- STATISTICAL RELEASE

Households and non-financial corporations in the euro area: fourth quarter of 2020

9 April 2021

- Households’ financial investment increased at higher annual rate of 4.0% in the fourth quarter of 2020, compared with 3.5% one quarter earlier

- Non-financial corporations’ financing increased at broadly unchanged annual rate of 2.1%

- Non-financial corporations’ gross operating surplus decreased at lower annual rate (-2.7% compared with ‑5.7% one quarter earlier)

Chart 1. Household financing and financial and non-financial investment

(annual growth rates)

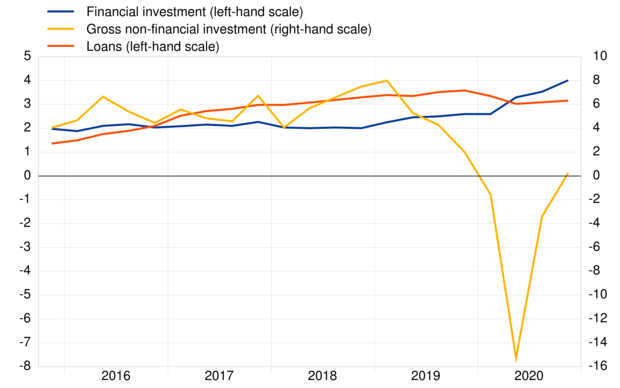

Chart 2. NFC gross-operating surplus, non-financial investment and financing

(annual growth rates)

Households

The annual growth rate of household gross disposable income decreased to 0.8% in the fourth quarter of 2020 (after 1.2% in the previous quarter). Gross operating surplus and mixed income of the self-employed decreased by -2.6% (after -0.2%) and compensation of employees declined by -0.9% (after ‑1.4%). Household consumption expenditure decreased at a higher rate (‑7.5% after ‑4.2%).

The household gross saving rate (calculated from four-quarter cumulated sums) was 19.6% in the fourth quarter of 2020, compared with 17.8% in the previous quarter.

Household gross non-financial investment (which refers mainly to housing) increased at an annual rate of 0.2% in the fourth quarter of 2020, after -3.4% in the previous quarter. Loans to households, the main component of household financing, increased at a broadly unchanged rate of 3.2%.

The annual growth rate of household financial investment increased to 4.0% in the fourth quarter of 2020, from 3.5% in the previous quarter, driven mainly by a rise in currency and deposits at a rate of 7.9% (after 6.9%). Investment in life insurance and pension schemes grew at a higher rate of 1.9% (after 1.6%), while shares and other equity rose at a broadly unchanged rate of 2.3%. Disinvestment in debt securities continued, at a higher rate (-7.3% after -5.3%).

The annual growth rate of household net worth increased to 5.4% in the fourth quarter of 2020, from 3.8% in the previous quarter. This was due to a rise in the value of housing wealth (5.2%, after 4.8%) and net valuation gains on financial assets, combined with net purchases of financial and non-financial assets, which together exceeded the increase in liabilities. The household debt-to-income ratio continued to increase, to 96.3% in the fourth quarter of 2020 from 93.8% in the fourth quarter of 2019, as loans to households grew faster than disposable income.

Non-financial corporations

Net value added by NFCs decreased at a lower rate in the fourth quarter of 2020 (-5.6% after -6.8% in the previous quarter). Gross operating surplus and net property income (defined in this context as property income receivable minus interest and rent payable) both declined. As a result gross entrepreneurial income (broadly equivalent to cash flow) decreased at a rate of -4.8% (after -5.6% in the previous quarter).[1]

NFC gross non-financial investment decreased at a lower annual rate in the fourth quarter of 2020 (-12.9% after -13.6% in the previous quarter).[2] Financing of NFCs increased at a broadly unchanged rate of 2.1%. Loan financing[3] grew at 3.6% (after 3.1%), and trade credit financing was broadly unchanged (‑0.1%) after decreasing (-2.5%) in the previous quarter. Conversely, equity financing grew at a rate of 1.1% (after 1.3%). The annual growth rate of issuance of debt securities by NFCs stood at an unchanged rate of 9.8%.

NFC's debt-to-GDP ratio (consolidated measure) increased to 84.2% in the fourth quarter of 2020, from 77.3% in the same quarter of the previous year; the non-consolidated (wider) debt measure increased to 148.3% from 137.3%. The increases in these ratios were due to an increase in the debt of NFCs and a decline in GDP over this period.

NFC financial investment grew at an annual rate of 3.5%, compared with 3.0% in the previous quarter. Among its components, other financial assets, which consist mainly of accounts receivable, increased (after decreasing in the previous quarter). This increase more than compensated a slower growth of investment in currency and deposits (18.6% after 20.3%) as well as shares and other equity (1.8% after 2.0%).

For queries, please use the Statistical information request form.

Notes

- The annual growth rate of non-financial transactions and of outstanding assets and liabilities (stocks) is calculated as the percentage change between the value for a given quarter and that value recorded four quarters earlier. The annual growth rates used for financial transactions refer to the total value of transactions during the year in relation to the outstanding stock a year before.

- Hyperlinks in the main body of the statistical release are dynamic. The data they lead to may therefore change with subsequent data releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.

- Gross entrepreneurial income is the sum of gross operating surplus and property income receivable minus interest and rent payable.

- Gross non-financial investment is the sum of gross fixed capital formation, changes of inventories, and the net acquisition of valuables and non-produced assets (e.g. licences).

- Loan financing comprises loans granted by all euro area sectors (in particular MFIs, non-MFI financial institutions, general government, and loans from other non-financial corporations) and by creditors that are not resident in the euro area.