Macroprudential analysis of residential real estate markets

Published as part of the Macroprudential Bulletin 7, March 2019.

This article presents the ECB framework for assessing financial stability risks stemming from residential real estate markets and for designing macroprudential policy responses. It reviews recent developments in residential real estate markets and policy initiatives to address risks.

1 Introduction

Developments in the residential real estate (RRE) sector can have strong repercussions on financial stability and the real economy.[1] The importance of the residential real estate sector for financial stability stems from its central role in the economy, the large fraction of household wealth invested in real estate assets, the primary role of the financial sector in financing real estate investments and the important collateral role of real estate assets.[2]

The identification and monitoring of RRE market risks to financial stability as well as the design of commensurate macro-prudential policies is a priority for macroprudential authorities, including the ECB. The ECB is a constituent part of the EU institutional framework for macroprudential oversight. Specifically, under Council Regulation (EU) No 1024/2013 (the SSM Regulation), the ECB is responsible for assessing macroprudential measures adopted by national authorities in the countries subject to European banking supervision. The ECB also has the power to apply, if deemed necessary, more stringent measures than those adopted nationally acting on its own initiative or at the request of national authorities. More generally, the ECB has responsibilities for the coordination and co-shaping of macroprudential policies in the euro area.

Given the economic and policy implications of RRE markets, this article discusses the relevant framework for risk and policy analysis applied by the ECB and highlights the key messages of its current RRE risk and policy assessment.

2 Macroprudential risk and policy framework for residential real estate markets

This section briefly presents a framework for macroprudential risk and policy analysis of residential real estate markets. This framework relies on experience gained in cooperation with the ESRB (2016) and current initiatives within the euro area and beyond.

2.1 The framework for risk analysis

The ECB uses a range of indicators to assess residential real estate risks from a macroprudential perspective. Such indicators have been identified as good leading indicators of emerging vulnerabilities preceding residential real estate downturns. Similarly to the ESRB (2016), core indicators are grouped into three main categories (or “stretches”) which capture different sources of residential real estate risks. This core set of indicators is complemented by other information encompassing linkages with the financial sector and structural features of real estate markets which might amplify adverse shocks.

Indicators in the collateral stretch inform risks stemming from unsustainable price developments. “Exuberant” price dynamics and misalignments could signal the formation of price bubbles early on, which could lead to financial instability and deep recessions.[3] Within the collateral stretch the ECB monitors measures of house price dynamics and different valuation measures.[4]

Indicators in the funding stretch help to identify risks stemming from unsustainable lending developments. “Exuberant” lending contributes to real estate price bubbles and makes bubble bursts more costly.[5] Furthermore, the deterioration of credit standards[6] might lead to fragilities in bank balance sheets which could amplify financial instability. Within the funding stretch, the ECB monitors indicators capturing the dynamics of mortgage loans, measures of loan pricing and credit standards.

Indicators in the household stretch help to detect fragilities in household balance sheets. Empirical evidence suggests that when households are highly indebted, housing busts are more likely to be associated with longer and more costly recessions.[7] Indicators monitored by the ECB include the level of household debt in relation to disposable income, household financial assets in relation to debt (a mitigating factor), and the aggregate debt service to income ratio.

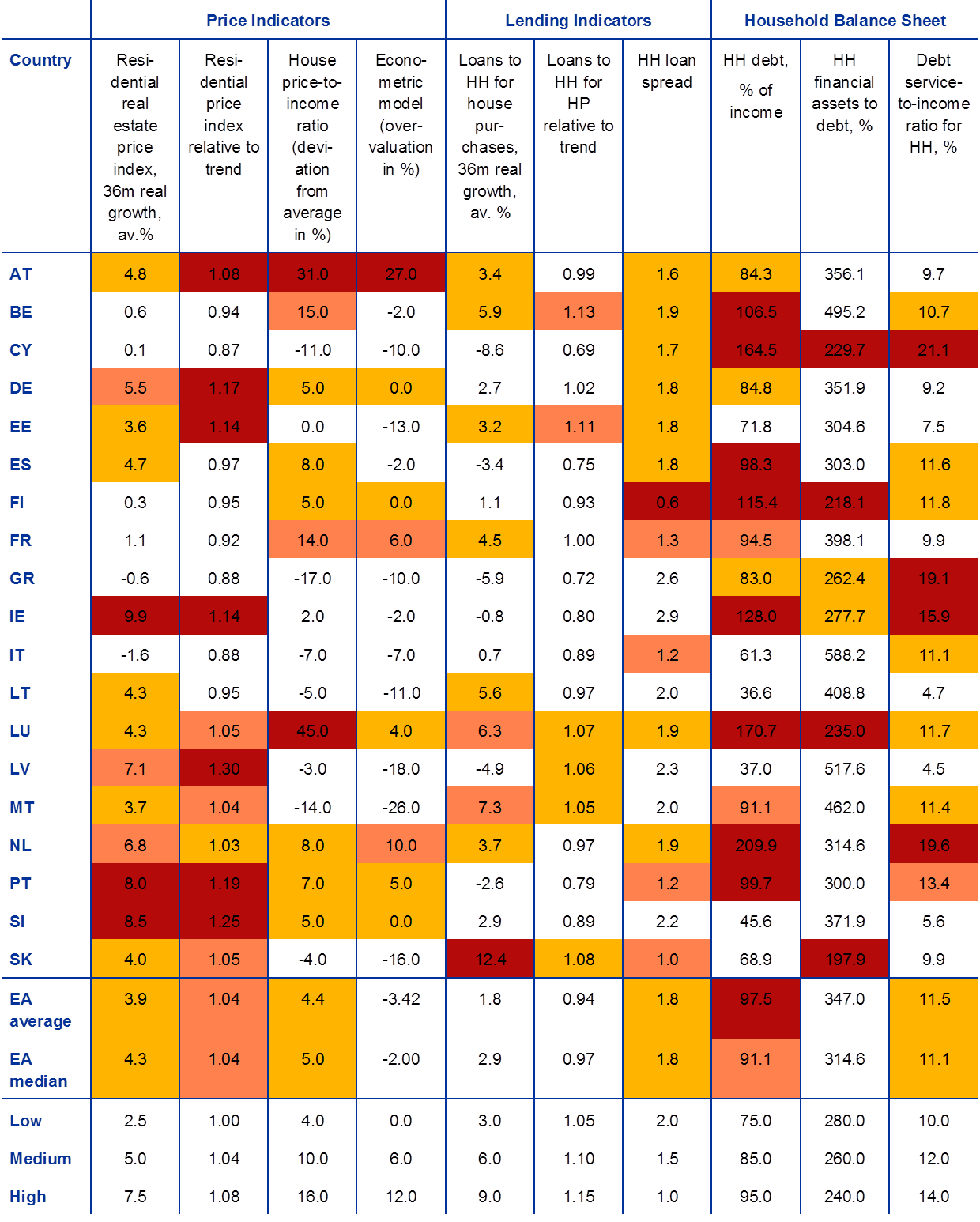

Table 1

Residential real estate scoreboard – an input to the risk identification process

Source: ECB and ECB computations.

Notes: Each cell of the scoreboard reports the latest available value of the respective indicator. Colour coding: a discrete rating with four categories is applied to each indicator based on whether the indicator value exceeds certain indicative threshold values. The threshold values, which are reported in the lower part of the table (low, medium and high), are based on early warning model thresholds and/or the views of experts, after checking the overall distribution of the indicator across time and countries. The colour coding relates to the intensity of risk signals as follows: no colour, no signal; yellow: low intensity signal (low threshold breached); orange: medium intensity signal (medium threshold breached); red: high intensity signal (high threshold breached). Last observation for pricing indicators was Q3 2018, except for BE (Q1 2018) and CY and FI (Q2 2018). Last observation for lending indicators was Q4 2018. Last observation for household balance sheet indicators was Q3 2018, except for CY, EE, LT, LU, LV and SK (Q4 2017) and MT (Q2 2017) in the case of HH debt, and except for AT, BE, DE, ES, FI, FR, GR, IE, IT, LU, NL and PT (Q2 2018) in the case of debt service to income ratio for HH.

Key indicators for the three stretches are presented in the scoreboard above (see Table 1). The latter consists of a heat map where each indicator is evaluated against a set of thresholds, guided in turn by model-based evidence using the ECB/ESRB crisis database[8] and/or by the cross-time and cross-country distributions of the indicators.[9]

The risk assessment also considers other information on links between real estate markets and the financial sector which could amplify adverse shocks. Additional risk information encompasses indicators related to (a) the size of the RRE market in a country, (b) the exposure of banks to RRE, (c) potential supply shocks (e.g. deleveraging) and (d) the importance of the collateral channel. Furthermore, analysing the exposure of banks to the construction sector is important in order to assess concentration and potential solvency risks as the dynamic of the construction sector is intertwined with that of RRE, particularly during downturns. Finally, household housing wealth is assessed to inform the negative impact on consumer spending following a sudden downturn in house prices.

Country-specific and structural features are also considered in view of the wide heterogeneity of the domestic residential real estate markets across euro area countries. The most important structural and institutional features include RRE market characteristics (home ownership rate, typical maturity and fixation of housing loans), rental market restrictions, tax policy and transaction costs. Further, supply-side characteristics (price elasticity of new housing, regulation and spatial planning) as well as demand-side factors (demographics and changes in household structures) are important drivers of housing markets. Nonetheless, the impact of certain structural features in RRE markets on financial stability is not clear ex-ante.[10]

To facilitate the policy discussion, risk signals from the indicators are distinguished along stock and flow dimensions. For example, stock vulnerabilities signalled by high household indebtedness and/or house price overvaluations indicate the need to increase resilience of lenders. Flow vulnerabilities related to increasing indebtedness and/or deteriorating lending standards associated with excessive credit growth call for the activation of policies to tame the cycle or to contain the accumulation of vulnerabilities.

2.2 The framework for policy analysis

Macroprudential policies to address real estate risks encompass two main categories: capital-based and borrower-based measures. Capital measures require banks to hold more capital against real estate exposures. Borrower-based measures consist of the imposition of limits to the volume of credit a borrower can obtain.

The legal framework for the implementation of capital-based instruments is harmonised across the EU while borrower-based instruments are based on national legislation and are not harmonised across the EU.[11] The framework for capital measures is provided by the Capital Requirements Directive (CRD IV) and the Capital Requirements Regulation (CRR).[12] Examples of capital-based macroprudential instruments to address real-estate-related risks encompass higher risk weights for real estate exposures (Article 124 CRR) and higher floors on banks’ loss-given-default (Article 164 CRR). Additional capital requirements for real estate exposures applying to all or a subset of domestic financial institutions may also be introduced via Article 458 CRR.

The legal basis for the macroprudential mandate of the ECB is provided by Council Regulation (EU) No 1024/2013 (the SSM Regulation). In general, the ECB and national authorities share a macroprudential mandate in that the ECB can top up selected national macroprudential measures, primarily related to capital instruments, while borrower-based instruments are the remit of national authorities. Where applicable, the ECB can act on its own authority as well as at the request of national authorities.

The choice of implementing one or a combination of macroprudential instruments crucially depends on the nature of the identified real estate vulnerabilities and on the specific policy objectives (Table 2). In general, macroprudential policy is used to strengthen the resilience of borrowers and lenders against the consequences of risks materialising as well as to counter the build-up of these risks, thereby lowering the probability of their materialisation. However, due to their characteristics, different instruments are particularly suited to target specific objectives.

Capital-based instruments are most suited to address risks stemming from stock vulnerabilities such as, for instance, high levels of household indebtedness or overvalued real estate prices. By requiring banks to hold more capital against the outstanding stock of real estate exposures, capital-based measures ensure that adequate buffers are in place to absorb losses on banks’ mortgage loan portfolios in case of adverse developments. Furthermore, additional capital requirements help to ensure the smooth provision of credit even during downturns, thereby mitigating the impact of crises on the broader economy.

Borrower-based instruments are best suited to address flow vulnerabilities stemming, for example, from excessive credit growth, deteriorating credit standards and increasing household indebtedness. By curtailing the new loan amount, borrower-based instruments such as limits to LTV, DTI and DSTI ratios restrain the growth of credit and that of household indebtedness, in addition to increasing households’ resilience to adverse income and interest rate shocks. Furthermore, borrower-based instruments improve the quality of banks’ mortgage loan portfolios by encouraging prudent lending standards, which gradually make loan portfolios less risky over time.

Table 2

Linking macroprudential instruments to vulnerabilities and policy objectives

Source: ECB.

Notes: “Collateral stretch” vulnerabilities relate to unsustainable price developments; “funding stretch” vulnerabilities are related to unsustainable lending developments; and “household stretch” vulnerabilities relate to fragilities in household balance sheets.

The design and calibration of macroprudential instruments are crucial to ensure that they achieve the policy objectives. The level at which instruments are calibrated determines the strength of the effect on the key target variables.

Other policies influence the design and calibration of macroprudential instruments to address residential real estate risks. The effects of monetary and fiscal policies on variables representing key macroprudential objectives should be taken into account when deciding to activate macroprudential instruments. Microprudential instruments affecting individual banks may also be used to address institution-specific risks related to real estate exposures. This interaction demands close cooperation between micro- and macroprudential authorities. Finally, other macroprudential instruments designed to counter broader-based vulnerabilities can also impact the real estate sector. Capital-based instruments, such as the Countercyclical Capital Buffer (CCyB)[13] and the Systemic Risk Buffer (SRB)[14] may also help to counter the build-up of real estate vulnerabilities.

3 Current developments in residential real estate markets and policy responses

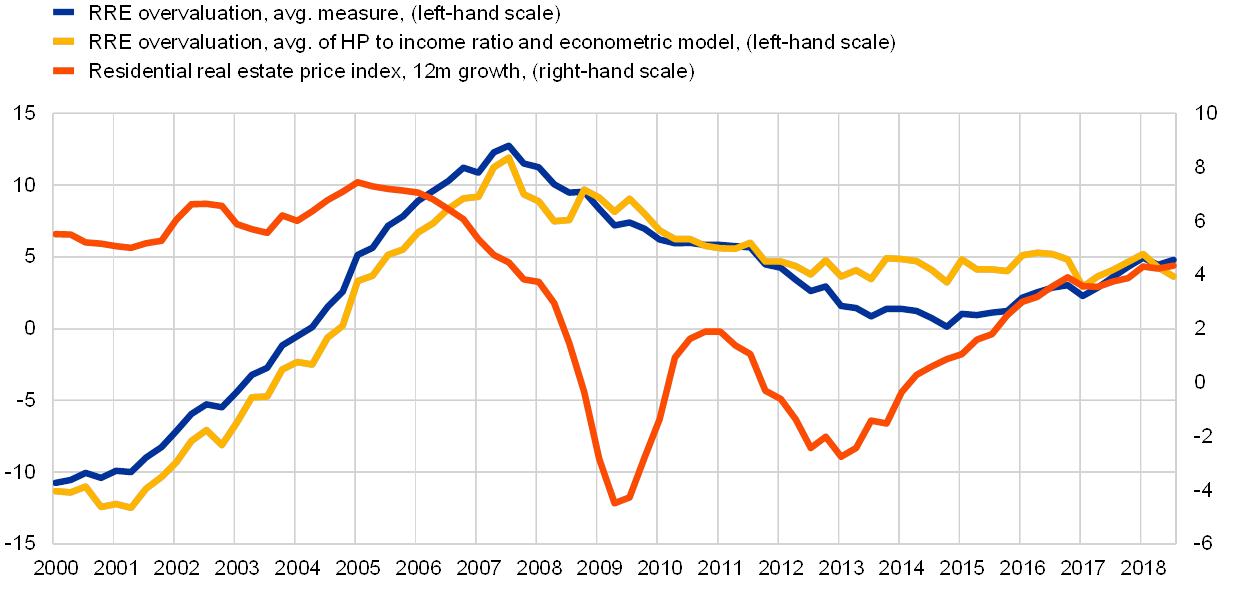

The residential real estate cycle across the euro area has been gaining momentum in recent years. The acceleration of the growth of residential house prices has been steady since the recovery in euro area housing markets started in mid-2014 (Chart 1). Nominal RRE price annual growth reached 4.3% in 2018 Q3 (2.2% in real terms), which is not far from annual growth rates recorded in the period 2003-2006, before the global financial crisis.

The robust price dynamics are contributing to some signs of overvaluation. The nominal RRE price index is currently 8.7 p.p. higher than the pre-crisis peak in Q3 2008. Prices increased faster than the disposable income, resulting in a slight deviation of the house price to income ratio from its long term average (6 p.p. in Q3 2018). A model based assessment, also points to slight overvaluation (1.2 p.p. in Q3 2018).[15]

Chart 1

Residential real estate annual price growth and valuations for the euro area

(percentages)

Sources: ECB and ECB calculations.

Notes: “RRE overvaluation, avg. measure” stands for the simple average of valuation measures based on price-to-income ratio, price-to-rent ratio, asset pricing approach, and valuation based on the econometric model estimates.

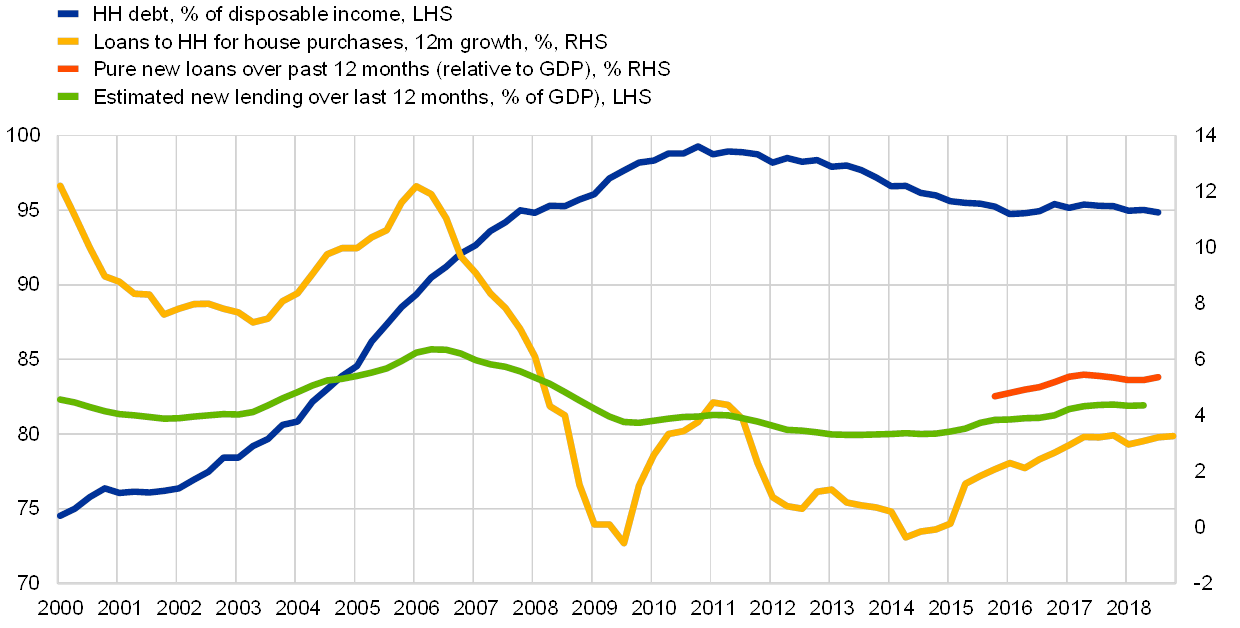

Although mortgage loan growth remains moderate, strong loan origination and signs of easing lending standards call for close monitoring of credit developments. Mortgage lending growth remains moderate in nominal and real terms (3.3% and 1.3%, y-o-y growth in Q4 2018, respectively; Chart 3). Nonetheless, these net loan growth figures are dampened by loan repayments resulting from the boom period in mortgage markets before the crisis. In contrast, loan origination (i.e. new bank loans) dynamics appear to be stronger (in line with figures observed in the period 2004 and 2005).[16] Against this background, lending terms should be monitored closely also in view of emerging evidence of a progressive easing of loan lending standards for house purchases since Q1 2017 as indicated by the ECB Bank Lending Survey (BLS).[17]

The trend decline in household indebtedness in the euro area appears to have halted and the debt-to-income ratio is hovering around the still relatively high level of 95% (Chart 3). In addition, households in countries where floating rate contracts are prevalent might be exposed to interest rate risks.

Against the backdrop of the recovery in residential real estate markets gaining momentum, a number of policy recommendations apply across euro area countries. National authorities should closely monitor lending standards on mortgage loans to ensure that banks apply sound lending practices. To this end, it is important that granular data are made available to policy makers in line with the ESRB recommendation 2016/14 on closing real estate data gaps.[18] To prevent the deterioration of lending standards, national authorities could provide guidance to banks on prudent lending practices and require banks to test long-term debt affordability at loan origination with a focus on interest rate risk.[19] This would ensure that loans will continue to perform in a scenario of rising interest rates. Finally, national authorities should stand ready to activate borrower-based measures. To this end, a comprehensive legislative framework for borrower-based measures should be available to policy makers.[20]

Chart 2

Loans to households for house purchase, new loans, and household debt

(percentage of disposable income, annual percentage change)

Sources: ECB and ECB calculations.

Note: Data for estimated new lending are from Adalid and Falagardia (2018).

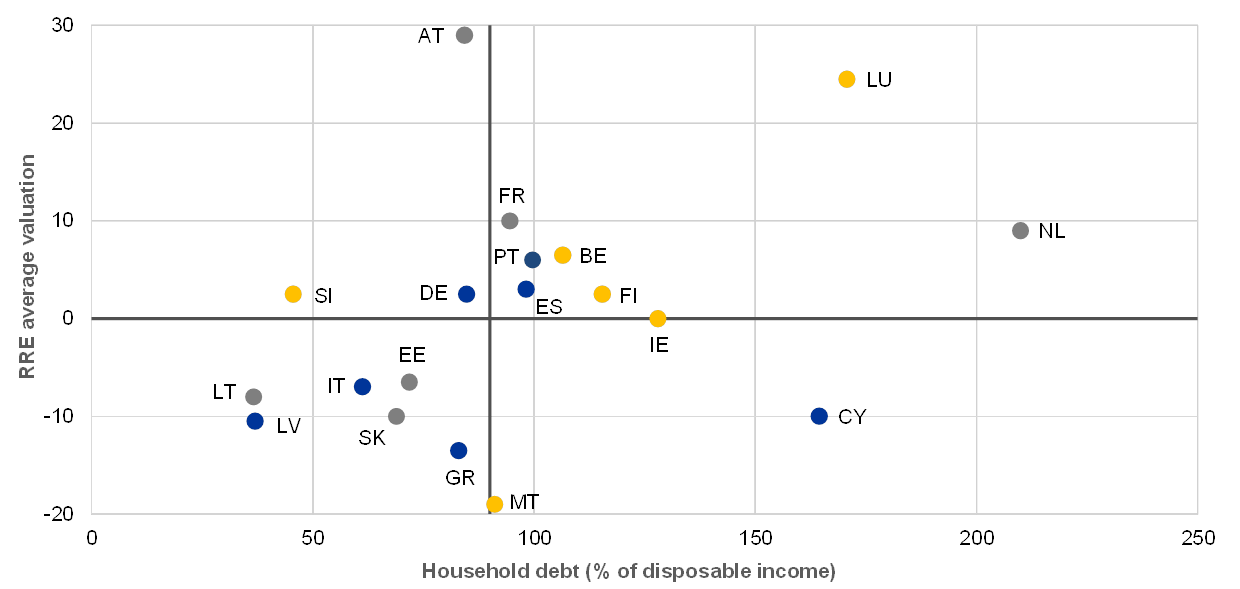

The aggregate developments in the euro area are underpinned by significant cross country heterogeneity. Stock (overvaluations and indebtedness) and flow vulnerabilities (price increases and lending growth) relevant for macroprudential policy are more evident in a number of euro area countries (Charts 3 and 4).

At least fourteen euro area countries have already adopted targeted macroprudential measures to address residential real estate vulnerabilities (Table 3). These measures include capital measures, in the form of higher risk-weights on mortgage exposures, and diverse mixes of borrower-based measures.

Policies appear commensurate to existing risks in a number of countries but further policy actions may be warranted in others. Whenever possible, the impact of enacted policies should be assessed as a matter of priority. At the same time, the continuation of risk build-up in residential real estate markets in some countries should be carefully monitored as it could require further policy interventions in the near future.

Chart 3

Stock vulnerabilities and capital measures

(yellow: countries that have implemented RRE specific capital measures, i.e. RW policies;

grey: countries with other capital measures, i.e. CCyB, SyRB)

Sources: ECB and ECB calculations.

Notes: “Average valuation” stands for the simple average of valuation measure based on price-to-income ratio and valuation based on the econometric model estimates. Last observation for RRE average valuation was Q3 2018, except for BE (Q1 2018) and CY (Q2 2018). Last observation for household debt was Q3 2018, except for CY, EE, LT, LU, LV and SK (Q4 2017) and MT (Q2 2017).

Chart 4

Flow vulnerabilities and borrower-based measures

(countries in yellow have implemented borrower-based measures.)

Sources: ECB and ECB calculations.

Notes: New loans are defined as any new agreement between the customer and the MFI. New agreements including all financial contracts, terms and conditions that specify for the first time the interest rate of the deposit or loan, and all renegotiations of existing deposit and loan contracts. Last observation was Q3 2018, except for BE (Q1 2018) and CY and FI (Q2 2018) in the case of annual RRE price growth.

Table 3

Overview of policies to address residential real estate vulnerabilities in the euro area

Sources: ECB and national authorities

Notes: As of 31 January 2019. The measures in Austria are in the form of recommendations. The measures are adopted by Banco de Portugal as a Recommendation, based on the "comply or explain" principle. The + sign indicates the exemption/speed limit (the percentage of new loans that can be granted above the limit of the lending standard). National specific measures are not always comparable given different definitions of loans, value/collateral and/or income.

* The limit in Finland is on loan-to-collateral (LTC), rather than loan-to-value (LTV).

** A maximum percentage of the value of new lending is allowed above the LTV limit: 5 per cent for first time buyers, 20 per cent for second and subsequent buyers, 10 per cent for buy-to-let borrowers. From January 2018, up to 20 per cent of the value of new lending to first time buyers and 10 per cent of the value of new lending to second and subsequent buyers will be permitted to be above the 3.5 LTI limit.

*** In the case of floating or mixed interest rate agreements, the impact of an interest rate rise is considered. The DSTI computation takes into account a reduction of the borrower's income if at the planned expiry of the agreement the borrower is aged 70 or over. For maturity, there is gradual convergence towards an average maturity of 30 years by the end of 2022.

**** Up to 25% of the value of new lending is allowed with LTV>80%. This allowance will be phased down as follows: 20% as of 1/7/2019. Up to 10% of the value of new lending is allowed above the DTI limit. For DTI, the allowance of 10% will be phased down as follows: 5%+5% with additional conditions as of 1/7/2019.

4 Conclusion

The strong linkages between residential real estate (RRE), the financial sector and the overall economy have been brought to the fore, in particular since the last global financial crisis. Therefore, an essential component of the financial stability surveillance and macroprudential policy mandate of the ECB is the application of a robust and comprehensive RRE risk detection and policy framework.

This article describes the key features of the ECB framework used to identify vulnerabilities in residential real estate markets and guide the appropriate macroprudential policy response and dialogue. Beyond regular analysis, the framework forms the basis for the macroprudential dialogue with national authorities, thereby facilitating a common understanding of risk developments and a more efficient policy process.

The current analysis indicates that residential real estate vulnerabilities relevant to macroprudential policy are present in a number of euro area countries. In general, the activation over the past years of macroprudential instruments related to residential real estate risks recognises the need for a proactive policy stance to avoid possible negative consequences for the financial sector and the broader economy. However, the continuation of observed trends in residential real estate markets in some countries suggests that further policy actions remain warranted in the near future.

References

Adalid, R. and Falagiarda, M. (2018), “How repayments manipulate our perceptions about loan dynamics after a boom”, Working Paper Series, No 2211, ECB.

Battistini, N., Le Roux, J., Roma, M. and Vourdas, J. (2018), “The state of the housing market in the euro area”, Economic Bulletin, Issue 7, ECB.

Barrell, R., Davis, E. P., Karim, D. and Liadze, I. (2010), “Bank regulation, property prices and early warning systems for banking crises in OECD countries”, Journal of Banking & Finance, Elsevier, Vol. 34(9), September, pp. 2255-2264.

Borio, C. and Drehmann, M. (2009), “Towards an operational framework for financial stability: ‘fuzzy’ measurement and its consequences”, BIS Working Paper, No 284.

Cerutti, E., Dagher, J. and Dell'Ariccia, G. (2017), “Housing finance and real-estate booms: A cross-country perspective”, Journal of Housing Economics, Elsevier, Vol. 38(C), pp. 1-13.

Claessens, S., Kose, A. and Terrones, M. (2009), “What Happens During Recessions, Crunches and Busts?”, Economic Policy, Vol. 24, No 60.

Crowe, C., Dell’Ariccia, G., Igan, D. and Rabanal, P. (2013), “How to deal with real estate booms: Lessons from country experiences”, Journal of Financial Stability, Elsevier, Vol. 9(3), pp. 300-319.

ESRB (2015), “Report on residential real estate”, December.

ESRB (2016), “Vulnerabilities in the EU residential real estate sector”, November.

ECB (2018), “The state of the housing market in the euro area”, Economic Bulletin, Issue 7.

Glick, R. and Lansing, K. (2010), “Global household leverage, house prices, and consumption”, FRBSF Economic Letter, Federal Reserve Bank of San Francisco.

Jordà, Ò., Schularick, M. and Taylor, A.M. (2015), “Leveraged bubbles”, Journal of Monetary Economics, Elsevier, Vol. 76(S), pp. 1-20.

Jordà, Ò., Schularick, M. and Taylor, A.M. (2016), “The great mortgaging: housing finance, crises and business cycles”, Economic Policy, Vol. 31(85), pp. 107-152.

Lo Duca, M., Koban, A., Basten, M., Bengtsson, E., Klaus, B., Kusmierczyk, P., Lang, J.H., Detken, C. (ed.) and Peltonen, T. (ed.) (2017), “A new database for financial crises in European countries”, Occasional Paper Series, No 194, ECB, July.

Mian, A and Sufi, A. (2011), “House prices, home equity-based borrowing and the US household leverage crisis”, American Economic Review, Vol. 101, pp. 2132-56.

Mian, A. and Sufi, A. (2014), House of debt: How they (and you) caused the Great Recession, and how we can prevent it from happening again, University of Chicago Press.

See for example Claessens, Kose and Terrones (2009) and Economic Bulletin, Issue 7, ECB, 2018.

For a comprehensive overview of residential real estate markets and their implications for financial stability in the EU, see ESRB (2016a).

See Borio and Drehmann (2009), Barell et al. (2010), and Cerutti et al. (2017).

For more details about the valuation measures, see Box 3 in Financial Stability Review, ECB, June 2011 and November 2015.

See Jordà et al. (2015), Cerutti et al. (2017), and Crowe et al. (2013).

Credit standards refer to the terms and conditions of lending applying to new mortgage loans. Examples of credit standards include the loan-to-value (LTV) ratio, the debt service to income (DSTI) ratio, the debt to income (DTI) ratio, loan maturity and amortisation practices.

See Glick et al. (2010), Mian and Sufi (2011), Mian and Sufi (2014), and Jordà et al. (2016).

See Lo Duca et al. (2017).

Where the estimation of early warning thresholds is possible, the medium threshold is based on balanced preferences between type I (missed crises) and type II errors (false alarms). The plausibility of thresholds and early warning signals is assessed on the basis of expert judgement.

Example: on the one hand, a structural gap between the demand and supply of housing can mitigate the risk of turning points in the short term. On the other hand, the structural gap can amplify vulnerabilities in the medium term. By inducing expectations of continued price increases, it could lead to the relaxation of lending standards and the emergence of speculative demand. See ESRB (2015) for a discussion of structural features of housing markets

Typically, frameworks for borrower-based measures include one or more of the following instruments: loan-to-value (LTV) ratio, the debt service-to-income (DSTI) ratio, the debt-to-income (DTI) ratio, loan maturity and amortisation practices. Loan-to-value (LTV) limits restrict the value of the loan relative to the value of the underlying (real estate) collateral. Therefore, LTV limits reduce bank losses when borrowers default and promote more responsible behaviour of borrowers by requiring them to finance house purchases with equity. Loan/debt-to-income (L/DTI) limits constrain the amount of a mortgage loan / overall debt relative to the borrower’s income. Debt service-to-income (DSTI) limits constrain debt-service payments in relation to borrowers’ income. Therefore, these income-based measures promote debt sustainability and contribute to lowering the probability of default by borrowers. Finally, maturity and amortisation requirements set limits to, respectively, the time for the full repayment of the loan and specific requirements on the periodic repayment of the loan’s principal. Therefore, they also contribute to reducing the default probability of borrowers. Maturity and amortisation requirements are also used to accompany DSTI limits to prevent their circumvention through a lengthening of loan maturities and/or slower amortisation schedules.

Several macro-prudential instruments explicitly target systemic risks stemming from real estate exposures, posing issues of consistency and coordination. Following the Commission proposal to remove the macroprudential use of Pillar 2, discussions are ongoing to streamline and improve the various instruments in the EU toolkit.

Article 136 CRD.

Article 133 CRD.

The model-based approach to valuation is described in Box 3 in Financial Stability Review, ECB, November 2015.

See Adalid and Falagardia (2018).

See The Euro area bank lending survey – Third quarter of 2018.

Recommendation of the European Systemic Risk Board of 31 October 2016 on closing real estate data gaps (ESRB/2016/14).

Such guidance has been issued, inter alia, in Austria and Portugal.

See the Governing Council statement on macroprudential policies (15 December 2016). A comprehensive legal framework for borrower-based measures should be in place in all countries, regardless of the current risk outlook, to ensure readiness to act with appropriate instruments should the need arise. In Germany, Spain, Finland, Greece, and Italy the framework is currently lacking or is incomplete. Efforts to introduce the framework are underway in Luxembourg.