Export activities of euro area SMEs: insights from the Survey on the Access to Finance of Enterprises (SAFE)

Published as part of the ECB Economic Bulletin, Issue 8/2019.

This box reports the responses to an ad hoc question in the latest round of the Survey on Access to Finance of Enterprises (SAFE) regarding the export activities of small and medium-sized enterprises (SMEs).[1] It has two aims: first, it provides an overview of the export activities of euro area SMEs, both within and outside the euro area; and, second, it explores the main characteristics of exporting SMEs and focuses on the analysis of some financial dimensions that are relevant to the decision to export, as derived from the survey responses.

The survey responses confirm that non-domestic sales are important for euro area SMEs. More than a third of SMEs exported goods or services in 2018. In addition, the percentage of exporting companies increases with company size, with only a quarter of micro firms reporting exports outside their domestic market, but more than half of medium-sized and large companies. Comparing sectors, the industrial sector had the highest proportion of SMEs reporting exports of goods and services in 2018, followed by the trade and services sectors.[2]

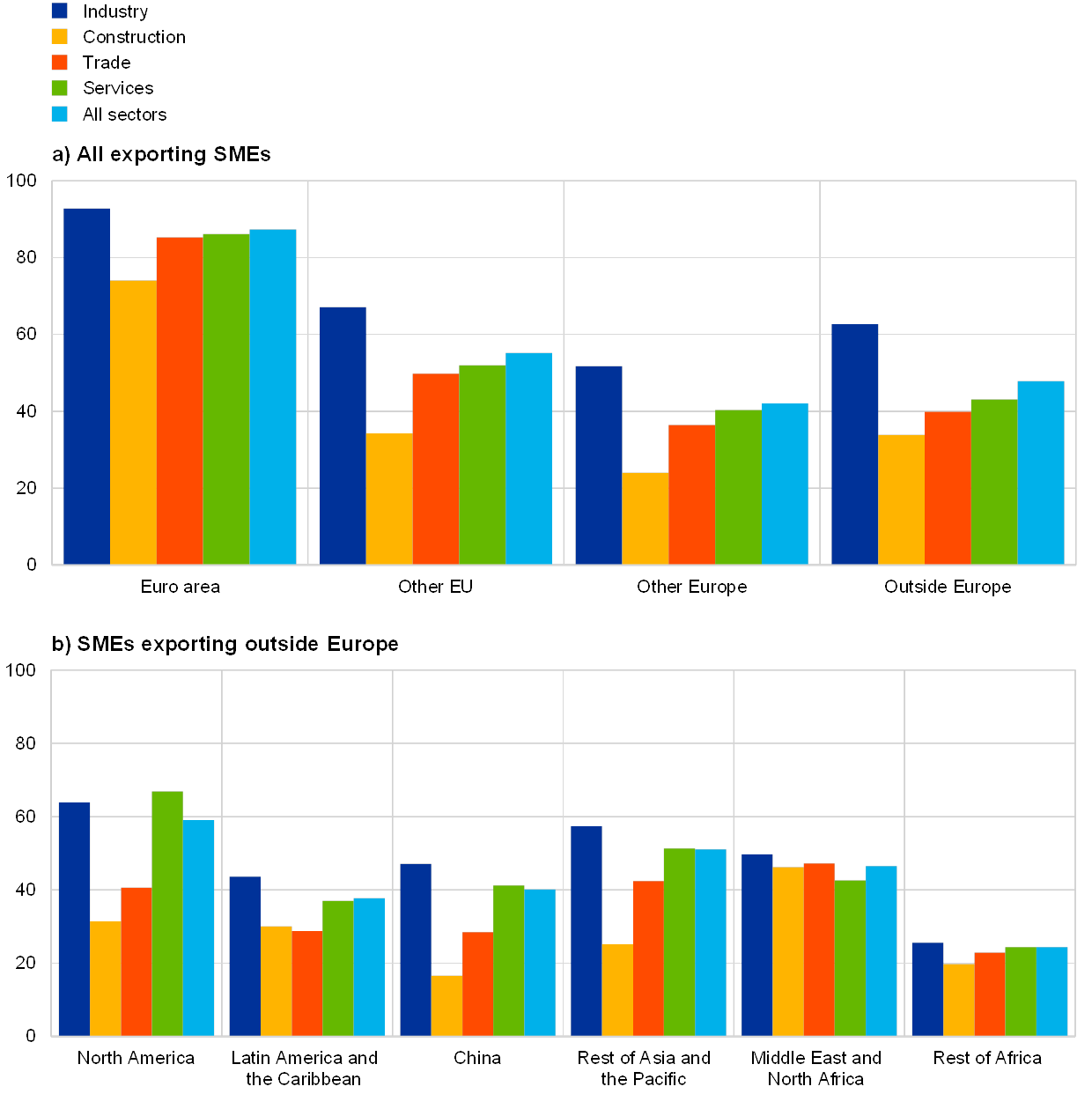

In terms of export destination, while SMEs exported predominantly within the euro area, a significant percentage of them also exported outside the euro area, and almost half of exporting SMEs exported outside Europe (see Chart A, panel a). Among the latter, North America is the most frequent export market, followed by Asia and the Pacific and the Middle East and North Africa (see Chart A, panel b). The pattern varies across sectors. Markets outside the euro area are of particular importance for SMEs in the industrial sector, where North America is the most common export destination for SMEs in both the industrial and service sectors.

Chart A

Export markets of euro area SMEs by sector

(weighted percentages of respondents)

Sources: SAFE and ECB staff calculations.

Notes: Panel a refers to all euro area SMEs that exported, and panel b refers to euro area SMEs that exported outside Europe. Results refer to round 21 of the survey (April to September 2019).

Turning to financial characteristics, there is evidence that SMEs face several challenges in order to become exporters. Exporting involves costs of entry into foreign markets and – in comparison with domestic sales – a longer time span between the export order and the final payment for the sale. In addition, these costs are often sunk costs that have to be paid up front, and exporters need to have sufficient financial flexibility to cope with the challenges. For these reasons, it has been argued that exporters may be particularly affected by constraints on their access to finance, and searching for supporting evidence has been the subject of many contributions in the academic literature.[3]

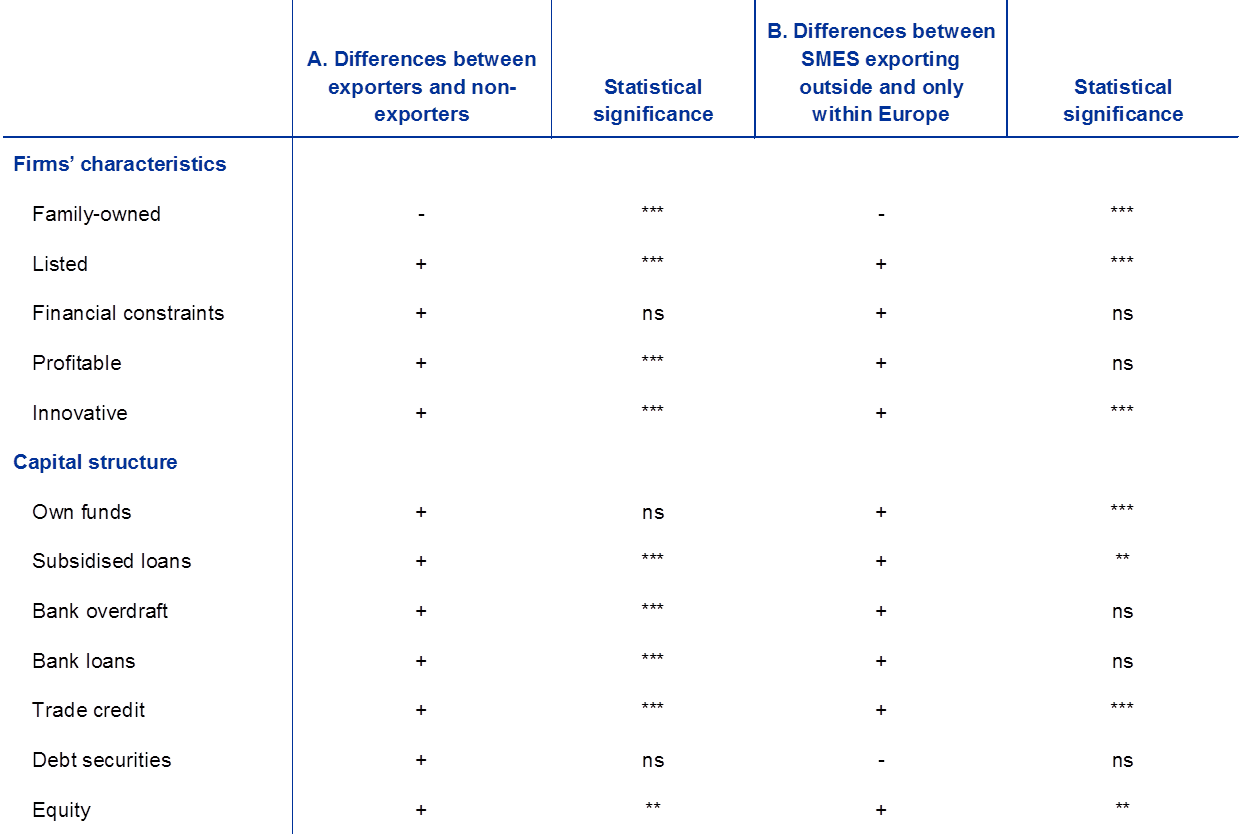

Exporting SMEs tend to be more profitable and innovative than non-exporting ones. A regular question in the survey on exporting companies[4] allows an overall picture of the financial characteristics of exporting SMEs to be formed. Table A reports evidence on whether exporting SMEs display a specific characteristic more often than non-exporting SMEs (see Table A, panel A). It also shows the differences between SMEs exporting to different markets, i.e. within and outside of Europe (see Table A, panel B).[5] The reported characteristics are those that are commonly considered to explain why a firm decides to export: corporate ownership, financial soundness, innovativeness and diversification of sources of finance.[6] The signs in the table should not be interpreted as signals of a causal relationship but as a mere description of the evidence provided by firms’ replies. For instance, a negative sign for the variable “family-owned” indicates that the percentage of SMEs that are family-owned is smaller among exporters than among non-exporters (see the first column in panel A of Table A) and the asterisks show that the difference with respect to non-exporters SMEs is statistically significant (see the second column in panel A of Table A).

Exporting SMEs tend more often to be listed on stock markets. In addition, there is a higher percentage of profitable[7] and more innovative firms among exporting SMEs. Furthermore, exporters make more use of external sources of finance, in particular subsidised loans – often in the form of guarantees or reduced interest rate loans – and normal bank loans. Trade credit is also an important external source of working capital, as it allows more flexibility in the capital requirements.

SMEs exporting to markets outside Europe tend to make more use of own funds and equity financing than SMEs exporting only within Europe. The ad hoc question also allows the investigation of which additional dimensions may characterise SMEs that export outside of Europe rather than confining themselves to the European market.[8] The prior is that, owing to additional trade barriers – technical rules, regulations and financial requirements, which might be different from those in the EU – and additional cross-border costs, these firms would need to be even more financially resilient than SMEs that export only within Europe. The results presented in panel B of Table A confirm that SMEs exporting outside of Europe are more innovative and tend to finance their activities more with their own funds and with subsidised loans than firms exporting only within Europe. At the same time, more of them report raising equity capital.

SMEs that operate in the industrial sector and export outside of Europe are even more innovative and make more use of subsided loans and trade credit than their peers who export only within Europe (see Table A). The fact that SMEs exporting outside Europe use subsidised loans (or grants) and trade credit more than those exporting only within Europe may reflect the presence of subsidised financing conditions for companies exporting outside the EU.

Table A

Financial characteristics of exporting SMEs

Sources: SAFE and ECB staff calculations.

Notes: Based on a two-sample t-test with equal variance. Asterisks denote significance level: *** = 1%, ** = 5%, * = 10%, ns = not statistically significant.

To conclude, the responses to an ad hoc question in the latest round of SAFE on the export activities of euro area SMEs signal that non-domestic sales are important. Moreover, a significant percentage of exporting SMEs are dealing with markets outside Europe, in particular in the industrial sector. In general, exporting SMEs tend to be more profitable and innovative than non-exporting SMEs. This evidence on the export activities of SMEs should help to improve understanding of the overall export dynamics among all euro area firms and the impact of external economic conditions on the euro area economy. However, it has to be taken into account that the ad hoc question only focused on direct exports by SMEs, but SMEs may well be part of the supply chain for larger companies, which, in turn, export other products.

The survey results also point to a few important features of exporting SMEs in the euro area. For example, most likely reflecting the additional costs and financing needs of exporting firms discussed above, the percentage of exporting companies increases with company size. They also tend to have greater diversification in their sources of external finance, which, together with the fact that they are more innovative, may suggest that they have to be more capital-intensive to compete in international markets. This underscores the need for well-functioning and well-developed financial markets that guarantee SMEs efficient access to finance to sustain their export activities.

- The Survey on Access to Finance of Enterprises (SAFE) has been carried out by the ECB and the European Commission on a biannual basis since 2009. It provides information on developments in firms’ access to and use of external financing in the euro area, broken down by firm size and sector of activity. The latest (21st) round of the survey was conducted from 16 September to 25 October 2019. The total euro area sample size was 11,204 firms, of which 10,241 (91%) had fewer than 250 employees. The main results and the questionnaire can be found on the ECB’s website.

- For more information on the sample composition, see “Survey on the access to finance of enterprises – Methodological information on the survey and user guide for the anonymised micro dataset”. Survey results are weighted by number of persons employed, and weights are calibrated by (i) country and size class and (ii) country and economic activity.

- For a recent contribution, see Wagner, J., “Access to Finance and Exports – Comparable Evidence for Small and Medium Enterprises from Industry and Services in 25 European Countries”, Open Economies Review, Vol. 30(4), 2019, pp. 739-757. For a seminal work on how credit constraints can hamper or even prevent exports, see Greenaway, D., Guariglia, A. and Kneller, R., “Financial factors and exporting decisions”, Journal of International Economics, Vol. 73(2), 2007, pp. 377-395.

- For more details, see question D7 of the SAFE questionnaire.

- All the results presented in Table A are based on univariate analyses. They are confirmed when multivariate regression analyses, based on probit models, are performed.

- See Paul, J., Parthasarathy, S. and Gupta, P., “Exporting challenges of SMEs: A review and future research agenda”, Journal of World Business, Vol. 52(3), 2017, pp. 327-342.

- This refers to an encompassing indicator calculated from the SAFE data to assess whether firms are financially sound in terms of turnover, profits, interest expenses and leverage. For more information, see “Survey on the Access to Finance of Enterprises in the euro area − April to September 2019”.

- Given the characteristics of the ad hoc question, SMEs exporting outside Europe may also export within Europe.