- PRESS RELEASE

April 2023 euro area bank lending survey

2 May 2023

- Banks reported a further substantial net tightening in credit standards for loans to firms and for house purchase

- Demand for loans decreased strongly, driven by rising interest rates, lower fixed investment and weakening housing markets

- Ongoing reduction in central bank balance sheet linked to TLTRO repayments and end of full APP reinvestments contributing to weakening lending dynamics

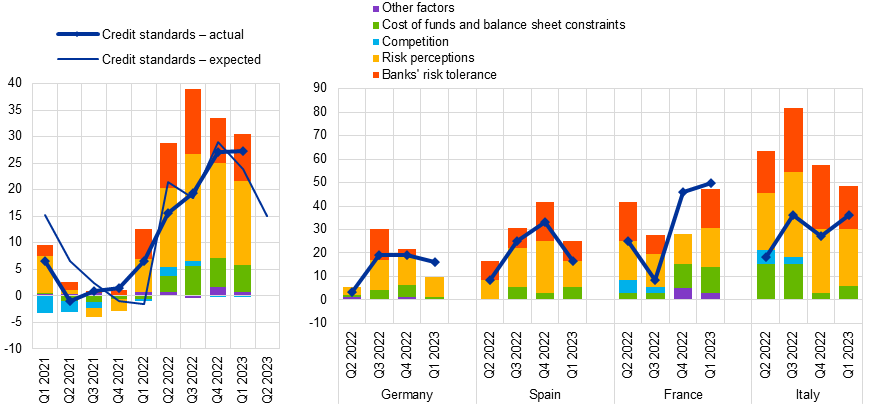

According to the April 2023 euro area bank lending survey (BLS), credit standards – i.e. banks’ internal guidelines or loan approval criteria – for loans or credit lines to enterprises tightened further substantially (with the net percentage of banks reporting a tightening standing at 27%) in the first quarter of 2023 (see Chart 1). From a historical perspective, the pace of net tightening in credit standards remained at the highest level since the euro area sovereign debt crisis in 2011. Banks also reported a further substantial net tightening of their credit standards for loans to households for house purchase, while the further net tightening became less pronounced for consumer credit and other lending to households (net percentages of banks at 19% and 10% respectively). The tightening for loans to firms and for house purchase was stronger than banks had expected in the previous quarter and points to a persistent weakening of loan dynamics. The main drivers of the tightening were higher perceptions of risk and, to a lesser extent, banks’ lower risk tolerance. Against the backdrop of increases in ECB key interest rates and decreases in central bank liquidity, banks’ cost of funds and balance sheet conditions also had a tightening impact on credit standards for loans to euro area firms. In the second quarter of 2023 euro area banks expect a further, though more moderate, tightening of credit standards on loans to firms and for house purchase. For consumer credit, euro area banks expect a further net tightening of credit standards at a similar pace as in the first quarter of 2023.

Banks’ overall terms and conditions – i.e. the actual terms and conditions agreed in loan contracts –tightened further for loans to firms and loans to households in the first quarter of 2023. Widening margins on riskier loans and rising interest rates accounted for the main tightening effect, reflecting the ongoing pass-through of higher market rates to lending rates for firms and households.

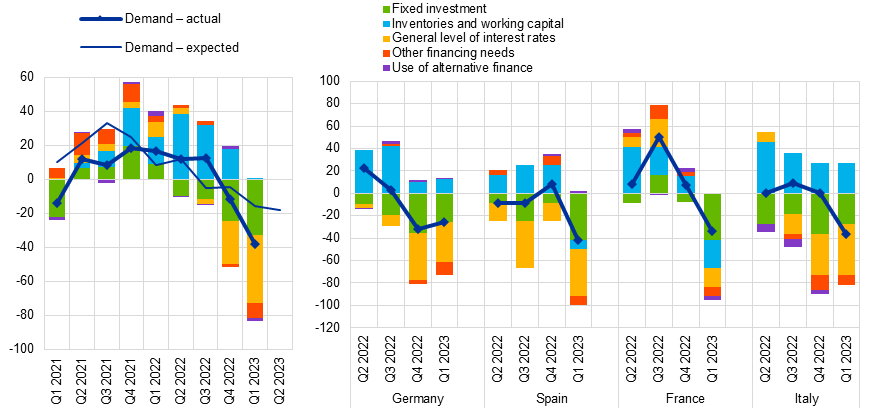

Banks reported a strong net decrease in demand from firms for loans or drawing of credit lines in the first quarter of 2023 (see Chart 2). The decline in net demand was stronger than expected by banks in the previous quarter and is the strongest since the global financial crisis. The general level of interest rates was reported to be the main driver of reduced loan demand, in an environment of monetary policy tightening. Fixed investment also had a strong dampening effect on loan demand. The impact of inventories and working capital turned broadly neutral, after having previously had a positive impact on loan demand. This may reflect the easing of supply bottlenecks and a moderation in energy input costs. In the second quarter of 2023, banks expect a further though smaller net decline in demand for loans to firms.

The net decrease in demand for housing loans remained strong and was close to the sharp net decrease reported for the previous quarter, which was the highest on record since the start of the survey in 2003. There was a smaller net decrease in demand for consumer credit and other lending to households. Rising interest rates, weakening housing market prospects, low consumer confidence and a decline in spending on durable consumer goods contributed negatively to the demand for loans to households. In the second quarter of 2023 banks expect a further strong net decrease in housing loan demand and a somewhat smaller net decrease in demand for consumer credit than in the first quarter.

According to the banks surveyed, access to retail and wholesale funding deteriorated in the first quarter. For money markets and debt securities, the deterioration reverses the improvement in access to these markets registered at the end of last year, possibly reflecting the March 2023 market turmoil and the lower overall level of excess liquidity. For retail funding, the deterioration in access reflects the continued increase in bank deposit rates and shifts towards more highly remunerated types of saving.

Banks reported that the ECB’s monetary policy asset portfolio – for which changes can arise as a result of any transactions, including less than full reinvestments from maturing securities – had a negative impact on their market financing conditions, liquidity positions and total assets over the past six months. The reported impact on profitability was broadly neutral. Developments in the ECB’s monetary policy asset portfolio and the related tightening of monetary policy had a net tightening impact on terms and conditions for loans to firms and households and a negative impact on bank lending volumes across all categories of lending.

Euro area banks indicated that the ongoing phase-out of TLTRO III has had a negative impact on their liquidity positions, profitability and their overall funding conditions over the past six months in the context of TLTRO III funds maturing or being voluntarily repaid early. The phase-out of TLTRO III had a tightening impact on credit standards. The impact on lending volumes is expected to turn negative across all categories of lending over the next six months.

In response to a new question introduced in this survey round, euro area banks have indicated that the ECB key interest rate decisions have had a marked positive impact on their net interest margins over the past six months. At the same time, while the impact on overall bank profitability was positive, the positive impact on banks’ interest margins was partly offset by a negative volume effect on net interest income. This is in line with the substantial weakening of loan and deposit dynamics over the past six months. Additional negative impacts stemmed from capital losses and net fee and commission income.

The euro area bank lending survey, which is conducted four times a year, was developed by the Eurosystem to improve its understanding of bank lending behaviour in the euro area. The results reported in the April 2023 survey relate to changes observed in the first quarter of 2023 and expected changes in the second quarter of 2023, unless otherwise indicated. The April 2023 survey round was conducted between 22 March and 6 April 2023. In this round, the size of the sample of banks surveyed was increased to 158 banks, mainly reflecting the enlargement of the euro area to include Croatia on 1 January 2023. The response rate was 100%.

For media queries, please contact Silvia Margiocco, tel.: +49 69 1344 6619.

Notes

- A report on this survey round is available on the ECB’s website. A copy of the questionnaire, a glossary of BLS terms and a BLS user guide with information on the BLS series keys can be found on the same webpage.

- The euro area and national data series are available on the ECB’s website via the Statistical Data Warehouse. National results, as published by the respective national central banks, can be obtained via the ECB’s website.

- For more detailed information on the BLS, see Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro area bank lending survey”, Occasional Paper Series, No 179, ECB, 2016.

Chart 1

Changes in credit standards for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Source: ECB (BLS).

Notes: Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for “other factors” refer to further factors which were mentioned by banks as having contributed to changes in credit standards.

Chart 2

Changes in demand for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Source: ECB (BLS).

Note: Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”.

Europejski Bank Centralny

Dyrekcja Generalna ds. Komunikacji

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Niemcy

- +49 69 1344 7455

- media@ecb.europa.eu

Przedruk dozwolony pod warunkiem podania źródła.

Kontakt z mediami