The ECB’s communication on the economic outlook: a comparative analysis

Published as part of the ECB Economic Bulletin, Issue 8/2021.

The ECB’s communication on the economic outlook has changed significantly over the past 20 years. This box shows how the ECB’s communication on the frameworks and concepts behind the economic outlook has evolved since the central bank was established in 1998. It also compares the ECB’s communication on the economic outlook with that of the Board of Governors of the Federal Reserve System (Federal Reserve Board) and the Bank of England, covering the period 2015-19. The analysis ends in 2019 to avoid the results being affected by the measures related to the coronavirus (COVID-19) pandemic or by the monetary policy strategy reviews conducted by the Federal Reserve Board and the ECB respectively. While this box focuses on a specific part of the ECB’s communication, the article entitled “ECB communication with the wider public” in this issue of the Economic Bulletin takes a wider perspective and includes the lessons learned from the ECB’s recent strategy review.[1]

In 2015 the ECB’s regular communication on the economic outlook saw two important changes. First, the ECB reduced the frequency of the Governing Council’s monetary policy meetings from a four to a six-week cycle. Second, the ECB started publishing accounts of the Governing Council’s monetary policy meetings. These changes reduced the risk of introducing noise in the communication of the economic outlook, which can arise when updates are published too frequently. They also increased the transparency and accountability of the decision-making process. Both changes brought the ECB’s approach closer to the monetary policy deliberation practice of the Federal Reserve Board in the United States. While the official communication on the economic outlook has been reduced from twelve times (Monthly Bulletin) to eight times (Economic Bulletin) a year, communication by the ECB’s Chief Economist via speeches and presentations on the economic outlook to external audiences (Chart A, panel a) has risen over the past 20 years. The Chief Economist also tended to give significantly more speeches on the economic outlook than the Chief Economist of the Bank of England or the Vice-Chair of the Federal Reserve Board (Chart A, panel b) during the period 2015-19.[2]

Chart A

Number of speeches on the economic outlook by the Chief Economist

(annual average)

Source: ECB staff calculations.

Notes: In panel (a) where the change in office took place during a year (i.e. 2006 Issing/Stark; 2019 Praet/Lane), the speeches have been attributed to the yearly average of the incoming Executive Board member. In panel (b) the Vice-Chair of the Federal Reserve Board (Fischer, Clarida) has been taken to correspond to the Chief Economist at the ECB (Praet, Lane) and at the Bank of England (Haldane). “BoE” stands for Bank of England; “Fed” stands for the Federal Reserve Board.

The readability of the ECB’s communication on the economic outlook has improved since 2008. This is illustrated in Chart B, panel a, which reports the number of years of education required to understand the ECB’s speeches on the economic outlook. It shows that the language used in speeches on the economic outlook has become less complex over time. This improvement is similar to that of the readability of all ECB speeches, including those on topics other than the economic outlook.[3] The readability of the ECB speeches on the economic outlook compares well with the readability of Bank of England speeches; the Federal Reserve Board speeches are somewhat more difficult to read than those of the ECB according to this metric (Chart B, panel b). On the other hand, the readability of the ECB’s monetary policy accounts, which have been published since 2015, is significantly lower than that of the minutes of the Federal Open Market Committee or the minutes of the Monetary Policy Committee of the Bank of England. While the ECB’s accounts may be targeted at experts, the higher score also implies that they would be harder for a wider public to understand.

Chart B

Readability of speeches on the economic outlook and accounts/minutes

(index)

Source: ECB staff calculations.

Notes: Measured using the Flesch-Kincaid Grade Level score for the period 2015-19. The score can be understood as the number of years of education required to understand the text. The higher the Flesch-Kincaid Grade Level score, the more difficult the language is to understand. All scores above 12 require an education beyond secondary school. “BoE” stands for Bank of England; “Fed” stands for the Federal Reserve Board.

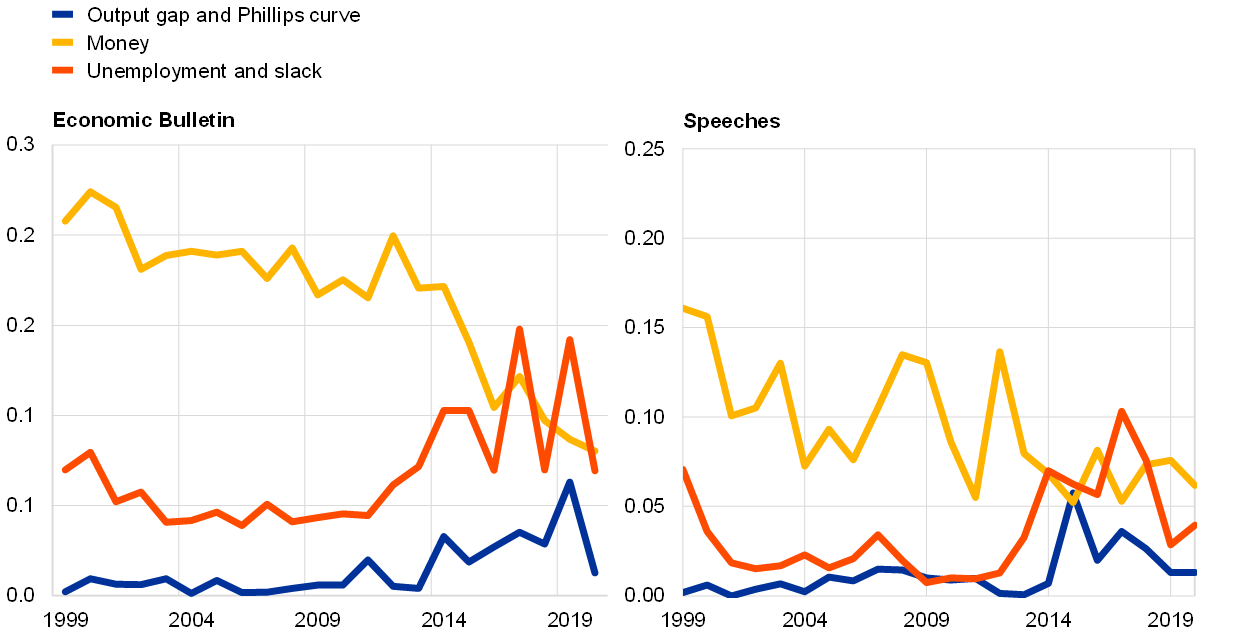

Changes in the way the ECB communicates on the economic outlook reflect the adoption of new theoretical concepts. Chart C, panel a shows that the occurrence of words or terms such as “output gap”, “Phillips curve”, “unemployment” and “slack” saw a clear upward trend during the second decade of the euro. Conversely, during the past ten years, the word “money” saw a pronounced downward trend. This reflects a shift in how growth and inflation in the euro area is interpreted and assessed ‒ increasingly relying on a relationship between measures of capacity utilisation and wage and price pressures.[4] The decline in the use of the word “money” in ECB speeches and rising frequency of “unemployment” and “slack” is also clear in the speeches given by members of the Executive Board (Chart C, panel a).

Two main differences between the ECB’s communication and that of other central banks are related to differences in their monetary policy strategies. First, Chart C, panel b shows that the words “unemployment” or “slack” are less used by ECB Executive Board members than in speeches by the Bank of England or the Federal Reserve Board, while being the most frequently used among the various topics. For the Federal Reserve Board, this reflects the importance of the goal of maximum employment, which is part of its dual mandate. The frequency of references to “output gap” or the “Phillips curve” is similar across the three central banks. This suggests that while these concepts were less frequently used in communication by the ECB in the past, they are now used to a similar extent as the Bank of England or the Federal Reserve Board. Second, ECB speeches use the term “money” more frequently than the Federal Reserve Board or the Bank of England, which might reflect the importance of the monetary analysis in its monetary policy strategy.

Chart C

Frequency of words related to various topics across central banks

a) Frequency in ECB communication

(percentage of total number of words)

b) Frequency in speeches across central banks

(percentage of total number of words)

Source: ECB staff calculations.

Notes: The frequency of the specific term/word is computed as the number of times the specific term/word is used divided by the total number of words published that year. “BoE” stands for Bank of England; “Fed” stands for the Federal Reserve Board.

References to inequality are comparable across the three major central banks; climate change is also a prominent topic. While the focus on inequality has increased over time in most central banks, it seems that the ECB pays comparable attention to this topic as the two other major central banks. Discussions on climate change appear to be more frequent in the speeches of the Bank of England than in those of the ECB or the Federal Reserve Board.

Textual analysis underscores the importance of “narratives” in the communication of economic forecasts. Sharpe et al. document how sentiment, or “tonality”, extracted from the narratives accompanying Federal Reserve Board economic forecasts is strongly correlated with future economic performance: positively with GDP and negatively with unemployment and inflation. Moreover, tonality conveys incremental information in that it predicts errors in both Federal Reserve Board and private-sector forecasts of GDP, and unemployment up to four quarters ahead.[5] The authors find that the forecasting power of tonality arises from its signalling of downside risks to economic performance. They also find that tonality has significant predictive power for monetary policy. A more optimistic tone in the Tealbook text precedes a higher than anticipated federal funds rate up to four quarters ahead.[6] Likewise, Jones et al. find that there is information in the qualitative discussion on output growth forecasts in the Bank of England’s quarterly Inflation Report which improves its quantitative nowcasts and one-quarter-ahead forecasts.[7]

The above evidence illustrates how qualitative discussions (or “narratives”) surrounding forecasts contain incremental information about the economy which supplements the quantitative analysis. This underscores the importance of clear and informative communication about the economic outlook ‒ a priority which has also been reaffirmed during the ECB’s recent strategy review.[8] The constant flow of new information means that the ECB’s economic outlook narrative is updated constantly too, which requires a broad set of economic models, tools and surveys.

- See the article entitled “ECB communication with the wider public” in this issue of the Economic Bulletin; and Assenmacher, K., Glöckler, G., Holton, S. and Trautmann, P., “Clear, consistent and engaging: ECB monetary policy communication in a changing world”, Workstream on monetary policy communications, Occasional Paper Series, No 274, ECB, September 2021.

- For the Bank of England speeches, the analysis focuses on the Chief Economist. Taking into consideration speeches by the Deputy Governor for Monetary Policy, who is closer to the ECB Chief Economist in terms of executive responsibility, in addition to those by the Chief Economist would not materially affect the results.

- See the article entitled “ECB communication with the wider public” in this issue of the Economic Bulletin.

- For further evidence, see Hartmann, P. and Smets, F., “The first twenty years of the European Central Bank: monetary policy”, Working Paper Series, No 2219, ECB, December 2018.

- See Sharpe, S., Sinha, N. and Hollrah, C., “The Power of Narratives in Economic Forecasts”, Finance and Economics Discussion Series, No 2020-001, Board of Governors of the Federal Reserve System, 2020.

- The official title of the Tealbook is “Report to the FOMC on Economic Conditions and Monetary Policy”, which is produced by the staff at the Federal Reserve Board. The “Tealbook” name was given when the Bluebook and Greenbook were merged in June 2010.

- See Jones, J., Sinclair, T. and Stekler, H., “A textual analysis of Bank of England growth forecasts”, International Journal of Forecasting, Vol. 36(4), 2020, pp. 1478-1487. For similar evidence from the Banco de España, see Sobrino, N., Ghirelli, C., Hurtado, S., Pérez, J. and Urtasun, A., “The narrative about the economy as a shadow forecast: an analysis using Bank of Spain quarterly reports”, Applied Economics, November 2021.

- See the article entitled “An overview of the ECB’s monetary policy strategy”, Economic Bulletin, Issue 5, ECB, 2021.