The digital economy and the euro area

Published as part of the ECB Economic Bulletin, Issue 8/2020.

1 Introduction

Digitalisation – the diffusion of digital technologies leading to a digital economy – is “virtually everywhere”. It transforms patterns of consumption and production, business models, preferences and relative prices, and thereby entire economies, making it an important issue from a central banking perspective. Some of the key effects of digitalisation relevant to monetary policy relate to output and productivity, labour markets, wages and prices.

The impact of digitalisation on the economy is a function, inter alia, of national economic structure and economic policies, institutions and governance. However, it is not clear whether digitalisation is going to deepen differences between countries or reduce them. It is nevertheless interesting to note that the degree of digitalisation varies across the euro area and EU countries and only a few are as digitalised as the most digital countries in the world.

This article mainly summarises and updates the evidence on the euro area and the EU digital economy, including international comparisons.[1] It documents the growth of the digital economy, measured in terms of value added based on the System of National Accounts, the diffusion of digital technologies as captured by suitable indicators, and the impact of digital technologies on the economic environment in which monetary policy operates through their effects on productivity, labour markets and inflation.[2]

This article also takes a closer look at the impact of the coronavirus (COVID-19) pandemic on the digital economy. Since the start of the pandemic, both producers and consumers have become more accustomed to and more reliant on digital technologies. Greater take-up of digital technologies may lead to an acceleration of the structural change that it implies and provide both opportunities and challenges for countries in the euro area and the broader EU.

It is important to note that digitalisation may have implications for the economy beyond those covered in this article. It may affect market structure and competition, with repercussions on innovation and the role of intangibles, and cause distributional issues. Digitalisation may also affect choices around work and leisure and have further welfare implications, both positive and negative, that are not easily measured by the concepts that are the focus of this article.

The remainder of this article is structured as follows. Section 2 considers the effects of digitalisation on productivity and the supply side. Section 3 reviews the effects of digitalisation on labour markets and inflation. Section 4 looks at the likely impact of the COVID-19 pandemic on digitalisation and the repercussions for the broader economy in the short, medium and longer term. The conclusion provides key insights and draws out the article’s main messages.

2 The size and growth of the digital economy

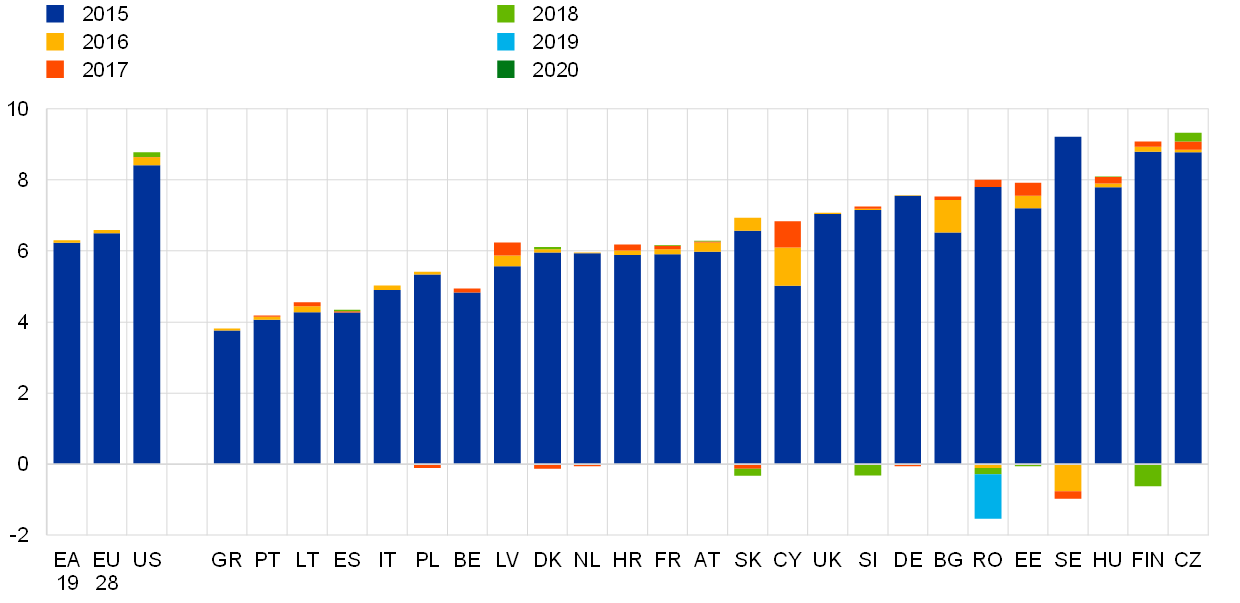

The digital economy is smaller in the euro area and EU than in the United States, and the gap has not changed dramatically in the past few years. Most euro area countries have much smaller value added from digital sectors (as a percentage of GDP) than the United States, with the euro area digital economy about two-thirds the size of that of the United States (see Chart 1). In the United States, the digital service sector alone contributes as much as the entire digital economy in the euro area. The size of the IT manufacturing sector in the United States is around twice that of the euro area and larger even than in countries specialised in manufacturing activities, such as Germany.[3] For most countries in the euro area, the annual percentage point increase in the share of the digital economy has been less than 0.1, the same as in the United States, leaving the gap more or less unchanged.

Chart 1

The digital economy, 2015-2020

(percentage of GDP)

Source: European Commission.

Notes: The entry for 2015 shows the data for that year. The entries for 2016-20 (where available) show the change implied by the data for those years.

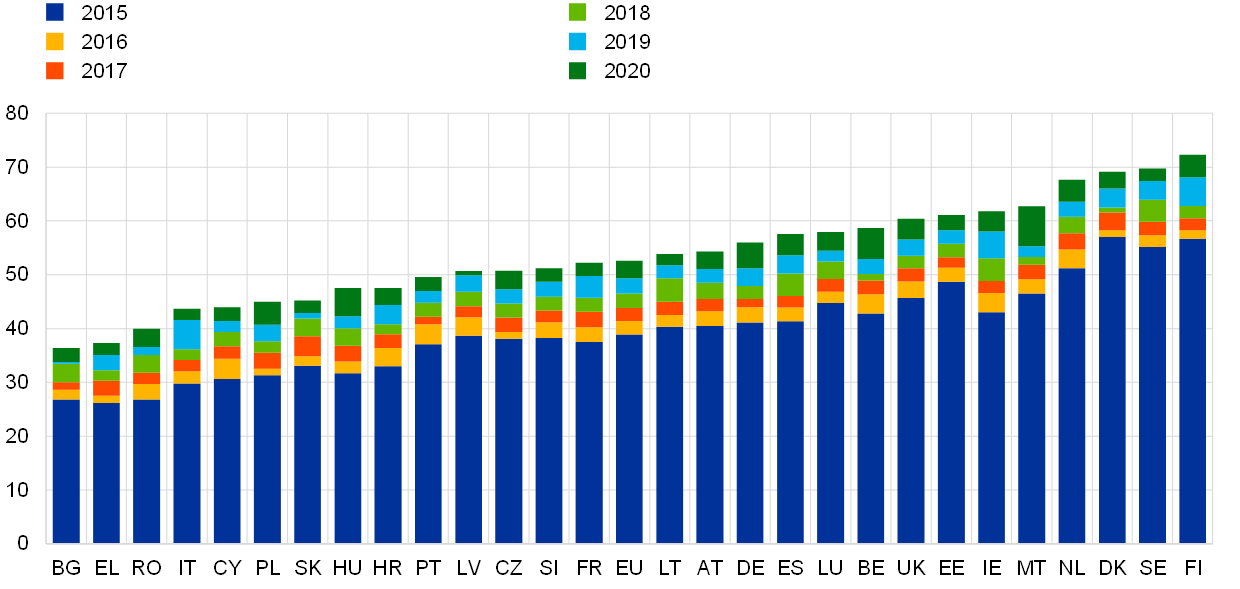

Digital adoption has increased notably since 2015, however. The Digital Economy and Society Index has risen from below 40 in 2015 to above 60 in 2020, as shown in Chart 2. This masks some diversity between countries, however, with the index below or close to 40 for three countries and close to or above 70 for a further three. While connectivity (notably broadband) has reached comparable levels in most countries, differences in other dimensions persist, such as the levels of human capital and the integration of digital technologies into the business and public sectors.[4] These differences in digital adoption across countries imply that the impacts of digitalisation may also differ across the euro area and EU countries.

Chart 2

Digital adoption in the euro area and EU economies

(Digital Economy and Society Index)

Source: European Commission.

Notes: The entry for 2015 shows the data published that year; the entries labelled 2016-20 show the change implied by the data published for those years. The data are for the year prior to the year they are published. The category “connectivity” includes fixed, fast and ultrafast broadband coverage and take-up; “human capital” focuses on internet usage, digital and ICT skills, and science, technology, engineering, and mathematics graduates; “use of internet services” combines citizens’ use of content, communication and online transactions including online banking; and “integration of digital technology” takes into account e-commerce and business digitalisation.

3 Productivity and the supply side

Productivity

The last two decades have seen a protracted slowdown in productivity across advanced economies. Productivity growth in the euro area started to slow significantly in the mid-to-late 1990s, well before other advanced economies, but the slowdown eventually became widespread even before the financial crisis. It was driven primarily by lower growth in total factor productivity (TFP) in the pre-crisis era, but in later years also by lower levels of capital deepening (capital per unit of labour), a result of a pronounced investment slump during the recovery. While it may seem paradoxical that an era of rapid technological progress is not accompanied by great productivity improvements, the slowdown is in fact most pronounced in the sectors that rely most on information and communication technology (ICT). This finding, among others, lends credence to the view that we are still in the installation phase of ICT.[5]

A consensus explanation for the pre-crisis slowdown of Europe relative to the United States is the lesser ability of European economies to reap the benefits of ICT, particularly in market services. In the United States, the mid-1990s saw a surge in innovations in ICT, a large increase in TFP growth in ICT-producing industries and a large increase in ICT capital deepening and higher TFP in the sectors that use ICT most intensively.[6] By contrast, European economies were late to develop or use these technologies. One reason for that may be related to the nature of ICT relative to older technologies. Machines and equipment were traditionally complementary to any type of labour, so the mere accumulation of such capital was sufficient to generate growth. By contrast, ICT capital requires skilled labour and the adaptation and rethinking of organisational processes, along with other relevant changes, which poses challenges to existing firms. As such, ICT capital is complementary to a more complex set of other inputs and synthesising them efficiently can generate higher productivity returns from ICT investment.[7]

Differences in management practices have emerged as a key explanation for why some countries are better at exploiting ICT. Bloom et al.[8] show that UK-based firms owned by US firms are more productive, owing to higher ICT-related productivity. They attribute this to the more flexible and decentralised organisational structures of US firms.[9] Poor management may be especially problematic in relation to ICT given that the dispersion of firm-specific shocks has risen (Decker et al. [10]), possibly as a result of the higher pace of technological change, which amplifies the importance of agile and flexible management. The productivity of frontier firms has, in fact, been growing rapidly, but laggard firms have been slow to catch up, suggesting bottlenecks in innovation diffusion (Andrews et al.[11]). Schivardi and Schmitz[12] show that countries whose firms had adopted good management practices achieved much faster productivity growth than others in the 1995-2008 period (when ICT-driven productivity growth in the United States took off) than the previous decade.

Technology adoption can be also affected by policy. Even if firms have the capabilities to exploit digital technologies, they will only adopt them if doing so is profitable; low levels of competition may lower such profits. Andrews et al.[13] show that the gap between laggard and frontier firms is higher for industries that are less affected by pro-competitive reforms (such as retail compared with telecommunications). At the same time, given that firms need to be able to attract skilled workers and respond to changing needs, rigid employment protection legislation (EPL) may make it harder for firms to attract these workers and adopt new technologies. Andrews et al.[14] provide evidence that higher EPL is associated with lower adoption of a set of digital technologies for sectors characterised by a high technological need for employee turnover. Cette et al.[15] show that higher EPL leads to (i) positive effects for non-ICT physical capital intensity and the share of high-skilled employment and (ii) negative effects for research and development capital intensity and the share of low-skilled employment. As such, EPL implies a high cost of low-skilled labour, which is substituted by non-ICT capital.[16]

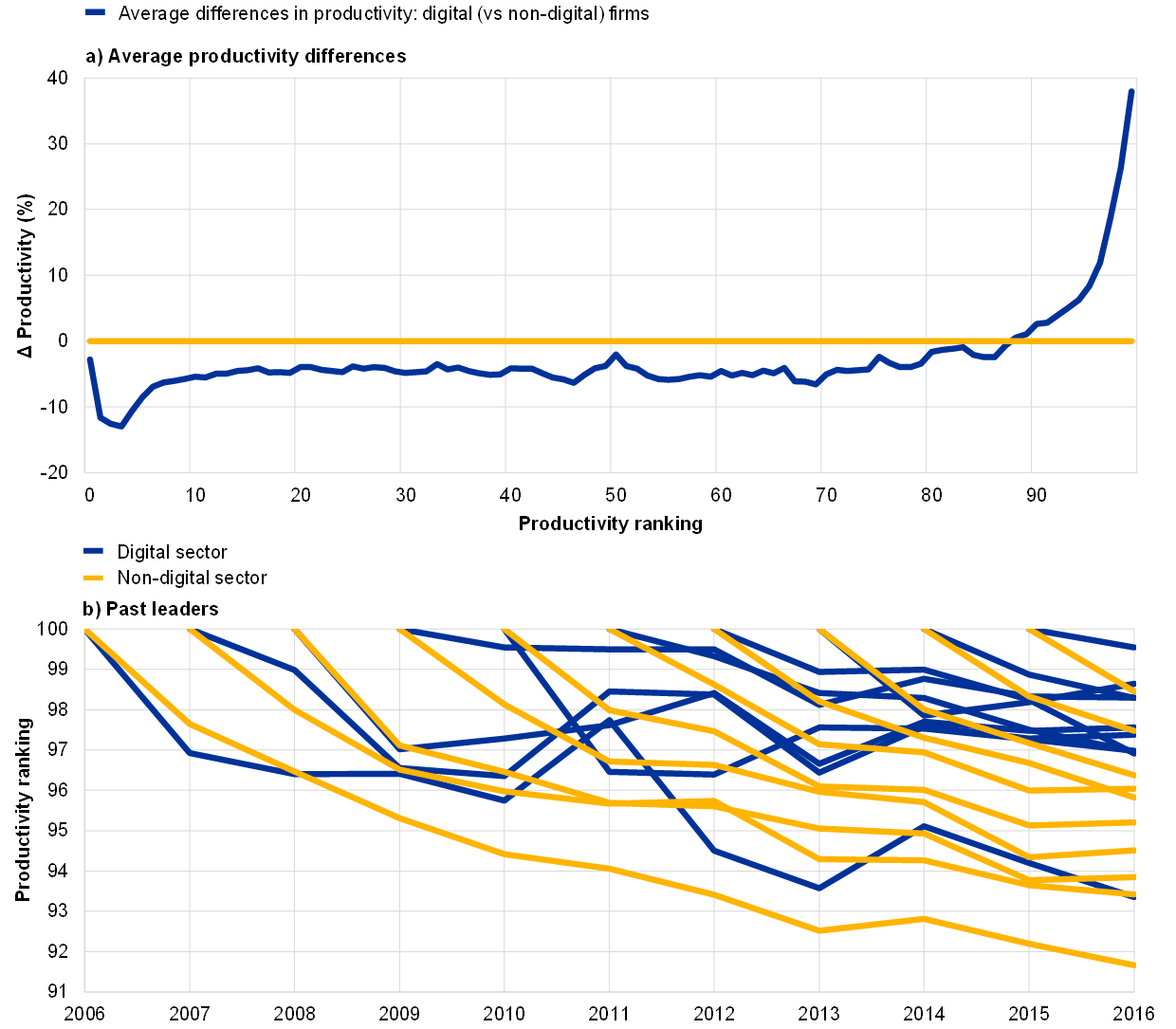

There are substantial differences between digital and non-digital companies in their productivity distribution and leadership persistence. Using firm-level data for the “big four” euro area countries, the top panel in Chart 3 shows the relative productivity of digital, compared with non-digital, firms across the distribution.[17] For the most part, digital firms are less productive than their non-digital peers, but for firms at the top decile of their respective distributions, digital firms are substantially more productive. They are also younger and larger across the distribution. Moreover, productivity leadership persistence is higher for the digital sector. The bottom panel in Chart 3 shows the average ranking of the top 1% productive firms in their sector in any given year as time passes; while on average leaders remain highly productive, persistence in leadership is substantially higher for digital firms. At the same time, the rise of new leaders seems broadly similar across sectors.

Chart 3

Productivity distribution and leadership persistence (Germany, Spain, France and Italy)

Sources: Orbis Europe (Bureau van Dijk) and ECB staff calculations.

Notes: The digital sector comprises the manufacture of computer, electronic and optical products (C26), the manufacture of electrical equipment (C27), publishing activities (J58), audiovisual and broadcasting activities (J59, J60), telecommunications (J61), and IT and other information services (J62, J63). The non-digital sectors comprise the remaining manufacturing industries (C11-C25, C28-C33); utilities (D, E); construction (F); and market services (G-I, M-N). Average firm-level productivity is measured as real gross operating revenue per employee, for firms with at least ten employees in any given year between 2006 and 2016. The sample consists of firms in Germany, Spain, France and Italy.

There is evidence that ICT’s contribution to productivity growth has declined across advanced economies. While the euro area performed substantially worse than its peers in terms of productivity growth in the 1995-2004 period, over the past decade, productivity gains from ICT capital have been muted across North America as well as the euro area. While some have suggested that the 1995-2004 gains were anomalous and the current period has seen a return to normal growth, the gains since 2005 have been much lower even than in the period before 1995.[18]

Digitalisation, including more recently artificial intelligence and machine learning, is a form of general purpose technology (GPT) with wide-ranging impacts across the economy. GPTs are pervasive, have inherent potential for technical improvement and spur complementary innovations (Bresnahan and Trajtenberg[19]). It is the combined effect of these three qualities that makes GPTs unique and leads to their singular productivity effects. At the same time, this implies that GPTs have very long implementation lags, of several decades for modern technologies such as the steam engine, electricity or ICT (Bresnahan and Trajtenberg[20], Nordhaus[21]). Adapting production and managerial practices to a new technology can be a long process. Investment in physical capital is lumpy, given adjustment costs, while the production of technology itself becomes more efficient over time. Skilled workers may also be hard to come by, especially before the new technology has become sufficiently widespread for a large enough scholarly base to be created, so that the technology can be taught on a massive scale. Complementary capital from peripheral innovations needs to be accumulated, which also takes time.[22], [23]

Supply side

Digital investments are often investments in intangibles. One of the defining features of the digital economy is the shift away from physical capital (building and equipment) towards intangible capital (for example: research and development, software, algorithms, databases and related analytics).[24] According to some estimates, between one-third (for the less digital economies) and two-thirds (for the more digital economies) of digital investments are in intangibles.

An important aspect of digital intangible investment is big data. The term refers not only to the size and complexity of a dataset, but also to its corresponding analytics. It is one of the digital technologies with the largest take-up across firms.[25] As with intangible assets in general, big data can take very different forms and are often highly firm-specific, i.e. not particularly valuable outside of the firm (an example of the “sunk” aspect of intangible assets).[26] Big data can be collected through online platforms and service providers and can be processed and analysed to generate revenues in many ways, e.g. through targeted advertising. The value of such data capital is difficult to estimate, but is potentially very large. Recent estimates put the value of the data market in Europe at €324 billion in 2019.[27]

Alternative sources of finance to traditional bank financing appear better suited to the financing of intangible investment, which is hard to collateralise. This is because of the higher uncertainty and risk associated with intangibles (owing to their exploratory nature), combined with issues relating to their transferability, in comparison with the more physical nature of tangible investment. Traditional intermediaries, such as local banks, often lack the sophistication necessary to evaluate risky projects involving innovative ideas based on complex technologies, while small firms lack the internal funds and reputation required to signal their quality to investors. Equity financing and venture capital may be more suitable for funding intangible investment, hence the latter may be disadvantaged owing to the heavy reliance on bank lending in the euro area.[28]

Digital technologies have some particular characteristics that make them conducive to higher concentration. The increasing importance of intangible capital, which implies substantial fixed costs but low marginal costs, together with the ability to use cloud computing as a way of rapidly increasing the size of a company at low cost, means companies are able to achieve “scale without mass” and reproduce business processes at zero cost (Brynjolfsson et al.[29]). Even outside the technology sector, superstar firms with low mark-ups, especially in retail, are very intensive users of ICT (Decker et al.[30]), employing advanced automation technologies for warehousing and logistics. Many digital technologies are also associated with substantial network effects, so early movers have a sizeable advantage and dominate their markets. The high business dynamism associated with ICT firms in the 1990s (which pulled the entire US economy upwards) gave way to muted dynamism and a lower start-up rate in the 2000s (Decker et al.[31]), itself a potential sign of lower competition.

There are signs of rising market power and concentration, particularly in the United States. Although there is some debate on the extent of the rise of market power and the link between mark-ups and concentration, as firms may keep mark-ups low to attract a large market share, there is broad agreement that firm mark-ups and concentration ratios have increased in the United States (De Loecker et al.[32], Autor et al. [33]). The literature for Europe is much slimmer – primarily as a result of sparser data coverage – and conclusions are mixed.[34] While a number of factors are at play, technology likely matters. The high-mark-up, high-concentration firms that Autor et al. identify as superstars include some well-known technology giants. Bessen[35] finds that use of proprietary ICT software is strongly associated with the level and growth of industry concentration, operating margins, larger revenues and productivity of the top firms, accounting (together with intangibles) for most of the rise in concentration. Crouzet and Eberly[36] show that intangibles are associated with greater concentration in the United States, which could be either the result of changes in technology in a competitive environment or the result of market power. Calligaris et al.[37] show that mark-ups in economies of the Organisation for Economic Co-operation and Development (OECD) are higher in digitally intensive sectors and that this difference has increased significantly over time, particularly for the most digitally intensive sectors. To the extent that digital technologies are an important driver of concentration, the smaller presence of technology firms in Europe could explain why there is no clear consensus as regards the increase in concentration in Europe compared with the United States (Cavalleri et al.[38]).

Box 1

Online platforms and the collaborative economy

The collaborative or sharing economy relies on digital platforms to coordinate and supervise the matching between the supply and demand sides of the market. Online platforms tend to be heterogeneous in a number of respects, including the technology adopted and the services or goods provided. For instance, trading mediated by digital platforms includes transport, food delivery and cleaning services, as well as online tasks such as translations, transcriptions, data collection, and software development. In the area of finance, the collaborative economy allows the coordination of investors and borrowers and the organisation of collective project financing (crowdfunding), while platforms operating in the accommodation sector facilitate access to property. The definition of the collaborative economy includes financial services, goods trading and encompasses the concept of the “gig economy”, which is often used to single out platforms where the service provided is the paid labour necessary to complete a task or solve a problem.[39]

Although the collaborative economy is not a new phenomenon, its size is increasing. According to estimates, although the size of online platforms has grown rapidly, their contribution to the economy remains relatively small. In 2016 they accounted for up to 1% of GDP and 3% of employment across EU countries, but with considerable cross-country heterogeneity (see Chart A). In terms of specialisation, financial sector platforms generate most of the revenues of the collaborative economy in Czech Republic, Estonia, Latvia and Sweden, while the online skills sector leads in Poland and Luxembourg. Meanwhile, for countries with smaller platform economies, the accommodation sector plays a larger role. Similarly to the size of the collaborative economy, platform employment has increased over time and accounted for 0.15% of overall employment in 2016 in the EU27 and the United Kingdom taken together.[40] Although surveys and studies often rely on different definitions of platform employment, other studies confirm similar magnitudes and cross-country heterogeneity. In 2018, for instance, as many as 2.6% of workers in Spain were engaged in platform work as a main job compared with as few as 0.6% of workers in Finland.[41]

Chart A

Size of the collaborative economy

(percentage of GDP (2016))

Source: Nunu, M. et al., (see footnote 41 below for more details).

Online platforms have the potential to be a significant source of innovation and competition, mainly by lowering the barriers to starting and operating small businesses. It is nevertheless important to make sure that differences in rules and regulations between platform and standard providers do not result in an uneven playing field. In addition, the relevance of large networks in the development of online platforms increases the risk of substantial disparities in market shares between big platform players and others. Therefore, policy questions arise in terms of how to promote fair competition and how to avoid the possible emergence of dominant platforms. This might require revising the legal framework in which they operate, including adapting taxation and monitoring mergers and acquisitions. Similarly, there are legal questions regarding the employment status of platform workers and whether online platforms should be considered as employers, with the results of related court cases so far mixed.[42] In addition, digital platforms need to ensure the application of principles such as transparency and non-discrimination in their business models, which rely heavily on the use of data and data processing.

4 Labour markets

This section reviews the effects of digitalisation on the labour market. It starts with a discussion on the phenomenon of job polarisation and then considers how digitalisation and automation may lead to the replacement, but also creation, of some jobs and tasks.[43]

From the early 1990s, labour markets in advanced economies started to polarise, whereby the share of low and high-skilled jobs increased at the expense of middle-skilled jobs. While employment and wage premiums for high skills rose, there was also a substantial increase in the employment share of low-skilled labour, albeit not always necessarily accompanied by rising wages. The increase in employment shares for high- and low-skilled workers therefore corresponded to a reduction in the share for middle-skilled employment, giving rise to job polarisation (or “hollowing out”), a phenomenon identified in virtually all advanced economies.[44] The principal explanation for polarisation is that the rise of digitalisation and automation has given rise to routine-biased technological change (RBTC); jobs characterised by a high content of routine and repetitive tasks (middle-skilled jobs, such as bank tellers, machine operators, office clerks) can eventually be performed more efficiently by machines or computers.[45]

Automation tends to favour skills at both high and low wages. On the one hand, RBTC favours jobs that require complex analytical skills with a certain level of abstraction (and hence limited automation potential) or a high level of interpersonal communication, which are naturally complemented by such technologies. On the other hand, automation and RBTC have not yet affected non-routine manual jobs, which typically require little to no specialised education but have a large content of tasks that require intuition, discretion, flexibility, adaptability or interpersonal interaction, which are also hard to automate. This category encompasses a very broad array of jobs mostly found in the service sector, such as cleaning, maintenance, personal care, security and food services.

Automation and its impacts on different types of jobs can be analysed through the lens of a framework that views jobs as collections of different tasks, some of which are more readily automated than others. In this framework, RBTC automates some tasks and creates new ones, destroying some existing jobs and creating new ones in the process.[46] Given that automation has a comparative advantage in middle-skilled tasks (routine-intensive with functions that can be relatively easily translated into computer code), automation can replace these jobs and middle-skilled workers shift away from these tasks.[47]

The evolution of job polarisation by task content for selected European countries is shown in Chart 4.[48] Non-routine cognitive tasks are split into analytical and personal (e.g. mathematicians and managers), routine tasks are split into cognitive and manual (e.g. clerks and machine operators), and non-routine manual tasks are split into physical and personal (e.g. cleaners and waiters). The chart shows the evolution of the task content of the mean job[49] and reveals the sharp reduction in its routine content and a corresponding increase in its non-routine cognitive content. The picture emerging from this chart is consistent with the view of polarisation as accompanied by a changing allocation of skills across occupations.[50] Furthermore, Dias da Silva et al.[51] find that declines in average hours worked over recent decades across a selection of EU countries have exacerbated job polarisation.[52]

Chart 4

Evolution of the task content of the mean job in selected European countries

(change in share of tasks)

Source: Dias da Silva et al. (see footnote 48).

Notes: Jobs are broken down into their task content according to the six categories shown and each line therefore shows the task content of the mean job; NRC=non-routine cognitive; NRM=non-routine manual; R=routine. Sample normalised to 0 in 1992. The countries comprise Belgium, Denmark, Ireland, Greece, Spain, Italy, Luxembourg, the Netherlands, Austria, Portugal, Finland, Sweden and the United Kingdom.

A leading example of a modern automation technology with a high potential to displace labour is that of industrial robots. Robots are currently primarily used to perform repetitive tasks in manufacturing and hence represent a prominent example of routine task replacement. Graetz and Michaels[53] show that robots raise TFP and labour productivity in Europe with no significant effects on employment except for a small shift in favour of high-skilled workers.[54] The relationship between digitalisation and employment is examined in further detail in Box 2 below, with a general finding that – at the aggregate level – digitalisation generally tends to be positively associated with employment.

Box 2

Digitalisation, employment and unemployment

Measuring the reach of the digital economy is not straightforward, but a metric for gauging the degree of digitalisation across EU countries is the extent to which employment is related to digital activities. Two EU countries – Estonia and Sweden – consistently top the digital employment charts. A relatively wide definition of ICT-dependent employment can include all those working in ICT-intensive occupations, whether or not they are employed directly in ICT sectors, as well as those employed in broader ICT task-intensive occupations. Such a measure demonstrates the high degree of cross-country heterogeneity, with the share of total ICT-dependent employment ranging from around 22% in Luxembourg (surpassing even that of the United States) to around 7% in Greece, Italy and Slovakia. While barely reaching 11% in the euro area and the EU, this broader definition of ICT-dependent employment amounts to roughly 17% of total employment in Sweden and Estonia, similar to the share seen in the United States.[55]

Sectors with higher digital intensity made substantial contributions to employment growth across advanced economies during the decade 2006-16 (see Chart A, left-hand panel). Looking at the relationship between total employment growth and the contribution of the digital-intensive sectors for selected European economies, Chart A (left-hand panel) suggests a strong contribution from digitally-intensive sectors to total employment growth between 2006-16. More heavily digitally dependent countries, i.e. Sweden and Estonia, appear to have been among the strongest performers in terms of the employment contribution of the digital-intensive sectors, outperforming many other EU economies.

Moreover, there is some evidence to suggest that economies with a higher digital economy share of total value added tend to be those with lower unemployment rates. Chart A (right-hand panel) shows a broadly negative correlation between aggregate unemployment rates and the shares of total value added accounted for by digital sectors for the EU economies and the United States over the period 2000-18. Although the chart does not imply causality, it seems to counter the notion that a higher degree of digitalisation leads to higher aggregate unemployment. That is not to say that digitalisation does not result in job displacement and job disruption, whereby some workers lose jobs and find it difficult to get back into employment for prolonged periods, but digitalisation also generates new jobs and tasks. The trends of those countries at the forefront of the digital transformation may hold lessons for others still in the catch-up phase.

Chart A

Digitalisation, employment and unemployment

(left-hand panel: x-axis: percentage growth in total employment; y-axis: employment contribution of digital-intensive-sectors; right-hand panel, x-axis: digital sector as percentage of the whole economy value added; y-axis: average annual unemployment rate 2000-18)

Source: OECD (2019).

How can labour markets still generate enough jobs after two centuries of incredible labour-saving technological advances? Acemoglu and Restrepo[56] argue that technology has a “reinstatement effect”, which creates new tasks as it destroys others. They argue for a reinterpretation of the relationship between technology and labour as a “race between automation and new labour-intensive tasks”, which reinstates labour and increases productivity. At the same time, these mechanisms may lead to greater inequality in the labour market.[57] In addition, the higher market power of large digital firms may also compress wages and be associated with a lower labour share.[58]

Recent work has attempted to quantify the threat of automation to existing jobs more precisely. Frey and Osborne[59] asked experts to give subjective views on whether specific occupations could be easily automated in the near future.[60] The results suggest that 47% of jobs in the United States are at a high risk (over 70%) of automation. Subsequent studies find smaller possible effects, such as Arntz et al.[61], who estimate that only 9% of jobs in the United States face a high risk of automation. Overall, there is wide variation in the empirical estimates of how many jobs are at risk of some degree of automation. In addition, although automation seems to be related to trends such as job polarisation and may imply some job losses, automation also leads to “reinstatement effects” resulting in new tasks and job creation.[62]

Precise numbers aside, there is undoubtedly a concern that task automation threatens a substantial number of jobs. Even though technology has had a positive net effect on labour historically, there is a risk that the pace of automation may be too fast for some workers, who will not be able to quickly reskill and be redeployed to new tasks. While education and retraining policies have an important role to play, they may be more challenging for more mature workers. Structural framework conditions, including both labour and product market policies, may need to be further adapted to fully reap the potential gains from digitalisation while maintaining inclusiveness.

5 Digitalisation and consumer price inflation

Digitalisation is often associated with a negative impact on the price of some goods and services and on overall inflation. This impact can be examined separately by distinguishing two transmission channels. The first is the direct transmission channel to consumer prices that occurs via the prices of digital products in the euro area and its member countries. The second transmission channel is more indirect. It captures digitalisation, i.e. online retail, effects on inflation as cost savings, higher price transparency, intensified competition, and productivity gains – which are generally very difficult to disentangle empirically.[63] Finally, it is important to distinguish the impact of digitalisation on price level from the rate of change, i.e. inflation, and to examine if there is a bias in measuring inflation using the Harmonised Index of Consumer Prices (HICP) given the increasing importance of online retail for household consumption.

The direct effects

The direct impact channel of digitalisation on consumer prices functions via the prices of digital products purchased by consumers. Because such products are part of the HICP for the euro area and its member countries, this will have a direct impact on inflation as measured by this index. It is difficult to clearly define what digital products are, but a proxy for an index of “digital products” can be constructed following the definition of an ICT index by Eurostat.[64] According to that proxy, declines in the prices of ICT products lowered the euro area annual HICP inflation rate by 0.15 percentage points on average each year in the period from 2002 to 2019 (see Chart 5). The impact was larger until around 2015 but decreased to some extent afterwards. Over the same period, the range of impacts for individual euro area countries was around 0.1 to 0.2 percentage points per year on average.[65]

Chart 5

ICT product contribution to headline HICP annual inflation rate across euro area countries

(percentage points)

Sources: Eurostat, ECB calculations.

Notes: The latest data refer to July 2020. The range is defined by the minimum and maximum across the euro area countries (in changing composition). The ICT products comprise audiovisual, photographic and information processing equipment, telephone and telefax equipment and services, as well as clocks and watches. The country price indices for clocks and watches have different starting months, but the weight is very small (for the euro area it is less than 0.5% of headline HICP), therefore the comparison across countries and time is not distorted (the impact on the aggregate ICT product contribution is negligible). Inflation rates for 2000 and 2001 are distorted as they reflect the methodological impact of the inclusion of internet services in Germany’s HICP.

A number of caveats surround the estimates of the inflation rate for digital items. First, digital products in the consumer basket do not comprise only the four categories used for the reported index. Many other goods and services are also exposed to ICT developments to various degrees. Second, ICT products (or electronic goods) are subject to sudden and very fast technological upgrades and thus create challenges for their inclusion in the HICP basket in terms of proper quality adjustment, replacement or expansion of the basket. Failure to appropriately incorporate the prices of such products in the HICP basket can lead to a bias (upward or downward) in the respective price indices.

The indirect effects

The indirect impact channels of digitalisation operate via cost savings and higher competition owing to increased price transparency. Digitalisation in the context of prices for final consumer goods is often associated with the narrower term “e-commerce”, which is typically used to describe the buying or selling of goods and services via the internet. Considering e-commerce between businesses and consumers, the inflation-lowering impact of growing e-commerce occurs in two ways. First, e-commerce can reduce costs compared with the standard offline distribution channels (e.g. online sales require lower expenditures than maintaining shops), which both traditional and online retailers may pass on to consumers. Second, e-commerce may lower prices (or constrain their increase following cost rises) because of higher transparency and intensified competition between suppliers. Customers search online for lower prices and bargains, forcing both traditional and online suppliers to contain prices, potentially eroding their profit margins. Both effects can take place when the share of e-commerce retail in total retail trade is still low.

Although e-commerce generally intensifies competition, the presence and wide use of internet-based trade technologies may also create opportunities for tacit collusion among suppliers or retailers, which may impair competition. While e-commerce enables consumers to compare the prices and quality of goods, it also facilitates opportunities for suppliers to check prices and possibly collude on pricing behaviour. Although such effects may be relevant for specific markets, the competition-enhancing impacts of e-commerce transaction technologies should dominate – notably as long as the technology is still relatively young and as long as online suppliers strive for market share in an effort to strengthen their position in the business.

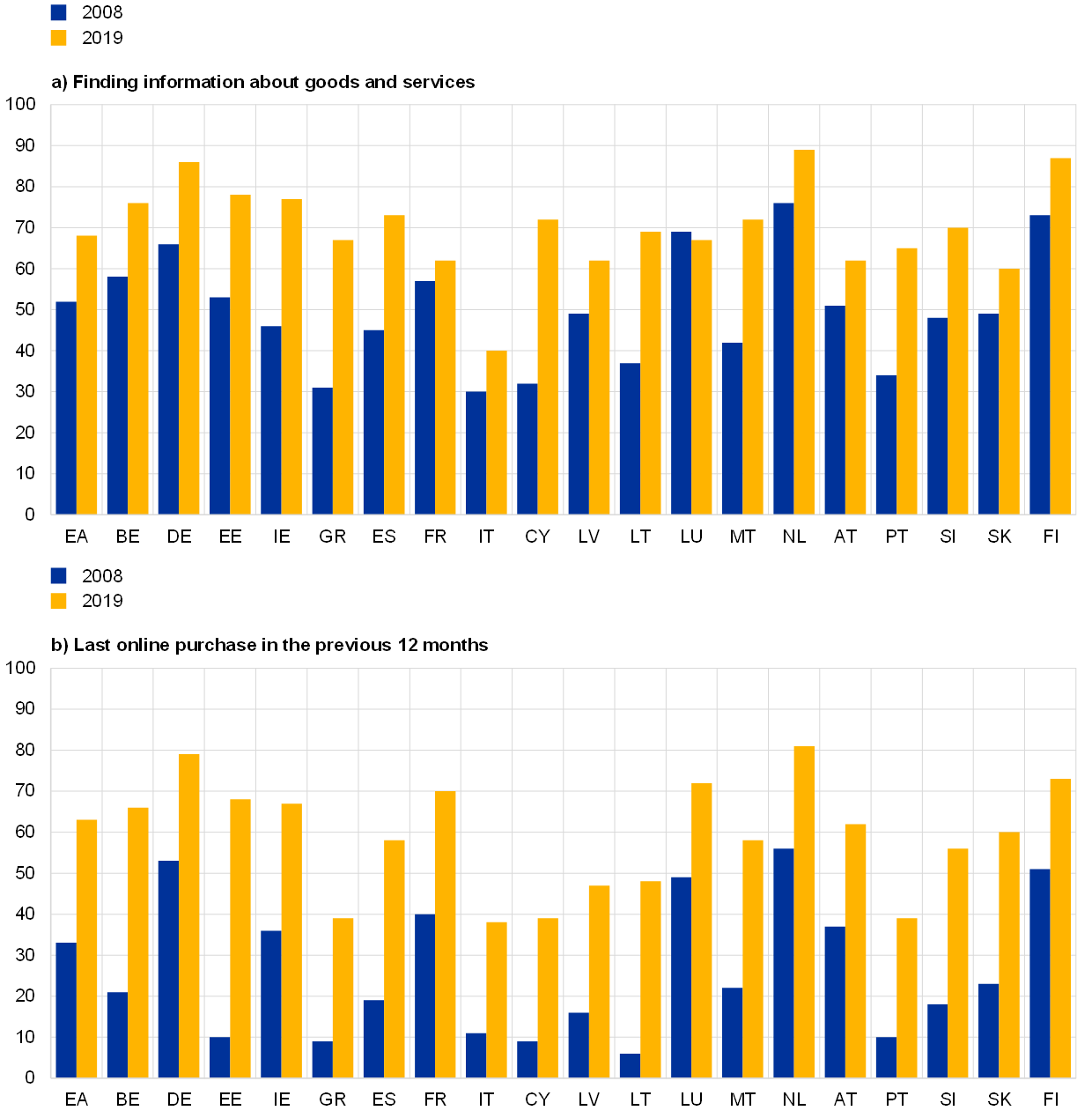

The extent to which the indirect effects described above have an impact on inflation partly depends on the prevalence of e-commerce in the euro area. Moreover, the opportunity to compare prices online may already be a competition-enhancing factor. Online sales to consumers comprised almost 14% of total retail sales (excluding cars and motorcycles) in the euro area in 2017 – a share that has almost doubled over the last ten years. The most frequently purchased items were clothing, accommodation and travel.[66] Consumers have also significantly increased their use of e-commerce. In 2019 the share of people using the internet to obtain information about goods and services reached 70%, with 60% using it to buy them – a significant increase over the last ten years (see Chart 6). Among euro area countries, Germany and the Netherlands take the lead, followed by Luxembourg and France, with southern economies (Greece, Italy, Cyprus and Portugal) somewhat lagging behind for actual purchases.

Chart 6

Household use of the internet for consumption and information gathering

(percentage share of all individuals)

Source: Eurostat.

To the extent that e-commerce adoption continues to increase, it could impact inflation for a protracted period. The empirical evidence on the effects of e-commerce penetration on inflation so far is scarce but points to a small negative effect. A number of studies, including internal ECB estimates, have used different approaches, compositions of countries (including euro area countries) and time periods (including the past ten years), and found that expansion of e-commerce (measured by various metrics) may have lowered the annual inflation rate by around 0.1 percentage points or.[67] Overall, however, price-lowering impacts from a more intensified use of e-commerce, if there are any, will only last until the diffusion of e-commerce technologies through markets has levelled off.[68] Despite widespread agreement that online retail likely dampens inflation, a smaller strand of literature argues that the adoption of digital technologies may be associated with market concentration among a handful of superstar firms, which may result in some inflationary effects in the longer run – an aspect to be monitored in the future.[69]

Changes in market power and digitalisation in general may have implications not only for inflation but also for the transmission of monetary policy. However, the academic discussion on the channels of this impact is still open. Syverson[70] shows that a monetary expansion would lead to a larger output expansion under conditions of perfect competition than it would under a monopoly. Monetary policy affects firms directly by changing their cost of capital and indirectly by affecting demand. Companies with high market power in general respond less to changes in costs, and hence to monetary policy, than perfectly competitive firms. This does not mean, however, that less market power will necessarily result in a higher pass-through of cost shocks or higher transmission of monetary policy. The transmission of monetary policy will depend on how the pricing decisions of firms change as market power changes.[71] Korinek and Ng[72] analyse the role of digital innovation costs of superstar firms and find that, as innovation proceeds, factor costs will fluctuate less with demand, leading to a flatter Phillips Curve, i.e. more price stickiness.[73] A somewhat contrasting finding is reported by Cavallo[74], who finds a decline in the degree of geographic price dispersion in the United States over the last ten years, which he attributes to the fact that online retailers have uniform pricing strategies limiting the opportunity for geographical price discrimination. As a result, the sensitivity of retail prices to global shocks, such as exchange rates and gas prices, has increased, which suggests a decline rather than an increase in price stickiness.[75] Overall, the impact of digitalisation on monetary policy needs further research, both to enrich structural models to capture its effects and to verify their empirical implications.[76]

Online retail and measurement of the HICP

Last but not least it is important to distinguish the impact of digitalisation on price levels from its impact on inflation. The inclusion of goods and services traded online in the HICP will have an impact on HICP inflation only if the prices of such products and services change at different rates than the prices of goods and services traded offline. The methodology for compiling the HICP implies that price-level differences between online and offline shop prices do not have a direct effect on the HICP. At the same time, increasing expenditure via the internet is reflected in adjustments to the weights of the respective HICP sub-items. Moreover, the statistical offices of the euro area countries continuously enhance their data collection methods and some online prices are already reflected in the HICP.[77]

The available evidence on possible measurement error in the consumer price indices resulting from the incomplete incorporation of online sales is scarce and inconclusive. While there is broad agreement in the literature that the frequency of price adjustment has increased over recent years in both retail channels, some studies document prices in online and brick-and-mortar shops changing with a similar frequency, whereas others find that price changes are more frequent for online stores.[78] The evidence on the average size of price changes is similarly inconclusive.[79] Overall, there is still not enough evidence to conclude that the partial exclusion of online sales leads to measurement error in price indices (upward or downward). If a bias does exist, its extent is even more unclear.

Policymakers should monitor and analyse the impact of digitalisation on consumer prices and inflation. It may have implications for price measurement and inflation trends as well as for the monetary policy transmission mechanism.[80]

6 Digitalisation and the COVID-19 pandemic

Since the onset of the pandemic there has been an increase in the take-up of digital technologies, especially in connection with lockdowns restricting physical mobility within and across regions and countries. The increase in take-up has affected digital services and goods alike, as reflected in the corresponding data, usage/subscription statistics in the case of digital services as available through online platforms[81], and retail sales in the case of digital (or digitally-ordered) goods, as illustrated in Chart 7 below.

Chart 7

Euro area retail trade – July 2020 compared with February 2020

(percentage change)

Sources: Eurostat and ECB staff calculations.

Notes: “Total” corresponds to “Retail trade, except motor vehicles and motorcycles”, “Food” to “Retail sale of food, beverages and tobacco”, “Non-food” to “Retail sale of non-food products”, “Textiles etc.” to “Retail sale of textiles, clothing, footware and leather goods in specialised stores”, “Medical etc.” to “Dispensing chemist; retail sale of medical and orthopaedic goods, cosmetic and toilet articles in specialised stores”, “Computers etc.” to “Retail sale of computers, peripheral units and software; telecommunications equipment, etc. in specialised stores”, “Audio/video etc.” to “Retail sale of audio and video equipment; hardware, paints and glass; electrical household appliances, etc. in specialised stores”, “Fuel” to “Retail sale of automotive fuel in specialised stores”, and “Mail order/internet” to “Retail sale via mail order houses or via the internet”.

The increase in digital take-up seems to be a result of both existing users who expand their usage as well as new users and uses, as more households resort to online services and more businesses to digitally-enabled conferencing and supply-chaining, for example, thereby also triggering an increase in digital literacy and skills. This may be an important step towards a larger digital economy in the euro area and EU; whether this represents a permanent change will be a key factor for the likely medium to long-term impact of the COVID-19 pandemic on the digital and broader economy in the euro area, EU and elsewhere.

As the COVID-19 pandemic is still unfolding, its impact on the digital economy remains uncertain, especially beyond the short term. Its impact on the digital and broader economy depends both on digital supply and demand. The supply response would enhance productivity, ICT and possibly human capital and thereby boost capacity and potential, while the demand response would do so only if it were more permanent. Overall, it seems that the euro area and EU economies have a greater chance of catching up with their peers in the global digital economy if a strong digital supply-side response materialises.

7 Conclusion

The digitalisation revolution is “virtually everywhere” and is transforming all our economies. The digital economy is increasing in importance, with a likely acceleration in the take-up of digital technologies during the COVID-19 pandemic, and is affecting monetary policy-relevant variables such as employment, productivity and inflation. There is considerable heterogeneity across the euro area and Europe in terms of the adoption of digital technologies and most of these countries are falling behind major competitors such as the United States. Structural policies, such as labour, product and financial market regulations, may have to be adapted in order to fully reap the potential gains from digital technologies while maintaining inclusiveness. In terms of digitalisation, the COVID-19 pandemic may create further challenges for EU countries, but it also provides important opportunities to catch up.

The contents of this article build on Anderton, R., Jarvis, V., Labhard, V., Morgan, J., Petroulakis, F. and Vivian, L., “Virtually everywhere? Digitalisation and the euro area and EU economies”, Occasional Paper Series, No 244, ECB, Frankfurt am Main, June 2020.

Digitalisation may also have welfare effects which are, however, not looked at in this article. Such welfare effects could stem from three broad sources: market products (with better quality, new varieties, or free services), non-market production (supported by digital products or information) and online shopping and the sharing economy (with lower prices and greater variety). Such aspects are being looked at in the context of a more people-focused approach to statistics on economic performance, as discussed for example in “Measuring Economic Welfare: What and How?”, IMF Staff Report, March 2020.

It should be noted that there are certain caveats when comparing countries and interpreting the digital economy’s subsectors. For example, some countries may have a high share of value added in the IT manufacturing subsector, but this can sometimes correspond to the outsourcing of computer parts to that country; therefore, high country shares of value added in that sector do not necessarily indicate that the country is at the forefront of digitalisation.

The public sector can play an important role in an economy’s overall digital adoption. The transformation of public administration, the promotion of digital options in public education, and the use of digital technologies in the public health sector may serve as triggers for a broader spread, and broader acceptance, of digital technologies across the entire economy. Some of the most digital economies in the euro area score highly in this respect.

Classification is based on the purchases of ICT assets and services over the value added of the sector. See van Ark, B., “The Productivity Paradox of the New Digital Economy”, International Productivity Monitor, Vol. 31, Centre for the Study of Living Standards, 2016, pp.3-18.

van Ark, B., O’Mahoney, M. and Timmer, M.P. “The Productivity Gap between Europe and the United States: Trends and Causes”, Journal of Economic Perspectives, Vol. 22, No 1, American Economic Association, 2008, pp. 25-44; Jorgenson, D.W., Ho, M.S. and Stiroh, K.J., “A Retrospective Look at the U.S. Productivity Growth Resurgence”, Journal of Economic Perspectives, Vol. 22, No 1, American Economic Association, 2008, pp.3-24.

See Bresnahan, T.F., Brynjolfsson, E. and Hitt, L.M., “Information Technology, Workplace Organization, and the Demand for Skilled Labor: Firm-Level Evidence”, The Quarterly Journal of Economics, Vol. 117, No 1, Oxford University Press, Oxford, February 2002, pp. 339-376 and DeLong, J.B. and Summers, L.H., “Equipment Investment and Economic Growth: How Strong Is the Nexus?”, Brookings Papers on Economic Activity, Vol. 23, No 2, Brookings Institution Press, Washington D.C., 1992, pp. 157-212.

Bloom, N., Sadun, R. and Van Reenen, J., “Americans Do IT Better: US Multinationals and the Productivity Miracle”, American Economic Review, Vol. 102, No 1, American Economic Association, February 2012, pp.167-201.

Even within the United States, Bloom et al. find huge differences in management practices: see Bloom, N., Brynjolfsson, E., Foster, L., Jarmin, R., Patnaik, M., Saporta-Eksten, I. and Van Reenen, J., “What Drives Differences in Management Practices?” American Economic Review, Vol. 109, No 5, American Economic Association, May 2019, pp. 1648-1683.

Decker, R.A., Haltiwanger, J., Jarmin, R.S. and Miranda, J., “Changing Business Dynamism and Productivity: Shocks versus Responsiveness”, American Economic Review, Vol. 110, No 12, American Economic Association, December 2020, pp. 3952-3990.

Andrews, D., Criscuolo, C. and Gal, P.N., “The Best versus the Rest: Divergence across Firms during the Global Productivity Slowdown”, mimeo, August 2019.

Schivardi, F. and Schmitz, T., “The IT Revolution and Southern Europe’s Two Lost Decades”, Journal of the European Economic Association, Vol. 18, No 5, Oxford University Press, Oxford, October 2020, pp. 2441-2486.

Andrews, D. et al., “The Best versus the Rest: Divergence across Firms during the Global Productivity Slowdown”, op. cit.

Andrews, D., Nicoletti, G. and Timiliotis, C., “Digital technology diffusion: A matter of capabilities, incentives, or both?”, OECD Economics Department Working Papers, No 1476, OECD Publishing, Paris, 2018.

Cette, G., Lopez, J. and Mairesse, J., “Labour Market Regulations and Capital Intensity”, NBER Working Papers, No 22603, National Bureau of Economic Research, Cambridge, Massachusetts, September 2016.

Bloom, N. and Van Reenen, J., “Measuring and Explaining Management Practices Across Firms and Countries”, The Quarterly Journal of Economics, Vol. 122, No 4, Oxford University Press, Oxford, November 2007, pp. 1351-1408.

At each percentile of the productivity distribution for each firm type, the chart shows the average productivity of digital versus non-digital firms. The digital sector is comprised of high-tech manufacturing (manufacture of computer, electronic and optical products and electrical equipment) and ICT services (publishing, audiovisual and broadcasting, telecommunications, IT and other information services).

See Cette, G. and de Pommerol, O.J., “Have the growth gains from ICT been exhausted?”, Eco Notepad, Banque de France, 18 October, 2018. For further updated analysis, see Cette, G., Devillard, A. and Spieza, V., “Growth factors in developed countries: a 1960-2019 growth decomposition”, Banque de France Working Paper Series, No 783, October 2020.

Bresnahan, T.F. and Trajtenberg, M., “General purpose technologies ‘Engines of growth’?”, Journal of Econometrics, Vol. 65, No 1, Elsevier, B.V., January 1995, pp.83-108.

Ibid.

Nordhaus, W., “Two Centuries of Productivity Growth in Computing”, The Journal of Economic History, Vol. 67, No 1, Cambridge University Press, Cambridge, March 2007, pp. 128-159.

Jovanovic, B. and Rousseau, P., “General purpose technologies” in Aghion, P. and Durlauf, S.N. (eds.), Handbook of Economic Growth, Vol. 1b, 2005, pp.1181-1224.

The delay in productivity growth from the fourth industrial revolution has called into question how we measure productivity. The consensus from this literature is that, while growth is likely mismeasured, this mismeasurement cannot account for the productivity slowdown. See the box entitled “Some measurement issues and the digital economy” in Anderton, R. et al., op. cit., for a general discussion as to how digitalisation may affect the measurement of various variables.

See the section entitled “Supply side” in Anderton, R. et al., op. cit., for details on the definition of intangible investment for the European system of accounts as well as the additional categories classified as intangible investment in the INTAN-Invest database.

See the box entitled “Investment in intangible assets in the euro area”, Economic Bulletin, Issue 7, ECB, 2018.

See Haskel, J. and Westlake, S., Capitalism without Capital: The Rise of Intangible Economy, Princeton University Press, Princeton, New Jersey, 28 November 2017.

See European Commission, European Data Market Study, 2020.

See Ahn, J., Duval, R.A. and Sever, C., “Macroeconomic Policy, Product Market Competition, and Growth: The Intangible Investment Channel”, IMF Working Paper, No 20/25, International Monetary Fund, February 2020.

Brynjolfsson, E., McAfee, A., Sorell, M. and Zhu, F., “Scale without mass: Business process replication and industry dynamics”, Harvard Business School Technology and Operations Management Unit Research Paper, No 07-016, 2008.

Decker, R.A., Haltiwanger, J., Jarmin, R.S. and Miranda, J., “Where has all the skewness gone? The decline in high-growth (young) firms in the U.S.”, European Economic Review, Vol. 86, Elsevier, B.V., July 2016, pp. 4-23.

Decker et al., “Changing Business Dynamism and Productivity: Shocks versus Responsiveness”, (see footnote 10 for more details).

De Loecker, J., Eeckhout, J. and Unger, G., “The Rise of Market Power and the Macroeconomic Implications”, The Quarterly Journal of Economics, Vol. 135, No 2, Oxford University Press, Oxford, May 2020, pp. 561-644.

See Autor, D., Dorn, D., Katz, L.F., Patterson, C. and Van Reenen, J., “The Fall of the Labor Share and the Rise of Superstar Firms”, The Quarterly Journal of Economics, Vol. 135, No 2, Oxford University Press, Oxford, May 2020, pp.645-709.

See the section entitled “Supply side” in Anderton, R. et al., op. cit., and references therein, for a broader discussion.

Bessen, J., “Information Technology and Industry Concentration”, Working Paper, Boston University School of Law, 12 January 2017.

Crouzet, N. and Eberly, J., “Understanding Weak Capital Investment: the Role of Market Concentration and Intangibles”, NBER Working Paper Series, National Bureau of Economic Research, Cambridge, Massachusetts, May 2019.

Calligaris, S., Criscuolo, C. and Marcolin, L., “Mark-ups in the digital era”, OECD Science Technology and Industry Working Papers, No 2018/10, OECD Publishing, Paris, 25 April 2018.

Cavalleri, M., Eliet, A., McAdam, P., Petroulakis, F., Soares, A. and Vansteenkiste, I., “Concentration, market power and dynamism in the euro area”, Working Paper Series, No 2253, ECB, Frankfurt am Main, March 2019.

See de Groen, W.P., Kilhoffer, Z., Lenaerts, K. and Mandl, I., “Employment and working conditions of selected types of platform work”, European Foundation for the Improvement of Living and Working Conditions, Publications Office of the European Union, Luxembourg, 2018 for an in-depth discussion of the terms used to group digital platforms.

Nunu, M., Nausedaite, R., Eljas-Tall, K., Svatikova, K. and Porsch, L., “Study to Monitor the Economic Development of the Collaborative Economy at sector level in the 28 EU Member States. Final Report”, Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs (European Commission), Technopolis, Trinomics, VVA Consulting, Publications Office of the European Union, Luxembourg, 2018.

Urzi Brancati, M.C., Pesole, A. and Fernández-Macías, E., “New evidence on platform workers in Europe”, JRC Science for Policy Report, Publications Office of the European Union, Luxembourg, 2020. For a review of the estimates on the platform economy in developed economies, see de Groen, W.P. et al., op. cit. For coverage of 75 countries around the world, see Berg, J., Furrer, M., Harmon, E., Rani, U., and Silberman, M.S., “Digital labour platforms and the future of work: Towards decent work in the online world”, International Labour Organization, Geneva, 20 September 2018.

For a detailed discussion on the employment and working conditions of platform workers in selected EU countries, see de Groen, W.P. et al., op. cit.

Two ECB podcasts also discuss the implications of digitalisation for European labour markets: “Virtually Everywhere? Digitalisation and jobs in the euro area (Part 1)”, ECB, Frankfurt am Main, 2 September 2020, and “Virtually Everywhere? Digitalisation and jobs in the euro area (Part 2)”, ECB, Frankfurt am Main, 29 September 2020.

See, for example, Goos, M., Manning, A. and Salomons, A., “Job Polarization in Europe”, American Economic Review, Vol. 99, No 2, American Economic Association, May 2009, pp. 58‑63.

It should be noted that “routine” does not imply trivial or mundane; instead the task at hand involves a high enough element of repetition that it can be readily codified.

The tasks framework is based on that of Autor, D.H., Levy, F. and Murnane, R.J., “The Skill Content of Recent Technological Change: An Empirical Exploration”, The Quarterly Journal of Economics, Vol. 118, No 4, Oxford University Press, Oxford, November 2003, pp. 1279‑1333.

Goos, M., “The impact of technological progress on labour markets: policy challenges”, Oxford Review of Economic Policy, Vol. 34, No 3, Oxford University Press, Oxford, July 2018, pp. 362-375.

The chart is reproduced from Dias da Silva, A., Laws, A. and Petroulakis, F., “Hours of work polarisation?”, Working Paper Series, No 2324, ECB, Frankfurt am Main, October 2019. The chart uses the finer task representation of Acemoglu, D. and Autor, D., “Skills, Tasks and Technologies: Implications for Employment and Earnings”, in Ashenfelter, O. and Card, D. (eds.), Handbook of Labor Economics, Vol. 4b, Elsevier, B.V., 2011, pp. 1043-1171.

All occupations or jobs are broken down into their tasks content according to the six task categories in Chart4. Using this methodology, the task content of the mean job is derived.

See Acemoglu, D. and Autor, D., op. cit. Also, the precise nature of the effects on labour depends on the equilibrium interaction of technology, skills supply, and consumer demand. As workers abandon middling tasks for low and high-skilled tasks, then the effects on employment and wages in these groups will depend on the relative comparative advantages of the middling workers in these tasks.

Dias da Silva et al., op. cit.

In more detail, Dias da Silva et al., op. cit., find that hours worked have fallen more for some routine jobs compared with non-routine jobs, hence the decline in hours worked is exacerbating the impact of job polarisation at the top and middle parts of the skill distribution.

Graetz, G. and Michaels, G., “Robots at Work”, The Review of Economics and Statistics, Vol. 100, No 5, MIT Press, Cambridge, Massachusetts, December 2018, pp. 753‑68.

Acemoglu, D. and Restrepo, P., “Robots and Jobs: Evidence from US Labor Markets”, Journal of Political Economy, Vol. 128, No 6, June 2020, pp. 2188-2244 show that local labour markets in the United States which were relatively more exposed to robots experienced broader negative effects on employment and wages.

For the full definition of ICT-dependent employment, and relevant data sources, see the box entitled “Digitalisation and EU labour markets: a comparative approach” in Anderton, R. et al., op. cit.

Acemoglu, D. and Restrepo, P., “The Race between Man and Machine: Implications of Technology for Growth, Factor Shares, and Employment”, American Economic Review, Vol. 108, No 6, American Economic Association, June 2018, pp. 1488-1542; and Acemoglu, D. and Restrepo, P., “Automation and New Tasks: How Technology Displaces and Reinstates Labor”, Journal of Economic Perspectives, Vol. 33, No 2, American Economic Association, 2019, pp. 3‑30.

See, for example, the section entitled “A general equilibrium perspective of how automation affects the labour market” in Anderton, R. et al., op. cit. Here, the impacts of an automation shock using a dynamic stochastic general equilibrium model show an increase in both low- and high-skilled jobs in the medium term, while increasing the wage premium of high-skilled workers relative to low-skilled ones.

There is also some evidence that the large increase in teleworking during the COVID-19 pandemic may be associated with a further rise in inequality as jobs that can be performed remotely are often associated with higher wages (see the article entitled “The impact of the COVID-19 pandemic on the euro area labour market” in this issue of the Economic Bulletin).

Frey, C.B. and Osborne, M.A., “The future of employment: How susceptible are jobs to computerisation?”, Technological Forecasting and Social Change, Vol. 114, Elsevier, B.V., January 2017, pp. 254‑280.

The specific question used in this study was: “Can the tasks of this job be sufficiently specified, conditional on the availability of big data, to be performed by state of the art computer-controlled equipment?”

Arntz, M., Gregory, T. and Zierahn, U., “The Risk of Automation for Jobs in OECD Countries: A Comparative Analysis”, OECD Social, Employment and Migration Working Papers, No 189, OECD Publishing, Paris, 14 May 2016.

See the box entitled “Digitalisation, employment and unemployment” in this article, which suggests that – across countries at the aggregate level – higher degrees of digitalisation are associated with lower unemployment.

A more thorough overview of these effects is available in the section entitled “Digitalisation and inflation” in Anderton, R., et al., op. cit.

In line with the guidelines published in the “Harmonised Index of Consumer Prices (HICP) Methodological Manual”, Eurostat, Publications Office of the European Union, Luxembourg, November 2018, the ICT product index consists of ECOICOP categories 08.2.0 Telephone and telefax equipment and 09.1 Audio-visual, photographic and information processing equipment as goods of a predominantly electronic character. Additionally, it includes categories 08.3.0 Telephone and telefax services and 12.3.1.2 Clocks and watches. The total weight of these items in the HICP is around 4% in 2020 in the euro area.

Differences across countries mainly reflect different inflation rates for telecommunication services – a sector that historically was very concentrated, but where market power has declined since 2003 (e.g., according to the OECD sector regulation indicators, overall regulation in the telecommunications sector in most euro area countries has declined since 2003). The inflation rates for audiovisual products and IT processing equipment and telephones were less diverse across the euro area countries.

The estimate for the share of online retail sales is obtained from country level business-to-consumer online sales data from the European Ecommerce Association and Eurostat.

See, for example, Choi, C. and Yi, M.H., “The effect of the Internet on Inflation: Panel data evidence”, Journal of Policy Modelling, Vol. 27, No 7, Elsevier, B.V., February 2005, pp. 885-889; Lorenzani, D. and Varga, J., “The Economic Impact of Digital Structural Reforms”, Economic Papers, No 529, European Commission, 2014; and Csonto B., Huang, Y., and Tovar, C.E., “Is Digitalization Driving Domestic Inflation?”, IMF Working Paper, No 19/271, International Monetary Fund, December 2019. More information on the internal ECB estimates can be found in the section entitled “Digitalisation and inflation” in Anderton, R. et al., op. cit.

See discussion by Meijers, H., “Diffusion of the Internet and low inflation in the information economy”, Information Economics and Policy, Vol. 18, No 1, March 2001, pp.1-23.

See, for example, Haldane, A.G., “Market Power and Monetary Policy”, a speech at the Federal Reserve Bank of Kansas City Economic Policy Symposium, Jackson Hole, Wyoming, 24 August 2018 and Shapiro, C., “Protecting Competition in the American Economy: Merger Control, Tech Titans, Labour Markets”, The Journal of Economic Perspectives, Vol. 33, No 3, American Economic Association, 2019, pp. 69-93.

Syverson, C., “Changing market structures and implications for monetary policy”, remarks made at the Federal Reserve Bank of Kansas City Economic Policy Symposium, Jackson Hole, Wyoming, 2018.

It is important to note that this discussion relates to one aspect of firms’ costs and monetary policy transmission, while there are obviously many other factors and mechanisms involved in the monetary policy transmission process.

Korinek, A. and Ng, D.X., “Digitization and the macro-economics of superstars”, mimeo, 2018.

As superstar firms gain market share, and as long as their innovation involves fixed costs, they spend an increasing share of their factor demand on fixed costs, which respond less to aggregate demand changes.

Cavallo, A., “More Amazon effects: Online competition and pricing behaviors”, NBER Working Papers, No 25138, National Bureau of Economic Research, 2018.

In other words, less space for price discrimination, combined with little or no menu costs for online retailers, can reduce price stickiness.

See Syverson, C., op. cit. and Cavallo, A., op. cit.

For example, Belgium’s statistical office collects data on internet prices for student housing and accommodation services, the statistical office in the Netherlands collects data on prices for clothing, and the German statistical office collects data on prices for long-distance buses and railway tickets.

Cavallo, A. documents a similar frequency of price changes: see Cavallo, A., “Are Online and Offline Prices Similar?: Evidence from Large Multi-channel Retailers”, American Economic Review, Vol. 107, No 1, American Economic Association, January 2017, pp. 283-303 and Cavallo, A., “More Amazon Effects: Online Competition and Pricing Behaviors”, op. cit., whereas Gorodnichenko, Y., Sheremirov, V. and Talavera, O., “Price Setting in Online Markets: Does IT Click?”, Journal of the European Economic Association, Vol. 16, No 6, Oxford University Press, Oxford, December 2018, pp. 1764-1811, report a higher frequency of price changes for online stores.

Lünnemann P. and Wintr, L., “Price Stickiness in the US and Europe Revisited: Evidence from Internet Prices”, Oxford Bulletin of Economics and Statistics, Vol. 73, No 5, Oxford University Press, Oxford, 3 August 2011, find changes in the prices of products traded online on average smaller, though more frequent, than those reported in the consumer price index data, whereas Cavallo, A., “Are Online and Offline Prices Similar?: Evidence from Large Multi-channel Retailers”, op. cit. and Gorodnichenko, Y., et al., op. cit., report that prices adjust in online shops by similar amounts, on average, as those in the brick-and-mortar shops.

For more discussion on policy implications for the United States, see Cavallo, A., “More Amazon Effects: Online Competition and Pricing Behaviors”, op. cit.

See, for example, Kemp, S., “Digital 2020: April Global Statshot”, Data Reportal, 23 April 2020.