How ECB purchases of corporate bonds helped reduce firms’ borrowing costs

In June 2016, the ECB launched its corporate sector purchase programme, through which it purchased corporate bonds in an effort to improve the financing conditions of euro area firms. In this article, I argue that the programme was successful. In particular, by increasing prices and reducing yields in the targeted bond market segment, the programme encouraged investors to shift their investments towards similar but somewhat riskier bonds. This reduced borrowing costs for many firms, including those whose bonds were not eligible for direct purchase by the ECB.

The corporate arm of the ECB’s quantitative easing

When interest rates are already so low that conventional rate cuts cannot further stimulate the economy, central banks may directly intervene in financial markets by buying assets from both the sovereign and the corporate sectors. That is exactly what the ECB started doing in March 2015. In that month, the ECB began purchasing assets issued by euro area central governments, agencies and European institutions. Then, in June 2016, it expanded the purchases to the corporate sector via the corporate sector purchase programme, or CSPP.

The aims of the CSPP were twofold. The first was straightforward: to signal that the ECB was committed to providing further stimulus to the economy. The second was somewhat more complex. Through the CSPP, the ECB wanted to lower the yield on the bonds that were targeted for purchase. However, mainly through the working of the so-called portfolio rebalancing channel, it also wanted to influence other asset prices, in particular those of corporate bonds not eligible for its own purchases. In this way, the ECB could support the financing conditions of all firms borrowing in the bond market (Draghi 2015, ECB 2017).

The portfolio rebalancing channel mainly works through investors shifting their investments away from the segment in which the ECB is making purchases. The idea is that investors, facing a scarcity of eligible bonds due to the ECB’s asset purchases, are encouraged to reallocate their holdings to other, riskier, bonds. This portfolio “rebalancing” in turn leads to higher prices and lower yields also for bonds in non-eligible market segments (Vayanos and Vila 2009, Krishnamurthy and Vissing-Jorgensen 2011, Hancock and Passmore 2011).[2]

While we know in theory how the rebalancing channel works, do we have any indication that it works in practice? In a recent research paper, I address this question through an empirical analysis (Zaghini, 2019). In particular, I analyse the evolution of the prices and quantities of bonds in three different market segments after the implementation of the CSPP: bonds actually purchased, eligible bonds not purchased, and bonds that were not eligible. Below I describe the article’s main findings. The main conclusion is that the CSPP, through the portfolio rebalancing channel, significantly reduced the cost of borrowing for euro area firms.

Portfolio rebalancing at work

In a nutshell, under the CSPP the Eurosystem purchases bonds issued by non-bank corporations registered in the euro area, denominated in euro, and that have at least an investment-grade rating. It purchases them both in the primary market (i.e. upon issuance) and in the secondary market.[3] I examine the effect of the CSPP by looking at changes in corporate bond spreads (the difference between the actual bond yield and an equivalent risk-free rate): if the implementation of the programme leads to a decline in such spreads, it will have succeeded in reducing borrowing costs for firms.

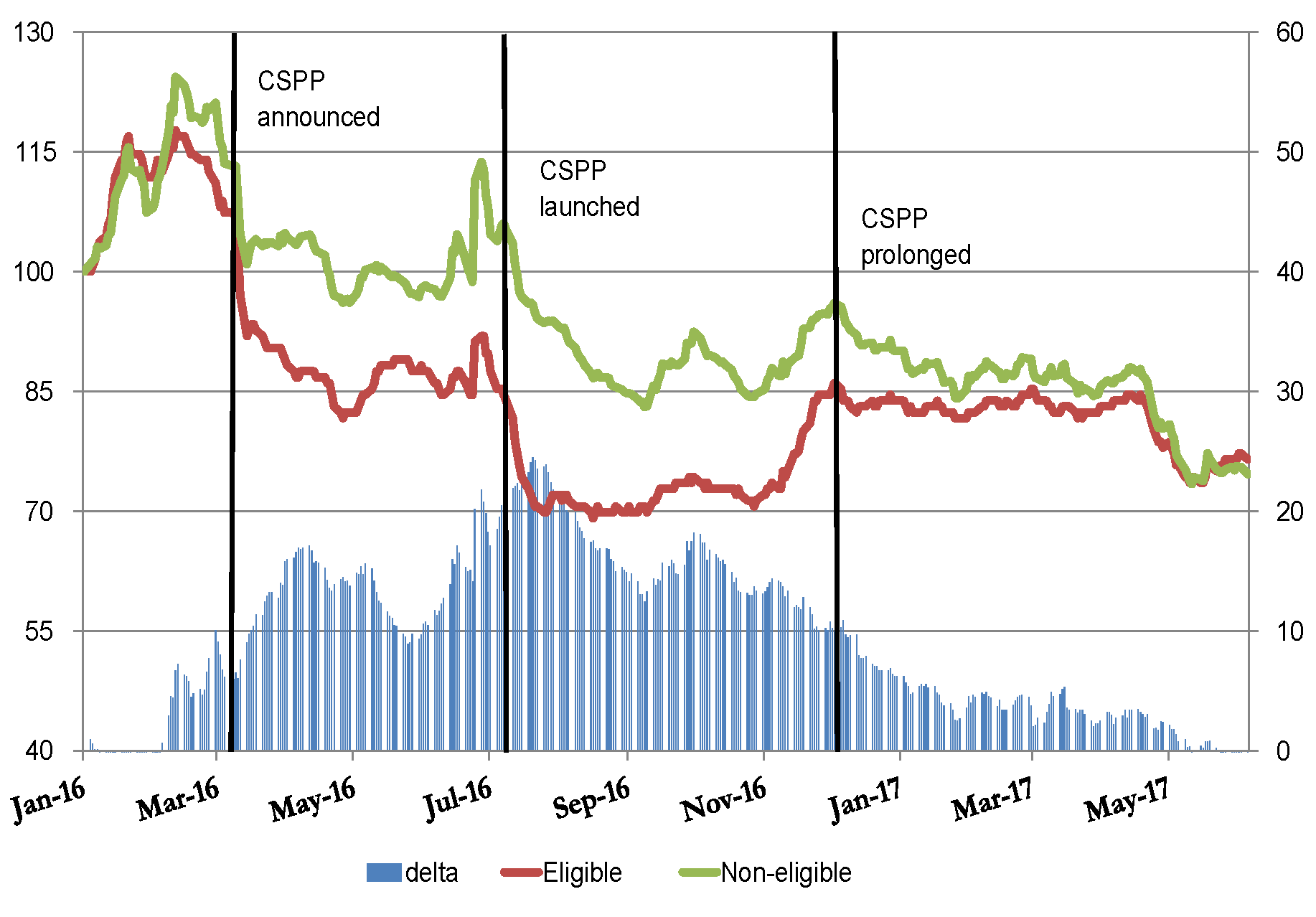

A first look at the evidence seems encouraging. Immediately after the announcement of the CSPP in March 2016, spreads on secondary market trades declined in both eligible and non-eligible market segments (see Chart 1). Initially, spreads on eligible bonds declined faster than those on non-eligible bonds, suggesting a larger improvement in the funding conditions for investment-grade firms. However, by June 2017 the gap had narrowed significantly, to the point of disappearance, thus hinting at better funding conditions also for lower rated firms.

While the evidence in Chart 1 is telling, bond spreads depend on many factors, such as the riskiness of the issuer, the amount placed and the maturity of the bond. Thus, in order to isolate the spread component due to the CSPP, I rely on a model proposed by Sironi (2003) and Zaghini (2016) for the euro area primary bond market. The model takes into account a large number of bond features and firm characteristics. In addition, it also considers the market conditions on the exact issuance date of every single bond. This makes it possible to isolate the effects of the CSPP on the bonds’ spreads quite precisely.

Chart 1

Spread performance of euro area bonds

(basis points)

Note: Bank of America-Merrill Lynch Indices of Option Adjusted Spread. The index Eligible is the BofA-Merrill Lynch Index EUR non-financial corporations; the index Non-eligible is the simple average of the BofA-Merrill Lynch Index EUR High yield and the BofA-Merrill Lynch Index EUR financial corporations (banking). Source: Thomson Reuters.

The empirical analysis shows that after a large signalling effect upon announcement (which saw spreads decrease by 36 basis points), the effect of the CSPP purchases on bond yields strengthened over time. In the first six months of the programme, from July to December 2016, eligible bonds enjoyed a spread (around 70 basis points) significantly lower than that on non-eligible bonds. This applied to all eligible bonds, regardless of whether or not they were purchased on the primary market by the ECB. By contrast, non-eligible bonds recorded a slight deterioration of their financing conditions. However, the difference between the two sets of bond spreads vanished in 2017. Indeed, in the first two quarters of that year non-eligible bonds caught up significantly, their spreads decreasing by around 50 basis points.

The spread dynamics estimated by the model are fully consistent with the theory on how the portfolio rebalancing channel works. In the first six months of the CSPP, the ECB purchased a great deal of eligible bonds. Doing so drove up prices (and accordingly reduced the spreads) in that market segment, crowding out other investors. Those investors then reached for the non-eligible bonds which are close substitutes, but have higher expected returns. Due to the higher demand for non-eligible bonds, that segment also saw prices increase and yields decrease.

In addition to price dynamics, the changes over time in the quantities of bonds issued in the two market segments suggest that the portfolio rebalancing channel was working. First there was a significant rise in both the number of bonds and the total volume issued in the eligible market segment in the second half of 2016. Then this was followed by a similar increase in the non-eligible segment in the first half of 2017. While the former increase was entirely driven by the additional demand from the ECB, the latter was purely market-driven and so due to the working of the rebalancing channel, since it only involved bonds which were not targeted by the ECB.

Concluding remarks

The announcement and actual deployment of the CSPP provide a good case study of the effects of large-scale asset purchase programmes. This analysis of developments in estimated bond spreads and amounts issued in the primary market shows that the programme eventually influenced the whole corporate bond market.

Indeed, in a first phase the CSPP only had an effect on the bonds directly targeted – immediately improving the funding conditions of eligible corporations, and gradually crowding out the other investors in that segment. Six months into the programme, the effect spilled over to non-eligible bonds. This was possible because the scarcity brought about in the eligible bond segment pressed investors to rebalance their portfolios towards other similar, but riskier, segments – in particular towards non-eligible corporate bonds. In this way the programme had an effect on both market segments. As a result, it achieved a more far-reaching improvement in the borrowing conditions of euro area corporations.

References

De Santis, R. A., Geis, A., Juskaite, A. and Vaz Cruz, L. (2018), “The impact of the corporate sector purchase programme on corporate bond markets and the financing of euro area non-financial corporations”, ECB Economic Bulletin, Issue 3 / 2018 – Articles.

Hancock, D. and Passmore, W. (2011), "Did the Federal Reserve's MBS purchase program lower mortgage rates?" Journal of Monetary Economics, Vol.58, pp. 498-514.

Krishnamurthy, A. and Vissing-Jorgensen, A. (2011), "The effects of quantitative easing on interest rates: Channels and implications for policy", Brookings Papers on Economic Activity, No.2, pp.215--87.

Sironi, A. (2003), "Testing for market discipline in the European banking industry: evidence from subordinated debt issues", Journal of Money, Credit and Banking, Vol.35, pp. 443-472.

Vayanos, D. and Vila, J. (2009), "A preferred-habitat model of the term structure of interest rates", NBER Working Paper, No.15487

Zaghini, A. (2016), "Fragmentation and heterogeneity in the euro-area corporate bond market: Back to normal?", Journal of Financial Stability, Vol. 23, pp. 51-61.

Zaghini, A. (2019), "The CSPP at work: yield heterogeneity and the portfolio rebalancing channel", Journal of Corporate Finance, Vol.56, pp. 282-297.

- Disclaimer: This article was written by Andrea Zaghini (Principal Economist, Directorate General Research, Financial Research Division). It is based on his ECB Working Paper No. 2264, The CSPP at work – yield heterogeneity and the portfolio rebalancing channel. The author gratefully acknowledges the comments of Ursel Baumann, Paul Dudenhefer, Wolfgang Lemke, Simone Manganelli, Alberto Martin, Zoe Sprokel and Giovanni Vitale. The views expressed here are those of the author and do not necessarily represent the views of the European Central Bank or the Eurosystem.

- See De Santis et al. (2018) for an overall assessment of the programme.

- For further details of the CSPP see: https://www.ecb.europa.eu/press/pr/date/2016/html/pr160421_1.en.html and https://www.ecb.europa.eu/mopo/implement/omt/html/cspp-qa.en.html .