- PRESS RELEASE

Euro area investment fund statistics: first quarter of 2020

22 May 2020

- In the first quarter of 2020 the outstanding amount of shares/units issued by investment funds other than money market funds was €11,463 billion, €1,485 billion lower than in the fourth quarter of 2019. This decrease was mainly accounted for by -€1,328 billion in price and other changes.

- The outstanding amount of shares/units issued by exchange-traded funds (ETFs) was €704 billion, which was €149 billion lower than in the fourth quarter of 2019.

- The outstanding amount of shares/units issued by money market funds was €1,251 billion, €14 billion higher than in the fourth quarter of 2019.

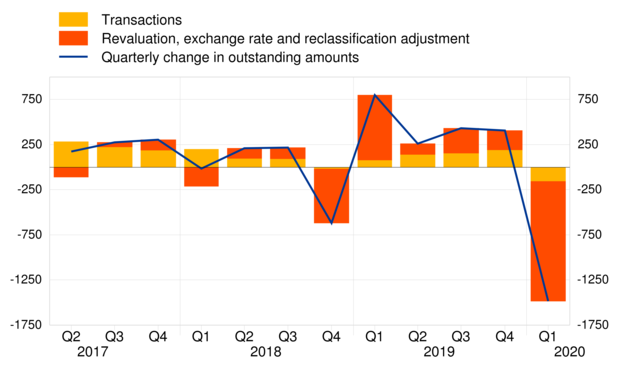

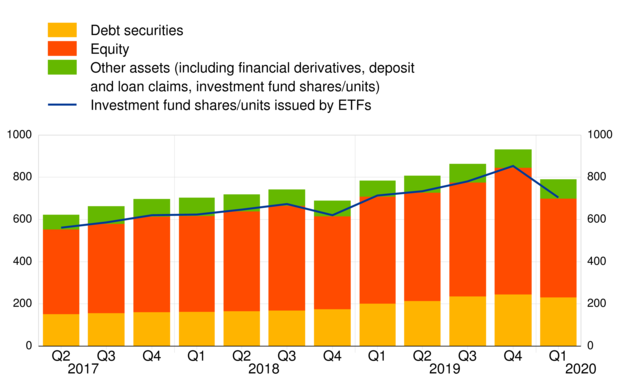

Chart 1

Investment fund shares/units issued

(EUR billions; not seasonally adjusted)

In the first quarter of 2020 the outstanding amount of shares/units issued by investment funds other than money market funds was €1,485 billion lower than in the fourth quarter of 2019 (see Chart 1). This development was accounted for by -€157 billion in net issuance of shares/units and -€1,328 billion in other changes (including price changes). The annual growth rate of shares/units issued by investment funds other than money market funds, calculated on the basis of transactions, was 2.7% in the first quarter of 2020.

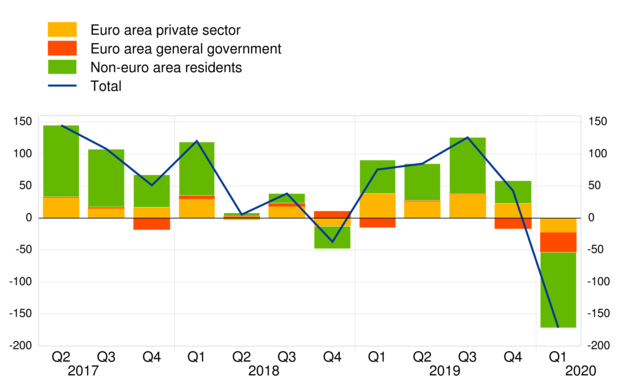

Chart 2

Investment funds' holdings of debt securities

(quarterly transactions in EUR billions; not seasonally adjusted)

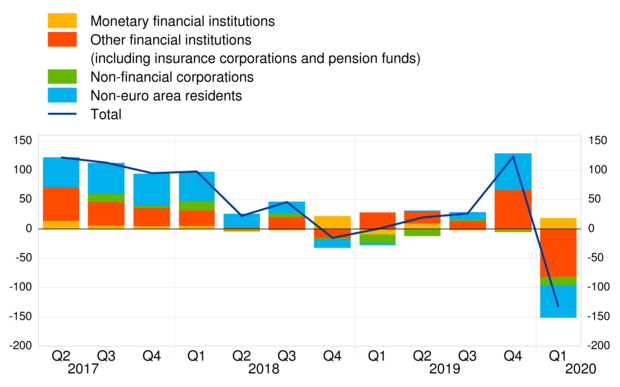

Chart 3

Investment funds' holdings of equity and investment fund shares/units

(quarterly transactions in EUR billions; not seasonally adjusted)

Within the assets of investment funds other than money market funds, the annual growth rate of debt securities was 1.8% in the first quarter of 2020, with transactions amounting to -€171 billion during this period (see Chart 2). The annual growth rate of equity and investment fund shares/units was 0.7% in the first quarter of 2020, with transactions amounting to -€133 billion during this period (see Chart 3). In the case of equity, the corresponding annual growth rate was 0.8%, with transactions totalling -€68 billion. For holdings of investment fund shares/units, the annual growth rate was 0.4% and transactions amounted to -€65 billion.

In terms of holdings by issuing sector, the annual growth rate of debt securities issued by euro area general government was -5.1% in the first quarter of 2020. In the same period, the net sales of debt securities issued by the euro area general government amounted to €31 billion (see Chart 2). In the case of debt securities issued by the private sector, the annual growth rate was 5.1%, whereby the net sales amounted to €23 billion. For debt securities issued by non-euro area residents, the corresponding annual growth rate was 2.4%, with net sales of €118 billion.

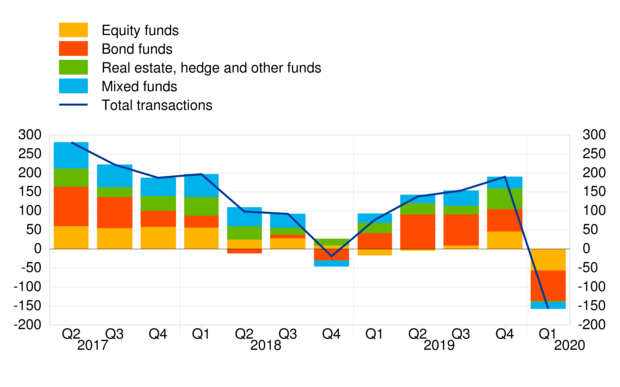

Chart 4

Investment fund shares/units issued by type of investment fund

(quarterly transactions in EUR billions; not seasonally adjusted)

In terms of the type of investment fund, the annual growth rate of shares/units issued by bond funds was 4.6% in the first quarter of 2020. In the same period, transactions in shares/units issued by bond funds amounted to -€80 billion (see Chart 4). In the case of equity funds, the corresponding annual growth rate was 0.0%, with transactions of -€57 billion. For mixed funds, the corresponding figures were 2.4% and -€18 billion.

Chart 5

Investment fund shares/units issued by ETFs and underlying assets

(quarterly transactions in EUR billions; not seasonally adjusted)

The shares/units issued by exchange-traded funds (ETFs), which are presented as a separate category within total investment funds, recorded an annual growth rate of 9.5% in the first quarter of 2020, with an outstanding amount of €704 billion (see Chart 5). In terms of assets held by ETFs, in the first quarter of 2020, 59% were equity, 29% were debt securities and 11% were other assets (including financial derivatives, deposit and loan claims and investment fund shares/units).

The outstanding amount of shares/units issued by money market funds was €14 billion higher than in the fourth quarter of 2019. This development was accounted for by €15 billion in net issuance of shares/units and -€1 billion in other changes (including price changes). The annual growth rate of shares/units issued by money market funds, calculated on the basis of transactions, was 7.0% in the first quarter of 2020.

Within the assets of money market funds, the annual growth rate of debt securities holdings was -3.2% in the first quarter of 2020, with transactions amounting to -€78 billion, which reflected net sales of €41 billion related to debt securities issued by euro area residents and net sales of €37 billion in debt securities issued by non-euro area residents. For deposits and loan claims, the annual growth rate was 45.8% and transactions during the first quarter of 2020 amounted to €99 billion.

Annex

Table: Annex to the press release on euro area investment fundsStatistical Data Warehouse:

All money market funds time seriesAll investment funds other than money market funds time series

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes:

- Money market funds are presented separately in this press release since they are classified in the monetary financial institutions sector within the European statistical framework.

- "Euro area private sector" refers to total euro area excluding general government.

- Hyperlinks in the main body of the press release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex table are a snapshot of the data as at the time of the current release.

- In addition to the data on net transactions presented in this press release, the ECB Statistical Data Warehouse also contains data on gross issues and redemptions of investment fund shares/units.

Euroopa Keskpank

Avalike suhete peadirektoraat

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Saksamaa

- +49 69 1344 7455

- media@ecb.europa.eu

Taasesitus on lubatud, kui viidatakse algallikale.

Meediakontaktid