The state of play regarding the deepening agenda for Economic and Monetary Union

Published as part of the ECB Economic Bulletin, Issue 2/2020.

This article provides an overview of progress with various aspects of the deepening of Economic and Monetary Union (EMU). The start of a new legislative period for the European Union (2019-24) provides a natural and opportune moment to take stock of progress towards completion of the architecture of EMU.

The EU’s last two legislative periods saw significant progress as regards the architecture of EMU in response to the global financial crisis more than a decade ago. A banking union was established, with shared supervision of Europe’s largest banks at supranational level and a common framework for addressing and resolving ailing banks. The European Stability Mechanism (ESM) was put in place to support euro area countries facing deep economic crises. And a number of adjustments were made to the shared rules governing national fiscal and economic policies.

However, there is no room for complacency: EMU needs to become even more resilient to adverse economic shocks. An increase in private risk sharing (whereby firms and households diversify their assets across borders through integrated capital and banking markets) can help to mitigate local recessions by allowing local shocks to be offset using income received from elsewhere. An increase in public risk sharing (e.g. through some form of common fiscal policy or shared backstops that safeguard financial stability in times of crisis) can also help to attenuate local and even euro area-wide recessions. Such private and public risk sharing are still more limited in the euro area than they are in other monetary unions, such as the United States. At the same time, the governance mechanisms that help to ensure resilient policies at national level and seek to prevent harmful spillover effects between euro area countries could be strengthened further.

Concrete decisions and further work on a number of aspects of EMU are scheduled for the near future. This includes work on the banking union and the capital markets union (CMU), both of which remain incomplete, leaving scope to further increase the stability and integration of Europe’s banking and capital markets. Other initiatives include reform of the ESM as part of work in the area of crisis management, as well as the establishment of a budgetary instrument for convergence and competitiveness (BICC), which aims to help euro area countries to invest and implement reforms with a view to improving the structure of their economies. In addition, the European Commission is also reviewing the fiscal and economic governance framework that coordinates national policies and is set to table a proposal for a European unemployment reinsurance scheme as a way of enhancing the euro area’s ability to withstand economic downturns.

The ECB has a clear interest in increasing the resilience of the euro area’s institutional architecture. Sound countercyclical fiscal policies, sufficient financial resilience and cross-border private and public risk sharing are all important to the ECB in order to allow for more effective transmission of monetary policy with fewer side effects, enhance the alignment of euro area business cycles, complement monetary policy and give European banking supervision greater traction.

Against that backdrop, this article provides an overview of various different elements of the deepening agenda for EMU and identifies a number of outstanding issues.

1 Introduction

Completing the institutional architecture of EMU will be an important challenge for the EU during the 2019-24 legislative period. A new European Parliament was elected in May 2019, and the new Commission President, Ursula von der Leyen, outlined her priorities in July 2019, before taking office on 1 December 2019 alongside the new College of Commissioners. Meanwhile, the EU’s heads of state or government set out ten priorities for the European Union for the period 2019-24 in a declaration in Sibiu on 9 May 2019.[2]

Responsibility for reforming the architecture of EMU is shared by all EU institutions and Member States. The Commission plays a key role by tabling proposals (including legislative drafts), which are adopted by the ECOFIN Council (the finance ministers of the EU27), typically in cooperation with the European Parliament. In policy terms, the Eurogroup (the finance ministers of euro area countries, who are sometimes joined in meetings by the finance ministers of non‑euro area countries) is the main locus when it comes to giving strategic guidance and negotiating the deepening of the euro area’s architecture. Ultimately, political decisions on EMU are taken at Euro Summits, which bring together the heads of state or government of euro area countries. Different decision-making processes apply if policy areas are intergovernmental (e.g. within the framework of the ESM). The ECB participates in these EU and euro area fora and acts as an adviser on EMU reforms. Thus, reforms to EMU are a product of the interplay between these various actors and their competences in the legislative process.

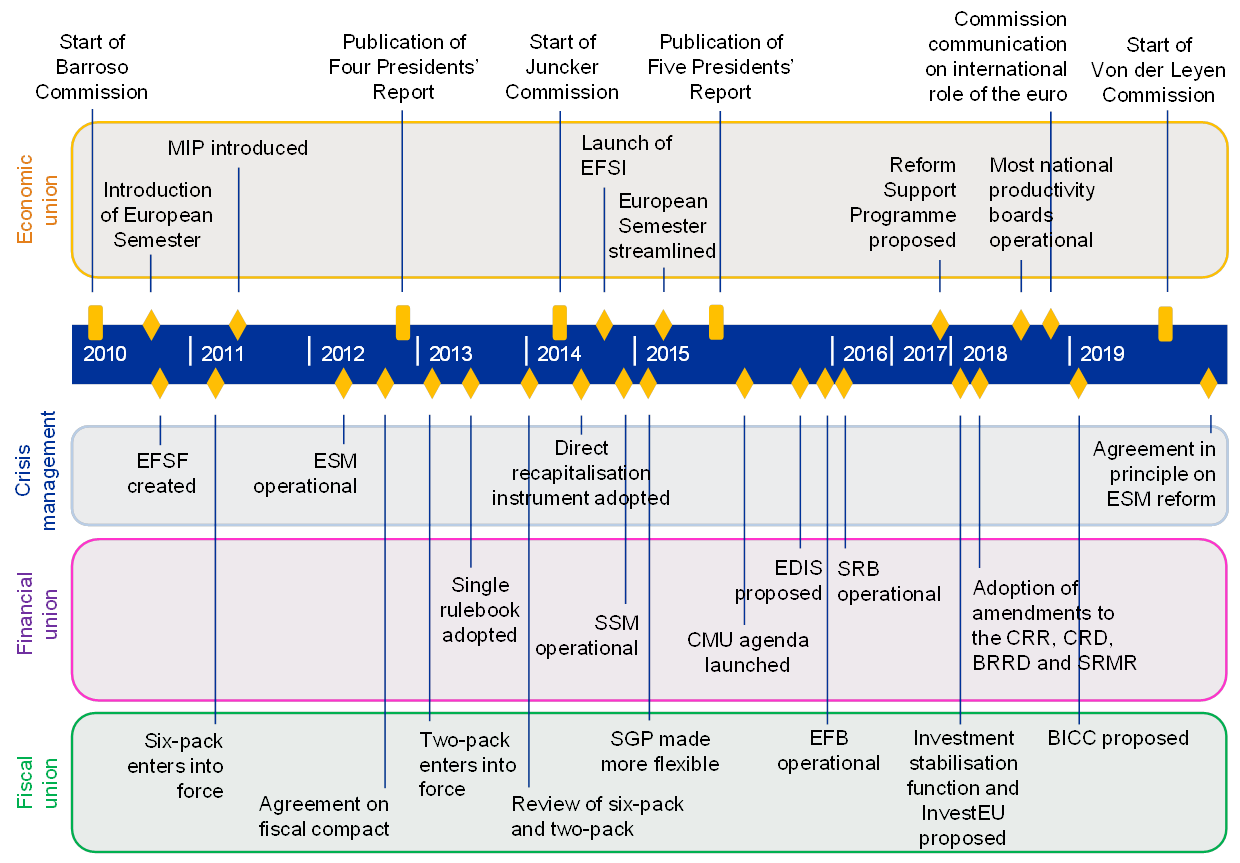

The EU’s last two legislative periods saw significant progress on the architecture of EMU (as outlined in Figure 1). The introduction of the Single Supervisory Mechanism (SSM) and the Single Resolution Mechanism (SRM) delivered two of the three pillars of the banking union, with the third pillar – a European Deposit Insurance Scheme (EDIS) – left incomplete. This built on institutional innovations achieved during the crisis, such as the creation of the ESM, reforms to fiscal rules, and the establishment of the macroeconomic imbalance procedure (MIP) in order to address harmful macroeconomic imbalances. These were all key steps with a view to reducing financial and macroeconomic risks, improving risk sharing, and enhancing the transmission of monetary policy across the euro area.

Figure 1

Timeline of EMU architecture reforms since 2010

Source: ECB, based on https://www.consilium.europa.eu/en/policies/emu-deepening/emu-glossary.

Notes: “MIP” refers to the macroeconomic imbalance procedure; “EFSI” denotes the European Fund for Strategic Investments; the “EFSF” is the European Financial Stability Facility; “ESM” refers to the European Stability Mechanism; “SRB” denotes the Single Resolution Board; the “CRR” is the Capital Requirements Regulation; the “CRD” is the Capital Requirements Directive; “BRRD” refers to the Bank Recovery and Resolution Directive; “SRMR” denotes the Single Resolution Mechanism Regulation; “EDIS” refers to the European Deposit Insurance Scheme; the “SGP” is the Stability and Growth Pact; the “EFB” is the European Fiscal Board; “BICC” refers to the budgetary instrument for convergence and competitiveness; the “six-pack” comprises six regulations aimed at strengthening the SGP and establishing the MIP; the “two-pack” comprises regulations aimed at strengthening the budgetary surveillance cycle in EMU; and the “fiscal compact” is an intergovernmental treaty on the anchoring of fiscal rules in national constitutions.

However, that deepening of EMU has lost its initial momentum. Private and public risk sharing are still more limited in the euro area than they are in other monetary unions (such as the United States). The banking union remains incomplete without the EDIS, and further progress is needed on the establishment of a genuine CMU. On the fiscal side, the euro area continues to lack a central fiscal capacity for the purposes of macroeconomic stabilisation. At the same time, mechanisms aimed at ensuring resilient policies at national level could be strengthened further. The Stability and Growth Pact (SGP) is widely regarded as requiring simplification in order to make the EU’s fiscal rules more effective and countercyclical and improve ownership at national level, while the implementation rate for structural reforms under the European Semester and the effectiveness of the MIP both remain poor. A deeper and more complete EMU (including an enhanced CMU) would, in the context of the pursuit of sound economic policies[3] in the euro area, also support the international role of the euro.[4]

The deepening of EMU is just one of a number of challenges facing the Commission, the Council and the European Parliament. Official statements by the new Commission indicate that significant emphasis will also be placed on the environment, migration and digitalisation, in addition to demographic issues and global tensions.[5] This reflects the changing priorities of European citizens, as reported in the autumn 2019 Standard Eurobarometer.[6] The Sibiu Declaration, in which Europe’s heads of state or government set out the EU’s strategic agenda for the period 2019-24,[7] contained a reference to the deepening of EMU under the general heading “Developing our economic base: the European model for the future”. Charles Michel, the new Council President, will be tasked with following up on that declaration and has indicated that enhancing EMU is particularly relevant in the context of strengthening the international role of the euro.[8] Alongside issues such as investment, employment and inequality, the European Parliament has called for further progress on all aspects of the deepening of EMU and has asked the Commission to table proposals in this regard.[9]

Further decisions and follow-up work on a number of different aspects of the deepening of EMU are scheduled for the near future. The Euro Summit of 13 December 2019 took stock of ongoing work in relation to the banking union, with the High-Level Working Group on a European Deposit Insurance Scheme being tasked, under the aegis of the Eurogroup, with drawing up proposals with a view to establishing a roadmap towards completion of the banking union. It also took note of the planned reform of the ESM (on which high‑level agreement had been reached at the Eurogroup’s December 2019 meeting) and the main features of the BICC. For the remainder of 2020, the work programmes of the various EU fora foresee that the ESM reform package will be ratified by national parliaments, the BICC will be legislated for by the European Parliament and the Council, and the High-Level Forum established by the Commission will put forward proposals for new CMU priorities. Moreover, work towards the establishment of a comprehensive banking union package is likely to continue, a review of the fiscal and economic governance framework is to be undertaken by the Commission, technical discussions on a fiscal capacity for the euro area will continue, and a new proposal for a European unemployment reinsurance scheme may potentially be made. The next section will provide more details on these various work streams.

2 State of play as regards the various elements of EMU architecture

The structure and approach advocated by the Four and Five Presidents’ Reports in 2012 and 2015 respectively provide a useful framework for analysing the current state of play.[10] Those reports, which were written by the Presidents of the European Commission, the European Council, the Eurogroup, the European Central Bank and – in the case of the Five Presidents’ Report – the European Parliament, set out a comprehensive roadmap. Both reports structured their architectural proposals around four unions (financial, fiscal, economic and political) and argued that there was important interplay between those unions. For example, advances in the banking union would reduce any negative feedback loops between struggling banks and the fiscal health of sovereigns, thereby reducing the need for public money and public risk sharing.[11] At the same time, private and public risk sharing were not just seen as substitutes; they were regarded as complementary. The Four and Five Presidents’ Reports also combined proposals aimed at achieving risk reduction and convergence with proposals encouraging more risk sharing – recognising that risk sharing, if designed appropriately, reinforces risk reduction. Finally, those reports proposed an approach to the deepening of EMU, linking risk sharing and risk reduction in a comprehensive roadmap with a timeline and clear milestones. That vision was based largely on a resilience narrative – a desire to make the euro area more resilient and better able to withstand any new crisis.[12] While that kind of holistic perspective continues to exist in the background and can serve as a useful benchmark, it is important to understand that, in practice, discussions in the various EU fora tend to now follow more of a dossier-by-dossier approach. Consequently, the sections below review the various individual dossiers in turn, but group them together in a manner similar to that applied in the Four and Five Presidents’ Reports.

2.1 Banking union

The financial crisis highlighted the need to make structural improvements to Europe’s institutional framework in order to safeguard financial stability and create a level playing field across the euro area. The Four Presidents’ Report of June 2012 proposed the establishment of an integrated financial framework, building on the single rulebook, with a single European banking supervisor and a common deposit insurance and resolution framework. That report argued that a single banking supervisor was needed to ensure uniform application of prudential rules and ensure that banks in all Member States were supervised with the same degree of effectiveness.

The Four Presidents’ Report also included proposals on bank resolution and deposit insurance. That report proposed the establishment of a European resolution scheme (to be funded primarily via contributions from banks) which could ensure the harmonised application of resolution measures to banks overseen by European supervision, with the goal of ensuring the orderly winding-down of non‑viable institutions and protecting taxpayers’ money. Finally, on the subject of deposit insurance, the report proposed the introduction of a European dimension to national deposit guarantee schemes for banks under European supervision, with the objective of increasing the credibility of existing arrangements and ensuring that depositors have sufficient protection.

The Five Presidents’ Report, which was published in June 2015, reiterated the key messages of the Four Presidents’ Report as regards the banking union, but also included a new and more detailed proposal for an EDIS. It called for the establishment of an EDIS as the third pillar of the banking union in order to increase resilience against future crises, since the current set-up with national deposit guarantee schemes was considered to be vulnerable to large local shocks, particularly where both the sovereign in question and the national banking sector were perceived to be fragile. That report argued that a European scheme was also more likely to be fiscally neutral over time than national schemes, since risks would be spread more widely and contributions to the European deposit insurance fund (ex ante and risk-based) would be raised across a much larger pool of financial institutions. While the report acknowledged that setting up a fully fledged EDIS would take time, it argued in favour of taking a number of concrete steps as a starting point, building on the existing framework – for example, by designing the EDIS as a reinsurance system for national deposit guarantee schemes.

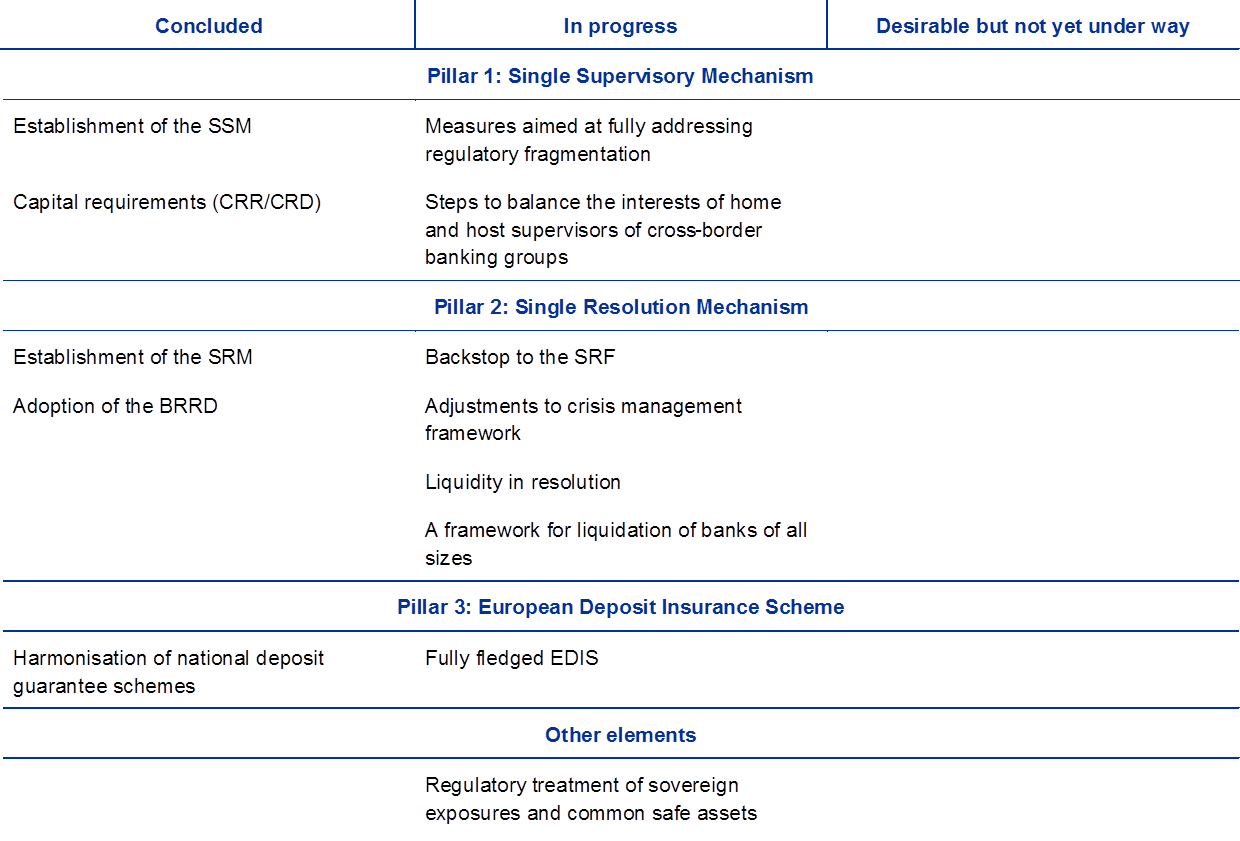

As originally proposed by the Four and Five Presidents’ Reports, the banking union should comprise three pillars (as illustrated in Table 1): (i) common supervision under the SSM; (ii) common resolution arrangements under the SRM; and (iii) common deposit insurance under an EDIS (which has yet to be established). The banking union is underpinned by a single rulebook, which builds on key contributions by the various European supervisory authorities (ESAs), with the European Banking Authority (EBA) having specific responsibility for the banking sector. The SSM is tasked with ensuring the safety and soundness of the European banking system, fostering financial integration and stability, and ensuring consistent supervision. Those objectives are achieved by adopting a uniform approach to day‑to-day supervision, by implementing harmonised supervisory actions and corrective measures, and by ensuring the consistent application of regulations and supervisory policies. The SRM and the Bank Recovery and Resolution Directive (BRRD) have strengthened the euro area’s crisis management framework, with the aim of reducing the cost of future bank failures for taxpayers and the real economy and tackling the bank-sovereign nexus. As regards the third pillar, the European Commission presented a proposal for an EDIS in November 2015. That proposal envisaged a gradual process, starting with reinsurance (whereby the European deposit insurance fund would intervene only after national schemes had been exhausted, and only within certain limits) and ending with a fully fledged European deposit insurance scheme (whereby the European fund would intervene immediately, with full coverage of all financial needs relating to deposit insurance functions). However, no agreement has yet been reached on this issue, and discussions are still ongoing. Establishing the third pillar of the banking union is crucial to ensure uniform deposit protection across the euro area, regardless of a bank’s location. This, in turn, will preserve depositors’ confidence, prevent bank runs and safeguard financial stability, thereby complementing the supervisory pillar. It will also help to address the bank-sovereign nexus, as it will prevent national governments from being called upon to act as a backstop for national deposit guarantee schemes, thereby complementing the resolution pillar. Thus, all three pillars of the banking union will be complementary and mutually reinforcing. It is therefore of the essence that the third pillar is established, completing the architecture of the banking union. Outside observers such as the IMF have also called for the banking union to be completed in a comprehensive manner.[13]

Table 1

State of play as regards the banking union

Source: ECB.

The SSM was established rapidly – becoming operational only two years after the Four Presidents’ Report – and has made significant progress. Indeed, the progress and achievements made by the SSM have been recognised by numerous outside observers, including the European Commission in its October 2017 report on the SSM[14] and the IMF in its 2018 financial system stability assessment for the euro area.[15] Those achievements include the harmonisation of supervisory practices, as well as significant improvements to a number of risk metrics, such as capital buffers, liquidity reserves and non-performing loans.

The establishment of the second pillar of the banking union was also rapid and represents a key milestone in the process of strengthening Europe’s bank resolution framework. The SRM, with the Single Resolution Board (SRB) at its heart and the Single Resolution Fund (SRF) providing resolution financing, has been operational since 2016. The SRF pools contributions received from credit institutions in the banking union and has a target capacity of at least 1% of the total covered deposits of all authorised credit institutions in participating Member States, which must be reached by the end of 2023. Under the supervision of resolution authorities, banks are in the process of building up loss-absorption capacity as required by the minimum requirements for own funds and eligible liabilities (MREL). MREL liabilities include regulatory capital, but they also include other liabilities (e.g. senior unsecured bonds) which are deemed able to absorb losses and contribute to recapitalisation needs in the event of resolution. At the Euro Summit in June 2018, it was agreed that the ESM would provide a common backstop to the SRF in the form of a revolving credit line, starting in 2024. That backstop will have the same firepower as the SRF (i.e. 1% of covered deposits), thus doubling the resources that are available to support and facilitate bank resolution. Moreover, it was agreed at the Euro Summit in December 2018 that the backstop could be introduced before 2024 if sufficient risk reduction had been achieved in banks’ balance sheets. Work on making the backstop operational is ongoing.

Despite the progress made so far, the banking union remains incomplete. Outstanding issues include regulatory fragmentation, gaps in the crisis management framework (e.g. the lack of a harmonised insolvency regime), the absence of a common deposit insurance scheme, and the lack of a common framework for the provision of liquidity in resolution. A number of these elements are linked, and in June 2019 the High-Level Working Group on a European Deposit Insurance Scheme (which consists of members of the Eurogroup Working Group) was tasked with carrying out further technical work and identifying a transitional path with a view to addressing unresolved issues and moving towards a steady state banking union (see Table 1 for an overview of the various elements). At the Eurogroup meeting on 4 December 2019, the Chair of the High-Level Working Group put forward several proposals:[16]

- An EDIS should be established, initially covering only liquidity needs, but eventually encompassing also loss coverage in line with progress on risk reduction. In the initial phase, a hybrid approach could be adopted, providing liquidity support within certain limits and relying on existing national deposit guarantee schemes, with a central fund gradually being established. In a subsequent phase, the EDIS could also increasingly cover losses.

- The regulatory treatment of sovereign exposures (RTSE) should be reformed gradually. Initially, supervisory (Pillar 2) and transparency (Pillar 3) requirements could be strengthened further. Following further analysis and an impact assessment, risk-based contributions to the EDIS could also take account of sovereign exposures, and that regulatory treatment could also include the gradual phasing-in of concentration charges for sovereign exposures. That gradual phasing-in of measures would take due account of the possible impact on national debt markets and financial stability. Further analysis of a “European safe portfolio” (i.e. safe assets and the role they play in the banking sector) should also be conducted.

- Proposals were also made in respect of the crisis management framework and cross-border integration. These involved, among other things, harmonising elements of insolvency law, formalising support arrangements within EU banking groups (i.e. establishing a formal mechanism for subsidiaries’ support by their parents), phasing out options and national discretions that had ceased to be justified, reviewing the governance of the SRB and facilitating cross‑border banking. These measures should ensure that bank failures can be tackled effectively and without bailouts, preserving a level playing field and ensuring financial stability. It was also suggested that financial integration should be strengthened by rolling back prudential and non-prudential obstacles to cross-border banking between Member States.

There was broad recognition at that Eurogroup meeting that the High-Level Working Group’s report contained important proposals for the strengthening of EMU. The High-Level Working Group and the Eurogroup Working Group have been asked to continue working on all elements. Further work will also be carried out by the institutions and the relevant Council working parties.

Work will also continue in the relevant European fora on the provision of liquidity to banks in resolution. When failing banks go into resolution, viable parts can be resolved and restructured, re-entering the marketplace either as a stand‑alone entity or as part of a larger banking group. During this transition phase, they may temporarily lack access to the market liquidity that they need in order to successfully reinitiate their operations. This is why other jurisdictions (such as the United Kingdom and the United States) have established public systems that provide liquidity to banks in resolution. Although they vary in terms of their precise design, these systems generally rely on central bank liquidity, underpinned by fiscal guarantees. No such functionality exists at euro area level, implying a de facto fallback onto national solutions.

National solutions, however, do not reflect the reality that large euro area banks are now supervised at European level, creating a mismatch between liability and control. Moreover, national solutions risk fuelling the bank-sovereign nexus, as fiscal authorities may have to backstop banks’ liquidity needs using national fiscal guarantees. Work is under way with a view to finding an adequate solution to this issue within the banking union, and various different options are on the table. As banks in resolution may sometimes have substantial liquidity needs, it is essential, in order to facilitate resolution and preserve confidence, that sufficient firepower is available – if necessary, beyond what is available via the SRF and the backstop to the SRF. However, when assessing potential solutions involving the Eurosystem, it is important to note, in this regard, that the Eurosystem can only provide liquidity against adequate collateral.

The Council and the European Parliament are expected to continue working on legislative initiatives relating to the banking union and banking regulation more broadly. This will include proposals made in the previous legislative period which have not yet come to fruition (such as a number of regulations/directives relating to collateral and the recovery and resolution of central counterparty clearing), as well as new initiatives and reviews of existing legislation (including the implementation of Basel III and aspects of the single rulebook relating to capital requirements and resolution).[17]

2.2 Capital markets union

The Five Presidents’ Report also called for further development of the CMU. The idea here is that well-functioning capital markets can strengthen cross-border risk sharing through deeper integration of bond and equity markets. An increase in private risk sharing and greater integration of markets can also provide a buffer against systemic shocks in the financial sector. In addition, companies – including small and medium-sized enterprises (SMEs) – will have access to a more diverse range of finance, in addition to bank credit.

The goals of the CMU project, as defined in the Commission’s 2015 action plan,[18] are manifold, with the overarching aim being to create “stronger capital markets” in the EU. The CMU project originally stemmed, in essence, from the observation that, relative to other monetary unions, the euro area had less well developed and less integrated capital markets, which were preventing it from enjoying a number of economic benefits. A fully fledged CMU (which, in combination with the banking union, could lay the foundations for a financial union) would “help mobilise capital in Europe and channel it to all companies”, as well as “deepen financial integration” through “more cross-border risk sharing, more liquid markets and diversified sources of funding”.[19] In its response to the Commission’s 2015 green paper,[20] the Eurosystem noted that “CMU has the potential to complement the banking union, strengthen Economic and Monetary Union (EMU) and deepen the Single Market”. Outside observers such as the IMF make similar arguments.[21]

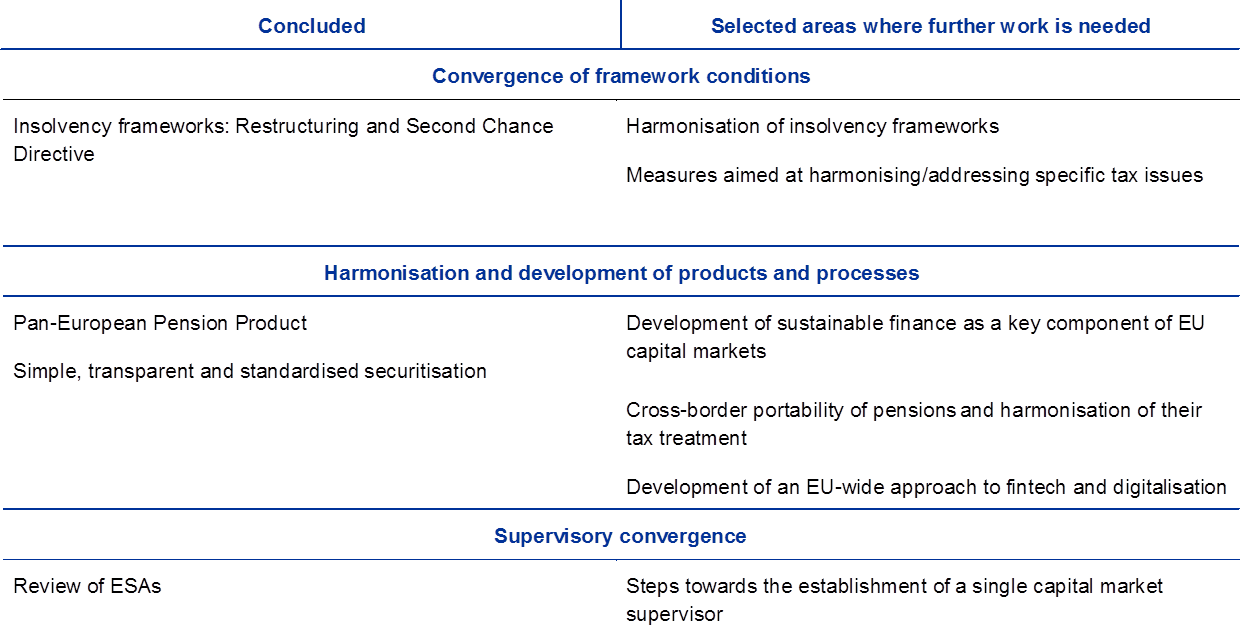

Most of the proposals listed in the 2015 action plan were implemented in the last legislative period, but more remains to be done. For example, little progress has been made on key issues such as taxation and the harmonisation of insolvency frameworks. Specifically, reforms aimed at removing biases in the tax code that favour debt over equity remain unfinished, and the withholding tax on capital gains remains heterogeneous across the euro area. On the subject of insolvency frameworks, there is still no alignment as regards the question of how to recoup collateral or assign the claims of creditors. In other areas, meanwhile, the initial level of ambition has been lowered significantly. This is true, for example, of the review of the ESAs (particularly as regards the competences of the European Securities and Markets Authority), the supervision of central counterparties as laid down in the European Market Infrastructure Regulation (EMIR 2.2) and the establishment of a Pan-European Pension Product. While measures in some areas may simply need more time in order to achieve their full effect, it seems unlikely that the original 2015 action plan will, on its own, be sufficient to achieve truly integrated capital markets. Specifically, further action will be needed in relation to the convergence of framework conditions, the harmonisation of capital market products and processes, and supervisory convergence (see Table 2 for an overview).

Table 2

State of play as regards the CMU

Source: ECB.

Strengthening the EU’s capital markets will become even more important after Brexit. Regulatory drivers – in particular, the end of passporting rights for certain UK-based activities – are already having an effect on the geography of financial centres in the EU. Preliminary evidence suggests that a small number of new financial hubs appear to be emerging as a result of the relocation – or planned relocation – of certain activities. The persistence of such dynamics, and the emergence of a clearly multi-centric euro area financial system, could pose a number of challenges. In particular, without further progress on the CMU, a more fragmented financial structure could eventually jeopardise private risk sharing.

Where services can continue to be provided out of London on the basis of third-country access regimes, regulatory and supervisory consistency is needed. A fragmented framework for third-country access, relying on a patchwork of existing national regimes, could give rise to regulatory arbitrage, with firms potentially seeking to circumvent host supervision and EU regulatory requirements. Appropriate oversight will be needed, with EU regulators and supervisors being given adequate tools, especially considering that existing third-country regimes were not designed to manage substantial cross-border provision of services.

Measures aimed at developing capital markets would help to strengthen the EU’s domestic capacity in areas where reliance on London is more pronounced. A substantial reduction in the provision of cross-border services by the City of London would strengthen the case for developing domestic capacity. CMU initiatives have been launched in order to support the development of certain market segments, such as securitisation and crowdfunding. The CMU project also seeks to increase the use of equity financing through its role in supporting investment and private risk sharing. Thus, in a post-Brexit world, initiatives fostering the development of genuine capital markets will be even more important.

The Commission has initiated further work on the CMU with a view to presenting legislative proposals in 2020. The High-Level Forum established by the Commission has been tasked with putting forward proposals for the next CMU action plan by the end of May 2020. The High-Level Forum is exploring three questions: (i) how to create an ecosystem that allows greater cross-border raising of capital, with a particular focus on innovative SMEs; (ii) how to establish pan‑European capital market architecture, with a particular focus on the question of how new financial technologies can support this process;[22] and (iii) how investment choices and access to capital market services can foster greater participation by retail investors.

The Council is also looking at issues in this area. In October 2019, a high-level working group established by a number of Member States published proposals aimed at relaunching the CMU. These included recommendations aimed at generating long-term savings opportunities, developing equity markets, enhancing cross-border financial flows, and developing debt, credit and forex financing tools. The conclusions of the December 2019 ECOFIN meeting call for a roadmap to be drawn up for the deepening of the CMU on the basis of six objectives: (i) enhanced access to finance for EU firms (especially SMEs); (ii) the removal of structural and legal barriers to increased cross-border capital flows; (iii) the provision of incentives encouraging well-informed retail savers to invest, and the removal of obstacles standing in their way; (iv) support for transition to sustainable economies; (v) the embracing of technological progress and digitalisation; and (vi) strengthening of the global competitiveness of EU capital markets.[23] Those conclusions invite the Commission to assess and explore detailed measures and actions that could help to achieve these objectives.

While there is broad acknowledgement of the importance of the CMU, the challenge will be to transform that ambition into concrete and ambitious measures during the current legislative cycle. Many of the proposals in the original 2015 action plan have already been implemented, but some have ended up being less ambitious than was originally intended.

2.3 Fiscal instruments for the euro area

In the realm of fiscal union, the Five Presidents’ Report called for the establishment of a euro area-wide fiscal stabilisation function for severe crisis situations. In such circumstances, national fiscal buffers may not be able to provide the degree of economic stabilisation that would be optimal from an aggregate euro area perspective. Mature monetary unions typically have a common macroeconomic stabilisation function in order to enhance the economy’s resilience to shocks that cannot be managed at national level alone.

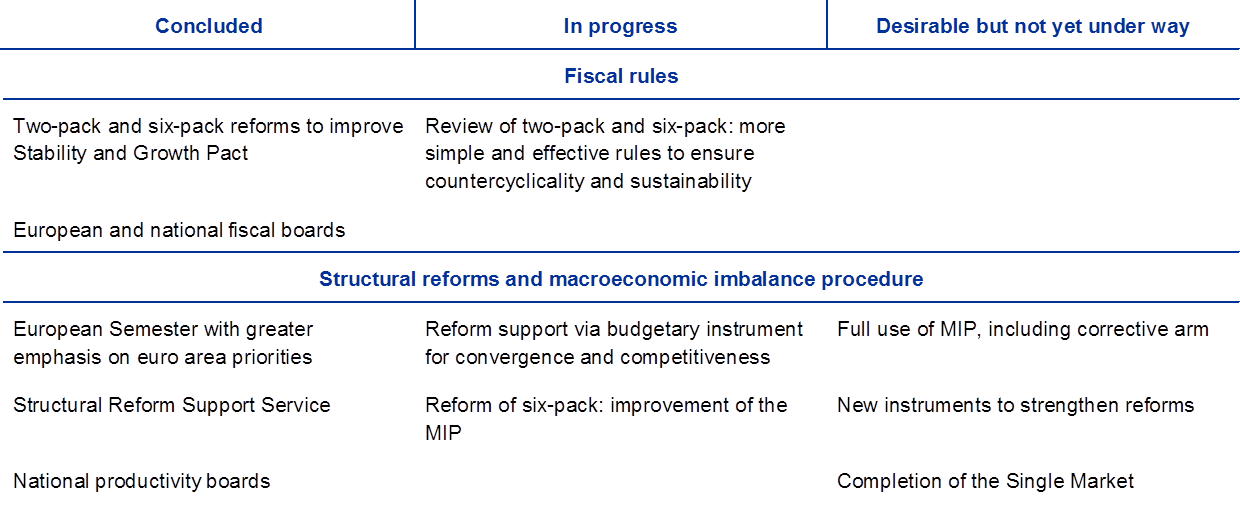

Discussions on the establishment and expansion of European fiscal instruments are currently ongoing, with three types of goal in mind: (i) stabilisation of the business cycle, (ii) fostering of convergence through support for structural reforms and (iii) increases in public investment. In addition, negotiations have also been taking place with regard to the reforming of the euro area’s crisis architecture (particularly the ESM) and the EU’s next multiannual financial framework (covering the period 2021-27) – issues which are not covered in great detail here. For an overview of concluded and ongoing work streams in this area, see Table 3.

Table 3

Fiscal and economic union: state of play as regards EU and euro area fiscal instruments

Source: ECB.

In its opinion on the establishment of a European investment stabilisation function (EISF), the ECB welcomed the fact that the creation of a common macroeconomic stabilisation function for the euro area was being discussed.[24] The ECB pointed out that other monetary unions have such functions in order to better deal with economic shocks that cannot be managed at national level. If designed appropriately, a common macroeconomic stabilisation function would increase the economic resilience of both individual participating Member States and the euro area as a whole, thereby also supporting the single monetary policy, particularly in the presence of deep euro area-wide recessions.

Thus far, little progress has been made on the establishment of a genuine stabilisation function. In addition to the Commission’s 2018 proposal for an EISF,[25] prominent proposals ranging from “rainy day funds” to investment protection schemes and unemployment (re)insurance schemes have been made by international institutions, academics and a number of Member States.[26] Those proposals have been discussed in EU fora, which are continuing to work on them, but only at a technical level. Meanwhile, Commission President Ursula von der Leyen has indicated that she intends to propose a European unemployment benefit reinsurance scheme. At this stage, however, there is no concrete information on the possible design of such a scheme.[27]

Rather than a stabilisation function, it has been agreed, as a compromise, that a budgetary instrument for convergence and competitiveness will be created in order to provide EU funds to Member States for structural reforms and investment. In its agreement of 10 October 2019, the Eurogroup set out the main features of the BICC, including key governance principles and financing modalities, as well as core parameters for the allocation of funds.[28] Funds will be allocated to each Member State on the basis of its population and the inverse of its gross national income (GNI) per capita, with a “juste retour” floor of 70%. (In other words, Member States can never receive less than 70% of the funds that they have paid in.) As regards national co-financing rates, the agreement foresees a rate of 25%, while a modulation procedure envisages that this rate can be cut in half in the presence of severe economic circumstances.[29] The main outstanding issues relating to the BICC concern its size and financing. As regards the amount of funding to be provided from the EU budget, the Eurogroup and the Commission had proposed a sum of €17 billion, but in December the Finnish EU Presidency proposed a substantially lower amount of €12.9 billion as part of the negotiation of the multiannual financial framework. On the subject of financing, the Eurogroup Working Group has been tasked with carrying out further discussions in 2020 on an intergovernmental agreement (IGA) that could funnel additional resources into the BICC. This has resulted in a dedicated report providing further information on the rationale for the IGA and its content, modalities and scope.[30] A final decision – including a decision on the IGA – will be taken by Europe’s leaders in the context of the MFF negotiations. Given that it is currently expected to be fairly limited in terms of capacity, the BICC will probably not have a material impact on the convergence, competitiveness or stabilisation of the euro area. Equipping the BICC with additional resources via an IGA will therefore be essential in order to increase its effectiveness.

At the same time, over the last few years, a number of budgetary instruments aimed at supporting investment have been developed and scaled up at EU28 – rather than euro area – level. In 2014, the European Commission launched its Investment Plan for Europe (the “Juncker Plan”) as a collective fiscal instrument at EU level in order to reverse the downward trend in investment and help sustain the economic recovery. By October 2019, the Investment Plan for Europe had triggered €439.4 billion in additional investment across the EU. Indeed, according to the Commission, investment under this programme had increased EU GDP by 0.9% by 2019 and will increase it by a cumulative total of 1.8% by 2022. The European Investment Bank (EIB) is another budgetary instrument that exists at EU level. In 2012, the EIB’s capital was increased further (bringing its subscribed capital to €232.4 billion) with the aim of contributing to economic growth in Europe. That increase in capital has allowed the EIB to provide about €60 billion in additional lending over a three-year period, thereby further increasing the macroeconomic impact of its operations.

Looking ahead, there are several proposals aimed at increasing the EU’s support for investment which may have a beneficial macroeconomic impact at euro area level, albeit they do not seek to achieve countercyclical effects and are limited in size. In the Commission’s proposal for the 2021-27 multiannual financial framework, the largest relative increase in the EU budget can be seen in the area of support for investment. The InvestEU programme proposed for the next MFF is expected to place the European Fund for Strategic Investments and 13 other EU financial instruments under a single roof, mobilising at least €650 billion in additional investment.[31] Moreover, the Sustainable Investment Plan announced by the new Commission is expected to trigger €1 trillion in climate-related investment between 2020 and 2030. The Commission tabled a proposal on this issue on 8 January 2020.

The establishment of a central fiscal capacity could involve the issuance of some form of safe asset at euro area level. In this context, the General Board of the European Systemic Risk Board (ESRB) set up a High-Level Task Force on Safe Assets, which investigated the practical considerations relating to sovereign bond‑backed securities (SBBSs).[32] At present, however, no specific proposals on euro area safe assets are being discussed in EU fora at political level.

A discussion on reorienting EU policies – including the EU budget – towards the provision of public goods such as environmental protection, digitalisation and security is gaining traction. The Commission has made climate change its central priority for the next five years, and the French and German governments recently commissioned a study looking at the potential of European public goods across a wide range of policy areas in the context of the changing geopolitical conditions facing the EU.[33] Even if they have no impact on policies at EU level, these discussions could still lead to greater coordination between the national policies of individual countries.

2.4 Governance of national fiscal and economic policies

In the realm of fiscal and economic union, the Five Presidents’ Report called for stronger coordination of national policies under both the Stability and Growth Pact and the MIP. On the subject of fiscal policies, that report emphasised the need for responsible budgetary policies at Member State level. A review of the six-pack and two-pack – a related consultation process was launched by the Commission on 5 February[34] – was identified as an opportunity to increase clarity, transparency, compliance and legitimacy, while preserving the stability‑oriented nature of the fiscal rules. Better compliance with fiscal rules was to be achieved via the establishment of the European Fiscal Board (EFB), which would coordinate and complement national fiscal councils and provide an independent assessment of Member States’ compliance with the rules of the Stability and Growth Pact. As regards economic policies, the Five Presidents’ Report emphasised the need for further economic convergence in order to achieve consistently resilient economic structures throughout the euro area. A network of competitiveness authorities (“national productivity boards”) was envisaged for the euro area in order to track performance in the field of competitiveness, prevent economic divergence and increase ownership of the necessary reforms at national level. Moreover, the Five Presidents’ Report also called for stronger surveillance under the MIP to encourage structural reforms and better capture imbalances at the level of the euro area as a whole. Meanwhile, the European Semester was to place greater emphasis on the coordination of economic policies.

An effective coordination system for national economic policies is essential for the smooth functioning of EMU. This is of vital importance in order to support the single monetary policy and bolster economic convergence both within and across countries.

The fiscal and economic governance framework in EMU has been reformed over the years, drawing on lessons learned both before and during the crisis. The six-pack reform of 2011 and the two-pack reform of 2013 sought to place greater emphasis on debt[35] and expenditure control, strengthening enforcement, improving the monitoring of macroeconomic imbalances and establishing independent fiscal institutions at national level. Since then, EU fiscal rules have been subject to continuous refinement and interpretative innovation, which has resulted in greater complexity and increased the scope for discretion. The EFB and national productivity boards have also been established. The Five Presidents’ Report, which called for the creation of the EFB, anticipated that it would act as an advisory body, coordinating and complementing national fiscal councils and providing a public and independent assessment of the implementation of the EU’s fiscal governance framework.[36] Meanwhile, the Five Presidents’ Report’s call for a network of competitiveness authorities in the euro area to prevent economic divergence and increase ownership of the necessary reforms at national level resulted in the Council recommending the establishment of national productivity boards.[37] Table 4 provides an overview of developments in this area.

Table 4

Fiscal and economic union: state of play as regards the governance of national policies

Source: ECB.

However, the reform of the Stability and Growth Pact has had mixed results. Overall, the debt and deficit levels of the euro area as a whole are below those seen in other major advanced economies. There are no ongoing excessive deficit procedures (EDPs) at present, and many euro area countries have now reached their medium-term budgetary objectives (MTOs).[38] At the same time, some countries have made insufficient progress in terms of reducing government debt and deficits.[39] There are currently limited fiscal buffers available to support growth if downside risks to the current economic outlook materialise, particularly in high-debt countries. In addition to criticism of their limited effect as a disciplining device, the EFB and others have also pointed out that the rules have become too complex and overly reliant on unobservable variables such as output gaps. Moreover, the Stability and Growth Pact does not contain rules or instruments aimed at steering the aggregate euro area fiscal stance, and little effort has been made to improve the quality of public finances, irrespective of the fiscal stance.[40]

As regards structural policies, continued weak implementation of country‑specific recommendations (CSRs) by Member States – including those with excessive imbalances – remains a challenge for the European Semester.[41] Indeed, in February 2019 the Commission concluded that none of the 2018 CSRs for euro area countries had been “fully” implemented.[42] Meanwhile, “substantial” progress was only observed for around 5% of CSRs. This was similar to the situation seen in previous years. As such, the streamlining of the European Semester (by reducing the number of CSRs) and the enhancement of the dialogue between the Commission and Member States have not yielded the intended improvements. Moreover, countries with excessive imbalances do not seem to have taken further decisive policy action to step up the implementation of their CSRs. Finally, the macroeconomic imbalance procedure has not yet been applied in full, as the Commission has never exercised its right to initiate an excessive imbalance procedure (EIP).[43]

The Commission is now in the process of reviewing both the six-pack and the two-pack, with that review due to be concluded in 2020.[44] That review, which was launched on 5 February, will take account of four key weaknesses in the fiscal framework: (i) the high levels of debt in some Member States; (ii) the procyclical nature of fiscal policies; (iii) the complexity of rules and the lack of ownership; and (iv) the fact that insufficient attention is paid to investment. The Commission has also launched a consultation process, inviting stakeholders (including the ECB) to provide their views on the question of how the economic governance framework has functioned so far and how best to enhance its effectiveness. That consultation process will run until the summer, and the Commission will then take all responses into consideration when it reflects internally on possible next steps in the second half of the year.

A number of possible ways of rectifying the EU’s fiscal governance framework have been put forward by stakeholders. In 2017, for instance, the Commission proposed amending the Treaty on Stability, Coordination and Governance (the “fiscal compact”) and integrating it into the EU’s legal framework.[45] Meanwhile, the IMF,[46] the EFB[47] and ECB staff[48] have all advocated reforming the Stability and Growth Pact on the basis of a single long-run debt target and a single operational instrument (such as an expenditure rule). The EFB has called for a wide-ranging review aimed at simplifying the rules, combined with progress towards the establishment of a stabilisation capacity.[49] Most observers also see a link between further risk sharing and market discipline.

On the subject of reforming the European Semester and the MIP, no major proposals have been tabled, other than the BICC. The Commission has, however, indicated that it intends to integrate the UN Sustainable Development Goals into the European Semester, as well as possibly replacing the EU2020 Agenda (which serves as an anchor for the European Semester) with the UN’s 2030 Agenda for Sustainable Development.

At the same time, in the context of growing concerns about global competition, digitalisation and climate change, the Single Market is set to feature more prominently in the Commission’s agenda going forward. Ambitious policy agendas in these three areas have the potential to open up new sources of growth and play an important role in accelerating convergence within EMU, which historically grew out of the Single Market. Services, for example, remain underdeveloped and could help to bring about more integrated and resilient product markets.[50] [51] The Commission has also launched a Green New Deal, which is expected to mobilise additional investment in order to finance the transition process.

2.5 Crisis management

The establishment of a fiscal backstop for the euro area in the form of the European Stability Mechanism was of fundamental importance for the resilience of EMU. In response to the euro area sovereign debt crisis, euro area countries established the European Financial Stability Facility (EFSF) in 2010. This was followed in 2012 by the establishment of the ESM as a permanent euro area crisis management body outside the EU’s legal framework. Together, the EFSF and the ESM have disbursed €295 billion in financial assistance since 2010.

Over the last two years, euro area countries have been negotiating a reform of the ESM in order to increase its operational capacity. In December 2019, the Eurogroup agreed in principle on four broad reforms, which will be reflected in a revised ESM Treaty. First, the ESM will act as a backstop for the Single Resolution Fund. Second, the ESM will play a more prominent role in the design and monitoring of conditionality requirements in macroeconomic adjustment programmes, as well as external programmes. Third, the conditions for accessing the ESM’s precautionary support will be set out more clearly. And fourth, the framework for assessing the sustainability of debt will be refined further, and single-limb collective action clauses (CACs) will be introduced as of 2022. The revised ESM Treaty should be signed in the coming months, once all remaining legal issues have been resolved.[52]

2.6 Other institutional issues (“political union”)

The Five Presidents’ Report stressed that institutional innovations need to be accompanied by greater economic integration. Specifically, greater responsibility at EU and euro area level needs to go hand in hand with “greater democratic accountability, legitimacy and institutional strengthening”.[53]

As regards these broader institutional reforms, a number of initiatives proposed in the Five Presidents’ Report have yet to materialise (see Table 5 for an overview). These initiatives include, for example, more unified external representation of the euro area and the establishment of a euro area treasury. Meanwhile, others have called for clearer separation between the prosecution and adjudicatory roles within the Commission, in order to strengthen its ability to act as the guardian of the Treaty in enforcing the Stability and Growth Pact. Moreover, the ESM and the fiscal compact have not yet been integrated into EU law. While the Commission put forward proposals in these areas, both co-legislators eventually decided not to follow up on them. In a similar vein, the policy proposal presented by the Commission in 2017 with a view to establishing a euro area treasury[54] met with strong scepticism in the Council, and the Commission never made a formal legislative proposal. These institutional reforms could potentially become more relevant when it comes to the institutional arrangements for any future fiscal capacity.

Table 5

State of play as regards other institutional issues

Source: ECB, based on Five Presidents’ Report.

Treaty change could potentially take place under this Commission, opening up avenues for broader institutional reforms. The Commission envisages a Conference on the Future of Europe, starting in 2020 and running for two years, which could result in the revision of EU Treaties. While the remit of such a conference will be decided in cooperation with the European Parliament and the Council, the Commissioner-designate in charge of this dossier has signalled an intention to focus mainly on the issue of democratic participation, which could include giving the European Parliament the right of legislative initiative.[55] In response to the Commission’s tabling of this suggestion, France and Germany published a joint paper on 25 November 2019 outlining their views on the remit and process for such an intergovernmental conference.[56]

3 Conclusions

The new European legislature will be able to build on the significant steps that were taken to improve EMU architecture in the previous decade. The establishment of the European Stability Mechanism, the reforming of fiscal rules and the establishment of the macroeconomic imbalance procedure all helped to address fault lines exposed by the crisis. The subsequent introduction of the Single Supervisory Mechanism and the Single Resolution Mechanism then delivered two of the three pillars of the banking union.

Nevertheless, the agenda that was proposed in the Five Presidents’ Report has yet to be fully implemented, with outstanding measures in the financial, fiscal, economic and political domains. There is no room for complacency when it comes to making EMU better able to withstand adverse shocks. Private and public debt remain elevated in many countries, private and public risk sharing are still more limited in the euro area than they are in other monetary unions, and mechanisms aimed at ensuring resilient policies at national level could be strengthened further.

The first priority is the need to complete the banking union. An unfinished banking union will prevent the euro area and its citizens from reaping the full benefits when it comes to market integration and the uniform protection of depositors. There is, however, some momentum in this regard, which should be seized upon in order to pursue a package of measures in parallel:

- Establish a European Deposit Insurance Scheme: The establishment of a fully fledged EDIS should be the key priority, as it is the main element that is missing in terms of completing the banking union. In the short to medium term, a common deposit insurance scheme could be set up on the basis of a hybrid model, relying on existing national schemes and a central fund, with loss coverage gradually increasing over the next five years. However, the end goal should be an EDIS with full loss and liquidity coverage, in order to ensure uniform protection of covered deposits.

- Harmonise national bank insolvency procedures at European level: Bank insolvency frameworks continue to vary across countries, potentially giving rise to very significant differences in terms of outcomes. Taking the US Federal Deposit Insurance Corporation (FDIC) as a model, a harmonised liquidation framework should be established, and the Single Resolution Board should be given the tools needed to oversee the orderly liquidation of banks (especially in the case of small and medium-sized banks which are not subject to resolution).

- Remove impediments to the free flow of capital and liquidity: In order to protect domestic bank balance sheets against adverse shocks, capital and liquidity should be allowed to flow freely within EMU (including within cross‑border banking groups). Striking a balance between the interests of financial integration and financial stability will be crucial in order to remove those impediments within the euro area.

- Recognise that the regulatory treatment of sovereign exposures and the development of a common euro area safe asset can be two additional mutually supportive aspects of the deepening of EMU: Work on a sound and prudent design for each concept should continue independently. The introduction of RTSE needs to take into account financial stability considerations and reinforces the case for ensuring sufficient availability of safe assets for the liquidity and risk management of financial institutions. At the same time, the creation of a common euro area safe asset, if so decided by Member States, should be pursued in a way that does not undermine incentives for sound national fiscal policies. That common safe asset will also be conducive to the smooth conduct of monetary policy. Together with RTSE, it will also contribute to the safety and soundness of banks, as well as contributing indirectly to the strengthening of the international role of the euro.

- Close the gap in terms of the provision of liquidity to banks in resolution: A European-level guarantee promising access to Eurosystem liquidity for banks in resolution would bring the euro area into line with other major jurisdictions such as the United Kingdom and the United States.

- Improve Europe’s anti-money laundering (AML) framework: The existing AML Directive should be turned into a regulation, establishing an effective European toolkit combating money laundering. An EU body outside the ECB should be given responsibility for AML tasks and could be equipped with direct supervisory powers.

A second priority is the development of a European capital market, which is vital in order to improve private risk sharing and is an area that remains underdeveloped. The European Commission and its High-Level Forum looking at the CMU are expected to make proposals on this issue in early 2020. Those proposals will need to show renewed ambition in order to drive the CMU project forward, particularly as regards the following:

- Fostering supervisory convergence: A genuine CMU will need to have a single capital market supervisor at European level, with a level playing field not only in terms of regulation, but also as regards supervisory practices and their application across the EU.

- Harmonising products and standards: Capital market products and standards should be harmonised, with a Pan-European Pension Product and common standards for securitisation, fintech and green bonds, for example.

- Convergence of framework conditions: In order to create a landscape conducive to vibrant capital markets, the EU requires greater convergence of framework conditions with a bearing on the CMU, such as tax and insolvency frameworks.

A third priority is the need to improve the euro area’s fiscal architecture, which has not entirely delivered as intended. The current fiscal rules do not do enough to ensure the achievement of sound and sustainable fiscal positions in economic good times. The resulting lack of fiscal space in bad times may then entail a need for procyclical fiscal tightening, which may render the macroeconomic policy mix inappropriate at the euro area level. Going forward, there is therefore a need for the following:

- Reforms to fiscal rules to make them simpler, more effective and less procyclical: There is a fairly broadly based consensus in both academia and policy institutions that it would be beneficial to move towards a framework with a single indicator (e.g. an expenditure rule) with links to a debt anchor. The ongoing review of the two-pack and the six-pack represents an opportunity to reassess the effectiveness of the SGP framework.

- Creation of a central fiscal capacity for the euro area for the purposes of macroeconomic stabilisation: The existing rules are not conducive to the establishment of a euro area-wide fiscal policy stance that could complement monetary policy, particularly at the effective lower bound. A central budgetary function of this kind would help to increase the euro area’s resilience when facing severe economic crises.

A fourth priority is the need to improve the resilience of national economic structures. The implementation of structural reforms to increase the resilience of labour and product markets, as well as institutions, has waned in recent years. Two different avenues can be leveraged in order to address this:

- Use the macroeconomic imbalance procedure more effectively: Existing means of coordinating economic policy – including the excessive imbalance procedure – should be applied more effectively.

- Deepen the Single Market: Europe is increasingly shifting from the production of goods to the provision of services – an area where the Single Market is not as well developed (partly as a result of shortcomings in terms of the implementation of the Services Directive). Consequently, there are still many national regulations governing the delivery of different types of service in the various Member States. With that in mind, the Commission should place renewed emphasis on initiatives aimed at deepening the Single Market, reaping the benefits of its proven track record of boosting economic growth. In parallel, it could explore the possibility of broadening the scope of the Single Market in areas where reform efforts have lost momentum (e.g. as regards conditions for doing business).

Progress in these outstanding areas will support the effectiveness of the single monetary policy and banking supervision and help to preserve financial stability. Sound countercyclical fiscal policies, completion of the banking union, sufficient financial resilience and cross-border private and public risk sharing are all important to the ECB in order to allow for more effective transmission of monetary policy with fewer side effects, enhance the alignment of euro area business cycles, complement monetary policy, give European banking supervision greater traction and safeguard financial stability.

- Valuable contributions were also made by Giovanni Di Iasio, Joachim Eule, Donata Faccia, Alessandro Giovannini, Anastasia Koutsomanoli-Filippaki, Rebecca Segall, Pär Torstensson and David Sondermann.

- See the Sibiu Declaration.

- See Masuch, K., Anderton, R., Setzer, R. and Benalal, N. (eds.), “Structural policies in the euro area”, Occasional Paper Series, No 210, ECB, 2018.

- See ECB, “The international role of the euro”, June 2019, and the European Commission’s communication of 5 December 2018 entitled “Towards a stronger international role of the euro”.

- For details of the Commission’s political priorities for the period 2019-24, see https://ec.europa.eu/info/strategy/priorities-2019-2024_en

- In particular, 34% of euro area respondents (unchanged from the previous survey six months earlier) regarded immigration as a pressing issue for the EU, while a cumulative 38% (up 3 percentage points) regarded climate change and the environment as priorities at EU level. In contrast, only 18% of euro area respondents (unchanged from the previous survey) regarded the economic situation as a priority, with 15% (down 3 percentage points) regarding Member States’ public finances as a key issue.

- See https://www.consilium.europa.eu/media/39291/en_leaders-agenda-note-on-strategic-agenda-2019-2024-0519.pdf

- See the remarks made by Charles Michel after the European Council meeting on 13 December 2019: https://www.consilium.europa.eu/nl/press/press-releases/2019/12/13/remarks-by-president-charles-michel-after-the-european-council-meetings-on-13-december-2019

- See, for example, https://www.europarl.europa.eu/doceo/document/TA-8-2016-0312_EN.html

- See the Four Presidents’ Report and the Five Presidents’ Report.

- See the article entitled “Risk sharing in the euro area”, Economic Bulletin, Issue 3, ECB, 2018.

- The recent “7+7 report” by seven French economists and seven German economists made similar arguments. See Bénassy-Quéré et al., “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insights, No 91, 2018.

- See, for example, the IMF’s 2018 financial system stability assessment for the euro area.

- See the Report from the Commission to the European Parliament and the Council on the Single Supervisory Mechanism established pursuant to Regulation (EU) No 1024/2013: “Based on document analysis and interviews with relevant stakeholders, the Commission comes to an overall positive assessment of the application of the SSM Regulation and the first years of the ECB acting in its supervisory capacity. The first Pillar of the Banking Union has now been fully implemented and is functional, with clear benefits in terms of level playing field and confidence emerging from the integrated supervision of credit institutions.”

- Op. cit. in footnote 13: “Banking supervision in the euro area has improved significantly following the creation of the Single Supervisory Mechanism (SSM). A detailed assessment against the Basel Core Principles finds that the SSM has established its operational independence and effectiveness, intensifying supervision while harmonizing at a high level. The SSM has also implemented sophisticated risk analysis in the process of setting capital targets for individual institutions.”

- For more detailed information on those proposals, see the letter that the Chair of the High-Level Working Group sent to the Eurogroup: https://www.consilium.europa.eu/media/41644/2019-12-03-letter-from-the-hlwg-chair-to-the-peg.pdf

- For updates on the progress of legislative initiatives, see https://www.europarl.europa.eu/legislative-train

- See https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52015DC0468&from=EN

- Ibid.

- See “Building a Capital Markets Union – Eurosystem contribution to the European Commission’s Green Paper”, April 2015.

- See Bhatia et al., “A Capital Market Union for Europe”, Staff Discussion Notes, No 19/07, IMF, 2019.

- The ECB is participating in this work stream as an observer.

- See https://www.consilium.europa.eu/en/press/press-releases/2019/12/05/capital-markets-union-council-sets-objectives-for-the-deepening-of-the-project

- See the general observations made in ECB Opinion CON/2018/51.

- The Commission has also made proposals on convergence and public investment in the form of a plan for a Reform Support Programme and a proposal to turn the European Fund for Strategic Investments (the “Juncker Plan”) into InvestEU (see http://europa.eu/rapid/press-release_IP-18-3972_en.htm).

- See, for example, the IMF’s proposal on a central fiscal capacity for the euro area and the proposal made by 14 French and German economists on reconciling risk sharing with market discipline.

- See “A Union that strives for more: My agenda for Europe – Political Guidelines for the next European Commission 2019-24”. For a technical assessment of the various different design options for a European unemployment insurance scheme, see Koester, G. and Sondermann, D., “A euro area macroeconomic stabilisation function: assessing options in view of their redistribution and stabilisation properties”, Occasional Paper Series, No 216, ECB, 2018.

- See the Eurogroup term sheet on the budgetary instrument for convergence and competitiveness.

- A national co-financing rate of 25% means that a quarter of the costs of a particular project are borne by the receiving Member State, while the remaining 75% are financed via the EU budget. The degree of co-financing required to receive EU funds may temporarily be reduced by half in the presence of severe economic circumstances, as defined in the Stability and Growth Pact. Such cyclical modulation can occur in the event of a negative annual GDP volume growth rate or if a country experiences an accumulated loss of output (see Article 2 of Council Regulation (EC) No 1467/97).

- See the Eurogroup report on a possible intergovernmental agreement for the budgetary instrument for convergence and competitiveness.

- See the European Commission’s press release of 6 June 2018.

- See the first volume of the report produced by the High-Level Task Force on Safe Assets for the main findings in this regard.

- See the Bruegel study by Jean Pisani-Ferry and Clemens Fuest that was prepared for the French and German finance ministers.

- See the Commission’s communication on its economic governance review, which was published on 5 February 2020.

- See the article entitled “Government debt reduction strategies in the euro area”, Economic Bulletin, Issue 3, ECB, 2016.

- See the box entitled “The creation of a European Fiscal Board”, Economic Bulletin, Issue 7, ECB, 2015.

- See the Council recommendation of 20 September 2016.

- See the article entitled “Fiscal rules in the euro area and lessons from other monetary unions”, Economic Bulletin, Issue 3, ECB, 2019.

- See Kamps, C. and Leiner-Killinger, N., “Taking stock of the functioning of the EU fiscal rules and options for reform”, Occasional Paper Series, No 231, ECB, 2019; and Kamps, C. and Hauptmeier, S., “Debt rule design in theory and practice – the SGP’s debt benchmark revisited”, Working Paper Series, ECB, forthcoming.

- See the article entitled “The euro area fiscal stance”, Economic Bulletin, Issue 4, ECB, 2016; and Bańkowski, K. and Ferdinandusse, M., “Euro area fiscal stance”, Occasional Paper Series, No 182, ECB, 2017.

- See Pierluigi, B. and Sondermann, D., “Macroeconomic imbalances in the euro area: where do we stand?”, Occasional Paper Series, No 211, ECB, 2018.

- See the box entitled “Country-specific recommendations for economic policies under the 2019 European Semester”, Economic Bulletin, Issue 5, ECB, 2019.

- See Sondermann, D. and Zorell, N., “A macroeconomic vulnerability model for the euro area”, Working Paper Series, No 2306, ECB, 2019, for a discussion of the MIP scoreboard indicators in the context of an early warning approach.

- See the Commission’s tentative schedule as of 3 December 2019.

- See ECB Opinion CON/2018/25 of 11 May 2018 on a proposal for a Council directive laying down provisions for strengthening fiscal responsibility and the medium-term budgetary orientation in the Member States.

- See Andrle, M. et al., “Reforming Fiscal Governance in the European Union”, Staff Discussion Notes, No 15/09, IMF, May 2015.

- See EFB, “Assessment of EU fiscal rules with a focus on the six and two-pack legislation”, August 2019.

- See Kamps, C. and Leiner-Killinger, N., “Taking stock of the functioning of the EU fiscal rules and options for reform”, Occasional Paper Series, No 231, ECB, 2019; and Hauptmeier, S. and Kamps, C., “Debt rule design in theory and practice – the SGP’s debt benchmark revisited”, Working Paper Series, ECB, forthcoming.

- The EFB has, however, noted that Member States do not regard the current practices as sufficiently destabilising to make such a review a high priority.

- See the Commission’s assessment of the implementation of the Services Directive.

- See ECB Opinion CON/2018/25 of 11 May 2018 on a proposal for a Council directive laying down provisions for strengthening fiscal responsibility and the medium-term budgetary orientation in the Member States.

- The euro area’s crisis management framework will be discussed in greater depth in a forthcoming issue of the Economic Bulletin, which will include a more detailed assessment of these ESM reforms.

- See the Five Presidents’ Report.

- See the Commission’s “Reflection Paper on the Deepening of the Economic and Monetary Union”, May 2017.

- See Commissioner-designate Dubravka Šuica's hearing before the European Parliament's Committee on Constitutional Affairs.

- See https://www.politico.eu/wp-content/uploads/2019/11/Conference-on-the-Future-of-Europe.pdf