Euro area monthly balance of payments (March 2017)

- In March 2017 the current account of the euro area recorded a surplus of €34.1 billion.[1]

- In the financial account, combined direct and portfolio investment recorded net acquisitions of assets of €75 billion and net incurrences of liabilities of €32 billion.

Current account

The current account of the euro area recorded a surplus of €34.1 billion in March 2017 (see Table 1). This reflected surpluses for goods (€29.0 billion), services (€11.6 billion) and primary income (€3.4 billion), which were partly offset by a deficit for secondary income (€9.8 billion).

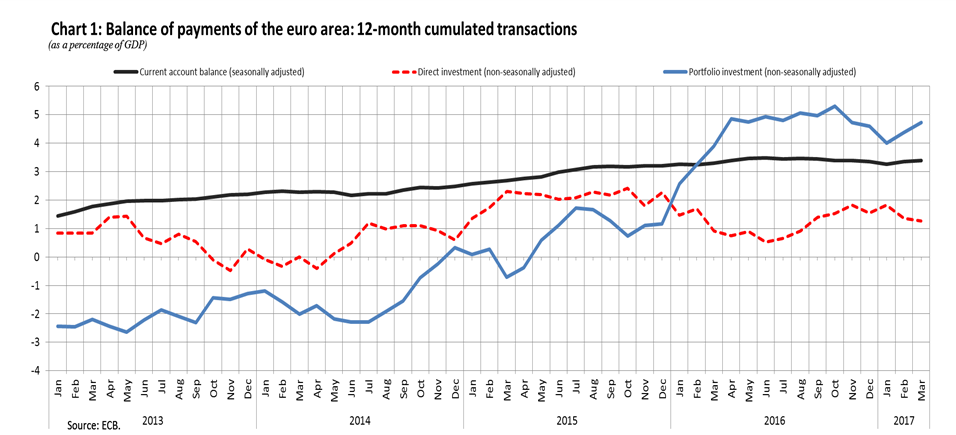

The 12-month cumulated current account for the period ending in March 2017 recorded a surplus of €363.6 billion (3.4% of euro area GDP), compared with one of €347.2 billion (3.3% of euro area GDP) for the 12 months to March 2016 (see Table 1 and Chart 1). This was due to increases in the surpluses for goods (from €353.8 billion to €364.7 billion) and primary income (from €48.5 billion to €79.3 billion). These were partly offset by a decrease in the surplus for services (from €72.3 billion to €54.8 billion) and an increase in the deficit for secondary income (from €127.3 billion to €135.3 billion).

Financial account

In March 2017 combined direct and portfolio investment recorded net acquisitions of assets of €75 billion and net incurrences of liabilities of €32 billion (see Table 2).

Euro area residents recorded net acquisitions of €23 billion of direct investment assets as a result of net acquisitions of equity (€70 billion), which were partly offset by a disinvestment in debt instruments (€47 billion). Direct investment liabilities also increased by €11 billion as a result of net acquisitions of euro area equity (€6 billion) and debt instruments (€5 billion) by non-euro area residents.

With reference to portfolio investment assets, euro area residents made net acquisitions of foreign securities amounting to €52 billion. This resulted from net purchases of short-term debt securities (€34 billion), long-term debt securities (€16 billion) and equity (€3 billion). Portfolio investment liabilities recorded a net increase of €22 billion as a result of net acquisitions of euro area equity (€12 billion), long-term debt securities (€7 billion) and short-term debt securities (€2 billion) by non-euro area residents.

The euro area net financial derivatives account (assets minus liabilities) was close to balance.

Other investment recorded decreases of €73 billion in assets and €72 billion in liabilities. The net disposal of assets by euro area residents is mainly attributable to the MFI sector (excluding the Eurosystem) (€82 billion). The net decrease in liabilities is also largely explained by the MFI sector (excluding the Eurosystem) (€105 billion), which was partly offset by the Eurosystem (€30 billion).

In the 12 months to March 2017 combined direct and portfolio investment recorded increases of €841 billion in assets and €197 billion in liabilities, compared with increases of €1,062 billion and €557 billion respectively in the 12 months to March 2016. This resulted from a significant decrease in the direct investment activity of both euro area residents abroad and non-residents in the euro area, as well as from a shift in portfolio investment liabilities, from net acquisitions of euro area securities to net disposals by non-euro area residents.

According to the monetary presentation of the balance of payments, the net external assets of euro area MFIs decreased by €249 billion in the 12 months to March 2017, compared with a decrease of €76 billion in the 12 months to March 2016. This reflected net financial transactions by non-MFIs. In particular, the cumulated transactions in portfolio investment liabilities issued by non-MFI euro area residents showed an increase in the net sales/amortisations of debt securities by non-euro area investors from €19 billion to €262 billion. This was partly offset by an increase in the surplus in the current and capital account balance (from €330 billion to €361 billion).

In March 2017 the Eurosystem’s stock of reserve assets decreased to €726.6 billion from €735.7 billion in the previous month (see Table 3). This decrease (€9.1 billion) is mainly explained by negative price revaluations of monetary gold (€7.5 billion) and exchange rate developments (€2.3 billion).

Data revisions

This press release incorporates revisions to the data for January and February 2017. These revisions have not significantly altered the figures previously published.

Additional information

Time series data: ECB’s Statistical Data Warehouse (SDW)

Methodological information

Monetary presentation of the balance of payments

Next press releases:

- Monthly balance of payments: 20 June 2017 (reference data up to April 2017);

- Quarterly balance of payments and international investment position: 5 July 2017 (reference data up to the first quarter of 2017).

Annexes

Table 1: Current account of the euro area

Table 2: Balance of payments of the euro area

Table 3: Reserve assets of the euro area

For media queries, please contact Philippe Rispal, Tel.: +49 69 1344 5482.

[1] References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are neither seasonally nor working day-adjusted.

Euroopa Keskpank

Avalike suhete peadirektoraat

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Saksamaa

- +49 69 1344 7455

- media@ecb.europa.eu

Taasesitus on lubatud, kui viidatakse algallikale.

Meediakontaktid