Euro area monthly balance of payments (October 2015)

- In October 2015 the current account of the euro area recorded a surplus of €20.4 billion. [1]

- In the financial account, combined direct and portfolio investment recorded increases of €98 billion in assets and €51 billion in liabilities.

Current account

The current account of the euro area recorded a surplus of €20.4 billion in October 2015 (see Table 1). This reflected surpluses for goods (€26.8 billion), services (€4.4 billion) and primary income (€3.1 billion), which were partly offset by a deficit in secondary income (€14.0 billion).

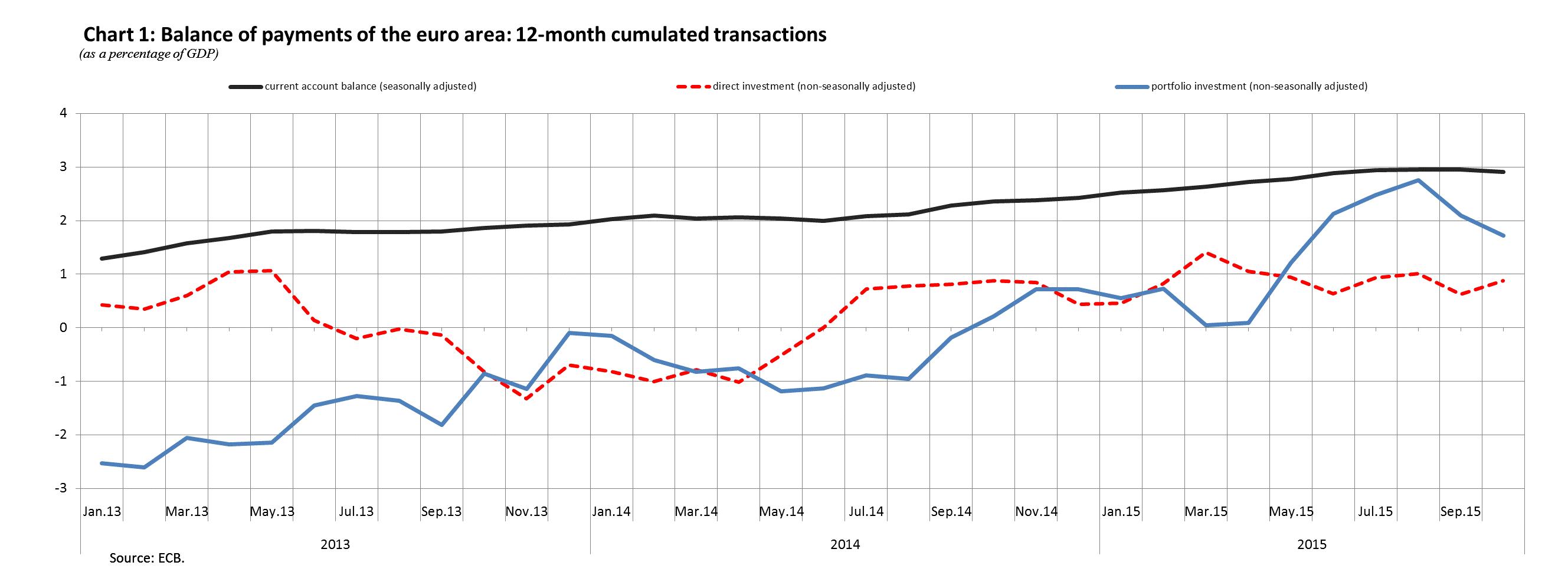

The 12-month cumulated current account for the period ending in October 2015 recorded a surplus of €299.9 billion (2.9% of euro area GDP), compared with a surplus of €237.5 billion (2.4% of euro area GDP) for the 12 months to October 2014 (see Table 1 and Chart 1). The increase in the current account surplus was largely due to an increase in the surplus for goods (from €239.6 billion to €313.6 billion) and, to a lesser extent, an increase in the surplus for primary income (from €57.9 billion to €67.0 billion). These were partly offset by a decrease in the surplus for services (from €75.4 billion to €57.2 billion) and an increase in the deficit for secondary income (from €135.5 billion to €137.9 billion).

Financial account

In October 2015 combined direct and portfolio investment recorded increases of €98 billion in assets and €51 billion in liabilities (see Table 2).

Euro area residents recorded an increase of €43 billion in direct investment assets, which was primarily due to an increase in equity (€39 billion). Direct investment liabilities increased by €22 billion, also on account of an increase in equity (€23 billion).

With reference to portfolio investment assets, euro area residents made net purchases of foreign securities amounting to €56 billion, which was mainly a result of net acquisitions of long-term debt securities (€37 billion) and, to a lesser extent, equity (€13 billion). In a similar vein, with regard to portfolio investment liabilities, non-euro area residents made net purchases of euro area securities amounting to €29 billion, which was mainly a result of net purchases of long-term debt securities (€20 billion) and equity (€17 billion).

The euro area net financial derivatives account (assets minus liabilities) recorded negative net flows of €2 billion.

Other investment recorded increases of €31 billion in assets and €11 billion in liabilities. The increase in assets was mainly driven by increases in the MFIs (excluding the Eurosystem) (€24 billion) and other sectors (€10 billion), which were partly offset by a decrease in the Eurosystem sector (€5 billion). The increase in liabilities can also be explained by an increase in the MFIs (excluding the Eurosystem) (€18 billion), which was partly offset by a decrease in the Eurosystem sector (€9 billion).

The Eurosystem’s stock of reserve assets increased by just over €10 billion in October 2015 (to €655 billion). This can be attributed to net purchases of reserve assets (€6 billion) and positive revaluations of gold prices (€4 billion).

In the 12 months to October 2015 combined direct and portfolio investment recorded cumulated increases of €819 billion in assets and €552 billion in liabilities, compared with increases of €563 billion and €453 billion respectively in the 12 months to October 2014. This resulted from an increase in the direct investment activity of both euro area residents abroad and non-residents in the euro area, with assets increasing from €159 billion to €425 billion and liabilities from €70 billion to €335 billion.

The activity in portfolio investment showed a different pattern. While the net acquisition of foreign securities by euro area residents decreased somewhat (from €405 billion to €394 billion), the level is still high. This can mainly be explained by increases in net purchases of long-term debt securities (from €196 billion to €368 billion). On the liability side , acquisitions of euro area securities by non-residents decreased (from €383 billion to €217 billion), which is reflected in fewer purchases of equity (from €309 billion to €209 billion) and a rise in disinvestments in short-term debt securities (from €11 billion to €71 billion).

According to the monetary presentation of the balance of payments, the net external assets of euro area MFIs decreased by €24 billion in the 12 months to October 2015, compared with an increase of €235 billion in the preceding 12-month period. This development in MFIs’ net external assets continued to primarily reflect a surplus of €287 billion in the current and capital account balance, which has in the last 12 months been offset by, among other things, a decrease in net purchases by non-residents of debt securities issued by euro area non-MFI residents (from €63 billion to €42 billion).

Data revisions

This press release incorporates revisions for July, August and September 2015. These revisions have not significantly altered the figures previously published.

Additional information

Time series data: ECB’s Statistical Data Warehouse (SDW)

Methodological information: ECB’s website

Monetary presentation of the balance of payments Next press releases:- Monthly balance of payments: 19 January 2016 (reference data up to November 2015);

- Quarterly balance of payments and international investment position: 13 January 2016 (reference data up to the third quarter of 2015).

Annexes

Table 1: Current account of the euro area

Table 2: Balance of payments of the euro area

For media queries, please contact Rocío González, tel.: +49 69 1344 6451.

[1]References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are neither seasonally nor working day-adjusted.

Európai Központi Bank

Kommunikációs Főigazgatóság

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Németország

- +49 69 1344 7455

- media@ecb.europa.eu

A sokszorosítás a forrás megnevezésével engedélyezett.

Médiakapcsolatok