Update on economic and monetary developments

Summary

The euro area is facing an economic contraction of a magnitude and speed that are unprecedented in peacetime. Measures to contain the spread of the coronavirus (COVID-19) have largely halted economic activity in all the countries of the euro area and across the globe. Survey indicators for consumer and business sentiment have plunged, suggesting a sharp contraction in economic growth and a profound deterioration in labour market conditions. Given the high uncertainty surrounding the ultimate extent of the economic fallout, growth scenarios produced by ECB staff suggest that euro area GDP could fall by between 5% and 12% this year, depending crucially on the duration of the containment measures and the success of policies to mitigate the economic consequences for businesses and workers. As the containment measures are gradually lifted, these scenarios foresee a recovery in economic activity, although its speed and scale remain highly uncertain. Inflation has declined as a result of the sharp fall in oil prices and slightly lower HICP inflation excluding energy and food.

In its determination to continue to support the euro area economy in the face of the current economic disruption and heightened uncertainty, the Governing Council decided to further ease the conditions on the targeted longer-term refinancing operations (TLTRO III) and to launch a new series of non-targeted pandemic emergency longer-term refinancing operations (PELTROs). In addition, purchases are conducted under the pandemic emergency purchase programme (PEPP), while net purchases are continuing under the asset purchase programme (APP) at a monthly pace of €20 billion together with the APP purchases under the additional €120 billion temporary envelope available until the end of the year. Together with the substantial monetary policy stimulus already in place, these measures will support liquidity and funding conditions and help to preserve the smooth provision of credit to the real economy. At the same time, the Governing Council will need to continually evaluate the measures, individually and as a package, to assess whether they are still adequately calibrated and of an appropriate size to provide the necessary degree of accommodation in the pursuit of its price stability mandate.

The coronavirus outbreak and the associated containment measures have paralysed the global economy and trade. The latest survey data point to a sharp contraction in global activity in the first half of 2020. China recorded its lowest growth level in decades in the first quarter of 2020, while the impact of the pandemic on other key economies is expected to be particularly visible in the second quarter. World trade is also estimated to have fallen sharply, driven by supply chain disruptions and a widespread demand shock. At the same time, the expected rapid deterioration in global activity and trade has been met with forceful policy measures globally. Global inflationary pressures are expected to decrease further as a result of both the sharp fall in oil prices and weak demand.

Since the Governing Council meeting in early March 2020, long-term sovereign yields have increased amid some volatility and the price of risky assets has decreased. The spread of the coronavirus and the lockdown of numerous economies have placed enormous strain on euro area financial markets. However, a number of policy actions have helped to calm markets, leading to a reversal of the negative trend in most asset prices. The EONIA forward curve shifted slightly upwards, as markets were no longer expecting an imminent reduction in the deposit facility rate. In foreign exchange markets, the euro weakened slightly in trade-weighted terms.

The latest economic indicators and survey results covering the period since the coronavirus spread to the euro area have shown an unprecedented decline, pointing to a significant contraction in euro area economic activity and to rapidly deteriorating labour markets. The coronavirus pandemic and the associated containment measures have severely affected the manufacturing and services sectors, taking a toll on the productive capacity of the euro area economy and on domestic demand. In the first quarter of 2020, which was only partially affected by the spread of the coronavirus, euro area real GDP decreased by 3.8%, quarter on quarter, reflecting the impact of the lockdown measures in the final weeks of the quarter. The sharp downturn in economic activity in April suggests that the impact is likely to be even more severe in the second quarter. Given the highly uncertain duration of the pandemic, the likely extent and duration of the imminent recession and the subsequent recovery are difficult to predict.[1] Euro area growth is expected to resume as the containment measures are gradually lifted, supported by favourable financing conditions, the euro area fiscal stance and a resumption in global activity. However, the extent of the contraction and the recovery will depend crucially on the duration and the success of the containment measures, how far supply capacity and domestic demand are permanently affected, and the success of policies in mitigating the adverse impact on incomes and employment.

According to Eurostat’s flash estimate, euro area annual HICP inflation decreased from 0.7% in March to 0.4% in April, largely driven by lower energy price inflation, but also slightly lower HICP inflation excluding energy and food. On the basis of the sharp decline in current and futures prices for oil, headline inflation is likely to decline considerably further over the coming months. The sharp downturn in economic activity is expected to lead to negative effects on underlying inflation over the coming months. However, the medium-term implications of the coronavirus pandemic for inflation are surrounded by high uncertainty, given that downward pressures linked to weaker demand may be partially offset by upward pressures related to supply disruptions. Market-based indicators of longer-term inflation expectations have remained at depressed levels. Even though survey-based indicators of inflation expectations have declined over the short and medium term, longer-term expectations have been less affected.

Regarding monetary developments, broad money (M3) growth increased to 7.5% in March 2020, from 5.5% in February. M3 growth continues to be backed by bank credit creation for the private sector, and the narrow monetary aggregate M1 remained the main contributor to broad money growth. Developments in loans to the private sector have also been shaped by the impact of the coronavirus. The annual growth rate of loans to households stood at 3.4% in March 2020, after 3.7% in February, while the annual growth rate of loans to non-financial corporations stood at 5.4% in March, after 3.0% in February. The results of the euro area bank lending survey for the first quarter of 2020 also indicate a surge in firms’ demand for loans and for drawing on credit lines to meet liquidity needs for working capital, while financing needs for fixed investment have declined. Credit standards for loans to firms tightened slightly, while credit standards for loans to households tightened more strongly. At the same time, banks expect an easing of credit standards for loans to firms in the second quarter of 2020. The Governing Council’s policy measures, in particular the more favourable terms for TLTRO III operations and the collateral easing measures, should encourage banks to extend loans to all private sector entities.

Combining the outcome of the economic analysis with the signals coming from the monetary analysis, the Governing Council confirmed that an ample degree of monetary accommodation is necessary for the robust convergence of inflation to levels that are below, but close to, 2% over the medium term.

On the basis of this assessment, the Governing Council decided to further ease the conditions on the ECB’s TLTRO III operations .This will support further the provision of credit to households and firms in the face of the current economic disruption and heightened uncertainty, buffering the coronavirus shock on credit conditions. Specifically, the Governing Council decided to reduce the interest rate on TLTRO III operations during the period from June 2020 to June 2021 to 50 basis points below the average interest rate on the Eurosystem’s main refinancing operations prevailing over the same period. Moreover, for counterparties whose eligible net lending reaches the lending performance threshold of 0%, the interest rate over the period from June 2020 to June 2021 will now be 50 basis points below the average deposit facility rate prevailing over the same period.[2]

The Governing Council also decided on a new series of non-targeted pandemic emergency longer-term refinancing operations (PELTROs) to support liquidity conditions in the euro area financial system and contribute to preserving the smooth functioning of money markets by providing an effective liquidity backstop. The PELTROs consist of seven additional refinancing operations commencing in May 2020 and maturing in a staggered sequence between July and September 2021 in line with the duration of the Governing Council’s collateral easing measures. They will be carried out as fixed rate tender procedures with full allotment, with an interest rate that is 25 basis points below the average rate on the main refinancing operations prevailing over the life of each PELTRO.[3]

Since the end of March the Governing Council has been conducting purchases under the ECB’s new pandemic emergency purchase programme (PEPP), which has an overall envelope of €750 billion, to ease the overall monetary policy stance and to counter the severe risks to the monetary policy transmission mechanism and the outlook for the euro area posed by the coronavirus pandemic. These purchases will continue to be conducted in a flexible manner over time, across asset classes and among jurisdictions. Net asset purchases will be conducted under the PEPP until the Governing Council judges that the coronavirus crisis phase is over, but in any case until the end of this year.

Moreover, net purchases under the ECB’s APP will continue at a monthly pace of €20 billion, together with the purchases under the additional €120 billion temporary envelope until the end of the year. The Governing Council continues to expect monthly net asset purchases under the APP to run for as long as necessary to reinforce the accommodative impact of the policy rates in the euro area, and to end shortly before it starts raising the key ECB interest rates.

The Governing Council also intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

In addition, the Governing Council decided to keep the key ECB interest rates unchanged and expects them to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.

Overall, the decisive and targeted policy measures that the Governing Council has taken since early March have provided crucial support to the euro area economy and especially to the sectors most exposed to the crisis. In particular, the measures are supporting liquidity conditions and helping to sustain the flow of credit to households and firms, especially small and medium-sized enterprises, and to maintain favourable financing conditions for all sectors and jurisdictions.

At the same time, in the current rapidly evolving economic environment, the Governing Council remains fully committed to doing everything necessary within its mandate to support all citizens of the euro area through this extremely challenging time. This applies first and foremost to the role of the Governing Council in ensuring that the ECB’s monetary policy is transmitted to all parts of the economy and to all jurisdictions in the pursuit of its price stability mandate. The Governing Council is, therefore, fully prepared to increase the size of the PEPP and adjust its composition, by as much as necessary and for as long as needed. In any case, the Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation moves towards its aim in a sustained manner, in line with its commitment to symmetry.

1 External environment

The coronavirus (COVID-19) outbreak has paralysed the global economy and trade. The measures taken by governments to contain the spread of the virus are a key factor driving the sharp decline in economic activity in the near term. Other factors also weighing on economic activity, especially in emerging market economies, include a sharp reduction in commodity prices, significant tightening of financial conditions and substantial capital outflows.

Survey data suggest that the economic fallout from containment measures is likely to be abrupt and deep. The global composite output Purchasing Managers’ Index (PMI) excluding the euro area declined sharply from 52 in January to 45 in February and further to 41 in March. The decline was driven by the strong contraction in the services index, which plummeted to 39.4, the lowest level since December 2008 (see Chart 1). This points to a sharp contraction in global activity (excluding the euro area) in the first half of 2020, which is likely to be more pronounced than at the trough observed during the global financial crisis (GFC).

Chart 1

Global composite output PMI (excluding the euro area)

(diffusion indices)

Sources: Markit and ECB calculations.

Note: The latest observations are for March 2020.

The expected rapid deterioration in activity has been met with forceful policy measures. Central banks that had room to decrease interest rates used it promptly and cut their key policy rates, while some have also resumed asset purchases. Liquidity-providing operations and swaps have been implemented to smooth the functioning of financial markets. In addition, large fiscal stimulus packages have been enacted, with the composition of such packages being heavily skewed towards loan guarantees and income support measures.

World trade is estimated to have fallen sharply, driven by supply chain disruptions and a widespread demand shock. In the first quarter of 2020 virus-related production disruptions in China affected international trade, especially in Asian countries strongly interconnected with China through regional value chains. However, as the outbreak turned into a pandemic, production disruptions spread and are likely to weigh on global trade for some time. Global merchandise imports contracted marginally further in February, extending the decline seen at the end of 2019. At the same time, the global PMI for new export orders excluding the euro area remained unchanged in March at a very low level, pointing overall to a sharp fall in global trade in the first quarter of 2020 (see Chart 2).

Chart 2

Surveys and global trade in goods (excluding the euro area)

(left-hand scale: three-month-on-three-month percentage changes; right-hand scale: diffusion indices)

Sources: Markit, CPB Netherlands Bureau for Economic Policy Analysis and ECB calculations.

Note: The latest observations are for February 2020 for global merchandise imports and March 2020 for the PMIs.

Global inflation slowed slightly in February. Annual consumer price inflation in the countries of the Organisation for Economic Co-operation and Development (OECD) declined to 2.2% in February, driven by a moderation in energy price inflation, while food price inflation increased slightly. Meanwhile, inflation excluding food and energy remained stable at 2.2% in February. The slowdown in inflation was broad-based across most advanced economies and major non-OECD emerging market economies. Looking ahead, global inflationary pressures are expected to decelerate further as a result of both the sharp fall in oil prices and weak demand.

Brent crude oil prices have declined by approximately 43% since the March meeting of the Governing Council, primarily owing to a sudden collapse in demand associated with the COVID-19 pandemic. On 12 April 2020 the OPEC+ group announced plans to restrict oil supplies, but these are unlikely to fully offset the loss of demand in the near term. While supply shocks contributed to market volatility, reduced demand and rising risk aversion were the key factors driving the fall in Brent crude oil prices to around USD 20 per barrel. Lack of adequate storage capacity has put further downward pressure on oil prices. Notably, North American producers were temporarily forced to dispose of oil at negative prices to avoid shutting down oil wells, as doing so would have permanently damaged their production capacity. The International Energy Agency expects full-year global oil demand to decline for the first time in over a decade, forecasting a fall of -9.3% in 2020. Total non-oil commodity prices have declined markedly (-8.5%) since the March Governing Council meeting as both metal prices (-9.2%) and food prices (‑5.7%) decreased.

Containment measures will lead to a decline in US economic activity in the first half of 2020, particularly in the second quarter. Advance estimates for the first quarter suggest that GDP contracted at an annualised rate of 4.8%. This constitutes the largest decline in GDP since the global financial crisis, when GDP fell by 8.4% in the final quarter of 2008. As this advance estimate is based on incomplete data and subject to further revisions, forthcoming releases could show an even larger decline in GDP. The impact on economic activity is expected to be even larger in the second quarter. By end-March, almost all US states had ordered wide-ranging business closures and strict limits on movement. The cumulative number of workers seeking unemployment insurance from mid-March to end-April reached around 30 million, i.e. 19% of the labour force. As a result, consumer confidence and spending has plunged. In early April the University of Michigan Consumer Sentiment Index fell to its lowest level since December 2011, while retail sales fell steeply by a record 8.7% in March. Sharp drops in other indicators, such as PMIs, point to a more generalised impact on activity. Overall, US GDP is expected to shrink in the first half of the year by more than during the GFC. The policy response has been immediate. On the fiscal side, US Congress agreed on fiscal support amounting to almost 10% of GDP, consisting of government spending to contain the outbreak and measures to attenuate its effects. On the monetary side, the Federal Reserve System cut the target range for the federal funds rate to between 0% and ¼%. It also established a number of credit facilities that can provide up to USD 2.3 trillion in financing against a wide range of collateral, activated swap lines with other central banks, expanded its repo operations and relaxed prudential policies to ensure that financial markets remain liquid and credit continues to flow through the economy.

In Japan, the pandemic has had a severe impact on activity, despite the strong policy response. The pandemic struck when the economy was starting to show signs of a modest rebound following the sharp contraction in the final quarter of 2019 related to the October VAT hike and typhoons. The Composite PMI fell to its lowest level since the March 2011 Great East Japan earthquake and tsunami, and the Reuters Tankan signalled a further deterioration in business conditions in April. Prior to declaring a state of emergency, the government announced a sizeable economic package in response to the coronavirus crisis. Although the overall size of the announced package appears unprecedented (JPY 108 trillion, about 20% of GDP), a large part is related to private sector outlays. In addition, it includes the December 2019 fiscal stimulus and the two 2020 emergency fiscal packages. This follows steps taken by the Bank of Japan, including the provision of ample supply of liquidity via JGB purchases and US dollar-providing operations, an increase in purchases of commercial paper and bonds and the introduction of a special funds-supplying operation to facilitate corporate financing.

Incoming data for the United Kingdom suggest that the coronavirus outbreak has had a significant adverse impact on an already slowing economy. The monthly GDP release for February, on a three-month-on-three-month basis, showed that the UK economy was stagnating even ahead of the pending coronavirus outbreak. Since then, the March PMI Composite Output Index has plummeted to a new series low, far below even the worst readings seen at the depths of the GFC. Economic policy responses have been swift and strong. On 11 March the Bank of England cut interest rates to 0.25% (subsequently reduced further to 0.1%), introduced a new Term Funding Scheme and reduced the countercyclical capital buffer. This support has been further extended to include a round of quantitative easing and the reactivation of a temporary monetary financing facility for the government. At the same time, the government introduced a series of coronavirus contingency measures, including a variety of income support measures, additional budget for the National Health Service, as well as an expansive array of loan facilities, tax payment holidays and grants to small businesses.

Economic growth in China has fallen to its lowest level in decades as a result of the pandemic and weak external demand. In the first quarter of 2020 GDP decreased by 6.8% year on year owing to virus containment measures. However, high-frequency indicators of economic activity suggest that activity is recovering. While daily coal consumption in early-April continued at levels that were around 15 percentage points lower than during the same period last year, real estate activity and traffic congestion indices are only marginally below the levels observed during the same period in 2019. Activity is expected to rebound only partly in the second quarter of 2020 as weak domestic demand is amplified by weak external demand, held back by cautious consumer behaviour and the prevailing containment measures. Policy measures have been implemented to support the economy and ensure liquidity in the banking system. The People’s Bank of China has repeatedly injected significant liquidity in the market since the beginning of the year and has cut policy and reserve requirement rates. Fiscal policy stimulus in the form of tax exemptions, purchase vouchers, income support and loan guarantees is expected to cushion the impact of the pandemic.

2 Financial developments

Long-term sovereign yields in the euro area increased over the review period amid some volatility in the wake of the spread of COVID-19 and the lockdown of numerous economies. Over the review period (12 March 2020 to 29 April 2020), the GDP-weighted euro area ten-year sovereign bond yield increased overall by 14 basis points to 0.25% (see Chart 3), more or less mirroring the increase in the ten-year overnight index swap (OIS) rate. There was some volatility, however, with markets reacting to news of the virus’ spread and related lockdowns by sharply increasing the yields of most euro area issuers. Following the announcement of accommodative economic policy measures (both monetary and fiscal), the increase in sovereign yields was partially reversed. Elsewhere, ten-year sovereign bond yields in the United States decreased by around 20 basis points over the review period to 0.63%, whereas UK yields increased slightly to 0.29%.

Chart 3

Ten-year sovereign bond yields

(percentages per annum)

Sources: Refinitiv and ECB calculations.

Notes: Daily data. The vertical grey line denotes the start of the review period on 12 March 2020.

The latest observations are for 29 April 2020.

Euro area sovereign bond spreads relative to the risk-free OIS rate initially decreased following the announcement of the new pandemic emergency purchase programme (PEPP) before increasing again for most countries. The spread on Portuguese, Spanish, German and Greek ten-year sovereign bonds increased overall by 7, 10, 13 and 29 basis points respectively over the review period. In contrast, the Italian and French spreads fell by 25 and 11 basis points respectively, following an increase prior to the review period. Overall, the GDP-weighted euro area spread increased by 14 basis points to 25 basis points.

Equity price indices for euro area non-financial corporations (NFCs) increased sharply, thus reversing part of the marked decline that started at the end of February. In a partial reversal of this severe decline, euro area NFC equity prices increased by 17.9% over the review period. This rebound was supported by a reduction in the equity risk premium which more than offset a large reduction in earnings expectations in a highly-uncertain environment. The rebound in equity prices for euro area financial corporations was smaller in size (a 10.9% increase over the review period). The underperformance of the financial indices highlights the challenges facing this sector.

Euro area corporate bond spreads increased over the review period, reflecting an increase in expected default rates. The spreads on both investment-grade NFC bonds and financial sector bonds relative to the risk-free rate increased to stand at 119 and 152 basis points respectively. Spreads reached an intra-period high on March 24 at around 75 and 45 basis points respectively above the levels prevailing at the end of the review period, but have been slowly declining since.

The euro overnight index average (EONIA) and the new benchmark euro short-term rate (€STR) averaged -45 and -53 basis points respectively over the review period.[4] Excess liquidity increased by approximately €246 billion to around €2,011 billion, mainly reflecting the introduction of the new PEPP and the asset purchase programme (APP), as well as the take-up of targeted longer-term refinancing operations (TLTRO III) and LTRO bridge operations.

The EONIA forward curve shifted slightly upwards over the review period, as markets did not expect an imminent reduction in the deposit facility rate. By the end of 2024, the curve reaches 10 basis points above the current level of the EONIA. Overall, it remains below zero for horizons up to 2027, reflecting continued market expectations of a prolonged period of negative interest rates.

In foreign exchange markets, the euro weakened slightly in trade-weighted terms over the review period (see Chart 4), reflecting an appreciation against the currencies of several emerging market economies which was largely offset by a depreciation against the US dollar. The euro’s nominal effective exchange rate, as measured against the currencies of 38 of the euro area’s most important trading partners, depreciated by 0.8%. Regarding bilateral exchange rate developments, the euro depreciated (by 3.5%) against the US dollar and pound sterling (by 1.4%) following a phase of increased volatility. The euro also depreciated against the Chinese renminbi (by 2.7%), reversing an earlier appreciation and reflecting the different timing of the main economic impacts of the COVID-19 pandemic. By contrast, the euro strengthened vis-à-vis the majority of currencies of non-euro area EU Member States and emerging economies, most notably the Turkish lira and the Brazilian real (both by 7.7%).

Chart 4

Changes in the exchange rate of the euro vis-à-vis selected currencies

(percentage changes)

Source: ECB.

Notes: EER-38 is the nominal effective exchange rate of the euro against the currencies of 38 of the euro area’s most important trading partners. A positive (negative) change corresponds to an appreciation (depreciation) of the euro. All changes have been calculated using the foreign exchange rates prevailing on 29 April 2020.

3 Economic activity

Euro area real GDP contracted sharply in the first quarter of 2020, reflecting in particular the impact of the coronavirus (COVID-19) outbreak and the associated containment measures. Total economic activity declined by 3.8%[5], quarter on quarter, in the first quarter of 2020, following growth of 0.1% in the fourth quarter of 2019 (see Chart 5). Although a breakdown is not yet available, short-term indicators suggest that the drop in GDP in the first quarter of 2020 was driven by domestic demand, while changes in inventories and net trade may have provided small positive contributions to growth. Economic indicators, particularly surveys, have recently shown unprecedented falls, pointing to a sharp decline in output in the period ahead. It is likely that the peak impact of the COVID-19 pandemic will materialise in the second quarter of 2020.

Chart 5

Euro area real GDP, Economic Sentiment Indicator and composite output Purchasing Managers’ Index

(left-hand scale: diffusion index; right-hand scale: quarter-on-quarter percentage changes)

Sources: Eurostat, European Commission, Markit and ECB calculations.

Notes: The Economic Sentiment Indicator (ESI) is standardised and rescaled to have the same mean and standard deviation as the Purchasing Managers’ Index (PMI). The latest observations are for the first quarter of 2020 for real GDP and April 2020 for the ESI and the PMI.

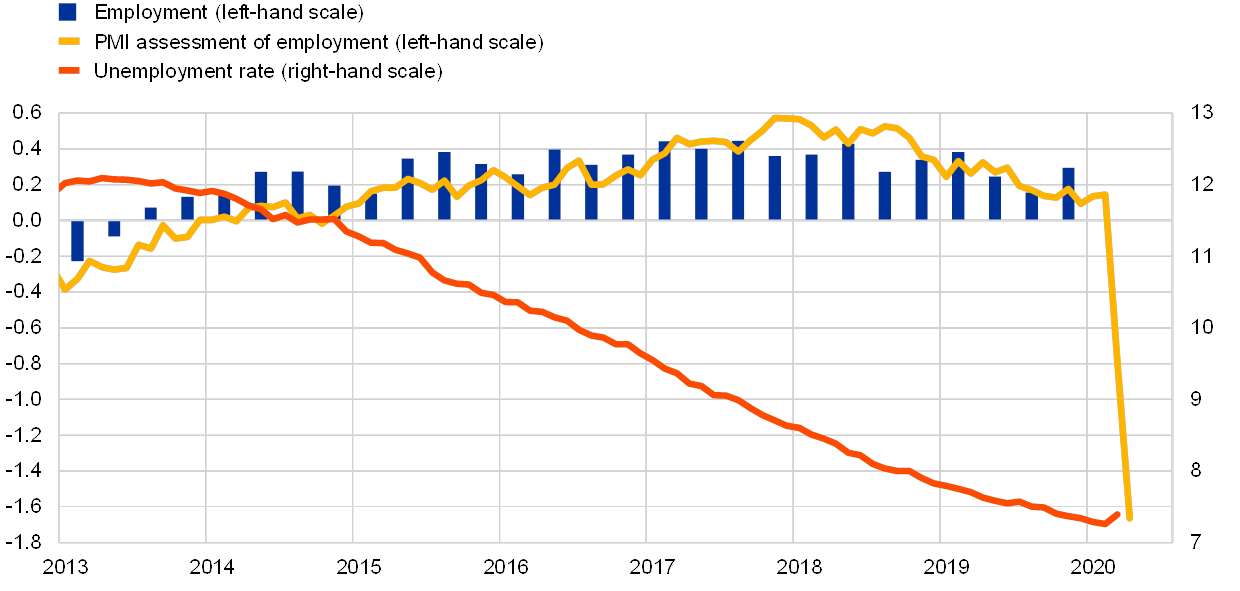

Short-term labour market indicators for March and April 2020 point to a sharp deterioration in the labour market related to COVID-19 developments. The Purchasing Managers’ Index (PMI) for employment recorded unprecedented falls from 51.4 in February to 42.2 in March and 33.4 in April, its lowest level on record, suggesting a strong contraction in employment. The decline was particularly sharp in the services sector.

However, the latest labour market data for the euro area only partly reflect the impact of the COVID-19 outbreak and associated containment measures. Employment data for the first quarter of 2020 are not yet available. The unemployment rate declined to 7.3% in February, a similar rate to that observed before the financial crisis. However, it increased to 7.4% in March, the first month affected by the spread of COVID-19 and the subsequent implementation of containment measures across the euro area (see Chart 6). The muted reaction of unemployment may be related to measures to ease access to short-time work schemes. Preliminary estimates show an unprecedented number of employees in these schemes across the five largest euro area countries.

Chart 6

Euro area employment, PMI assessment of employment and the unemployment rate

(left-hand scale: quarter-on-quarter percentage changes, diffusion index; right-hand scale: percentages of labour force)

Sources: Eurostat, Markit and ECB calculations.

Notes: The PMI is expressed as a deviation from 50 divided by 10. The latest observations are for the fourth quarter of 2019 for employment, April 2020 for the PMI and March 2020 for the unemployment rate.

The deterioration in consumption indicators is unprecedented. Consumer confidence fell strongly following the COVID-19 outbreak, dropping to -22.7 in April (from -6.6 in February), close to the historical lows recorded in March 2009. However, there are indications that the fall in consumer confidence may in fact underestimate the underlying decline in consumption. The speed and severity of the COVID-19 shock have been so exceptional that the historical relationship between consumer confidence and consumption growth currently seems quite unstable.[6] In March 2020 euro area passenger car registrations recorded a steep drop (-56.4%) as a result of the COVID-19 outbreak. With lockdown measures in place in most markets from around the middle of March, the vast majority of euro area car dealerships were closed during the second half of that month. Similarly, other high-frequency indicators suggest an unprecedented drop, by up to 45%, in household expenditure (e.g. restaurants, transport services, recreation, tourism and retail sales).

The medium-term impact of COVID-19 on private consumption is very uncertain. There is a direct effect of the COVID-19 shock through the rationing of several expenditure components. The indirect effects are expected to materialise via the impact on income, wealth and access to credit. Furthermore, pent-up demand may have a positive impact once containment measures are lifted. The medium-term impact on private consumption depends on the duration of the lockdowns, the pace at which measures are relaxed, changes in household behaviour and the effectiveness of public policies.

Business investment is expected to fall substantially as a result of the lockdowns and further containment measures across euro area countries since March 2020. Following non-construction investment growth of 8.0%, quarter on quarter, in the fourth quarter of 2019 (0.2% excluding Irish data), investment dynamics decelerated in the first quarter of 2020 and the outlook for the second quarter is poor. The dramatic fall in manufacturing production and sales, driven by a combination of supply and demand factors related to the COVID-19 pandemic, is expected to have had a major adverse impact on business investment from March 2020 onwards. European Commission survey data up to April show strong declines in order books and production expectations in the capital goods sector. High-frequency data also point to a substantial deterioration in firms’ profit expectations and financing conditions as well as a sharp increase in uncertainty, which would adversely affect future investment decisions. While the euro area sectoral accounts showed continued growth in gross operating surplus in the fourth quarter of 2019, market data of one-year-ahead expected earnings per share among European listed firms dropped significantly in April 2020. Investment-grade corporate bond yields also rose steeply, particularly in the oil and automotive sectors. Uncertainty in terms of stock market volatility indices has spiked in Europe, with the European composite indicator of systemic stress reaching unprecedented levels in April 2020. There are also substantial downside risks to firms’ investment plans from rising debt levels, potential insolvencies and corporate defaults on long-term debt commitments, as well as declining cash flows. The extent to which national, euro area and EU-wide policy measures to provide liquidity and credit can alleviate the situation remains to be seen. Euro area forecasts for investment have been revised down significantly, with the European Commission’s biannual industrial investment survey published in April 2020 showing an expected contraction of 4% in 2020.

Housing investment is expected to have fallen dramatically since March 2020 as a result of the containment measures and increased uncertainty. Although housing investment increased slightly in the fourth quarter of 2019 (by 0.3%, quarter on quarter), some short-term indicators reflecting the impact of the pandemic have already started to signal a substantial decline in construction activity. In particular, the euro area PMI for business expectations in construction plunged to 33.5 in March 2020, its lowest level on record, from 52.5 in February, pointing to an unprecedented decline in activity. The suspension of plans and the shutdown of construction sites – especially in countries where lockdown measures were implemented at an early stage, such as Germany, Italy and Spain – have already caused severe financial problems for construction companies, according to the European Commission’s survey on limits to production. Over the medium term, while construction activity may benefit from lockdown measures being lifted earlier than in other sectors, it is likely that the pandemic will result in a significant decline in housing demand owing to income and wealth losses. Moreover, the uncertainty caused by the pandemic might have even larger and longer-lasting effects on activity, as it could encourage households and investors to postpone property transactions until an effective medical solution for COVID-19 is found.

Euro area trade is likely to have contracted in the first quarter of 2020 and to weaken further in the second quarter, as COVID-19 has paralysed economies globally. The early signs of a recovery in euro area trade at the beginning of 2020 were reversed by the effects of the pandemic. In particular, extra-euro area imports have been contracting since February, signalling that supply interruptions due to the lockdown in China had reduced the country’s exports to the euro area. There was an unprecedented deterioration in new export orders, a leading indicator, to 18.9 in April, from 49.5 in January. Containment measures in several euro area countries resulted in a combination of adverse demand and supply shocks, leading to the largest drop on record in euro area foreign trade. There are a number of reasons why euro area trade is severely affected by the negative shocks of the pandemic. First, investments and durable goods consumption, which are highly sensitive to both uncertainty and cyclical swings, are core components of foreign trade. Second, disruptions to global supply chains, in particular the reduction in imports of intermediate goods, also affect the euro area during this pandemic. Finally, the spillover and spillback via regional production networks magnify domestic shocks in euro area economies, resulting in an even sharper contraction in intra-euro area flows than in total trade flows. Countries specialised in services or in manufacturing related to services are expected to face particularly severe economic consequences. Tourism and transport services are the worst affected by lockdown measures, as seen in the collapse in new services export orders and in flight schedules.

Incoming economic data, particularly survey results, show unprecedented falls, pointing to contracting output in the euro area. The COVID-19 outbreak and the associated containment measures have had an adverse impact on activity in manufacturing and services via increasing supply constraints and rapidly falling demand. As regards recent survey data, the European Commission’s Economic Sentiment Indicator and the composite output PMI both posted the largest decline on record in March[7], before falling further in April. Both the ESI and the PMI displayed broad-based declines across both countries and economic sectors. This decline in economic activity is also confirmed by high-frequency indicators such as electricity consumption (see Chart 7).

Chart 7

Euro area electricity consumption

(annual percentage changes)

Sources: European Network of Transmission System Operators for Electricity (ENTSO-E) and ECB calculations.

Notes: Data are not corrected for temperatures. The latest observation is for 27 April 2020.

Looking beyond the immediate disruption stemming from the coronavirus pandemic, euro area growth is expected to resume as the containment measures are gradually lifted, supported by favourable financing conditions, the euro area fiscal stance and a resumption in global activity. However, uncertainty is extremely elevated and will remain high, making it very difficult to predict the likely extent and duration of the imminent recession and subsequent recovery.[8] The results of the latest round of the ECB Survey of Professional Forecasters, conducted in early April, showed that the private sector GDP growth forecasts have been revised substantially downwards for 2020 and have been revised upwards for 2021, compared with the previous round conducted in early January.

4 Prices and costs

According to Eurostat’s flash estimate, HICP inflation decreased further to 0.4% in April, after 0.7% in March 2020 and 1.2% in February 2020. The decrease in April mainly reflected a drop in annual energy inflation rates from -4.5% in March to -9.6% in April on account of the recent oil price slump, but services and non-energy industrial goods inflation also declined compared to the previous month. These declines more than offset an increase in food inflation, which in turn was mostly due to a doubling of unprocessed food inflation. According to Eurostat, prices for at least 50% or more of the underlying basket for the euro area HICP flash estimate and the special aggregates were collected as usual.[9] However, there have been price collection difficulties for some countries and some products, leading to a higher share of imputations than usual (see also the box entitled “Inflation measurement in times of economic distress” in this issue of the Economic Bulletin).

Chart 8

Contributions of components of euro area headline HICP inflation

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: The latest observations are for April 2020 (flash estimates). Growth rates for 2015 are distorted upwards owing to a methodological change (see the box entitled “A new method for the package holiday price index in Germany and its impact on HICP inflation rates”, Economic Bulletin, Issue 2, ECB, 2019).

Measures of underlying inflation declined or remained unchanged. HICP inflation excluding energy and food declined to 0.9% in April, from 1.0% in March and 1.2% in February. Other measures of underlying inflation, for which data are available up to March, were broadly unchanged. HICP inflation excluding energy, food, travel-related items and clothing remained at 1.1% in March, unchanged from February and January. Signals from other measures of underlying inflation, including the Persistent and Common Component of Inflation (PCCI) indicator and the Supercore indicator,[10] also remained broadly unchanged.

Chart 9

Measures of underlying inflation

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Notes: The latest observations are for April 2020 for HICP excluding energy and food (flash estimate) and for March 2020 for all other measures. The range of measures of underlying inflation consists of the following: HICP excluding energy; HICP excluding energy and unprocessed food; HICP excluding energy and food; HICP excluding energy, food, travel-related items and clothing; the 10% trimmed mean of the HICP; the 30% trimmed mean of the HICP; and the weighted median of the HICP. Growth rates for HICP excluding energy and food for 2015 are distorted upwards owing to a methodological change (see the box entitled “A new method for the package holiday price index in Germany and its impact on HICP inflation rates”, Economic Bulletin, Issue 2, ECB, 2019).

Pipeline price pressures for HICP non-energy industrial goods remained stable at the later stages of the supply chain in February. The annual rate of change in producer prices for domestic sales of non-food consumer goods was 0.7% in February 2020, unchanged since October 2019. The annual rate of change in import prices for non-food consumer goods rose to 0.4% in February, up from 0.2% in January. At the earlier stages of the supply chain, domestic producer price inflation for intermediate goods weakened, declining to -1.2% in February, from -1.1% in January. Import price inflation for intermediate goods increased slightly to -0.1% in February, from -0.3% in January and -1.2% in December.

Wage growth decreased. Annual growth in compensation per employee stood at 1.7% in the fourth quarter of 2019, down from 2.1% in the third quarter. The figures for 2019 were affected by a significant drop in employers’ social security contributions in France.[11] Annual growth in wages and salaries per employee, which excludes social security contributions, was 2.1% in the fourth quarter, down from 2.5% in the third quarter, and averaged 2.4% in 2019, compared with 2.3% in 2018. Looking across the different indicators and through temporary factors, wage growth decreased slightly in the course of 2019, although it remained at rates around or slightly above historical averages.

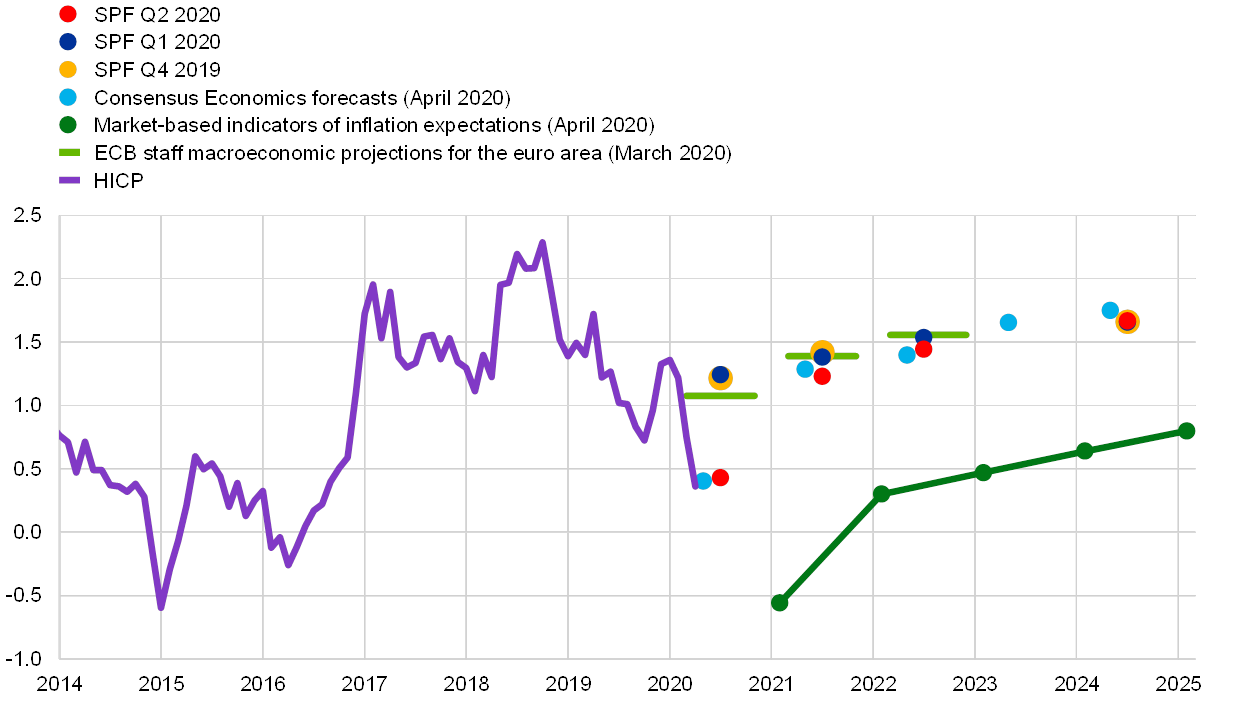

Market-based indicators of longer-term inflation expectations stood largely unchanged at the end of the review period, despite large movements, while survey-based indicators of inflation expectations remained at the relatively low levels seen over the course of 2019. Despite reaching a new all-time low of 0.72% at the end of March, market-based indicators of longer-term inflation expectations recovered in April to stand largely at the level prevailing at the beginning of the review period. The five-year forward inflation-linked swap rate five years ahead stood at 0.90% on 29 April 2020. The market-based probability of deflation increased strongly, reaching a new all-time high. The increase comes in part from large decreases in the price of oil. At the same time, the forward profile of market-based indicators of inflation expectations continues to point to the risk of a prolonged period of very low inflation. The results of the ECB Survey of Professional Forecasters (SPF) for the second quarter of 2020 show average longer-term inflation expectations unchanged at 1.7%, while short-term inflation expectations have been revised downwards sharply, mainly owing to a combination of a changed profile for oil price assumptions and the weaker economic outlook. Average point forecasts for annual HICP inflation now stand at 0.4% for 2020, 1.2% for 2021 and 1.4% for 2022. This represents decreases of 0.8, 0.2 and 0.1 percentage points for 2020, 2021 and 2022, respectively.

Chart 10

Market and survey-based indicators of inflation expectations

(annual percentage changes)

Sources: ECB Survey of Professional Forecasters (SPF), ECB staff macroeconomic projections for the euro area (March 2020) and Consensus Economics (14 April 2020).

Notes: The SPF for the second quarter of 2020 was conducted between 31 March and 7 April 2020. The market-implied curve is based on the one-year spot inflation rate and the one-year forward rate one year ahead, the one-year forward rate two years ahead, the one-year forward rate three years ahead and the one-year forward rate four years ahead. The latest observations for market-based indicators of inflation expectations are for 29 April 2020.

5 Money and credit

Broad money growth accelerated in March. With an increase of 7.5% in March 2020, after 5.5% in February, the annual growth rate of M3 recorded its largest month-on-month increase since the start of monetary union in 1999 (see Chart 11). While the slowdown in economic growth dampened M3, growth in M3 was strongly supported by emergency liquidity needs, uncertainties related to the pandemic crisis, and the very low opportunity cost of holding monetary instruments. The narrow aggregate M1, which includes the most liquid components of M3, was the main contributor to broad money growth. The annual growth rate of M1 increased by more than 2 percentage points to 10.3% in March 2020, after 8.1% in February. In addition to a strong increase in overnight deposits, the annual growth rate of currency in circulation increased substantially, to 7.0% in March, after 5.4% in February, pointing to precautionary motives in firms’ and households’ demand for liquidity. Firms increased their deposit holdings, which rose at an annual growth rate of 9.6% in March, up from 6.5% in February. This reflects substantial borrowing from banks, the overall ample issuance of corporate bonds, and direct liquidity support from governments. Despite a considerable reduction in the holdings of money market fund shares in March, marketable instruments made a significant, positive contribution to annual M3 growth.

Chart 11

M3 and its counterparts

(annual percentage changes; contributions in percentage points; adjusted for seasonal and calendar effects)

Source: ECB.

Notes: Credit to the private sector includes monetary financial institution (MFI) loans to the private sector and MFI holdings of securities issued by the euro area private non-MFI sector. As such, it also covers the Eurosystem’s purchases of non-MFI debt securities under the corporate sector purchase programme. The latest observation is for March 2020.

In March 2020 credit to the private sector remained the main source of money growth, followed by external monetary flows. Credit to the private sector, which has long been the main driver of M3 growth (see the blue portion of the bars in Chart 11), was behind the strong increase in M3 growth in March 2020. External monetary flows have been the second main source of money creation since October 2018 (see the yellow portion of the bars in Chart 11). These inflows reflect the interest of foreign investors in euro area assets (in particular newly issued government securities), and have provided a significant contribution to M3 since the beginning of 2019. The ECB’s net asset purchases under the pandemic emergency purchase programme (PEPP), which was launched on 18 March 2020, together with the increased purchases under its asset purchase programme (APP), made a positive contribution to M3 growth (see the red portion of the bars in Chart 11). Furthermore, the contribution of longer-term financial liabilities remained small in March 2020 (see the dark green portion of the bars in Chart 11).

Loans to the private sector also increased significantly. The annual growth rate of monetary financial institution (MFI) loans to the private sector (adjusted for loan sales, securitisation and notional cash pooling) increased to 5.0% in March 2020, after 3.7% in February (see Chart 12). This development was due to an increase in the annual growth rate of loans to non-financial corporations (NFCs) from 3.0% in February 2020 to 5.4% in March. The increase in bank lending to firms was widespread across countries. For the second half of 2020, the leading indicators of the euro area bank lending survey point to a further increase in the demand for loans to firms. By comparison, the annual growth rate for loans to households decreased somewhat from 3.7% in February 2020 to 3.4% in March. The diverging developments between firms and households in March reflect a number of factors that affected demand from the two sectors, as evidenced by the results of the bank lending survey. In addition, the fact that government policies supported the corporate sector with extraordinary, though temporary, credit support could also explain the diverging patterns. The ECB’s policy measures, in particular the more favourable terms for targeted longer-term refinancing operations (TLTRO III) and the collateral easing measures, should encourage banks to extend loans to all private sector entities.

Chart 12

Loans to the private sector

(annual growth rate)

Source: ECB.

Notes: Loans are adjusted for loan sales, securitisation and notional cash pooling. The latest observation is for March 2020.

The April 2020 euro area bank lending survey shows that in the first quarter of 2020 credit standards tightened somewhat for loans to enterprises and households, while firms’ demand for loans surged owing to emergency liquidity needs related to the coronavirus (COVID-19) crisis.[12] Overall, these developments reflect the deterioration in the economic outlook and the risks surrounding the COVID-19 crisis. Given that the financing needs are emergency-related, firms’ loan demand was significantly higher for short-term loans than for long-term loans. The main factors underlying firms’ loan demand in the first quarter of 2020 were financing needs for inventories and working capital, whereas loan demand for fixed investment and for mergers and acquisitions declined in net terms. Moreover, the deterioration in households’ creditworthiness and a lower risk tolerance on the part of banks provide an explanation for the relatively stronger tightening of credit standards for loans to households and the lower net increase in demand for housing loans and consumer credit compared with demand for loans to enterprises. In addition, the decrease in consumer confidence was a key factor dampening the demand for loans for house purchase and consumer loans. For the second quarter of 2020, banks expect credit standards for firms to ease again on account of the liquidity support measures and loan guarantees introduced by governments. Although the heterogeneity of banks’ replies is currently high, the results suggest that firms’ loan demand will increase further, as is evident from the highest net balance since the start of the survey in 2003. For households, however, a continuation of the net tightening of credit standards and a further decrease in household loan demand were foreseen by banks. In addition, euro area banks reported that the ECB’s asset purchase programmes (APP and PEPP) and the third series of targeted longer-term refinancing operations (TLTRO III) had a positive impact on their liquidity position and market financing conditions. Together with the negative deposit facility rate (DFR), these measures had an easing impact on bank lending conditions and a positive impact on lending volumes. At the same time, banks suggest that the ECB’s asset purchases and the negative DFR had a negative impact on their net interest income, while the ECB’s two-tier system supported bank profitability.

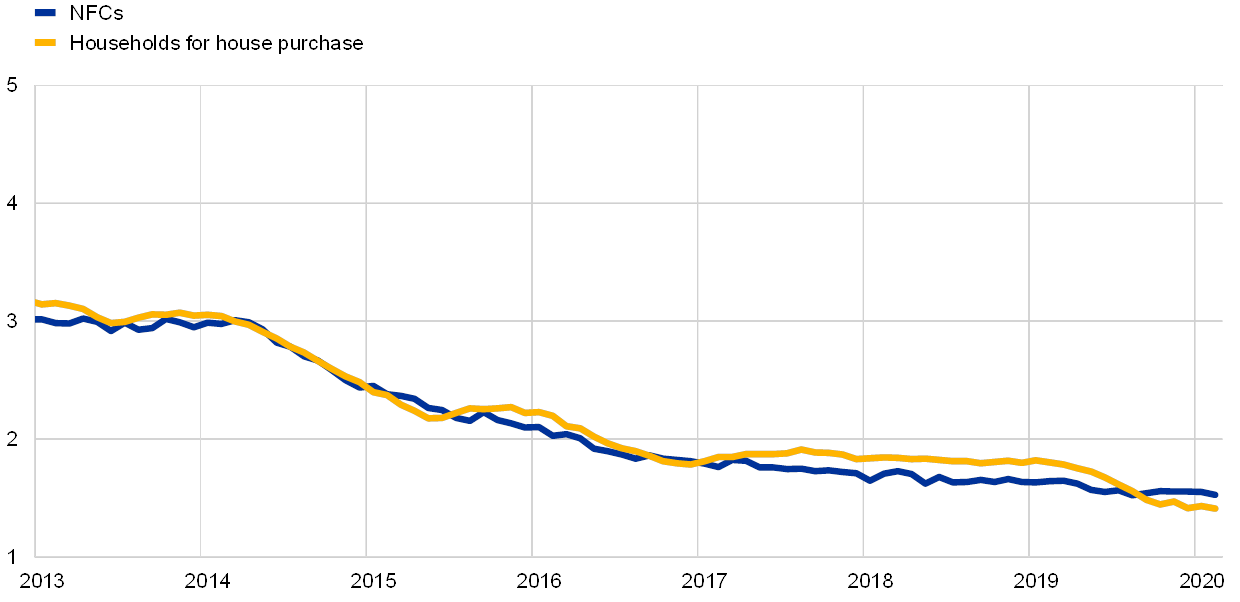

Very favourable lending rates continued to support euro area economic growth. Lending rates touched historical lows again, having declined in line with market reference rates over previous months. In February 2020 the composite bank lending rates for loans to NFCs and households declined to 1.52% and 1.41% respectively (see Chart 13). Competitive pressures, favourable bank funding costs, the APP, and the pass-through of the ECB’s deposit facility rate cut in September 2019 had a further dampening effect on lending rates for loans to NFCs and households. Overall, between May 2014 and February 2020, composite bank lending rates for loans to NFCs and households fell by around 140 and 150 basis points respectively.

Chart 13

Composite bank lending rates for NFCs and households

(percentages per annum)

Source: ECB.

Notes: Composite bank lending rates are calculated by aggregating short and long-term rates using a 24-month moving average of new business volumes. The latest observation is for February 2020.

Boxes

1 Alternative scenarios for the impact of the COVID-19 pandemic on economic activity in the euro area

The outbreak of the COVID-19 pandemic has dramatically affected global economic activity since early 2020. The rapid spread of the novel coronavirus (COVID-19) has required drastic measures to be taken, ranging from social distancing and the banning of public events to shutdowns, lockdowns and restrictions on numerous activities. The severity of these measures has begun to ease in some jurisdictions, as authorities are proceeding to gradually lift them and reopen certain sectors of the economies. Nevertheless, there could still be a prolonged period of social distancing and other containment measures in force for some time. These containment measures have weighed on supply and – together with increased uncertainty and self-isolation by individuals due to the rapid spread of the disease – have also induced households and firms to retrench their spending, thereby reducing aggregate demand. Widespread closures of firms have triggered a marked deterioration in employment conditions, an increase in firms’ liquidity needs, and pronounced financial market disruptions. Despite the shortage of timely hard data, it is already clear that there has been a decline in economic activity of an unprecedented magnitude.

More2 The fall in manufacturing and services activity in the euro area: foreign versus domestic shocks

The coronavirus (COVID-19) pandemic, which has brought human suffering and disruption in economic activity globally, has affected manufacturing and services activity in all euro area countries. Economic growth in the euro area will be severely undermined in the short term. Three concomitant developments have adversely affected economic growth in the euro area since the beginning of 2018: (i) a weakening in global trade, related in part to rising international trade tensions and persistent policy uncertainty surrounding Brexit; (ii) a fall in automotive production, mainly owing to a decline in foreign demand as well as the introduction of more stringent environmental regulations in Europe; and (iii) a severe drop in economic activity as a result of the coronavirus. Between January 2018 and February 2020, despite the weakness in manufacturing in the euro area, the services sector as a whole – in particular market services – remained relatively resilient (see Chart A). In March, however, economic activity in both sectors fell sharply owing to the pandemic. Survey-based indicators such as the Purchasing Managers’ Index (PMI) (see Charts B and C), business and consumer sentiment indicators, and other more timely statistics such as international air travel and energy consumption, all point to a severe downturn in both manufacturing and services in the euro area as well as in many other countries.

More3 Disentangling aggregate and sectoral shocks

The growth slowdown in 2018-2019 was characterised by a marked divergence of industrial production and retail sales. Activity in both sectors is usually characterised by positive co-movement, particularly during recessions.[13] However, there are also episodes where the correlation between the growth of industrial production and retail sales is low or even turns negative (see Chart A). Despite a strong contraction in industrial production, retail sales barely slowed in 2018-2019. This box uses this co-movement to uncover whether the euro area economy was hit by aggregate or sectoral shocks. It then tries to understand whether these two shocks differ in their impact on output over time. The recent COVID-19 shock is undoubtedly an aggregate shock, hitting industrial production and retail sales simultaneously. Yet its impact on economic activity over time remains uncertain as its characteristics differ substantially from past aggregate shocks.

More4 Inflation measurement in times of economic distress

The Harmonised Index of Consumer Prices (HICP) is compiled on the basis of consumption weights that are kept constant within a given calendar year. This reflects the index’s purpose of measuring pure price changes without accounting for adjustments in consumption patterns. In times of sharp economic contraction such as those triggered now by the coronavirus (COVID-19) pandemic, such adjustments can occur over shorter horizons. This box explains inflation measurement issues both in the context of general economic downturns and in the current situation triggered by the COVID-19 shock.

MoreArticles

1 The transmission of exchange rate changes to euro area inflation

Exchange rate changes play an important role in explaining inflation developments. Understanding how exchange rates are passed through to inflation and growth is a crucial part of economic analysis. This article summarises the findings of a research group comprised of experts from the European System of Central Banks (ESCB) who, over the past two years, reviewed and analysed the exchange rate pass-through (ERPT) to inflation in Europe.[14]

More2 Negative rates and the transmission of monetary policy

As structural and cyclical factors have brought nominal interest rates closer to zero, the need to ease financing conditions further has prompted the adoption of a negative interest rate policy (NIRP). The introduction of negative policy rates has been part of a comprehensive policy strategy adopted by the ECB since mid-2014 in order to stave off the unprecedented disinflationary forces that arose in the aftermath of the global and sovereign debt crises. The ECB has cut its deposit facility rate (DFR) into negative territory five times since 2014. The latest lowering of the DFR in September 2019 and the associated market expectations of a longer period of negative rates have reignited the question of how negative rates are transmitted to the economy, especially through banks, and whether they may have counter-productive effects by impinging on banks’ intermediation capacity.

MoreStatistics

Statistical annex© European Central Bank, 2020

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

This Bulletin was produced under the responsibility of the Executive Board of the ECB. Translations are prepared and published by the national central banks.

The cut-off date for the statistics included in this issue was 29 April 2020.

For specific terminology please refer to the ECB glossary (available in English only).

ISSN 2363-3417 (html)

ISSN 2363-3417 (pdf)

QB-BP-20-003-EN-Q (html)

QB-BP-20-003-EN-N (pdf)

- For further information on growth scenarios produced by ECB staff, see the box entitled “Alternative scenarios for the impact of the COVID-19 pandemic on economic activity in the euro area” in this issue of the Economic Bulletin.

- For more detailed information on the new TLTRO conditions, see the ECB press release of 30 April 2020.

- For more detailed information on PELTROs, see the ECB press release of 30 April 2020.

- The methodology for computing the EONIA changed on 2 October 2019; it is now calculated as the €STR plus a fixed spread of 8.5 basis points. See the box entitled “Goodbye EONIA, welcome €STR!”, Economic Bulletin, Issue 7, ECB, 2019.

- Eurostat released its preliminary GDP flash estimate on 30 April 2020. This estimate is expected to be revised in the forthcoming GDP releases on 15 May and 9 June 2020, when more complete primary source data are expected to be available. The revisions to the preliminary GDP flash estimate might be greater than usual (+/-0.1 percentage points) as some countries had to adapt their national estimation methods, by using alternative sources or different models, to address the disrupted availability of source data and ensure the best possible quality.

- The European Commission’s consumer confidence indicator has been constructed as a coincident indicator of private consumption growth. In April 2020 no data could be collected in Italy, therefore the April 2020 values for the euro area aggregate were computed assuming that the changes compared with March were the same as in the euro area aggregate excluding Italy. For more details on this consumer confidence indicator, see A revised consumer confidence indicator, European Commission, 2018.

- For more details on the foreign versus domestic factors driving the fall in economic activity, see the box entitled “The fall in manufacturing and services activity in the euro area: foreign versus domestic shocks” in this issue of the Economic Bulletin.

- For detailed analysis on alternative scenarios, see the box entitled “Alternative scenarios for the impact of the COVID-19 pandemic on economic activity in the euro area” in this issue of the Economic Bulletin.

- See the Eurostat press release on the HICP flash estimate for April.

- For further information on these measures of underlying inflation, see Boxes 2 and 3 in the article entitled “Measures of underlying inflation for the euro area”, Economic Bulletin, Issue 4, ECB, 2018.

- For a discussion, see the box entitled “Recent developments in social security contributions and minimum wages in the euro area”, Economic Bulletin, Issue 8, ECB, 2019.

- In the first quarter of 2020, the net percentage of banks reporting a tightening of credit standards (i.e. banks’ internal guidelines or loan approval criteria) for loans or credit lines to firms was 4%, whereas the net tightening was 9% for loans to households for house purchase and 10% for consumer credit and other lending to households.

- Positive co-movement between retail sales and industrial production plays a prominent role in the NBER’s recession dating procedure. It is also the centrepiece of Burns and Mitchell’s definition of business cycles, see Burns, A. and Mitchell, W., “Measuring Business Cycles”, NBER Studies in Business Cycles, No 2, National Bureau of Economic Research, 1946.

- A comprehensive report on the findings of the expert group, including a more detailed discussion of the ERPT definition, various determinants and empirical findings, as well as a more comprehensive list of references than that provided in this article, is available in Ortega, E. and Osbat, C. (eds.), “Exchange rate pass-through in the euro area and EU countries”, Occasional Paper Series, No 241, ECB, Frankfurt am Main, 2020.

- Data support provided by Maria Dimou and Michele Federle. The authors gratefully acknowledge input from Giacomo Carboni, Matteo Falagiarda, Florian Heider and Glenn Schepens, as well as comments and suggestions from Ugo Albertazzi and Csaba Móré.