TARGET2 celebrates 10th anniversary

The Eurosystem launched TARGET2 on 19 November 2007 as a single technical platform to replace the use of multiple local real-time gross settlement (RTGS) systems connected via TARGET. TARGET2 offered a harmonised and resilient service for settlement in central bank money at a lower cost. It has greatly contributed to driving forward the European integration process and is often referred to as the “RTGS system of the euro”.

Connecting financial institutions in Europe

In 2017 TARGET2 processed 89% of the value and 63% of the volume settled by large-value payment systems in euro. This makes it one of the biggest payment systems in the world and the market share leader in Europe. One way to imagine the scale of TARGET2 turnover is to compare it with the euro area GDP. It takes only six operational days for the system to processes a value of transactions equivalent to the whole euro area GDP. This is possible due to the velocity of money circulation in TARGET2. On average, each euro in the system is exchanged 2.4 times a day.

TARGET2 has also broadened its outreach over the past decade, ensuring a smooth flow of liquidity among an increasing number of financial institutions. The RTGS system has become attractive to both big and small actors in the financial industry due to its flexible pricing for the provision of core services. The number of accounts held with TARGET2 increased from about 900 in 2008 to nearly 2,000 in 2017.

Chart 1: Number of active RTGS accounts in TARGET2

Source: TARGET2.

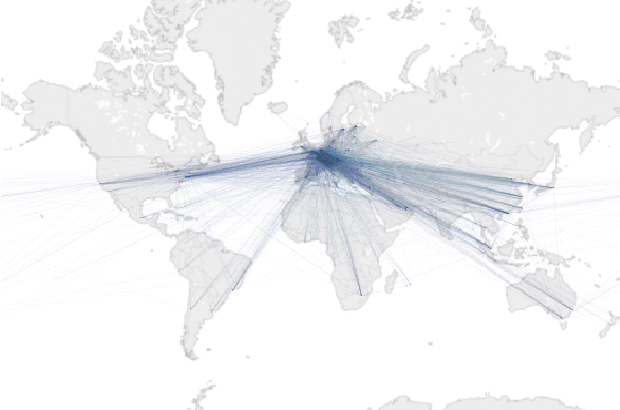

Although its main geographical focus is Europe, the system has a global outreach to more than 51,000 credit institutions. These include the TARGET2 participants as well as their branches located around the world.

Map: Flow between originators and beneficiaries of payments for the period January-October 2017

Source: TARGET2, ECB calculations.

The share of cross-border payments processed by TARGET2 has also been growing since mid-2012, reaching the pre-crisis level of the first half of 2008. The increasing cross-border activity shows that the European financial markets are becoming more interconnected. A trend that illustrates the contribution of TARGET2 to greater financial market integration in Europe.

Chart 2: Cross-border share of payments in TARGET2

Source: TARGET2, ECB calculations.

Traffic developments in TARGET2

Over the past decade, TARGET2 has maintained relatively stable traffic and turnover. The fluctuations in the daily average value and number of transactions processed by the system can be explained by a number of factors.

The average value of transactions in TARGET2 significantly dropped after its first year in operation. This was mainly the result of technical adjustments, such as the migration of national infrastructure payment components to TARGET2 and changes in the statistical framework. The further drop in the average daily value processed by the RTGS system for the period 2015-2017 can be attributed to the migration of central securities depositories (CSDs) to the securities settlement platform TARGET2-Securities (T2S).

Chart 3: Average daily value processed by TARGET2 for the period 2008-2017

(EUR billions)

Source: TARGET2.

At the same time, the average daily volume in TARGET2 fluctuated at a much slower pace. The changes resulted from two factors: the outbreak of the financial crisis in the second half of 2008 and the finalisation of the migration to SEPA in 2014. The latter reduced the customer payments segment leading to lower overall TARGET2 volumes.

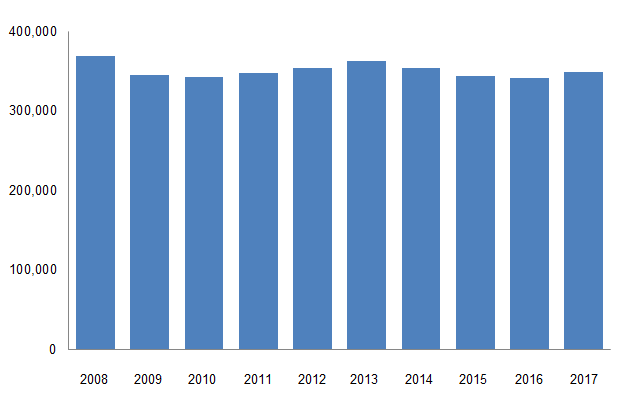

Chart 4: Average daily volume processed by TARGET2 for the period 2008-2017

(number of transactions)

Source: TARGET2.

Supporting the financial industry through challenging times

The main objective of TARGET2 is to support the implementation of the Eurosystem’s monetary policy, the operations of other financial market infrastructures, as well as the settlement of both interbank and commercial payments in euro.

When Europe was successively hit by the global financial crisis and the sovereign debt crisis, TARGET2 continued to serve as a robust and reliable financial market infrastructure. In recent years, it has not been affected by any major operational incidents and has maintained close to 100% technical availability.

TARGET2 has supported the unconventional monetary policy conducted by the ECB throughout the challenging times of financial turmoil and low inflation. The RTGS system has maintained smooth operations, despite excess liquidity, negative interest rates and quantitative easing. Throughout these times, the banks benefited from the effective liquidity savings mechanism in TARGET2, which helped them cope with the challenging liquidity conditions.

Facilitating securities settlement in T2S

The launch of the pan-European platform for securities settlement T2S in 2015 was another chapter in the story of TARGET2. T2S brought together both cash and securities accounts on a single technical platform. The two market infrastructures are interlinked as TARGET2 facilitates the settlement in T2S by providing the liquidity needed for the cash leg of securities transactions.

Adapting to an instant payments environment

The global payments landscape is going through a transformation driven not only by policy and regulation, but also by technological innovation and changing consumer behaviour. By definition, the RTGS systems offer settlement in real time. The past years have also seen a growing demand for near real-time settlement of retail payments, also known as instant payments.

To meet this demand the European payments industry is moving fast forward. Aiming to ensure a pan-European solution, the European Payments Council developed a SEPA Instant Credit Transfer (SCT Inst) rulebook. The scheme itself was launched on 21 November 2017. In order to support its users in adopting SCT Inst, TARGET2 amended a procedure offered to financial market infrastructures by way of its latest software release deployed on 13 November 2017. This allows automated clearing houses to support a pan-European solution for instant payments in euro.

Furthermore, the Eurosystem is developing a new service for the settlement of instant payments as part of TARGET2. TARGET Instant Payment Settlement (TIPS) will enable payment service providers to offer fund transfers in real time and around the clock, 365 days a year. It will join the family of TARGET services offered to the financial industry in November 2018.

What else does the future hold for TARGET2?

Instant payments are not the only area in which TARGET2 plans to enhance its service and functionalities. The RTGS services provided by the system are also going through a revision. The main objectives are to address the business needs of its users stemming from new market and regulatory developments; to optimise the processes by building on the synergies between TARGET2 and T2S; and to further enhance the cyber resilience of the system.

With the possible consolidation of TARGET2 and T2S and the launch of the TIPS service, TARGET2 is heading towards exciting times.

Follow us here on our journey ahead!

Disclaimer: The data were compiled by members of the TARGET Analytics Group (TAG), who have access to TARGET2 data in accordance with Article 1 of Decision (EU) 2010/9 of the European Central Bank of 29 July 2010 on access to and use of certain TARGET2 data.

The ECB and the Market Infrastructure Board/Market Infrastructure and Payments Committee (former PSSC) have checked the data to ensure they are compliant with the rules for guaranteeing the confidentiality of transaction-level data pursuant to Article 1(4) of the above-mentioned Decision.