- Financial fragmentation remains high, despite improvements reflecting end of redenomination risk

- ECB presents new SYNFINT financial integration index

- Michel Barnier: Banking union is crucial to enable financial sector to support growth without generating too much risk

The European Central Bank (ECB) and the European Commission have today published reports analysing financial integration and stability in Europe. The two annual publications, “Financial Integration in Europe” and the “European Financial Stability and Integration Report”, were presented at a conference at the ECB headquarters in Frankfurt. The reports show that significant financial fragmentation remains in the European Union and euro area, despite considerable improvements in recent years.

The main conclusions are the following.

- The financial market integration recovery process that started in mid-2012 continued in most market segments in the first months of 2014. This improvement reflects the fact that there is no longer a redenomination risk linked to the perception of a possible euro area break-up.

- Developments in 2013 suggest that banks’ balance sheets have continued to improve, and that financial institutions have started to increase their exposure to cross-border sovereign debt instruments. At the same time, the banking sector is still concentrated and increasingly interconnected.

- In 2013 improvements in financial integration and stability were the result of many factors. These included monetary policy actions – particularly Outright Monetary Transactions (OMTs) – the adoption of relevant regulatory reforms, the progress towards the establishment of the banking union, and a steady reform process in euro area countries.

- Both the euro area and the single market are more economically and financially fragmented compared to the pre-crisis period; there is room to promote further integration in specific segments such as corporate bonds, equity and banking markets.

“Both reports underline the crucial importance of implementing the banking union to restore the financial sector’s capacity to support economic activity in the single market without creating excessive amounts of risk for society,” said Internal Market and Services Commissioner Michel Barnier. “After the entry into force of the Single Supervisory Mechanism regulation, the Single Resolution Mechanism and Bank Recovery and Resolution Directive were voted by the European Parliament on 15 April, and are scheduled to be voted by the Council in May. The new legal framework will ensure that banks will face the same market discipline as any other business, rather than being bailed out by European taxpayers.”

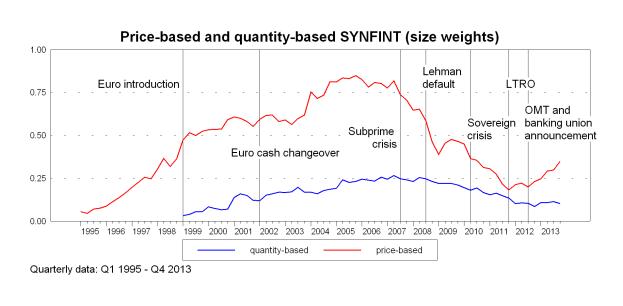

The ECB today presented a new synthetic indicator of financial integration (SYNFINT) (see chart below) which tracks the overall level of financial integration over time. The indicator reflects the developments in four main market segments: money, bonds, equities and banking, and shows the damage caused by the financial crisis, as it triggered fragmentation to reach levels similar to those seen before the euro was introduced, with a slow recovery taking place now. For instance, in the banking markets, the large variation in borrowing costs for non-financial corporations, especially small and medium enterprises, remains a key concern. The price and quantity-based SYNFINT will be developed further and used regularly in future ECB financial integration reports.

“A return to higher levels of financial integration cannot be taken for granted and requires sustained policy actions in the short term, especially the effective implementation of the banking union and, at the national level, carrying on with structural reforms,” said the ECB’s Vice-President, Vítor Constâncio.

About the SYNFINT

The Synthetic Indicator of Financial Integration (SYNFINT) has been constructed in a multi-layered structure that starts with the aggregation of selected indicators into four intermediate sub-indices for each relevant market segment: money, bonds, equities and banking. Prior to aggregation, all indicators are homogenised in their distributional properties by an appropriate statistical transformation. Using the information contained both in prices and in cross-border quantities, two separate composite indicators (a price- and a quantity-based SYNFINT) are then computed by using weighted averages of the relevant sub-indices. The weights reflect the average relative size of each market segment in terms of outstanding amounts. The general statistical framework is similar to that of the Composite Indicator of Systemic Stress (CISS) presented by the ECB in 2012, except that the SYNFINT does not apply correlation weighting when aggregating the segment-specific indices into the composite indicator.

For media queries, please contact:

Andreas Adriano: +49 69 1344 8035

Chantal Hughes: +32 2 296 44 50

Carmel Dunne: +32 2 299 88 94

Audrey Augier: +32 2 297 16 07