The initial fiscal policy responses of euro area countries to the COVID-19 crisis

The initial fiscal policy responses of euro area countries to the COVID-19 crisis

Published as part of the ECB Economic Bulletin, Issue 1/2021.

This article was updated on 10 February to amend footnote 4 and the title of Chart 2 on the European Commission’s evaluation of Member States’ draft budgetary plans for 2021.

Euro area countries have relied extensively on fiscal policy to counter the harmful impact of the coronavirus (COVID-19) pandemic on their economies. They have implemented a broad range of measures, some with an immediate budgetary impact and others, such as liquidity measures, which, in principle, are not expected to cause an immediate deterioration in the fiscal outlook. Since all euro area countries were hit by the economic shock largely through the same channels, their fiscal responses in the early stages of the crisis were similar in terms of the instruments used. Fiscal emergency packages were mostly aimed at limiting the economic fallout from containment measures through direct measures to protect firms and workers in the affected industries. Simultaneously, extensive liquidity support measures in the form of tax deferrals and State guarantees were announced to help firms particularly impacted by the containment policies to avoid liquidity shortages. In order to support the recovery, fiscal policy needs to provide targeted and mostly temporary stimulus, tailored to the specific characteristics of the crisis and countries’ fiscal positions. Government investments, complemented by the Next Generation EU package, and accompanied by appropriate structural policies, should play a major role in this respect.

1 Introduction

This article discusses the initial fiscal policy responses of euro area countries to the COVID-19 crisis and the implications for further policy measures. It examines the specific fiscal policy measures taken in the course of 2020 and elaborates on the experiences of euro area countries during the pandemic. The article finds that successful recovery strategies from previous crisis episodes cannot be replicated without being adapted to the current crisis’ circumstances. Looking forward, it discusses the implications for the fiscal stance and considers the main policy questions such as the design and timing of fiscal measures.

Fiscal policy is the most suitable instrument for addressing the detrimental impact of the pandemic on the economy, as it is well equipped to differentiate and channel economic support to where it is most needed. First and foremost, by providing adequate public health care, fiscal policies can help in dealing with the immediate health consequences of the pandemic, which is also a prerequisite for countering the economic effects of the health crisis. Moreover, fiscal policy can alleviate the negative impact of the crisis by bolstering aggregate demand and providing well targeted support to vulnerable households and firms. Overall, fiscal policies have supported the euro area economy in two ways: through the functioning of automatic stabilisers and discretionary actions. In general, automatic stabilisers are sizeable in euro area countries and are effective in cushioning economic shocks. However, the severity and particularities of the COVID-19 crisis, with both demand and supply significantly affected, in particular during the lockdown phases, required the use of significant discretionary fiscal support measures.

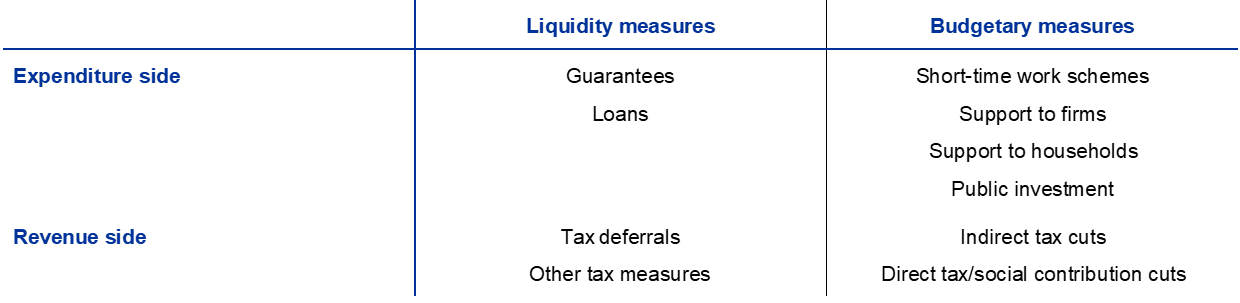

A wide range of discretionary fiscal instruments was implemented or announced in 2020. The fiscal policy reactions were unparalleled in size and scope, as the COVID-19 pandemic and its economic implications posed specific challenges, leading to multi-measure fiscal policy responses. The measures taken by countries can be roughly categorised into two categories: (i) budgetary measures, which typically have an immediate effect on the budget balance, and (ii) liquidity measures, which typically do not immediately affect the budget balance in the year in which they are implemented, but imply contingent liabilities that may affect the fiscal positions. These two types of fiscal measure affect both the expenditure and the revenue side of government budgets (see Table 1).

Table 1

Categories of fiscal instrument

Notes: Own representation.

The fiscal interventions took account of the particular challenges posed by the pandemic. First, in the initial phase of the crisis, emergency packages consisting of both liquidity support and budgetary measures were announced to cope with the first phase of broad lockdowns in March 2020, when all euro area countries introduced strict restrictions on businesses and movement of people. Those measures were aimed at supporting the firms and households particularly affected by the health crisis. These emergency measures were renewed, albeit to a lesser extent, towards the end of 2020, when Member States had to introduce partial or “lighter” lockdowns to address the second wave of the pandemic. Second, additional measures were gradually introduced during the interim phase that followed the phasing out of most lockdown measures in mid-2020 in order to support the recovery. In this phase, most businesses reopened, but some sectors were still impaired by ongoing health measures and local and targeted shutdowns, as well as changed consumer behaviour and preferences. Third, further recovery measures are envisaged which are aimed at the more medium to long-term challenges that may arise once the health-related restrictions come to an end.

This article consists of seven sections. Section 2 presents the overall fiscal policy response during the initial phases of the crisis. The subsequent sections review in detail the various measures introduced. Budgetary and liquidity measures on the expenditure side are discussed in Sections 3 and 4 respectively. Sections 5 and 6 give an overview of budgetary and liquidity measures on the revenue side. Section 7 elaborates on the challenges associated with the assessment of the fiscal stance using standard measures, and Section 8 concludes.

2 Budgetary impact of fiscal responses

The COVID-19 crisis led to a substantial expansion in budget deficits in the euro area. According to the European Commission’s Autumn 2020 Economic Forecast, the euro area budget deficit is expected to increase from 0.6% of GDP in 2019 to 8.8% of GDP in 2020 (see Chart 1). The fiscal deficits and the contraction in GDP led to an increase in the euro area debt ratio from 85.9% of GDP in 2019 to a projected 101.7% of GDP in 2020. The deterioration in fiscal balances partly reflects the operation of automatic stabilisers, which are designed to dampen the effects of the economic cycle. According to European Central Bank (ECB) estimates, these account for around one-third of the large budget deficit in 2020.[1] But the worsening of the fiscal outlook is principally a result of the discretionary fiscal measures adopted since the outbreak of the crisis. According to the Commission’s forecast, the expected improvement in the economic situation and withdrawal in 2021 of part of the discretionary fiscal measures taken the year before are projected to reduce the euro area aggregate deficit to 6.4% of GDP in 2021. However, these projections are subject to exceptionally high uncertainty, as they depend, inter alia, on the course of the pandemic. In particular, at the time of publication of the European Commission’s Autumn Forecast in early November 2020, the implications of the growing number of infections and the new containment measures imposed later in the autumn and beyond had not fully unfolded.

Chart 1

Projected change in the euro area and euro area countries’ budget balances relative to the preceding year

(percentages of GDP)

Source: European Commission’s Autumn 2020 Economic Forecast.

Fiscal measures were implemented via sequences of fiscal packages that reflected the change in priorities over the course of 2020. The four largest Member States, namely Germany, France, Italy and Spain, implemented their first emergency packages as of mid-March, a few days after the introduction of the first broad lockdown measures in Italy (see Figure 1). These packages aimed to address the health crisis and to support the sectors most hit by lockdown measures. They were relatively similar across countries. Later, some of the countries announced further fiscal packages to extend the liquidity and emergency measures included in the first package. Following the end of the broad lockdowns in the summer, Member States progressively announced further packages, which were typically more concerned with supporting the recovery and had a longer-range focus, including measures that would come into effect in 2021 and beyond. Most notably, in June Germany announced its “Konjunktur- und Zukunftspaket” with measures amounting to €130 billion (i.e. 3.9% of GDP) and in September France launched its “France Relance” package comprising measures worth €100 billion, (i.e. 4.4% of GDP). Later, around mid-October, several other Member States announced in their draft budgetary plans for 2021 additional measures for 2021 and subsequent years. Overall, the timing of the recovery packages is much more heterogeneous than that of the emergency measures taken in the spring. Finally, at the end of October 2020 several Member States reacted quickly to the second wave of the pandemic and announced additional emergency measures specifically targeting firms affected by the new partial lockdowns.

Figure 1

Largest fiscal packages announced in the euro area

Source: Own illustration.

Quantifying the discretionary fiscal measures in response to the COVID-19 crisis and comparing them across countries is subject to major challenges. First, there is no consistent track record of the measures that countries have implemented. While Member States typically announced ex ante estimates of the budgetary costs at the time of announcement of the fiscal packages, those numbers were often prone to substantial revisions over time, in particular owing to lower take-up rates than expected.[2] The stability programmes published in spring 2020 did not provide full details on fiscal measures, especially in the longer term, as countries considered uncertainty to be too high. In their DBPs for 2021, many countries did not provide a detailed quantitative overview of the actual costs of the measures they had taken in 2020. Second, statistical recording of the often unprecedented measures is challenging, even with Eurostat providing guidance. For instance, while tax deferrals were often reported by Member States as part of the total costs of fiscal packages, these typically do not affect the budget balance (see the discussion below). Third, the boundaries between discretionary measures and automatic stabilisers are in some cases difficult to discern. For instance, the treatment of short-time work schemes differs across countries, because in some countries the existing elements are treated as automatic stabilisers.

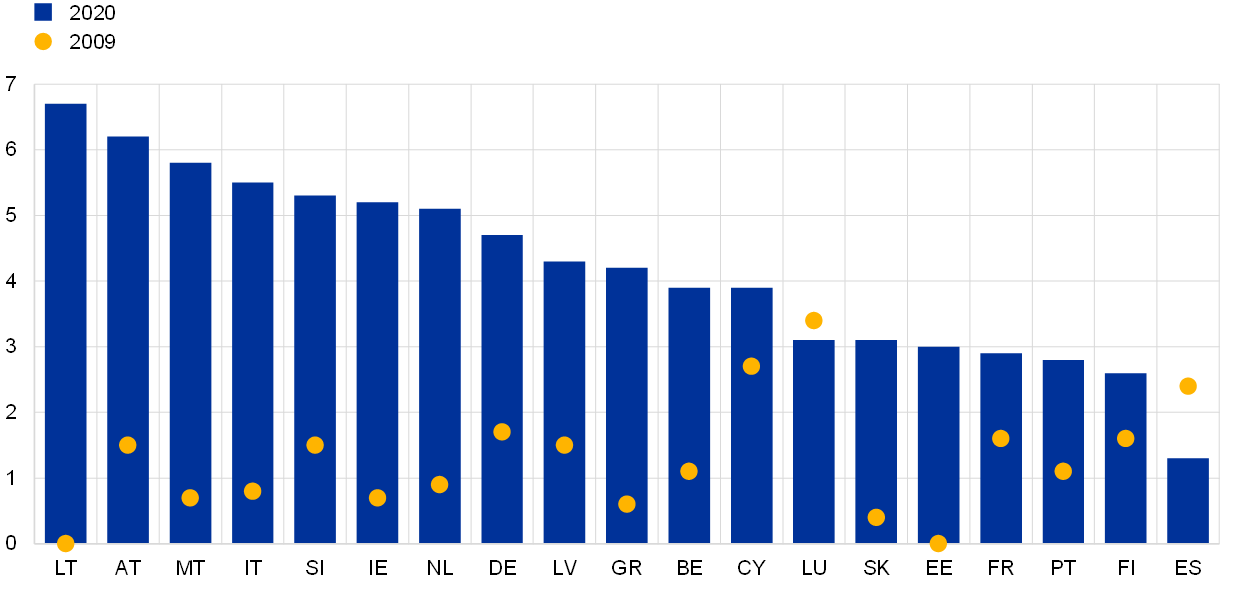

Against this backdrop, the following overview first aims to capture the size of the overall fiscal packages that countries implemented in the course of 2020 to address the pandemic, before reporting on their composition. In the absence of a consistent overview of discretionary measures, the following analysis scrutinises the information provided by the European Commission on the overall size of coronavirus-related measures as incorporated in Member States’ draft budgetary plans (DBPs). Chart 2 shows the expected overall effect of discretionary fiscal measures related to COVID-19 on the budget balances of Member States in 2020, which has been included in the European Commission’s Autumn 2020 Economic Forecast.[3] All reporting countries had legislated for substantial fiscal packages in 2020, with a weighted average of slightly above 4% of GDP. However, as mentioned above, the cross-country comparison is cumbersome owing to heterogeneity in the reporting of the measures. For instance, for a few countries, the Commission’s quantifications differ from those of the national authorities, notably as regards spending related to short-time work schemes. Whereas the Commission tends to treat this spending as part of the operation of automatic stabilisers, possibly but not necessarily under the assumption that this spending is triggered automatically by criteria such as a decline in sales or a drop in output, some countries report this as a discretionary measure in their DBPs.[4] Other differences relate to the treatment of deferrals of taxes and social contributions. Moreover, the actual outcome of fiscal measures taken in 2020 might have been even higher in a number of countries than that assessed by the Commission, given that the DBPs were prepared before the second wave of the pandemic in the autumn, which led to additional costs for existing measures and the adoption of new measures.

Chart 2

Discretionary fiscal measures related to COVID-19 with a budgetary impact in 2020 compared with gross discretionary stimulus in 2009

(percentages of GDP)

Sources: Own presentation based on Commission Staff Working Documents accompanying the Commission Opinions on the Draft Budgetary Plans for 2021; “Public finances in EMU – 2010”, European Economy, Issue 4, European Commission Directorate-General for Economic and Financial Affairs, 2010.

The budgetary impact of discretionary fiscal measures is unprecedented compared with previous crisis episodes. By comparison, at the height of the Global Financial Crisis (GFC) in 2009, the overall amount of discretionary stimulus in EU countries amounted to 1.5% of GDP.[5] Moreover, the heterogeneity of measures appears to have been larger during the GFC than in the COVID-19 crisis. In 2009 stimulus measures reached over 3% in Luxembourg, while some countries did not provide any stimulus at all, even implementing considerable consolidation measures.

A more detailed look at the aggregate euro area fiscal responses in 2020 shows that emergency measures were predominantly focused on supporting firms and employment. In Chart 3, the composition of aggregate discretionary fiscal measures in the euro area is estimated based on information provided in the DBPs for 2021.[6] As shown, the biggest contribution to the fiscal stimulus in 2020 was from emergency measures to address the immediate consequences of the COVID-19 pandemic. First, Member States took substantial measures to protect employment, in particular in the form of short-time work schemes and other support measures to the most affected firms, such as subsidies. Second, to address the health crisis, Member States increased health spending to cover the additional costs for staff, pharmaceuticals and hospitals, as well as additional public spending to ensure the functioning of the public sector.

Chart 3

Estimated composition of measures related to COVID-19 in 2020

Source: Own calculations based on DBPs for 2021.

Turning to governments’ plans for 2021, measures tend to shift towards supporting a recovery, although the amount and composition of fiscal measures is uncertain. For 2021, the overall amount of planned discretionary measures reported in the DBPs is substantially smaller and more heterogeneous across Member States compared with that for 2020. On average, the size of the concrete discretionary measures included in the DBPs amounts on average to slightly above 1% of GDP. Among the larger Member States, Germany stands out with measures amounting to 2.1% of GDP in 2021. For the euro area as a whole, the decline compared to 2020 mostly reflects the planned unwinding of the bulk of emergency measures. The composition of stimulus measures also changes compared with 2020, as new discretionary measures included in the budgets for 2021 tend to focus on economic stimulus policies, with a larger share related to public investment and tax measures. Moreover, the stimulus in 2021 will depend on the extent to which Member States will be able to absorb funds from the new Next Generation EU (NGEU) instrument (see Box 1). Some Member States have included estimates in their DBPs for 2021, but more information will become available in spring 2021 as Member States submit their recovery and resilience plans, which should outline the projects that they intend to finance using the NGEU.

However, a continuation of the health and economic crisis will inevitably lead to an increase in the costs of existing policy measures, including additional health spending or higher costs of prolonged short-time work schemes. Moreover, several Member States have announced in their DBPs that they will provide additional support in the event that the pandemic worsens. In particular, additional support measures for firms appear likely in the case of new lockdowns, as already observed in autumn 2020.

The following sections describe how the set of measures introduced during the early stages of the crisis on both the expenditure and the revenue side were aimed at dealing with the immediate consequences of the pandemic. The sharp economic downturn following the outbreak of the virus differed from previous crisis episodes, such as the GFC, as it did not result from economic imbalances. It was a truly exogenous shock, which hit otherwise sound economic structures in the euro area. Consequently, there was broad consensus that fiscal policies should focus on preserving the pre-crisis structure of the economy where it was viable and on minimising crisis-related insolvencies and the exit of firms from the market. The exit of healthy firms hit by the temporary lockdown would be detrimental to the subsequent recovery, as it would lead to an inefficient loss of production capital, in particular firm-specific intangible and human capital.

In addition to the discretionary measures with an immediate effect on the budget balance, Member States also implemented liquidity measures, mainly in the form of State guarantees and tax deferrals. These measures were introduced by most euro area countries at the start of the broad lockdowns to support companies affected by the restrictions. They facilitated companies’ access to external financing and allowed them to shift tax obligations to when normal activity resumes.

3 Budgetary measures on the expenditure side

Short-time work schemes played a particularly important role in stabilising employment during the COVID-19 crisis, in particular during the period of broad lockdowns. These programmes accounted for more than a quarter of the fiscal packages in 2020 (see Chart 3). Such schemes aim to prevent the loss of human capital and stabilise consumption for those who would have become unemployed. Moreover, they can help the labour market recover faster, as they allow firms and workers to resume activity without the costly and lengthy process of search and matching that would have to occur if an employment relationship was lost.[7] The use of short-time work schemes during the lockdown was unprecedented: in Germany, almost 10 million people were using the country’s short-time work scheme in mid-May 2020, compared with a maximum of around 1.4 million during the GFC. An empirical analysis of the short-time work schemes of 23 developed countries during the GFC finds that such schemes had a significant impact on preserving jobs during the crisis as employment became less elastic with respect to output.[8] Further studies of country-specific schemes confirm a positive effect on employment during the crisis, e.g. for Germany[9] and France[10]. Another study for Italy confirms a positive effect for temporary shocks, but highlights that, when shocks become persistent, the short-term benefits in terms of employment need to be traded off against the potential reallocation effects of the scheme.[11] During the COVID-19 crisis, the extension of such schemes is particularly useful in cases where demand in specific sectors is still depressed owing to health restrictions or temporary local lockdowns. Moreover, the extension of such schemes supports private demand and business confidence during the recovery phase. However, past experience shows that broad use of short-time work schemes during the recovery may hamper the reallocation of workers if structural changes occur, and therefore adversely influence job creation during the recovery.[12] Consequently, it has been recommended that time limits reduce the risk that jobs that are no longer viable in the longer term are supported, and that the provision of training and support for job search to subsidised workers can facilitate job mobility.[13]

The high income losses incurred by firms, in particular small and medium-sized enterprises (SMEs), during the lockdowns have led to the provision of substantial support to firms in many Member States. While almost all countries provided support to the firms most affected by the lockdowns at an early stage in the form of loan guarantees and a partial sharing of wage costs in the context of short-time work schemes, fixed costs may still lead to liquidity shortfalls which – if left unaddressed – could ultimately result in firms’ insolvency and market exit. Given the uncertainty and swift developments during the lockdown, it was difficult to tailor solvency support to firms’ needs, as the true burden for firms was difficult to assess. Moreover, support could only be linked to very broad criteria, such as the degree to which the sector as a whole was affected. Consequently, governments faced a trade-off between providing emergency support quickly and unbureaucratically on the one hand and avoiding windfall gains for enterprises and fraud on the other. A few countries chose to provide direct support schemes for firms at an early stage, most notably Germany, which provided several programmes for emergency assistance to small companies and the self-employed across all sectors facing a threat to their existence. Other countries later initiated programmes for partial compensation of losses incurred during the lockdown, which were often linked to specific fixed costs of companies or related sector, or turnover losses. In several countries, such measures were renewed in the autumn in order to compensate firms affected by the partial lockdowns in response to the second wave of the pandemic. Finally, at an early stage several countries provided subsidies to self-employed or other workers who were not sufficiently covered by existing national social security systems. However, those transfers were typically rather limited, as they merely served as social assistance in the form of replacement income and did not cover operational costs.

Member States have pledged substantial amounts for capital injections to firms, which may lead to additional fiscal costs in the future. In the early stages of the crisis, several governments already announced the provision of substantial amounts for capital injections to firms (for example, 3% of GDP in Germany and 0.9% of GDP in France), and a relaxation of State aid rules has in principle facilitated the recapitalisation of bigger firms. The first larger-scale recapitalisation operations in the euro area were limited to the aviation industry, but long-run fiscal costs from recapitalisations may rise if other sectors are also affected in the longer term. In particular, fiscal and economic costs might arise if companies that were already unhealthy before the crisis are artificially kept going, hampering structural change. Moreover, such State aid measures need to address competition concerns, as differing approaches across countries might impair the Single Market. The Commission has therefore approved the recent transactions subject to certain conditions, such as the State having a credible exit strategy.

The effectiveness of other spending measures to support private demand is hampered by the COVID-19 crisis. In previous crises, such as the GFC, the majority of fiscal measures taken to stimulate the economy were aimed at supporting household purchasing power, either by increasing income, reducing taxes or providing benefits to stimulate consumption, as the increase in uncertainty about future income and higher risk of unemployment leads to a rise in precautionary savings. The emergency measures supported incomes and allowed households to maintain their living standards to a large extent. However, as a consequence of the containment measures, their immediate impact on consumption was reduced. These measures prevented consumers from making purchases and led to a strong increase in the saving ratio particularly in the higher income groups.[14] This implies that income support that is targeted towards lower income households has a larger macroeconomic impact, since these have a higher propensity to consume and are more likely to raise their consumption following the lockdowns. In fact, several countries have already taken measures consisting of targeted transfers to certain households, such as families or the unemployed. Such measures can be assumed to have a stronger impact insofar as they target households with a higher propensity to consume. Little recourse has been made to direct consumption incentives which were a popular instrument in the GFC, in particular car scrapping schemes. This is because the car sector is expected to be less affected than others in the current crisis, in which the service sector in particular is hit to a greater extent. Notable exceptions are a few countries that have provided consumption incentives for other sectors, such as holiday vouchers.

Government spending on investment should be a priority during the interim phase in the run-up to the economic recovery. Whereas fiscal stimulus in the form of tax cuts or transfers may not be very effective in stimulating the economy during the interim phase, where partial lockdowns and high levels of uncertainty may still be in place, stimulating the economy through various public works is more effective.[15] This type of spending is not significantly affected by social distancing and, given its complementary nature to private investment, may act to crowd-in private investment. Some countries, most notably Germany[16] and France[17], have already announced fiscal packages in 2020 which foresee considerable increases in government investment in 2021 and beyond. In practice, however, achieving these increases swiftly can be challenging owing to the time needed to properly assess investment needs and roll out expenditures. It is therefore important to have “shovel-ready” projects which can be automatically rolled out when the need arises. In that respect, maintenance activities can be frontloaded as they tend to be more easily implemented than new projects. In this way, the increases in investment can be implemented in a timely manner and provide effective stabilisation.

Government investment also has an important role to play in the post-pandemic economic recovery, most notably through the financing provided by the Next Generation EU scheme. In particular, the additional investment under the Next Generation EU scheme will play a major role in supporting the recovery once the pandemic ends.[18] It is expected that this facility would imply a debt-based fiscal expansion of around 1% of GDP on average in the euro area over the period 2021-24. Most of this expenditure should be spent on investment and growth-enhancing structural reforms (see Box 1). It is thus important to ensure the additionality of these expenditures over and above national expenditures, so that the EU funds do not crowd out national government investment expenditures. It is important to note that even if NGEU funded investments were to replace national expenditure, the impact would nonetheless be beneficial, as EU grants do not raise domestic public debt levels. This expected increase in investment in the aftermath of the crisis stands in sharp contrast to the years following the GFC, when considerable cuts in government investment took place as part of the fiscal consolidation strategies followed by euro area Member States,[19] with the government investment ratio in the euro area dropping from 3.7% of GDP in 2009 to 2.7% in 2018.

Both national and EU responses are expected to have a significant component dedicated to meeting environmental objectives. The July 2020 European Council[20] agreement set an overall target of at least 30% of the total amount of the EU’s budget and NGEU expenditures in support of climate objectives. A notable example is France, where according to the 2021 DBP, 30% of the €100 billion “France Relance” programme is earmarked for investments in all aspects of “ecological transition, including the energy retrofitting of buildings, green infrastructure and mobility, decarbonisation of industrial processes and support for green innovation, support for the circular economy, limits on land take, and agricultural transition.” This is not the first time that stimulus measures in an economic crisis pursue environmental objectives, as during the GFC over 16% of all GFC-related fiscal stimulus was directed towards various green activities.[21] The experience has shown that the implementation of sufficiently large, timely and properly designed green stimulus measures can generate economic growth while also delivering environmental benefits. However, there can also be various trade-offs between growth and environmental objectives, which in turn highlights the importance of proper policy design.

4 Liquidity measures on the expenditure side

In the early phase of the COVID-19 crisis, loan guarantees were the predominant instrument used to address firms’ liquidity shortages. Such guarantees aimed to avert liquidity shortages for firms particularly affected by the containment policies, in particular SMEs. In addition, several Member States provided additional liquidity to firms in the form of loans through State-owned development banks. At the euro area level, announced guarantees amounted to over 16% of GDP (see Chart 4). While the announcement of such sizeable loan guarantees certainly helped to restore business confidence in the short run, the announced amounts are only loosely related to the actual take-up. In the four largest Member States, overall take-up up to October-November 2020 spanned from around 1.3% of GDP in Germany to 9.7% of GDP in Spain.[22] The effectiveness of the schemes depends on certain design features which determine whether borrowers can access the loans quickly, and which differ significantly across countries. In addition, loan guarantees were also provided by the European Investment Bank (EIB) (see Box 1).

Chart 4

Guarantees

(percentages of GDP in 2019)

Source: Own calculations based on DBPs for 2021 and the International Monetary Fund (IMF) Database of Fiscal Policy Responses to COVID-19.

Notes: Data are from the DBPs for 2021 posted on the European Commission’s website. In some cases, the figures were provided as a percentage of GDP, while in others the amount was provided in € billions. In the latter case, the amounts were expressed as a percentage of GDP using the nominal growth projections for 2020 included in the DBPs. For AT, CY, EE, IT, LV, NL and SI, the size of the State guarantee envelopes was obtained from the IMF Database of Fiscal Policy Responses to COVID-19 with a cut-off date of 11 September 2020. The amounts were converted into euro using the EUR/USD exchange rate of 11 September 2020 and the GDP figures from the DBPs were used to calculate the ratios.

While guarantees to non-financial corporations were also used in previous downturns, their size is a particular feature of the policy response to the COVID-19 crisis. The guarantees granted to the financial sector during the GFC mainly aimed at restoring confidence and ensuring the proper financing of the financial sector. Commitments for those guarantees amounted to about 18% of GDP in 2010,[23] a similar dimension as current guarantees to non-financial corporations. Moreover, as the financing conditions for SMEs worsened in the wake of the GFC owing to difficulties in the banking sector, most euro area countries extended the use of public guarantee schemes and public credit to ensure liquidity provision to firms. While the amounts announced for such programmes were sometimes very large (for example, Germany earmarked guarantees of about €100 billion in the context of its Wirtschaftsfonds Deutschland and France provided loans and guarantees to SMEs amounting to €22 billion), the actual amounts used were usually substantially lower,[24] in particular compared with commitments to the financial sector.

The empirical literature points to guarantees having had a positive effect on lending in previous crises, but also to some possible negative incentive effects, although these appear less likely under current circumstances. Empirical analyses of schemes for SMEs in Italy[25] and the Netherlands[26] found that they had positive effects on access to credit during the GFC, but they also provide some evidence of moral hazard by firms. Moral hazard arose as guarantees reduced banks’ incentives to screen and monitor the quality of loans, leading to riskier loans as firms undertook riskier projects. In the COVID-19 crisis, the provision of loan guarantees appears to be a particularly efficient instrument for ensuring the liquidity of firms, as the crisis has mostly hit firms that would be viable and productive in a non-pandemic world. In principle, moral hazard concerns could arise if banks replace existing problematic loans from before the crisis with new ones guaranteed by the State. However, owing to the specific characteristics of the current crisis, the risks that moral hazard might lead to high costs from lending to non-viable firms are lower.[27] In contrast to previous financial crises, this time the economic shock was not caused by excessive risk-taking, therefore the liquidity problems of firms are assumed to be mostly of a temporary nature. Moreover, the extensive fiscal support to firms can partly compensate their losses during the pandemic.

5 Budgetary measures on the revenue side

Several euro area countries have introduced temporary VAT cuts to stimulate consumption following strict lockdowns. Most notably, Germany temporarily cut the standard VAT rate of 19% by 3 percentage points and the reduced VAT rate of 7% by 2 percentage points from July to December 2020, while Ireland cut its standard rate of 23% by 2 percentage points from September 2020 to February 2021. Under the assumption of full pass-through, the VAT cut in Germany would reduce euro area HICP inflation in July 2020 by around 0.6 percentage points.[28] However, the actual impact of this measure is uncertain, as it is temporary and taken in a situation of weak economic activity and high uncertainty. While there is little experience with such stimulus policies in the euro area, empirical evidence for the United Kingdom,[29] which used a temporary VAT cut as a measure to stimulate consumer spending during the GFC, shows that firms initially passed through the lower VAT rate to a large extent, but after two months reversed some of the price cuts. Overall, in that specific case, a temporary VAT cut was successful in bringing forward consumption of durable goods. However, early evidence based on a consumer survey in Germany indicates that, while about half of consumers had perceived a drop in prices, only 11% of consumers planned to frontload purchases originally planned for 2021, which points to the temporary VAT cut having some, albeit limited, effectiveness in stimulating consumption.[30]

The continued health restrictions and behavioural changes posed some challenges to the operation of temporary VAT cuts as stimulus policy. Most notably, such cuts benefit less the sectors that were most affected by containment policies and often continued to face supply restrictions during the interim phase following the broad lockdowns and provide more support to consumption of durable goods. Therefore, a few countries (such as Belgium and Austria) restricted VAT cuts to more affected sectors, such as travel and hospitality. Finally, once the VAT cuts come to an end, in most cases at the beginning of 2021, a temporary drop in consumption can be expected in the event that the economy is still suffering from depressed demand.

In their budgets for 2021, some euro area countries plan to reduce direct taxes or social security contributions in response to the COVID-19 crisis. Most notably, France has announced a reduction in production taxes in 2021 in order to improve the competitiveness of firms. While several countries provided some tax incentives for firms, for example in the form of investment allowances, so far no major cuts have been made to corporate tax rates. While, in general, corporate tax cuts may have a positive effect on potential growth, as they improve the growth-friendliness of the tax systems,[31] these are less likely to generate strong positive effects on growth in the short run. First, corporate tax cuts typically benefit profit-making firms and therefore do not support those firms which are making a loss as a result of the pandemic. Second, in times of high uncertainty, such as the current crisis, empirical research has found that firms do not react strongly to tax incentives in their investment decisions.[32] With regard to labour taxes, subsidy programmes that temporarily exempt firms from social contributions or taxes for new hires have been introduced in a few countries, for example Greece. Such temporary and targeted measures can be efficient instruments to support labour reallocation in the recovery phase. Broad-based cuts to personal income taxes or social contributions implemented on a temporary basis (such as in Greece) or permanently (for example, in poorer regions in Italy) are typically much more costly, but are expected to support employment growth in the medium to long run.

6 Liquidity measures on the revenue side

During the lockdowns, the liquidity position of firms was further enhanced by various tax-related measures, in particular tax deferrals, which are not expected to have a substantial impact on the budget balance of 2020. Very early on in the pandemic, all euro areas countries took measures to relieve the immediate tax payments of firms severely affected by the lockdowns. Typically, such measures did not reduce the overall tax obligations of firms but shifted the payment dates from the time of the broad lockdowns in the first half of the year to later dates, thus providing additional liquidity to firms. These measures comprised tax deferrals (covering VAT, corporate and personal income taxes, and social contributions), reductions in corporate tax prepayments (as the calculation of the current year’s corporate tax payments is mostly based on last year’s outcome) and speeding up of tax refunds and arrears or the suspension of enforcement measures. In most countries, the amounts of deferred taxes amounted to between 0.5% and 2% of GDP and in several cases were very substantial, reaching close to 8% of GDP in the case of Luxembourg, according to the country’s DBP for 2021. However, the overall effect of these measures on the budget balance in 2020 is relatively small for two reasons. First, in most countries the payment of the deferred taxes was due in the second half of that year. Second, even if payment is deferred to the following years, the expected revenue is accrued to the year in which the tax liability arose.

Tax-related liquidity measures were an efficient instrument to increase the liquidity of firms. As tax obligations typically only react with a delay to changes in revenues, such tax measures serve as a stabiliser for firms’ earnings. While the widespread use of such measures is a new feature of the COVID-19 crisis, they were already applied to a limited extent during the GFC (for example in Italy and Spain). There is relatively limited evidence regarding their effectiveness, with the notable exception of one empirical analysis,[33] which studies the deferral of labour-related taxes and fees in Sweden in 2009. This study points to tax deferrals having positive effects, as they alleviated short-term liquidity constraints, in particular for younger and more leveraged firms, and seemed to have made it less likely that they would encounter severe financial distress in the years after the crisis.

Box 1

EU reaction to the COVID-19 crisis

The response of the European Union (EU) to the coronavirus (COVID-19) crisis has been unprecedented and significantly complements the fiscal measures taken at the national level. Although national fiscal measures are the first line of defence, the extent of the crisis and the fact that not all Member States have the same fiscal room for manoeuvre has meant that an EU response over and above the national responses can support the recovery and reduce the risk of fragmentation in the EU.

The EU’s response has also been tailored to the challenges arising in the different phases of the crisis. Short-term initiatives were used to deal with the urgent need to combat the crisis during the initial lockdown phase, while the more medium to long-term initiatives are aimed at sustaining the required fiscal stimulus, most notably in the more vulnerable Member States, in a manner that paves the way for a more competitive EU in the long term.

The first set of measures included:

The activation of the general escape clause of the Stability and Growth Pact (SGP) was one of the key immediate initiatives. The general escape clause[34] allows for a coordinated and temporary deviation from the usual fiscal requirements of the SGP for all Member States provided that this does not endanger fiscal sustainability in the medium term. It thus allows them to undertake the budgetary measures needed to achieve a counter-cyclical response in a situation of generalised crisis caused by a severe economic downturn in the euro area or the EU as a whole. The ECOFIN Council activated the clause for the first time since its inclusion in the rules in 2011. According to the Statement of the EU ministers of finance on the Stability and Growth Pact in light of the COVID-19 crisis of 23 March,[35] the triggering of the general escape clause aims to ensure the needed flexibility for Member States to undertake both the measures required to contain the impact of the pandemic and potentially provide more general support beyond this through further discretionary stimulus and coordinated action. The measures should be designed, as appropriate, to be timely, temporary and targeted.

Measures are aimed at ensuring that the EU rules-based framework is supportive of the implementation of emergency measures. Most notably, the European Commission adopted a specific temporary State aid framework to expedite the provision of public support measures to companies, while also stressing the need to maintain a level playing field in the Single Market.

With regard to the EU budget, the European Commission set up the Coronavirus Response Investment Initiative, which allows the use of funds under the EU’s cohesion policy to address the consequences of the COVID-19 crisis.

As a second step, three safety nets were established to support Member States’ measures for workers and businesses, and to safeguard countries’ access to financing, amounting to a package worth €540 billion. These safety nets aim to provide liquidity support to businesses and help Member States fund their crisis-response policies.

1. Support to mitigate Unemployment Risks in an Emergency (SURE): The SURE scheme is a temporary, loan-based instrument providing financial assistance to sovereigns, which provides financing of the national funding for short-time employment schemes and some health-related costs for the duration of the emergency. Loans of up to €100 billion in total are granted on favourable terms by the EU to Member States, building on the EU budget as much as possible, and additionally secured by guarantees provided by Member States. The contributions from Member States will be provided in the form of irrevocable, unconditional and on-demand guarantees.

2. Strengthening European Investment Bank (EIB) activities: Based on the initiative of the EIB Group, a pan-European guarantee fund of €25 billion was established. In turn, this can support €200 billion of financing for companies with a focus on small and medium sized enterprises throughout the EU, including through national promotional institutions. The aim is to complement national guarantee systems and ensure that companies have sufficient short-term liquidity and are able to continue their growth and development in the medium to long term.

3. Safety nets for sovereigns in the euro area: To safeguard euro area countries’ financing, the Pandemic Crisis Support tool was developed. This is based on the existing precautionary credit line of the European Stability Mechanism (ESM), the Enhanced Conditions Credit Line, and adjusted in the light of the current specific challenge. The aim of this tool is to ensure access to financing during the crisis. Requests for Pandemic Crisis Support may be made until 31 December 2022. The access granted will constitute 2% of the respective euro area country’s GDP as of end-2019, as a benchmark, with an overall envelope worth €240 billion. The sole requirement to access the credit line is that the countries receiving support “commit to use this credit line to support domestic financing of direct and indirect healthcare, cure and prevention-related costs due to the COVID-19 crisis”. The credit line was made operational by the ESM’s Board of Governors on 15 May 2020, but as at the end of 2020 no country had expressed interest in using it.

To support the recovery further, the European Council adopted the ground-breaking recovery package entitled the “Next Generation EU” (NGEU).[36] The package is worth €750 billion in 2018 prices and is centred around a Recovery and Resilience Facility (RRF) with a €672 billion envelope consisting of €360 billion in loans and €312.5 billion in grants. The remainder of the NGEU funds are directed towards other initiatives, such as research and development (HorizonEurope), crisis cohesion funding (REACT-EU), climate change (Just Transition Fund), rural development and civil protection (RescEU), with REACT-EU being the largest of these items. All RRF funds should be committed by the end of 2023, and all payments should be executed by the end of 2026. The Commission will be empowered to borrow funds on the capital markets on behalf of the EU up to the amount of €750 billion in 2018 prices, with new net borrowing activity stopping at the latest by the end of 2026. The repayment schedule is until the end of 2058. Those EU countries identified as particularly vulnerable are expected to receive considerable net transfers from the RRF. To receive financial support under the RRF, EU Member States need to draw up national recovery and resilience plans in which they set out their reform and public investment agenda for the years 2021-23. These reforms and investments should address the challenges identified in the context of the European Semester and strengthen job creation, the growth potential, and economic and social resilience of the Member State concerned. On 9 November 2020 the European Parliament adopted the RRF, which also calls for each recovery and resilience plan to contribute at least 40% of its budget to climate and biodiversity and at least 20% to digital investments and reforms.

7 Implications for the fiscal stance

The interpretation of the fiscal stance for 2020 and 2021 is challenging owing to the one-off impact of the emergency measures. As shown above, the overall amount of fiscal measures specified in the DBPs for 2021 is substantially lower than that for 2020. This implies that a massive fiscal expansion in 2020 will be succeeded by some scaling down of fiscal support in the subsequent year in the absence of additional measures or an extension of existing ones in response to a resurgence of the crisis. However, this mainly results from the expiry of the fiscal emergency measures, which have different economic implications from standard stimulus measures, with a more durable positive effect on growth. The rationale for those measures was not to boost growth in the first half of the year when the bulk of the spending took place, but rather to preserve those firms and employment relationships that would not otherwise have survived the lockdown. The effect of such measures on economic activity will be felt more strongly during the recovery, as in the counterfactual situation of widespread firm collapses and dismissals, the catch-up would have been slowed down by time-consuming restructuring processes in otherwise healthy firms and distortions in the labour market.

The substantial fiscal measures taken in 2020 counteracted the output losses related to the crisis. As shown above, the specific features of the COVID-19 crisis had an impact on the effectiveness of fiscal measures. Therefore, the estimation of their growth effects based on historical elasticities can be misleading, as any model should take into account the economic characteristics of the pandemic. Early model-based evidence[37] suggests that the emergency measures implemented at the start of the COVID-19 crisis strongly counteracted the pandemic-related output loss and speeded up the recovery. It estimates that the stabilisation gains from short-time work schemes and guarantees reduced the pandemic-related macroeconomic loss by a quarter, in other words an improvement in real GDP by more than 4 percentage points. In the model context, short-time working schemes are assumed to stabilise investment by firms, as they reduce costs and therefore increase liquidity, and to reduce the persistency of the recession, as they help firms to avoid the costly and time-consuming hiring process during the recovery period. Moreover, the more generous nature of short-time work schemes compared with unemployment payments supports household demand. Liquidity support measures are assumed to stabilise investment and employment by firms that are liquidity-constrained during the crisis.

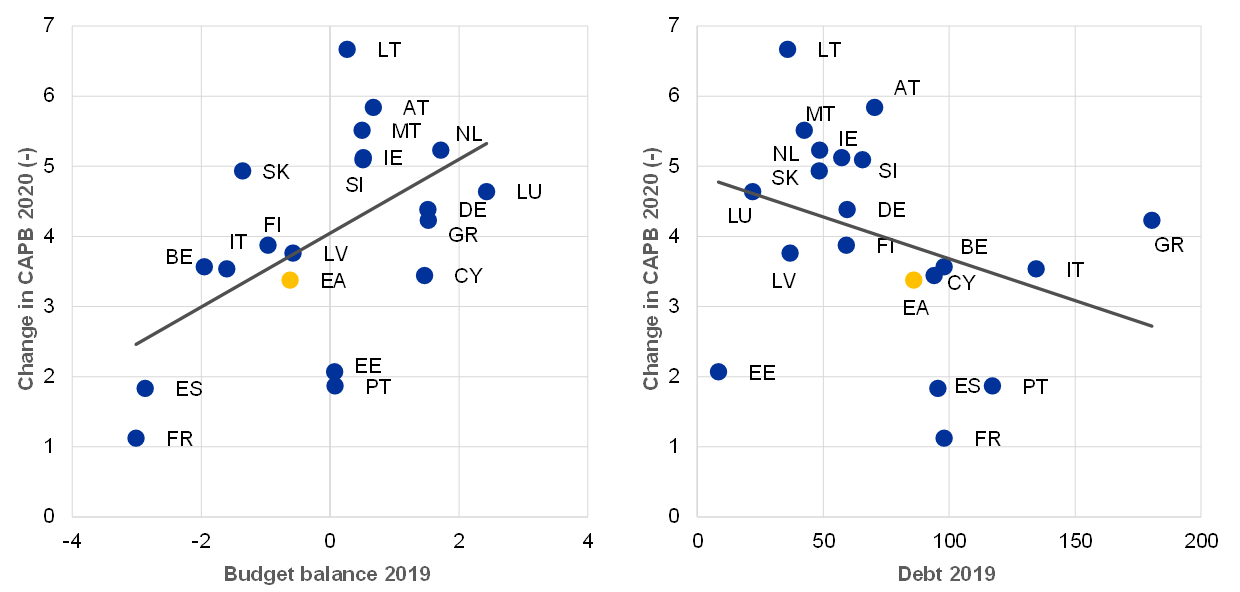

Chart 5

Fiscal loosening in 2020 and initial fiscal position

(percentages of GDP)

Source: European Commission’s Autumn 2020 Economic Forecast.

Notes: The size of the fiscal loosening in 2020 is measured as a change in the cyclically adjusted primary balance (CAPB) of the European Commission’s Autumn 2020 Economic Forecast (with the sign changed to make the interpretation of the chart easier).

The estimated size of the loosening of the fiscal stance in 2020 also reflected the initial fiscal positions of Member States. The favourable macroeconomic developments observed up to 2020 induced some euro area countries to reduce their budget deficits and build substantial fiscal buffers. In particular, countries with a favourable starting position in terms of a positive budget balance and lower debt level were able to provide considerable support to the economy in a timely manner (see Chart 5).

Looking forward, the NGEU package will provide additional stimulus in 2021-26 on top of national measures shown above. The additional investment spending of the NGEU is expected to provide additional stimulus for Member States in the years 2021 to 2026. However, it will not be reflected in the their deficits but will lead to fiscal liabilities at the EU level. While these will be long-term liabilities, servicing this debt will place a burden on the EU economies in the long run. The European Council agreement of July 2020 calls for the steady and predictable reduction in those liabilities up to 31 December 2058. For the repayment of the grants, Member States agreed to work towards reforming the own resources system and ensuring that repayments will be covered by higher Member States’ Gross National Income (GNI)-based contributions and by new genuine EU own resources. For this purpose, the amounts of the EU own resources ceilings will be temporarily increased by 0.6 percentage points.

For the NGEU to be effective it is crucial that Member States use the European aid at this unique juncture to channel funds into much needed productive spending, accompanied by productivity-enhancing reforms. This would allow the Next Generation EU programme to contribute to a faster, stronger and more uniform economic recovery and would increase economic resilience and the growth potential of Member States’ economies. Structural policies are particularly important in addressing long-standing structural and institutional weaknesses and in accelerating the green and digital transitions. In that respect, particular attention has to be paid to the preparation of the Member States’ recovery and resilience plans to ensure that the funds are directed towards reforms that have been identified and are thus consistent with country-specific recommendations.

8 Conclusions and policy implications

Overall, the immediate response in the form of emergency measures has been strong and relatively homogenous across countries and has substantially helped to contain the effects of the pandemic on the euro area economy. Since all euro area countries were hit by the economic shock at the same time and to a similar extent, the fiscal responses in the form of emergency measures were relatively similar in terms of the size and scope of the instruments used. Given the specific nature of the crisis, it is assumed that those instruments were well targeted to the specific challenges of the first crisis phase of broad lockdowns. Moreover, the response to the crisis was supported by decisions at the EU level, such as the activation of the SGP’s general escape clause and the adoption of a specific temporary State aid framework to expedite the provision of public support measures to companies.

The recovery needs to be supported by appropriate measures which take into account the future path of the pandemic and the effectiveness of policy instruments. For 2021, the amount of stimulus announced in the DBPs differs substantially across Member States. While the recovery would benefit from appropriate stimulus measures, the design of such measures needs to be contingent on restrictions and temporary local lockdowns which limit the effectiveness of many conventional stimulus measures. At the same time, the extension of emergency measures appears sensible for those sectors in which businesses are still affected by containment measures and have business models that are likely to be viable after the pandemic. While countries with fiscal space are less constrained in the pursuit of such measures, countries with limited fiscal space will benefit from prioritising and pursuing more targeted support measures, such as continuing to support the most vulnerable sections of society.

Longer-term recovery policies should aim to improve the growth-friendliness of public finances. Even though the economies are expected to rebound once the virus containment measures have ended, the recovery may be impaired by the legacy of the lockdown, such as a debt overhang among the worst hit firms or structural changes in the behaviour of firms and households, such as an increase in digitalisation. Consequently, additional stimulus measures could support the recovery in the medium run but should not hamper necessary structural changes to the economies. In fact, the impact of the funds on growth will be magnified if they are accompanied by appropriate structural policies. It is therefore essential for the funds available through the Next Generation EU fund to be absorbed quickly and channelled into growth-enhancing investment projects. Additional public expenditures should be targeted towards boosting potential growth, and, in particular, should support the long-term objectives of the EU in the areas of addressing climate change and promoting digitalisation.

Finally, once the economic recovery is firmly under way, it is crucial that medium-term fiscal policies are designed in a way that ensures public debt sustainability. Although countries should not withdraw fiscal support too fast, the fact that debt levels have risen dramatically means that it is crucial for euro area Member States to have credible fiscal consolidation strategies in the medium term. Furthermore, the COVID-19 crisis has demonstrated that the accumulation of comfortable fiscal buffers during times of economic growth is key to being able to address the consequences of a sudden downturn triggered by exogenous events.

- See “Automatic fiscal stabilisers in the euro area and the COVID-19 crisis”, Economic Bulletin, Issue 6, ECB, 2020.

- For instance, out of €75 billion provided as emergency support to small companies by the German federal government, only €15 billion had been drawn on by the end of October 2020. See Sachverständigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung, “Jahresgutachten 2020/21 - Corona-Krise gemeinsam bewältigen, Resilienz und Wachstum stärken”, Wiesbaden, 2020.

- The information is provided in the Commission Working Documents accompanying the Draft Budgetary Plans 2021.

- For instance, this assumption partly explains why the figures for Spain and Luxemburg are substantially below those reported in the countries’ DBPs (5.5% and 5.1% of GDP respectively). In addition, in the case of Spain, some measures reported in the DBP, such as the COVID-19 fund for regions, the salary increase in the public sector and the pension indexation to the consumer price index, are incorporated implicitly in the Commission’s baseline projections and are therefore not included in Chart 2.

- “Public finances in EMU – 2010”, European Economy, Issue 4, European Commission Directorate-General for Economic and Financial Affairs, 2010.

- The estimates are based on a subset of Member States, as not all countries have provided detailed information on the composition of discretionary measures in 2020.

- “A preliminary assessment of the impact of the COVID-19 pandemic on the euro area labour market”, Economic Bulletin, Issue 5, ECB, 2020.

- Hijzen, A. and Martin, S., “The role of short-time work schemes during the global financial crisis and early recovery: a cross-country analysis”, IZA J Labor Policy, Vol. 2, Issue 5, 2013.

- Balleer, A., Gehrke, B., Lechthaler, W. and Merkl, C., “Does short-time work save jobs? A business cycle analysis”, European Economic Review, Vol. 84, 2016, pp. 99-122.

- Cahuc, P., Kramarz, F. and Nevoux, S., “When Short-Time Work Works”, Banque de France Working Paper, No 692, 2018

- Giupponi, G. and Landais, C., “Subsidizing Labor Hoarding in Recessions: The Employment and Welfare Effects of Short Time Work”, CEPR Discussion Paper, No 13310, 2020.

- See footnote 8.

- “Job retention schemes during the COVID-19 lockdown and beyond”, OECD, 2020.

- While the surge in the household saving rate in the second quarter of 2020 can in principle be explained by forced savings owing to lockdown measures and precautionary savings owing to the risk of future unemployment, an empirical analysis suggests that forced savings seem to be the main driver; see “COVID-19 and the increase in household savings: precautionary or forced?”, Economic Bulletin, Issue 6, ECB, 2020.

- “Fiscal Monitor: Policies for the Recovery”, IMF, 2020.

- In June 2020 the German government reached agreement on a fiscal stimulus package which includes a €50 billion envelope for investment promotion measures, including support for E-cars and more charging stations, investment in support of digitalisation and additional support for Deutsche Bahn.

- On 3 September 2020 the French government announced the “France Relance” (Relaunch France) recovery plan, which is expected to mobilise €100 billion. This initiative has a significant public investment component. Some 30% of the funds will be devoted to financing environmental investments, while the plan also envisages investments in future technologies.

- See the box entitled “The fiscal implications of the EU’s recovery package”, Economic Bulletin, Issue 6, ECB, 2020.

- See the article entitled “The composition of public finances”, Economic Bulletin, Issue 5, ECB, 2017.

- The conclusions adopted on 21 July 2020 by the European Council on the recovery plan and multiannual financial framework for 2021-2027.

- The green policies supported comprised renewable energy generation, energy efficiency in buildings, scrappage payments for vehicles with low fuel efficiency, support for clean technology development, mass transit, nature conservation and water resource management; see Agrawala, S., Dussaux, D. and Monti, N., “What policies for greening the crisis response and economic recovery? Lessons learned from past green stimulus measures and implications for the COVID-19 crisis”, OECD Environment Working Papers, No 164, 2020.

- Updated figures of information appearing in “Public loan guarantees and bank lending in the COVID-19 period”, Economic Bulletin, Issue 6, ECB, 2020.

- For a detailed overview of guarantees to the financial sector during the GFC, see “Measures taken by euro area governments in support of the financial sector”, Monthly Bulletin, ECB, April 2010.

- For an overview, see “Assessment of government support programmes for SMEs’ and entrepreneurs’ access to finance in the global crisis”, OECD Working Party on SMEs and Entrepreneurship, Paris, 2010.

- D’Ignazio, A. and Menon, C., "Causal Effect of Credit Guarantees for Small‐ and Medium‐Sized Enterprises: Evidence from Italy", Scandinavian Journal of Economics, Vol. 122, 2020, pp. 191-218.

- Ioannidou, V., Liberti, J.M., Mosk, T. and Sturgess, J., “Intended and Unintended Consequences of Government Credit Guarantee Programs” in Mayer, C., Onado, S. M., Pagano, M. and Polo, A. (eds), Finance and Investment: The European Case, 2018.

- For a discussion on the risks of zombification of the economy and policy actions to prevent it, see Laeven, L., Schepens, G. and Schnabel, I., “Zombification in Europe in times of pandemic”, VoxEU, 11 October 2020.

- See “The role of indirect taxes in euro area inflation and its outlook”, Economic Bulletin, Issue 6, ECB, 2020.

- Crossley, C, Low, H. and Sleeman, C., "Using a temporary indirect tax cut as a fiscal stimulus: evidence from the UK," IFS Working Papers, No W14/16, Institute for Fiscal Studies, 2014.

- Sachverständigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung, “Jahresgutachten 2020/21 - Corona-Krise gemeinsam bewältigen, Resilienz und Wachstum stärken”, Wiesbaden, 2020.

- “The composition of public finances in the euro area”, Economic Bulletin, Issue 5, ECB, 2017

- Guceri, I. and Albinowski, M., “Investment Responses to Tax Policy Under Uncertainty”, CESifo Working Paper, No 7929, 2019.

- Brown, J.R., Martinsson, G. and Thomann, C., “Government Lending in a Crisis”, Swedish House of Finance Research Paper, No 20-28, October 2020.

- See the box entitled “The COVID-19 crisis and its implications for fiscal policies”, Economic Bulletin, Issue 4, ECB, 2020.

- See the Statement of the EU ministers of finance on the Stability and Growth Pact in light of the COVID-19 crisis of 23 March 2020.

- See the box entitled “The fiscal implications of the EU’s recovery package”, Economic Bulletin, Issue 6, ECB, 2020.

- Pfeiffer, P., Roeger, W. and in ’t Veld, J., “The COVID19-Pandemic in the EU: Macroeconomic Transmission and Economic Policy Response”, European Economy Discussion Paper, No 127, 2020.