Central banks in a shifting world: selected takeaways from the ECB’s online Sintra Forum

12 May 2021

The 2020 ECB Forum on Central Banking addressed some key issues from the ongoing monetary policy strategy review and embedded them in discussions of major structural changes in advanced economies and the post-COVID recovery. In this column, two of the organisers highlight some of the main points from the papers and debates, including whether globalisation is reversing, implications of climate change, options for formulating the ECB's inflation aim, challenges with informal monetary policy communication, relationships between financial stability and monetary policy, how to make a monetary policy framework robust to deflation or inflation traps and the role of fiscal policy for the recovery from the pandemic.

1 Introduction

The 2020 ECB Forum was one of the “ECB listens” events through which the ECB collects the views of relevant outside parties on its monetary policy framework. Policymakers, academics and market economists debated the implications of selected key structural changes that have a bearing for how monetary policy works in the euro area, combined with discussions on core topics featuring in the strategy review. We group some of the main issues debated in five sections below. All papers, discussions and speeches can be found in the conference e-book (ECB 2021). Video recordings of all sessions are available on the ECB website.

2 Fundamental structural changes in the world economy: “Slowbalisation” and climate change

One of the key structural changes in the world economy over the last decades was globalisation. But since the Great Financial Crisis and with the rise of populism the issue has emerged as to whether this process is reversing to de-globalisation. Pol Antras (in Antras 2021) argues that international trade and supply chains have slowed but not reversed ("slowbalisation") and may be regarded as not likely to turn to de-globalisation. The backward-looking part is illustrated in Chart 1, which shows that after a period of very fast "hyperglobalisation" between the mid-eighties and 2008, the share of world trade in world GDP has stayed roughly constant.

Chart 1

World trade relative to world GDP (1970-2018)

Source: Antras (2021), based on World Bank’s World Development Indicators (link).

Note: Trade is defined as the sum of exports and imports of goods and services.

Looking forward, Antras argues that two out of three main factors that explained "hyperglobalisation" are unlikely to reverse. First, new technologies will continue to foster trade, because those substituting (foreign) labour (such as robotisation or 3D printing) still generate increased demand for traded goods (such as machines or IT parts). Second, the high sunk costs of establishing global supply chains make them resilient to temporary shocks and re-shoring only attractive for very persistent shocks. The only hyperglobalisation factor risking to reverse is multilateral trade liberalisation. To the extent that agents perceive the COVID-19 pandemic as temporary, it is unlikely to become a persistent de-globalisation force.

Susan Lund (in Lund 2021) added that China rotating from exports to domestic consumption and building domestic supply chains can account for most of the global trade slowdown over the last decade. As both reflect economic development, it may be regarded as a positive story, one also other emerging economies may go through in the future.

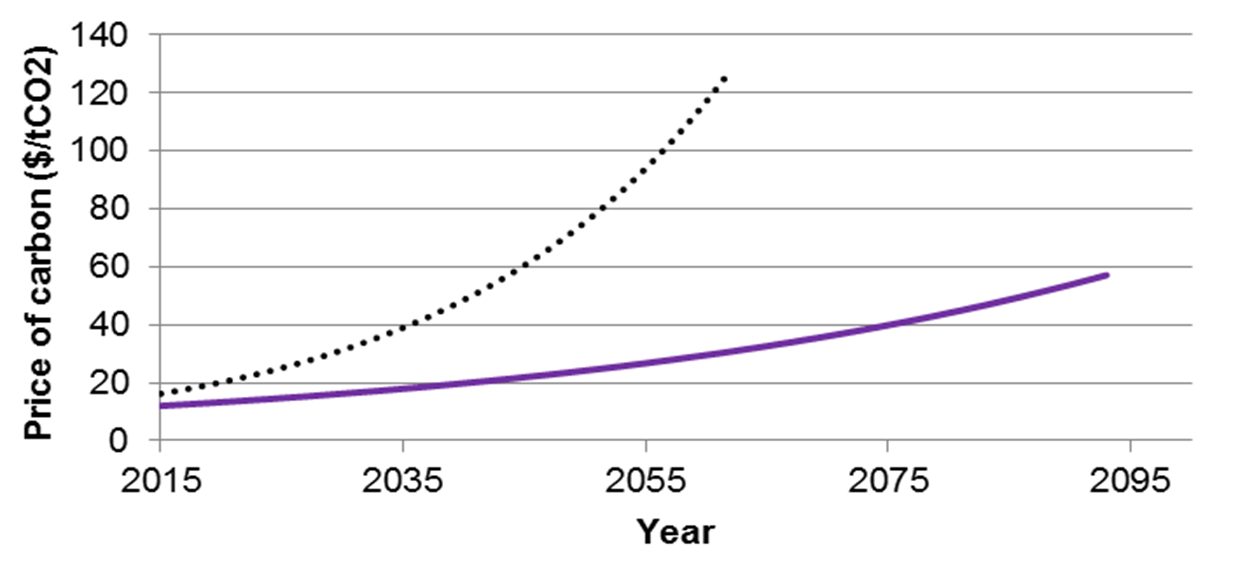

Climate change is likely to set in motion another set of major structural changes in the world economy. But Frederick van der Ploeg (in van der Ploeg 2021) strongly warns of the great risk that policy responses will be too timid and too late, implying an unsmooth carbon transition with stranded assets and financial instability. A sudden shift in climate policy or a technological breakthrough can lead to sudden changes in the market valuation of firms (so-called tipping events). Chart 2 (taken from van der Ploeg 2018) illustrates that the route of a cap to global warming taken by the Intergovernmental Panel on Climate Change (dotted line) would increase the carbon price (and therefore reduce carbon emissions and increase renewables) much faster than economists' preferred approach of pricing carbon at its estimated social costs (solid line). The reason is that economists' "Pigouvian" approach does not take peak temperature constraints into account, and thus prices do not have to rise so fiercely under it.

Chart 2

Evolution of the carbon price implied by the Pigouvian versus the carbon budget approach to climate policy

Source: van der Ploeg (2018) and van der Ploeg (2021)

Note: The solid line represents the necessary evolution of the calibrated optimal carbon price, as derived from a simplified Dynamic Integrated Climate-Economy (DICE, see e.g. Nordhaus 1993) model that sets the optimal price equal to the social cost of carbon ("Pigouvian approach"). The social cost is defined as the present discounted value of all future production losses stemming from emitting one ton of carbon today. The dotted line not only takes into account the social cost of carbon but also the need to keep peak global warming below 2 ℃ (relative to global temperature in the pre-industrial era; "carbon budget approach"). This is in line with the route taken by the IPCC.

Van der Ploeg (2021) calls for climate policies being delegated to a politically independent emissions authority ("carbon central bank"), the carbon price starting relatively high and then growing moderately but steadily (avoiding paradoxical emission increases due to the anticipation of future policy tightening), using revenues to compensate low-income households and to support firms at risk from carbon-intensive imports as well as keeping financial stability risks under control with climate stress tests. Francois Villeroy de Galhau suggested that central banks look at whether climate risks are adequately reflected in their collateral frameworks. Krogstrup (2021) concluded that fiscal policy should be first in line for a cost-efficient carbon transition, but central banks will address their stake in it.

3 Formulations of central banks' inflation aim close to the effective lower bound of nominal interest rates

One of the key challenges for monetary policy in our times is the sustained downward trend in natural interest rates that can be estimated for the past decades (Laubach and Williams 2003, Brand et al. 2018). The low estimates of natural rates imply that central banks' conventional interest rate policy may not be able to provide sufficient stimulus in the presence of negative shocks, as policy rates cannot be reduced low enough below the natural rate.

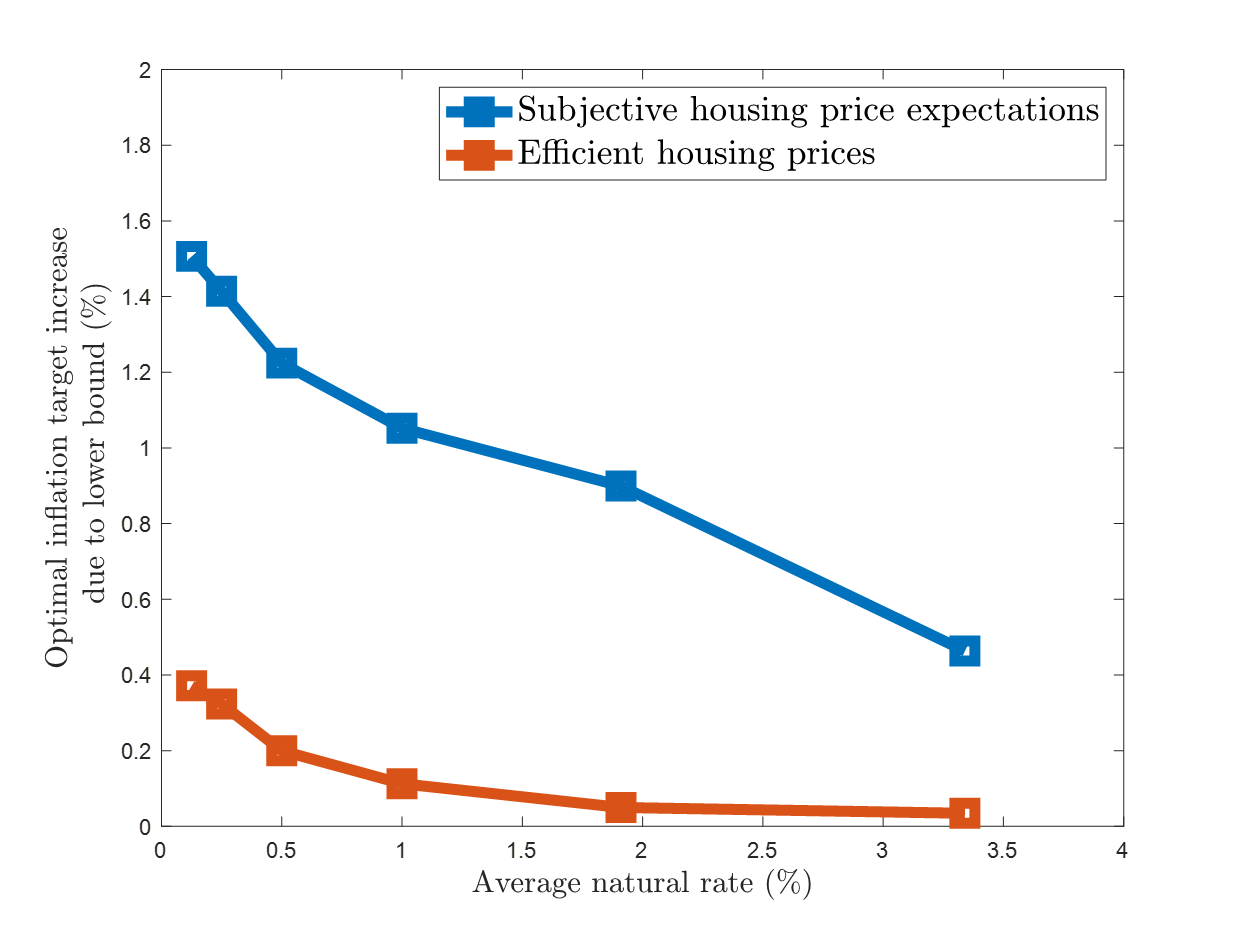

Klaus Adam (in Adam 2021) argued that an increase in the inflation target could be a solution, because - if the increase is credible - the inflation expectations that it would induce would stimulate the economy through lower real interest rates. His research suggests that the declining natural rate also influences asset price volatility and that therefore the efficiency of financial markets has a bearing on the extent to which the target should be increased and whether monetary policy should react to longer run asset price fluctuations. More precisely, the New-Keynesian model developed in Adam et al. (2020) suggests that, with rational expectations in financial markets, the optimal increase in the target to compensate for the constrained policy rate is relatively small (red line in Chart 2). The inflation target needs to be increased by much more when subjective price expectations create procyclical asset price fluctuations (blue line in Chart 2), as the effective lower bound (ELB) of monetary policy rates is hit more often.

Chart 3

Relationships between the optimal inflation target, the natural rate of interest and expectation formation in housing markets due to the effective lower bound on nominal rates

Source: Adam (2021)

Note: This chart illustrates the optimal inflation target, i.e., the average inflation outcome under optimal conduct of monetary policy. For each considered level of the average natural rate (on the x-axis), the chart reports the optimal inflation target (on the y-axis) in an economy with an effective lower bound constraint, relative to the target that would be optimal in the absence of a lower-bound constraint. The blue line shows the optimal inflation target in an economy where house prices are efficient (i.e. driven by fundamentals only). The red line reports the optimal inflation target for the case where housing prices are driven – at least partly – by fluctuations in subjective housing price expectations. Numbers are based on a New Keynesian sticky price model from Adam, Pfaeuti and Reinelt (2020), calibrated to US data. In the absence of a lower bound constraint, the optimal inflation target is zero, because the model abstracts from other forces that make targeting positive average rates of inflation optimal.

Interestingly, in this model the central bank finds "leaning" against inefficient asset price fluctuations optimal, undershooting the inflation target in upturns and overshooting it in downturns. The reason is that inefficiently high asset price volatility has too high a welfare cost in terms of capital misallocation towards appreciating assets.

Argia Sbordone (in Sbordone 2021) argued that, in Adam's model, the increased incidence of the lower bound constraint does not imply that optimal policy raises the long-term inflation target. Instead, it increases the time for which the central bank should temporarily target higher future inflation than its stated long-term inflation target. This de facto would be similar to average inflation targeting (AIT), the policy announced by the US Federal Reserve in 2020. In Sbordone's view such a policy is preferable, because it faces a lower risk of permanently higher inflation when ELB incidences turn out to be infrequent. Alan Blinder made the point, however, that the vague formulation by the Fed risked undermining the basic idea of AIT.

Jordi Galí (in Galí 2021, Chart 1) showed a similar negative relationship as Adam between the natural rate and the central bank's optimal inflation target, based on a New-Keynesian model calibrated to euro area data (Andrade et al. 2021). It suggests that while a target between 1.5 and 2 per cent would be optimal for a higher real interest rate, for the lower levels estimated nowadays the target could easily increase to around 3 per cent. However, for increasingly aggressive monetary policy rules embodying an AIT with long enough averaging window, the optimal target could be reduced to close to 2 per cent. Aggressive countercyclical fiscal policy rules would have a similar effect in the model. Galí concluded that rather than deciding in favour of one of the three options, policy makers may want to pursue all the three at the same time.

Volker Wieland (in Wieland 2021) regarded it as problematic to raise the ECB's inflation aim at a time when inflation is very low, as the distance between the two is very large in such a situation and further policy easing may be difficult to achieve. Hence, the desired inflation expectations effect may not materialise and the central bank’s credibility be eroded. Vítor Constâncio and Ignazio Visco argued the other way around, worrying that too little ambition could contribute to de-anchoring inflation expectations making convergence to the desirable levels of inflation more difficult.

Moreover, as Wieland saw a significant part of low inflation in the euro area being caused by import prices and the headline HICP inflation index does not cover faster rising owner-occupied housing prices, he recommended that the ECB uses a wider range of inflation measures. Based on a model in Wieland (2020), he also wondered whether uncertainty about the effectiveness of quantitative easing and some unintended side effects would not justify a slower rather than faster convergence towards the inflation aim.

4 Undesirable informal monetary policy communication

Annette Vissing-Jorgensen opened the topic of monetary policy communication (Vissing-Jorgensen 2021). One of her main points was that unattributed individual communication, such as "sources stories" in the media driven by disagreements among policy makers, are subject to a prisoner's dilemma-type problem and unambiguously detrimental. She illustrated this point with a game-theoretic model of individual policy makers trying to "spin" market expectations towards their preferred choices (Vissing-Jorgensen 2020). While asset prices may not be distorted on average, as victories and defeats cancel out over time, the policy space of the decision-making body will still be constrained, as central banks have to mind about too material deviations between market expectations and ultimate decisions. Vissing-Jorgensen recommended consensus-building in monetary policy committees, as it would naturally reduce incentives for engaging in such individual informal communications.

5 Monetary policy, the allocation of risk and central bank independence

Lucrezia Reichlin (in Reichlin 2021) spelled out a conceptual framework for the relationships between monetary policy, risk and financial stability in the new world of unconventional instruments. She stressed the multi-dimensional nature of unconventional monetary policy "packages", which control the entire yield curve and create complex interactions between macroeconomic and financial risks.

These policies can only be effective in supporting the macroeconomy, if they induce the creation of new assets climbing up the risk spectrum. If the new assets finance productive activities, then the additional risks are "good". But prudential policy would need to prevent the creation of "bad" risks. Delayed, partial or incoherent use of the range of instruments would undermine effectiveness; and so would be neglecting interactions and coordination with fiscal policy.

Hyun Shin (in Shin 2021) complemented this with emphasising the importance of "elastic nodes" in the financial system, which need to help accommodate the much-increased demand for money in situations of stress. The first line of defence should be well-capitalised and resilient commercial banks; an example being how US banks allowed companies to draw on their credit lines during the "dash for cash" in March 2020 (at the start of the COVID crisis). In fact, several Forum speakers - such as Jerome Powell and Bank of England Governor Andrew Bailey - confirmed that banks generally stood up to this first major test of the reforms introduced after the Great Financial Crisis.

Markus Brunnermeier (in Brunnermeier 2021) broadened the discussion with a proposal about how a monetary policy strategy can be robustified against the risk of a central bank getting trapped in high inflation or deflation. In the post-COVID recovery an "inflation whipsaw" could emerge, in that pent-up demand, government commitments or capital re-allocation could create a reversal from low to high inflation (Brunnermeier et al. 2020). In other words, it is necessary that the central bank can "put on the breaks" later, in order to be able to confidently stimulate the economy with force in the low inflation context.

But if during the downturn government debt becomes too high, a situation of fiscal dominance could occur, as the central bank could not raise interest rates in the upturn without destabilising the budgets. Similarly, if the banking sector was not to maintain its resilience and if the government was unwilling or unable to recapitalise the banks, the central bank may be forced to stabilise them with monetary policy redistributing risk - a situation of financial dominance. Brunnermeier suggested that the relevant tail risks would be considered in a re-oriented second pillar in the ECB's monetary policy strategy. This would institutionalise heterogeneous thinking and go against relying on a uniform class of economic models.

6 The role of fiscal policy in the post-COVID recovery

Evi Pappa (in Pappa 2021) made a strong plea for discretionary fiscal policy taking a prominent role in the recovery from the COVID pandemic. The theoretical case relies on higher fiscal multipliers in a situation in which conventional monetary policy is close to the ELB, as the central bank would not tighten in response to inflation expectations ensuing from the fiscal stimulus. In line with this, Christine Lagarde argued in her introductory speech to the Forum (Lagarde 2021) that monetary policy should minimise any crowding out effects on private investment that may emerge from rising market interest rates that the fiscal expansion could induce.

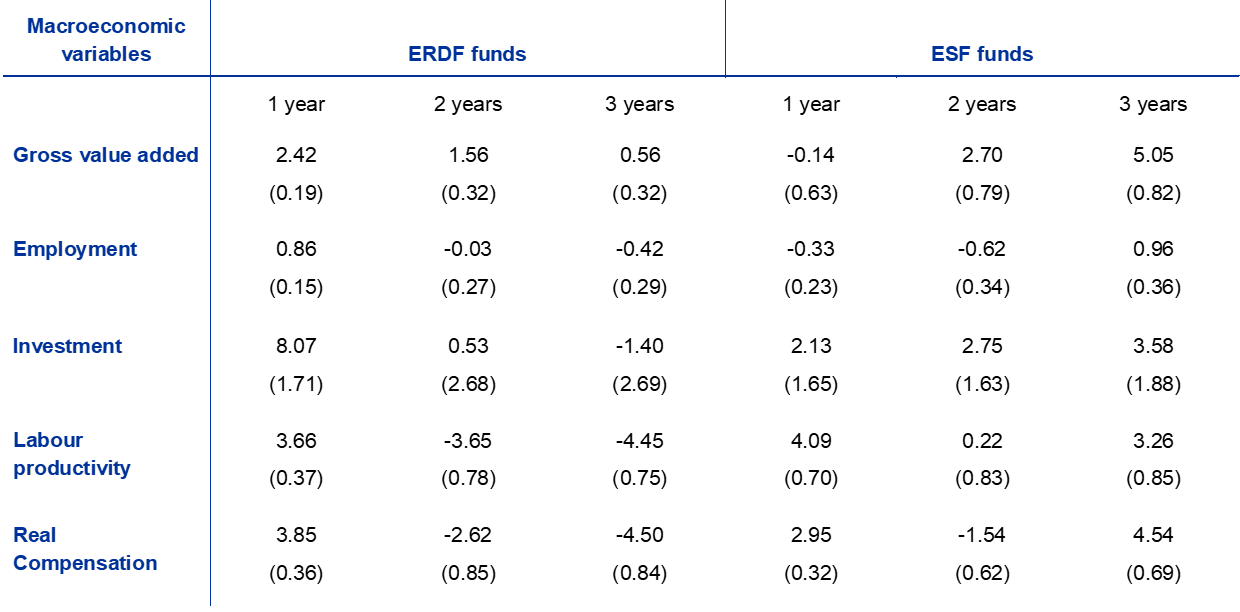

Based on the experiences with European Union structural funds for member states and regions over the last 30 years, Pappa particularly supported public investment spending funded by the Next Generation EU recovery programme. Her estimations in Table 1 (Canova and Pappa 2020) suggest that grants provided by the European Regional Development Fund have sizeable short-term effects. Measurable effects of grants by the European Social Fund take more time to materialise. At the same time, Pappa cautioned that the literature suggests that the size of fiscal multipliers can depend on many factors.

Table 1

Average cumulative multipliers from grants under the European Regional Development Fund (ERDF) and the European Social Fund (ESF)

Source: Canova and Pappa (2020)

Notes: This table examines the dynamic effects of ERDF and ESF grants on regional (NUTS3-level) macroeconomic variables in European Union countries, using local projections. The main regression specification is as follows:

,where

is the cumulative growth of the macroeconomic variable of interest in region i and year t over the time-horizon h (either 1,2 or 3 years, see columns) and

is the cumulative change in the relevant grant (scaled by regional gross-value added). The estimated coefficients displayed in the table correspond to

and standard errors are in parentheses. The coefficients can therefore be interpreted as the cumulative fiscal multipliers of the fund grants (euro change per euro of grants), or put differently as elasticities measured in per cent, at each horizon h. Given the potential endogeneity of structural funds to EU economic conditions, the authors instrument actual grants with their "innovations". To this effect they run the following auxiliary regression:

, where

represents a set of four aggregate euro area variables: GDP, employment, the GDP deflator, the nominal interest rate, and the nominal effective exchange rate. They then use the "innovation"

as an instrument for

in the main equation.

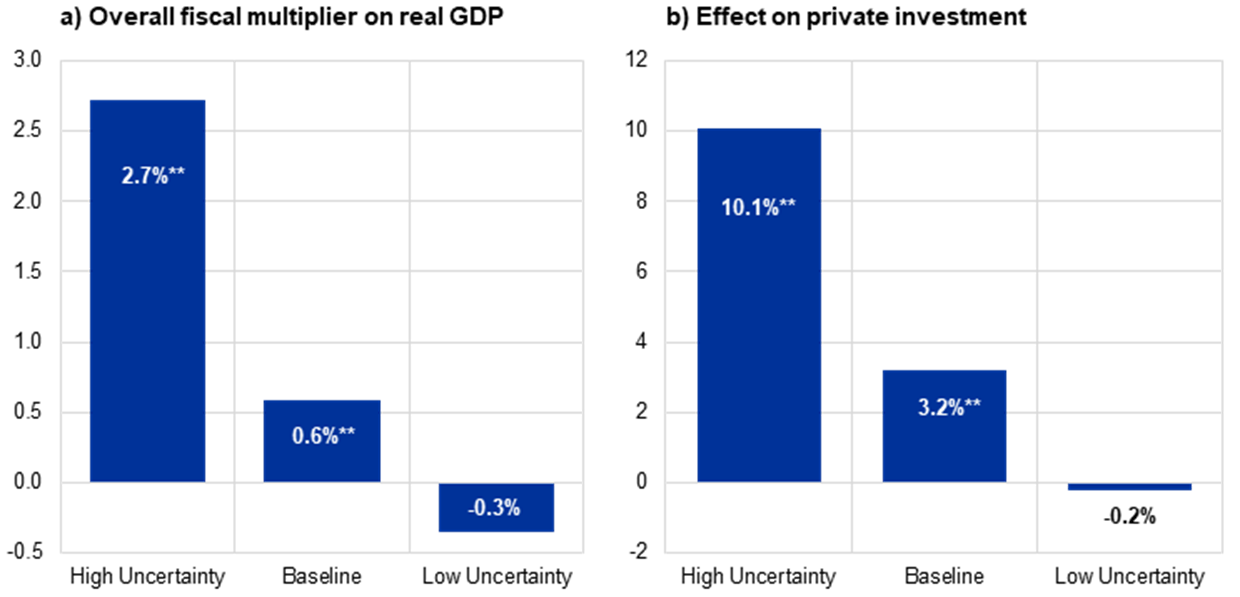

Vítor Gaspar (in Gaspar 2021) added that while national fiscal support packages increased euro area public debt by about 17 percentage points during 2020 to above 100 per cent of GDP, the primary risk at the time of the Forum was the premature withdrawal of fiscal support. Moreover, he joined Evi Pappa in supporting public investment, emphasising the International Monetary Fund's assessment that fiscal multipliers are particularly elevated in periods of high uncertainty (see Chart 4, based on IMF 2020), such as the case during the COVID pandemic (e.g. Barrero and Bloom 2020). According to Gaspar, this happens because public support to investment in green and digital technologies would facilitate and give confidence to private firms to invest, in part because public investments signal governments' commitment to sustainable growth.

Chart 4

Public investment multipliers and private investment "crowd-in" for different levels of economic uncertainty

Cumulative two-year-ahead macroeconomic effects of a one-percent-of-GDP unexpected increase of public investment

Source: Gaspar (2021) and IMF Fiscal Monitor (October 2020)

Note: Effects on the vertical axes are measured in percentage changes over two years. Results are based on local projection estimations using the model

, where

is the log of the macroeconomic variable of interest (real GDP for panel a) and private investment for panel b) for country i in year t,

is a positive unexpected shock to public investment spending (as share of GDP), in deviation from IMF forecasts, z is an indicator of the degree of uncertainty, and

is the corresponding smooth transition function between different levels of uncertainty.

includes lagged GDP growth and lagged shocks. Uncertainty is measured by the standard deviation of GDP growth rate forecasts across professional forecasters as published by Consensus Economics, using for each year the spring vintage of the forecasts. Data covers 72 advanced and emerging markets; the sample period is 1994-2019.

Lagarde (2021) contributed that in a pandemic emergency, when interest rates are already very low, private demand is constrained by health containment measures and levels of economic uncertainty are very high, fiscal policy can be particularly effective for at least two more reasons. First, it can support the sectors most affected in a more targeted way than monetary policy (Woodford 2020). Second, as fiscal policy determines about half of total spending in the euro area, it can help coordinate the other half, breaking "paradox of thrift" dynamics in the private sector and thereby also reinvigorating the transmission of monetary policy. All in all, the right policy mix requires that fiscal policy remains at the centre of the stabilisation effort.

Authors’ note: All views expressed are summarised to the best of our understanding from the various participants’ Forum contributions and should not be interpreted as the views of the ECB or the Eurosystem.

References

Adam, K. (2021), “Monetary policy changes from falling natural interest rates”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Adam, K., Pfaeuti, O. and Reinelt, Z. (2020), “Falling natural rates, rising housing volatility and the optimal inflation target”, Collaborative Research Center Transregio 224 Discussion Paper, No. 235, November.

Andrade, P., Galí, J., Le Bihan, H., and Matheron, J. (2021), "Should the ECB Revise its Strategy in the Face of a Lower r*," mimeo, Pompeu Fabra University, January.

Antras, P. (2021), “De-globalisation? Global value chains in the post-Covid-19 era”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Attig, D., Baker, S., Barrero, J. M., Bloom, N., Bunn, P., Chen, S., Davis, S. J., Leather, J., Meyer, B., Mihaylov, E., Mizen, P., Parker, N., Renault, T., Smietanka, P., Thwaites, G. (2020), “Economic uncertainty before and during the COVID-19 pandemic,” Journal of Public Economics, Vol. 191, 104274.

Barrero, J. and Bloom, N. (2020), “Economic uncertainty and the recovery,” in Navigating the Decade Ahead: Implications for Monetary Policy, Federal Reserve Bank of Kansas City, Economic Policy Symposium Proceedings, pp. 255-284.

Brand, C., Bielecki, M., and Penalver, A. (2018), “The natural rate of interest: estimates, drivers, and challenges to monetary policy”, ECB Occasional Paper Series, No 217, December.

Brunnermeier, M. (2021), “De- and inflationary traps: strengthening ECB’s second pillar to avoid fiscal and financial dominance”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Brunnermeier, M., Merkel, S., Payne, J., and Sannikov, Y. (2020), COVID-19: inflation and deflation pressures, mimeo., Princeton University, September.

Canova, F., and Pappa, E. (2021), “What are the likely macroeconomic effects of the EU Recovery plan?”, mimeo., Pompeu Fabra University, February.

ECB (2021), “Central Banks in a Shifting World”, ECB, Frankfurt am Main.

Gali, J. (2021), “The decline in r* and the ECB strategy”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Gaspar, V. (2021), “Discussion of Evi Pappa’s “Fiscal rules, policy and macroeconomic stabilization in the euro area””, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

IMF (2020), Fiscal monitor: policies for the recovery, International Monetary Fund, Washington. https://www.imf.org/en/publications/fm/issues/2020/09/30/october-2020-fiscal-monitor.

Krogstrup, S. (2021), “Discussion of “Macro-financial implications of climate change and the carbon transmission” by Frederick van der Ploeg”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Lagarde, C. (2021), "Monetary policy in a pandemic emergency", in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Laubach, T., and Williams, J. C. (2003). Measuring the natural rate of interest. Review of Economics and Statistics, 85(4), pp. 1063-1070.

Lund, S. (2021), “De-globalisation? The recent slowdown of global trade and prospects for future rebalancing”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Nordhaus, W. D. (1993), "Optimal greenhouse-gas reductions and tax policy in the 'DICE' model", American Economic Review, Vol. 83, pp. 313-317.

Pappa, E., (2021), “Fiscal rules, policy and macroeconomic stabilization in the euro area”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Reichlin, L. (2021), “Non-standard monetary policy instruments: effectiveness and risks”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Sbordone, A. (2021), “Discussion of “Monetary Policy Challenges from Falling Natural Interest Rates” by Klaus Adam”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Shin, H.S. (2021), “Central bank balance sheets and financial stability”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

van der Ploeg, F. (2018), “The safe carbon budget”, Climate Change, Vol. 147, pp. 47-59.

van der Ploeg, F. (2021), “Macro-financial implications of climate change and the carbon transmission”, in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Vissing-Jorgensen, A. (2020), " Central banking with many voices: the communications arms race", mimeo., University of California at Berkeley, 2 February.

Vissing-Jorgensen, A. (2021), "Informal central bank communication", in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Wieland, V. (2020), “Quantitative easing: The proportionality principle and Brainard-style policy attenuation”, unpublished manuscript, University of Frankfurt.

Wieland, V. (2021), “The decline in euro area inflation and the choice of policy strategy", in Central Banks in a Shifting World, ECB, Frankfurt am Main.

Woodford, M. (2020), “Effective Demand Failures and the Limits of Monetary Stabilization Policy”, NBER Working Paper Series, No 27768, National Bureau of Economic Research, September.