Euro area balance of payments (September 2014)

In September 2014, the current account of the euro area recorded a surplus of €30.0 billion. [1]

In the financial account, combined direct and portfolio investment recorded net increases of €84 billion and €27 billion in assets and liabilities respectively.

Current account

The current account of the euro area recorded a surplus of €30.0 billion in September 2014 (see Table 1). This reflected surpluses for goods (€20.7 billion), services (€10.4 billion) and primary income (€7.6 billion), which were partly offset by a deficit for secondary income (€8.7 billion). [2]

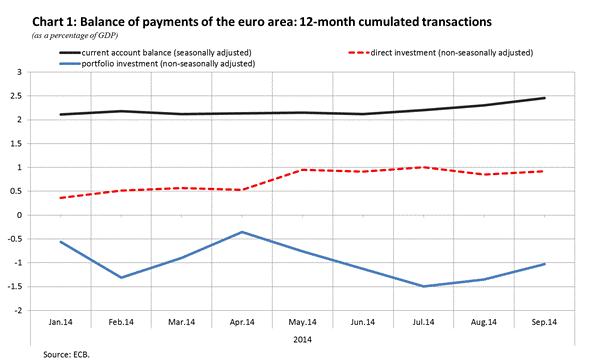

The 12-month cumulated current account for the period ending in September 2014 recorded a surplus of €245.6 billion (2.5% of euro area GDP), compared with one of €229.7 billion (2.4% of euro area GDP) for the 12 months to August 2014 (see Table 1 and Chart 1). The increase in the current account surplus was due mainly to increases in the surpluses for goods (from €211.5 billion to €217.3 billion) and, to a lesser extent, to increases in the surplus for services (from €92.3 billion to €95.2 billion) and primary income (from €68.0 billion to €71.9 billion), as well as to a decrease in the deficit for secondary income (from €142.0 to €138.8 billion).

Financial account

In the financial account (see Table 2), combined direct and portfolio investment recorded net increases of assets of €84 billion and of liabilities of €27 billion in September 2014.

Euro area residents recorded direct investment abroad (assets) of €33 billion, almost evenly split between equity and debt instruments (mostly inter-company loans). Foreign direct investors increased their investments in the euro area (liabilities) by €10 billion, almost entirely by means of debt instruments. As regards portfolio investment assets, euro area residents had net acquisitions of foreign securities of €51 billion, mostly debt securities (€47 billion). On the liability side, non-residents had net acquisitions of euro area securities of €17 billion (net purchases in equity securities of €20 billion partially offset by €3 billion of net sales in debt securities).

The euro area financial derivatives account recorded net flows of €7 billion. Other investment recorded net decreases of €39 billion and €4 billion in assets and liabilities respectively. The net decrease of assets was explained by developments in the MFIs excluding the Eurosystem (€37 billion) and the general government (€4 billion) sectors. The net decrease of liabilities was explained by decreases in the Eurosystem (€3 billion), general government (€3 billion) and other sectors (€14 billion), which were partly offset by an increase in MFIs excluding the Eurosystem (€17 billion).

The Eurosystem’s stock of reserve assets increased by €3 billion in September 2014 (to €597 billion). This was explained by net disposals of reserve assets of €2 billion and positive revaluations of €5 billion.

Data revisions

This press release incorporates revisions to the data for the reference periods from January 2013 to August 2014.

Additional information

Time series data: ECB’s Statistical Data Warehouse (SDW).

Methodological information: ECB’s website.

Next press releases: Monthly balance of payments: 19 December 2014 (reference data up to October 2014).

For media queries, please contact Stefan Ruhkamp, Tel.: +49 69 1344 5057.

Annexes

Table 1: Current account of the euro area

Table 2: Balance of payments of the euro area

-

[1]References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are non-seasonally or working day-adjusted.

-

[2]In broad terms, the new concept of “primary income” used in the sixth edition of the IMF’s Balance of Payments and International Investment Position Manual (BPM6) corresponds to the BPM5 concept of “income”, and the BPM6 concept of “secondary income” corresponds to the BPM5 concept of “current transfers”.

Euroopan keskuspankki

Viestinnän pääosasto

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu.

Kopiointi on sallittu, kunhan lähde mainitaan.

Yhteystiedot medialle