- PRESS RELEASE

- 7 April 2020

Euro area quarterly balance of payments and international investment position: fourth quarter of 2019

- Current account surplus at €320 billion (2.7% of euro area GDP) in 2019, down from €361 billion (3.1% of GDP) in 2018.

- Geographic counterparts: largest bilateral surpluses vis-à-vis the United Kingdom (€184 billion in 2019, up from €158 billion in 2018) and the United States (€111 billion, down from €133 billion), with largest deficits vis-à-vis offshore centres (€77 billion, up from €9 billion) and China (€69 billion, up from €65 billion).

- International investment position at end-2019 showed net liabilities of €63 billion (below 1% of euro area GDP), after net liabilities of €153 billion at the end of the third quarter of 2019.

Current account

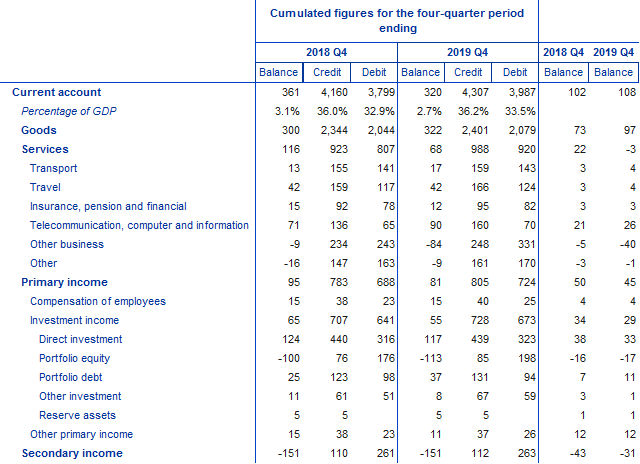

The current account surplus of the euro area declined to €320 billion (2.7% of euro area GDP) in 2019 from €361 billion (3.1% of euro area GDP) in 2018 (see Table 1). This decrease reflected smaller surpluses for services (down from €116 billion in 2018 to €68 billion in 2019) and primary income (down from €95 billion to €81 billion). These developments were partly offset by an increase in the surplus for goods (up from €300 billion to €322 billion), while the deficit for secondary income remained unchanged at €151 billion.

The smaller surplus in services resulted mainly from an increase in the deficit for other business services (up from €9 billion to €84 billion), triggered primarily by higher imports of research and development services. This was partially compensated by an increase in the surplus for telecommunication, computer and information services (up from €71 billion to €90 billion), which was mostly driven by higher exports.

The decrease in the primary income surplus was largely due to developments in the investment income balance (down from €65 billion to €55 billion), which mainly reflected a lower surplus in direct investment income (down from €124 billion to €117 billion) and a larger deficit for portfolio equity income (up from €100 billion to €113 billion). These developments were partly offset by a larger surplus for portfolio debt income (up from €25 billion to €37 billion).

Current account of the euro area

(EUR billions, unless otherwise indicated; transactions during the period; non-working day and non-seasonally adjusted)

Source: ECBNotes: “Equity” comprises equity and investment fund shares. Discrepancies between totals and their components may arise from rounding.

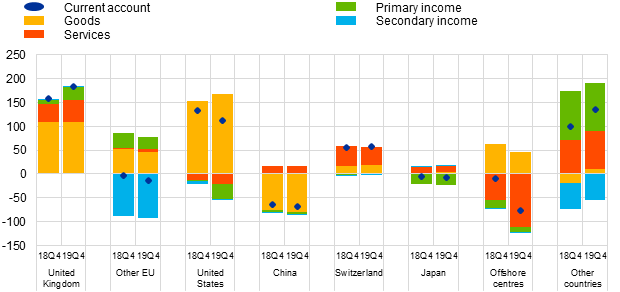

Data on the geographic counterparts of the euro area current account (see Chart 1) show that in 2019 the euro area recorded its largest surpluses vis-à-vis the United Kingdom (€184 billion, up from €158 billion in 2018), a residual group of other countries (€136 billion, up from €99 billion), the United States (€111 billion, down from €133 billion) and Switzerland (€57 billion, up from €55 billion). The largest bilateral deficits in the euro area current account were recorded vis-à-vis offshore centres (€77 billion, up from €9 billion) and China (€69 billion, up from €65 billion).

The most significant geographic change in the goods balance from 2018 to 2019 was the shift from a deficit of €20 billion vis-à-vis the residual group of other countries to a surplus of €11 billion. Moreover, an increase was recorded in the surplus vis-à-vis the United States (up from €154 billion to €167 billion), while the surplus vis-à-vis offshore centres declined from €63 billion to €46 billion. In services, the deficit vis-à-vis offshore centres widened from €55 billion to €111 billion. In primary income, the deficit vis-à-vis the United States increased from €3 billion to €33 billion, while the surplus vis-à-vis the United Kingdom rose from €7 billion to €26 billion.

Geographical breakdown of the euro area current account balance

(Four-quarter moving sums in EUR billions; non-seasonally adjusted)

Source: ECB.Notes: “Other EU” comprises EU Member States and EU institutions outside the euro area excluding the United Kingdom. “Other countries” includes all countries and country groups not shown in the chart as well as unallocated transactions.

International investment position

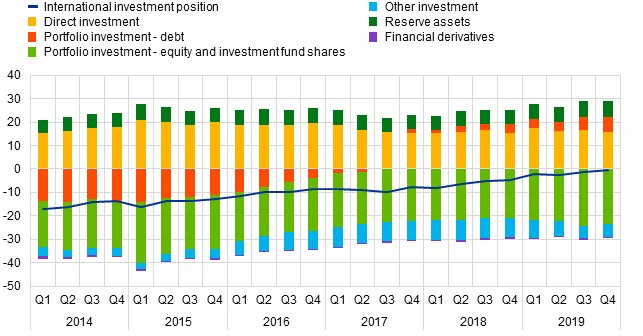

At the end of 2019 the international investment position of the euro area showed net liabilities of €63 billion vis-à-vis the rest of the world (below 1% of euro area GDP), compared with net liabilities of €153 billion at the end of the third quarter of 2019 (see Chart 2 and Table 2).

Net international investment position of the euro area

(Net outstanding amounts at the end of the period as a percentage of four-quarter moving sums of GDP)

Source: ECB.

This improvement of €90 billion mainly reflected higher net assets for portfolio debt (€756 billion, up from €639 billion) and lower net liabilities in portfolio equity (€2,793 billion, down from €2,858 billion). These developments were partly offset by lower net assets in direct investment (€1,885 billion, down from €1,969 billion) and higher net liabilities in other investment (€675 billion, up from €639 billion).

International investment position of the euro area

(EUR billions, unless otherwise indicated; amounts outstanding at the end of the period, flows during the period; non-working day and non-seasonally adjusted)

Source: ECB.Notes: “Equity” comprises equity and investment fund shares. Net financial derivatives are reported under assets. Discrepancies between totals and their components may arise from rounding.

The improvement in the euro area’s net international investment position in the fourth quarter of 2019 was mainly driven by positive net price changes and transactions, which were partly offset by negative net exchange rate changes (see Chart 3).

Net assets in portfolio debt increased primarily due to transactions (see Table 2), while lower net liabilities in portfolio equity resulted mainly from positive net price changes. Net assets for direct investment decreased due to negative developments in all components (transactions and price, exchange rate and other volume changes). Net liabilities for other investment declined mainly due to negative net exchange rate changes and transactions.

At the end of 2019 the gross external debt of the euro area amounted to €14.5 trillion (around 122% of euro area GDP), which represents a decrease of €596 billion compared with the third quarter of 2019.

Changes in the net international investment position of the euro area

(EUR billions; flows during the period)

Source: ECB.Note: Other volume changes mainly reflect reclassifications and data enhancements.

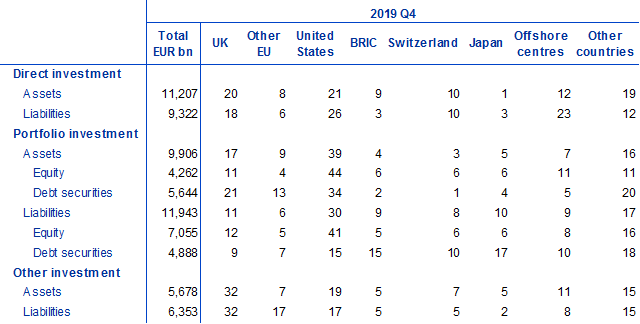

At the end of 2019 the stock of euro area direct investment assets was €11.2 trillion, 21% of which was invested in the United States and 20% in the United Kingdom (see Table 3). The stock of foreign direct investment liabilities was €9.3 trillion, with 26% being investments by the United States, 23% by offshore centres and 18% by the United Kingdom.

In portfolio investment, euro area holdings of foreign securities amounted to €4.3 trillion in equity and to €5.6 trillion in debt at the end of 2019. The largest issuers of equity securities were the United States (accounting for 44% of euro area holdings), followed by the United Kingdom and offshore centres (both accounting for 11%). For debt securities, the largest issuing countries were the United States (accounting for 34%) and the United Kingdom (21%). On the portfolio investment liabilities side, non-residents’ holdings of securities issued by euro area residents stood at €7.1 trillion in equity and at €4.9 trillion in debt at the end of 2019. The largest holder countries of euro area equity securities were the United States (41%) and the United Kingdom (12%), while for euro area debt securities the largest holders were Japan (17%), the BRIC group of countries and the United States (both with 15%).

In other investment, euro area residents’ claims on non-residents amounted to €5.7 trillion, 32% of which were vis-à-vis the United Kingdom and 19% vis-à-vis the United States. Euro area other investment liabilities amounted to €6.4 trillion, with the United Kingdom accounting for 32%, while the shares of the Other EU and the United States were both 17%.

International investment position of the euro area – geographical breakdown

(As a percentage of the total, unless otherwise indicated; positions during the period; non-working day and non-seasonally adjusted)

Source: ECB. Notes: “Equity” comprises equity and investment fund shares. “Other EU” comprises EU Member States and EU institutions outside the euro area excluding the United Kingdom. The “BRIC” countries are Brazil, Russia, India and China. “Other countries” includes all countries and country groups not listed in the table as well as unallocated positions.

Data revisions

This press release incorporates revisions to the data for the reference periods between the first quarter of 2016 and the third quarter of 2019. The revisions to direct investment and portfolio investment were particularly sizeable and partly reflected revised national contributions to the euro area aggregates. Further revisions were due to the introduction of a new balancing mechanism at the euro area level as described in this note.

Next press releases

- monthly balance of payments: 20 April 2020 (reference data up to February 2020)

- quarterly balance of payments and international investment position: 3 July 2020 (reference data up to the first quarter of 2020)

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- All data are neither seasonally nor working day-adjusted. Ratios to GDP (including in the charts) refer to four-quarter sums of non-seasonally and non-working day-adjusted GDP figures.

- Hyperlinks in this press release lead to data that may change with subsequent releases as a result of revisions.

- With today’s release, full consistency between financial transactions in the euro area balance of payments and those recorded for the “rest of the world” sector of the euro area accounts (EAA) statistics, also published today, has been implemented for all reference quarters from 2016 Q1 onwards.

Europejski Bank Centralny

Dyrekcja Generalna ds. Komunikacji

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Niemcy

- +49 69 1344 7455

- media@ecb.europa.eu

Przedruk dozwolony pod warunkiem podania źródła.

Kontakt z mediami