Euro area balance of payments in July 2014

In July 2014 the seasonally adjusted current account of the euro area recorded a surplus of €18.7 billion. In the financial account, combined direct and portfolio investment recorded net outflows of €17 billion (non-seasonally adjusted).

Current account

The seasonally adjusted current account of the euro area recorded a surplus of €18.7 billion in July 2014 (see Table 1). This reflected surpluses for services (€12.8 billion), goods (€10.7 billion) and income (€3.6 billion), which were partly offset by a deficit for current transfers (€8.5 billion).

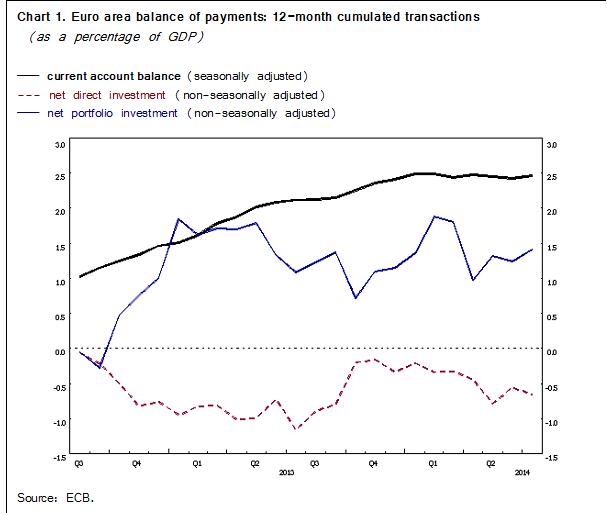

The seasonally adjusted 12-month cumulated current account for the period ending in July 2014 recorded a surplus of €237.6 billion (2.5% of euro area GDP), compared with one of €201.3 billion (2.1% of euro area GDP) for the 12 months to July 2013 (see Table 1 and Chart 1). The increase in the 12-month cumulated current account surplus was due mainly to increases in the surpluses for goods (€179.4 billion, up from €145.9 billion) and services (€120.0 billion, up from €102.6 billion), which were partly offset by a decrease in the surplus for income (€54.7 billion, down from €69.7 billion); the deficit for current transfers remained broadly stable.

Financial account

In the financial account (see Table 2), combined direct and portfolio investment recorded net outflows of €17 billion in July 2014 as a result of net outflows for both portfolio investment (€15 billion) and direct investment (€3 billion).

The net outflows for direct investment were a result of net outflows for equity capital and reinvested earnings (€4 billion), which were partly offset by net inflows for other capital (mostly inter-company loans) (€1 billion).

The net outflows for portfolio investment were almost entirely accounted for by net outflows for debt instruments (€15 billion), which were mainly driven by net purchases of foreign debt securities by euro area residents.

The financial derivatives account recorded net inflows of €4 billion.

Other investment recorded net outflows of €25 billion, which mainly reflected net outflows for MFIs excluding the Eurosystem (€17 billion) and for the Eurosystem (€14 billion), which were partly offset by net inflows for other sectors (€4 billion) and general government (€3 billion).

The Eurosystem’s stock of reserve assets increased by €2 billion in July 2014 (from €583 billion to €585 billion), mainly on account of valuation effects (transactions contributed to a decrease of €1 billion in overall reserve assets).

In the 12 months to July 2014 combined direct and portfolio investment recorded cumulated net inflows of €73 billion, compared with net outflows of €7 billion in the 12 months to July 2013. This shift resulted from lower net outflows for direct investment (€63 billion, down from €111 billion) and higher net inflows for portfolio investment (€137 billion, up from €103 billion).

Data revisions

This press release incorporates regular revisions for June 2014. These revisions have not significantly altered the figures previously published for the current and capital accounts. In the financial account, the revisions mainly resulted in higher net portfolio investment inflows (€18 billion instead of €6 billion).

Additional information on the euro area balance of payments and international investment position

In this press release, the seasonally adjusted current account refers to working day and seasonally adjusted data. Data for the financial account are not working day or seasonally adjusted.

In line with the agreed allocation of responsibilities, the European Central Bank compiles and disseminates monthly and quarterly balance of payments statistics for the euro area, whereas the European Commission (Eurostat; see news releases for “Euro-indicators”) focuses on quarterly and annual aggregates for the European Union. These data comply with international standards, particularly those set out in the IMF’s Balance of Payments Manual (fifth edition). The aggregates for the euro area and the European Union are compiled consistently on the basis of transactions and positions vis-à-vis residents of countries outside the euro area and the European Union respectively.

A complete set of updated euro area balance of payments statistics (including a quarterly geographical breakdown for the main counterparts) and international investment position statistics as well as historical euro area balance of payments time series, can be downloaded from the ECB’s Statistical Data Warehouse (SDW). Data up to July 2014 will also be published in the October 2014 issue of the ECB’s Monthly Bulletin. Detailed methodological notesare available on the ECB's website. The next press release on the euro area monthly balance of payments will be published on 20 October 2014. In the fourth quarter of 2014 the ECB will start publishing the euro area balance of payments and international investment position statistics in accordance with its Guideline ECB/2011/23, which adheres to the sixth edition of the IMF’s Balance of Payments and International Investment Position Manual (BPM6). More detailed information is available on a dedicated webpage

For media inquiries please call Philippe Rispal on +49 69 1344 5482.

Annexes

Table 1: Current account of the euro area

Table 2: Monthly balance of payments of the euro area

Europejski Bank Centralny

Dyrekcja Generalna ds. Komunikacji

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Niemcy

- +49 69 1344 7455

- media@ecb.europa.eu

Przedruk dozwolony pod warunkiem podania źródła.

Kontakt z mediami