- SPEECH

Inflation in the near-term and the medium-term

Opening remarks by Philip R. Lane, Member of the Executive Board of the ECB, at MNI Market News Webcast

Frankfurt am Main, 17 February 2022

In these brief opening remarks, I wish to discuss the forces shaping near-term and medium-term inflation dynamics.

On near-term inflation, I emphasised in a blog post last week that the current high inflation rates have been largely shaped by a pandemic cycle that has generated global bottlenecks for manufactured goods over the last year and, most importantly for the euro area, has seen a very substantial surge in energy prices in recent months.[1]

A comprehensive analysis of the implications of high energy prices for near-term and medium-term inflation dynamics should take into account four factors: first, the direct impact through the energy component of the HICP; second, the indirect impact, since energy is an important input for many other components of the HICP, such as food, transportation, goods and many consumer services; third, the potential for second-round effects on wages, with due differentiation between a one-off or catch-up wage adjustment and a revision in inflation expectations that would have persistent effects on wage growth; and, fourth, the macroeconomic impact, with high energy prices operating through negative income and wealth effects, while also affecting energy-sensitive production and investment plans. At a global level, the macroeconomic impact of an energy shock differs between energy-producing and energy-using regions. Since the euro area is a significant net importer of energy, a surge in energy prices constitutes a significant adverse terms of trade shock. Higher import prices for energy reduces the disposable incomes of households and the cash flows of energy-intensive firms. The impact of this terms of trade shock on euro area macroeconomic dynamics will warrant close monitoring in the coming quarters.

Moving from near-term to medium-term inflation dynamics, there is a clear potential linkage: if currently-high inflation causes a rethink about the likely level of medium-term inflation, a persistent shift in inflation expectations can play a significant role in determining inflation dynamics. There are several mechanisms at work here.

First, at any given time, the recent history of inflation is an important input in shaping the beliefs of households, firms and investors. Before the pandemic, there were widespread concerns that a long period of below-target inflation in the euro area had led to a downside de-anchoring of inflation expectations. In particular, there was a widely-held conjecture that myriad structural forces (combined with the effective lower bound for monetary policy) would keep inflationary pressures low for an extended period, with persistent monetary accommodation only gradually returning inflation to the two per cent target. The currently-high inflation rate calls this into question this conjecture through a stark demonstration that inflation is not destined to be always super low.

Of course, precisely how much medium-term inflation expectations might be affected by the current burst of inflation will depend on the intensity and duration of this spell of above-target inflation, the nature of its underlying drivers (in particular, the balance between external supply shocks versus domestic demand shocks) and the extent to which the central bank is trusted to deliver the two per cent target over the medium term.

It is especially important that the central bank is seen as symmetric in its commitment to the two per cent target – being fully prepared to react proportionately if there is a threat that inflation will settle above two per cent in the medium term, while also making sure not to over-react to the extent that there is a risk that high near-term inflation might induce an excessive monetary tightening that pushes inflation persistently below the two per cent target over the medium term.

Moreover, it should also be recognised that medium-term inflation expectations have been increasing from a low base towards the two per cent inflation target over the last year, even before the energy shock. In the specific context of the euro area, there are several factors indicating that the excessively-low inflation environment that prevailed from 2014 to2019 (a period over which inflation averaged just 0.9 per cent) might not re-emerge even after the pandemic cycle is over.

First, the scale of the fiscal and monetary response to the pandemic demonstrated the strength of the commitment to delivering macro-financial stability, rather than seeing a return of the pre-pandemic dynamics that acted as a powerful anti-inflationary force after the global financial crisis and the euro area sovereign debt crisis (the twin crises between 2008 and 2013). Importantly, this included substantial policy action at both EU and national level; with the former including the SURE programme, extra funding for the European Investment Bank and, most significantly, the NGEU initiative. In particular, the medium-term nature of the NGEU programme has provided an important anchor for medium-term economic prospects, especially for the main beneficiaries.

At the national level, we have witnessed the deployment of large-scale government interventions to buffer the impact of the pandemic shock on household and corporate incomes – through temporary employment protection schemes and tax cuts, among other initiatives – and to facilitate the normal financing of economic activity – especially through large-scale public loan guarantees. All this stands in contrast to the macroeconomic configuration that characterised the period after the twin crises which involved very muted aggregate demand, with many governments, households, firms and banks focused on sustained deleveraging after a period of excessive imbalances.

Second, the re-anchoring of medium-term inflation expectations towards two percent has also been supported by the clarity of the ECB’s new monetary policy strategy, which was finalised in July 2021 and backed up by its revised interest rate forward guidance. The revised strategy makes it clear that the monetary policy of the ECB is dedicated to delivering the two per cent target over the medium term, with a symmetric aversion to below-target and above-target deviations. The simplicity and transparency of the two per cent target increases accountability and improves clarity compared to the previous target of “below, but close to, two per cent.”

Third, in relation to structural forces, some revisions to beliefs about the operation of the world economy might also be contributing to a shift in inflation expectations. In particular, the level of excess capacity in global manufacturing might be structurally diminishing to the extent that China has embarked on a transition from an export-led to a domestically-focused economy. In related fashion, rising wages and incomes in emerging economies mean that demand-side factors might be more powerful than supply-side factors in relation to the impact of globalisation in the coming years. In parallel, the increasing visibility of aging dynamics in some Western economies – a trend that is also becoming visible in some emerging areas (especially China) – may result in a less dynamic labour supply at the global level. The net impact of demographic change on inflation dynamics is not straightforward: while a lower labour supply may potentially have a direct impact on labour costs, it could also have adverse implications for the potential growth rate of the world economy. Furthermore, the net impact on labour supply in individual regions will also depend on international migration policies that can amplify or mitigate regional imbalances in labour supply. Moreover, in relation to structural forces, the pandemic may also have accelerated the digitalisation of the world economy, which could operate as an anti-inflationary force by increasing national and international competition, including in previously-sheltered services sectors.

The carbon transition constitutes an important structural force that will be a primary contributor to macroeconomic dynamics in this decade and in the decades to come. The net impact of the carbon transition on inflation dynamics will depend on the exact transition path that emerges and the time horizon considered. In particular, the mechanical impact of the carbon transition on energy prices (which, in turn, will depend on the evolving mix between fossil fuels and renewables in energy production) must be assessed jointly with the implications of a sustained phase of transition-focused corporate, household and public investment. In particular, the impact on inflation dynamics must take into account the shift in the composition of economic activity between investment and consumption and the wealth effects of the transition on the value of carbon-intensive assets, including housing. Moving towards a longer horizon, massive investment in renewable energy technologies should deliver sizeable efficiency gains in the production and use of energy over time, reducing overall expenditure on energy. Clearly, an orderly transition will have a more benign macroeconomic impact than a deferred process that requires sharper policy adjustment at a later stage.

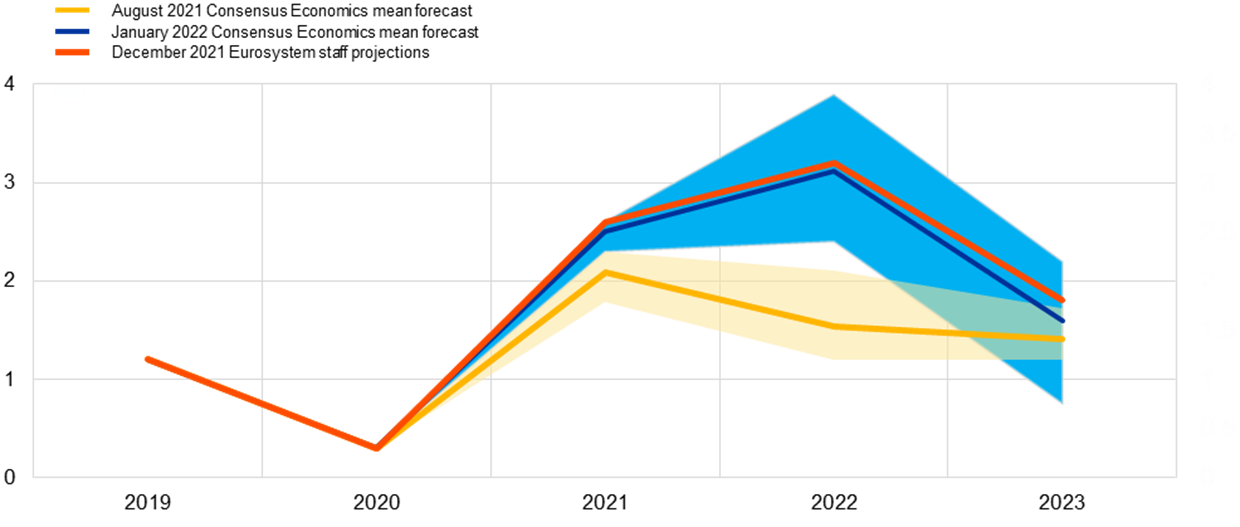

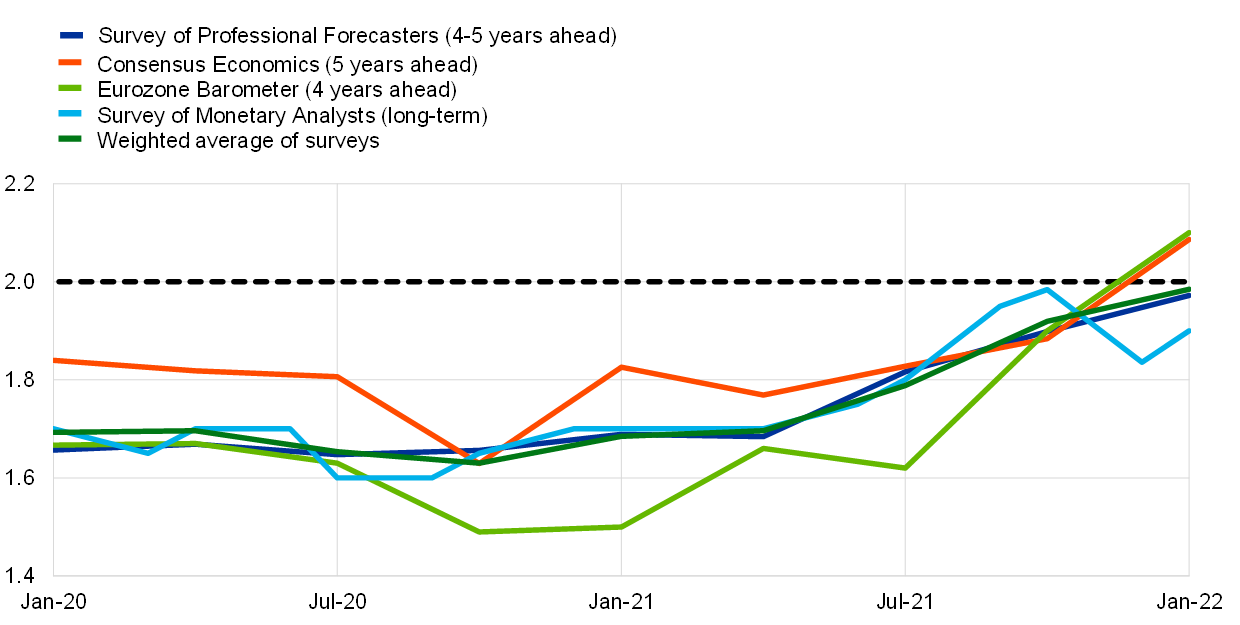

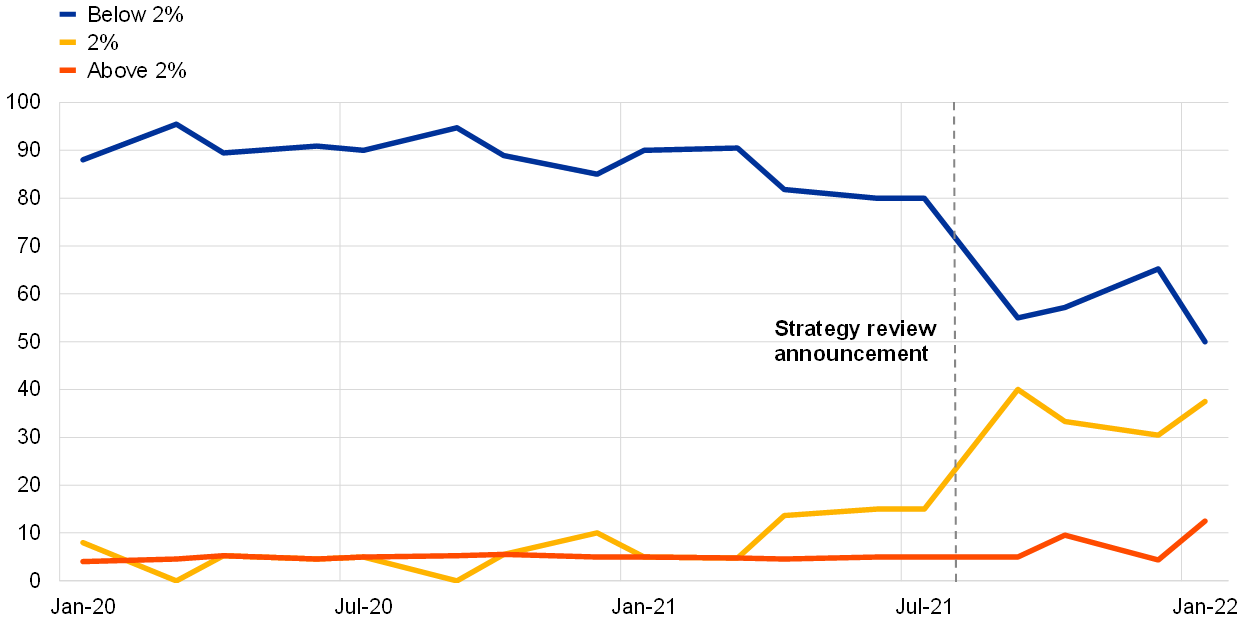

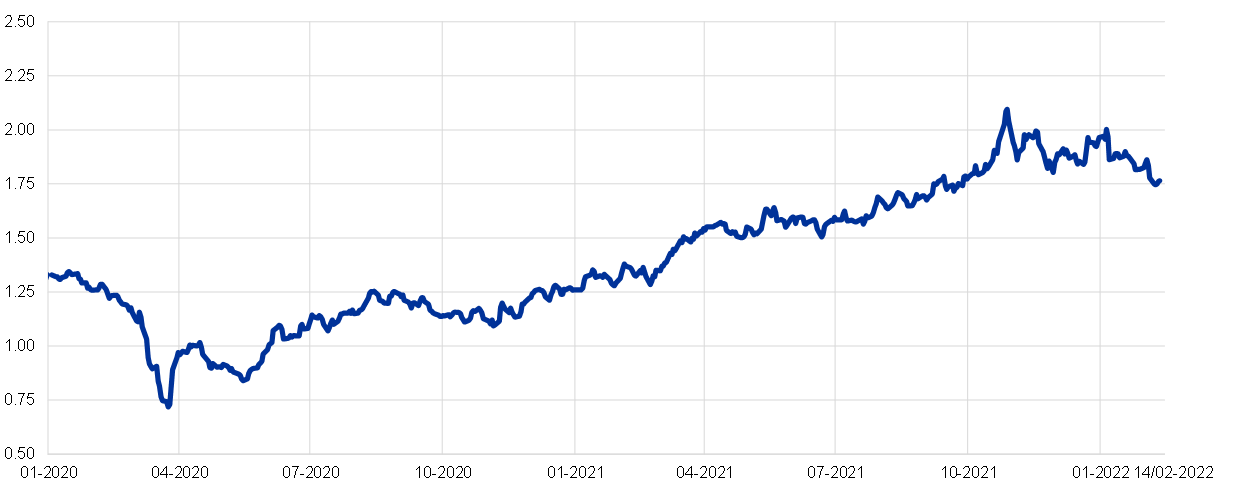

Charts 1-7 show the evolution of inflation expectations across a range of indicators. Taken together, these indicators signal that the current high inflation rate is not expected to persist. At the same time, at a lower frequency, these indicators also support increasing confidence that the pre-pandemic below-target inflation pattern will not re-emerge as a medium-term equilibrium, with inflation expected to settle around the two per cent target.[2]

Chart 1

Euro area HICP inflation: Consensus Economics forecasts and Eurosystem staff projections

(annual percentage changes)

Sources: Consensus Economics, Eurostat, Haver Analytics and ECB staff calculations.

Note: The shaded blue and yellow areas denote the ranges of forecasts included in Consensus Economics surveys.

Chart 2

Longer-term inflation expectations from professional forecaster surveys

(annual percentage changes)

Sources: Survey of Professional Forecasters, ECB Survey of Monetary Analysis, Consensus Economics, Eurozone Barometer and ECB staff calculations.

Notes: The weighted average is calculated using the average number of respondents from each survey as weights. The latest observations is for the first quarter of 2022 for the SPF, January 2022 for Consensus Economics and the Eurozone Barometer and February 2022 for the Survey of Monetary Analysts.

Chart 3

Survey of Professional Forecasters: cross-sectional distribution of longer-term inflation point forecasts

(percentages of respondents; inflation point forecasts)

Sources: Survey of Professional Forecasters and ECB staff calculations.

Note: The latest observations are for the first quarter of 2022.

Chart 4

Survey of Monetary Analysts: distribution of longer-term inflation expectations

(percentages of respondents)

Sources: ECB Survey of Monetary Analysts (SMA) surveys between January 2020 and January 2022.

Notes: Values were rounded to one decimal prior to aggregation. The latest observations are for January 2022.

Chart 5

Consumer inflation expectations

(annual percentage changes)

Sources: ECB Consumer Expectations Survey and Eurostat.

Notes: Average denotes the winsorised (±2%) mean. The latest observations are for January 2022.

Chart 6

Inflation-linked interest rate swap rate in the euro area: 5-year rate 5 years ahead

(percentage per annum)

Sources: Reuters and ECB staff calculations.

Note: The latest observation is for 14 February 2022.

Chart 7

Headline inflation in the euro area

(annual percentage changes)

Sources: Eurostat and ECB staff calculations.

Notes: The latest observations are for the fourth quarter of 2021. The end-of-horizon projected values show the projected HICP inflation rate for the final year within the projection horizon.

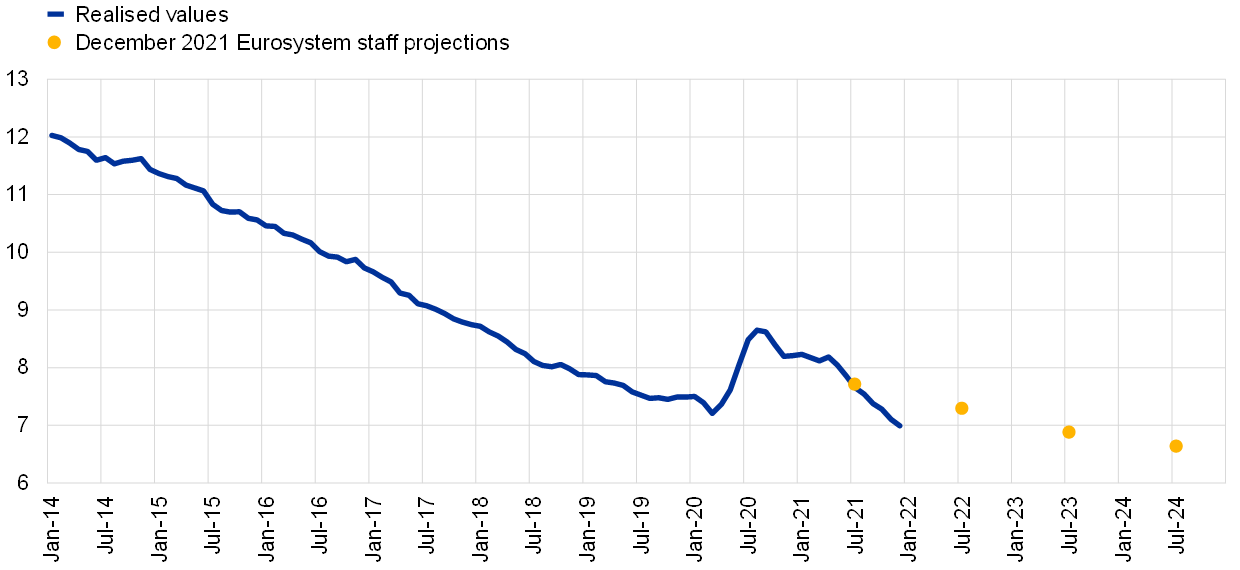

The re-anchoring of inflation expectations has also been reinforced by improving labour market prospects. Since labour costs constitute the dominant share of domestic costs, it is difficult to sustain inflation at the target two per cent level if the labour market is too weak. Chart 8 shows the evolution of the unemployment rate since 2014, while Chart 9 shows the evolution of projected unemployment during the pandemic. Chart 8 and 9 show that the labour market has turned out to be stronger than was expected during the pandemic and that the latest staff projections postulate a significant further decline of the unemployment rate over 2022-2024, to a level of 6.6 per cent toward the end of this horizon. We would have to look back more than forty years to see such a low level of unemployment in the euro area. Of course, while these charts focus on the unemployment rate, it is always essential to take into account a wider set of indicators of labour market slack, especially in view of the role of pandemic-related labour market policies that might distort for longer the relation between the measured unemployment rate and the overall degree of labour market tightness.[3]

Chart 8

Unemployment rate in the euro area

(percentages of the labour force)

Sources: Eurostat and December 2021 ECB/Eurosystem staff projections.

Note: The latest observations are for December 2021.

Chart 9

Unemployment rate in ECB/Eurosystem staff projections

(percentages of the labour force)

Sources: ECB/Eurosystem staff projections and ECB staff calculations.

The projected tightening of the labour market in part reflects the success of macroeconomic policies during the pandemic, with fiscal policy focused on protecting household incomes, mitigating corporate vulnerabilities and maintaining the link between firms and workers through a focus on wage subsidy schemes and short-time working schemes rather than solely focusing on improving unemployment support programmes. It also is predicated on favourable aggregate demand conditions, including supportive financing conditions and fiscal policies. However, the projected tightening of the labour market also reflects the ageing of the euro area population and the possibility that the scale of the labour supply contribution from foreign workers may be weaker compared to the pre-pandemic trend. While such labour supply trends might tighten the labour market, these also have adverse implications for the trend path for potential output.

In summary, monetary policy must take into account both the near-term and medium-term forces shaping inflation dynamics. In line with its new monetary policy strategy, it should be clear that the ECB will set its monetary policy to deliver its symmetric two per cent target over the medium term, tolerating neither over-reactions nor under-reactions to emerging inflation risks. In particular, if the medium-term inflation dynamic is anticipated to stabilise around the two per cent target, this will permit a gradual normalisation of monetary policy. Whereas if inflation threatens to persist significantly above the two per cent target over the medium term, a tightening of monetary policy will be required. And finally, if inflation is anticipated to fall significantly below the two percent target over the medium term, setting an accommodative monetary policy will be necessary.

- See Lane, P.R. (2022), “Bottlenecks and monetary policy”, The ECB Blog, 10 February.

- At the same time, the visible decline in market-based measures of inflation compensation to below-target levels in recent weeks that is shown in Chart 6 will warrant monitoring. Since market-based measures of inflation compensation combine compensation for expected inflation and compensation for inflation risk premia, such indicators do not allow for straightforward interpretation but the variation over time in these measures is informative.

- For inflation dynamics, it is also essential to monitor the extent of slack in capital utilisation and the mix of domestic and export demand (see also Lenza, M. and Jarocinski, M. ”An Inflation-Predicting Measure of the Output Gap in the Euro Area”, Journal of Money, Credit, and Banking, Vol. 50(6), pp. 1189-1224). In particular, the relation between output levels and price-determining expenditure levels will be different between current account surplus regions and current account deficit regions (see also See Galstyan, V. (2019), “Inflation and the Current Account in the Euro Area,” Economic Letter No 4, Central Bank of Ireland and Eser, F., Karadi, P., Lane, P.R., Moretti, L. and Osbat, C. (2020), “The Phillips Curve at the ECB,” The Manchester School, Vol. 88(S1), pp. 50-85..

Euroopan keskuspankki

Viestinnän pääosasto

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu.

Kopiointi on sallittu, kunhan lähde mainitaan.

Yhteystiedot medialle