Unconventional monetary policy operations – to what extent is there an upside for central bank balance sheet risks?

This article studies this question by revisiting the Eurosystem's experience during the euro area sovereign debt crisis between 2010 and 2012. In some instances, the Eurosystem was able to remove excess risk from parts of its balance sheet by extending the scale of its operations, in line with Bagehot's well-known assertion that occasionally "the brave plan is the safe plan."

A bank’s balance sheet lists the bank’s assets, liabilities and shareholder equity. Each of those items is subject to risk, especially during a so-called liquidity crisis – roughly speaking, a situation in which banks lack the cash to meet their short-term obligations. But to what extent are a central bank’s balance sheet risks influenced by its own actions?

Risk and profitability are not first-order measures of success for a central bank. When taking monetary policy decisions, the financial consequences for the central bank's bottom line are usually not a primary concern. If a central bank endures sustained losses, however, its independence may be, or be perceived to be, impinged. This in turn may have adverse consequences for its ability to achieve its goals.

In addition, a central bank is not a risk taker in the same way that commercial banks are. Commercial banks are unlikely to have material influence over their financial risks beyond judiciously choosing exposures. This is less true for central banks as risk perceptions can respond to both a central bank's large-scale actions as well as its communications. A central bank’s credit risks are partially endogenous in this sense, particularly during a liquidity crisis.

For at least 150 years, going back to Thornton (1802) and Bagehot (1873), central bankers have wondered to what extent they can actively influence rather than only passively accept their own balance sheet risks. In the context of a pure liquidity crisis without solvency concerns, for example, the simple announcement by a central bank that it will act as a generalised lender-of-last-resort (LOLR) to the entire financial system in line with certain principles[2] could shift the economy from a “bad” to a “good” equilibrium. This could cause all illiquidity-related credit risks to quickly disappear at virtually no cost or additional central bank balance sheet risk. In a similar vein, the central bank could announce that it will act as an investor-of-last-resort (IOLR) by purchasing stressed assets in illiquid markets. Doing so could likewise shift expectations and eliminate risks associated with “bad” fire-sale equilibria.

Whether such possibilities are based on wishful "Münchhausen thinking[3]" or are instead proven to work is currently unclear. Empirical studies of central banks' financial risks are rare, primarily because the required data are almost always confidential. As a result, the response of central bank credit risks to large-scale policy interventions has not received much academic scrutiny. However, since the global financial and euro area sovereign debt crisis the credit risk component of central banks' balance sheets has received particular and increasing attention from the public and the financial press[4].

We can point to recent real-world events to shed some light on the issue. During the euro area sovereign debt crisis, severe liquidity squeezes and market malfunctions forced the Eurosystem – the European Central Bank and at the time 17 national central banks – to act as an LOLR to the entire financial system.

Large-scale central bank lending available to all banks helped avert a collapse of vital parts of the financial system and, at the same time, allowed monetary policy to have the intended effects. Large-scale liquidity provision occurred via main refinancing operations (MROs), multiple long-term refinancing operations (LTROs), as well as two very-long-term refinancing operations (VLTROs). All three types of operations were backed by repeated expansions of the set of eligible collateral.

In addition, the Eurosystem acted as an IOLR in stressed markets. For example, it purchased government bonds in at the time illiquid secondary markets within its Securities Markets Programme (SMP) between 2010 and 2012, and committed to doing so again under certain circumstances within its Outright Monetary Transactions (OMT) programme as announced in August 2012.

These actions had first-order impacts on the size, composition and credit risk of the Eurosystem’s balance sheet. At the time, its policies raised concerns about the materialisation of this credit risk and its effects on the ECB’s credibility, independence, and ultimately its ability to steer inflation towards its target of close to, but below, 2% over the medium term. Against this background, we wrote a working paper in 2019 asking a central question: can increased central bank liquidity provision or additional asset purchases during a liquidity crisis reduce credit risk in other parts of the central bank’s balance sheet? This could happen if, for example, more collateralised lending helped reduce the risk of other lending operations or asset portfolios. Do we have evidence of any such spillovers within the central bank’s balance sheet? If so, how important were they? How economically important were such risk spillovers across monetary policy portfolios?

Expected shortfall from Eurosystem operations

We measure credit risk with two metrics which are traditionally used in the risk literature: Expected Losses (EL) and Expected Shortfall (at the 99% confidence level – ES99%). In our modelling framework, EL refers to the average losses that the Eurosystem can expect to have at any point in time over the respective upcoming year due to defaults in its financial positions. By contrast ES99% is a measure of “tail risk”, and it refers to the losses that the Eurosystem could expect to have in the worst 1% of scenarios over the same one-year horizon at any point in time. Both measures are estimated assuming a static balance sheet.[5]

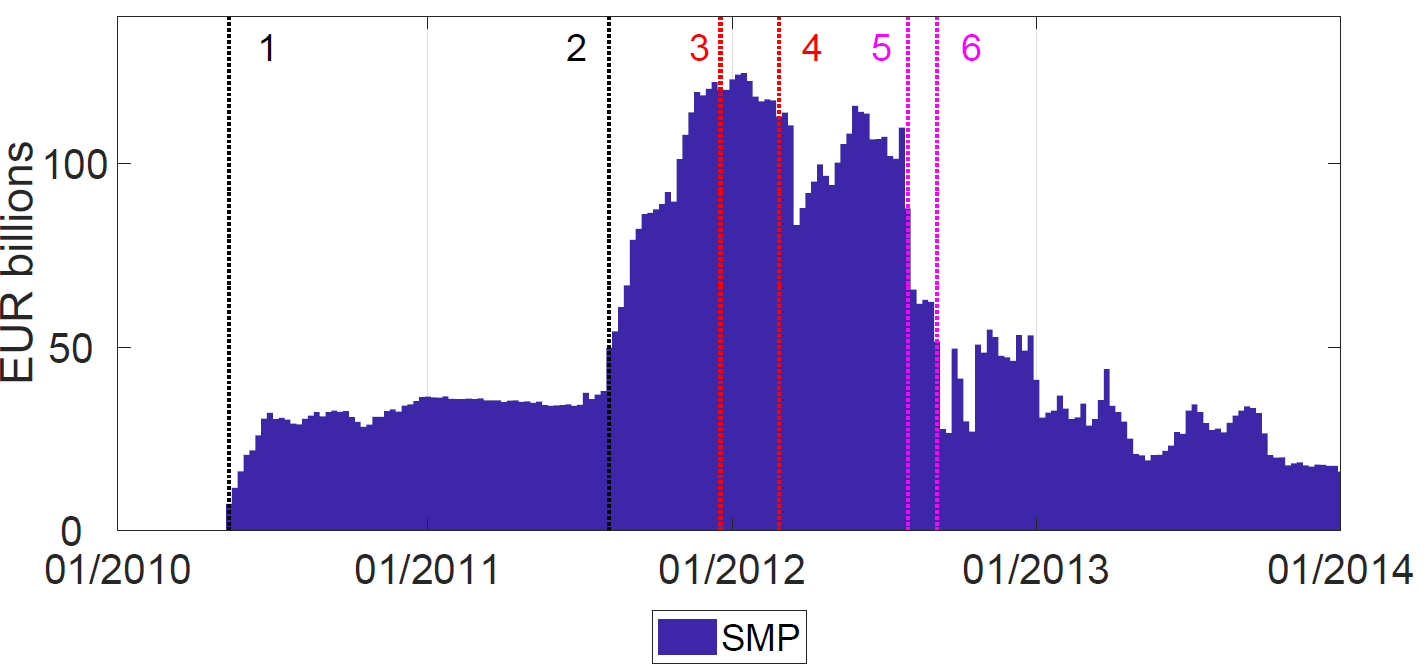

Figure 1

ES99% for all collateralised lending portfolios (LOLR, top) and the SMP portfolio (IOLR, bottom)

Figure 1 plots the ES99% associated with all Eurosystem collateralised lending operations (top panel) and to SMP asset holdings (bottom panel) at a weekly frequency. There are three takeaways from the figure. First, the credit risks associated with collateralised lending portfolios are substantially lower than those associated with outright asset holdings. Second, both risks increased significantly around 2012, at the height of the euro area sovereign debt crisis. Third, together with additional analysis conducted in Caballero et al (2019), the figure suggests that LOLR and IOLR-implied credit risks tend to be negatively related around key policy announcement dates. This last finding suggests that the central bank's increased exposure to risk in its balance sheet (e.g. the announcement and implementation of SMP asset purchases) tended to reduce risks associated with other positions (e.g. the collateralised lending exposures from MROs and previous LTROs). The allotment of each of the two large-scale VLTRO credit operations, for instance, decreased the expected shortfall of the SMP asset portfolio. As a result of such beneficial risk spillovers, central banks' overall risks can be non-linear in exposures, meaning that – in bad times– additional lending or asset exposures can increase overall risk less than proportionally. Conversely, reducing balance sheet exposures after a crisis may not reduce total risk in direct proportion to total balance sheet size.

Risk responses following an expansion of operations

In a more formal vein, our 2019 working paper documents that some unconventional policy operations in fact reduced – rather than increased – risk in other parts of the Eurosystem's balance sheet. For example, the initial OMT announcement reduced the risk associated with SMP assets and all collateralised lending portfolios by approximately EUR 41 billion (in terms of ES99%). The announcement of the technical details of the OMTs on 6 September 2012, moreover, was associated with a further reduction in ES99% of approximately EUR 18 billion. This was achieved without a euro being spent on the programme to date.

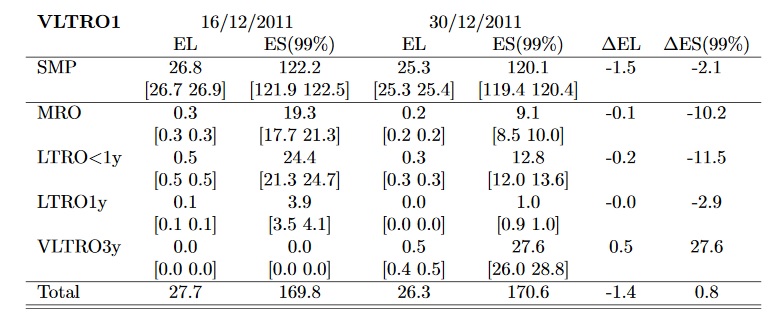

Table 1

Portfolio credit risks before and after the first VLTRO allotment

(EL and ES in EUR billions)

Sources and notes: Exposures are retrieved from the Eurosystem's balance sheet and measured at a weekly frequency between 2009 and 2015. Point-in-time risk measures are obtained from Moody's Analytics (for banks) or are calculated from credit default swaps (CDS) for sovereigns. All risk model parameters are estimated by the method of maximum likelihood. The expected loss and expected shortfall estimates are obtained through Monte Carlo simulation. Intervals in square brackets denote 99% simulation intervals. The LGD assumptions are discussed in Caballero et al (2019). This credit risk model is particularly tailored to a risk assessment at a high frequency and does not coincide with ECB or Eurosystem internal risk models.

The results reported in Table 1 provide another example. The allotment of the first VLTRO on 21 December 2011 raised the ES99% associated with VLTRO lending from zero to approximately EUR 27.6 billion. However, the allotment also sharply reduced the need for shorter-term central bank funding (MRO, LTROs) and reduced point-in-time risk measures for both banks and sovereigns. It also lowered the risk of the SMP asset portfolio as banks funnelled some of the additional central bank liquidity into government bonds, mitigating sovereigns' funding stress. The overall ES99% increased, but only marginally so, by EUR 0.8 billion. The total expected loss actually decreased, by EUR 1.4 billion.

Concluding remarks

The examples of the OMT announcement and first VLTRO allotment suggest that, in exceptional circumstances, a central bank can remove illiquidity-related credit risk from parts of its balance sheet by extending the scale of its operations. As the nineteenth-century British journalist Walter Bagehot wrote in his classic Lombard Street, "only the brave plan is [sometimes] the safe plan."

A reduction in risk is by no means guaranteed, however. A central bank's risk response can in principle go either way. In all likelihood, this response is strongly affected by market perceptions about the sustainability of and the central bank's commitment to its unconventional policies, and therefore its communication with the public. Moreover, one limitation of our study is that it focuses only on balance sheet risks: this means risks that are not reflected in the central bank’s balance sheet, such as contingent liabilities, are not captured in the study.

From a policy perspective, one message of our findings is that risk spillovers across monetary policy portfolios may call for small, gradual steps in reducing balance sheet size after a financial crisis.

References

Bagehot, W. (1873), "Lombard Street: A description of the money market", Henry S. King & Co., London.

Caballero, D., Lucas, A., Schwaab, B., Zhang, X. (2019), “Risk endogeneity at the lender/investor-of-last-resort”, ECB Working Paper No 2225.

Thornton, H. (1802), "An enquiry into the nature and effects of paper credit of Great Britain", Hatchard Pub., London.

- This article was written by Diego Caballero (Economist, Directorate General Risk Management, Risk Analysis Division) and Bernd Schwaab (Senior Economist, Directorate General Research, Financial Research Division). It is based on a paper entitled “Risk endogeneity at the lender/investor-of-last-resort”. The authors thank Paul Dudenhefer, Simone Manganelli, Alberto Martin, Zoë Sprokel, and Alexandru Penciu for their comments. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

- We have in mind here the principles inspired by Walter Bagehot (1873), who famously argued that the lender-of-last-resort should lend freely to solvent banks, against good collateral valued at pre-crisis levels, and at a penalty rate.

- This fictional German nobleman remarkably pulled himself, along with his horse, out of a morass by his own hair.

- This focus on credit risk does not imply, however, that other risk components (interest rate risk, exchange rate risk, liquidity risk, political risk, redenomination risk, and various other market risks) are not important.

- A static balance sheet refers to the assumption that there will be no changes in the composition or size of the assets or liabilities of the central bank over a given horizon.