The May 2022 Financial Stability Review (FSR) has been prepared against the backdrop of the devastating invasion of Ukraine. We do not yet know how the war will be resolved. But we do know that the human suffering it has caused is enormous. We hope for peace.

This war is also affecting the economy, in Europe and beyond. The invasion and the associated uncertainty have prompted some repricing in global financial markets, albeit with much less turmoil than seen in March 2020, and dampened the confidence of businesses and consumers that are only just emerging from the tight restrictions imposed during the coronavirus (COVID-19) pandemic. Higher energy and commodity prices are pushing up inflation and slowing the economic recovery. Elevated volatility has highlighted some liquidity risks, notably in some commodity derivatives markets. However, the main threat to euro area financial stability comes from the impact through macroeconomic channels. This implies additional challenges for indebted businesses at a point in time when countries’ fiscal space is very limited and support may need to be more targeted than the broad fiscal policy response to the pandemic.

With these developments in mind, this FSR assesses financial stability vulnerabilities and their implications for financial markets, debt sustainability, bank resilience, the non-bank financial sector and macroprudential policies.

This issue of the FSR also includes two special features on topics that are increasingly part of our routine financial stability assessment at the ECB. The first focuses on recent advances in the monitoring of financial stability risks stemming from climate change, building on previous special features on the topic. The second special feature explores risks arising from crypto-assets – which have been increasing over time, as this sector grows both in its size and in its integration with the core financial system.

This issue of the FSR has been prepared with the involvement of the ESCB Financial Stability Committee, which assists the decision-making bodies of the ECB in the fulfilment of their tasks. The FSR exists to promote awareness of systemic risks among policymakers, the financial industry and the public at large, with the ultimate goal of promoting financial stability.

Luis de Guindos

Vice-President of the European Central Bank

Overview

Higher prices, exacerbated by the Russia-Ukraine war, weaken the recovery and increase global risks

Financial stability conditions have deteriorated, as the post-pandemic recovery has been tested by higher inflation and Russia’s invasion of Ukraine. Since late 2021, rising inflationary pressures have threatened to slow the momentum of the recovery in 2022. Upside risks to euro area inflation and downside risks to growth rose sharply following the outbreak of the Russia-Ukraine war (Chart 1, panel a). In particular, large rises in commodity and energy prices (Chart 1, panel b) and ongoing global supply chain pressures are expected to prolong the period of elevated inflation. The course and consequences of the Russia-Ukraine war are still hard to predict. While peace could reverse some pressures, a protracted conflict could imply sustained higher inflation and even lower growth outturns than currently expected. Risks to inflation, growth and global financial conditions could also be triggered by other global events, such as a broader resurgence of the coronavirus (COVID-19), emerging market weakness or a sharper economic slowdown in China (Box 4).

Chart 1

Risks of higher inflation and lower growth outturns in the euro area amplified by an intensified commodity and energy price shock

Sources: Consensus Economics Inc., Refinitiv, Hamburg Institute of International Economics and ECB calculations.

Note: Panel a: shaded areas display one and two standard deviations in Consensus expectations for euro area real GDP growth and HICP inflation. HICP stands for Harmonised Index of Consumer Prices. Panel b: other commodities include food (cereals, oilseeds/oils and tropical beverages/sugar) and industrial raw materials (agricultural raw materials, non-ferrous metals and iron-ore/scrap).

Higher inflation and lower growth could increase market volatility and challenge debt servicing capacity as financing costs rise. The consequences of the war and the shift to a lower-growth, higher-inflation environment affect virtually every aspect of economic activity and financing conditions. In turn, these developments might not only amplify, but could also trigger the materialisation of pre-existing financial stability vulnerabilities identified in previous issues of the FSR. These include heightened debt sustainability concerns in non-financial sectors or the possibility of corrections in both financial and tangible asset markets (Box 3).

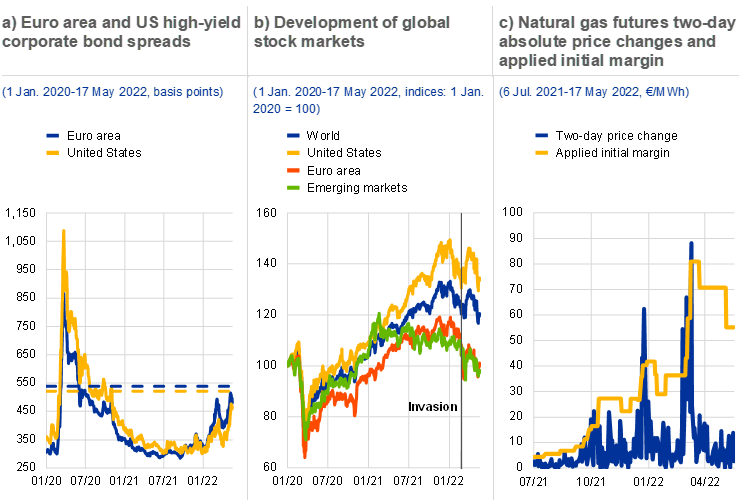

Initial risk-off reaction in markets largely orderly, but asset price correction concerns remain

The Russian invasion of Ukraine triggered a large but, in most cases, short-lived market reaction. In early 2022, markets, positioning for solid growth, a temporary spike in inflation and relatively modest policy tightening, saw a repricing in global equity and bond markets. The outbreak of the war, which increased the risk of a higher-inflation, lower-growth scenario, saw market volatility increase, credit spreads widen and equity indices decline (Chart 2, panels a and b). The market response was substantial, but more modest than at the onset of the pandemic. Movements in commodity markets were most pronounced, as Russia and Ukraine are key suppliers. Euro area assets, given greater proximity and links to Russia and Ukraine, experienced larger losses than US assets. By the end of March, euro area markets had recovered most of the initial losses, but commodity prices remained elevated. Over the course of April and May, concerns about the global growth outlook and central banks’ response to higher inflation rates led to renewed weakness in risky asset valuations.

Chart 2

The initial market correction to the war was largely orderly, but liquidity pressures arose in some derivatives markets

Sources: Bloomberg Finance L.P., EPFR Global, ICE Clear Europe and ECB calculations.

Notes: Panel a: dashed lines represent the long-term average over the past two decades. Government option-adjusted spreads are employed. Panel b: equity indices shown are the MSCI All Country World Index, the MSCI USA Index, the MSCI Euro Index and the MSCI Emerging Markets Index. Panel c: data on margins are provided by ICE Clear Europe in accordance with the Terms of Use. Applied initial margins are based on the scanning ranges published by ICE Clear Europe. Full initial margins should be computed with the CCPs’ proprietary risk models, in this case those of ICE Clear Europe, taking into account all risk parameters and full exposures.

Further corrections in financial markets could be triggered by an escalation of the war, even weaker global growth or if monetary policy needs to adjust faster than expected. Despite recent asset price corrections, valuations remain stretched in the light of the deterioration in macro-fundamentals, and further sharp corrections are a risk. Such corrections could be triggered by a further escalation of the war, emerging market stresses or by more persistent inflation than currently foreseen, which might prompt faster monetary policy normalisation by major central banks. Higher interest rates could challenge the valuations of riskier assets, such as equities. Euro area sovereign and high-yield credit spreads have widened over the course of 2022. Spread increases are in part related to the rise in underlying risk-free rates, as the latter mechanically have a larger impact on the earnings and budget deficits of more indebted firms and sovereigns.

Large shifts in commodity prices and related margin requirements have posed challenges to liquidity management for some derivative market participants. Commodity derivatives markets are used by a wide range of firms, including energy producers, suppliers and distributors, and users, to manage risks arising from volatile commodity prices, and enable them to fulfil contracts with corporates and households. In response to the recent rise in commodity price volatility, central clearing counterparties (CCPs) and clearing members have increased the initial margins for commodity derivatives (Chart 2, panel c). Margin requirements must be met by posting cash or highly liquid collateral. For some firms, these liquidity requirements may become prohibitive, while for others, the cost of hedging may have started to outweigh the perceived benefit. As a result, some firms may choose to reduce their hedging activities, or switch to contracts with lower collateralisation needs, including non-centrally cleared derivatives (Chapter 2). In the latter case, both the firm and the counterparty could be more exposed to counterparty credit risk. Sufficient margining is an important safeguard in the financial system. But recent developments do raise the question of whether margining practices (including those between the clearing member and their client) might be unnecessarily procyclical, and whether they are sufficiently transparent (Chapter 5).

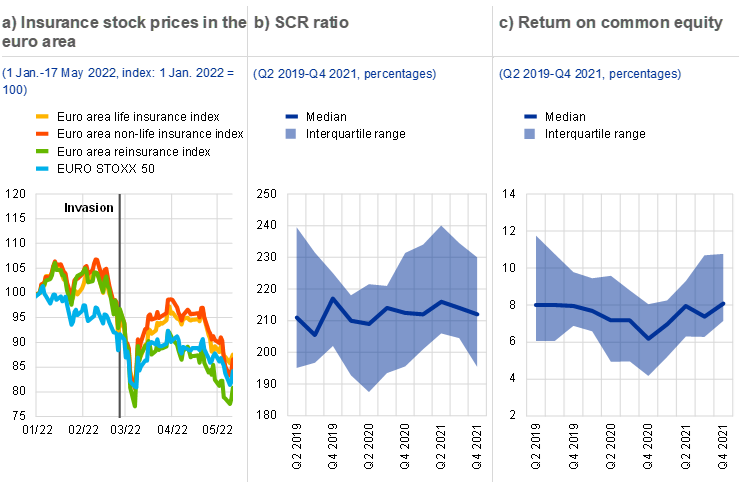

Investment funds saw manageable outflows following the invasion, but euro area non-banks remain vulnerable to a further market correction, given high duration, credit and liquidity risk. Limited aggregate exposure to Russian and Ukrainian assets meant that only a few of the more specialist investment funds were suspended. That said, since early 2022, there has been a rotation from corporate to sovereign bond funds, as well as from growth to value equity funds. After the start of the war, there had been renewed interest in inflation-protected bond funds in anticipation of higher inflation, and in commodity-related equity funds in the light of the surge in energy prices. These trends slowed down or reversed again in late April in line with weaker performance of these asset classes (Chart 3, panel a). Some duration risk for non-banks has started to materialise in recent quarters, and further valuation losses may arise. Non-banks also have large exposures to weaker corporates which may be especially vulnerable to higher inflation and lower growth. The risk that investment funds could amplify a market correction due to fire sales remains, given low liquidity buffers (Chart 3, panel b). For some non-banks, additional vulnerabilities stem from their excessive synthetic leverage via derivatives (Box 7) or investments in crypto-assets, where growing institutional investor interest is deepening the linkages with the mainstream financial system (Special Feature B). In the medium term, however, a higher interest rate environment could reduce the non-bank sector’s incentives to search for yield and benefit the insurance and pension fund sector because of its negative duration gap, thereby mitigating overall financial stability risks (Chapter 4).

Chart 3

Non-banks proved largely resilient to the market impact of the invasion, but underlying credit, duration and liquidity risks remain causes for concern

Sources: EPFR Global, ECB (Investment Funds Balance Sheet Statistics and Securities Holding Statistics) and ECB calculations.

Note: Panel b: average residual maturity is a proxy for duration risk and is used here because of the longer available time series.

Input price increases and higher financing cost add strains for more indebted firms and sovereigns

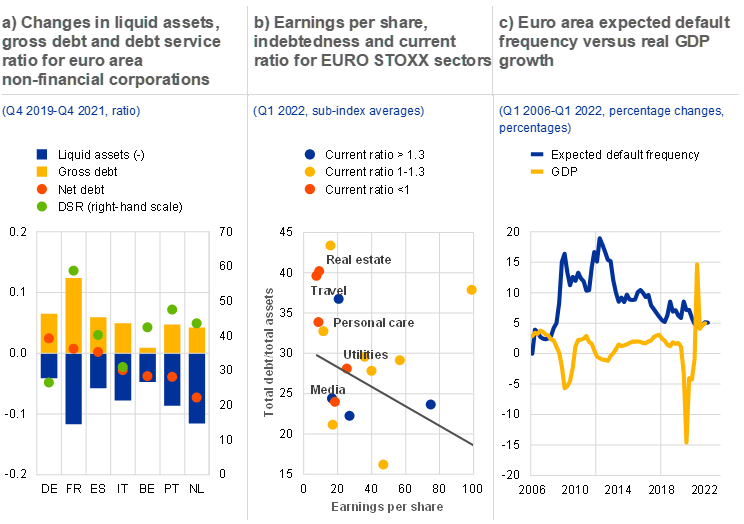

Euro area corporates face renewed headwinds as input prices have soared and the economic outlook has become more clouded. A solid economic recovery helped measures of aggregate corporate vulnerability to improve towards the end of 2021 (Chapter 1.3). Gross profits recovered to 7% above pre-pandemic levels, while policy support measures have kept corporate insolvencies at historic lows. However, a weaker economic growth outlook, coupled with growing margin pressure as a result of soaring input prices, has led to some increase in expected corporate default rates (Chart 4, panel a).

There is a sizeable cohort of more vulnerable and pandemic-strained firms, some of which are also sensitive to commodity prices. The most vulnerable corporates which are more indebted, less liquid and have lower sales levels might face particular challenges in the event of a pronounced economic slowdown (Box 1). Higher energy and commodity prices could hurt activity in economic sectors which have not yet fully recovered from the pandemic, such as air transport, accommodation, and food and beverages (Chart 4, panel b), or which have low pricing power to pass on higher costs (Chapter 2). These vulnerabilities are compounded by the prospect of tighter financing conditions that would adversely affect the debt servicing capacity of lower-rated firms in particular. This could also fuel corporate downgrade risk, as the bulk of issuance activity in recent years has taken place in the lowest investment grade bucket (BBB).

Chart 4

Signs of renewed risks for the corporate sector, with some pandemic-strained sectors highly exposed to higher energy prices

Sources: Moody’s Analytics, OECD Trade in Value Added (TiVA) database (2018), Eurostat and ECB calculations.

Notes: Panel a: European speculative-grade default rates forecast by Moody’s Analytics as at January 2022 (solid lines) and April 2022 (dotted lines). The baseline forecasts incorporate low refinancing risk and healthy corporate fundamentals. The optimistic scenario builds on the favourable baseline, expecting markets to remain very supportive of speculative-grade issuers in 2022, while showing exceptional demand for high-yield debt in the search for yield. By contrast, the pessimistic scenario acknowledges a particularly weak ratings mix among European speculative-grade issuers. For more details on the different scenarios, see the Moody’s website. There is a structural break in the time series of realised rates as of March 2022, as defaulting and non-defaulting Russian issuers whose ratings were recently withdrawn have been excluded. Panel b: energy use includes direct and indirect use of: (i) electricity, gas, steam and air conditioning; (ii) mining and quarrying; and (iii) coke and refined petroleum products as a share of total output. Energy inputs by industry are classified according to the United Nations International Standard Industrial Classification for All Economic Activities (ISIC), Rev. 4, and are attributed to each sector based on the four-digit SIC code. The red vertical line represents the median usage of energy inputs as share of total output across all sectors of economic activity. Out of 42 NACE sectors, 24 are shown in the chart.

Euro area fiscal positions also face challenges as they now encounter a weaker recovery and tighter financial conditions. In 2021, as the euro area economy began recovering from the COVID-19 shock, governments gradually withdraw the stimulus they provided during the pandemic. As a result, fiscal positions in 2022 are expected to improve compared to 2021. However, the repercussions of the war in Ukraine may create new draws on public finances. While immediate stress in euro area sovereign bond markets remained low, short-term fiscal pressures have increased in a number of countries (Chart 5, panel a). This is attributable to measures aimed at cushioning the adverse impact of higher energy prices on households and corporates, as well as the cost of managing the flow of refugees and higher defence spending in some countries. Market participants estimate the associated additional fiscal impact for the largest euro area countries at around 1.2 percentage points of GDP on average. Also, where coupled with lower economic growth than previously anticipated, higher interest rates may translate into higher refinancing needs (Chart 5, panel b). This could put sovereign debt dynamics on an unfavourable trajectory, especially in higher-debt countries.

Additional fiscal space to cushion the economy from future shocks may have become more limited in some euro area countries. This, coupled with debt sustainability concerns, could contribute to a reassessment of sovereign risk by market participants and spur fragmentation pressures in sovereign bond markets. That said, countries with higher sovereign risk have taken advantage of low rates to prolong their debt maturity profile, which reduces their vulnerability to abrupt changes in market sentiment. To the extent that higher sovereign vulnerabilities coincide with fragilities in the corporate and banking sectors, risks materialising in any of these sectors (in isolation or combination) may lead to adverse feedback loops between sovereign, banks and corporates (Box 1).

Chart 5

Euro area sovereigns transition from pandemic support to tackling the repercussions of the war, as higher rates and lower growth challenge more indebted sovereigns

Sources: IMF Fiscal Monitor, ECB and ECB calculations.

Notes: Panel a: the horizontal and vertical red lines represent the 3% of GDP Maastricht threshold for the budget deficit. The size of the bubble represents the general government gross debt-to-GDP ratio in 2021. Panel b: the aggregate of higher-debt countries includes euro area countries with a 2021 general government debt-to-GDP ratio above 90%. The lower-debt aggregate includes the remaining euro area countries. The threshold of 90% of GDP for sovereign debt is based on findings in the empirical literature. See, for example, Checherita and Rother*. The benchmark refers to the main scenario of the debt sustainability analysis simulations based on the December 2021 Eurosystem staff macroeconomic projection exercise for the period 2021-24 and assumes broad minimum compliance of the fiscal path thereafter with the Stability and Growth Pact (gradual convergence to countries’ specific medium-term fiscal objectives, with current debt rule requirements not included in the simulations). In the first scenario, a permanent increase in interest rates of 100 basis points is applied to all new and refinancing operations as of 2023 across the whole yield curve over a ten-year horizon. In the second scenario, the increase in interest rates is combined with a fall in potential GDP growth by one percentage point for three years over the period 2023-2025. No catching-up effect is expected after 2025, leading to a permanent downward shift of 3% in the potential GDP level.

*) Checherita, C. and Rother, P., “The impact of high and growing government debt on economic growth – an empirical investigation for the euro area”, Working Paper Series, No 1237, ECB, 2010.

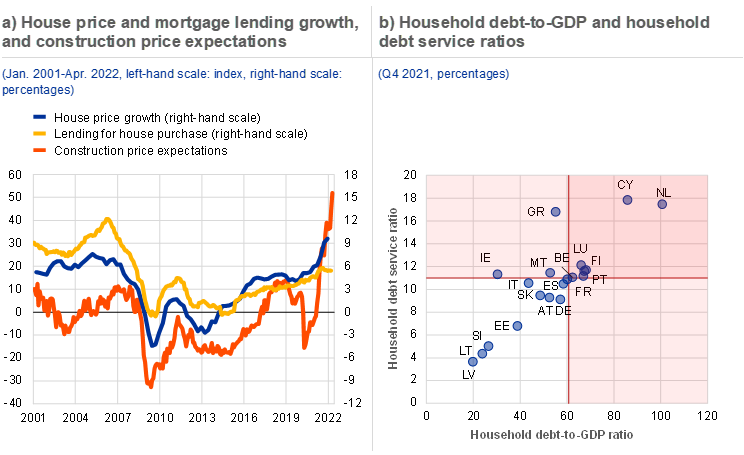

Expansion continues in residential real estate markets, increasing the vulnerability to corrections

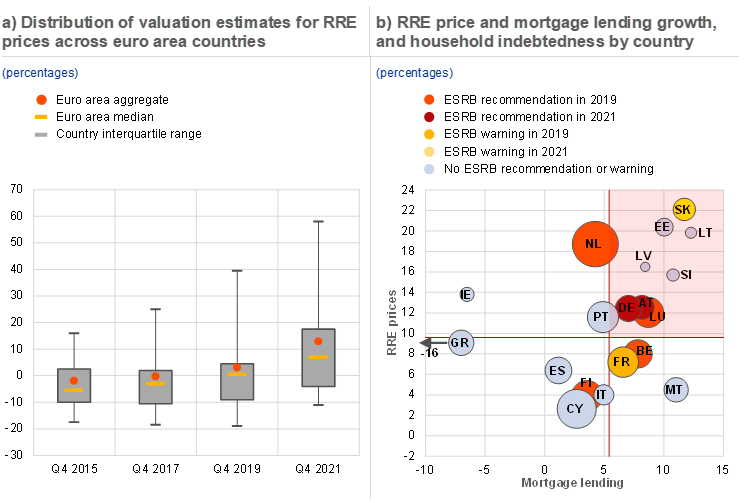

Vulnerabilities in euro area residential real estate markets continued to build. Euro area house prices increased at a rate of almost 10% in the final quarter of 2021 – the fastest pace observed in the last 20 years (Chart 6, panel a). The trend was driven among other things by changes in housing preferences triggered by the pandemic, low interest rates and supply-side constraints (Box 2). At the same time, the buoyant growth of residential real estate prices is coupled with robust mortgage lending (Section 1.5). The associated rise in vulnerabilities led to the European Systemic Risk Board issuing new warnings and recommendations in December 2021, strengthening the case for macroprudential action in some countries (Chapter 5). While house price pressures are buttressed in the near term by tight supply conditions and continued demand amid household and investor preference for housing, signs of overvaluation render some housing markets prone to price corrections. In particular, an abrupt increase in real interest rates could induce house price corrections (Box 2).

Chart 6

Euro area households could face the triple challenge of possible corrections in residential real estate markets, higher interest rates and an income squeeze

Sources: Eurostat, ECB and ECB calculations.

Notes: Panel a: construction price expectations refer to the three months ahead. RRE price growth is shown until the fourth quarter of 2021 and lending for house purchase until March 2022. Panel b: the red horizontal and vertical lines represent the euro area aggregate values. The debt service ratio is calculated as debt service cost divided by income following Drehmann et al.* Compensation of employees is used to measure the income of households.

*) Drehmann, M., Illes, A., Juselius, M. and Santos, M., “How much income is used for debt payments? A new database for debt service ratios”, BIS Quarterly Review, September 2015.

Risks from mortgage indebtedness are amplified by the impact of higher costs on the debt servicing capacity of euro area households. Despite rising indebtedness since the start of the pandemic (Section 1.4), balance sheet fundamentals of euro area households remained relatively solid overall. However, higher inflation and energy price outturns may reduce households’ purchasing power, unless wages catch up sufficiently without destabilising inflation expectations. The associated squeeze may particularly affect lower-income households, which spend a larger portion of their incomes on food and energy. At the same time, the currently relatively favourable financial and employment situations of euro area households could worsen, should prolonged economic weakness translate into a growing number of corporate insolvencies and restructurings. In an environment of deteriorating income positions and higher interest rates, households’ debt servicing capacity could be challenged, particularly in countries with elevated debt levels and high debt servicing needs (Chart 6, panel b). That said, the shift towards more fixed-rate mortgage lending in recent years will shield many households from the immediate impact of higher interest rates (Chart 7, panel c). Similarly, active use of macroprudential policies in most euro area countries, notably through borrower-based measures, are helping to improve the resilience of borrowers.

Euro area banks show resilience, but profitability prospects worsen as asset quality concerns resurface

The positive market sentiment towards euro area banks in 2021 reversed sharply following the Russian invasion of Ukraine. Marked corrections in bank share prices (Chart 7, panel a) erased the gains made in 2021 amid improved earnings and expectations of higher interest rates. After the initial shock, markets reversed some of the losses as it became apparent that only a few banks had material direct exposures to Russia and Ukraine. In addition, the majority of banks signalled their commitment to previously announced dividend and share buyback plans for 2022.

After a remarkable recovery in bank profitability in 2021, projections for 2022 have been revised down as credit risks have increased. Bank profitability surpassed pre-pandemic levels in 2021, driven by higher operating income and lower loan loss provisions, but profitability prospects have worsened in line with a weaker macroeconomic backdrop. Profitability remained solid at the start of 2022 too, but bank analysts revised down their 2022 return on equity (ROE) forecasts for euro area banks to around 7% (Chart 7, panel a) – a level which is still low by international standards. While banks showed resilience and credit risks associated with direct exposures are limited, the banking sector could be indirectly affected by the repercussions of the war. For example, it may be exposed to greater corporate and household credit risks as a result of higher commodity prices and disrupted global supply chains. In fact, a further major energy price shock could translate into higher corporate probabilities of default (PDs), including in some sectors that were badly hit by the pandemic, such as accommodation and food services (Chart 7, panel b). However, a broader vulnerability exercise suggests that overall the banking sector is resilient to the second-round effects arising from the Russia-Ukraine war (see Box 6).

A rise in interest rates may provide some support to bank margins in the short run, but some banks might face challenges in the medium term. A higher interest rate environment and steeper yield curve will mechanically support interest income and, in turn, bank profitability, but funding low-yielding assets profitably may become challenging in the medium term. In particular, the large-scale shift over the last decade from floating to fixed-rate lending, especially for households, may dampen some of the benefits that banks enjoy from higher interest rates (Chart 7, panel c). This may pose a risk to banks’ medium-term profitability prospects in cases where such interest rate exposures are less well hedged (Box 5). As interest rates rise, banks could also face higher credit risks, given growing exposures to vulnerabilities in the non-financial sector in recent years.

Chart 7

Bank stock prices reflect an uncertain outlook amid resurfacing asset quality concerns and rising interest rate risks for some banks

Sources: Bloomberg Financial L.P., Urgentem, Moody's Analytics, Bureau van Dijk – Orbis database, ECB and ECB calculations.

Notes: Panel a: 2022 bank ROE expectations indicate the weighted average of a sample of 32 listed euro area banks. Panel b: adverse scenario: +69% on gas price and +24% on oil price; severe scenario: +138% on gas and +48% on oil price. The energy price assumptions are consistent with the scenario analysis conducted in the context of the March 2022 ECB staff macroeconomic projections. NACE codes and corresponding economic activities: A – Agriculture, forestry and fishing, B – Mining and quarrying, C – Manufacturing, D – Electricity, gas, steam and air conditioning supply, E – Water supply; sewerage, waste management and remediation activities, F – Construction, G – Wholesale and retail trade; repair of motor vehicles and motorcycles, H – Transportation and storage, I – Accommodation and food service activities, J – Information and communication, L – Real estate activities, M – Professional, scientific and technical activities, N – Administrative and support service activities, O – Public administration and defence; compulsory social security, P – Education, Q – Human health and social work activities, R – Arts, entertainment and recreation, S – Other service activities. Panel c: NFCs stands for non-financial corporations.

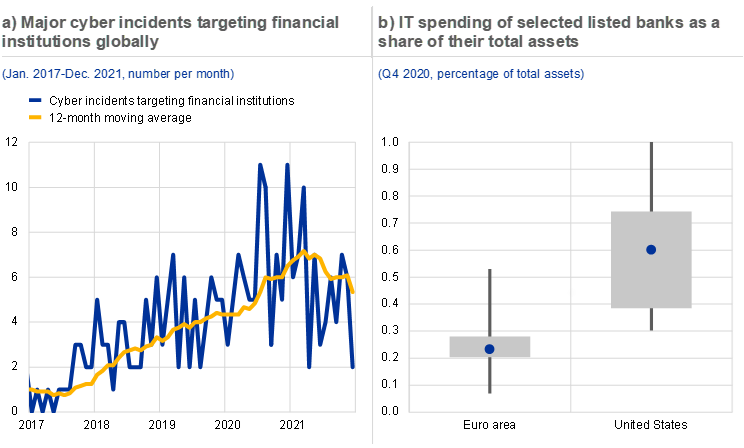

Long-standing structural challenges, together with a greater need to manage cyber risk, continue to weigh on the outlook for euro area banks. Longer-term challenges associated with low cost-efficiency, limited revenue diversification and overcapacity compound growing cyclical headwinds. In addition, euro area banks urgently need to press ahead with their digital transformation, not least to be able to manage the growing threat of cyber risks. However, having focused on cost-cutting in recent years to boost profits, parts of the banking sector continue to lag behind global peers in terms of IT infrastructure investment (Chapter 3). Heightened uncertainty surrounding the outlook and lower profit expectations may now further delay the transformation plans of euro area banks, which would have an adverse impact on their competitiveness.

Financial institutions and markets need to accelerate the transition to a low-carbon economy

Banks and non-banks alike need to step up their efforts to support the move towards a net-zero economy. Metrics of financial institutions’ exposure to climate-related risks show little evidence of a decline over the last few years. In fact, while euro area NFCs have reduced actual emissions, loans to more polluting firms still represent around two-thirds of banks’ credit exposures (Special Feature A). Similarly, banks and non-banks have reduced their holdings of securities issued by firms with higher emission levels only slightly over the last five years (Chart 8, panel a). The Russian war in Ukraine has highlighted the risks that can arise from high dependency on fossil fuels, whose price and supply can be volatile.

Chart 8

The carbon footprint of financial institutions’ portfolios has not decreased significantly, and greenwashing risks remain high in financial markets

Sources: ECB (AnaCredit and Securities Holding Statistics), Bureau van Dijk – Orbis database, Refinitiv, Urgentem and ECB calculations.

Notes: Panel a: ICPFs stands for insurance corporations and pension funds; IFs stands for investment funds. High/low emitters are defined as firms with reported emission intensity in the top/bottom 33% of the distribution across euro area banks’ borrowers as of end-2020, i.e. firms with annual emission intensity registered in 2020 above 556 tCO2e/USD million and below 47 tCO2e/USD million. ICPFs stands for insurance corporations and pension funds, IFs stands for investment funds. Panel b: combined market capitalisation refers only to firms disclosing emission-reduction targets.

While green financial markets continue to deepen, there is a need to monitor greenwashing risks. Sustainable financial markets continued to grow at a brisk pace in 2021, amid growing investor interest in green finance. Firms are increasingly disclosing their exposure to transition risk as well as their commitments to reduce emissions (Chart 8, panel b), indicating increasing awareness of the need to transition to a low-carbon economy. That said, greenwashing risks do remain in capital markets. These need to be tackled using better, more consistent information and enhanced standards for financial instruments, to ensure that green finance effectively supports the transition to a low-carbon economy.

Macroprudential policy needs to strengthen resilience to handle future shocks

The euro area financial stability outlook has deteriorated as inflation has risen, especially since the start of the Russia-Ukraine war. Upside risks to inflation, especially from energy prices, and downside risks to growth are amplifying pre-existing vulnerabilities identified in previous issues of the FSR, such as those associated with mispricing in some financial and tangible asset markets, as well as the legacy of higher debt levels in non-financial sectors. The vulnerabilities identified could be exacerbated by shocks such as (i) a further escalation of the Russia-Ukraine war or further economic sanctions imposed in response to the war; (ii) unexpected changes in growth or inflation; or (iii) a resurgence in COVID-19 infections, with a greater economic impact than currently expected. The potential for these vulnerabilities to materialise simultaneously and possibly amplify each other further increases the medium-term risks to financial stability.

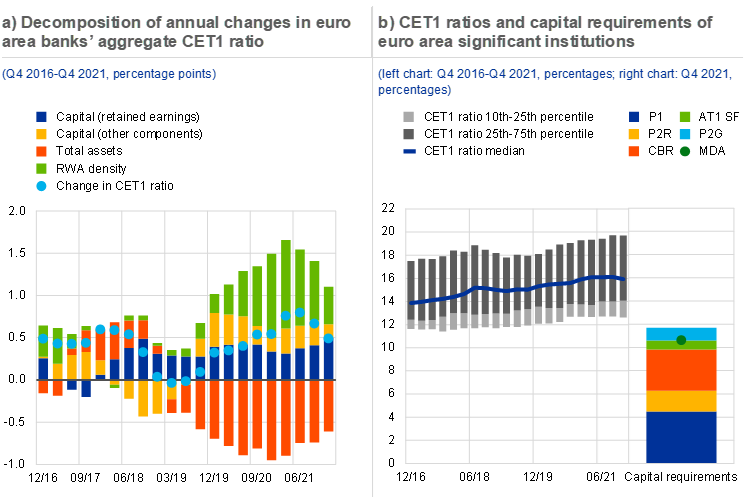

As economic conditions allow, further building resilience in a timely manner remains a sound policy strategy. Banks currently have ample capital headroom on top of their regulatory requirements, and a vulnerability analysis specifically assessing the adverse implications of the war in Ukraine indicates that the euro area banking system remains resilient under the scenarios considered. Nevertheless, macroprudential policy action would further enhance resilience against vulnerabilities that have already accumulated, including those in residential real estate markets, and mitigate the risk of bank de-leveraging if systemic risk materialises. As long as economic conditions do not deteriorate significantly, existing bank capital generation capacity and headroom should mitigate a detrimental impact on credit supply from increasing capital buffers. In addition, there are also costs associated with delayed action, especially if uncertainty persisted into the medium term and vulnerabilities remained unaddressed or continued to build. Overall, if the economic costs of activating additional capital buffers remain low and the financial cycle is expected to remain on an upward trend, as was the case prior to the outbreak of the war, when policy tightening commenced in some countries, authorities can continue to act appropriately while taking into account the uncertainty related to the war to avoid procyclical effects. Authorities should tailor their policy strategy to the national context by using the whole range of macroprudential instruments that are at their disposal, including borrower-based measures as already in place in several countries.

Creating additional macroprudential space while also enhancing the effectiveness of the existing countercyclical capital buffer would support the resilience of the financial system over the medium term. In its input to the European Commission’s review of the macroprudential framework, the ECB has called for more macroprudential space in the form of a higher amount of releasable capital buffers that could further improve banks’ loss absorption capacity while maintaining the provision of key services in a downturn. In addition, increasing the flexibility in the existing countercyclical capital buffer (CCyB) framework could facilitate timely policy action in both the activation and release phases. The ECB’s response also included additional proposals to fill other gaps in the policy toolkit, promote the implementation of instruments at the national level, streamline the activation and coordination procedures for macroprudential measures and address global risks.

Regulatory initiatives to tackle risks from liquidity mismatches, leverage and margining practices in the non-bank financial sector should continue to progress. Developing a comprehensive macroprudential approach for non-banks remains essential to address structural vulnerabilities and strengthen the sector’s resilience. The focus of the international policy agenda has now shifted to structural liquidity mismatches in the investment fund sector and should prioritise a better alignment of asset liquidity with redemption terms. The use of leverage by non-banks in a highly interconnected global financial system is a key concern for financial stability and needs to be tackled using a range of measures across entities and activities. In addition, recent events have underlined the need to make further progress with international efforts to assess financial stability risks arising from margining practices.

1 Macro-financial and credit environment

1.1 Euro area economic outlook weakens on the back of global cost pressures and the war in Ukraine

Since the November 2021 Financial Stability Review, the economic outlook for the euro area has weakened, while inflation projections have been revised upwards. Private sector forecasters have downgraded their growth expectations significantly since the end of last year as the repercussions of the Russian war in Ukraine reverberate globally, likely slowing the economic recovery. The supply chain and cost pressures that built up during the coronavirus (COVID-19) pandemic have been amplified by the war, which has prompted further increases in commodity prices, affected supply chains and substantially weakened consumer confidence. As a result, consensus expectations for real GDP growth in the euro area in 2022 have been downgraded to 2.7% (down 1 percentage points since late February), while inflation expectations have been revised upwards to 6.8% (up 2.6 percentage points since late February) (Chart 1.1, panel a).

Chart 1.1

Forecasters pare back growth prospects and raise inflation projections as sanctions slow the economic recovery and hit the Russian economy particularly hard

Sources: Consensus Economics Inc. and ECB calculations.

Notes: Panel a: HICP stands for the Harmonised Index of Consumer Prices measure of inflation. The dashed vertical lines represent the average forecast values. Panel b: selected other major economies include Australia, Canada, China, Japan and the United States. CEE stands for central and eastern Europe and includes Bulgaria, Czech Republic, Estonia, Latvia, Lithuania, Hungary, Poland, Romania, Slovenia and Slovakia. CEE and Russia forecasts show April 2022 consensus GDP growth expectations.

While the war in Ukraine has prompted material increases in energy and commodity prices, the more direct impact via euro area exports has been contained. Sanctions have served to significantly isolate Russia’s economy, which is reflected in a sharp downgrade of its economic growth outlook and a simultaneous increase in inflation expectations (Chart 1.1, panel b). The direct impact of the conflict on the euro area economy has been relatively modest. On aggregate, exports to Russia account for 3% of foreign demand, with some eastern European countries having significantly larger exposures (Chart 1.2, panel a). Imports from Russia, at around 4% of the total, are also modest. However, the relatively small headline figures for imports and exports conceal the euro area’s greater dependency in terms of energy supply. The euro area relies on Russian imports for 20% of its oil and 35% of its gas needs, with some larger economies showing even greater levels of dependency. Accordingly, those economies with a larger share of Russian energy in their total energy mix may face greater challenges in finding alternative sources and might be harder hit if further sanctions are imposed.

Chart 1.2

Trade links with Russia and Ukraine are modeston aggregate, but both countries are critical sources of some key commodities

Sources: Bloomberg Finance L.P., UN Comtrade database, Eurostat, ECB and ECB calculations.

Note: Panel b: price change is based on active future contracts quoted by Bloomberg.

The conflict in Ukraine has added to pre-existing global inflationary pressures as the war has increased the prices of food and non-food commodities. Prices have increased strongly in those commodities of which Russia and Ukraine are major global exporters (Chart 1.2, panel b). Moreover, the sharp rise in commodity prices observed since the start of the conflict is adding to pre-existing inflationary pressures in commodities used in the extraction or processing of other commodities (e.g. steel, aluminium) and potash used to produce fertilisers and metals. Spiralling commodity prices are posing particular difficulties for importing emerging market economies. Moreover, emerging markets, such as India, Turkey, Mexico and developing CEE countries, may experience significant rises in headline figures on the back of the weighting of commodities in their consumption baskets. Added to these concerns is the prospect of global monetary tightening and associated spillovers, which could have a negative effect on debt sustainability in emerging markets (Chapter 2).

Supply chain bottlenecks continue to weigh on the global recovery and may intensify. Global supply chains have been under pressure since late 2020 on account of strong demand for manufactured goods, shortages in the supply of certain key inputs and disruptions in the logistics industry. As a result, suppliers’ delivery times in the euro area have lengthened considerably over the past year and have contributed to significantly higher input prices (Chart 1.3, panel a). Going forward, some supply chains are also likely to be affected by the war in Ukraine, given the significant role, among others, played by both Russia and Ukraine in global metal exports, among others (Chart 1.2, panel b). In addition, China’s zero-COVID policy has resulted in strict lockdowns being imposed in several economic centres, further disrupting the supply of certain goods. Moreover, although the euro area Purchasing Managers’ Index (PMI) remains comfortably in expansionary territory (55.8 in April 2022), disruptions continue to weigh on the business cycle, delaying the (global) recovery from the pandemic (Chart 1.3, panel b).

Chart 1.3

Supply chain disruptions increase input prices and depress the economic recovery

Sources: IHS Markit, ECB and ECB calculations.

Notes: Panel a: suppliers’ delivery times shown on an inverted scale; a lower reading indicates longer supplier delivery times. First lockdown refers to the period between March and May 2020. Panel b: historical decomposition of euro area output PMI, which was obtained using a two-variable Bayesian VAR with output PMI and suppliers’ delivery times component of PMI, identified through sign restrictions and estimated over the period from January 1999 to April 2022. See also the box entitled “Supply chain disruptions and the effects on the global economy”, Economic Bulletin, Issue 8, ECB, 2021. The identification strategy was inspired by Bhushan and Struyven*.

*) Bhushan, S. and Struyven, D., “Supply Chains, Global Growth, and Inflation”, Global Economics Analyst, Goldman Sachs Research, 20 September 2021.

The slowdown in the Chinese economy is adding to the vulnerabilities in emerging markets and is increasing the downside risks to the global recovery. The turmoil in China’s property development sector continued at the start of 2022, with growth in residential real estate sales remaining negative and house prices weakening further. In addition, strict pandemic containment policies are depressing economic activity, which is forecast to grow at around 5% annually in the period 2022-24, significantly below the long-term average of 8%. A slowing Chinese economy also poses additional challenges for emerging market economies with close financial links to China. All in all, these developments add further downside risks for global economic prospects, with a potentially significant spillover to the euro area (Box 4).

The new economic challenges come at a time when some sectors and countries are still recovering from the pandemic shock. Although high vaccination levels and the less deadly Omicron variant have allowed euro area economies to largely reopen since the start of the year, economic sectors continue to be affected asymmetrically by the pandemic. For example, activity in the arts and entertainment sector still lags pre-pandemic levels, while the technology sector has clearly benefited from the consumption trends observed during the pandemic (Chart 1.4, panel a). This sectoral fragmentation is also reflected in the economic recoveries of euro area countries. Some countries have only recently recovered from the pandemic but are currently facing high inflationary pressures (Chart 1.4, panel b). Moreover, depending on their degree of trade dependency with Russia and Ukraine, some euro area countries will be hit harder by the war in Ukraine than others, exacerbating asymmetries in growth and inflation rates.

Chart 1.4

While most euro area authorities have lifted major pandemic restrictions, some economic sectors and countries are still recovering

Sources: Eurostat and ECB calculations.

Notes: Panel a: capital letters reflect NACE codes; RTU = Arts, entertainment and recreation; other service activities; activities of household and extra-territorial organisations and bodies, GTI = Wholesale and retail trade, transport, accommodation and food service activities, BTE = Industry (except construction), MTE = Professional, scientific and technical activities; administrative and support service activities, F = Construction, OTQ = Public administration, defence, education, human health and social work activities, J = Information and communication, K = Financial and insurance activities, L = Real estate activities, A = Agriculture, forestry and fishing. Panel b: Q4 2019 reflects the pre-pandemic real GDP level.

1.2 Normalisation of fiscal positions is challenged by a slower economic recovery and the impact of the war

Downside risks to fiscal positions predominate as the recovery slows and governments cope with the economic impact of the Russia-Ukraine war. Before the war, it was expected that the euro area budget deficit would improve in response to lower discretionary spending on pandemic support measures, significant windfall revenues[1] and a lower cyclical component (Chart 1.5, panel a). However, fiscal assumptions and projections are currently surrounded by a high degree of uncertainty, given the implications of the war in Ukraine. Slower economic growth than previously anticipated will have a negative impact on deficits. In addition, governments will face increases in expenditure on account of several factors including measures to mitigate the impact of higher energy prices on households, the influx of refugees from Ukraine and the higher levels of defence spending announced by some euro area governments. This could result in a slightly lower cyclically adjusted primary balance in 2022 than previously anticipated (Chart 1.5, panel b).

Chart 1.5

Public finances could be challenged by a slower economic recovery, energy price support measures, refugee flows and increased defence spending

Sources: Eurostat, March 2022 and September 2021 ECB staff macroeconomic projections, IMF Fiscal Monitor and ECB calculations.

Notes: Panel a: the grey line depicts the 3% of GDP budget deficit threshold set in the Maastricht Treaty. The data refer to the aggregate general government sector of euro area countries. The fiscal stance is adjusted for the impact of Next Generation EU (NGEU) grants on the revenue side. The cyclical component refers to the impact of the economic cycle as well as temporary measures taken by governments, such as one-off revenues or one-off capital transfers. Panel b: the term “cyclically adjusted primary balance” is defined as the cyclically adjusted balance plus net interest payable/paid (interest expense minus interest revenue), following the IMF’s World Economic Outlook convention.

Higher than projected budget deficits and a slower economic recovery might make debt dynamics less favourable. Following the implementation of economic support measures of around 4.0% of GDP in 2020 in response to the pandemic, crisis and recovery spending is estimated to have increased to about 4.3% of GDP in 2021. Despite this sizeable fiscal support, the economic recovery and favourable financing conditions have helped to stabilise government debt-to-GDP ratios in euro area countries with higher or lower levels of debt, although debt levels continue to diverge widely between euro area countries (Chart 1.6, panel a). The projected improvement in the budget balance from 2022 onwards is expected to be driven by a higher cyclically adjusted primary balance, as many of the emergency measures not funded by NGEU grants will expire. As a result, euro area debt-to-GDP levels are projected to decline from 95.6% of GDP in 2021 to 88.7% in 2024. Going forward, however, risks to sovereign indebtedness are to the upside as governments face challenges from higher than anticipated deficits and slowing economic activity. As such, debt-to-GDP ratios might not follow the downward path currently envisaged under the baseline scenario (Overview).

Chart 1.6

Debt ratios have declined under favourable growth dynamics as sovereign stress has so far been contained

Sources: Eurostat, ECB and ECB calculations.

Notes: Panel a: the debt-deficit adjustment (DDA) captures the effects of the accumulation or sale of financial assets; see Kezbere and Maurer*. The aggregate of higher-debt countries includes euro area countries with a 2019 debt-to-GDP ratio above 90%. The lower-debt aggregate includes the remaining euro area countries. Figures are in nominal terms. Panel b: “sovereign debt crisis” refers to November 2011, “pandemic” refers to April 2020 and “Russia-Ukraine war” to April 2022. CISS stands for composite indicator of systemic stress. The chart shows the euro area countries for which a sovereign CISS Index is available, i.e. Belgium, Germany, Ireland, Greece, Spain, France, Italy, the Netherlands, Austria, Portugal and Finland.

*) Kezbere, L. and Maurer, H., “Deficit-debt adjustment (DDA) analysis: an analytical tool to assess the consistency of government finance statistics”, Statistics Paper Series, No 29, ECB, November 2018.

Higher than expected inflation can contribute to debt servicing pressures, especially in cases of high refinancing needs and relatively large shares of inflation-indexed securities. Although debt ratios would benefit from a declining real debt burden owing to first round effects (a favourable denominator effect), higher risk premia and slower economic growth could still contribute to increasing debt ratios in the medium term, particularly for high-debt countries.[2] As such, additional fiscal space to cushion the economy from future economic downturns might become more limited in some euro area countries. Moreover, the level of recovery from the pandemic and inflation rates diverge widely across euro area countries, contributing to higher fragmentation risks (Section 1.1).

Financing conditions for euro area sovereigns have remained favourable overall. Although government bond yields have increased of late, financing conditions have remained relatively favourable in recent months, despite the heightened uncertainty, increasing sovereign bond yields and deteriorating macroeconomic backdrop. Moreover, although measures of sovereign stress are rising, so far this has not affected higher-debt countries more than other euro area countries (Chart 1.6, panel b). In addition, governments had extended the average residual maturity to eight years by the end of March 2022, mostly by issuing longer-term securities, increasing their resilience to rising interest rates. At the same time, debt servicing needs remain elevated, with some euro area countries facing refinancing and interest expenditure in excess of 40% of GDP over the next two years. As such, a further deterioration in financial conditions could weigh on fiscal positions going forward.

All in all, risks to sovereign debt sustainability appear to be manageable in the short run, but sovereign risks could intensify in the event of a sustained rise in credit risk premia or more subdued growth outturns. Although sovereign yields have increased of late, the economic recovery at the end of 2021 and largely favourable financing conditions have helped to stabilise debt levels in the euro area. Going forward, fiscal policy will be affected by both exposure to the war and recovery from the pandemic. Moreover, the fundamental role of economic growth dynamics in determining fiscal sustainability underlines the need for fiscal policy to be growth-friendly. The NGEU package could provide additional cushioning for the euro area economy and trigger the kind of reforms required to boost long-term growth potential. Adding to sovereign risks, some sovereigns with higher debt are also exposed to weaker banks and exhibit a less robust, more fragmentated corporate landscape, increasing risks relating to a sovereign-bank-corporate nexus (Box 1). These adverse developments could trigger a reassessment of sovereign risk by market participants and reignite pressures on more vulnerable sovereigns.

1.3 Corporates face new headwinds as supply bottlenecks persist

Following the solid recovery seen in the second half of 2021, euro area corporates are now facing increasing headwinds from rising producer prices and supply chain pressures. Measures of aggregate corporate vulnerabilities improved as the economy experienced a robust recovery in the second half of 2021, with gross profits bouncing back to 7% above pre-pandemic levels. Moreover, the economic recovery and pandemic support measures have helped to keep financing conditions favourable, cushioning debt service needs and rollover risks. As a result, the composite indicator for euro area corporate vulnerabilities has remained well below its historical average (Chart 1.7, panel a). However, corporates now face new headwinds stemming from a slowing economy, higher interest rates, worsening supply chain bottlenecks and rising energy prices (Section 1.1).

Chart 1.7

Euro area non-financial corporates have benefited from favourable financing conditions and robust profits, but activity remains subdued

Sources: Eurostat, ECB, IHS Markit and ECB calculations.

Notes: Panel a: positive values indicate higher vulnerability and negative values indicate lower vulnerability. The shaded area represents a forecast. For the construction of the index in more detail, see the box entitled “Assessing corporate vulnerabilities in the euro area”, Financial Stability Review, ECB, November 2020. Panel b: total assets are the sum of total financial and non-financial assets (liabilities) of non-financial corporations. Sales and earnings before interest and taxes (EBIT) are approximated by the four-quarter moving average of gross value added and mixed income respectively, as reported in the quarterly sector accounts. Series multiplied by 100.

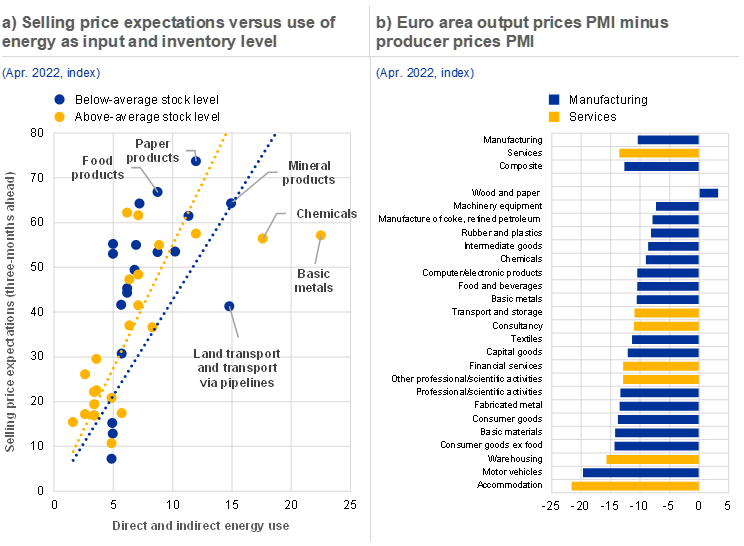

The sharp increase in input prices may squeeze corporate profit margins. Despite the robust recovery in corporate earnings, activity in the corporate sector remained subdued towards the end of 2021 (Chart 1.7, panels a and b). Moreover, corporate profitability partially recovered on account of higher profit margins, offsetting the more persistent loss in output since the start of the pandemic (Chart 1.7, panel b). Going forward, it might become harder for some sectors to sustain high profit margins as input prices soar in many sectors and the economy slows. Higher input prices currently translate into expectations of increased selling prices going forward, especially for sectors with high energy consumption and low inventories (Chart 1.8, panel a). At the same time, some firms have started to indicate that input prices are increasing faster than output prices, possibly resulting in margin compression. This seems to be the case for the corporates that still face challenges stemming from the pandemic and for corporates with high energy needs, such as manufacturers of metals (Chart 1.8, panel b). Historically, higher input prices are largely passed on to end users, particularly when the cost-push shock is global, although given the fact that the economic outlook has softened considerably some producers might have less pricing power going forward. Moreover, the magnitude of current price volatility could be a concern for companies with (unhedged) fixed contractual obligations, and which cannot easily adjust pricing, such as utilities and construction firms (Chapter 2).

Chart 1.8

Margins might come under pressure as input prices soar and the economy slows

Sources: OECD Trade in Value Added (TiVA) database (2018), European Commission, Eurostat, IHS Markit and ECB calculations.

Notes: Panel a: energy intensity measured is measured by the average share of input from mining and quarrying, energy producing products, coke and refined petroleum product and the electricity, gas, steam and air-conditioning industries for each sector, classified according to the United Nations International Standard Industrial Classification for All Economic Activities (ISIC), Rev. 4. Rev. 4. ISIC codes are converted back to NACE codes and matched with survey data on selling price expectations. Selling price expectations reflect seasonally adjusted selling price expectations for the services, retail and industry sectors. The data are extracted on subsector level from the European Commission business and consumer surveys. Direct and indirect energy use reflect 2018 figures. Selling price expectations reflect expectations from the April 2022 European Commission Business and consumer surveys. Panel b: shown as the PMI output price index minus the producer prices PMI on sector level. A narrowing spread between output and producer prices PMIs can be interpreted as margin compression.

External financing needs have risen in response to robust economic activity, but the economic impact of the war in Ukraine might dampen credit growth going forward. Bank lending to corporates continued to increase in the first months of 2022, but moderated in March as credit standards tightened, and risk perceptions increased as a result of the war in Ukraine. During the first months of the year the demand for loans remained high on account of high working capital and fixed investment requirements. The need for higher working capital mainly reflects financing demands created by the pandemic situation, while the increase in fixed investment is driven by the economic recovery. Amid a wide range across firms and euro area countries, debt levels declined to 80% of GDP in the fourth quarter of 2021 but remained above the 75% of GDP recorded before the pandemic.[3] The increase in net debt has been much less pronounced, reflecting elevated working capital levels and liquid holdings (Chart 1.9, panel a). Going forward, corporate financing conditions might deteriorate when economic growth slows, inflation remains elevated and both markets and banks reassess the risk surrounding corporate activity (Chapter 2). Moreover, banks anticipate a stronger net tightening of credit standards in the future, reflecting the uncertain economic impact of the war. This might be particularly concerning for firms that exited the pandemic with high debt levels, subdued earnings and lower liquidity buffers (Chart 1.9, panel b, and Box 1).

Chart 1.9

The increase in debt levels has varied across firms and euro area countries as default rates might rise

Sources: Bank for International Settlements, Bloomberg Finance L.P., Moody’s Analytics, ECB and Eurostat.

Notes: Panel a: “Liquid assets” comprises currency and deposits; “Gross debt” refers to consolidated debt securities and loans of non-financial corporations; “Net debt” is the difference between gross debt and liquid assets. The debt service ratio (DSR) is defined as the ratio of interest payments plus amortisations to income. As such, the DSR provides a flow-to-flow comparison – the flow of debt service payments divided by the flow of income; see “How much income is used for debt payments? A new database for debt service ratios”, BIS Quarterly Review, September 2015. Panel b: earnings per share reflect Bloomberg consensus estimates for the sector level sub-indices of the STOXX EUROPE index. The total debt and current ratio are sub-index averages. The current ratio reflects the ratio of current assets to current liabilities and measures a firm’s ability to settle short-term liabilities with its short-term assets.

Insolvencies, which would normally be expected to rise as economic growth softens, have remained well below their pre-pandemic levels. Policy support measures have successfully mitigated solvency risks which, together with robust economic growth, kept insolvencies 20% below their pre-pandemic levels in the first quarter of 2022. Moreover, forward-looking measures for defaults remain subdued (Chart 1.9, panel c). At the same time, firms whose balance sheets weakened by the pandemic now face fresh challenges from strong input price inflation, softening economic growth and rising interest rates. Furthermore, results from the latest ECB bank lending survey show banks indicating that they are concerned that supply chain disruptions, high energy and other input prices, and corporate exposures to Russia, Ukraine and Belarus might amplify firms’ credit risks. As such, insolvencies could rise in the sectors most affected by supply chain disruptions and by an economic recovery that has proved fragile since the pandemic.

Overall, firms weakened by the pandemic now face additional challenges from intensifying cost pressures as the economic recovery slows. Some countries and sectors have experienced an increase in net debt levels since the start of the pandemic. Moreover, some corporates will also face significant debt servicing needs over the coming years (Chart 1.9, panel a). Although public guarantee schemes have helped corporates to attract longer-term funding during the pandemic and corporates have built significant cash buffers, a possible further rise in interest rates might impact non-financial corporations that borrow at variable rates. In addition, some firms have been less able to profit from the economic recovery over recent quarters as their business models have continued to be affected by pandemic containment measures. Some of these corporations also have higher debt, lower liquidity and lower sales levels and might face challenges when the economy slows or if they cannot pass on increases in input prices to end users in full (Box 1). Adding further to these vulnerabilities, weaker corporates are also concentrated in countries with greater sovereign and bank vulnerabilities.

Box 1

Identifying the corporates most vulnerable to price shocks following the pandemic

By the end of 2021, the aggregate profitability and debt positions of euro area non-financial corporations (NFCs) had recovered to pre-pandemic levels. While overall gross debt relative to gross value added remains elevated at around 160%, net debt has returned to its pre-pandemic level of around 100% of gross value added, with firms having increased precautionary cash buffers amid favourable financing conditions. However, these aggregate developments were mostly driven by large firms, while the net debt positions of small firms increased as they used credit to offset those cash flow losses that were not covered by government support measures. In addition, many corporates now face broad-based increases in input prices on the back of energy price rises and supply chain disruptions. Against this backdrop, this box uses firm-level balance sheet data for around 91,000 euro area non-financial corporations to identify vulnerable firms based on the Altman Z-score, a measure of insolvency risk that uses five balance sheet and income statement ratios and their joint importance.[4], [5], [6] It then matches bank and sovereign exposures to consider related risks associated with the sovereign-bank-corporate nexus.

1.4 Households face rising inflation and greater uncertainty

While the aggregate financial position of euro area households has remained stable, downside risks have increased in the light of higher inflation and the war in Ukraine. Throughout the second half of 2021, households benefited from the economic recovery, low unemployment and favourable financing conditions. The debt-to-disposable income ratio stabilised at 98%, as nominal income growth remained solid and debt servicing costs reached record lows (Chart 1.10, panel a). Supported by valuation gains in financial investments and house prices, households’ net worth surged to 785% of disposable income in the fourth quarter of 2021, up 26 percentage points on a year earlier, but remains unevenly distributed across households. At the same time, however, consumer sentiment became clouded by the pick-up in consumer prices and, when energy and food prices rose further following the Russian invasion of Ukraine, plunged back towards the low levels observed after the pandemic first broke out in Europe (Chart 1.10, panel b). In a tail risk scenario, the war may also indirectly affect households via labour markets, where conditions could deteriorate if a large number of firms fail to withstand the adverse effects of higher input prices and supply chain disruptions reinforced by sanctions on Russia.

Chart 1.10

Household debt levels remain contained, but rising inflation and the war in Ukraine have prompted a sharp deterioration in sentiment

Sources: Eurostat and ECB calculations.

Notes: Panel a: debt is defined as total loans granted to households by all institutional sectors. Gross interest payments are measured before allocation of financial intermediation services indirectly measured (FISIM). Panel b: HICP stands for the Harmonised Index of Consumer Prices measure of inflation.

Inflation weighs on real household incomes and may have a disproportionate effect on both lower-income households and those with weaker debt servicing capacity. Nominal income growth returned to pre-pandemic levels in the fourth quarter of 2021. However, due to increases in consumer prices driven predominantly by energy and food items, real incomes shrunk in the same period (Chart 1.11, panel a). Many households may be able to temporarily cushion the impact of higher prices by scaling back saving or drawing on excess savings accumulated during the pandemic. But these savings are likely concentrated in higher-income households, whereas lower-income households are more exposed to the inflation shock as they spend a relatively larger share of their income on energy and food-related items (Chart 1.11, panel b). Accordingly, a share of households has to rely on fiscal relief measures or cut down on non-essential consumption. In general, some households may benefit from higher than expected inflation in the sense that it lowers the real cost of pre-existing debt, but it is unlikely that these households are sufficiently compensated for the rise in inflation through higher nominal income.

Chart 1.11

A decline in real incomes may disproportionately affect lower income households

Sources: Eurostat, ECB (Consumer Expectations Survey) and ECB calculations.

Notes: Panel b: data cover surveys from Belgium, Germany, Spain, France, Italy and the Netherlands. The share of income spent on energy and food is calculated as the share of households’ reported spending on utilities, transport and food, beverages, groceries and tobacco divided by monthly income, where income is inferred from income buckets. Data shown are averages over the full period for which CES data are available, i.e. April 2020 to January 2022. Questions on spending are surveyed once per quarter. Accordingly, the data should be interpreted with caution and mainly as an illustration of differences across different income classes. Panel c: shaded bars show projections. The simulations capture the effects of a permanent one-off 100 basis point increase in short and long-term market interest rates in July 2022 (with higher rates kept constant thereafter) on gross interest payments (based on a national accounts concept before FISIM allocation) and consolidated gross indebtedness ½, 1½ and 2½ years after the shock. The results are based on models and tools used in the context of the Eurosystem projection exercises. They take into account the dampening impact of higher market interest rates on economic activity, prices and debt financing. The increase in the household debt-to-GDP ratio is mostly due to a denominator effect as GDP is projected to decline more than debt levels.

Vulnerabilities among households have picked up, albeit from generally moderate levels. With strong balance sheets thanks to excess savings, solid net wealth and low debt servicing costs, households are well positioned to weather economic headwinds. At the same time, rising inflation is having an adverse effect on households’ purchasing power, which could slow the economy’s return to its pre-pandemic growth path. Some households may have to limit consumption or become dependent on government support. While the impact of rising interest rates on aggregate household indebtedness and interest payments may be limited (Chart 1.11, panel c), some households’ debt servicing capacity could suffer. Vulnerabilities could build further over the medium term and concerns over household debt sustainability may rise, especially in countries where residential properties are overvalued, debt levels are elevated and a larger share of household debt has variable interest rates.

1.5 Vulnerabilities continue to build in euro area real estate markets

Prices in euro area residential real estate (RRE) markets rose at a record pace, resulting in increasingly stretched valuations. Nominal house prices rose by 9.6% year-on-year at the euro area level in the fourth quarter of 2021, the fastest rate observed in the last 20 years (Chart 6, panel a, Overview). The key factors putting upward pressure on prices are the low cost of borrowing coupled with stronger demand for housing stemming from shifts in household preferences (e.g. demand for home office space) and supply-side constraints. Shortages of both labour and materials are raising expectations of increasing prices in the construction sector, contributing to further upward pressure on house prices going forward. Such growing supply-side constraints, together with flight-to-safety effects amid higher inflation, may be exacerbated by the war in Ukraine. As house price dynamics exceed the fundamentals, estimates of overvaluation are also growing (Chart 1.12, panel a).

Accelerating mortgage lending has increased household indebtedness, raising concerns of further debt-fuelled house price rises. Lending for house purchase in the euro area remains robust, with the pace of growth at 5.4% in March 2022, contributing to the build-up of household debt. Patterns vary greatly from country to country: in some euro area countries, upward movements in both house prices and lending are pronounced, indicating that a price-loan spiral may have started emerging. Overall, while most euro area countries have macroprudential measures in place, a further build-up of medium-term vulnerabilities in some countries led the ESRB to issue new warnings and recommendations in December 2021 (Chart 1.12, panel b).[7] This strengthens the case for considering further macroprudential policy measures to build resilience, as economic conditions allow and taking into account the uncertainty related to the war (Chapter 5).

Chart 1.12

Rising RRE prices result in increasingly stretched valuations, underpinned in some countries by buoyant lending growth

Sources: ECB, Eurostat, European Systemic Risk Board (ESRB) and ECB calculations.

Notes: Panel a: the average valuation estimate is the simple average of the price-to-income ratio and an estimated Bayesian vector autoregression (BVAR) model. For details of the methodology, see Box 3 in the Financial Stability Review, ECB, June 2011, and Box 3 in the Financial Stability Review, ECB, November 2015. Overall, estimates from the valuation models are subject to considerable uncertainty and should be interpreted with caution. Alternative valuation measures can point to lower/higher estimates of overvaluation. Whiskers denote minimum and maximum values. For Belgium, Ireland, Finland and Austria the last observation is from Q3 2021. Panel b: latest available data are shown, RRE price growth and household debt-to-GDP ratio refer to Q4 2021 and mortgage lending growth refers to Q1 2022. Horizontal and vertical red lines indicate the euro area aggregate. The bubble size indicates the size of the household debt-to-GDP ratio.

Conditions in commercial real estate (CRE) markets appear to be stabilising, and markets have initially not priced in a major impact from the war in Ukraine. After suffering a tangible decline during the pandemic, price growth dynamics for prime CRE are beginning to stabilise (Chart 1.13, panel a). However, prime segments account for only a relatively small share of CRE markets. Conditions remain challenging in non-prime markets due to environmental, social and governance (ESG) concerns and changed patterns of behaviour in the wake of the pandemic. Comparing initial REIT price reactions with those in wider equity markets after the outbreak of the war in Ukraine suggests that investors see real estate as a sector less affected by the war (Chart 1.13, panel b). Nevertheless, demand for CRE assets would be affected by any economic downturn resulting from the war. A pronounced correction in CRE markets could have an adverse effect on the wider financial system and the real economy. This is because financial institutions may suffer from direct losses, increased credit risk and declines in collateral values, which could limit their ability to provide financing to non-financial corporations and may be exacerbated through negative feedback loops.

Chart 1.13

Conditions in commercial real estate markets appear to be stabilising as the initial impact of the war in Ukraine appears limited

Sources: Jones Lang LaSalle, Bloomberg Finance L.P. and ECB calculations.

Notes: Panel b: 9 February 2022 corresponds to the peak of the EURO STOXX index before the invasion of Ukraine. REITs stands for real estate investment trusts. The FTSE EPRA Nareit Eurozone Index is shown here.

Uncertainty in real estate markets is rising as different factors put upward pressure on prices simultaneously while also increasing the risk of a price correction. RRE prices have continued to benefit from tight supply conditions and stable household and investor demand for housing. Over the medium term, this continued expansion and signs of overvaluation render some RRE markets prone to a correction. At the same time, an abrupt increase in real interest rates could induce house price corrections in the near term, with the current low level of interest rates making substantial house price reversals more likely (Box 2). In CRE markets, low-quality segments are under pressure from structural demand shifts. While resilience is supported by macroprudential measures and relative household strength (Section 1.4), the financial sector may be exposed to the risk of real estate market corrections, especially in those countries where debt levels are elevated, exposures are high and properties are overvalued.

Box 2

Drivers of rising house prices and the risk of reversal

House prices increased substantially during the pandemic, fuelling concerns about possible price reversals and their implications for financial stability. In many advanced economies, real house price growth exceeded 4% during the pandemic (Chart A, panel a), reaching 4.3% in the euro area in the fourth quarter of 2021[8] amid signs of exuberance in some countries.[9] At the same time, real mortgage lending rates in the euro area have fallen further to reach historic lows in the current low interest rate environment (Chart A, panel b).[10] Against this backdrop, this box discusses the main drivers of recent house price increases across advanced economies and in the euro area, and the associated risks of possible price reversals and the potential implications for financial stability.

2 Financial markets

2.1 War exacerbates existing trends of higher energy prices and higher inflation

The Russian invasion of Ukraine triggered a moderate, short-lived “risk-off” market reaction, during which market functioning remained largely orderly. In the immediate aftermath of the invasion, volatility increased (Chart 2.1, panel a), credit spreads widened, euro area equity indices fell (Chart 2.2, panel a) and government bond yields declined. Compared with the March 2020 market turmoil following the outbreak of the coronavirus (COVID-19) pandemic, the initial market reaction to the invasion was relatively mild. Despite the profound medium and long-term implications of the war, as discussed in detail below, this correction was followed by a relatively fast rebound. A significant further escalation, in economic and/or military terms, could still cause renewed market stress. However, regardless of how the conflict evolves (e.g. a ceasefire agreement, prolonged entrenchment or further escalation), several medium-term consequences have crystallised, as discussed below. Notably, the war increases the risk of a higher-inflation, lower-growth scenario resulting from higher energy prices and supply chain disruptions (Chapter 1). The policy response to higher inflation and concerns about the global growth outlook have contributed to renewed weakness in financial markets during the second quarter of 2022.

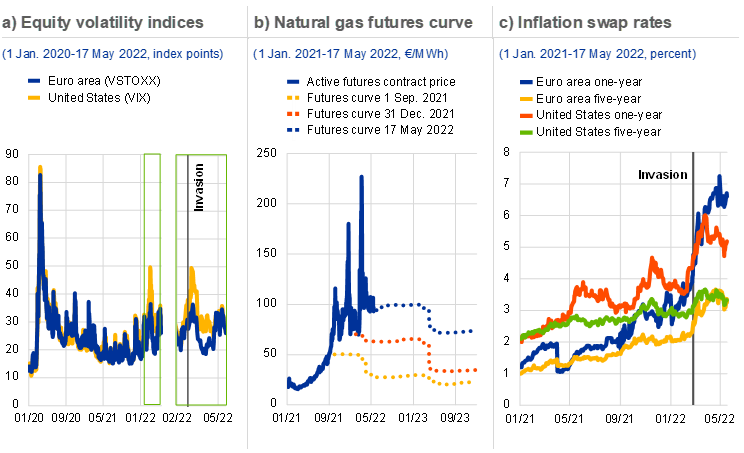

Chart 2.1

The initial risk-off market reaction to the invasion was temporary and limited, but energy prices are expected to be higher for longer and the upward trend in inflation swap rates accelerated after the invasion

Sources: Bloomberg Finance L.P., Refinitiv and ECB calculations.

Notes: Panel b: futures curves are based on futures contracts for different delivery dates. The active futures contract price refers to the futures contract that matures in the next month. Futures contracts are traded on the Intercontinental Exchange (ICE) and linked to Dutch TTF natural gas. Panel c: inflation swap rates refer to the fixed rate at which contracts are opened, whereby the floating leg, with annual payments over the duration of the contract, is tied to an inflation index. Inflation swap rates do not purely reflect inflation expectations, as they also include a risk premium.

Commodity futures prices suggest that energy prices will remain higher for longer. Energy prices had already increased markedly before the start of the war in Ukraine: tensions had already risen in the second half of 2021, with strong demand for commodities as economies recovered from the pandemic. For example, the average natural gas price in the fourth quarter of 2021 was 550% higher than in the same quarter of 2020. As the conflict escalated, increases were not limited to spot prices. The natural gas forward curve now points to elevated prices up to and including the winter of 2023 (Chart 2.1, panel b).

The upward trend in inflation swap rates accelerated after the invasion was launched. Inflation swap rates surged, driven in part by rising energy prices (Chart 2.1, panel c). The euro area one-year inflation swap rate currently stands at around 6.6%,[11] its highest level since the introduction of the euro, up from around 3.4% at the end of 2021. The implications of higher than expected inflation are discussed from a conceptual point of view in Box 3, while empirically observed consequences for financial markets are discussed in this chapter.

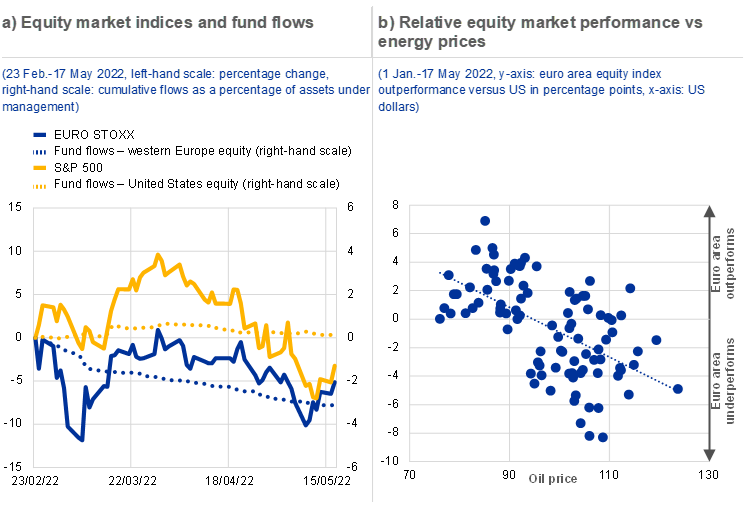

Chart 2.2

A divergence between the United States and the more energy import-dependent euro area emerged after the start of the invasion of Ukraine

Sources: Bloomberg Finance L.P., EPFR Global, Refinitiv and ECB calculations.

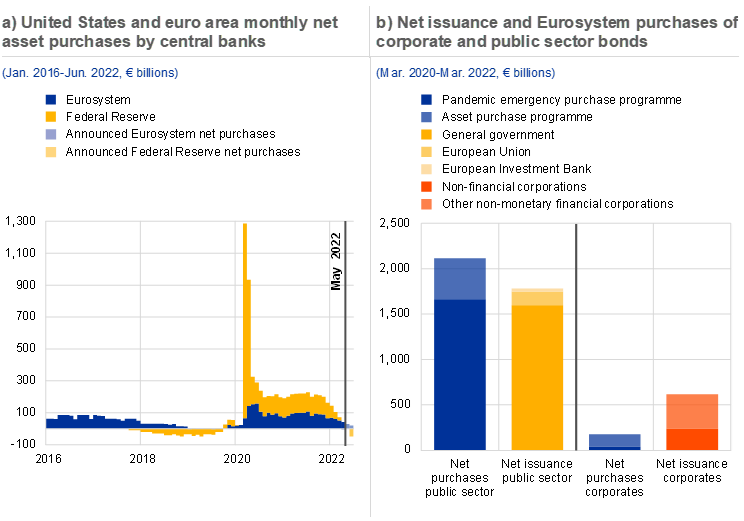

Notes: Panel a: percentage change since 23 February 2022, fund flows as a share of assets under management. Western Europe equity refers to funds that invest in developed European markets, namely Austria, Belgium, Denmark, Finland, France, Germany, Greece, Italy, Ireland, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom. Panel b: daily data on relative performance in terms of the EURO STOXX price change versus the S&P 500 price change, as of 1 January 2022, mapped against the oil price in US dollars. The result is not driven by differences in the shares of the oil and gas sector between the indices.