credit.

One consequence of financial exclusion from payments is that it may lead to the rise of “shadow payments”. If people cannot make payments through conventional systems, they may look to unregulated arrangements, such as informal savings clubs, peer-to-peer platforms or cryptocurrencies. In doing so, they may find themselves using payment arrangements that lack operational robustness, appropriate risk management, legal certainty and consumer protection.

Thankfully, these types of arrangement do not yet serve as credible replacements for the conventional payment system. But they may gain ground if we fail to expand payments access more broadly.

Promoting the broadest access to payment services

Broader access to payment systems is therefore crucial. It is the first step in the long journey towards truly universal financial integration.

Central banks and other authorities should recognise this. They should be explicit in their commitment to expand payments access. We need to make it known to the industry and the general public alike that we, as authorities, are putting the emphasis on inclusion for everyone.

The CPMI is working with the World Bank to review the lessons learned from applying the PAFI framework, to develop a toolkit for countries, and to analyse fintech developments in the context of financial inclusion. We are also part of the Financial Inclusion Global Initiative to provide targeted technical assistance to China, Egypt and Mexico to expand electronic payments acceptance, increase the use of digital identification for financial services, and enhance payment system security, infrastructure and technology.[7]

The work of the CPMI and our partners supports the new IMF-World Bank Bali Fintech Agenda launched a few months ago with a view to fostering fintech solutions that promote financial inclusion and further develop financial markets.[8] To take this agenda forward, I trust the leadership of Governor Kganyago in his capacity as Chair of the IMF’s International Monetary and Financial Committee.

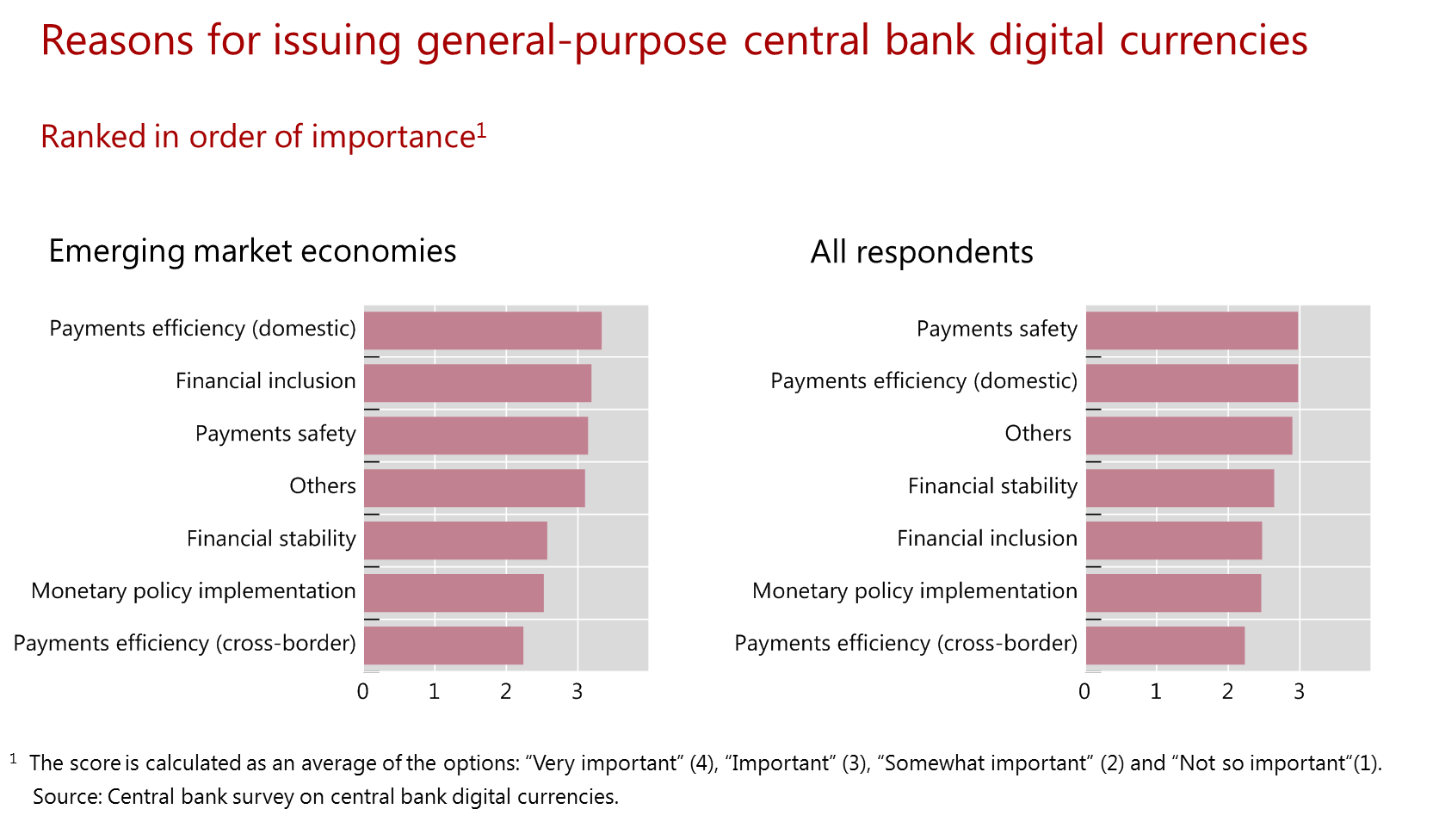

Fintech solutions are not limited to the private sector. The CPMI recently conducted a survey on the potential issuance of central bank digital currencies that can enhance access to financial services for underserved populations.[9] The results revealed that many central banks from emerging market economies are, in fact, exploring digital currencies as a way to expand financial access. You can see this in Chart 3.

Chart 3

But we arguably still have a long way to go. Survey respondents are proceeding with great caution on digital currencies – and, in my view, rightly so. While they are likely part of the future for central banks, digital currencies raise complex challenges related to their safety and broader impact on financial structures.[10]

We also need to analyse much more deeply how they would support financial inclusion and how central banks aim to overcome the big hurdle of providing consumers with access to basic transaction accounts or a payment device. Recent experiments, such as Uruguay’s e-Peso, provide useful food for thought.

Digital currencies are, however, only one way in which central banks can foster financial inclusion. Modernising our existing retail and wholesale payment systems is another.[11] In November last year, for example, the ECB launched a new market infrastructure to support fast payments.[12] Target Instant Payment Settlement (TIPS) allows payment service providers to offer funds transfers to customers in real time and around the clock across Europe.

TIPS could be a role model for developing economies. It not only has the potential to help better prepare incumbents for the challenges arising from digital giants, such as Alibaba, Apple and Google, who are integrating payment services into their ecosystems; it also has the potential to be a catalyst for financial inclusion.

Innovations like TIPS have the potential to curb the use of “shadow payments”, in particular in the area of cross-border payments. As many of you know all too well, making cross-border payments is inefficient and expensive. According to one study, the average revenue per cross-border transaction is more than $20 across payment methods, values and corridors.[13]

These existing barriers to fast, cheap cross-border payments are the main appeal of using unregulated cryptocurrencies, in particular in developing economies where foreign workers want to send money home, and where families want to finance education overseas, in the cheapest and fastest way possible.

To date, innovation and competition in cross-border retail payments seem to have been focusing mainly on the front-end of the market, i.e. the one that faces end-users. As noted by the 2018 CPMI report on cross-border retail payments[14], expanding “closed-loop” proprietary systems across borders and peer-to-peer mechanisms based on distributed ledger technology may also have the potential to bring improvement to the back-end of the market. Upholding the global correspondent banking network by clarifying compliance requirements, and by upgrading know-your-client (KYC) processes and utilities, can also make a difference – to which fintech can also contribute.

Upgrading and interconnecting our domestic payment systems, which are convenient and have earned public trust, is certainly a complex undertaking. But it can go a long way towards helping us rise to the challenges emerging from currently unsafe crypto-assets. I believe this should be a key priority for international action.

Providing safe and effective regulation and supervision

A second priority that should go hand-in-hand with public efforts to study and apply new technologies is making sure that our regulation and oversight is up to the challenges of fintech.

In the rest of my remarks I would therefore like to address three fintech-related challenges to regulation and oversight. The first is who and what should be regulated and supervised. The second is how regulators can foster innovation and competition. And the third is how to keep the system safe in the age of fintech.

Let me start with the who and what.

Entity-based regulation and supervision may not be effective in the digital age. Fintech is indifferent to conventional organisational forms. It cannot easily be covered by current regulatory conventions. Some fintech firms provide services similar to those of regulated entities but are not held to the same type of risk management standards and consumer protection rules. This may incentivise regulated entities to migrate towards the less-regulated parts of the financial system. This is what Charles Goodhart called the “boundary problem” of financial regulation.[15]

Of course, activity-based regulation is easier said than done. In some cases, it may be difficult to determine who should be regulated and supervised. Take bitcoin as an example. Authorities will find it difficult to find a legal entity responsible for bitcoin, and therefore may not be able to regulate it. But they may be able to regulate the broader ecosystem. Authorities are now actively overseeing crypto-asset “gatekeepers“, such as exchanges and wallets, service providers and financial institutions, with respect to their bitcoin-related activities.

A prerequisite for activity-based regulation is stronger international cooperation. Fintech knows no borders. New technologies may make regulatory arbitrage an even more prominent concern. Again using bitcoin as an example, banning the cryptocurrency in one jurisdiction does not stop it from being used in that jurisdiction. As a decentralised system, bitcoin will continue to function if a jurisdiction, or even multiple jurisdictions, curtails its use, unless we all pull in the same direction. International cooperation in the Financial Stability Board, its regional fora and in standard-setting bodies is therefore of the essence.

My second point relates to innovation and competition.

Regulatory initiatives will affect the direction and speed of innovation in the financial sector.[16] For example, if we intentionally or unintentionally protect incumbents, and prevent new contenders from establishing their business, then we might miss out on opportunities that could broaden financial inclusion.

On the other hand, authorities also need to keep an eye on the stability of traditional financial intermediaries. New entrants in the payments arena may give rise to specific concerns, such as the winner-takes-all effect and the bundling of technical services provided by tech giants, not to mention possible challenges to privacy regulation. All in all, with technological progress moving faster than ever before, authorities are faced with the difficult challenge of protecting the stability of the financial system while also allowing new businesses to grow and new services to thrive.

My third and final point relates to keeping the system safe in the age of fintech, at its core and its periphery.

Financial market infrastructures (FMIs) are the backbone of the global financial system and new technologies are challenging our ability to keep them safe. The core of the system is being increasingly confronted with sophisticated cyber threats. Failure to effectively address cyber risks can be destabilising. As I’ve noted on other occasions, leaving these issues unaddressed may trigger the next financial crisis.

Our cyber guidance, co-produced with IOSCO, provides details of how FMIs should enhance their cyber resilience capabilities.[17] We are also working closely with FMIs on establishing several industry taskforces to encourage greater cooperation among global FMIs.[18] This work builds upon a similar European effort, led by the ECB, to foster greater industry coordination on cyber-related matters.[19]

And to secure the periphery, the CPMI recently published a strategy for reducing the risk of wholesale payments fraud related to endpoint security.[20] Mark Carney, as chair of the Global Economy Meeting at the Bank for International Settlements, and I recently invited central banks around the world to join us in the global effort to strengthen endpoint security.

Conclusion

Enhancing financial inclusion – and with this I would like to conclude – needs to remain a key priority for policymakers. Over the last five years as Chair of the CPMI, I have seen laudable progress in reducing the proportion of people excluded from the financial system. But we can do even better.

Millions in Africa and elsewhere do not yet have a basic transaction account. And if people don’t have access to basic payment services, we may find them using risky and unsafe arrangements – “shadow payments” – that do not offer sound credit and liquidity risk management, legal certainty and consumer protection rights.

We have an obligation to bring the financial system closer to the people so that everyone benefits from access to credit, savings and insurance products. And we have an obligation to ensure that the benefits of innovation reach everyone and not just a portion of the population. We need to encourage fintech to be built “for the people” – old and young, rich and poor, expert and layman alike.

Thank you.

- [1]I would like to thank Paul Wong for his contributions to this speech. I remain solely responsible for the opinions contained herein.

- [2]CPMI and World Bank Group, Payment aspects of financial inclusion, April 2016.

- [3]See, for example, CPMI, Fast payments – Enhancing the speed and availability of retail payments, November 2016; and CPMI, Distributed ledger technology in payment, clearing and settlement: An analytical framework, February 2018.

- [4]See Mastercard Foundation and International Finance Corporation, DIGITAL ACCESS: The Future of Financial Inclusion in Africa, March 2018.

- [5]See T Philippon, “The Fintech Opportunity”, NBER Working Papers, No 22476, August 2016.

- [6]See R Levine, “Finance and growth: Theory and evidence“ in P Aghion and S N Durlauf (eds), Handbook of Economic Growth, Volume 1A, pp. 865–934, Elsevier, 2005; and A Bénassy-Quéré, B Cœuré, P Jacquet, and J Pisani-Ferry, Economic Policy: Theory and Practice, Second Edition, Chapter 6, pp. 336-9, Oxford University Press, 2019.

- [7]The Financial Inclusion Global Initiative also includes the World Bank Group, the International Telecommunications Union and the Bill & Melinda Gates Foundation.

- [8]See International Monetary Fund and World Bank Group, The Bali Fintech Agenda, October 2018.

- [9]See C Barontini and H Holden, Proceeding with caution – a survey on central bank digital currencies, BIS papers, No 101, January 2019.

- [10]See CPMI-Markets Committee, Central bank digital currencies, March 2018.

- [11]See B Cœuré, “The future of financial market infrastructures: spearheading progress without renouncing safety”, speech at the Central Bank Payments Conference, Singapore, 26 June 2018.

- [12]For additional information, see the ECB’s webpage on What is TARGET Instant Payment Settlement (TIPS)?

- [13]See McKinsey and Swift, A vision for the future of cross-border payments, October 2018.

- [14]See CPMI, Cross-border retail payments, February 2018.

- [15]See C Goodhart, “The Boundary Problem in Financial Regulation”, National Institute Economic Review, No 206, pp. 48-55, 2008.

- [16]See B Cœuré, “The known unknowns of financial regulation”, panel contribution at the conference on Rethinking Macroeconomic Policy IV, Washington DC, 12 October 2017.

- [17]See CPMI-IOSCO, Guidance on cyber resilience for financial market infrastructures, June 2016.

- [18]See CPMI, Payment, clearing and settlement operators meet on global cyber-resilience [Press release], 14 September 2018.

- [19]See B Cœuré, “A Euro Cyber Resilience Board for pan-European Financial Infrastructures”, introductory remarks at the first meeting of the Euro Cyber Resilience Board for pan-European Financial Infrastructures, Frankfurt, 9 March 2018; and B Cœuré, “Euro Cyber Resilience Board for pan-European Financial Infrastructures”, introductory remarks at the second meeting of the Euro Cyber Resilience Board for pan-European Financial Infrastructures, Frankfurt, 7 December 2018.

- [20]See CPMI, Reducing the risk of wholesale payments fraud related to endpoint security, May 2018.

Europos Centrinis Bankas

Komunikacijos generalinis direktoratas

- Sonnemannstrasse 20

- 60314 Frankfurtas prie Maino, Vokietija

- +49 69 1344 7455

- media@ecb.europa.eu

Leidžiama perspausdinti, jei nurodomas šaltinis.

Kontaktai žiniasklaidai