The impact of fiscal support measures on the liquidity needs of firms during the pandemic

Published as part of the ECB Economic Bulletin, Issue 4/2021.

European governments responded to the outbreak of the coronavirus (COVID-19) pandemic by deploying large fiscal packages with the aim of supporting households, workers and firms. After nearly a year of fiscal support, information on how these packages have been used during this time to help firms’ liquidity needs in the short and medium term was gathered through the survey on the access to finance of enterprises (SAFE).[1] The government fiscal measures are classified into three main groups: i) payroll support;[2] ii) tax cuts and tax moratoria; and iii) other types of support.[3] This box provides a summary of the survey results, grouping the outcomes for individual countries in four distinct sectors (industry, construction, wholesale and retail trade, and other business services).[4]

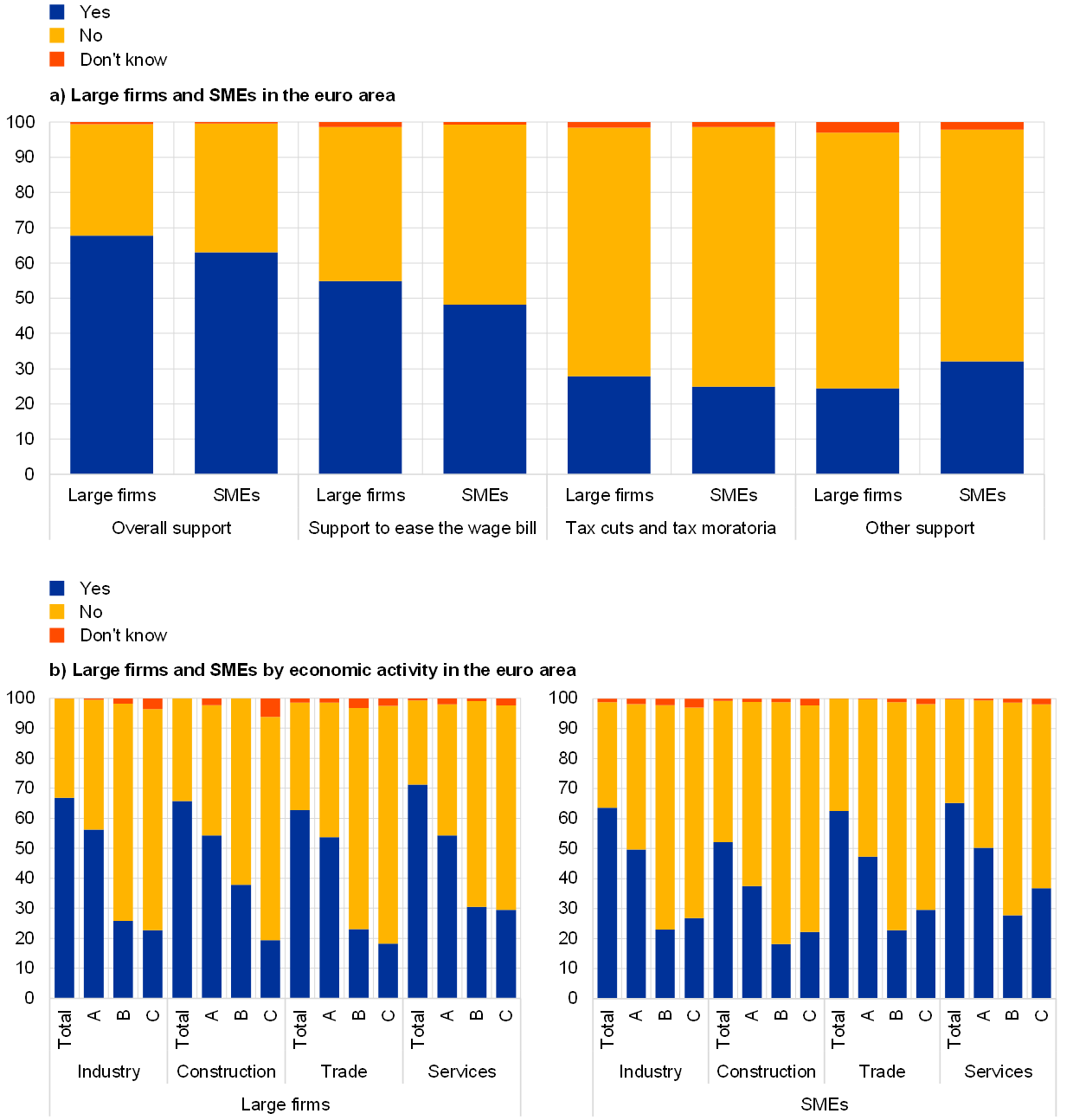

Two-thirds of the firms surveyed made use of at least one government policy support measure introduced in response to the pandemic. Around 55% of the large euro area firms and 48% of the euro area SMEs surveyed tapped government support to ease their wage bills; around 28% of the large firms and 25% of the SMEs benefited from tax cuts and tax moratoria; and around 24% of the large firms and 32% of the SMEs made use of other government support schemes (Chart A, panel a).

Chart A

Percentage of euro area enterprises that received government fiscal support in response to the pandemic: size and sectoral breakdown

(percentage of respondents)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Note: “A” refers to government payroll support; “B” refers to government support in the form of tax cuts and tax moratoria; “C” refers to other government support schemes; “Total” refers to the aggregate of the policy schemes (i.e. at least one type of policy support received).

Across sectors, government support to SMEs was higher in industry and services than in construction. Activities that were severely affected by social distancing measures, such as hospitality, travel, entertainment and culture, are typically run by small and medium-sized enterprises (SMEs) with up to 249 employees, i.e. the type of companies that feature most prominently in the SAFE. For these types of activity, SMEs received relatively more support than large firms in the form of other government support schemes, in part reflecting the fact that country-specific policies were mainly designed to help smaller firms. Government support to SMEs was relatively higher in industry and services than in construction, particularly in the form of payroll support. Instead, large firms benefited from government support to ease the wage bill across all sectors (Chart A, panel b). Around half of the surveyed SMEs in industry, wholesale and retail trade (labelled “Trade” in the charts) and other business services (labelled “Services”) and 37% of SMEs in construction received government support to ease their wage bills; these shares decline to around one-quarter and 18% respectively for support in the form of tax cuts and tax moratoria. The divergence across sectors is larger for support in the form of other government support schemes (Chart A, panel b).

Government support varied across countries. A lower fraction of SMEs in Spain and Germany made use of fiscal support in relative terms compared to that of SMEs in France and Italy, independently of the type of support (Chart B). Specifically, around two-thirds of firms in France used government liquidity support to ease their wage bills, while only one-third of firms in Spain said they received such support. As for support in the form of tax cuts and tax moratoria, one-third of firms in Italy said that they had benefited from such support, while this share declines to 14% in Spain. 44% of the surveyed firms in France also made use of other government support schemes, while the equivalent figure for firms located in Spain is around 21%.

Chart B

Percentage of SMEs that used government fiscal support in response to the pandemic: country breakdown

(percentage of respondents)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Note: “A” refers to government payroll support; “B” refers to government support in the form of tax cuts and tax moratoria; “C” refers to other government support schemes; “Total” refers to the aggregate of the policy schemes (i.e. at least one type of policy support received).

An analysis based on firm-level responses suggests that firms more negatively affected by the pandemic made more use of fiscal support. Looking at the financial situation of individual firms, we distinguish between “vulnerable” firms, i.e. those which in in the latest survey round (October 2020-March 2021) had signalled declining turnover and profits and increasing interest expenses and leverage compared to the previous six months, and “profitable” firms, which over the same period had signalled increasing turnover and profits and decreasing interest expenses and leverage.[5] Chart C shows the proportion in their respective groups of firms that used at least one type of fiscal support across all euro area countries. Both shares are very large in Ireland and France and smaller in Portugal. On average, across the euro area, 80% of the more vulnerable firms and around 40% of the more profitable firms, within their own group in each case, used fiscal support during the pandemic. Compared to the historical evidence, a relatively large share of vulnerable firms had been classified as non-vulnerable before the pandemic outbreak. This suggests that there was more fiscal support for the worst-hit firms that had faced immediate liquidity needs.

Chart C

Share of vulnerable and profitable firms that used government fiscal support

(percentage of respondents within their respective groups)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Note: Vulnerable firms are defined as those that reported in the current SAFE wave (October 2020-March 2021) compared to the previous SAFE wave (April-September 2020 ) simultaneously lower turnover and profits, higher interest expenses and a higher or unchanged debt-to-total assets ratio; profitable firms are defined as those that reported in the current compared to the previous SAFE wave simultaneously higher turnover and profits, lower or no interest expenses and a lower or no debt-to-assets ratio.

Most firms that took up government support used it to cover their immediate and short-term obligations. Firms that used government support were requested to assess the importance of the different measures in easing their liquidity needs (where liquidity refers to the amount of cash needed to cover the firm’s immediate and short-term obligations). Overall, these support schemes played an important role in mitigating liquidity risk, albeit with some variation across sector and type of public support. Across those firms that obtained government support to ease their wage bills, on average around 90% of euro area SMEs considered it important in helping them to meet their short-term obligations, with the highest percentages being reported by firms in the services sector (Chart D). Similarly, tax cuts and moratoria were considered important by 87% of SMEs on average, with the highest percentages in the industry and services sectors. Finally, other support schemes were considered important by more than two-thirds of SMEs, notably in the services sector. Across countries, of the relatively small fraction of SMEs in Germany that took up fiscal support (Chart B), the majority of them reported to have made widespread use of all types of government support schemes to boost their liquidity. Italian SMEs found the wage bill support and tax cuts and moratoria to be more important, while French SMEs reported higher percentages for other types of support and payroll support schemes.

Chart D

Importance of government support measures by type for euro area SMEs that used support to address short-term obligations

(percentage of respondents who replied either very important or moderately important)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Note: “A” refers to government payroll support; “B” refers to government support in the form of tax cuts and tax moratoria; “C” refers to other government support schemes.

More than two-thirds of firms that used government support measures indicated that the measures either currently in place or planned in response to the pandemic would make it easier for them to meet their debt obligations in the next two years. Firms were asked to assess whether the pandemic-related support measures either currently in place or expected to be introduced by governments in the near future would be sufficient to reduce the risk of their enterprise facing bankruptcy in the next two years (i.e. how likely it was that the firm would be unable to meet its medium and long-term debt obligations). In response, 74% of SMEs and 65% of large firms that had received government support indicated that the policies would ease their liquidity needs in the medium term (Chart E, panel a). In particular, firms in other business services stated that the schemes would help to reduce their bankruptcy risk in the next two years. Across all countries, firms considered the government liquidity support measures to be critical in reducing bankruptcy risk.

Chart E

Importance of government support measures for euro area enterprises that used support to address longer-term obligations

(percentage of respondents)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Overall, government fiscal support measures were effective in easing the liquidity needs of firms following the outbreak of the pandemic. Around two-thirds of large firms and SMEs surveyed made use of government policy support measures. Most firms used the schemes to cover their immediate and short-term obligations, particularly to ease their wage bills and tax situation. Firms also indicated that pandemic-related measures either currently in place or planned by governments would make it easier for them to meet their debt obligations in the next two years.

- The biannual SAFE was conducted between 8 March and 22 April 2021. Euro area firms were asked to report on changes in their financial situation and on the need for and availability of external financing during the period between October 2020 and March 2021. The total sample size was 11,007 firms, of which 10,054 (91%) are SMEs. All figures in this box are weighted by size class, economic activity and country to reflect the economic structure of the underlying population of firms. See the SAFE report.

- Payroll support refers to government subsidies in the form of subsidised wages for employees who temporarily saw a full or partial reduction of their working hours, so-called short-time work schemes.

- Although not specified in the questionnaire, this third category might include several schemes related to government support, such as bank loan guarantees not used for the wage bills, direct financial aid, recapitalisation and restructuring funds. See also the box entitled Government support policies during the COVID-19 period in the SAFE report for further details on the ad hoc questions introduced in the SAFE.

- This box complements related assessments of government schemes. Albertazzi et al. assess how the announced public loan guarantee schemes might affect the scale of losses that banks may face. Falagiarda et al. discuss the characteristics of these schemes and their take-up across the larger euro area countries. Anderson et al. provide a summary of the credit support measures in Europe’s five largest economies. A 2021 OECD study provides a summary of liquidity and structural support measures globally. See Albertazzi, U., Bijsterbosch, M., Grodzicki, M., Metzler, J. and Ponte Marques, A., “Potential impact of government loan guarantee schemes on bank losses”, Financial Stability Review, ECB, May 2020; Falagiarda, M., Prapiestis, A. and Rancoita, E., “Public loan guarantees and bank lending in the COVID-19 period”, Economic Bulletin, Issue 6, ECB, 2020; Anderson, J., Papadia, F. and Véron, N., “COVID-19 credit-support programmes in Europe’s five largest economies”, Working Paper, 03/2021, Bruegel, 2021; and One year of SME and entrepreneurship policy responses to COVID-19: Lessons learned to “build back better”, OECD, April 2021.

- For developments over time of vulnerable and profitable firms before the pandemic see Survey on the Access to Finance of Enterprises in the euro area, October 2017 to March 2018, ECB.