Update on economic, financial and monetary developments

Summary

Economic activity

At the global level, economic activity continued to expand, albeit at a measurably moderating pace, amid a combination of factors, most prominently persistent supply bottlenecks. The Purchasing Managers’ Index data for August and September 2021 suggest that momentum moderated in advanced economies, although it remained above its historical average, while it was softer in emerging market economies. At the same time, global supplier delivery times remained at record highs in September, owing primarily to strong demand. World trade growth also continued to soften, albeit from still high levels. Price pressures remain elevated on account of increasing food and energy inflation, reflecting the rebound from the low price levels recorded immediately after the onset of the coronavirus (COVID-19) pandemic. Most of the price pressures are judged to be of a temporary nature.

The euro area economy continued to recover strongly, although momentum moderated to some extent. Output is expected to exceed its pre-pandemic level by the end of the year. The grip of the pandemic on the economy has visibly weakened, with a high share of people now vaccinated. This is supporting consumer spending, especially on entertainment, dining, travel and transportation. But higher energy prices may reduce purchasing power in the months to come.

The recovery in domestic and global demand is also supporting production and business investment. That said, shortages of materials, equipment and labour are holding back the manufacturing sector. Delivery times have lengthened considerably, and transport costs and energy prices have surged. These constraints are clouding the outlook for the coming quarters. The labour market continues to improve. Unemployment has fallen and the number of people in job retention schemes is down significantly from the peak last year. This supports the prospect of higher incomes and increased spending. But, both the number of people in the labour force and the hours worked in the economy remain below their pre-pandemic levels.

To sustain the recovery, targeted and coordinated fiscal support should continue to complement monetary policy. This support will also help the economy adjust to the structural changes that are under way. An effective implementation of the Next Generation EU programme and the “Fit for 55” package will contribute to a stronger, greener and more even recovery across euro area countries.

Inflation

Euro area inflation increased to 3.4% in September and is expected to rise further this year. But while the current phase of higher inflation will last longer than originally expected, inflation is expected to decline in the course of next year. The upswing in inflation largely reflects a combination of three factors. First, energy prices – especially for oil, gas and electricity – have risen sharply. In September, energy inflation accounted for about half of overall inflation. Second, prices are also going up because recovering demand related to the reopening of the economy is outpacing supply. These dynamics are especially visible in the prices of consumer services, as well as the prices of goods affected most strongly by supply shortages. And finally, base effects related to the end of the VAT cut in Germany are still contributing to higher inflation. The influence of all three factors is expected to ease in the course of 2022 or to fall out of the year-on-year inflation calculation. As the recovery continues, the gradual return of the economy to full capacity will underpin a rise in wages over time. Market and survey-based measures of longer-term inflation expectations have moved closer to 2%. These factors will support underlying inflation and the return of inflation to the ECB’s 2% target over the medium term.

Risk assessment

The recovery continues to depend on the course of the pandemic and further progress with vaccinations. The Governing Council sees the risks to the economic outlook as broadly balanced. In the near term, supply bottlenecks and rising energy prices are the main risks to the pace of recovery and the outlook for inflation. If supply shortages and higher energy prices last longer, these could slow down the recovery. At the same time, if persistent bottlenecks feed through into higher than anticipated wage rises or the economy returns more quickly to full capacity, price pressures could become stronger. However, economic activity could outperform current expectations if consumers become more confident and save less than currently expected.

Financial and monetary conditions

Growth and medium-term inflation dynamics still depend on favourable financing conditions for all sectors of the economy. Market interest rates have increased. Nevertheless, financing conditions for the economy remain favourable, not least because bank lending rates for firms and households remain at historically low levels.

The forward curve of the benchmark euro short-term rate (€STR) steepened significantly during the review period, which in part reflected market participants’ repricing of an earlier rise in policy interest rates. At the same time, longer-term nominal risk-free rates – as well as sovereign bond yields – rose on the back of a marked rise in inflation compensation. Equity prices for non-financial corporations and corporate bond spreads remained broadly unchanged, while bank equity prices increased. The euro depreciated in trade-weighted terms.

Money creation in the euro area continued to normalise in September 2021, reflecting an improving situation regarding the pandemic and policy support measures. Eurosystem asset purchases remained the dominant source of money creation.

While there was a pick-up in September, lending to firms remains moderate. This continues to reflect the fact that firms generally need less external funding, since these have high cash holdings and are increasingly retaining their earnings. Lending to households remains strong, driven by demand for mortgages. The most recent euro area bank lending survey shows that credit conditions for firms stabilised and were supported – for the first time since 2018 – by a reduction in banks’ risk perceptions. By contrast, banks are taking a slightly more cautious approach to housing loans and have tightened their lending standards for these loans accordingly. Bank balance sheets continue to be supported by favourable funding conditions and remain solid.

Monetary policy decisions

Against this background, at its monetary policy meeting in October, the Governing Council continued to judge that favourable financing conditions can be maintained with a moderately lower pace of net asset purchases under the pandemic emergency purchase programme (PEPP) than in the second and third quarters of this year.

The Governing Council also confirmed its other measures to support the ECB’s price stability mandate, namely the level of the key ECB interest rates, the Governing Council’s forward guidance on their likely future evolution, Eurosystem purchases under the asset purchase programme (APP), the Governing Council’s reinvestment policies and its longer-term refinancing operations.

The Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation stabilises at the ECB’s 2% target over the medium term.

1 External environment

At the global level, economic activity is decelerating owing to combination of factors, most prominently persistent supply bottlenecks. The Purchasing Managers’ Index data for August and September suggest that momentum moderated in advanced economies, although it remained above its historical average, while it was softer in emerging market economies. At the same time, global supplier delivery times remained at record highs in September, owing primarily to strong demand but also reflecting persistent supply constraints. World trade growth also continued to soften, albeit from still elevated levels. Price pressures are still elevated on account of increasing food and energy inflation, reflecting the rebound from the low price levels recorded immediately after the onset of the coronavirus (COVID-19) pandemic. Most of the price pressures are judged to be of a temporary nature.

Global economic activity is decelerating owing to a combination of factors, most prominently persistent supply bottlenecks. The moderating growth momentum partly reflects a normalisation from the post-COVID-19 rebound as base and re-opening effects fade and stimulus wanes. At the same time, adverse idiosyncratic factors in selected major economies – such as COVID-19 resurgences, labour shortages and a property sector slowdown – imply rising downside risks to the outlook. These are reinforced by broad-based supply chain disruptions. Box 1 presents an assessment of the scarring effects of the pandemic at a global level. It concludes that global potential output has declined during the pandemic, albeit less than during the Great Recession and mostly on account of temporary factors.

The slowdown in the global recovery is reflected in survey data. The global composite output Purchasing Managers’ Index (PMI) – excluding the euro area – confirmed that growth momentum moderated in advanced economies in August and September (Chart 1), although it remained well above its historical average. Growth momentum in emerging market economies remained softer than in advanced economies, especially in manufacturing. Specifically, industrial production momentum continued to soften in advanced economies in July, while it contracted for the third consecutive month in emerging markets.

Supply bottlenecks show no signs of normalisation. Global supplier delivery times remained at record highs in September. According to internal estimates, demand factors account for about two-thirds of the lengthening of delivery times. Supply constraints are proving to be rather persistent, given that pre-existing bottlenecks, such as the semiconductor shortage, are being compounded by other factors, namely global strains in energy markets, rising labour shortages and, in some regions, pandemic-related disruptions, such as factory and port closures.

Chart 1

Global composite output PMI (excluding the euro area)

(diffusion indices)

Sources: Markit and ECB calculations.

Note: The latest observations are for September 2021.

World trade growth continues to soften, albeit from still-elevated levels. Although world (excluding the euro area) merchandise import volumes were still above their pre-pandemic levels and picked up slightly in August, trade growth momentum (measured in three-month-on-three-month terms) remained in negative territory (Chart 2). The volume of merchandise trade has decreased since the peak recorded in March. The moderation in global trade activity is confirmed by the global manufacturing new export orders PMI, which in the third quarter was, on average, just above the expansionary threshold. At the same time, new data from the World Trade Organization (WTO) point to a steady increase in commercial services trade in the second quarter, although it remains 20 percentage points below its pre-pandemic level.

Chart 2

Surveys and global trade in goods (excluding the euro area)

(left-hand scale: three-month-on-three-month percentage changes; right-hand scale: diffusion indices)

Sources: Markit, CPB Netherlands Bureau for Economic Policy Analysis and ECB calculations.

Note: The latest observations are for August 2021 for global merchandise imports and September 2021 for the PMIs.

Global price pressures remain elevated. Annual consumer price index (CPI) inflation in the countries of the Organisation for Economic Co-operation and Development (OECD) increased marginally in August to 4.3% on account of increasing food and energy inflation, still reflecting the rebound from the low price levels recorded after the COVID-19 outbreak. Meanwhile, core inflation remained stable at 3.1%, unchanged since June. Most of the current price pressures are still seen as temporary. Nevertheless, inflation expectations for 2022 slightly increased in advanced economies in September. At the same time, input and output prices from PMIs for advanced economies remained close to historically high levels, amid record-high freight rates, while price pressures again rose in emerging markets.

Oil prices climbed on the back of demand and supply factors. Oil prices have increased to well above pre-pandemic levels since the Governing Council meeting in September, supported by the ongoing global economic recovery and substitution from gas to oil amid high gas prices. On the supply side, OPEC+ failed to reach its targets in August and September, mainly owing to capacity problems in Nigeria and Angola. Moreover, at its October meeting OPEC+ indicated that it would stick to its existing plan, resisting calls to further lift its production targets to stabilise energy prices. In the United States, the recovery in shale oil production has been sluggish and supply was further interrupted by Hurricane Ida. Food and metal prices have also increased since the last Governing Council meeting, with higher energy input costs more prominently supporting copper and aluminium prices.

In the United States, the economic recovery is moderating amid supply chain constraints and the surge in Delta variant cases. COVID-19 cases increased at the start of the third quarter, leading to a plunge in consumer confidence and lower spending, especially in vulnerable industries. In addition, household disposable income fell in real terms in August, as unemployment benefits fell back to pre-COVID-19 levels. These two factors, together with the ongoing challenges along supply chains, are expected to weigh on activity in the second half of the year. Annual headline CPI remained high at 5.4% in September, while inflation less food and energy remained unchanged at 4.0%. In month-on-month terms, inflation increased in September after having decreased in August. Supply chain disruptions represent an upside risk to future inflation. However, although households’ short-term inflation expectations have risen recently, longer-term expectations have remained well anchored so far.

In the United Kingdom, the economy is slowing following a strong rebound in the second quarter of 2021. UK GDP rebounded sharply by 5.5% in the second quarter of 2021, which also reflected an improved trade balance. However, the combination of the Delta variant spike, labour shortages and broader supply-side disruptions led to a moderation of growth to 0.4% month on month in August. Retail sales and business and consumer confidence surveys also signal a slowdown in the third quarter. Annual UK CPI, the Bank of England’s target inflation rate, eased to 3.1% in September, while core CPI inflation dropped to 2.9%. The slowdown in the annual rate of headline inflation in September was mainly driven by a lower contribution from restaurant and hotel prices, which was only partially offset by an increase in transport prices.

In Japan, a firmer recovery is no longer expected until nearer the end of the year amid headwinds from lingering supply bottlenecks. A surge in new infections in the early summer and the expansion of the latest state of emergency weighed on mobility and consumption in August. Given that the number of cases has steadily decreased, consumption is expected to recover to some extent in September, as indicated by the latest survey data. As a result, the economy is expected to move towards a broader recovery by the end of the year. Annual headline inflation returned to positive territory in September (0.2%), partly reflecting a higher energy price contribution and increasing food prices. However, core inflation declined marginally to -0.8% in September.

In China, GDP decelerated in the third quarter. Economic activity rose by 0.2% in quarter-on-quarter terms in the third quarter (4.9% year on year), compared with 1.2% in the previous quarter. The slowing momentum is related to the COVID-19 outbreak, power shortages and the property sector slowdown. Monthly indicators for September point to a gradual pick-up in retail sales since July. By contrast, industrial production and investment continued to decelerate. Rising uncertainties related to real estate activity and energy constraints are increasing downside risks for the near-term growth outlook. CPI inflation decreased to 0.7% year on year in September, pointing to subdued inflation, which was due largely to base effects and ongoing food price deflation amid normalising pork prices. By contrast, producer price index (PPI) inflation increased to 10.7% year on year, the highest rate of increase in around 25 years, mainly on the back of strong price increases in coal and other energy-intensive industries.

2 Financial developments

Against the backdrop of rising inflationary pressures as the dominant theme in the financial markets during the review period, the forward curve of the benchmark euro short-term rate (€STR) steepened significantly, mainly reflecting market participants pricing in an earlier rise in policy interest rates. Likewise, longer-term nominal risk-free rates – and with them sovereign bond yields – rose on the back of a marked rise in inflation compensation. Equity prices for non-financial corporations and corporate bond spreads remained broadly unchanged in the review period, while bank equity prices increased. The euro depreciated in trade-weighted terms.

The benchmark €STR and euro overnight index average (EONIA) averaged -57 and -49 basis points respectively over the review period (9 September to 27 October 2021).[1] Excess liquidity increased by approximately €20 billion to around €4,424 billion, mainly reflecting asset purchases under the pandemic emergency purchase programme (PEPP) and the asset purchase programme (APP), as well as the €97.57 billion take-up of the ninth operation under the third series of targeted longer-term refinancing operations (TLTRO III). However, the growth in excess liquidity was substantially curtailed by €79.24 billion in early repayments of funds borrowed under previous TLTRO III operations and a net decline in other assets of around €107 billion over the review period.

The €STR forward curve steepened considerably, with market participants, in response to rising near-term inflationary pressures, pricing in an earlier rise in policy interest rates. The forward curve implies that the €STR remains at its current level (-57 basis points) until June 2022, after which it increases and reaches 26 basis points at the end of 2027. On the back of a significant increase in market-based measures of inflation compensation, the timing of the €STR exceeding its current level by 10 basis points, as reflected in the forward curve, has shifted from the beginning of 2024 to late 2022, and now stands more than a year earlier than at the beginning of the review period.

Long-term sovereign bond yields broadly mirrored the development of nominal risk-free rates (Chart 3). Over the review period, the GDP-weighted euro area and German ten-year sovereign bond yields increased by 20 and 19 basis points to 0.20% and -0.18% respectively, while ten-year sovereign bond yields in Spain and Portugal increased by 16 and 18 basis points respectively. These increases broadly mirrored developments in long-term risk-free interest rates, with the ten-year nominal overnight index swap (OIS) rate increasing by 16 basis points to 0.08%. Over the same period, ten-year US government bond yields increased by 25 basis points to 1.55%, while ten-year UK government bond yields rose by 24 basis points to 0.98%. The marginally smaller increase in euro area sovereign bond yields relative to the United States and the United Kingdom can be attributed to market participants pricing in an earlier monetary policy normalisation in the United States and the United Kingdom than in the euro area. Euro area bond markets smoothly absorbed the EU’s successful auction of its first Next Generation EU green bond, the largest green bond issue on record.

Chart 3

Ten-year sovereign bond yields

(percentages per annum)

Sources: Refinitiv and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 9 September 2021. The latest observation is for 27 October 2021.

Long-term euro area sovereign bond spreads relative to OIS rates edged up slightly. The German ten-year sovereign bond spread became slightly less negative, ending the review period at -0.25%. The French and Italian ten-year bond spreads over the corresponding OIS rate widened by 4 and 6 basis points to 0.09% and 0.82% respectively. Overall, changes in individual sovereign spreads to risk-free rates were limited, as also reflected in the aggregate ten-year euro area GDP-weighted sovereign bond spread, which widened by 4 basis points to 0.12%. This metric remains close to the very low levels observed at the beginning of the review period and significantly below the levels prevailing before the start of the coronavirus (COVID-19) crisis.

Equity prices of non-financial corporations remained broadly unchanged over the review period, while bank equity prices recorded strong gains. The negative impact of higher discount rates on equity prices was counterbalanced by stronger earnings growth expectations in both the euro area and the United States. Non-financial stock prices remained broadly unchanged, continuing to stand close to record high levels. While higher discount rates weighed on equity prices more generally, bank equity prices increased by 6% in the euro area and by 12% in the United States. Over the second half of September, the impact of a potential default by Chinese property developer Evergrande had weighed on global capital markets, as reflected in temporarily higher price volatility, but was later perceived as sufficiently contained by the Chinese authorities.

Both financial and non-financial corporate bond spreads remained broadly unchanged over the review period, standing below their pre-pandemic levels. Spreads (relative to the risk-free rate) on investment-grade financial and non-financial bonds stood at 49 and 39 basis points respectively at the end of the review period, well below their pre-pandemic levels. Overall, investors and rating agencies appear to remain optimistic about the profitability and credit outlook for euro area corporates.

In foreign exchange markets, the euro depreciated in trade-weighted terms (Chart 4), reflecting a broad-based weakening against several major currencies. Over the review period the nominal effective exchange rate of the euro, as measured against the currencies of 42 of the euro area’s most important trading partners, weakened by 0.9%. The euro depreciated against the US dollar (by 1.8%), continuing its recent downward trend and reflecting market expectations of a faster normalisation of US monetary policy relative to the euro area. The euro also weakened against other major currencies, including the Chinese renminbi (by 2.8%), the Swiss franc (by 1.8%) and the pound sterling (by 1.2%), and strongly depreciated (by 5.5%) against the Russian rouble, which displayed broad-based strength in the context of the recent increase in energy prices. Over the same period the euro appreciated significantly against the Turkish lira (by 9.9%) and the Brazilian real (by 2.9%), amid their recent broad-based volatility. The euro also continued appreciating against the currencies of several non-euro area EU Member States, including the Hungarian forint (by 3.8%), the Polish zloty (by 1.9%) and the Czech koruna (by 1.1%).

Chart 4

Changes in the exchange rate of the euro vis-à-vis selected currencies

(percentage changes)

Source: ECB.

Notes: EER-42 is the nominal effective exchange rate of the euro against the currencies of 42 of the euro area’s most important trading partners. A positive (negative) change corresponds to an appreciation (depreciation) of the euro. All changes have been calculated using the foreign exchange rates prevailing on 27 October 2021.

3 Economic activity

Economic activity in the euro area continued its recovery path in the third quarter of 2021 after having expanded by 2.1%, quarter on quarter, in the second quarter. The lifting of pandemic-related restrictions, high vaccination rates and reduced fear of contagion enabled contact-intensive market services and tourism to rebound strongly in the summer months. At the same time, production in the manufacturing sector has continued to be held back by shortages of materials, equipment and labour, as well as by rising transport costs and energy prices.

Output growth is expected to remain dynamic in the period ahead, albeit slowing towards the end of the year. Consumer spending, particularly for services, continues to rebound and consumer confidence is strong, although the impact of the higher oil prices may reduce households’ purchasing power. At the same time, the labour market continues to improve, which supports the prospect of higher incomes and increased spending. Moreover, the recovery in domestic and global demand is supporting business investment, but supply-side constraints continue to weigh on production and trade, particularly in the capital goods sector.

To sustain the recovery, targeted and coordinated fiscal support should continue to complement monetary policy. This support will also help the economy adjust to the structural changes that are under way. An effective implementation of the Next Generation EU programme and the “Fit for 55” package will contribute to a stronger, greener and more even recovery across euro area countries.

The risks to the euro area growth outlook are seen as broadly balanced. Nevertheless, the pandemic-related uncertainties remain high. The pace of the recovery could be slowed by downside risks relating to supply bottlenecks and rising energy prices. However, greater than expected dissaving by consumers could lead to a stronger expansion than currently envisaged.

Following two quarters of falling output, euro area real GDP rebounded in the second quarter of 2021 and is estimated to have strengthened further in the third quarter.[2] In the second quarter economic activity rebounded, with GDP rising by 2.1%, quarter on quarter. This outcome more than offset the 0.7% cumulative fall over the two previous quarters. However, GDP was still 2.7% below the pre-pandemic peak seen at the end of 2019 (Chart 5). The expenditure breakdown shows that domestic demand was the main contributor to growth alongside a small positive contribution from net trade. At the same time, changes in inventories contributed negatively to growth in the second quarter, following two quarters of strong positive contributions. The rise in activity in the second quarter was broad-based across countries.

Chart 5

Euro area real GDP, composite output PMI and ESI

(left-hand scale: quarter-on-quarter percentage changes; right-hand scale: diffusion index)

Sources: Eurostat, European Commission, Markit and ECB calculations.

Notes: The two lines indicate monthly developments; the bars show quarterly data. The European Commission’s Economic Sentiment Indicator (ESI) has been standardised and rescaled to have the same mean and standard deviation as the Purchasing Managers’ Index (PMI). The latest observations are for the second quarter of 2021 for real GDP, September 2021 for the ESI and October 2021 for the PMI.

The combination of hard data, survey results and high-frequency indicators point to continued strong GDP growth in the third quarter of this year, before a moderation in the fourth quarter. This outcome would reflect the increased vaccination rates and declining infection rates in the third quarter that enabled the observed relaxation of containment measures. Growth in the third quarter is likely to have been mainly driven by the services sector, as part of the manufacturing sector remained affected by supply-side bottlenecks. These bottlenecks, together with labour shortages, are likely to curb output growth towards the end of the year, while any offsetting impact from the services sector might be less pronounced given that the fourth quarter typically is a less tourism-intense period. Box 5 provides a more in-depth review of the role of contact-intensive services in the recovery. Companies operating in the non-financial sector broadly confirm this overall narrative about the short-term outlook (see Box 2).

Turning to the most recent monthly data, industrial production fell by 1.6%, month on month, in August after a similar-sized increase in July. The more timely composite output Purchasing Managers’ Index (PMI) rose to 58.4 in the third quarter of 2021, up from 56.8 in the second quarter, reflecting falling manufacturing output (to 58.6) and rising activity in services (to 58.4). However, in October the PMI declined further, reaching 54.3, driven by developments in both services business activity and manufacturing output. Manufacturing supply bottlenecks, as captured by the PMI suppliers’ delivery times index, intensified in October. A record high level of stocks of purchases in manufacturing was recorded in October, suggesting additional inventory building to deal with potential supply shortages. The European Commission’s Economic Sentiment Indicator (ESI) also increased from the second to the third quarter, remaining well above the pre-pandemic level seen in February last year. This rise was broad-based across its components, with the largest increase recorded for services. At the same time, high-frequency indicators related to consumption stabilised at around pre-pandemic levels in the third quarter, signalling stronger demand for services (e.g. recreation, restaurants and hotels) than for goods (e.g. passenger cars).

The unemployment rate in the euro area declined in August, still supported by job retention schemes.[3] The rate stood at 7.5% in August, 0.1 percentage points lower than in July (Chart 6) and around 0.1 percentage points higher than before the pandemic in February 2020. The number of workers in job retention schemes is declining and represented around 2% of the labour force in August. Employment increased by 0.7% in the second quarter of 2021, following a decrease of 0.1% in the first quarter.[4] Total hours worked increased by 2.3% in the second quarter, following a 0.3% decline in the first quarter of 2021. These recent developments reflect the impact of the relaxation of pandemic-related restrictions following the vaccination campaigns. However, total hours worked in the second quarter of 2021 remained 4.1% below the level recorded in the fourth quarter of 2019. Similarly, labour force participation in the second quarter of 2021 was still lower than pre-crisis levels by around 1.4 million people.[5]

Chart 6

Euro area employment, the PMI employment indicator and the unemployment rate

(left-hand scale: quarter-on-quarter percentage changes, diffusion index; right-hand scale: percentages of the labour force)

Sources: Eurostat, Markit and ECB calculations.

Notes: The two lines indicate monthly developments; the bars show quarterly data. The PMI is expressed as a deviation from 50 divided by 10. The latest observations are for the second quarter of 2021 for employment, October 2021 for the PMI and August 2021 for the unemployment rate.

Short-term labour market indicators have continued to improve. The monthly composite PMI employment indicator, encompassing industry and services, increased to 56.1 in October from 54.4 in September, thus remaining above the threshold level of 50 that indicates an expansion in employment. The PMI employment index has recovered significantly since its all-time low in April 2020 and stood in expansionary territory in October 2021 for the ninth consecutive month.

Household spending continued to rebound in the third quarter, reflecting high vaccination rates and reduced fear of infection. Following a few weaker readings, consumer confidence rose again to -4.0 in September (after -5.3 in August). Retail sales in July and August stood on average 0.1% above their level in the second quarter, reflecting the rebalancing from goods to services. Spending on holidays continued to rise during the summer, in line with improving business confidence in the accommodation and travel services sectors. Looking ahead, households remain confident about their financial situation despite rising energy prices. The extent to which the current surge in energy prices may slow down the recovery in private consumption depends on whether the price increases are the consequence of higher aggregate demand or disruptions in energy supply. The European Commission’s consumer survey suggests that the current rise in consumer prices has so far largely been driven by higher economic activity, given elevated levels of household expectations regarding both economic activity and their own financial situation. This stands in stark contrast with, for example, the response at the time of the Iraqi invasion of Kuwait in 1990, when severe disruptions in oil supply led households to immediately revise down their expectations regarding income and activity.

Corporate investment continued to be hampered by supply-side disruptions during the third quarter. In July and August 2021 capital goods production fell on average by 1.2% relative to the second quarter. The PMI for new orders of capital goods continuously declined during the summer months, amid persistent supply chain bottlenecks, although it remained at high levels. At the same time, the ESI is near its all-time high and the assessment of order books according to the Commission’s industry survey has increased recently, indicating ongoing strong demand for capital goods. On balance, the available indicators suggest that business investment growth remained in positive territory in the third quarter. Developments in supply-side disruptions will remain a crucial source of uncertainty for investment dynamics over the next few quarters. Since the beginning of 2021 there has been an increasing divergence between capital goods production and supplier delivery times supporting the view that the supply-side disruptions, which have caused a lengthening of intermediate input delivery times, are likely hampering capital goods production and business investment. To the extent that supply bottlenecks are expected to be resolved only gradually, they could continue to weigh on future business investment.

Housing investment continued to be affected by supply bottlenecks in the third quarter, in an environment of buoyant demand. Housing investment had already exceeded the pre-crisis level recorded in the last quarter of 2019 by more than 2% in the second quarter of 2021.[6] Although robust demand continued to support the recovery, supply constraints increasingly hampered construction activity in the third quarter. In July and August building activity was, on average, around 1% below its level in the second quarter. According to the PMI for construction output, available up to September, supply bottlenecks materialised in historically long delivery times and high input prices. Furthermore, the European Commission’s construction survey, available up to September, suggests that the main limits to production were shortages of materials and workers, with only negligible constraints from demand. The uncertain evolution of the balance between supply-side headwinds and demand-side tailwinds entails high uncertainty around the short-term prospects for housing investment. On the one hand, persistent bottlenecks may lead to further rises in construction costs, thus denting profitability for firms, and put upward pressure on house prices, hence reducing affordability for households. On the other hand, favourable financing conditions and income support measures, as well as a large stock of accumulated savings, could further sustain demand, as shown by households’ intentions to purchase and renovate houses, which are well above their pre-pandemic levels.[7]

The recovery in euro area trade continues at two speeds, with exports of goods remaining subdued and exports of services rebounding somewhat. Euro area total exports increased by 2.7%, quarter on quarter, in the second quarter of 2021. However, goods exports momentum slowed at the end of the second quarter, and available data for July and August point to continued weak trade developments in the third quarter of 2021. Volumes of euro area exports and imports fell in July, and the decline was broad-based across major trading partners and goods categories. The weakness can be attributed to declining foreign demand for euro area products, visible in global imports (excluding the euro area) and order-based forward-looking indicators that have also moderated. Moreover, shipping and input-related bottlenecks continued to exert a drag, in particular on euro area goods trade, in the third quarter.[8] Leading indicators for services trade have also moderated somewhat yet continue to signal some rebound in the third quarter of 2021, driven by tourism.

The euro area economy is expected to continue its recovery path, supported by monetary and fiscal policies. At the same time, the pandemic may produce more lasting shifts in demand that could lead to lingering supply and demand imbalances across sectors. To support the recovery, ambitious, targeted and coordinated fiscal policy should continue to complement monetary policy. The results of the latest round of the Survey of Professional Forecasters (conducted in early October) show that GDP growth forecasts have been revised upwards for 2021, while remaining broadly unchanged for 2022 and 2023, relative to the previous round conducted in early July.

4 Prices and costs

According to Eurostat’s final release for September, euro area annual HICP inflation increased further to 3.4% in September, up from 3.0% in August 2021. Inflation is expected to rise further this year. While the current phase of higher inflation will last longer than originally expected, inflation is expected to decline in the course of next year. The upswing in inflation largely reflects a combination of three factors. First, energy prices have risen sharply and accounted for about half of overall inflation in September. Second, prices are going up because recovering demand related to the reopening of the economy is outpacing supply. These dynamics are especially visible in the prices of consumer services, as well as the prices of goods affected most strongly by supply shortages. Finally, base effects related to the end of the VAT cut in Germany are still contributing to higher inflation. The influence of all three factors is expected to ease in the course of 2022 or to fall out of the year-on-year inflation calculation. As the recovery continues, the gradual return of the economy to full capacity will underpin a rise in wages over time. Market and survey-based measures of longer-term inflation expectations have moved closer to 2%. These factors will support underlying inflation and the return of inflation to our target over the medium term.

Annual HICP inflation increased further in September, owing to higher growth in energy and services prices (Chart 7). According to Eurostat’s final release for September, the increase in headline HICP inflation to 3.4%, up from 3.0% in August, mainly reflects higher inflation for energy, amounting to an annual rate of change of 17.6% in September compared with 15.4% in August. However, HICP inflation excluding food and energy (HICPX) also increased further from 1.6% in August to 1.9% in September, as a result of stronger increases in services prices which stood at 1.7% in September, up from 1.1% in August. At the same time, the increase in non-energy industrial goods (NEIG) prices slowed to 2.1% in September, down from 2.6% in the previous month. In September, annual growth in food prices remained at 2.0%, while there was a decline in the dampening effect on inflation of changes in HICP weights. Using 2020 HICP weights, the September outcomes for headline HICP inflation and HICPX would have been 0.3 and 0.2 percentage points higher respectively, compared with 0.5 and 0.6 percentage points higher in August.[9]

Chart 7

Headline inflation and its components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: Contributions of HICP components are computed using HICP weights for 2020. The impact of the changes in weights is estimated by the ECB. The latest observations are for September 2021.

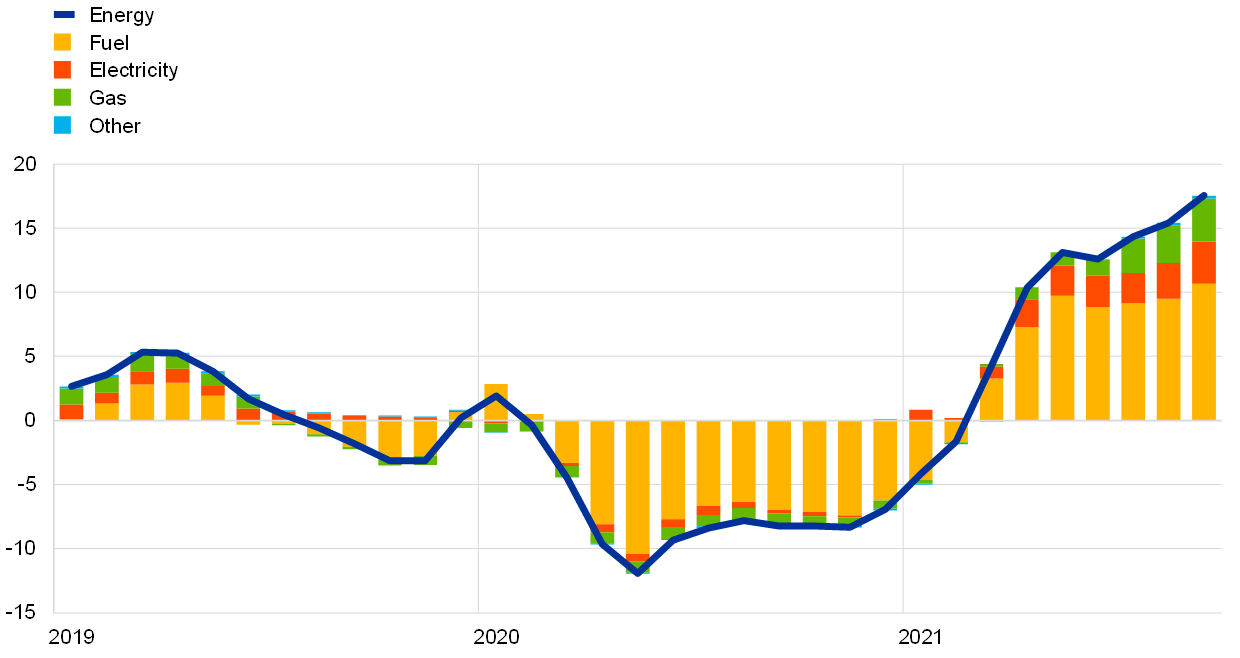

The surge in the energy components of HICP energy is broad-based, reflecting increases in the prices of energy commodities. Globally, energy commodity prices dropped sharply at the onset of the pandemic in 2020. They then started to recover at the end of 2020 and continued to increase in 2021. As prices have risen from the low levels recorded in 2020, these dynamics have resulted in a strong upward base effect, to a large extent explaining the current buoyant annual growth rates. However, current prices for energy commodities have surpassed pre-pandemic levels. The all-time high for HICP energy of 17.6% in September can be attributed to increases in the gas, electricity and fuel HICP components (Chart 8). Until May, the surge was driven mainly by an increase in the fuel component, reflecting the rebound in oil prices. Over more recent months, the contribution of the fuel component remained high, accompanied by increases in the gas and electricity components. The extent to which these increases translate into changes in consumer prices varies greatly from one country to another, and the impact is often lagged.

Chart 8

Energy inflation decomposition

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: “Fuel” refers to the HICP component “liquid fuels and fuels and lubricants for personal transport equipment”. “Other” includes “solid fuels” and “heat energy” COICOP5 items. The latest observations are for September 2021.

Most indicators of underlying inflation continued to increase (Chart 9). While the temporary VAT cut in Germany from July to December 2020 continues to have a small upward impact on HICPX inflation rates in the second half of 2021, the impact of changes in weights currently has a small dampening effect. Net of these special effects, HICPX inflation would stand at 1.9%. HICPXX inflation, which also excludes travel-related items, clothing and footwear, increased to 1.9% in September from 1.8% in August. The model-based Persistent and Common Component of Inflation (PCCI), which is less affected by the changes in weights and the temporary VAT rate reduction in Germany, declined marginally from 1.7% in August to 1.6% in September. The Supercore indicator lies at the lower end of the range of measures of underlying inflation and increased for the fourth consecutive month, edging up to 1.6% in September from 1.3% in August. Most measures of underlying inflation remain below the target of 2%.[10]

Chart 9

Measures of underlying inflation

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Notes: The range of indicators includes HICP excluding energy, HICP excluding energy and unprocessed food, HICPX (HICP excluding energy and food), HICPXX (HICP excluding energy, food, travel-related items, clothing and footwear), 10% and 30% trimmed means and the weighted median. The latest observations are for September 2021.

Pipeline price pressures for HICP non-energy industrial goods continued to build up in August, proving to be longer lasting than initially thought (Chart 10). Producer prices at different stages of the pricing chain continued to rise in July and August compared with June. At the earlier input stages, the annual rate of change in producer prices for intermediate goods rose from 12.7% in July to 14.2% in August, while for intermediate goods the annual rate of change in import prices increased from 14.5% in July to 15.5% in August. Focusing on the later stages of the pricing chain, domestic producer price inflation for non-food consumer goods – a key measure of pipeline pressures in NEIG inflation – continued to increase gradually for the sixth consecutive month, rising from 2.0% in July to reach the historically high value of 2.2% in August. The annual rate of change of import prices for non-food consumer goods also increased to 2.2% in August, up from 1.3% in July, mainly reflecting an exchange rate depreciation rather than selling prices in trading partner countries. As pipeline pressures materialise in NEIG prices with a delay, further upward pressure can be expected in the near term.

Chart 10

Indicators of pipeline price pressures

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for August 2021.

Wage pressures remain subdued overall. The latest available indicators of wage growth, such as growth in compensation per employee or growth in compensation per hour, continued to be strongly affected by measures to cushion the effects of the pandemic, such as job retention schemes. In spring 2020 these schemes pushed down compensation per employee and pushed up compensation per hour, which gave rise to strong base effects in the second quarter of 2021. Accordingly, compensation per employee increased by 8% in the second quarter of 2021, while compensation per hour decreased by 3.9%. By contrast, negotiated wages were not directly affected by developments in hours worked and the recording of benefits from job retention schemes in 2020, making them a more reliable indicator of wage pressure throughout the pandemic. At the same time, one-off pandemic-related payments recently introduced some volatility into this measure. Overall, growth in negotiated wages has remained low in recent months, and it is uncertain whether the upward impacts of recent increases in consumer price inflation will pass through to wages.[11]

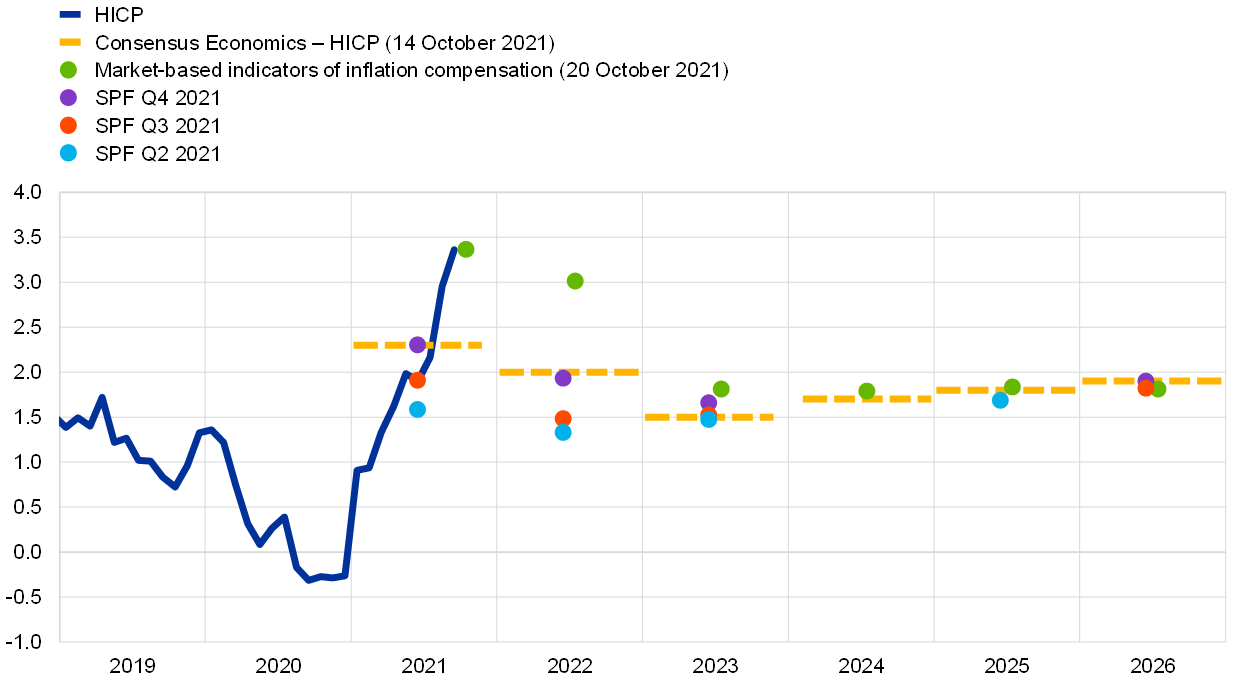

Market-based indicators of longer-term inflation expectations continued to increase further, with the five-year forward inflation-linked swap (ILS) rate five years ahead having surpassed 2% for the first time in seven years. Market-based indicators of longer-term inflation expectations reached new highs. Over the review period, the five-year forward ILS rate five years ahead rose above 2%, a level not seen since August 2014, and stood at 2.1% on 27 October 2021. While ILS rates rose across the maturity spectrum, the increase was most pronounced in short and medium-term maturities, in line with a transient but more persistent increase in near-term inflation. Markets priced in a stronger and longer transitory rise in near-term inflation compensation than at the beginning of the review period. The increase in market-based indicators of inflation expectations, particularly in the near term, can mainly be attributed to ongoing supply-demand imbalances, namely, more persistent supply bottlenecks and rising energy prices. Nevertheless, over the next five years, inflation options markets still signal around a 40% risk-neutral probability of average inflation in the euro area staying below 2%, with the probability of inflation exceeding 3% having increased to 11%. According to the ECB Survey of Professional Forecasters (SPF) for the fourth quarter of 2021, inflation expectations have been revised upwards across the forecast horizon (Chart 11). HICP inflation expectations stand at 2.3%, 1.9% and 1.7% for 2021, 2022 and 2023 respectively. Compared with the previous round, this is an increase of 0.4 percentage points for 2021 and 2022 and 0.2 percentage points for 2023. Respondents attributed the upward revisions mainly to higher energy prices and the impact of supply chain tensions. Regarding the near-term inflation outlook, many respondents reported that they expected a further increase in the inflation rate in the last months of 2021, but continue to expect a sharp fall in inflation in the course of 2022. SPF five years ahead inflation expectations increased from 1.8% to 1.9%, moving closer to the 2% target.

Chart 11

Survey-based indicators of inflation expectations and market-based indicators of inflation compensation

(annual percentage changes)

Sources: Eurostat, Thomson Reuters, Consensus Economics, ECB (SPF) and ECB calculations.

Notes: The market-based indicators of the inflation compensation series are based on the one-year spot inflation rate and the one-year forward rate one year ahead, the one-year forward rate two years ahead, the one-year forward rate three years ahead and the one-year forward rate four years ahead. The latest observations for market-based indicators of inflation compensation are for 20 October 2021. The ECB SPF for the fourth quarter of 2021 was conducted between 1 and 11 October 2021. The Consensus Economics cut-off date is 14 October 2021.

5 Money and credit

Money creation in the euro area continued to normalise in September 2021, reflecting an improving situation regarding the coronavirus (COVID-19) pandemic and policy support measures. Eurosystem asset purchases remained the dominant source of money creation. Growth in loans to the private sector stabilised at pre‑pandemic levels and benefited from favourable financing conditions. Moreover, according to the euro area bank lending survey, credit standards remained broadly unchanged for loans to firms and tightened somewhat for housing loans in the third quarter of 2021, while demand for loans by firms and households continued to increase.

In September 2021 broad money growth moderated further. The annual growth rate of M3 declined to 7.4% in September, down from 7.9% in August (Chart 12), as it continued to be affected by negative base effects linked to the exceptional increase in liquidity between March and September 2020. The quarterly pace of money growth moved closer to its longer-term average, with shorter-run dynamics of M3 continuing to benefit from the significant support provided by monetary, fiscal and prudential policies. On the components side, the main driver of M3 growth was the narrow aggregate M1, which includes the most liquid components of M3. Having already started to moderate in the second quarter of 2021 from the high growth rates observed during the first year of the pandemic, the annual growth rate of M1 remained stable at 11.0% in September, mainly as a result of strong growth in overnight deposits. In the same month, although the contribution of other short-term deposits remained negative, notably owing to time deposits, marketable instruments continued to make a small contribution to annual M3 growth, reflecting the low level of interest rates and investors’ search-for-yield behaviour.

Money creation continued to be driven by Eurosystem asset purchases. As in previous quarters, the largest contribution to M3 growth came from the Eurosystem’s net purchases of government securities under the asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP) (red portion of the bars in Chart 12). Further support for M3 growth came from credit to the private sector (blue portion of the bars). Bank credit to general government continued to make a negative contribution to money creation, owing to sales of government bonds and reduced issuance of government securities (light green portion of the bars). Net external monetary flows also had a slight negative impact on money creation, coinciding with a weakening of the effective euro exchange rate (yellow portion of the bars). However, other counterparts supported broad money growth (dark green portion of the bars), as favourable conditions for targeted longer‑term refinancing operations provided incentives for the substitution of bank funding away from longer-term liabilities.

Chart 12

M3 and its counterparts

(annual percentage changes; contributions in percentage points; adjusted for seasonal and calendar effects)

Source: ECB.

Notes: Credit to the private sector includes monetary financial institution (MFI) loans to the private sector and MFI holdings of securities issued by the euro area private non-MFI sector. As such, it also covers the Eurosystem’s purchases of non-MFI debt securities under the corporate sector purchase programme and the PEPP. The latest observations are for September 2021.

Loan growth to the private sector increased in September 2021. Lending to firms and households continued to benefit from favourable financing conditions and the ongoing economic recovery. Loan growth to the private sector rose to 3.2% in September, up from 3.0% in August, driven by lending to firms and reflecting a positive base effect (Chart 13). The annual growth rate of loans to firms reached 2.1% in September, up from 1.5% in August, supported by a rise in longer-term loans. Despite that increase, the high cash balances and the availability of other non-bank funding sources might still weigh on firms’ demand for bank loans. At the same time, the growth rate of loans to households edged down slightly to 4.1% in September (Chart 13). The growth in household borrowing was due mainly to a rise in mortgage lending, as consumer credit growth remained weak. This is attributable to the fact that the recovery has become less credit intensive, with households instead tending to finance their consumption with their disposable income and savings accumulated during the pandemic. Overall, loan developments are masking considerable differences across euro area countries, which, among other things, is a reflection of the uneven impact of the pandemic and progress of the economic recovery across countries.

Chart 13

Loans to the private sector

(annual percentage changes)

Source: ECB.

Notes: Loans are adjusted for loan sales, securitisation and notional cash pooling. The latest observations are for September 2021.

According to the October 2021 euro area bank lending survey, credit standards for loans to firms and to consumers remained broadly unchanged, while those for housing loans tightened somewhat in the third quarter of 2021 (Chart 14). Following a strong tightening in the earlier stages of the pandemic, credit standards for loans to firms remained broadly unchanged for the second consecutive quarter. This reflects an overall improvement in the euro area economy as containment measures have been gradually lifted and monetary, fiscal and supervisory authorities continue to provide support. Banks reported that risk perceptions and competition from other banks had had a slight net easing impact on credit standards, while banks’ cost of funds and balance sheet constraints had had a broadly neutral impact, owing to banks’ solid capital ratios and favourable funding costs. For housing loans, the net tightening of credit standards was related to banks’ risk tolerance and their cost of funds and balance sheet constraints, whereas these factors had a broadly neutral impact on consumer credit. For the fourth quarter of 2021, euro area banks expect a moderate net tightening of credit standards for loans to firms and a further tightening of credit standards for loans to households for house purchase.

The survey shows that demand for loans continued to increase in the third quarter of 2021, albeit more among households than firms. This increase is attributable to improved consumer confidence, the historically low level of interest rates and housing market prospects. Banks also indicated that firms’ financing needs for both fixed investment and inventories and working capital had contributed positively to loan demand. For the fourth quarter of 2021, banks expect a further rise in demand for loans by firms and no change in demand for loans by households for house purchase.

The survey also suggests that, on balance, the ECB’s unconventional monetary policy measures supported banks’ credit intermediation activities. Banks indicated that the ECB’s asset purchase programmes (APP and PEPP), along with the third series of targeted longer-term refinancing operations (TLTRO III) had had a positive impact on their liquidity position and market financing conditions. Furthermore, together with the negative deposit facility rate, banks reported that these measures had had an easing impact on bank lending conditions and a positive impact on lending volumes. At the same time, banks suggested that the ECB’s asset purchases and the negative deposit facility rate had had a negative impact on their net interest income, while a large percentage of banks reported that the TLTRO III operations and the two-tier system had supported bank profitability.

Chart 14

Changes in credit standards and net demand for loans (or credit lines) to enterprises and households for house purchase

(net percentages of banks reporting a tightening of credit standards or an increase in loan demand)

Source: Euro area bank lending survey.

Notes: For the bank lending survey questions on credit standards, “net percentages” are defined as the difference between the sum of the percentages of banks responding “tightened considerably” or “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” or “eased considerably”. For the survey questions on demand for loans, “net percentages” are defined as the difference between the sum of the percentages of banks responding “increased considerably” or “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” or “decreased considerably”. The latest observations are for the third quarter of 2021.

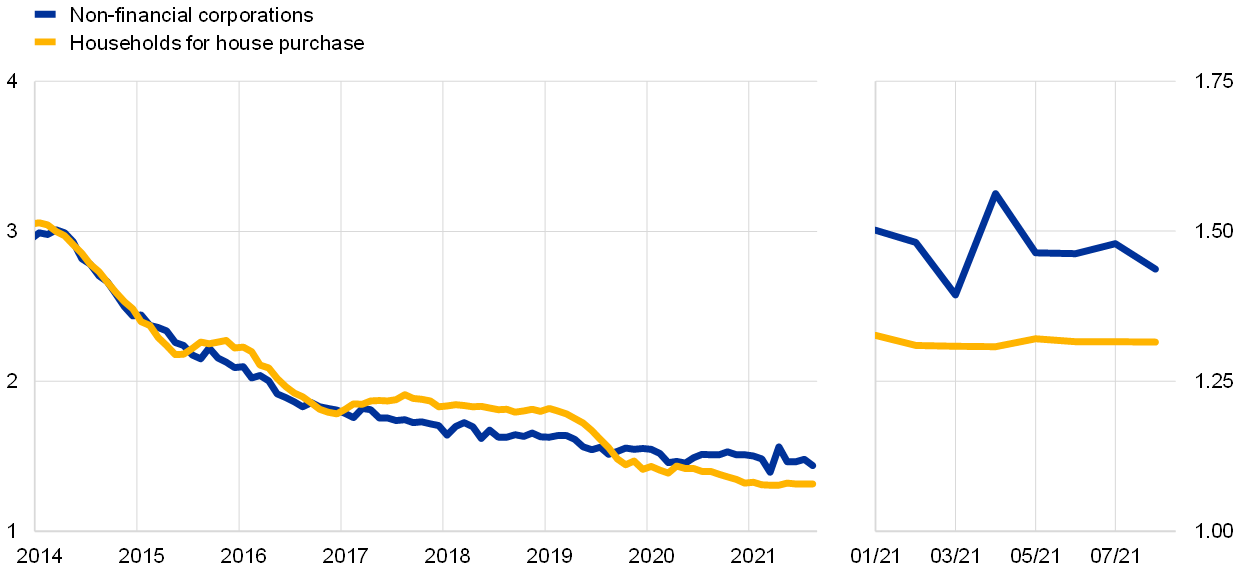

Bank lending rates have stabilised close to their historical lows. In August 2021 the composite bank lending rate fell slightly, to 1.44%, for loans to non-financial corporations and remained broadly unchanged, at 1.32%, for loans to households for house purchase (Chart 15). The decline in lending rates to firms was widespread across euro area countries. Moreover, the spread between bank lending rates on very small loans and those on large loans remained stable at low levels, mainly reflecting declines in rates on very small loans. There is still considerable uncertainty regarding the longer-term economic consequences of the pandemic, but policy support measures have prevented a broad-based tightening of financing conditions, which would have amplified the adverse impact it has had on the euro area economy.

Chart 15

Composite bank lending rates for non-financial corporations and households

(percentages per annum)

Source: ECB.

Notes: Composite bank lending rates are calculated by aggregating short and long-term rates using a 24-month moving average of new business volumes. The latest observations are for August 2021.

Boxes

1 Scarring effects of the COVID-19 pandemic on the global economy – reviewing recent evidence

The recession caused by the coronavirus (COVID-19) pandemic weighed on potential output across advanced economies and emerging market economies, but whether it will have a temporary or lasting impact remains to be seen. Taking a production function approach perspective, the decline in potential output can be explained by (i) smaller contributions from production factors (employment and capital), and/or (ii) lower technological gains (i.e. the efficiency with which inputs are combined). Although strong policy responses, particularly in advanced economies, cushioned the overall economic impact of the COVID-19 pandemic, there is still a risk of long-term output scarring. This relates, for instance, to hysteresis effects, as many workers have been at least temporarily excluded from the labour market, potentially resulting in skills losses and/or a permanent exit. While job retention schemes during the pandemic preserved employment and shielded productive but fragile firms, they might have partly hindered labour reallocation and hampered productivity. This box reviews evidence on the scarring effects of the COVID-19 shock and compares recent data relevant for determining the evolution of potential output with developments in the aftermath of the Great Recession.

More2 Main findings from the ECB’s recent contacts with non-financial companies

This box summarises the results of contacts between ECB staff and representatives of 68 leading non-financial companies operating in the euro area. The exchanges mainly took place between 4 and 13 October 2021.[12]

More3 Labour supply developments in the euro area during the COVID-19 pandemic

In this box we look at what has contributed to the evolution of labour force participation during the pandemic, as well as its outlook. This is relevant from a policy perspective as a depressed participation rate over a prolonged period could point to scarring effects in the labour market, whereas a continued recovery may help to address existing labour shortages, contain emerging wage pressures and support the economic recovery overall.

More4 The impact of the COVID-19 pandemic on labour productivity growth

The growth of euro area labour productivity, measured by real GDP per hour worked, increased at the onset of the coronavirus (COVID-19) pandemic before declining in the course of the subsequent economic recovery. [14] This contradicts the general notion of productivity being procyclical and reflects the unique nature of this crisis.[15] This box discusses the recent patterns in labour productivity and considers the extent to which some of these developments might fade or consolidate after the crisis.

More5 Economic developments and outlook for contact-intensive services in the euro area

This box takes stock of the development of economic activity in euro area contact-intensive services that were adversely affected by the pandemic. During the first wave of the coronavirus (COVID-19) pandemic, value added in the manufacturing and services sectors behaved very similarly, contracting by more than 15% in the second quarter of 2020 compared with pre-pandemic levels. However, since then the recovery paths of the two sectors have been markedly different. The rebound in services activity was interrupted around the turn of the year, as some consumer services (henceforth “more contact-intensive services”) were largely shut down as a result of the resurgence of the pandemic and the tightening of COVID-19 restrictions, while other consumer services (henceforth “less contact-intensive services”) and manufacturing continued to recover (Chart A, panel a).[16]

More6 The recovery of housing demand through the lens of the Consumer Expectations Survey

This box reports past trends and future expectations related to housing demand based on the ECB’s new Consumer Expectations Survey (CES).[18] The decisions of households to purchase a house or flat depend on many factors, including their working status and financial situation, income and wealth, and their expectations regarding the general level of prices, housing prices and mortgage credit conditions. The CES can provide micro-level insights into the purchasing decisions of households as well as some of the determining factors. For instance, the share of CES respondents who have purchased a house/flat in the past 12 months can be seen as an indicator of recent housing demand for different socioeconomic groups. Similarly, the share of respondents who intend to buy a house/flat in the next 12 months provides a forward-looking indicator of housing demand. House purchases reported by CES respondents increased between the second and third quarters of 2020 and then plateaued (Chart A, panel a). At the same time, expected purchases in the next 12 months remained relatively stable throughout the period (dark blue bars).

More7 The prevalence of private sector wage indexation in the euro area and its potential role for the impact of inflation on wages

Shocks to inflation can have longer-lasting effects in the presence of second-round effects and second-round effects are more likely in the presence of wage indexation. Second-round effects can occur if households and/or firms attempt to compensate the loss of real income incurred by higher inflation when setting wages and/or prices. The potential effects of wage indexation mechanisms on wage setting and inflation developments depend not only on the prevalence of wage indexation to inflation, but also on the inflation indicator used for indexation. This box investigates the prevalence of wage indexation mechanisms in the private sector.[19] As wage-setting mechanisms differ considerably across euro area countries, regulations across countries are analysed and a euro area indicator is derived by aggregating characteristics of national wage indexation schemes using country shares in euro area private sector employment as weights.

More8 Results of a special survey of professional forecasters on the ECB’s new monetary policy strategy

Along with the Survey of Professional Forecasters (SPF) for the fourth quarter of 2021, participants were asked to complete an additional special survey on the ECB’s new monetary policy strategy. The aim of that survey was to gain an insight into how the participants in the regular SPF have assessed the new strategy and into whether it has already had, or will have, an impact on their forecasts. The questionnaire, together with the aggregate results, is available on the “Background on the survey of professional forecasters” webpage. This box summarises some of the findings.

MoreArticles

1 The predictive power of equilibrium exchange rate models

Central banks carefully monitor the evolution of exchange rates. In the case of the European Central Bank (ECB) and other major central banks, the exchange rate is not a policy target. But the “market value” of the euro is highly relevant for understanding the medium-term inflation outlook via its impact – through import prices and through general equilibrium effects – on the real economy.

More2 Key factors behind productivity trends in euro area countries

Productivity, defined broadly as efficiency in production, plays a key role in the economic resilience and social welfare of countries.[21] Productivity growth influences the economy in important ways, affecting key variables such as output, employment and wages. Productivity is also relevant for monetary policy as it is a fundamental determinant of potential output growth and the natural rate of interest and, therefore, of the monetary policy space needed to deliver price stability over the medium term. As such, changes in productivity can influence the transmission mechanism of monetary policy and should be closely monitored.

More3 The euro area housing market during the COVID-19 pandemic

The euro area housing market was in a relatively long expansionary cycle before it entered the coronavirus (COVID-19) crisis.[22] On the eve of the COVID-19 crisis, the euro area housing market was on solid ground. In the last quarter of 2019, house prices, housing investment and housing loans were on an upward trend, supported by robust income developments and bank lending rates for house purchases at historical lows (Charts 1 and 2).[23] Given the phase in which the housing cycle stood, an economic shock like the COVID-19 crisis might have been expected to turn the cycle.

MoreStatistics

Statistical annex© European Central Bank, 2021

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

This Bulletin was produced under the responsibility of the Executive Board of the ECB. Translations are prepared and published by the national central banks.

The cut-off date for the statistics included in this issue was 27 October 2021.

For specific terminology please refer to the ECB glossary (available in English only).

ISSN 2363-3417 (html)

ISSN 2363-3417 (pdf)

QB-BP-21-007-EN-Q (html)

QB-BP-21-007-EN-N (pdf)

- The methodology for calculating the EONIA changed on 2 October 2019; it has since been calculated as the €STR plus a fixed spread of 8.5 basis points. See the box entitled “Goodbye EONIA, welcome €STR!”, Economic Bulletin, Issue 7, ECB, 2019. The EONIA will be discontinued on 3 January 2022.

- Real GDP grew by 2.2% in the third quarter according to Eurostat’s flash estimate that was published after the Governing Council meeting on 28 October. This estimate is broadly in line with the September 2021 ECB staff macroeconomic projections for the euro area.

- For an overview of the use of government-supported job retention schemes during the pandemic, see Chart 11 in the article entitled “Hours worked in the euro area”, Economic Bulletin, Issue 6, ECB, 2021. For a broader assessment of the euro area labour market during the pandemic, see the article on “The impact of the COVID-19 pandemic on the euro area labour market”, Economic Bulletin, Issue 8, ECB, 2020.

- See also Box 4 entitled “The impact of the COVID-19 pandemic on labour productivity growth” in this issue of the Economic Bulletin.

- More recent but preliminary monthly unemployment figures for July and August 2021 suggest that the labour force participation rate increased in the third quarter of 2021. See also Box 3 entitled “Labour force participation during the pandemic” in this issue of the Economic Bulletin.

- For a comprehensive assessment of the recent drivers and near-term outlook of the euro area housing market, see the article entitled “The euro area housing market during the COVID-19 pandemic” in this issue of the Economic Bulletin.

- This evidence is confirmed by recent data from the ECB’s new Consumer Expectations Survey. See Box 6 entitled “The recovery of housing demand through the lens of the Consumer Expectations Survey” in this issue of the Economic Bulletin.

- See Box 4 entitled “The impact of supply bottlenecks on trade” Economic Bulletin, Issue 6, ECB, 2021.

- For a detailed overview of the role of the changes in HICP weights on the measurement of inflation in 2021, see Box 6 entitled “2021 HICP weights and their implications for the measurement of inflation”, Economic Bulletin, Issue 2, ECB, 2021.

- Trimmed means (which remove around 5% or 15% from each tail of the distribution of annual price changes) stand above the target of 2% because they include some energy items that currently have very high inflation rates. For further information on these and other measures of underlying inflation, see Boxes 2 and 3 in the article entitled “Measures of underlying inflation for the euro area”, Economic Bulletin, Issue 4, ECB, 2018.

- For an overview of the extent to which wages are indexed to inflation in the euro area and on the role this might play in second-round effects, see Box 7 in this issue of the Economic Bulletin: “The prevalence of wage indexation in the euro area and its potential role for the impact of inflation on wage developments”.

- For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.

- We would like to thank ECB colleagues Vasco Botelho, Rodrigo Barrela, Paul Reims and Charles Hoffreumon for their input.

- Total factor productivity (TFP) is another measure of productivity. Developments in TFP growth outside the euro area are discussed in Box 1.

- A paper by Basu and Fernald, for instance, starts with the sentence: “Productivity rises in booms and falls in recessions.” See Basu, S. and Fernald, J., “Why Is Productivity Procyclical? Why Do We Care?”, NBER Working Paper Series, No 7940, October 2000.

- More contact-intensive services, representing 22% of the total economy before the pandemic, refer to wholesale and retail trade, transport, accommodation and food services (NACE2 Rev2 classification: G, H, I) as well as arts and entertainment (R, S, T, U). Less contact-intensive services, representing 33% of the total economy before the pandemic, cover information and communication (J), financial and insurance activities (K), real estate (L), professional, scientific and technical activities (M), and administrative and support service activities (N).

- The author would like to thank Pedro Neves, Niccolò Battistini, Johannes Gareis, Virginia di Nino and Moreno Roma for their input and comments.

- More detail on the CES is available in “ECB Consumer Expectations Survey: an overview and first evaluation”, Occasional Paper Series, ECB, forthcoming.

- This box focuses primarily on inflation effects through the indexation of private sector wages to inflation. Additional effects could stem from the public sector, for example, through the indexation of public sector pensions to inflation or through other special indexation schemes.

- This article has benefited from helpful comments by Philip Lane, Fabio Panetta, Livio Stracca, João Sousa, Michael Fidora, David Lodge, Arnaud Mehl, Chiara Osbat and Alexandra Buist.

- Productivity can be defined in several ways. From a single-factor perspective, labour productivity is defined as units of output (real GDP or value added) produced per unit of labour input, where labour input can be the number of employed persons or the total hours they work. However, the productivity of any single input of production, such as labour input, depends on the quantity of the other inputs. To capture the efficiency with which all inputs are used, economists use a broader concept of productivity, namely, total factor productivity (TFP), unobservable and computed as a residual. In a production function framework, labour productivity growth is determined by TFP growth and the growth of capital per labour input (capital deepening).

- For an assessment of the state of the euro area housing market before the COVID-19 pandemic, see the article entitled “The state of the housing market in the euro area”, Economic Bulletin, Issue 7, ECB, 2018.

- Throughout this article, unless otherwise indicated, house prices refer to the nominal house price index, housing investment to real investment in residential construction and housing loans to loans to households for house purchases in nominal terms.