- STATISTICAL RELEASE

Euro area financial vehicle corporation statistics: third quarter of 2021

18 November 2021

- In third quarter of 2021 outstanding amount of debt securities issued by euro area FVCs engaged in securitisation rose to €1,623 billion, from €1,621 billion in previous quarter

- Net redemptions of debt securities by FVCs during third quarter of 2021 amounted to €1 billion

- Euro area FVCs disposed €3 billion of securitised loans in third quarter of 2021, with outstanding amounts totalling €1,252 billion

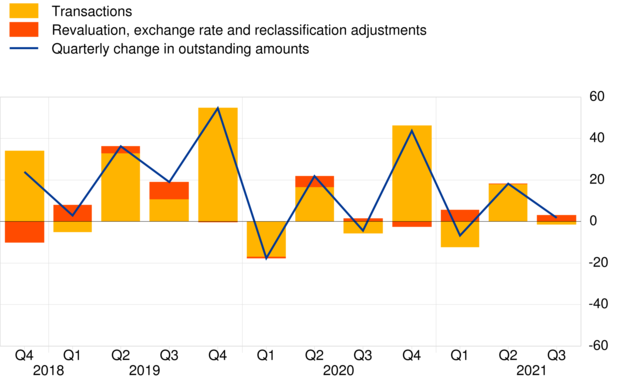

Chart 1

Debt securities issued by euro area FVCs

(EUR billions; not seasonally adjusted)

The outstanding amount of debt securities issued by euro area FVCs was €1,623 billion at the end of the third quarter of 2021, €2 billion higher than at the end of the previous quarter. Over the same period, transactions amounted to a net redemption of €1 billion (see Chart 1). The annual growth rate of debt securities issued, calculated on the basis of transactions, increased to 3.2% in the third quarter of 2021, from 2.9% in the previous quarter.

Euro area FVCs' holdings of securitised loans – accounting for most of the assets backing the debt securities issued – were €1,252 billion at the end of the third quarter of 2021, unchanged from the previous quarter (see Chart 2). Net disposals of securitised loans originated by euro area monetary financial institutions (MFIs) amounted to €3 billion.

Chart 2

Loans securitised by FVCs by originator

(quarterly transactions in EUR billions; not seasonally adjusted)

Turning to the borrowing sector of securitised loans, loans to euro area households amounted to €759 billion at the end of the third quarter of 2021, with a net disposal of €6 billion during the third quarter of 2021, while loans to euro area non-financial corporations amounted to €358 billion, with a net acquisition of €3 billion.

Among the other assets of euro area FVCs, deposits and loan claims amounted to €179 billion at the end of the third quarter of 2021, predominantly claims on euro area MFIs (€93 billion). There was also a net disposal of deposits and loan claims of €15 billion during the quarter. Holdings of debt securities amounted to €429 billion at the end of the third quarter 2021, while net acquisitions amounted to €12 billion. Other securitised assets held by FVCs – including for example trade, tax and other receivables – amounted to €107 billion, with negligible net transactions.

For queries, please use the statistical information request form.

Notes

- Hyperlinks in the main body of the statistical release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.

- 18 November 2021