The euro and European financial market integration

Speech by Otmar Issing, Member of the Executive Board of the ECB8th German Corporate Conference, Deutsche Bank, Frankfurt am Main, 31 May 2005

Introduction

It is a pleasure for me to deliver a speech on the euro and European financial market integration here at the Deutsche Bank in Frankfurt. Frankfurt has recently become the home of the European Central Bank and the euro and is the place at which the in 1870 founded Deutsche Bank in 1886 opened a branch. The history of the Deutsche Bank reflects the economic and political relations of several German generations. The Deutsche Bank’s initial capital was denominated in the Taler, the old Preussian currency, succeeded by the Mark, Rentenmark, Reichsmark and, in 1948, by the Deutsche Mark. The new-born generation will only experience the Deutsche Bank capital denominated in the euro.

The topic of today is of natural interest to all of us: bankers, firms, households, central bankers and other policy makers. A high degree of financial integration increases the efficiency of the economy, by reducing the cost of capital and improving the allocation of financial resources. This will ultimately lead to higher and more sustainable non-inflationary growth. Financial integration also fosters the diversification of activities and risks of financial institutions and thus the efficiency and soundness of the financial system. This will result in higher productivity in the financial sector and therefore higher welfare. Moreover, for the smooth functioning of the single monetary policy it is important that decisions are not channelled to euro area countries in a non-uniform manner due to fragmented financial markets. For all these reasons, the European Central Bank strongly supports efforts aimed at enhancing the European financial integration.

I will argue that those financial markets that are crucial for the transmission of the ECB monetary policy are nowadays satisfactorily integrated and that the euro has played a very important role to come so far. Imperfections hampering a more advanced degree of European financial integration remain, however, and I will discuss ways forward to tackle these obstacles.

I. Main features of present situation

The present situation of European financial integration is the result of several policy initiatives that have been set up to lift obstacles and so to promote financial integration. The most important stimulus has been the establishment of the Economic and Monetary Union, in particular Stage Three with the introduction of the euro and a single monetary policy in the monetary union. Before speaking about the impacts of the euro on the European financial market integration, I would like to elaborate on the current degree of financial market integration in the euro area.

How integrated are European financial markets nowadays? The answer depends on the segment of the financial markets.[1] The degree of integration of the wholesale financial markets in the euro area is very advanced, but the retail financial markets are comparatively more fragmented.

Following the introduction of the single monetary policy and the ceasing of exchange rate risk among euro area countries, a liquid money market with single interbank market interest rates was established. A large share of the daily transactions in this market is cross-border. This is very important, since any change in official ECB interest rates first affects the money market. The degree of integration of the secured money markets, such as the repo market, is high, but less advanced than unsecured money markets due to a still fragmented infrastructure for these money market transactions.

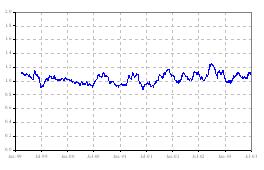

The distinction in the degree of integration in the two segments of the money market is illustrated in Charts 1 and 2. The ratios between average cross-country EONIA/EURIBOR rate deviations and average within-country deviations remained close to one since 1999 onwards, whereas the ratios between average cross-country EUREPO rate deviations and average within-country deviations have been somewhat higher.

| Chart 1 Ratio between average cross-country EONIA rate deviations and average within-country deviations (30-day moving average) | Chart 2 Ratio between average cross-country EUREPO rate deviations and average within-country deviations (30-day moving average) |

|---|---|

|

|

| Source: European Banking Federation, ECB calculation. | Source: European Banking Federation, ECB calculation. |

In the government bond market segment, the degree of market integration is also high, given the convergence of bond yields. Government bond yields tend to be driven predominantly by common news. Government bond yields convergence is not perfect nor should it be so, given the presence of different credit and liquidity risks. The issuance activity at the euro-denominated bond market is nowadays higher than the sum of all issuances in former national currency denominated bonds. This holds particularly for the private segments.

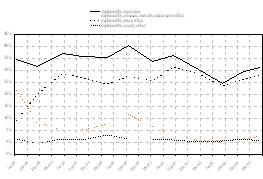

Chart 3 shows that the variation coefficient in government bond yields went close to zero with the run up to the introduction of the euro. Chart 4 shows that country effects are seen to explain only a small proportion of the cross-sectional variance of corporate bond yield spreads. Both charts are consistent with a high degree of integration in the bond market.

| Chart 3 Variation coefficient in government bond yield spreads for 2-, 5- and 10-year maturities | Chart 4 Explanatory factors of cross-sectional variance in corporate bond yield spreads |

|---|---|

|

|

| Source: ECB. | Source: Bloomberg and ECB calculations. |

Also equity markets in the euro area are reasonably well integrated, but less than money and bond markets. Integration is manifest through changes in the fundamentals underlying equity markets, such as increasing synchronisation of macroeconomic activities across the euro area, increasing reliance on intra-European trade and the internationalisation of corporate ownership and of the scope of corporate activities.[2] Also the convergence of equity premia can be associated with enhancing financial integration. Equity returns in the various euro area equity markets have increasingly been determined by common euro area factors. The introduction of new European stock indices has made it easier to gauge performance, and the trend to diversify equity investments across Europe has appreciably increased. Institutional investors increasingly hold foreign shares in their portfolios.

The integration of retail markets, such as loans to households and small and medium-sized enterprises, is lagging behind compared with the wholesale markets. This becomes evident from persistently cross-country differences for these bank lending rates and the rather limited cross-border retail banking activity. National banking sectors have remained largely segregated with only marginal cross-border penetration. Still less than 5% of total bank loans are granted cross-borders to customers in other euro area countries.

II. Impacts of the euro

What have the impacts of the euro been on the current state of the degree of European financial market integration? The euro has played a very important catalysing role for the financial integration process. Several impacts of the euro on the financial integration process in Europe have become evident over the past six years, although the time span since the introduction of the euro is still too short for drawing definitive conclusions. In parallel with the euro’s catalysing role in this regard, a host of other factors might have contributed to enhancing financial integration. These include the various steps towards gradual economic integration, structural and technological changes, globalisation and liberalisation.

Looking at the actual use of the euro in international capital and foreign exchange markets as well as an international financing currency, we observe that the euro share has remained broadly stable in recent years.[3] The euro share in the total stock of international debt securities was in 2004 31% and in foreign exchange transactions 37% based on survey results and 44% based on foreign exchange trades settled via Continuous Linked Settlement. There have been signs of an increasing use of the euro as an international settlement and invoicing currency.

I will today focus on three, interrelated, impacts of the euro on financial integration.

(1) Market- versus bank-based financing

While bank-based finance continues to be important in the euro area after the introduction of the euro there has been a clear trend towards market-based financing. This can be seen in traditional market segments, such as the fixed income and equity markets, but even more in “non-traditional” market segments, such as mortgage-backed and assets-backed securities and collateralised debt obligations markets. The growing importance of securitisation transactions is reflected in the remarkable growth of bonds issued by euro area non-monetary financial corporations.

What has the size of the impact of the euro on the euro area corporate bond market growth been? Tentative empirical evidence for the first five years of the euro suggests that the euro indeed has had a statistically sizeable direct impact on bonds issued by non-monetary financial corporations, which are mainly securitisation transactions. Issuers moved towards a euro area-wide perspective and benefited from easier access to the larger investor base. The euro and the idea of truly integrated euro area financial markets also have played an indirect effect by triggering a wave of mergers and acquisitions that, at least in part, has been funded by bonds. Conducting business in a common currency across the euro area had widened the market perspective of corporations to reach a sufficient euro area scale through mergers and acquisitions. The size of this indirect impact of the euro has been estimated to be up to 2½ percentage points per year of the annual bond market growth.

The amount outstanding of bonds issued by euro area non-financial and non-monetary financial corporations tripled since the end of 1998. The euro area corporate bond market has not only remarkably grown in quantitative terms, but also its qualitative nature has changed. The euro area corporate bond market is nowadays characterised by large issues with all possible investment and speculative-grade ratings from all types of economic sectors and typically low underwriting fees. For example, Telecom Italia managed earlier this year to successfully open the 50-year segment in the euro corporate bond market, just several weeks after the French Treasury had done so in the government bond market. As a consequence, bond markets are gaining importance as means of obtaining corporate finance.

(2) Relationship banking

Banks are increasingly adapting to the trend towards more market-based financing and thus transaction banking. As a consequence, the nature of relationship banking is gradually changing. Again, this process is not only influenced by the euro. Irrespective of the euro, relationship banking has come under pressure in recent years because more and more bank customers are no longer putting their foot in any bank office. They arrange their bank business from a distance, by mail, phone or especially via internet. The personal face of the bank employee has been replaced by a computer screen for a growing number of bank customers.

The first consequence of banks’ adoption to more market-based finance is that they generate more fee incomes from market-based transactions. The relation changes from banks providing funds to firms into banks assisting corporate clients in tapping the bond market.

The nature of relationship banking is also affected by the rapidly growing securitisation markets since the introduction of the euro. Securitisation allows banks to broaden and deepen the relation with their customers without necessarily keeping the loans on their balance sheets. Banks exploit their private information about the quality of the debtor or their greater ability to assess the value of the debtor. The separation of the origination and funding of credit from the allocation of the credit risk facilitates a broader dispersion of risk. With wider access to credit risk exposure, banks can reduce their vulnerability to idiosyncratic or industry-specific shocks. Securitisation provides banks the possibility to broaden and deepen their relation to, for instance, the car industry without increasing their exposure to that sector.

Another consequence of the broadening and deepening of the euro area corporate bond market, including securitisation transactions, is that the supply of credit can be less dependent on conditions affecting banks’ ability and willingness to grant a loan or take credit risk. Multiple avenues of corporate finance, that is the co-existence of a well-developed bank and market-based finance system, could in principle reduce the urgent need from corporate clients for the availability of bank credit during “bad times”. A broad, deep and liquid euro area corporate bond market can now be tapped for finance when banks cut back on lending or corporate profits are under pressure. Consequently, relationship banking, in the sense of banks granting loans at all times, might weaken.

Does this all lead to a disappearing of relationship banking? No, relationship banking will remain strong especially for households and those firms that are more exposed to asymmetric information, such as small and medium-sized enterprises. Bank customers may continue their habit of conducting local business according to regional conventions as long as costs of local information gathering, cultural and linguistic barriers exist.

(3) Pass-through of monetary policy

Banks also adapted to the change in corporate loan demand deriving from firms directly tapping capital markets. Banks have changed their price setting behaviour. Tentative empirical results suggest a quicker retail bank interest rate pass-through since the introduction of the euro in most segments of the retail bank market.[4]

What might explain the quicker retail bank interest rate pass-through in the euro area since the introduction of the euro? Likely economic explanations are lower interest rate variability and premia and lower pricing power of banks since 1999.

The higher stability of nominal interest rates across the maturity spectrum in an environment of medium-term price stability and the decline in money market variability facilitates the comparison of prices across different suppliers. As a consequence, bank customers have become more sensitive to changes in the interest rates on bank loans and deposits. Moreover, the ongoing consolidation of the European banking sector seems to have promoted higher efficiency in the banking markets. Traditional funding of bank loans by domestic deposits has declined since the euro. Notwithstanding the consolidation in the banking industry, new players have become active in the retail bank market, such as internet banks. Banks also face intensified competition from other financial intermediaries such as insurance companies and pension funds.

III. Remaining imperfections

Notwithstanding the substantial progress over recent years towards further financial market integration, imperfections remain at European financial markets. I will focus on the retail credit markets, while their integration is comparatively less advanced. I will distinguish between two, interrelated, issues: infrastructure and cross-border market integration.

Infrastructure

The distinction between the degree of integration between the wholesale and retail segment is also manifest in the payments and settlements systems. Whereas wholesale transactions take place in integrated systems, such as TARGET, the retail payments systems are still fragmented, especially due to the fact of a lack of common standards. Only in recent years banks started to develop pan-European retail payment products and systems. The main obstacles to tackle are the higher fees for cross-border transactions than for domestic ones and differences in legal systems.

Cross-border market integration

Cross-border market integration allows banks to diversify their loan portfolio, improving their risk-return profile, and to reduce liquidity risk by diversifying their deposit base. Of course, these gains will only be realised if existing markets differ from one another in terms of business cycle and industry structure. The number and value of bank merger and acquisition deals were high in 1998 to 2000, but strongly declined afterwards and were predominantly of a domestic nature. These developments suggest some remaining frictions for cross-border bank consolidation, an issue closely followed by the European Commission.

Another related aspect is the low degree of internationalisation of the banking sector. The share of foreign banks in the total assets of the EU-15 banks has been less than a quarter in 2003 and rarely higher than before 1999.[5] Moreover, striking differences exist across EU countries. In the new EU member states the share is on average higher than two third. Also in a financial centre such as Luxembourg the banking sector is dominated by foreign banks.

IV. Ways forward

What are the ways forward in lifting these remaining obstacles? All market participants, that are banks, bank customers and central banks, should contribute to this process.

Banks will contribute by the creation of a Single European Payment System. Not least to – let us call it strong encouragement – by the European Commission and the European Central Bank, the European banking industry will introduce a new euro area payment schemes for electronic credit transfers and direct debits as well as a unified framework for debit and credit cards by January 2008. This is a very positive development. In this payment system cross border euro transactions can be carried out with the same efficiency and quality as domestic euro payments. One bank account is then in principle sufficient for the whole euro area, since the new system is likely to apply initially only to the euro area, and not immediately to the whole European Union.

Another contribution of banks is to foster efficiency and productivity in the banking sector. This could take the form of continued consolidation at the national level and of enhanced cross-border market integration, aiming to reap the full benefits of economies of scale and scope. The household credit markets could particularly potentially benefit from these efficiency and productivity gains.

Bank customers will also contribute to enhance the retail integration process. Firms and households will increase their cost awareness and frequency to regularly reassess their fidelity towards their chosen service provider. A growing availability of internet sites that provide price and product advices are likely to strengthen retail bank customers’ cost and product awareness.

Finally, the best contribution that monetary policy can make to a smooth functioning and integration of European financial markets and thus to economic growth and satisfactory employment prospects is to maintain a steady medium-term price stability orientation. Such a policy will be beneficial, as it will minimise the adverse effects of inflation and high inflation uncertainty. In an environment of low inflation expectations, inflation risk premia become less and less important as a determinant of financial prices. Ultimately, this results in a more efficient allocation of financial resources and therefore higher welfare.

Concluding remarks

Let me now conclude. What are the lessons to take home?

Firstly, the wholesale financial market integration in Europe is very advanced, whereas the integration of the retail sector is lagging behind. European firms and households have already benefited from financial integration, through the efficiency gains of wholesale integration. Further potential benefits for retail bank customers are within reach if integration were to come to the final stage of the value-added chain, in the retail financial sector. Secondly, the euro has played a very important catalysing role for the observed enhanced financial market integration since 1999. The third lesson is that the main remaining imperfections hindering European financial integration are in the retail payments and settlements infrastructure and limited cross-border market integration. My fourth and final message is that all of us: banks, firms, households, and central banks, can and should contribute to the challenging and inspiring process of European financial market integration.

-

[1] European Commission (2004), Financial integration monitor 2004, Commission staff working document SEC 559; European Central bank, 2004, Research network on capital markets and financial integration in Europe. Results and experience after two years, December; L. Baelen, A Ferrando, P. Hördahl, E. Krylova and C. Monnet (2004), Measuring financial integration in the euro area, ECB Occasional Paper, 14; and P.P. Barros, E. Berglöf, P. Fulghieri, J. Gual, C. Mayer and X. Vives (2005), Integration of European banking: the way forward, Monitoring European Deregulation 3, CEPR, Fundación BBVA.

-

[2] K. Adjaouté and J.-P. Danthine (2004), Equity returns and integration: is Europe changing?, FAME Research Paper, 117.

-

[3] European Central Bank (2005), Review of the International Role of the Euro, January.

-

[4] G. de Bondt (2005), Interest rate pass-through: empirical results for the euro area, German Economic Review, 6, 1, 37-78.

-

[5] ECB, (2004), Review of structural developments in the EU banking sector (year 2003), November.

Euroopan keskuspankki

Viestinnän pääosasto

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu.

Kopiointi on sallittu, kunhan lähde mainitaan.

Yhteystiedot medialle