Overview

Following weak growth in the second quarter of 2019, recent short-term indicators suggest that the recovery in the second half of the year that was envisaged in the previous projection exercise will be postponed. Economic sentiment indicators have continued to worsen over recent months, notably in the industry sector. This reflects the ongoing weakness in global trade in an environment of continued global uncertainties, such as increased protectionism, a potential sharper slowdown in China and a disorderly Brexit. These factors are weighing on business expectations in the manufacturing sector and are expected to continue to hamper euro area activity in the near term. At the same time, sentiment in the domestically oriented services and construction sectors, as well as consumer confidence, continues to exhibit more resilience, while the labour market situation has continued to improve. The baseline is conditioned on the technical assumption of notably lower interest rates reflecting market expectations, an assumption of an orderly Brexit and some fiscal easing – all of which should support a return to the medium-term growth path foreseen in the June 2019 projections. In addition, having reached very low levels in 2019, foreign demand is expected to recover and to provide impetus to activity over the remainder of the projection horizon. Overall, real GDP growth is projected to be 1.1% in 2019, before gradually increasing to 1.4% in 2021. Compared with the June 2019 projections, the short-term outlook has deteriorated due to weaker confidence indicators and continued global uncertainties, leading to downward revisions in 2019 and in 2020, which in 2020 are mainly due to carry-over effects. Beyond the short term the impact of negative external shocks is broadly offset by the impact of more favourable financing conditions and lower oil prices.

HICP inflation is expected to moderate this year and remain subdued next year, before recovering to reach 1.5% in 2021. HICP inflation excluding energy and food will rise slightly by the end of 2019 and move sideways in the course of 2020 before strengthening in 2021, supported by the expected pick-up in activity and the associated recovery in profit margins as past increases in labour costs feed into prices. Compared with the June 2019 projections, HICP inflation has been revised downwards, largely owing to the energy component which is revised notably downwards for both 2019 and 2020, due to lower oil prices. In addition, HICP inflation excluding energy and food is also revised downwards, reflecting weaker data outturns, weaker activity, indirect effects from lower energy prices and persistent past over-predictions.[1]

1 Real economy

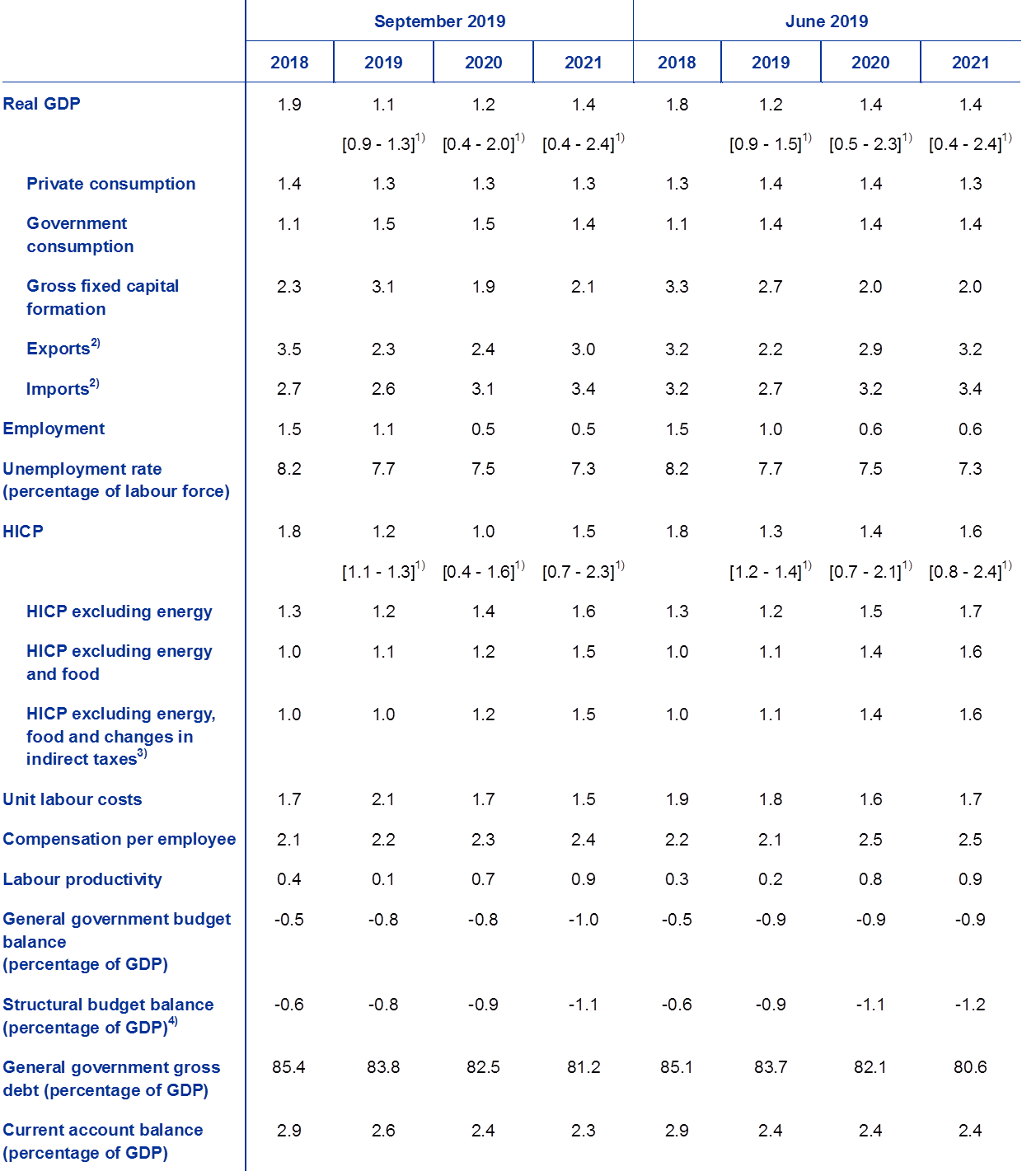

Real GDP growth in the euro area fell to 0.2% in the second quarter of 2019, as export growth slowed down sharply (see Chart 1). Growth in the second quarter came in as had been expected in the June 2019 projections. Despite decelerating slightly in the second quarter of 2019, domestic demand remained the main driver of growth, while the net trade contribution turned negative.

Chart 1

Euro area real GDP

(quarter-on-quarter percentage changes, seasonally and working day-adjusted quarterly data)

Note: The ranges shown around the central projections are based on the differences between actual outcomes and previous projections carried out over a number of years. The width of the ranges is twice the average absolute value of these differences. The method used for calculating the ranges, involving a correction for exceptional events, is documented in “New procedure for constructing Eurosystem and ECB staff projection ranges”, ECB, December 2009, available on the ECB’s website.

Short-term indicators point to weak growth in the second half of 2019. The Economic Sentiment Indicator compiled by the European Commission has continued to decline in recent months driven by sentiment in the manufacturing sector which has fallen further below its longer-term average level. This seems to reflect the ongoing weakness of global trade, as well as the impact of global uncertainty, in particular related to global trade disputes, a possible no-deal Brexit and risks of a sharper slowdown in China. In contrast, sentiment in the more domestically oriented services and construction sectors, as well as consumer confidence, has continued to exhibit more resilience, despite some declines in August. The latest developments in the Purchasing Managers’ Indices confirm this divergence across sectors. Overall, the latest indicators suggest that the weak growth seen in the second quarter will continue in the second half of 2019, driven by a negative contribution from net trade, while domestic demand is expected to remain relatively resilient.

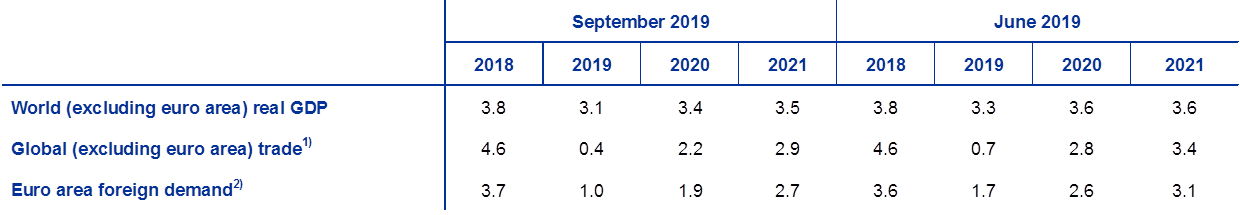

Over the medium term the baseline assumes a gradual dissipation of global headwinds, allowing fundamental factors supporting the euro area expansion to regain traction (see Table 1). In particular, the baseline assumes an orderly exit of the United Kingdom from the EU and no further protectionist measures (beyond those already announced), which also reduces the chances of a sharp slowdown in China. Thus, the current level of uncertainty will gradually decline, allowing the fundamentals supporting growth to regain traction. The ECB’s monetary policy stance is expected to remain very accommodative and to continue to be transmitted to the economy. More specifically, the technical assumptions imply that at the end of the projection horizon nominal interest rates would still stand below the very low levels they reached in mid-2019. Lending to the non-financial private sector should also strengthen modestly towards the end of the projection horizon, spurred by the improving macroeconomic environment, very low interest rates and favourable bank lending conditions for both households and non-financial corporations. Lower deleveraging needs across sectors and rising profits will also contribute to the dynamism of private expenditure. Growth in private consumption and residential investment should also benefit from relatively robust wage growth and net worth, as well as from declining unemployment. Euro area exports are expected to benefit from the projected recovery in foreign demand. Finally, the fiscal stance is expected to be mildly expansionary over the whole horizon (see Section 3).

Nevertheless, the fading-out of some tailwinds would lead to slower growth towards the end of the projection horizon. Business investment is expected to weaken over the projection horizon, reflecting a prolonged period of low business confidence and the expiration of some tax incentives. Employment growth is also expected to slow down over the medium run, mostly reflecting increasingly binding labour supply shortages in some countries.

Table 1

Macroeconomic projections for the euro area

(annual percentage changes)

Note: Real GDP and components, unit labour costs, compensation per employee and labour productivity refer to seasonally and working day-adjusted data.

1) The ranges shown around the projections are based on the differences between actual outcomes and previous projections carried out over a number of years. The width of the ranges is twice the average absolute value of these differences. The method used for calculating the ranges, involving a correction for exceptional events, is documented in New procedure for constructing Eurosystem and ECB staff projection ranges, ECB, December 2009, available on the ECB’s website.

2) Including intra-euro area trade.

3) The sub-index is based on estimates of actual impacts of indirect taxes. This may differ from Eurostat data, which assume a full and immediate pass-through of tax impacts to the HICP.

4) Calculated as the government balance net of transitory effects of the economic cycle and temporary measures taken by governments.

Real disposable income is expected to gain momentum in 2019 before weakening in 2020 and 2021. The strengthening in 2019 reflects an increase in nominal disposable income growth and a decline in consumer price inflation. Both weakening nominal income growth and gradually rising inflation are expected to dampen real income growth in 2020 and 2021. The contribution of gross wages and salaries to nominal disposable income growth is projected to decline in 2020 (due to the impact of weaker employment growth) and to remain broadly unchanged in 2021. Other personal income is projected to increase moderately over the projection horizon. The contribution of net fiscal transfers is expected to turn positive in 2019, for the first time since 2010, reflecting a mix of cuts in direct taxation and rising transfers to households. This positive contribution is expected to decline in 2020 and to turn broadly neutral in 2021, in the context of marginally lower transfers to households and gradually increasing direct taxation.

Private consumption growth fell slightly in the second quarter of 2019, partly due to an unwinding of a temporary boost seen at the start of the year, but should remain solid over the projection horizon. Still relatively favourable consumer confidence, expected further improvements in labour market conditions and continued growth of real compensation per employee suggest further steady consumption growth over the projection horizon, also supported by positive effects of some fiscal easing in certain countries.

Private consumption growth should be supported by favourable financing conditions and rising net worth. Nominal bank lending rates are projected to decline further in the near term, before stabilising and then increasing modestly in 2021. Lending rates on mortgages are foreseen to remain somewhat below their mid-2019 levels until the end of the projection horizon, while lending rates on consumer credit are expected to exceed their current levels by a small margin. Given that bank lending rates are projected to stay at low levels and bank lending to households is expected to strengthen only moderately in the current and coming years, gross interest payments are expected to remain at low levels and, therefore, continue to support private consumption. At the same time, gross interest revenues are projected to increase slightly, owing to the continued accumulation of interest-bearing assets. In addition, net worth is projected to increase further, spurred by continued robust valuation gains on real estate holdings which explain more than half of the projected increase. Together with the progress achieved in deleveraging, rising net worth should also provide support to consumption.

Box 1

Technical assumptions about interest rates, exchange rates and commodity prices

Compared with the June 2019 projections, the technical assumptions include lower oil prices and significantly lower interest rates. The technical assumptions about interest rates and commodity prices are based on market expectations, with a cut-off date of 19 August 2019. Short-term rates refer to the three-month EURIBOR, with market expectations derived from futures rates. The methodology gives an average level for these short-term interest rates of -0.4% for 2019 and -0.6% for 2020 and 2021. The market expectations for euro area ten-year nominal government bond yields imply an average level of 0.4% for 2019, 0.1% for 2020 and 0.2% for 2021.[2] Compared with the June 2019 projections, market expectations for short-term interest rates have been revised down by about 10 basis points for 2019, 30 basis points for 2020 and around 40 basis points for 2021, while euro area ten-year nominal government bond yields have been revised down by around 40 basis points for 2019, 80 basis points for 2020 and about 90 basis points for 2021.

As regards commodity prices, on the basis of the path implied by futures markets by taking the average of the two-week period ending on the cut-off date of 19 August 2019, the price of a barrel of Brent crude oil is assumed to decrease from USD 71.1 in 2018 to USD 62.5 in 2019, and to ease further to USD 56.3 in 2021. This path implies that the decline in oil prices in US dollars will be much sharper than entailed in the June 2019 projections. The prices of non-energy commodities in US dollars are assumed to decline in 2019 but to rebound over the subsequent years of the projection horizon.

Bilateral exchange rates are assumed to remain unchanged over the projection horizon at the average levels prevailing in the two-week period ending on the cut-off date of 19 August 2019. This implies an average exchange rate of USD 1.12 per euro over the period 2019-21, as in the June 2019 projections. The effective exchange rate of the euro (against 38 trading partners) appreciated moderately compared with the June 2019 projections, reflecting the relative strength of the euro against the pound sterling as well as against the Chinese renminbi and other emerging market currencies.

Technical assumptions

The expansion of residential investment is expected to continue, albeit at a more moderate pace. The recovery in housing investment seems to have lost some momentum during the course of 2018, notably in Spain, France and the Netherlands, following a period of very strong growth in 2017. Residential investment growth is expected to moderate over the projection horizon. This weakening is suggested by a decline in building permits granted over the last few months and by recent surveys which show a decline in the share of households planning to undertake home improvements over the next year, notwithstanding increasing intentions to purchase or build a home within the next two years. In addition, capacity constraints in the construction sector are expected to be increasingly binding, in particular in Germany and the Netherlands. Adverse demographic trends in some countries, including Germany and France, are also expected to dampen housing investment.

Business investment is expected to increase over the projection horizon, albeit at a rather subdued pace. Following weakness in the first half of 2019, business investment is expected to be rather subdued in the second half of the year, reflecting the impact of the relative weakness of global trade and concerns about a further escalation of trade disputes, as well as fears of a no-deal” Brexit and of a hard landing in China. Beyond the short term, however, as uncertainty is assumed to gradually dissipate, a number of favourable fundamental factors are expected to support business investment in the euro area. First, a higher than usual share of manufacturing firms report lack of equipment as a factor limiting production. Second, financing conditions are expected to remain very supportive over the projection horizon. Third, profits are expected to increase, further adding to the sizeable liquid asset overhang firms have built up in recent years. Fourth, companies may increase investment as a means of compensating for labour-related supply-side constraints. Finally, the leverage ratio of non-financial corporations has declined over recent years, driven by a recovery in stock prices, continued accumulation of assets and moderate debt financing growth, although consolidated gross indebtedness still stands above pre-crisis levels. At the same time, gross interest payments of non-financial corporations have declined to record low levels in recent years and are expected to increase only gradually in the coming years.

Extra-euro area exports are projected to be subdued in the rest of 2019 before recovering over the remainder of the horizon, largely in line with developments in foreign demand (see Box 2). Recent extra-euro area export growth has been volatile. Stockpiling ahead of the original Brexit date in March 2019 lifted euro area exports to the United Kingdom in the first quarter of this year. In the second quarter this effect is estimated to have been reversed, resulting in stagnating extra-euro area exports. As short-term trade indicators remain subdued, extra-euro area exports are projected to be weak in the second half of 2019, increasing below the pace of foreign demand. Thereafter, over the medium term, extra-euro area exports are projected to recover and grow broadly in line with foreign demand, resulting in a flat export shares path. Extra-euro area import growth is also expected to remain rather weak in the near term, reflecting developments in exports themselves and, at the same time, weak investment and activity dynamics in some euro area countries. Looking further ahead, extra-euro area imports are expected to grow broadly in line with total demand (domestic demand plus exports). Overall, the contribution of net trade to real GDP growth is expected to be negative during the second half of 2019 before turning neutral over the remainder of the projection horizon.

Box 2

The international environment

Global real GDP growth continued to moderate in the first quarter of 2019, mainly reflecting a slowdown in several emerging market economies. While activity in China remained stable in the first quarter of the year amid resilient private consumption, several other emerging market economies in Asia, Latin America, and the Commonwealth of Independent States underwent a large contraction. This reflected a combination of adverse idiosyncratic factors (particularly in Brazil and Russia), but also other persistent headwinds, such as elevated domestic political uncertainty (particularly in Mexico and Brazil). In contrast, GDP growth held up comparatively well in most advanced economies in the first quarter owing mainly to temporary favourable factors in some countries (e.g. positive contributions from net trade and inventory building in the United States and from stockbuilding prior to the first Brexit deadline in the United Kingdom). As the impact of these factors unwound, growth in the advanced economies moderated in the second quarter, in line with the June 2019 projections. In particular, in the United States the negative contribution of net trade, as imports stabilised and exports fell, weighed on growth in spite of the fiscal stimulus and resilient private consumption. In the United Kingdom, the economy contracted in the second quarter owing mainly to a decline in investment. Recent survey-based evidence, such as the global composite output Purchasing Managers’ Index (PMI) (excluding the euro area), confirms that the global growth momentum likely softened further in the second quarter. After a small rebound in July, this index declined again in August, pointing to continued subdued global activity.

Global growth is projected to remain subdued in the second half of 2019. A number of headwinds will continue to weigh on the global economy. Global manufacturing activity is expected to remain weak, on the back of declining growth in global investment and in consumption of durable goods, which form a large part of manufacturing output. Given the current elevated level of uncertainty related to the future of international trade relations, global investment growth is unlikely to regain traction in the near term. Faced with a slowing global economy, policymakers around the globe have adopted a number of measures to mitigate the negative impact of economic headwinds. In China, fiscal stimulus measures to cushion the slowdown in domestic demand are expected to have an effect mostly in the second half of the year.[3] In the United States, in addition to the sizeable pro-cyclical fiscal stimulus and the recent agreement on more flexible public spending caps, the Federal Reserve System decided to cut its benchmark interest rate with a view to supporting the ongoing economic expansion. Moreover, a number of other economies have eased monetary policy (e.g. Australia, Brazil, South Korea, Indonesia, India and Turkey) and market expectations embedded in the technical assumptions suggest that others will follow suit.

Over the medium-term global growth is projected to pick up and stabilise at a rate below its long-term average of 3.8%. After declining to 3.1% in 2019, from 3.8% in 2018, global growth (excluding the euro area) is projected to pick up and stabilise at 3.5% by 2021. Developments in global growth are shaped by three main forces. First, in advanced economies, cyclical momentum is projected to slow as capacity constraints become increasingly binding, amid positive output gaps and low unemployment rates across the key economies, while towards the end of the projection horizon policy support would gradually diminish. Second, the progressive slowdown of the Chinese economy and its rebalancing from investment to consumption are projected to weigh negatively on global growth and on trade in particular. Third, emerging economies (excluding China) are, conversely, projected to support global growth as they recover from past recessions and negative output gaps increasingly narrow. Compared with the June 2019 projections, the global growth outlook is revised down over the projection horizon, reflecting a less dynamic recovery in some emerging market economies than previously expected, and, to a lesser extent, the impact of the ongoing trade tensions.

The international environment

(annual percentage changes)

1) Calculated as a weighted average of imports.

2) Calculated as a weighted average of imports of euro area trading partners.

Global trade is estimated to have decelerated significantly this year, amid slowing global industrial activity, heightened trade tensions and, to some extent, a weakening tech cycle. National accounts data suggest that, after stalling at the end of 2018, global import growth (excluding the euro area) dipped into negative territory in the first quarter of 2019, broadly in line with the June 2019 projections. The contraction in global trade was broad-based across countries. In addition to one-off factors (e.g. temporarily weak domestic demand in the United States given the partial federal government shutdown), the weakness in trade stemmed mostly from weak intra-Asia trade. The latter appears to be related to the slowdown in China’s domestic demand. Finally, specific shocks related to the weakening tech cycle or disruptions in the car industry may have also played a role, though this seems confined to specific countries. Global trade growth is expected to broadly stabilise in the second quarter.

Over the medium term global imports are projected to increase gradually, growing at a more subdued pace than global activity. The recent escalation of trade tensions, the effects of which will continue to be felt into 2020, coupled with a more gradual recovery in emerging economies than previously projected, will contribute to a slower recovery in global trade. Global import growth (excluding the euro area) is expected to decline markedly, from 4.6% in 2018 to 0.4% this year, before recovering to 2.2% and 2.9% in 2020 and 2021 respectively. Higher tariffs are expected to reduce global trade, adversely affecting euro area foreign demand. Empirical analysis suggests that trade diversion towards third markets, including the euro area, which could cushion the negative impact of higher tariffs on global trade, is so far very limited. Euro area foreign demand, which expanded by 3.7% last year, is expected to slow down to 1.0% in 2019, before increasing gradually to 1.9% and 2.7% in 2020 and 2021 respectively. Compared with the June 2019 projections, it has been revised down notably over the entire projection horizon. In addition to the impact of tariffs, these revisions also reflect broad-based weakness in import momentum across both advanced and emerging economies on the back of a weaker growth outlook. The global trade outlook, as embedded in the September 2019 projections, remains below that of most recent projections by other institutions, mostly for 2019.

Employment growth is projected to be subdued, in part reflecting temporary factors in the short term, while labour supply constraints are expected to emerge later in the horizon. Eurostat’s flash estimate of headcount employment growth in the second quarter of 2019 was 0.2%, quarter on quarter, indicating a slowing of momentum compared with the past four years. Employment growth is projected to remain rather subdued over the projection horizon as labour supply is expected to limit further employment growth, while labour demand is also projected to moderate in line with the slowdown in activity.

Labour force growth is expected to moderate over the projection horizon. The labour force is expected to continue to expand, reflecting the projected net immigration of workers, the expected integration of refugees and ongoing increases in the participation rate. Nevertheless, these factors are projected to fade over the projection horizon and the adverse impact of the ageing of the population on labour force growth is therefore expected to increase, as older cohorts leave the workforce in higher numbers than younger cohorts enter it.

The unemployment rate is expected to decline to 7.3% in 2021. The unemployment rate declined to 7.6% in the second quarter of 2019, which is the lowest level observed since the third quarter of 2008. Looking ahead, it is projected to remain broadly unchanged from its current level until the beginning of 2020, and to decrease thereafter. While the decline in the unemployment rate is expected to be broadly based across countries, rates of unemployment in 2021 are expected to still exhibit substantial differences.

Labour productivity is projected to recover over the projection horizon. After recording strong momentum in 2017, per worker and per hour labour productivity growth declined in 2018, reflecting the unexpected weakening of activity. Productivity growth is expected to pick up to 0.9% by 2021, as activity is expected to regain momentum while labour input growth slows down.

Compared with the June 2019 projections, real GDP growth is revised down in 2019 and 2020, while it is unrevised for 2021. Given the continued weakness in sentiment indicators, mainly reflecting more persistent weakness in global trade than previously expected and global uncertainties, the short-term outlook has been revised down for both the third quarter and the fourth quarter of 2019. These revisions imply a weaker carry-over in 2020, reducing annual GDP growth in that year. The quarterly profile of economic growth, however, remains unrevised from early 2020, as the impact of sizeable downward revisions to foreign demand is broadly offset by the impact of more favourable financing conditions and lower oil prices.

Box 3

How resilient has euro area domestic demand been to external shocks?

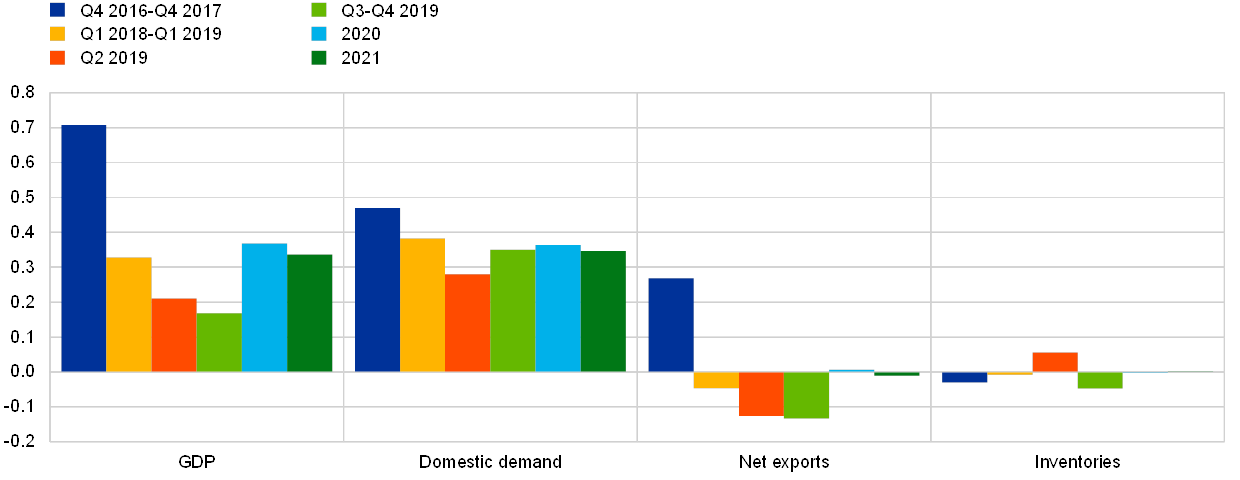

This box highlights some evidence regarding the resilience of euro area domestic demand with regard to adverse external shocks. The slowdown in euro area real GDP growth in the period from the fourth quarter of 2017 to the second quarter of 2019 was largely associated with a weakening of net trade, while the contribution to the slowdown from domestic demand was markedly smaller (see Chart A). Domestic demand growth is expected to remain rather resilient over the projection horizon, supporting real GDP growth, while the contribution from net exports will turn neutral.

Chart A

GDP and expenditure components

(average quarter-on-quarter growth; contributions)

Sources: Eurostat, September 2019 ECB staff macroeconomic projections and ECB calculations.

Note: The decomposition of GDP in the second quarter of 2019 was not available by the cut-off date for the projections and was therefore estimated by ECB staff.

According to ECB models, growth in euro area domestic demand has deteriorated as a result of external weakness to a lesser extent than implied by historical regularities. Adverse external developments have clearly played an important role in the economic slowdown since the end of 2017, mainly via a weakening of export growth. In the course of 2018, the adverse external shock spilled over to domestic demand. However, ECB models that gauge the drivers of the GDP growth path over time suggest that in the case of domestic demand there have also been some positive factors at play over the past year which cushioned the adverse impact of weaker external demand. This may be interpreted as a sign of domestic demand resilience, as domestic demand deteriorated in response to the external shocks to a lesser extent than implied by historical regularities, as captured by ECB models. In turn, this resilience of domestic demand could be due to the strength of the labour market as well as other supporting factors.

The resilience of euro area domestic demand to adverse external shocks may be partly related to the absorption capacity[4] of the labour market. Employment growth and the unemployment rate have shown a high degree of resilience since 2017, with unexpectedly robust employment growth despite the deceleration in activity. An estimated simple static relationship between employment/unemployment and GDP illustrates this point (see Chart B). Employment growth was increasingly higher than predicted by the Okun relationship during the course of 2018, and was 0.5 percentage points above its predicted level in the second quarter of 2019. Recently total hours worked have also grown more strongly than predicted, while the unemployment rate has trended below its predicted value.[5] These developments are particularly related to the extensive job creation in the services sector. One possible factor behind the resilience of the labour market is that external trade is far less labour-intensive than other components of GDP. Hence, adverse external trade shocks may have had a rather limited downward impact on the labour market compared with adverse domestic demand shocks.[6]

Chart B

Residuals from static Okun estimates

(percentage points)

Sources: ECB staff computations on Eurostat data and the September 2019 projections.

Notes: A positive residual indicates that the variable in question reached a level higher than that predicted by the Okun relationship. The chart shows the residuals that refer to the unemployment rate and to the year-on-year growth rates of total employment and total hours worked. Estimates are based on data for the period between the first quarter of 1998 and the second quarter of 2019. Residuals are from a static Okun relationship that relates the year-on-year changes in the unemployment rate, the year-on-year growth rate of total employment and the year-on-year growth rate of total hours to the contemporaneous year-on-year growth rate of real GDP.

Several other factors, in addition to the labour market, may have also contributed to the resilience of euro area domestic demand in the assessed period. These factors comprise the accommodative monetary policy stance supporting financing conditions, improvements in the balance sheets of non-financial corporations and households including private sector deleveraging and increasing net wealth, expectations of dynamic growth in the gross operating surplus and some fiscal easing.

In sum, the slowdown in euro area activity since 2017 is largely explained by a weaker external environment, while domestic demand has been relatively resilient, largely as a result of the strength of the labour market. Looking ahead, the September 2019 projections feature the assessment that despite the downward revision to the external environment, the labour market will continue to support household disposable income and other factors supporting domestic demand will remain in place, albeit to a lesser extent than in the recent past.

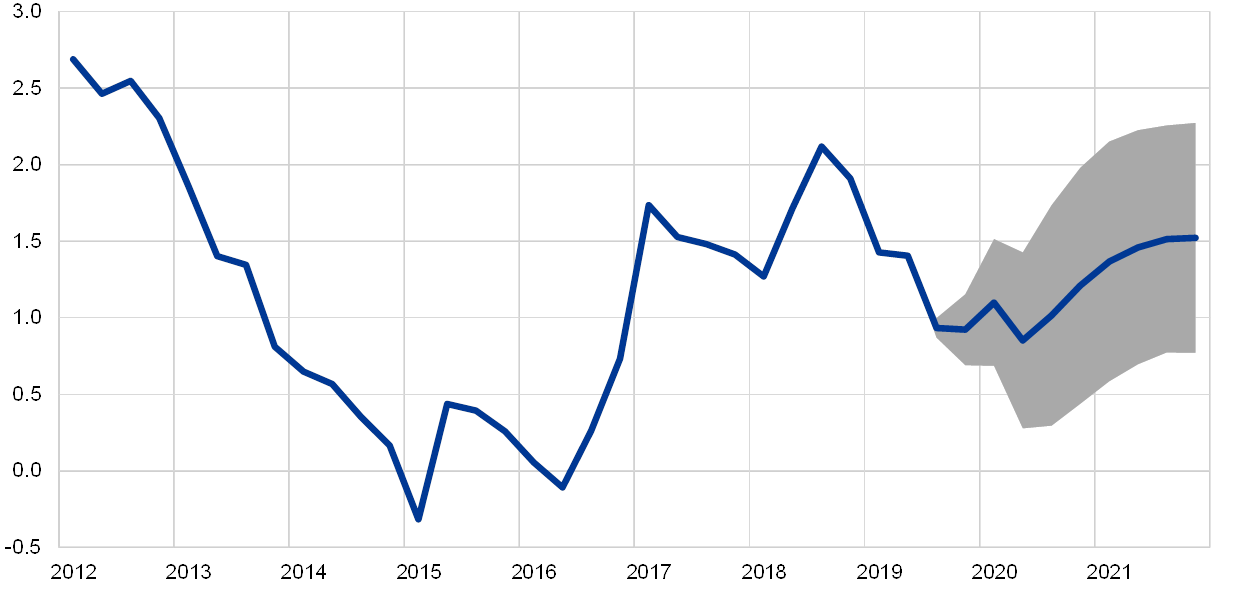

2 Prices and costs

HICP inflation is expected to average 1.2% in 2019, decline to 1.0% in 2020 and reach 1.5% in 2021 (see Chart 2). HICP inflation will be volatile around rather subdued levels until the second half of 2020, mainly reflecting developments in HICP energy inflation related to recent oil price declines, downward and upward base effects, and, to a small extent, lower administered prices for electricity and gas. Until the end of 2020 HICP energy inflation will remain negative and will only turn positive in 2021 as the oil price futures curve stabilises. After increasing in the near term due to lagged effects from past increases in farm gate prices, HICP food inflation is envisaged to hover around rates of 1.9%. HICP inflation excluding energy and food will move sideways in the course of 2020 and strengthen to 1.5% in 2021. The moderate upward path of underlying inflation is expected to be supported by the expected pick-up in activity and the associated recovery in profit margins as past increases in labour costs feed into prices. As a result, domestic cost pressures would rise. Rising non-energy commodity prices and underlying global inflation are also expected to provide some support to underlying inflation.

Chart 2

Euro area HICP

(year-on-year percentage changes)

Note: The ranges shown around the central projections are based on the differences between actual outcomes and previous projections carried out over a number of years. The width of the ranges is twice the average absolute value of these differences. The method used for calculating the ranges, involving a correction for exceptional events, is documented in “New procedure for constructing Eurosystem and ECB staff projection ranges”, ECB, December 2009, available on the ECB’s website.

Growth in compensation per employee is projected to be relatively robust as labour markets remain tight. Following a spike in 2019 in the context of the cyclical slowdown in productivity growth, unit labour cost growth is expected to moderate somewhat over the projection horizon as productivity growth is envisaged to strengthen alongside economic growth. The main driver supporting wage growth is the envisaged increase in labour market tightness in some parts of the euro area. Beyond the cyclical momentum, the pick-up in headline inflation over the last two years can also be expected to contribute to relatively robust wage growth in euro area countries where wage formation processes include backward-looking elements. In addition, some countries have introduced increases in minimum wages that might pass through to the wage distribution.

Profit margins are expected to develop more favourably over the projection horizon than in 2018. Profit margins have been squeezed over the past few quarters by a surge in unit labour costs and past increases in oil prices that weighed on the terms of trade, adversely affecting profit margin developments. These factors should become less important following recent declines in oil prices and as economic activity regains pace.

Import price inflation is expected to recede in 2019 and to rise moderately over the remainder of the projection horizon. Following a strong growth rate in 2018, the annual growth rate of the import deflator is envisaged to decline in 2019 and then gradually increase by 2021. This profile is strongly determined by movements in oil prices, which pushed up import prices in 2018 and will dampen them over the projection horizon, although their effect will gradually decline as the downward sloping oil futures curve flattens out towards the end of the horizon. At the same time, rising non-oil commodity prices and underlying global price pressures should provide some – albeit more moderate – support, to import price inflation.

Compared with the June 2019 projections, the projection for HICP inflation is revised down over the whole horizon. These revisions are largely explained by the energy component which is revised notably downwards for both 2019 and 2020, due to lower oil prices. In addition, HICP inflation excluding energy and food is also revised downwards, reflecting weaker data outturns, weaker activity and indirect effects from lower energy prices, as well as persistent past over-predictions.

3 Fiscal outlook

The euro area aggregate fiscal stance is assessed to be mildly expansionary over the entire projection horizon. The fiscal policy stance is measured as the change in the cyclically adjusted primary balance net of government support to the financial sector. After having been neutral in 2018, the fiscal stance is projected to become mildly expansionary in 2019, mostly on account of cuts to direct taxes as well as public expenditure increases in some countries. For 2020, a slightly larger fiscal loosening is projected, mainly due to further cuts to direct taxes as well as higher transfers in some countries. For 2021, the bulk of the fiscal loosening stems from Germany on account of higher expenditure growth and the newly approved partial repeal of the solidarity surcharge, which reduces the direct tax burden on households.

The euro area budget balance is projected to deteriorate over the entire projection horizon, while the debt ratio remains on a downward path. The largest deterioration in the balance is seen in 2019 on account of the expansionary fiscal stance. Thereafter the headline budget balance deteriorates at a slower pace, as the additional loosening of the fiscal stance is partly compensated by savings in interest payments, while the cyclical component remains largely unchanged. The declining path of the government debt-to-GDP ratio is supported by primary surpluses, albeit declining over time, and by a favourable interest rate-growth rate differential.

The euro area fiscal outlook remains broadly unchanged compared with the June 2019 projections. The slightly higher budget deficit at the end of the projection horizon reflects the additional fiscal loosening and the deterioration in the cyclical component, which are partly compensated by lower interest expenditure. The debt ratio is projected to be on a slightly higher path compared with the June 2019 projections, on account of upward revisions to the interest rate-growth rate differential and lower primary surpluses.

Box 4

Sensitivity analyses

Projections rely heavily on technical assumptions regarding the evolution of certain key variables. Given that some of these variables can have a large impact on the projections for the euro area, examining the sensitivity of the latter with respect to alternative paths of these underlying assumptions can help in the analysis of risks around the projections. This box discusses the uncertainty around some key underlying assumptions and the sensitivity of the projections with respect to these variables.

1) Alternative oil price paths

This sensitivity analysis aims to assess the implications of alternative oil price paths. The technical assumptions for oil price developments underlying the baseline projections, based on oil futures markets, predict a slightly declining profile for oil prices, with the price per barrel of Brent crude oil at about USD 56 by the end of 2021. Two alternative oil price paths are analysed. The first is based on the 25th percentile of the distribution provided by the option-implied densities for the oil price on 19 August 2019. This path implies a gradual decrease of the oil price to USD 42 per barrel in 2021, which is 25% below the baseline assumption for that year. Using the average of the results from a number of staff macroeconomic models, this path would have a small upward impact on real GDP growth (around 0.1 percentage points in 2020 and 2021), while HICP inflation would be 0.1 percentage points lower in 2019, 0.6 percentage points lower in 2020 and 0.4 percentage points lower in 2021. The second path is based on the 75th percentile of the same distribution and implies an increase of the oil price to around USD 69 per barrel in 2021, which is 22% above the baseline assumption for this year. This path would entail a faster increase in HICP inflation, which would be 0.1 percentage points higher in 2019, 0.5 percentage points higher in 2020 and 0.3 percentage points higher in 2021, while real GDP growth would be slightly lower (down by 0.1 percentage points in 2020 and 2021).

2) An alternative exchange rate path

This sensitivity analysis investigates the effects of a strengthening of the exchange rate of the euro. This scenario is consistent with the distribution of the option-implied risk-neutral densities for the USD/EUR exchange rate on 19 August 2019, which is heavily skewed towards an appreciation of the euro. The 75th percentile of that distribution implies an appreciation of the euro vis-à-vis the US dollar to an exchange rate of USD 1.25 per euro in 2021, which is 12% above the baseline assumption for that year. The corresponding assumption for the nominal effective exchange rate of the euro reflects historical regularities, whereby changes in the USD/EUR exchange rate correspond to changes in the effective exchange rate with an elasticity of just above one half. In this scenario, the average of the results from a number of staff macroeconomic models points to both real GDP growth and HICP inflation being 0.3 percentage points lower in 2020 and 0.4-0.5 percentage points lower in 2021.

Box 5

Forecasts by other institutions

A number of forecasts for the euro area are available from both international organisations and private sector institutions. However, these forecasts are not strictly comparable with one another or with the ECB/Eurosystem staff macroeconomic projections, as they were finalised at different points in time. Additionally, they use different (partly unspecified) methods to derive assumptions for fiscal, financial and external variables, including oil and other commodity prices. Finally, there are differences in working day adjustment methods across different forecasts (see the table).

As indicated in the table, most other institutions’ currently available projections for real GDP growth and HICP inflation are within the ranges surrounding the staff projections (shown in square brackets in the table). The figure for HICP inflation in 2020 is notably lower than all other forecasts, possibly on account of more up-to-date oil price assumptions in the September 2019 projections.

Comparison of recent forecasts for euro area real GDP growth and HICP inflation

(annual percentage changes)

Sources: OECD Economic Outlook, May 2019 ; MJEconomics for the Euro Zone Barometer, August 2019 survey; Consensus Economics Forecasts, August 2019 survey; European Commission Economic Forecast, Summer 2019 interim Economic Forecast; ECB’s Survey of Professional Forecasters, 2019Q3; IMF World Economic Outlook Update, July 2019.

Notes: The Eurosystem and ECB staff macroeconomic projections and the OECD forecasts both report working day-adjusted annual growth rates, whereas the European Commission and the IMF report annual growth rates that are not adjusted for the number of working days per annum. Other forecasts do not specify whether they report working day-adjusted or non-working day-adjusted data.

© European Central Bank, 2019

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

PDF ISSN 2529-4466, QB-CE-19-002-EN-N

HTML ISSN 2529-4466, QB-CE-19-002-EN-Q

- The cut-off date for technical assumptions, such as for oil prices and exchange rates, was 19 August 2019 (see Box 1). The cut-off date for including other information in this exercise was 29 August 2019. The current macroeconomic projection exercise covers the period 2019-21. Projections over such a long horizon are subject to very high uncertainty, and this should be borne in mind when interpreting them. See the article entitled “An assessment of Eurosystem staff macroeconomic projections” in the May 2013 issue of the ECB’s Monthly Bulletin. See http://www.ecb.europa.eu/pub/projections/html/index.en.html for an accessible version of the data underlying selected tables and charts.

- The assumption for euro area ten-year nominal government bond yields is based on the weighted average of countries’ ten-year benchmark bond yields, weighted by annual GDP figures and extended by the forward path derived from the ECB’s euro area all-bonds ten-year par yield, with the initial discrepancy between the two series kept constant over the projection horizon. The spreads between country-specific government bond yields and the corresponding euro area average are assumed to be constant over the projection horizon.

- For this year, China announced a fiscal stimulus package in the range of 2-3% of GDP. However, only some elements of this package have been implemented and announced in detail so far. These include a reduction in the VAT rate, effective as of 1 April, which is expected to have a stronger effect in the second half of this year, and an increase in the quota for local government borrowing as of the beginning of this year, which is expected to be channelled into infrastructure spending by local governments.

- The absorption capacity can also be thought of as the ability of an economy to cushion the direct impact of a shock, i.e. minimising the direct output and job losses by affecting other variables which act as stabilisers, namely responsive wages and prices, credit provision and financial risk sharing. See European Commission (2017).

- See “Employment growth and GDP in the euro area”, Economic Bulletin, Issue 2, ECB, Frankfurt am Main, 2019.

- See Anderton, R. Aranki, T., Bonthuis, B. and Jarvis, V, “Disaggregating Okun’s Law: Decomposing the impact of the expenditure components of GDP on euro area unemployment”, Working Paper Series, No 1747, ECB, Frankfurt am Main, December 2014.