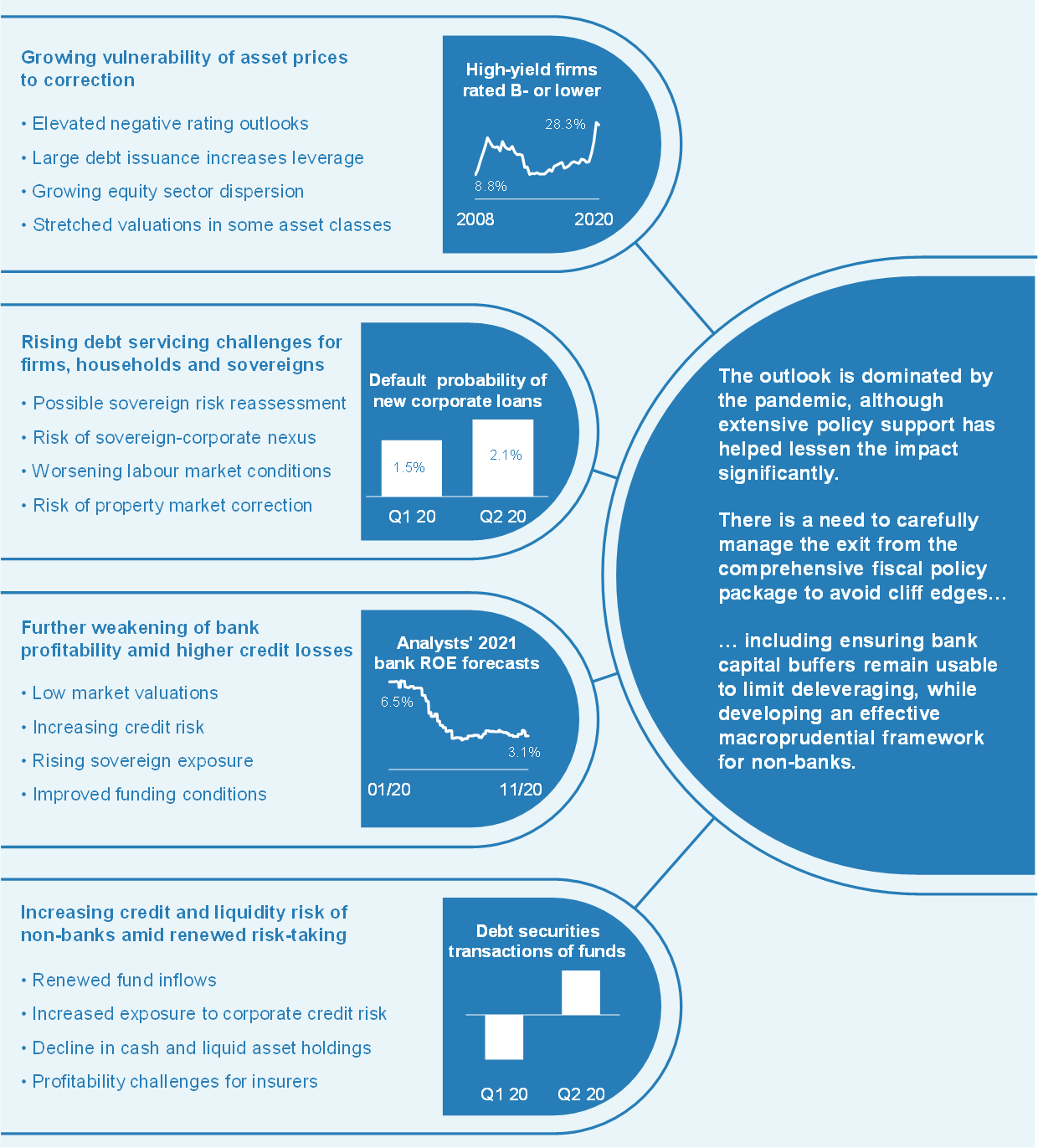

The year at a glance

The euro area economy was struck by the extraordinary and severe coronavirus (COVID-19) pandemic shock in 2020. Economic activity contracted sharply during the first half of the year as a consequence of lockdown measures and heightened risk aversion. The strong and coordinated monetary and fiscal policy reaction, combined with positive news on vaccines, helped stabilise activity in the second half of the year. Overall, euro area GDP contracted by 6.6% in 2020. Annual headline inflation declined to 0.3%, from 1.2% in 2019, in large part as a result of falling energy prices, although there were also factors relating to the pandemic. For example, sectors that were hardest hit by the crisis, such as transport and hotels, contributed to the fall in inflation during the second half of the year.

The ECB substantially eased its monetary policy stance to counter the negative impact of the pandemic on the euro area economy, through a comprehensive set of measures that were recalibrated in the course of the year. This included: introducing a new, temporary, pandemic emergency purchase programme; relaxing eligibility and collateral criteria; and offering new longer-term refinancing operations. The monetary policy response was a crucial stabilising force for markets and helped to counter the serious risks posed by the pandemic to the monetary policy transmission mechanism, the outlook for the euro area economy and, ultimately, the ECB’s price stability objective. In addition, macroprudential policies focused on maintaining the flow of credit to the economy, while ECB Banking Supervision introduced microprudential measures to moderate the impact of the crisis and promote the resilience of the European banking sector.

In January, the Governing Council launched a review of the ECB’s monetary policy strategy, to ensure it remains fit for purpose. The review aims to thoroughly analyse the implications of the profound changes that have occurred since the previous review in 2003. These include the persistent decline in inflation and equilibrium interest rates, and the impacts of globalisation, digitalisation and climate change. The review will consider whether and how the ECB should adjust its monetary policy strategy in response, and is expected to be concluded in the second half of 2021.

The ECB is exploring all possible ways within its mandate in which it could contribute to limiting the potentially substantial economic and social consequences of climate change. This includes careful analysis across relevant policy areas, investing the ECB’s pension fund and own funds portfolios in a sustainable and responsible fashion and focusing on the carbon footprint of the ECB itself. The ECB has recently created a climate change centre in order to shape and steer its climate agenda.

The Eurosystem has developed a comprehensive retail payments strategy to harness the innovative potential of digitalisation, focusing on enabling instant payments, developing a pan-European payment solution and investigating the possibility of a digital euro. A public consultation on a digital euro was launched in October 2020 to ensure that any new form of money and payments the Eurosystem may provide would retain the public’s trust.

The ECB enhanced its communication and outreach in 2020 to meet the challenges posed by the pandemic and to better understand the economic concerns and imperatives of European citizens. It also introduced the ECB Blog. 19 posts were published in 2020, with many focusing on the ECB’s response to the crisis. The first ECB Listens event took place in October 2020, and the ECB Listens Portal received almost 4,000 comments on the monetary policy strategy.

2020 was a year of intense and urgent activity, which was conducted in close cooperation with European institutions but also with other central banks across the world to confront the immense exogenous shock faced by the global economy. The ECB played its part.

Frankfurt am Main, April 2021

Christine Lagarde

President

The year in figures

1 The economy was hit by the extraordinary and severe pandemic shock

In 2020 the global economy underwent a deep recession amid unprecedented challenges. The COVID-19 shock was, however, of a more exogenous nature than the factors behind the previous crises in 2008 and 2011-12. While in previous crisis episodes specific problems in the financial sector had taken centre stage, the recession in 2020 had its root cause outside the economy. The spread of COVID-19 had a very severe impact on economic activity, initially in China and later at the global level. International trade contracted sharply, the functioning of global value chains was severely impaired and uncertainty in global financial markets soared.

The euro area economy also suffered the intense impact of the pandemic. The impact could be seen, for instance, in consumption, which contracted sharply in the first half of the year as a consequence of widespread lockdown measures and heightened risk aversion. Activity, especially in the services sector, also weakened markedly in view of a lack of demand and restrictions on activity. As a result, real GDP contracted at exceptionally fast rates in the second quarter of the year. At the same time, monetary and fiscal policymakers acted promptly and with determination to address the collapse in demand and the high levels of uncertainty, inter alia ensuring favourable and stable financing conditions and continued access to liquidity. From the onset of the COVID-19 crisis, expectations about the depth and duration of the recession were greatly affected by the prospects for medical solutions, especially a vaccine. Together with strong and coordinated policy action, positive news in the late autumn relating to progress in vaccine development led to a gradual rebuilding of confidence. While growth developments remained volatile in the second half of the year when a renewed wave of contagion hit, growth expectations firmed and stabilised. Price developments were also strongly affected by the pandemic. As a result of faltering demand, lower oil prices and weakened activity, HICP inflation declined over the course of the year and hovered in negative territory from August onwards. Other factors, such as the temporary reduction in the German VAT rate in the second half of the year, also pushed inflation down. At the same time, the expectation of a solid recovery in 2021 and a reversal of temporary factors such as the German VAT rate reduction underpinned the prospect of a pick-up in inflation. Decisive policy action kept credit and financing conditions supportive and largely offset the tightening impact on banks’ credit standards stemming from the deterioration in the risk environment. Although the market dislocation induced by the pandemic shock led to a sharp tightening of financial conditions in March, swift policy action contributed to an overall decline of euro area government bond yields in 2020 and to the gradual recovery of euro area equity prices in the second half of the year from their pandemic lows. The period of high uncertainty also led to an acceleration in money and credit growth, reflecting a strong preference for and the build-up of liquidity by firms and households.

1.1 The pandemic caused a deep economic slump

The coronavirus caused the largest contraction in the global economy since the Great Depression, but positive vaccine news led to a gradual rebuilding of confidence

The development of the COVID-19 pandemic, along with the accompanying virus containment measures and policy support to cushion the economic impact of the pandemic, were the key determinants of the growth trend at the global level. The global economy was hit by a sharp external shock and overall governments responded with strong policy support to cushion the pandemic’s economic impact. After reaching a trough in the second quarter of 2020 due to the virus containment measures, the global economy started to recover in the third quarter as the pandemic and containment measures eased and news of effective vaccines emerged. However, the second wave of the pandemic and the reintroduction of strict containment measures in some advanced economies slowed down growth considerably in the last quarter of the year (see Chart 1). Across large emerging market economies, quarterly growth was negative in the first half of 2020, but recovered strongly in the second half.

Chart 1

Global GDP growth

(annual percentage changes; quarterly data)

Sources: Haver Analytics, national sources and ECB calculations.

Notes: Regional aggregates are computed using GDP adjusted with purchasing power parity weights. The solid lines indicate data and go up to the fourth quarter of 2020. The dashed lines indicate the long-term averages (between the first quarter of 1999 and the fourth quarter of 2020). The latest observations are for 25 February 2021.

The sharp global economic contraction was mainly driven by a substantial decline in services sector output, which was affected strongly by the pandemic containment measures, and a contraction in trade and investment. Manufacturing sector output growth recovered faster than services sector output growth, supported by government stimulus plans, increased demand for electronics, computers and medical products, and the quicker removal of pandemic containment measures compared with the more face-to-face services sector.

Trade and investment contracted considerably in 2020, driven by virus containment measures and trade disruptions

COVID-19-related disruptions and uncertainty rose sharply and remained elevated, weakening the global economy. The pandemic also disrupted international trade and global supply chains. These disruptions moderately eased in the second half of 2020 as virus containment measures were only partly lifted. Despite the US-China phase-one deal, trade tensions between the two countries remained elevated, as shown by a range of different indicators. Amid elevated trade tensions, the pandemic’s hit to demand and earlier enacted tariffs drove the sharp decline in trade, while the increased uncertainty and deteriorating economic sentiment held back investment (see Chart 2).

Chart 2

Global trade growth (import volumes)

(annual percentage changes; quarterly data)

Sources: Haver Analytics, national sources and ECB calculations.

Notes: Global trade growth is defined as growth in global imports including the euro area. The solid lines indicate data and go up to the fourth quarter of 2020. The dashed lines indicate the long-term averages (between the fourth quarter of 1999 and the fourth quarter of 2020). The latest observations are for 25 February 2021.

Headline inflation fell, but core inflation decreased less

Global inflation declined in 2020, reflecting weak global demand linked to the pandemic (see Chart 3) and the sharp decline in the prices of many commodities. In the OECD area, headline annual consumer price inflation fell from around 2% in the second half of 2019 to 1.2% in December 2020 on account of falling energy prices and slowing food price inflation. Underlying inflation (excluding energy and food) declined less than headline inflation to around 1.6% at the end of 2020.

Chart 3

OECD consumer price inflation rates

(annual percentage changes; monthly data)

Source: Organisation for Economic Co-operation and Development (OECD).

Note: The latest observations are for January 2021.

Oil prices fluctuated, driven by expectations of weak global demand

Oil prices declined sharply in the first half of the year, following the sharp fall in global demand, in particular as travel and work-from-home restrictions led to lower oil consumption. The price of the international benchmark Brent crude oil fluctuated widely between USD 20 (its lowest level in two decades) and USD 70 per barrel in 2020. The price of the US benchmark West Texas Intermediate oil fell below zero for a brief period in April.

The euro appreciated against currencies of euro area trading partners

The euro appreciated by around 7% in nominal effective terms over the course of 2020. In bilateral terms, this was driven by an appreciation of the euro mainly against the US dollar. The euro-pound sterling exchange rate rose, but exhibited significant volatility throughout 2020 mainly on account of changing expectations relating to Brexit.

The risks to global activity were tilted to the downside, but the prospect of a medical solution could boost the economic recovery

At the end of 2020, in the context of positive developments regarding COVID-19 vaccines, the outlook for global growth entailed a strong recovery in 2021. This outlook was highly uncertain however and, on balance, the risks to global activity were tilted to the downside, as the surge in new infections and further containment measures in major economies were affecting the pace of the recovery.[1]

1.2 The euro area economy co-moved closely with the global economy[2]

Following a moderation in economic activity in 2019, euro area real GDP contracted by 6.6% in 2020 (see Chart 4). The dramatic decline in economic activity and its unevenness throughout 2020 were the consequences of the impact of the COVID-19 pandemic shock and the associated lockdown measures implemented to contain the spread of the virus. The first wave of the pandemic hit euro area countries mainly between March and April, at a speed and with an intensity which were unprecedented, and was accompanied by strict economy-wide containment measures in most countries. As a result of these measures, euro area economic activity contracted by a cumulative 15.3% in the first half of 2020. The containment of the pandemic and the lifting of the containment measures, as of May 2020 in the majority of countries, led to a strong rebound in activity in the third quarter. However, by the autumn economic activity had started to decelerate again and the renewed spike in infections generated a further round of lockdowns in the final quarter of the year, which were however more targeted than those in place during the first wave. While the pandemic above all constituted a common shock hitting all economies, the economic impact of the pandemic was also heterogeneous to some degree across euro area countries, largely due to the different exposures to the sectors most affected by social distancing measures and also reflecting differences in the intensity of the health crisis itself and in the extent and character of the implemented stimulus measures. By the end of 2020 economic activity was 4.9% below pre-pandemic levels in the euro area, featuring considerable heterogeneity across countries, with Spain 9.1% below its pre-pandemic level and the Netherlands 3.0% below its pre-pandemic level.

Chart 4

Euro area real GDP

(annual percentage changes; percentage point contributions)

Source: Eurostat.

Note: The latest observations are for the fourth quarter of 2020.

Compared with recent long-lasting recessionary episodes, such as the 2008-09 global financial crisis or the 2011-12 euro area sovereign debt crisis, the recession accompanying the pandemic was more acute in the early phases. At the same time, strong signals and expectations of a recovery emerged much earlier than in other crises. This mainly reflected the exogenous nature of the COVID-19 shock, the role of timely and determined monetary and fiscal policy measures, and progress in developing vaccines, as well as the much more contained feedback loops with the financial sector compared with previous crisis episodes, the latter also helped by the targeted central bank measures.

Euro area private consumption decreased by 8.0% in 2020, declining particularly strongly in the first half of 2020 mainly on account of the lockdown measures. As losses in real disposable income caused by the lockdowns were buffered by substantial public transfers, the decline in consumption was also reflected in a sharp increase in the saving rate. As lockdown measures were eased significantly in the third quarter of 2020, private consumption showed a robust rebound, which was however interrupted in the final quarter of the year during the second wave of the pandemic. By the end of 2020 private consumption remained below pre-pandemic levels in the context of the hit to labour markets and the high degree of uncertainty.

Business investment also collapsed in the first half of 2020. As a result of the implemented lockdown measures and the ensuing severe falls in revenue, firms postponed investment decisions. Furthermore, impaired global and domestic demand continued to act as a drag on investment. In the second half of the year the business investment outlook was characterised by further heightened uncertainty amid a second wave of the pandemic and the expectation of lasting moderate developments in view of a weakened external environment, more moderate final demand and the observed deterioration in corporate balance sheets.

The net contribution by the external sector to euro area output was also negative in 2020. The lockdown in China, imposed to suppress COVID-19, dented euro area trade at the beginning of the year and the measures to contain the spread of the virus in Europe led to a slump in both imports and exports in the second quarter, with exports being hit the hardest by the temporary closure of business activities. Over the summer months the easing of restrictions paved the way for a rebound in trade flows, with improvements lagging behind in the hardest-hit travel, tourism and hospitality sectors. The renewed wave of the pandemic slowed down the recovery of euro area trade, which was incomplete at the end of the year.

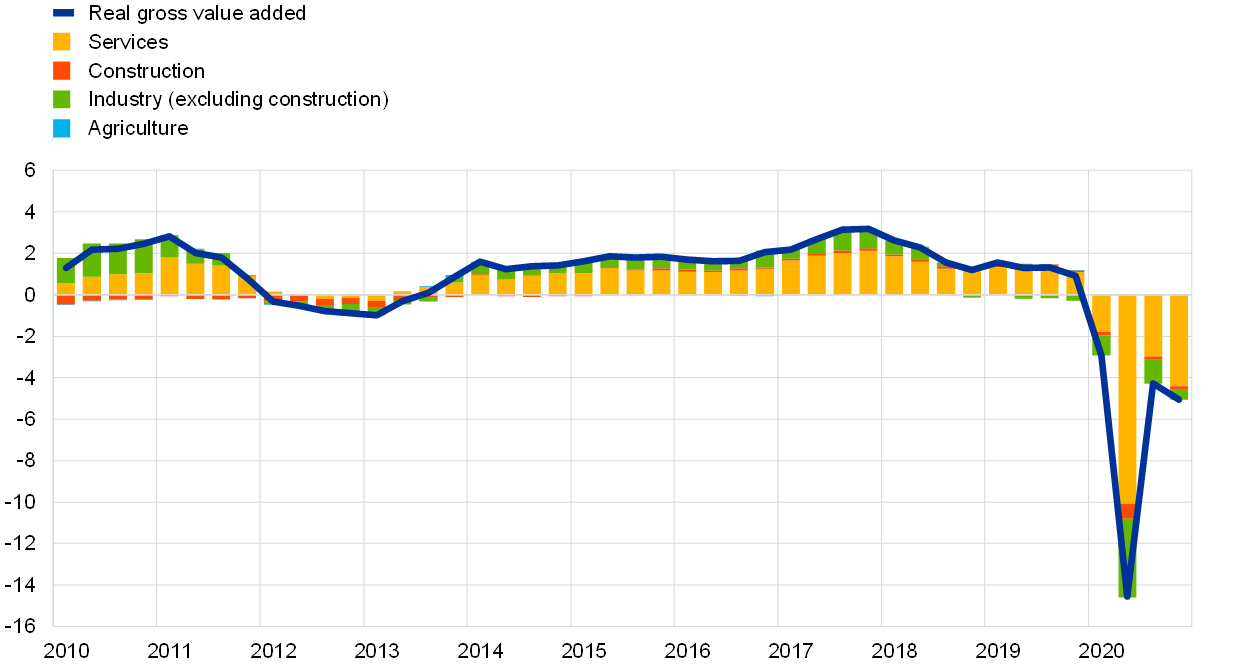

The impact of COVID-19 on output growth was also uneven across sectors, with the services sector contributing the most to the fall in real gross value added, reflecting its particular exposure to social distancing measures as well as the sectoral composition of the euro area economy (see Chart 5).

Chart 5

Euro area real gross value added by economic activity

(annual percentage changes; percentage point contributions)

Source: Eurostat.

Note: The latest observations are for the fourth quarter of 2020.

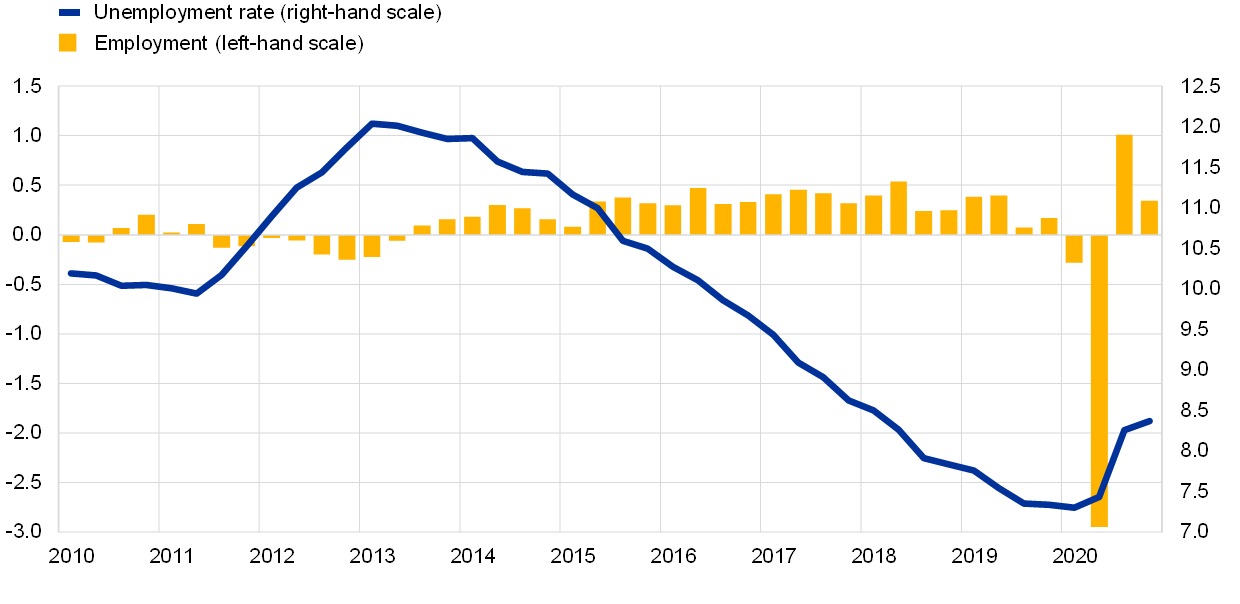

Euro area labour markets weakened, although government policies helped to cushion the impact on unemployment

Employment losses in 2020 remained contained, reflecting the impact of job retention schemes

While employment growth was also significantly affected by the pandemic, labour market policies shaped the outcomes in euro area labour markets in 2020 (see Chart 6). Compared with the large and rapid contraction of economic activity by about 15% during the first half of 2020, the employment contraction was smaller, but still very significant. Total employment decreased by about 5 million people over the same period, which brought employment back to pre-2018 levels. Government support measures across euro area countries helped to limit job dismissals (see Box 1 for a discussion on job retention schemes). In comparison with previous economic and financial crises, euro area governments increased the number of workers covered by job retention schemes, which greatly limited job lay-offs, thereby helping to preserve firm and worker-specific human capital. Nevertheless, the labour force participation rate decreased significantly during the pandemic crisis and about 3 million people moved out of the labour force during the first half of 2020. The ongoing labour market adjustment has affected workers differently because of the relevance of the current crisis for the services sector and for the firms most affected by social distancing measures and mobility restrictions. In particular, the labour force contracted by almost 7% for people with low skills and 5.4% for those with medium skills, but it actually grew by 3.3% for those with high skills.

Chart 6

Labour market indicators

(percentage of the labour force; quarter-on-quarter growth rate; seasonally adjusted)

Source: Eurostat.

Note: The latest observations are for the fourth quarter of 2020.

The increase in the unemployment rate was smaller than in previous recessions

Employment contracted by 1.9% in 2020, while the unemployment rate rose to 8.4%. The increase in the unemployment rate was smaller than in previous recessions, such as the ones in 2008-09 and 2011-12, also thanks to the timely and extensive response of euro area governments. At the same time, hourly labour productivity growth averaged around 1% in 2020 and was buffered by the significant reduction in hours worked because of the use of job retention schemes.

Box 1

The medium and long-term economic impact of COVID-19

Euro area labour markets have reacted to the economic consequences of the COVID-19 pandemic in a rather resilient fashion, supported by economic policies – such as job retention schemes and loan guarantees – which have helped to limit employment losses and to avoid an abrupt surge in firm exits as a result of the pandemic. In order to prevent long-term scars from the crisis, and also to avoid impeding the necessary restructuring of the economy, the design and timing of the exit strategies for these policies will be as important as those of the support packages themselves. Looking ahead, the long-term consequences of the pandemic for labour mobility, as well as the increasing adoption of digitalisation, may call for significant job and firm reallocation.

In a recent survey of leading euro area companies, considerable emphasis was placed on how the pandemic has accelerated the take-up of digital technologies, raising productivity but reducing employment in the long term.[3] When asked to explain, in order of importance, up to three ways in which the pandemic would have a long-term impact on their businesses, the most frequently cited effects related to the increased use of the “home office” environment and the accelerated use of digital technologies. Other factors widely mentioned were a more permanent reduction in business travel and/or an increase in virtual meetings, as well as increased e-commerce (or – in business-to-business segments – “virtual selling”). A large majority of the respondents agreed that their business would be more efficient and/or more resilient as a consequence of what had been learned during the pandemic. Around three-quarters of respondents said that a significantly higher share of their workforce would work remotely in the long term. At the same time, they did not believe that remote working would reduce staff productivity. In this regard, while reduced informal personal interaction was seen as a downside, many advantages were also perceived, including the time gains due to diminished commuting needs, the possibility to better juggle home and work commitments, and increased connectivity. Consistent with this, more than half of the respondents said that productivity in their business or sector would increase, while hardly any saw productivity decreasing as a long-term consequence of the pandemic. Conversely, more than half anticipated a negative long-term impact on employment, compared with only around 10% who saw a positive long-term effect on employment. Views on the long-term impact on sales as well as prices, costs and wages were more mixed, but on balance negative.

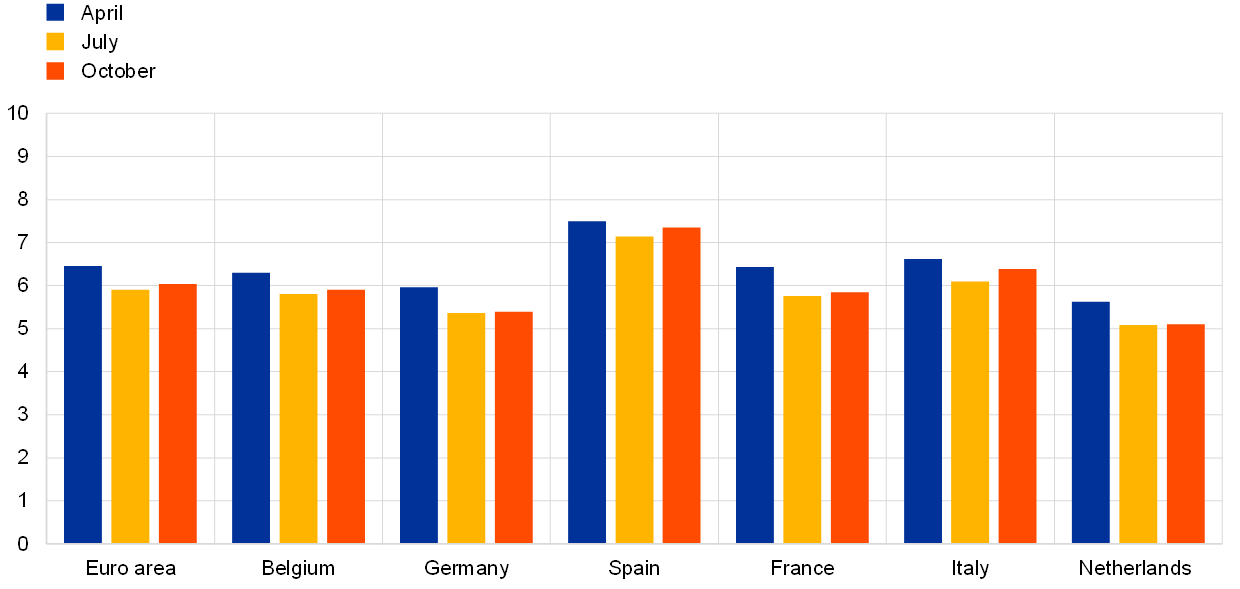

The pandemic crisis has had a significant impact on the euro area labour market. The euro area unemployment rate (see Chart A, blue line) has shown a muted response compared with the contraction in economic activity and does not fully reflect the impacts of COVID-19 on the labour market. To better measure the amount of labour underutilisation during the pandemic crisis, the standard unemployment rate can be adjusted to reflect the number of discouraged workers who are currently inactive (see Chart A, yellow line). In addition, a special feature of the pandemic crisis has been the widespread use of job retention schemes, which have helped to protect jobs while reducing working hours and supporting the income of workers. The number of workers in job retention schemes reached about 30 million (about 19% of the labour force) in April 2020. Combining the standard unemployment rate with discouraged workers and also with the number of workers in job retention schemes (see Chart A, red line) hence provides a more representative picture of the state of labour underutilisation.

Chart A

Standard and non-standard measures of unemployment

(percentages)

Sources: ECB calculations based on Eurostat data.[4]

Overall, the COVID-19 shock has increased the share of firms at risk, which could have a further long-term effect on employment losses. Following the strong decline in economic activity in the second quarter of 2020, the recovery seen during the third quarter suggested that the pandemic shock could be of a largely transitory nature. However, the second wave of lockdown measures intensified the risk of long-term scarring effects on economic growth and jobs. The COVID-19 shock has affected sectors heterogeneously, with weaker effects on firms featuring a higher adoption of digital technologies and a stronger impact on firms involved in face-to-face interactions. The latter firms might be at risk of exiting the market, depending on the length of the pandemic and whether national policy measures are successful in limiting and bridging liquidity shortfalls. The second distinct characteristic of the COVID-19 shock relates to its exogenous nature, implying that the shock has affected both productive and unproductive firms. Indeed, the cleansing effect resulting from the exit of less productive firms, typically more affected by a productivity shock, will be smaller than in previous crises because also more productive firms with temporary liquidity problems might be at risk.[5]

1.3 The fiscal policy response to the crisis

The COVID-19 pandemic posed unprecedented challenges to public finances

In 2020 public finances were deeply marked by the COVID-19 pandemic, which posed unprecedented challenges to governments, but also triggered a strong policy response. The fiscal position was significantly affected on both sides of government budgets, through the increase in expenditure needed to tackle the crisis and through lower fiscal revenues reflecting both the sharp recession and expenditure measures targeting firms and households. As a result, the general government deficit ratio for the euro area increased from 0.6% of GDP in 2019 to 8.0% of GDP in 2020, according to the December 2020 Eurosystem staff macroeconomic projections (see Chart 7). Reflecting the strong economic support from governments, the fiscal stance[6] thus went from mildly expansionary in 2019 to highly accommodative, at 4.8% of GDP, in 2020, although it should be noted that the size of the fiscal response and thereby the fiscal stance differed significantly across countries. Overall, however, the swiftness and scope of the support provided by euro area governments demonstrated a heightened capacity to react in times of crisis and to do so in a coordinated way. The latter was facilitated by the activation of the general escape clause foreseen in the Stability and Growth Pact.

Chart 7

General government balance and fiscal stance

(percentage of GDP)

Sources: Eurostat and ECB calculations.

The bulk of additional spending was related to either direct costs of addressing the health crisis or support to households and firms

According to estimates by the European Commission[7], the fiscal measures taken in response to the pandemic amounted to 4.2% of GDP in 2020 for the euro area as a whole. The bulk of this additional spending was related to either direct government costs of addressing the public health crisis or support measures targeted at households and firms (see Chart 8). A primary aim of these support measures was to preserve employment and production capacity so that the economy is well positioned to stage a rapid recovery once the pandemic abates. In line with this aim, the large majority of the support provided to households was through short-time work or furlough schemes designed to avoid mass unemployment, while only a smaller part took the form of direct fiscal transfers to households.[8] Towards the end of the first wave of the pandemic, some more limited measures aimed at supporting the economic recovery were introduced, such as cuts to indirect taxes or an increase in public investment projects. However, given that the pandemic was far from resolved in 2020, with the eruption of a second wave in the autumn, these measures are more likely to play a prominent role going forward.

Chart 8

Estimated composition of COVID-19-related measures in 2020

Sources: ECB calculations based on the 2021 draft budgetary plans.

Governments also provided sizeable liquidity support to the economy

In addition to the fiscal support for their economies, euro area countries provided a sizeable amount of loan guarantees to bolster the liquidity position of firms, particularly to small and medium-sized enterprises, which often do not have easy access to external financing. Such liquidity support was particularly prominent in the policy mix in the early phase of the crisis before other support programmes were put in place. In total, these guarantees amounted to around 17% of GDP for the euro area as a whole.[9] The loan guarantees are contingent liabilities for governments and the amount of guarantees called on will therefore constitute additional public spending. Moreover, many governments also granted tax deferrals and provided loans to and made equity injections into firms. Such cash injections and other liquidity support are generally not captured in the budget balance, but are partly reflected in government debt.

Debt levels of governments were adversely affected, but risks to debt sustainability continued to be well contained

The crisis has also led to a marked increase of debt levels of sovereigns across the euro area. This was reflected in the December 2020 Eurosystem staff macroeconomic projections, which showed that the aggregate debt-to-GDP ratio was estimated to have surged to 98.4% of GDP in 2020, which is an increase of 14.5 percentage points compared with 2019. Sovereigns additionally took on extensive contingent liabilities in the form of loan guarantees. Although it will take time to substantially reduce debt levels, there are no signs that public debt sustainability in the euro area would be questioned. This assessment rests on the improved expectations for a recovery in 2021, especially after positive developments on several COVID-19 vaccines, but importantly also on financing conditions which should continue to be supportive for the foreseeable future. Moreover, the coordinated fiscal action taken at the EU level should provide a stabilising effect (see Box 4 for a recent example). It is still important that Member States return to sound fiscal positions once economic activity has recovered.

1.4 Inflation declined markedly due to the drop in oil prices and the economic contraction[10]

Headline inflation in the euro area stood at 0.3% on average in 2020, down from 1.2% in 2019. In terms of the components of the Harmonised Index of Consumer Prices (HICP), this decline essentially reflected lower contributions from energy inflation, but in the second half of the year also from HICP inflation excluding energy and food (see Chart 9). In terms of its driving factors, the disinflationary process took place against the background of sharp contractions in economic activity, which significantly weakened consumer demand and posed severe downside risks to the economic outlook. Disinflationary pressures also reflected some factors specific to the economic implications of and responses to the COVID-19 pandemic. For instance, the further decline of inflation in the second half of the year was partly due to the drop in the prices of travel-related services (especially transport and hotels), hit hardest by the crisis, and to the impact of the temporary reduction in the VAT rate in Germany.

Chart 9

HICP inflation and contributions by components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Volatile components of the HICP partly developed in opposite directions

Developments in energy inflation contributed to a large extent to the decline in average headline inflation in 2020 compared with 2019, reflecting the drop in oil prices at the beginning of the pandemic. By contrast, the contribution of total food inflation to headline HICP inflation increased slightly to 0.4 percentage points in 2020, slightly above the level in 2019, largely reflecting the fact that in particular unprocessed food inflation temporarily increased substantially amid the pandemic (with a spike of 7.6% in April 2020).[11]

Underlying inflation declined over the course of 2020

Measures of underlying inflation declined over the course of 2020. HICP inflation excluding energy and food was 0.7% on average after 1.0% in 2019, with a record low being recorded in the last four months of 2020. Weak developments in both non-energy industrial goods and services inflation contributed to subdued HICP inflation excluding energy and food. Non-energy industrial goods inflation turned negative in August 2020, reaching a record low in December 2020, and services inflation reached an all-time low of 0.4% in October 2020, although it increased slightly thereafter. Developments in these two components were affected by a common set of factors but to a somewhat different extent. The appreciation of the euro in the second half of the year affected non-energy industrial goods inflation somewhat more than services inflation. The same holds for the changes in indirect taxes as some components of services such as rents are exempted from VAT. The lockdowns and containment measures in the context of the pandemic had a larger impact on the level of services inflation, which was particularly visible in the drop in inflation for travel and leisure-related items. More generally, however, non-energy industrial goods inflation and services inflation were dominated by the plummeting demand that the pandemic triggered via increased uncertainty and risk aversion, containment measures, and income and job losses. This considerably outweighed some upward effects from supply disruptions in certain sectors. Furthermore, the pandemic hampered HICP price collection. As a result, the share of imputed prices in the HICP spiked in April and then declined, with imputed prices only being used for a few items from July to October. The share of imputed prices was again elevated in November and December, albeit below the level during the spring.[12] The demand and supply effects likely also implied that the shares of individual goods and services in consumption were different from those underlying the construction of the HICP in 2020.

Domestic cost pressures increased

Domestic cost pressures, as measured by the growth in the GDP deflator, increased on average in 2020, at a rate above the average level of 2019 (see Chart 10). By contrast, the annual growth in compensation per employee declined rapidly in 2020, standing at -0.6%, well below the 2019 value. At the same time, the even larger drop in productivity growth implied a substantial increase in unit labour cost growth, contributing to the observed growth in the GDP deflator. Unit labour cost growth stood at 4.6% in 2020, up from 1.9% in 2019. However, developments in unit labour cost growth, productivity growth and compensation per employee growth in 2020 were affected by the widespread application of short-time work schemes, which implied, for instance, that employment remained much more resilient than output or actual hours worked. There were also issues related to the statistical recording of these measures, which implied an unusually large contribution of subsidies to developments in domestic costs and hampered the comparability of recent developments with past developments.[13] On the expenditure side, such statistical issues were, for example, visible in the sharp increase in the growth rate of the government consumption deflator in the second quarter.

Chart 10

Breakdown of the GDP deflator

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Longer-term inflation expectations remained at historically low levels

Longer-term inflation expectations in the ECB Survey of Professional Forecasters (SPF) remained at historically low levels in 2020, hovering between 1.6% and 1.7%, having fallen to these levels in the previous year. Expectations for inflation five years ahead from the SPF stood at 1.7% in the fourth quarter of 2020, unchanged from the fourth quarter of 2019. Market-based measures of longer-term inflation expectations, in particular the five-year inflation-linked swap rate five years ahead, showed notable volatility throughout the year. The latter rate declined sharply at the beginning of the pandemic and reached its lowest level on record at the end of the first quarter of 2020 (standing at 0.7% on 23 March), before recovering and stabilising close to pre-pandemic levels towards the end of the year (standing at 1.3% on 31 December). That said, market-based indicators of longer-term inflation expectations remained very subdued.

1.5 Decisive policy action kept credit and financing conditions supportive

Euro area government bond yields declined in 2020 against the background of a resolute monetary and fiscal crisis response

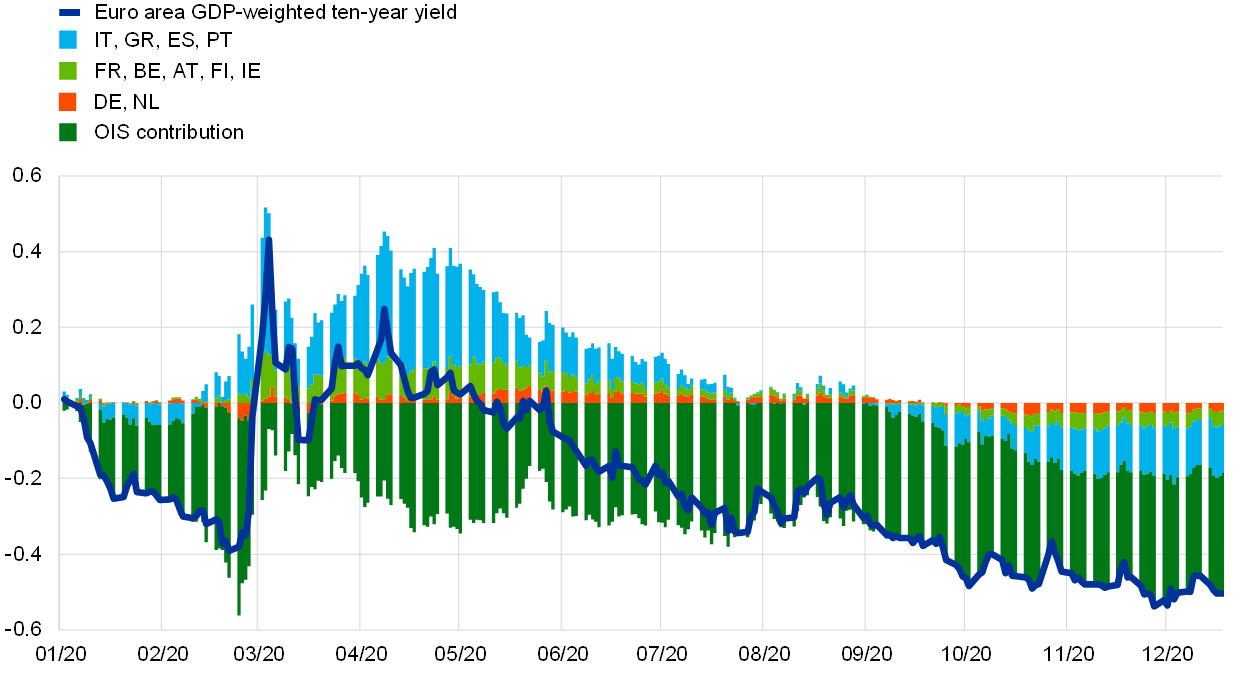

The COVID-19 pandemic led to a swift deterioration in the global and domestic economic outlook, together with a sharp increase in sovereign spreads in an environment of generally tightening financial conditions. To counter the impact of the pandemic shock on the economy and inflation and faced by emerging risks for financial stability and the smooth functioning of monetary policy transmission, monetary and fiscal policy authorities responded promptly and resolutely (see Section 2.1). They thus effectively countered the shock-induced tightening of financial conditions and contributed, in particular, to a decline in long-term risk-free rates and a compression, from their pandemic highs, of the spreads of euro area countries’ ten-year government bond yields vis-à-vis the ten-year overnight index swap rate. As a result, the euro area GDP-weighted average of ten-year government bond yields declined by 50 basis points between 1 January 2020 and 31 December 2020, when it stood at -0.23% (see Chart 11).

Chart 11

Long-term yields in the euro area and the United States

(percentages per annum; daily data)

Sources: Bloomberg, Thomson Reuters Datastream and ECB calculations.

Notes: The euro area data refer to the GDP-weighted average of ten-year government bond yields and the ten-year overnight index swap (OIS) rate. The latest observations are for 31 December 2020.

Despite recovering from their pandemic lows, euro area equity prices remained below their early 2020 levels

After their collapse in mid-March, stock prices staged a gradual but consistent recovery on the back of the rebound in activity and firming growth expectations, supported by monetary and fiscal policies, and encouraging news concerning potential vaccines, which likely lowered the equity risk premium and supported market expectations of a recovery in earnings. As such, this development was quite different from the larger and especially more protracted stock market correction which occurred in the wake of the 2008-09 financial crisis. At the same time, euro area equity prices showed distinct sectoral divergence compared with the respective levels at the end of 2019. The broad index for euro area non-financial corporation (NFC) equity prices stood by the year-end marginally above end-2019 levels, while euro area bank equity prices declined more severely and remained around 24% lower (see Chart 12).

Chart 12

Equity market indices in the euro area and the United States

(index: 1 January 2019 = 100)

Sources: Bloomberg, Thomson Reuters Datastream and ECB calculations.

Notes: The EURO STOXX banks index and the Datastream market index for non-financial corporations (NFCs) are shown for the euro area; the S&P banks index and the Datastream market index for NFCs are shown for the United States. The latest observations are for 31 December 2020.

NFCs’ borrowing from banks and issuance of debt securities increased

The external financing flows of non-financial corporations increased in 2020 compared with the previous year, but remained below their latest peak observed in 2017 (see Chart 13). During 2020 bank lending rates remained broadly stable around their historical lows, in line with the evolution of market rates. At the same time, strong growth in borrowing by NFCs from banks and their issuance of debt securities could be observed, reflecting the exceptionally high liquidity needs in the light of the substantial economic contraction and sharp declines in corporate sales and cash flows. Net issuance of listed shares was negative, which can mainly be explained by a delisting in the second quarter of 2020. By contrast, net issuance of unlisted shares and other equity was robust, also when correcting for the impact of the delisting, likely also reflecting capital injections in the face of losses. Finally, the use of other sources of financing, including inter-company loans and trade credit, was broadly stable.

Chart 13

Net flows of external financing to non-financial corporations in the euro area

(annual flows; EUR billions)

Sources: Eurostat and ECB.

Notes: “Other loans” include loans from non-MFIs (other financial intermediaries, pension funds and insurance corporations) and from the rest of the world. “MFI loans” and “other loans” are corrected for loan sales and securitisation. “Other” is the difference between the total and the instruments included in the chart and includes inter-company loans and trade credit. The latest observations are for the third quarter of 2020.

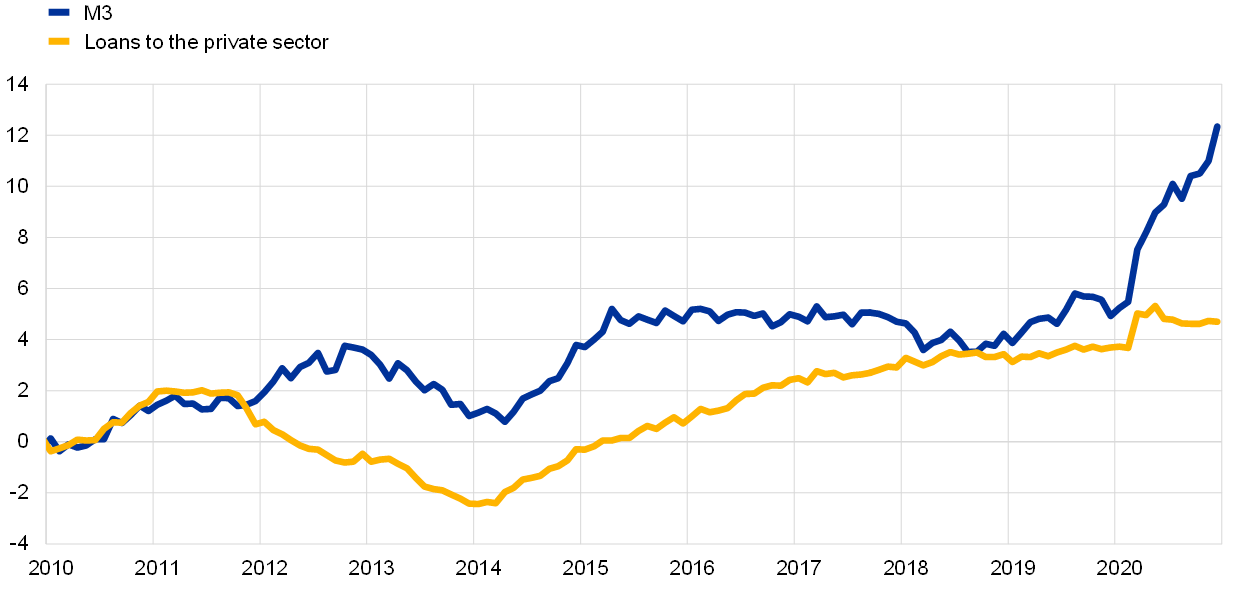

Money and loan growth accelerated in response to the COVID-19 crisis

Broad money growth sharply increased in response to the COVID-19 crisis (see Chart 14), mainly driven by the narrow aggregate M1. This acceleration reflected the build-up of liquidity buffers by firms and households amid increased uncertainty but also, in the case of households, some forced savings owing to reduced opportunities to consume. Money creation was driven by an expansion of domestic credit, both to the private sector and to governments, in the latter case mainly reflecting the asset purchases of the Eurosystem. The timely and sizeable measures taken by monetary, fiscal and supervisory authorities have ensured the flow of credit to the euro area economy at favourable terms.

Chart 14

M3 and loans to the private sector

(annual percentage changes; adjusted for seasonal and calendar effects)

Sources: Eurostat and ECB.

Note: The latest observations are for December 2020.

Banks’ heightened risk perceptions exerted a tightening impact on credit standards

While bank lending conditions were overall supportive during the year, the euro area bank lending survey showed that banks’ credit standards (i.e. approval criteria) for loans to firms tightened in the second half of 2020. This was mainly driven by banks’ heightened risk perceptions associated with the impact of the pandemic on the outlook for borrower creditworthiness. At the same time, asset purchases under the asset purchase programme and the pandemic emergency purchase programme, as well as the third series of targeted longer-term refinancing operations, especially after the recalibrations in March and April, were reported by banks to have contributed to improvements in banks’ liquidity position and market financing conditions. These measures, together with those introduced by governments such as loan guarantees and moratoria, prevented a more pronounced tightening of credit standards.

2 Monetary policy: preserving favourable financing conditions

The ECB substantially eased the monetary policy stance over the course of 2020 to counter the negative impact of the COVID-19 pandemic on the euro area economy. The comprehensive set of measures and their subsequent recalibrations mitigated the threat of a liquidity and credit crunch by preserving ample liquidity conditions in the banking system, protected the flow of credit to the real economy and safeguarded the accommodative monetary policy stance by averting a procyclical tightening of financing conditions. The monetary policy response in 2020 was a crucial stabilising force for markets and helped to counter the serious risks posed by the rapid spread of the virus to the monetary policy transmission mechanism, the outlook for the euro area economy and, ultimately, the ECB’s price stability objective. The size of the Eurosystem’s balance sheet reached a historical high of €7 trillion in 2020, an increase of €2.3 trillion compared with the end of the previous year. At the end of 2020 monetary policy-related assets accounted for 79% of the total assets on the Eurosystem’s balance sheet. Risks related to the large balance sheet continued to be mitigated by the ECB’s risk management framework.

2.1 The ECB’s monetary policy response to the pandemic emergency provided crucial support to the economic recovery and the inflation outlook[14]

The ECB’s initial response to the COVID-19 pandemic

The cautiously optimistic mood at the start of the year was forcefully interrupted by COVID-19

At the start of the year, incoming information signalled ongoing, but moderate, growth of the euro area economy. While the weakness of international trade in an environment of global uncertainty was still a drag on growth, employment gains in conjunction with rising wages, the mildly expansionary euro area fiscal stance and the ongoing – albeit somewhat slower – growth in global activity supported the euro area economy. Inflation developments remained subdued overall, but there were some signs of a moderate increase in underlying inflation in line with expectations. The monetary policy measures taken in the course of 2019 were underpinning favourable financing conditions, thereby supporting the euro area economic expansion, the build-up of domestic price pressures and the convergence of inflation towards the Governing Council’s medium-term aim.

At its January 2020 meeting, the Governing Council decided to launch a review of the ECB’s monetary policy strategy. Since its last strategy review, the euro area and world economies have been undergoing profound structural changes. Declining trend growth, on the back of slowing productivity and an ageing population, as well as the legacy of the financial crisis, have driven interest rates down, reducing the scope for the ECB and other central banks to ease monetary policy with conventional instruments in the face of adverse cyclical developments. In addition, addressing low inflation is different from the historical challenge of addressing high inflation. The threat to environmental sustainability, rapid digitalisation, globalisation and evolving financial structures have further transformed the environment in which monetary policy operates, including the dynamics of inflation. In the light of these challenges, the Governing Council decided to launch a review of its monetary policy strategy, in full respect of the ECB’s price stability mandate as enshrined in the Treaty (see Box 2).

The cautiously optimistic mood at the start of the year was forcefully interrupted in late February by the outbreak and global spread of COVID-19. Although the magnitude and duration of the downward revision to the growth outlook were uncertain, it became increasingly clear that the pandemic would have a major impact on the euro area economy. While disruptions to global supply chains were seen to potentially exert some upward pressure on euro area inflation, this was expected to be dominated by weaker demand holding inflation back. Moreover, the sharp deterioration in risk sentiment caused a severe tightening in financial and bank funding conditions, which – in combination with the moderate appreciation of the euro exchange rate – risked adding downward pressure on inflation.

A comprehensive package of monetary policy measures was necessary

Against this background, the Governing Council decided at its monetary policy meeting on 12 March 2020 that a comprehensive package of monetary policy measures was necessary. The package aimed, on the one hand, to mitigate the threat of a liquidity and credit crunch by preserving ample liquidity conditions in the banking system and protecting the flow of credit to the real economy, and, on the other hand, to safeguard the accommodative monetary policy stance by averting a procyclical tightening of financing conditions in the economy.

In particular, the Governing Council decided on additional longer-term refinancing operations (LTROs) at an interest rate equal to the deposit facility rate. It also decided to apply considerably more favourable terms to all operations under the third series of targeted longer-term refinancing operations (TLTRO III) during the period from June 2020 to June 2021. The interest rate on TLTRO III operations was reduced by 25 basis points and could be as low as 25 basis points below the average deposit facility rate during the period from June 2020 to June 2021 for all TLTRO III operations outstanding during that period. Moreover, the maximum total amount that counterparties were entitled to borrow in TLTRO III operations was raised to 50% of their stock of eligible loans. Accordingly, the additional LTROs would effectively allow banks to immediately benefit from very favourable borrowing conditions and would provide an effective bridge until the start of the recalibrated TLTRO III operations, which aimed to ease funding conditions for banks more sustainably in order to support credit flows to affected sectors and avoid a tightening in credit supply.

The Governing Council also decided to add a temporary envelope of additional net asset purchases of €120 billion to the asset purchase programme (APP) until the end of the year, ensuring a strong contribution from the private sector purchase programmes. Limiting the additional envelope to the current calendar year was deemed an appropriate response to a shock that was assessed as being temporary. In combination with the existing APP, this temporary envelope aimed to support favourable financing conditions for the real economy in times of heightened uncertainty.

In the week following the March 2020 Governing Council meeting, the situation deteriorated significantly owing to the rapid spread of COVID-19, with nearly all euro area countries enforcing far-reaching containment measures. Financial markets exhibited extreme volatility, with signs of severe dislocations due to illiquidity and market freezes and rising fragmentation. This led to a sharp tightening in financing conditions, which could have impaired the smooth transmission of the ECB’s monetary policy across all euro area countries and put price stability at risk.

In view of this rapid deterioration, the Governing Council decided on 18 March 2020 that a further forceful monetary policy response was warranted in order to stabilise markets and counter the sharp tightening of financial conditions. The aim of this action was to counter the serious risks posed by the pandemic to the outlook for the euro area economy, the monetary policy transmission mechanism and, ultimately, the ECB’s price stability objective. The Governing Council announced the following additional measures.

The Governing Council decided to launch a new temporary asset purchase programme: the pandemic emergency purchase programme

First, it decided to launch a new temporary asset purchase programme – the pandemic emergency purchase programme (PEPP). The PEPP, with an overall envelope of €750 billion, would include all the asset categories eligible under the APP. In addition, the Governing Council also expanded the range of eligible assets under the corporate sector purchase programme to include non-financial commercial paper, making marketable debt instruments with an initial maturity of below one year eligible if their remaining maturity was at least 28 days at the time of purchase. The expansion of eligible assets would support the funding situation of companies, thereby providing crucial assistance to a part of the economy that was being hit hard by the effects of the virus. For purchases under the PEPP, the Governing Council also decided to grant a waiver of the eligibility requirements for debt securities issued by the Hellenic Republic. In addition, the Governing Council decided that public sector securities with a remaining time to maturity of below one year, but at least 70 days, would be eligible for purchases under the PEPP, owing to its temporary nature.

The PEPP was designed to fulfil a dual role. First, together with the other components of the monetary policy framework, the PEPP aimed to deliver the monetary accommodation required to ensure that medium-term price stability was protected by supporting the economic recovery from the pandemic crisis. Second, purchases under the PEPP would be conducted in a flexible manner, allowing for fluctuations in the distribution of purchase flows over time, across asset classes and among jurisdictions. The flexibility embedded in the design of the programme ensured that the PEPP could fulfil a market stabilisation role in an efficient manner, especially in view of the high uncertainty associated with the effects of the pandemic across different asset markets and euro area countries.

In addition, the Governing Council announced at the same meeting that it would temporarily ease collateral standards by adjusting the main risk parameters of the collateral framework to ensure that counterparties could continue to make full use of the Eurosystem’s credit operations. More specifically, the Governing Council subsequently adopted two packages of temporary collateral easing measures. The first set of measures announced on 7 April 2020 aimed to facilitate the availability of eligible collateral to Eurosystem counterparties so that they could make full use of liquidity-providing operations, such as the TLTRO III operations. On 22 April 2020 the Governing Council decided that marketable assets and the issuers of such assets that fulfilled minimum credit quality requirements on 7 April 2020 would continue to be eligible in the event of rating downgrades as long as the ratings remained above a certain credit quality level and all other eligibility requirements were still fulfilled. This measure aimed to mitigate the effect on collateral availability of possible rating downgrades and avoid potential procyclical dynamics.

At the time of the monetary policy meeting of the Governing Council in April 2020, the economic situation was still deteriorating rapidly as economic activity was contracting and labour market conditions were worsening visibly. Measures to contain the spread of the virus had largely halted economic activity across the euro area and the globe. While the full extent and duration of the consequences of the pandemic for the economy were still difficult to predict, it was now clear that the euro area economy was heading towards a decline in economic activity of a magnitude and at a speed that was unprecedented in recent history.

The worsening economic outlook, together with a sharp fall in oil prices and declining inflation expectations, introduced significant downside risks to the euro area inflation outlook. The Governing Council decided therefore in April 2020 to further strengthen its policy support to households and firms. In particular, the Governing Council further eased the conditions on the TLTRO III operations by reducing the interest rate on the operations during the period from June 2020 to June 2021 to 50 basis points below the average interest rate on the Eurosystem’s main refinancing operations prevailing over the same period. Moreover, for counterparties whose eligible net lending reached the lending performance threshold, the interest rate over the period from June 2020 to June 2021 would be 50 basis points below the average deposit facility rate prevailing over the same period. In addition, the Governing Council decided on a new series of non-targeted pandemic emergency longer-term refinancing operations (PELTROs) to support liquidity conditions in the euro area financial system and contribute to preserving the smooth functioning of money markets by providing an effective liquidity backstop. Finally, over the course of March and April 2020, the ECB also set up temporary swap and repo lines with non-euro area central banks and established in June 2020 a temporary Eurosystem repo facility for central banks (EUREP) to enhance the provision of euro liquidity outside the euro area and prevent spillback effects on euro area financial markets.

The recalibration of the monetary policy stance in June

Incoming information confirmed that the euro area economy was experiencing an unprecedented contraction

In June, incoming information confirmed that the euro area economy was experiencing an unprecedented contraction as a result of the pandemic and the measures to contain it. Severe job and income losses and exceptionally elevated uncertainty about the economic outlook led to a significant fall in consumer spending and investment. While survey data and real-time indicators of economic activity had shown some signs of a bottoming-out alongside the gradual easing of the containment measures, the improvement had so far been tepid compared with the speed at which the indicators plummeted in the preceding two months. The June 2020 Eurosystem staff macroeconomic projections, although surrounded by an exceptional degree of uncertainty, foresaw economic activity contracting at a record pace in the second quarter of the year. Price pressures were expected to remain subdued on account of the sharp decline in real GDP and the associated significant increase in economic slack. The June 2020 projections entailed a substantial downward revision to both the level of economic activity and the inflation outlook over the whole projection horizon. In particular, inflation was revised downwards from 1.6% at the end of the projection horizon in the December 2019 Eurosystem staff macroeconomic projections to 1.3% in the June 2020 projections.

The Governing Council decided to increase the envelope for the PEPP by €600 billion to a total of €1,350 billion

Against this backdrop, the Governing Council decided on a set of further monetary policy measures to support the economy during its gradual reopening and to safeguard medium-term price stability. Specifically, it decided to increase the envelope for the PEPP by €600 billion to a total of €1,350 billion, to lengthen the horizon for net purchases under the PEPP until at least the end of June 2021 and to extend the reinvestment of principal payments from maturing securities purchased under the PEPP until at least the end of 2022.[15] The recalibration of the PEPP aimed to further ease the monetary policy stance, thereby supporting favourable financing conditions for all sectors and jurisdictions, and ultimately to ensure that inflation moves towards the Governing Council’s aim in a sustained manner.

Over the course of the summer, incoming information signalled a strong rebound in economic activity, owing mainly to the relaxation of containment measures. However, the recovery was asymmetrical, being further advanced in the manufacturing sector than in the services sector, and activity remained well below pre-pandemic levels. Headline inflation continued to be dampened by low energy prices and weak price pressures in the context of subdued demand and significant labour market slack.

The recalibration of the monetary policy stance in December

After a strong – albeit partial and uneven – rebound in activity over the summer, the euro area economic recovery was losing momentum

In the autumn, it became increasingly clear that after a strong – albeit partial and uneven – rebound in economic activity over the summer months, the euro area economic recovery was losing momentum more rapidly than previously expected. The resurgence in COVID-19 infections and the associated containment measures presented renewed challenges to public health and the growth prospects of the euro area and global economies. Inflation remained very low in the context of weak demand and significant slack in labour and product markets. Overall, incoming data signalled a more pronounced near-term impact of the pandemic on the economy and a more protracted weakness in inflation than previously envisaged. The Governing Council therefore signalled in October 2020 that it would recalibrate its instruments, as appropriate, at its next meeting in December 2020 to respond to the unfolding situation and to ensure that financing conditions would remain favourable to support the economic recovery and counteract the negative impact of the pandemic on the projected path of inflation.

At the time of the December 2020 Governing Council meeting, the incoming data and the Eurosystem staff macroeconomic projections suggested a more pronounced near-term impact of the pandemic on the economy and a more protracted weakness in inflation than previously envisaged. The renewed intensification of the pandemic was significantly restricting global and euro area economic activity, which was expected to contract in the fourth quarter of 2020. Headline inflation was expected to remain negative for longer than previously expected, and measures of underlying inflation were declining and inflation pressures were expected to remain subdued on account of weak demand, lower wage pressures and the appreciation of the euro over the spring and the summer of 2020.

In view of the economic fallout from the resurgence of the pandemic, the Governing Council recalibrated its monetary policy instruments.

The Governing Council decided to increase the envelope of the PEPP by €500 billion to a total of €1,850 billion

The Governing Council decided to increase the envelope of the PEPP by €500 billion to a total of €1,850 billion, to lengthen the horizon for net purchases under the PEPP until at least March 2022 and to extend the reinvestment of principal payments from maturing securities purchased under the PEPP until at least the end of 2023. Purchases would continue to be conducted flexibly according to market conditions and over time, across asset classes and among jurisdictions in order to prevent a tightening of financing conditions that would be inconsistent with countering the downward impact of the pandemic on the projected path of inflation and to support the smooth transmission of monetary policy. The Governing Council also announced that if favourable financing conditions could be maintained with asset purchase flows that did not exhaust the envelope over the net purchase horizon of the PEPP, the envelope need not be used in full. Equally, the envelope could also be increased if required to maintain favourable financing conditions to help counter the pandemic shock to the path of inflation.

Furthermore, the Governing Council decided to further recalibrate the conditions of the TLTRO III operations. Specifically, the Governing Council announced that it would extend by twelve months until June 2022 the period over which considerably more favourable terms would apply, conduct three additional operations during 2021 and raise the total amount that counterparties would be entitled to borrow from 50% to 55% of their stock of eligible loans.

Finally, the Governing Council decided to extend the duration of the set of collateral easing measures adopted in April 2020 until June 2022, to offer four additional PELTROs in 2021, to extend until March 2022 all temporary swap and repo lines with non-euro area central banks, as well as the EUREP repo facility for central banks, and to continue to conduct all regular lending operations as fixed rate tender procedures with full allotment at the prevailing conditions for as long as necessary.

The monetary policy measures taken aimed to contribute to preserving favourable financing conditions over the pandemic period

Together, the monetary policy measures taken aimed to further contribute to preserving favourable financing conditions over the pandemic period, thereby supporting the flow of credit to all sectors of the economy, underpinning economic activity and safeguarding medium-term price stability. At the same time, uncertainty remained high, including with regard to the dynamics of the pandemic and the timing of vaccine roll-outs as well as developments in the euro exchange rate. Hence, the Governing Council signalled its readiness to adjust all of its instruments, as appropriate, to ensure that inflation moved towards its aim in a sustained manner, in line with its commitment to symmetry.

To sum up, to counter the negative impact of the pandemic, substantial monetary policy accommodation was implemented over the course of 2020. The comprehensive set of measures and their subsequent recalibrations were a crucial stabilising force for markets and helped to reverse the tightening in financial conditions observed earlier in the year. The measures were effective in containing government bond yields (see Chart 15), which are the basis for funding costs for households, firms and banks. They also kept bank funding costs very favourable throughout the pandemic (see Chart 16). In addition, they also ensured that households and firms benefited from these supportive financing conditions, with the respective lending rates reaching historical lows of 1.32% and 1.46% (see Chart 17). The monetary policy response in 2020 thus secured favourable financing conditions to support the economic recovery and counteract the negative impact of the pandemic on the projected path of inflation, thereby fostering the convergence of inflation towards the Governing Council’s aim in a sustained manner.

Chart 15

Changes in the euro area GDP-weighted ten-year government bond yield

(percentage points)

Source: ECB calculations.

Notes: The latest observations are for 31 December 2020. OIS: overnight index swap.

Chart 16

Composite cost of debt financing for banks

(composite cost of deposit and unsecured market-based debt financing; percentages per annum)

Sources: ECB, Markit iBoxx and ECB calculations.

Notes: The composite cost of deposits is calculated as an average of new business rates on overnight deposits, deposits with an agreed maturity and deposits redeemable at notice, weighted by their corresponding outstanding amounts. The latest observations are for December 2020.

Chart 17

Composite bank lending rates for non-financial corporations and households

(percentages per annum)

Source: ECB.

Notes: Composite bank lending rates are calculated by aggregating short and long-term rates using a 24-month moving average of new business volumes. The latest observations are for December 2020.

2.2 Eurosystem balance sheet dynamics in challenging times

Since the onset of the global financial crisis in 2007-08, the Eurosystem has taken a variety of standard as well as non-standard monetary policy measures, which have had a direct impact on the size and composition of the Eurosystem’s balance sheet over time. The non-standard measures have included refinancing operations to provide funding to counterparties with an initial maturity of up to four years, as well as purchases of assets issued by private and public entities (under the APP). In 2020, in response to the outbreak of COVID-19 and in addition to the already existing non-standard measures, the ECB adopted a comprehensive package of complementary monetary policy measures, which had a significant impact on the Eurosystem’s balance sheet. In March 2020 the ECB added a temporary additional envelope for 2020 to the APP and launched the PEPP, which both resulted in an increase in the holdings of assets purchased outright. In addition, between March and April 2020, the ECB eased its TLTRO III conditions (twice) and amended the collateral as well as the risk control frameworks. These complementary measures together resulted in a sizeable increase in Eurosystem intermediation.[16] Overall, during 2020 the Eurosystem’s balance sheet continued to grow on account of these non-standard policy measures, which injected €2.2 trillion of additional liquidity into the banking system, and by the end of 2020 its size had reached a historical high of €7 trillion, an increase of 49% (€2.3 trillion) compared with the end of 2019.

At the end of 2020 monetary policy-related assets amounted to €5.5 trillion, accounting for 79% of the total assets on the Eurosystem’s balance sheet (up from 70% at the end of 2019). These monetary policy-related assets include loans to euro area credit institutions, which accounted for 26% of total assets (up from 13% at the end of 2019), and assets purchased for monetary policy purposes, which represented around 53% of total assets (down from 56% at the end of 2019) (see Chart 18). Other financial assets on the balance sheet mainly consisted of foreign currency and gold held by the Eurosystem and euro-denominated non-monetary policy portfolios.

On the liabilities side, the overall amount of counterparties’ reserve holdings and recourse to the deposit facility increased to €3.5 trillion (up from €2 trillion at the end of 2019) and represented 50% of the liabilities side at the end of 2020 (up from 39% at the end of 2019). Banknotes in circulation grew at a rate above the historical growth trend due to a strong increase in March 2020 and accounted for 21% of liabilities at the end of 2020 (down from 28% at the end of 2019). Other liabilities, including capital and revaluation accounts, increased to €2.1 trillion (up from €1.6 trillion at the end of 2019) and accounted for 30% (down from 34% at the end of 2019) (see Chart 18). The increase in other liabilities mainly came from an increase in government deposits from €0.2 trillion to €0.5 trillion, accounting for 25% of other liabilities (up from 11% at the end of 2019).

Chart 18

Evolution of the Eurosystem’s consolidated balance sheet

(EUR billions)

Source: ECB.

Notes: Positive figures refer to assets and negative figures to liabilities. The line for excess liquidity is presented as a positive figure, although it refers to the sum of the following liability items: current account holdings in excess of reserve requirements and recourse to the deposit facility.

APP and PEPP portfolio maturity and distribution across asset classes and jurisdictions

The APP comprises four active asset purchase programmes: the third covered bond purchase programme (CBPP3), the asset-backed securities purchase programme (ABSPP), the public sector purchase programme (PSPP) and the corporate sector purchase programme (CSPP). The PEPP was introduced in 2020 and all asset categories that are eligible under the APP are also eligible under the PEPP. A waiver of eligibility requirements for purchases under the PEPP was granted for debt securities issued by the Hellenic Republic. In addition, in March 2020, the eligibility of non-financial commercial paper under the CSPP was expanded to include securities with a remaining maturity of at least 28 days.

At the end of 2020 APP holdings amounted to €2.9 trillion

At the end of 2020 APP holdings amounted to €2.9 trillion (at amortised cost). The ABSPP accounted for 1% (€29 billion), the CBPP3 for 10% (€288 billion) and the CSPP for 9% (€250 billion) of total APP holdings at the year-end. Out of the private sector purchase programmes, the CSPP contributed the most to the growth in APP holdings in 2020, with €66 billion of net purchases. CSPP purchases are made based on a benchmark which reflects the market capitalisation of all eligible outstanding corporate bonds.

The PSPP accounted for 80% of total APP holdings

The PSPP accounted for the bulk of the APP holdings, amounting to €2.3 trillion or 80% of total APP holdings at the end of 2020, down from 82% at the end of 2019. Under the PSPP, the allocation of purchases to jurisdictions was guided by the ECB’s capital key on a stock basis. In addition, some national central banks (NCBs) purchased securities issued by EU supranational institutions. The weighted average maturity of the PSPP holdings stood at 7.3 years at the end of 2020, somewhat higher than the 7.12 years at the end of 2019, with some variation across jurisdictions.[17]

At the end of 2020 PEPP holdings amounted to €753.7 billion

At the end of 2020 PEPP holdings amounted to €753.7 billion (at amortised cost). The covered bond holdings accounted for less than 1% (€3.1 billion), the corporate sector holdings for 6% (€43.2 billion) and the public sector holdings for 94% (€707.4 billion) of total PEPP holdings at the year-end.

For the purchases of public sector securities under the PEPP, the benchmark, on a stock basis, for allocation across jurisdictions is the NCBs’ contributions to the ECB’s capital. At the same time, purchases were conducted in a flexible manner, which led to fluctuations in the distribution of purchase flows over time, across asset classes and among jurisdictions. The weighted average maturity of the PEPP public sector securities holdings stood at 7.0 years at the end of 2020, with some differences across jurisdictions.

The Eurosystem reinvested the principal payments from maturing securities held in the APP and PEPP portfolios. Redemptions under the private sector purchase programmes amounted to €80.2 billion in 2020, while redemptions under the public sector purchase programmes amounted to €229.4 billion. The assets purchased under the PSPP, CSPP and CBPP3 continued to be made available for securities lending[18] in order to support bond and repo market liquidity.[19] PEPP holdings are also available for securities lending under the same conditions as under the APP. In November 2020 the Eurosystem adjusted the pricing conditions of its securities lending facilities, making them more favourable for counterparties and ensuring that they remain an effective backstop.

Developments in Eurosystem refinancing operations

The outstanding amount of Eurosystem refinancing operations increased by €1.2 trillion since the end of 2019, standing at €1.8 trillion at the end of 2020. This can be largely attributed to the €1.75 trillion allotted in the TLTRO III series, in addition to the €26.6 billion allotted in the PELTROs. The voluntary repayments of €192 billion and the maturity of €303 billion of the TLTRO II series only to a small extent counterbalanced the increase in outstanding operations. Banks were given the opportunity to roll over previous TLTRO outstanding amounts in the June, September and December 2020 TLTRO III operations. The weighted average maturity of outstanding Eurosystem refinancing operations increased from around 1.2 years at the end of 2019 to around 2.4 years at the end of 2020.

The ECB’s collateral easing measures

The ECB’s temporary collateral easing measures announced in April 2020 and extended in December 2020 were a core element of the ECB’s monetary policy response to the pandemic. A central element of these measures was to temporarily expand the acceptance of credit claims as collateral, in particular through the potential expansion of the additional credit claim (ACC) frameworks. Under the revised temporary framework, NCBs are permitted to accept as collateral, among other things, loans to small and medium-sized enterprises or self-employed individuals that benefit from COVID-19-related government guarantee schemes.

To avoid potential procyclical dynamics of rating downgrades, the Governing Council in addition decided to temporarily maintain the eligibility of marketable assets and the issuers of such assets that fulfilled minimum credit quality requirements on 7 April 2020. In particular, the Eurosystem continues to accept as collateral marketable assets that were eligible for liquidity operations on the reference day, provided that the rating remains above a certain credit quality level and all other eligibility requirements are still fulfilled.

Furthermore, the ECB decided on a temporary general reduction of collateral valuation haircuts by a fixed proportion of 20% across all eligible collateral asset categories, thereby temporarily tolerating more risk on the Eurosystem’s balance sheet. In addition, the Governing Council decided to increase the concentration limit for unsecured bank bonds from 2.5% to 10% and lowered the level of the non-uniform minimum size threshold for domestic credit claims to €0 from €25,000 to facilitate the mobilisation as collateral of loans to small corporate entities. As part of its policy response to the economic shock from the pandemic, the Governing Council also decided to temporarily waive the minimum rating requirement for marketable debt securities issued by the Hellenic Republic.

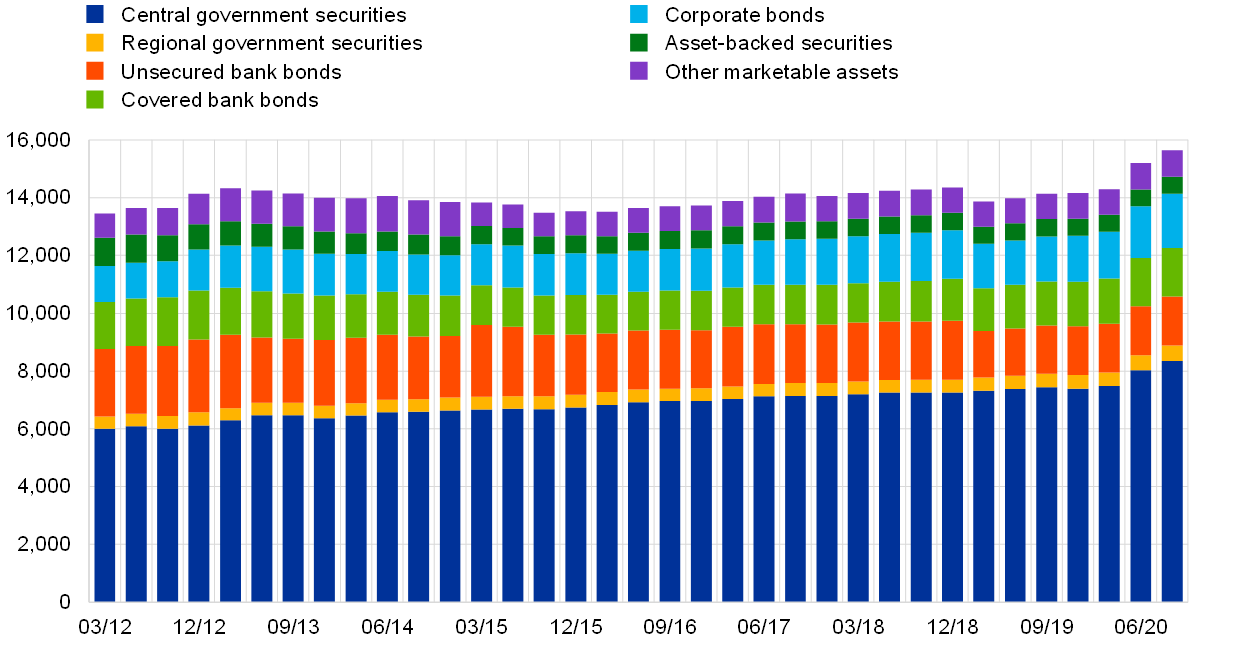

The amount of marketable eligible assets increased by €1,493 billion, reaching a level of €15,657 billion at the end of 2020 (see Chart 19). Central government securities continued to be the largest asset class (€8,385 billion). Other asset classes encompass unsecured bank bonds (€1,667 billion), covered bonds (€1,640 billion) and corporate bonds (€1,872 billion). Regional government bonds (€552 billion), asset-backed securities (€584 billion) and other marketable assets (€958 billion) each accounted for a comparatively small fraction of the universe of eligible assets.

Chart 19

Developments in eligible collateral

(EUR billions)

Source: ECB.

Notes: Collateral values are nominal amounts. The averages of end-of-month data for each time period are shown.