COVID-19 and the increase in household savings: precautionary or forced?

Published as part of the ECB Economic Bulletin, Issue 6/2020.

The propensity of households to save has reached unprecedented levels in response to COVID-19. The household saving rate derived from the sectoral accounts (Chart A) shows a sharp increase in the first quarter of 2020. As quarterly sectoral accounts are released with a lag of about three months, real time information on the household saving rate is usually scarce. However, using the European Commission’s consumer survey, a qualitative but more timely monthly indicator of the propensity to save can be constructed. The indicator is computed as the difference between the answers to the survey question about households’ expected savings and the answers to the question about their expected financial situation. The indicator has reached unprecedented levels, pointing to a sharp increase in household savings in the second quarter of 2020. This is also reflected in the increase in households’ bank deposits since March 2020, as discussed below.

Chart A

Households’ propensity to save

(percentage points and percentages)

Sources: DG-ECFIN, Eurostat and authors’ calculations.

Notes: Grey bars represent the recession periods as defined by the Centre for Economic Policy Research. The latest observation is the first quarter of 2020 for the household saving rate, and August 2020 for the measure based on the consumer survey. All data are seasonally adjusted.

The increase in household savings is potentially explained by two prominent factors. First, the lockdown measures imposed to contain the virus prohibited households from consuming a large share of their normal expenditure basket, leading to forced, or in other words involuntary, savings.[1] Second, the sudden outbreak of the pandemic caused uncertainty regarding future income, and in particular the risk of future unemployment, to shoot up, leading to precautionary savings.[2] This raises the question of how to quantify the contribution of both factors to the increase in household savings during the first half of 2020.

This box uses a parsimonious panel model to estimate the determinants of the saving rate. Following Mody et al., a panel model for the saving rate can be estimated using quarterly data for the five largest euro area countries from 2003 to 2019.[3] While this model includes most standard drivers of household savings, this box uses household expectations about future unemployment to estimate the impact of precautionary savings.[4] This is in line with existing literature approximating household-specific unemployment risk by household expectations about the aggregate unemployment rate (for example, Carroll et al.). This choice matters particularly in the current situation where, despite a spike in household expectations about future unemployment (Chart B), the actual unemployment rate has so far been very sticky.[5]

Chart B

Unemployment rate and unemployment expectations

(percentage balance and percentage of labour force)

Sources: DG-ECFIN and Eurostat.

Note: The latest observation is August 2020 for unemployment expectations and July 2020 for the unemployment rate.

Using the estimated model, the contribution of precautionary savings can be computed. The expected unemployment rate explains a large share of the historical variation in the saving rate. During downturns precautionary motives are typically an important factor in explaining the increase in household savings. As information on household expectations about future unemployment is available until June 2020, we can use the estimated model to compute the contribution of precautionary savings in the first half of 2020.

Forced savings seem to be the main driver of the recent spike in household savings. Chart C shows how the recent rise in expected unemployment has led to a significant contribution of precautionary savings to the rise in the saving rate in the second quarter. While the model fits the data quite well over the estimation sample, it is not able to explain most of the recent increase in the saving rate. Most of this unexplained residual seems to be attributable to constraints on the consumption of many goods and services during periods of lockdown and therefore constitutes an estimate of forced savings. In the chart, the contribution of precautionary savings looks very small compared with the estimate of forced savings in the second quarter. However, it should be noted that this contribution of precautionary savings is large in historical perspective, even though it appears small relative to forced savings.

Chart C

Drivers of the increase in the household saving rate

(change with respect to Q4 2019, percentage points of disposable income)

Sources: Eurostat and authors’ calculations.

Note: The change in the saving rate in the first quarter of 2020 is based on official statistics, while the change in the second quarter of 2020 is an internal estimate.

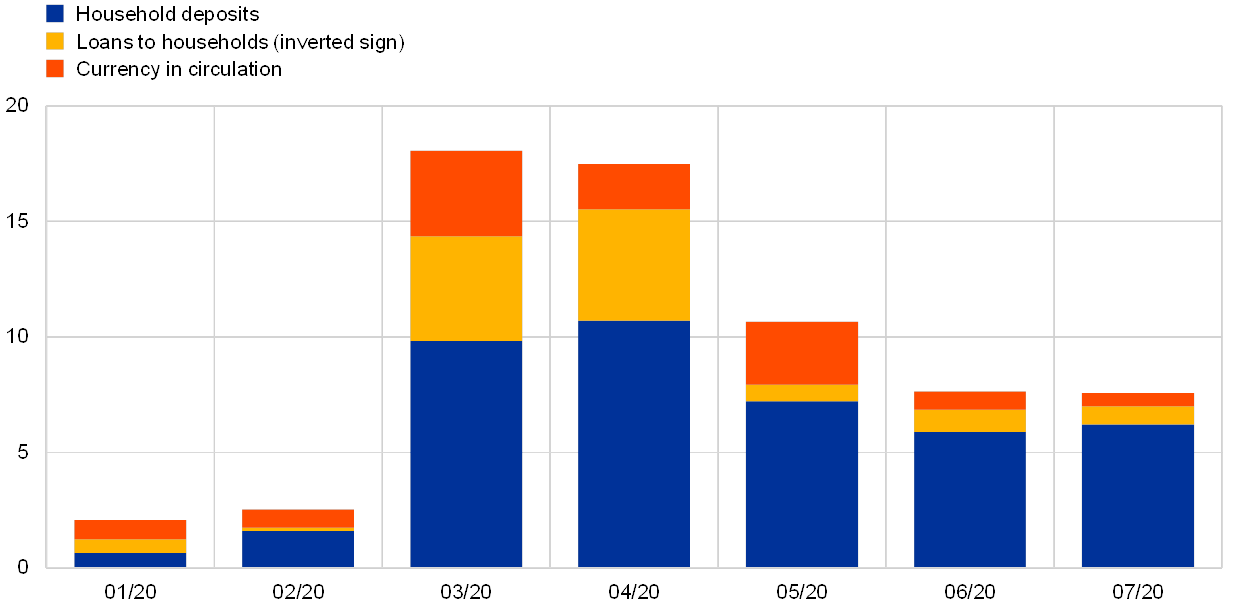

Household bank deposits surged during periods of lockdown. In line with a large contribution from forced savings, the spike in savings is mainly reflected in a spike in bank deposits, although lower credit flows to households also seem to have played a role in March and April (Chart D). In this regard, it should be noted that the decline in credit to households over those months may also have been explained by the impact of lockdown measures. Consumer credit is typically driven by consumption, while lower mortgage flows may have reflected difficulties in conducting real estate purchases.

Chart D

Household deposits, loans and currency in circulation

(change with respect to December 2019, percentage points of disposable income)

Sources: Eurostat and ECB.

Notes: Loans to households are reported with an inverted sign. The contribution of currency flows is to be considered as an upper bound, as a breakdown by holding sector is not available. The latest observation is for July 2020.

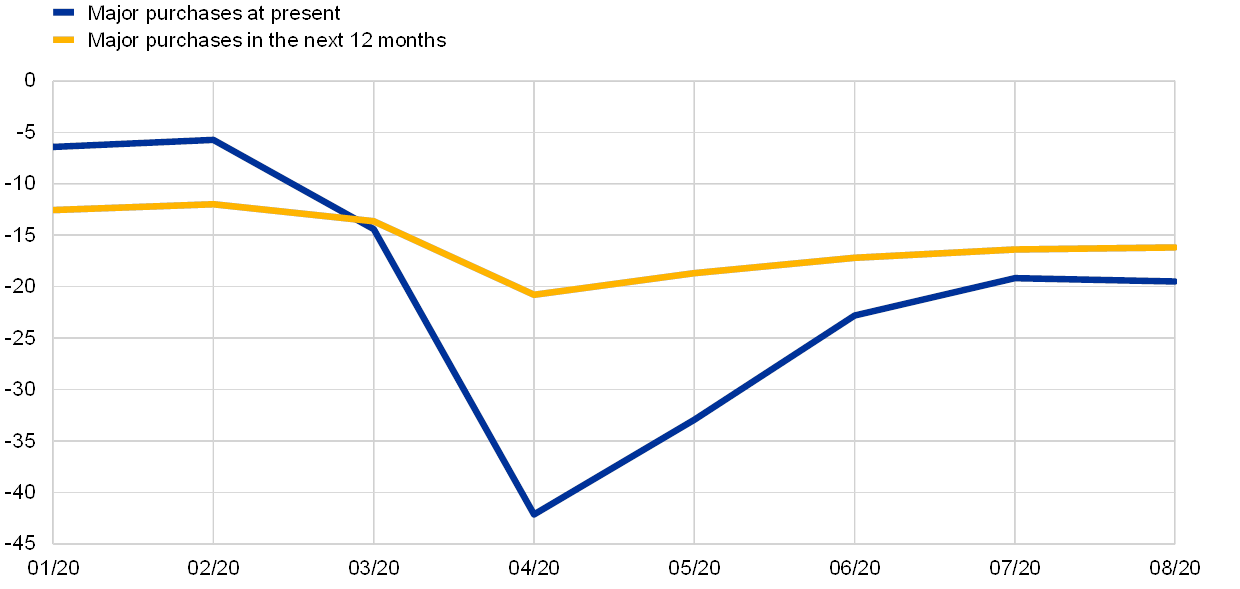

Despite accumulated savings, there is considerable uncertainty regarding pent-up demand in the short term. Pent-up demand describes a rapid increase in the demand for goods, temporarily exceeding pre-downturn levels. As consumers tend to hold off making purchases during a recession, they build up a backlog of demand that is unleashed when signs of economic recovery emerge. The COVID-19 downturn is, however, different given the partly forced nature of the contraction in household spending. Nearly half of the contraction in private consumption reflects expenditure components which could be postponed (e.g. electronics, cars). Recent retail trade data indeed show a strong rebound in a number of product categories which could partly reflect a catching-up effect. However, at this stage it is hard to distinguish this effect from an apparent shift in consumption baskets in response to COVID-19 (e.g. bicycles, home office equipment). The EC consumer survey covering the period up to August (Chart E) suggests that in the next twelve months households expect to spend less on major purchases than at the beginning of 2020, despite the amount of savings they have accumulated. Therefore, over the next year precautionary motives may still keep households’ propensity to save at levels that are higher than before the COVID-19 crisis.

Chart E

Major purchases

(percentage balance)

Source: DG-ECFIN.

Note: The latest observation is for August 2020.

- Note that given the infection risk of COVID-19 this factor may also include the impact of consumers’ voluntary restraints on certain types of expenditure (e.g. restaurant visits, travel), even if such consumption was not prohibited.

- For existing evidence on unemployment risk and precautionary savings, see Campos, R. and Reggio, I., “Consumption in the shadow of unemployment”, European Economic Review, Vol. 78, 2015, pp. 39‑54, and Ravn, M. and Sterk, V., “Job uncertainty and deep recessions”, Journal of Monetary Economics, Vol. 90, 2017, pp. 125-141.

- See Mody, A., Ohnsorge, F. and Sandri, D., “Precautionary savings in the Great Recession”, IMF Economic Review, Vol. 60, 2012, pp. 114-138, and Carroll, C., Slacalek, J. and Sommer, M., “Dissecting Saving Dynamics: Measuring Wealth, Precautionary, and Credit Effects”, National Bureau of Economic Research Working Paper No 26131, August 2019.

- In the model the saving rate is the dependent variable, with households’ unemployment expectations, expected household income growth, the lagged household financial wealth ratio and credit conditions for households as explanatory variables. Expected household income is proxied by the next quarter’s realised income.

- European Commission, European Economic Forecast, Summer 2020, Institutional Paper 132, July 2020.