- PRESS RELEASE

Monetary developments in the euro area: March 2021

29 April 2021

- Annual growth rate of broad monetary aggregate M3 decreased to 10.1% in March 2021 from 12.2% in February (revised from 12.3%)

- Annual growth rate of narrower monetary aggregate M1, comprising currency in circulation and overnight deposits, decreased to 13.6% in March from 16.4% in February

- Annual growth rate of adjusted loans to households increased to 3.3% in March from 3.0% in February

- Annual growth rate of adjusted loans to non-financial corporations decreased to 5.3% in March from 7.0% in February

Components of the broad monetary aggregate M3

The annual growth rate of the broad monetary aggregate M3 decreased to 10.1% in March 2021 from 12.2% in February, averaging 11.6% in the three months up to March. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate M1, which comprises currency in circulation and overnight deposits, decreased to 13.6% in March from 16.4% in February. The annual growth rate of short-term deposits other than overnight deposits (M2-M1) stood at 1.0% in March, unchanged from the previous month. The annual growth rate of marketable instruments (M3-M2) decreased to 7.1% in March from 13.8% in February.

Chart 1

Monetary aggregates

(annual growth rates)

Looking at the components' contributions to the annual growth rate of M3, the narrower aggregate M1 contributed 9.4 percentage points (down from 11.3 percentage points in February), short-term deposits other than overnight deposits (M2-M1) contributed 0.3 percentage point (as in the previous month) and marketable instruments (M3-M2) contributed 0.4 percentage point (down from 0.7 percentage point).

From the perspective of the holding sectors of deposits in M3, the annual growth rate of deposits placed by households decreased to 9.1% in March from 9.5% in February, while the annual growth rate of deposits placed by non-financial corporations decreased to 18.0% in March from 21.3% in February. Finally, the annual growth rate of deposits placed by non-monetary financial corporations (excluding insurance corporations and pension funds) decreased to 4.0% in March from 14.6% in February.

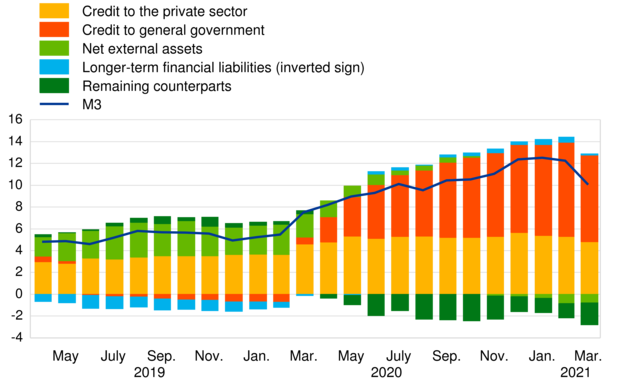

Counterparts of the broad monetary aggregate M3

As a reflection of changes in the items on the monetary financial institution (MFI) consolidated balance sheet other than M3 (counterparts of M3), the annual growth rate of M3 in March 2021 can be broken down as follows: credit to general government contributed 7.9 percentage points (down from 8.6 percentage points in February), credit to the private sector contributed 4.8 percentage points (down from 5.3 percentage points), longer-term financial liabilities contributed 0.1 percentage point (down from 0.5 percentage point), net external assets contributed -0.8 percentage point (as in the previous month), and the remaining counterparts of M3 contributed -2.0 percentage points (down from -1.3 percentage points).

Chart 2

Contribution of the M3 counterparts to the annual growth rate of M3

(percentage points)

Credit to euro area residents

As regards the dynamics of credit, the annual growth rate of total credit to euro area residents decreased to 9.1% in March 2021 from 9.8% in the previous month. The annual growth rate of credit to general government decreased to 21.9% in March from 24.0% in February, while the annual growth rate of credit to the private sector decreased to 4.6% in March from 5.0% in February.

The annual growth rate of adjusted loans to the private sector (i.e. adjusted for loan sales, securitisation and notional cash pooling) decreased to 3.6% in March from 4.5% in February. Among the borrowing sectors, the annual growth rate of adjusted loans to households increased to 3.3% in March from 3.0% in February, while the annual growth rate of adjusted loans to non-financial corporations decreased to 5.3% in March from 7.0% in February.

Chart 3

Adjusted loans to the private sector

(annual growth rates)

Notes:

- Data in this press release are adjusted for seasonal and end-of-month calendar effects, unless stated otherwise.

- "Private sector" refers to euro area non-MFIs excluding general government.

- Hyperlinks in the main body of the press release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.

Europejski Bank Centralny

Dyrekcja Generalna ds. Komunikacji

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Niemcy

- +49 69 1344 7455

- media@ecb.europa.eu

Przedruk dozwolony pod warunkiem podania źródła.

Kontakt z mediami-

29 April 2021