- STATISTICAL RELEASE

Euro area economic and financial developments by institutional sector: second quarter of 2020

29 October 2020

- Euro area net saving decreased to €625 billion in four quarters to second quarter of 2020, from €775 billion one quarter earlier.

- The household debt-to-income ratio increased to 94.9% in second quarter of 2020, from 93.4% one year earlier.

- Non-financial corporations' debt-to-GDP ratio (consolidated measure) increased to 83.3% in second quarter of 2020, from 78.7% one year earlier.

Total euro area economy

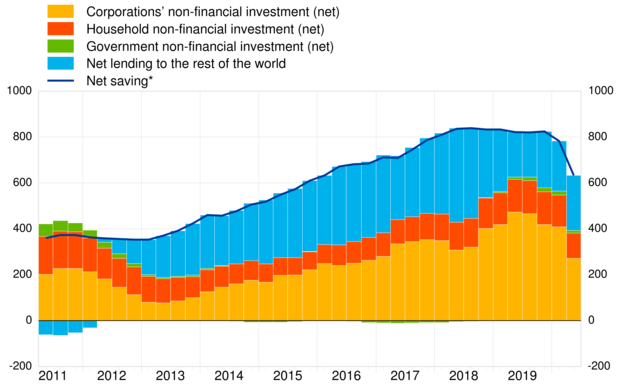

Euro area net saving decreased to €625 billion (6.8% of euro area net disposable income) in the four quarters to the second quarter of 2020 compared with €775 billion in the four quarters to the previous quarter. This reflected strongly increasing net saving by households, and an even stronger decline of net saving by general government. Euro area net non-financial investment decreased to €394 billion (4.3% of net disposable income), from €565 billion, mainly due to decreased investment by non-financial corporations and households.

Euro area net lending to the rest of the world increased to €239 billion (from €218 billion previously), reflecting net non-financial investment decreasing by more than net saving. Net lending of non-financial corporations increased to €20 billion (0.2% of net disposable income) from €-79 billion while that of financial corporations was broadly unchanged at €74 billion (0.8% of net disposable income). Net lending by households increased to €569 billion (6.2% of net disposable income) from €354 billion. The increase in net lending by the total private sector was largely offset by an increase in net borrowing by the government sector (-4.6% of net disposable income, after -1.4% previously).

Chart 1. Euro area saving, investment and net lending to the rest of the world

(EUR billions, four-quarter sums)

* Net saving minus net capital transfers to the rest of the world (equals change in net worth due to transactions).

Households

The annual growth rate of household financial investment increased to 3.3% in the second quarter of 2020, from 2.6% in the previous quarter. Investment in currency and deposits, as well as shares and other equity, were the main contributors to this strengthening of growth.

Households were overall net buyers of listed shares. By issuing sector, they were net buyers of listed shares of non-financial corporations, other financial institutions, insurance corporations and the rest of the world (i.e. of shares issued by non-residents), while they were net sellers of listed shares issued by MFIs. Net sales of debt securities by households continued, in particular those issued by MFIs and government (see Table 1 below and Table 2.2. in the Annex).

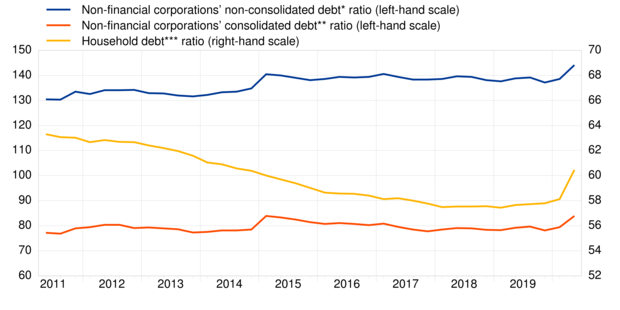

The household debt-to-income ratio[1] increased to 94.9% in the second quarter of 2020, from 93.4% in the second quarter of 2019, as the outstanding amount of loans to households increased more than disposable income. The household debt-to-GDP ratio increased more strongly to 60.5% in the second quarter of 2020 from 57.7% in the second quarter of 2019, as GDP declined (see Chart 2).

Table 1. Financial investment and financing of households, main items

(annual growth rates)

Financial transactions |

|||||

2019 Q2 |

2019 Q3 |

2019 Q4 |

2020 Q1 |

2020 Q2 |

|

Financial investment* |

2.4 |

2.5 |

2.6 |

2.6 |

3.3 |

Currency and deposits |

5.0 |

5.3 |

5.1 |

5.2 |

6.5 |

Debt securities |

-3.3 |

-9.4 |

-10.6 |

-12.8 |

-10.2 |

Shares and other equity |

-0.4 |

-0.3 |

0.3 |

1.2 |

2.1 |

Life insurance and pension schemes |

2.6 |

2.9 |

2.8 |

2.1 |

1.9 |

Financing** |

3.6 |

3.9 |

4.1 |

3.7 |

3.6 |

Loans |

3.3 |

3.5 |

3.6 |

3.4 |

3.0 |

* Items not shown include: loans granted, prepayments of insurance premiums and reserves for outstanding claims and other accounts receivable.

** Items not shown include: financial derivative's net liabilities, pension schemes and other accounts payable.

Chart 2. Debt ratios of households and non-financial corporations

(debt as a percentage of GDP)

* Outstanding amount of loans, debt securities, trade credits and pension scheme liabilities.

** Outstanding amount of loans and debt securities, excluding debt positions between non-financial corporations.

*** Outstanding amount of loan liabilities.

Non-financial corporations

In the second quarter of 2020, the annual growth of financing of non-financial corporations declined to 1.8%, after 2.1% in the previous quarter. This resulted from a deceleration of loans and a decline in trade credits and advances, only partially offset by an acceleration in financing by debt securities. The deceleration of loan financing was due to a decline in loans from the rest of the world, while loans from MFIs and other resident sectors grew at higher rates (see Table 2 below and Table 3.2 in the Annex).

Non-financial corporations' debt-to-GDP ratio (consolidated measure) increased to 83.3% in the second quarter of 2020, from 78.7% in the second quarter of 2019; the non-consolidated (wider) debt measure increased to 144.1% from 138.8% (see Chart 2).

Table 2. Financial investment and financing of non-financial corporations, main items

(annual growth rates)

Financial transactions |

|||||

2019 Q2 |

2019 Q3 |

2019 Q4 |

2020 Q1 |

2020 Q2 |

|

Financing* |

1.4 |

1.6 |

1.9 |

2.1 |

1.8 |

Debt securities |

5.2 |

5.5 |

5.8 |

4.3 |

10.2 |

Loans |

2.1 |

1.8 |

2.0 |

3.8 |

3.3 |

Shares and other equity |

0.6 |

0.9 |

1.4 |

1.1 |

1.2 |

Trade credits and advances |

1.0 |

1.5 |

1.7 |

0.6 |

-4.9 |

Financial investment** |

1.5 |

1.8 |

2.4 |

2.5 |

2.6 |

Currency and deposits |

5.3 |

6.1 |

5.8 |

9.6 |

18.1 |

Debt securities |

-7.6 |

-1.0 |

-8.9 |

-2.2 |

10.7 |

Loans |

1.0 |

0.7 |

1.6 |

1.3 |

0.2 |

Shares and other equity |

1.7 |

1.7 |

2.2 |

1.9 |

2.0 |

* Items not shown include: pension schemes, other accounts payable, financial derivative's net liabilities and deposits.

** Items not shown include: other accounts receivable and prepayments of insurance premiums and reserves for outstanding claims.

For queries, please use the Statistical information request form.

Notes

- These data come from a second release of quarterly euro area sector accounts from the European Central Bank (ECB) and Eurostat, the statistical office of the European Union. This release incorporates revisions and completed data for all sectors compared with the first quarterly release on "Euro area households and non-financial corporations" of 2 October 2020.

- The debt-to-GDP (or debt-to-income) ratios are calculated as the outstanding amount of debt in the reference quarter divided by the sum of GDP (or income) in the four quarters to the reference quarter. The ratio of non-financial transactions (e.g. savings) as a percentage of income or GDP is calculated as sum of the four quarters to the reference quarter for both numerator and denominator.

- The annual growth rate of non-financial transactions and of outstanding assets and liabilities (stocks) is calculated as the percentage change between the value for a given quarter and that value recorded four quarters earlier. The annual growth rates used for financial transactions refer to the total value of transactions during the year in relation to the outstanding stock a year before.

- The next release of the Household Sector Report containing results for the euro area and all EU countries is scheduled for 10 November 2020.

- Hyperlinks in the main body of the statistical release lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.

- The production of quarterly financial accounts (QFA) may have been affected by the COVID-19 crisis. More information on the potential impact on QFA can be found here.

- Calculated as loans divided by gross disposable income adjusted for the change in pension entitlements.