Published as part of the ECB Economic Bulletin, Issue 4/2022.

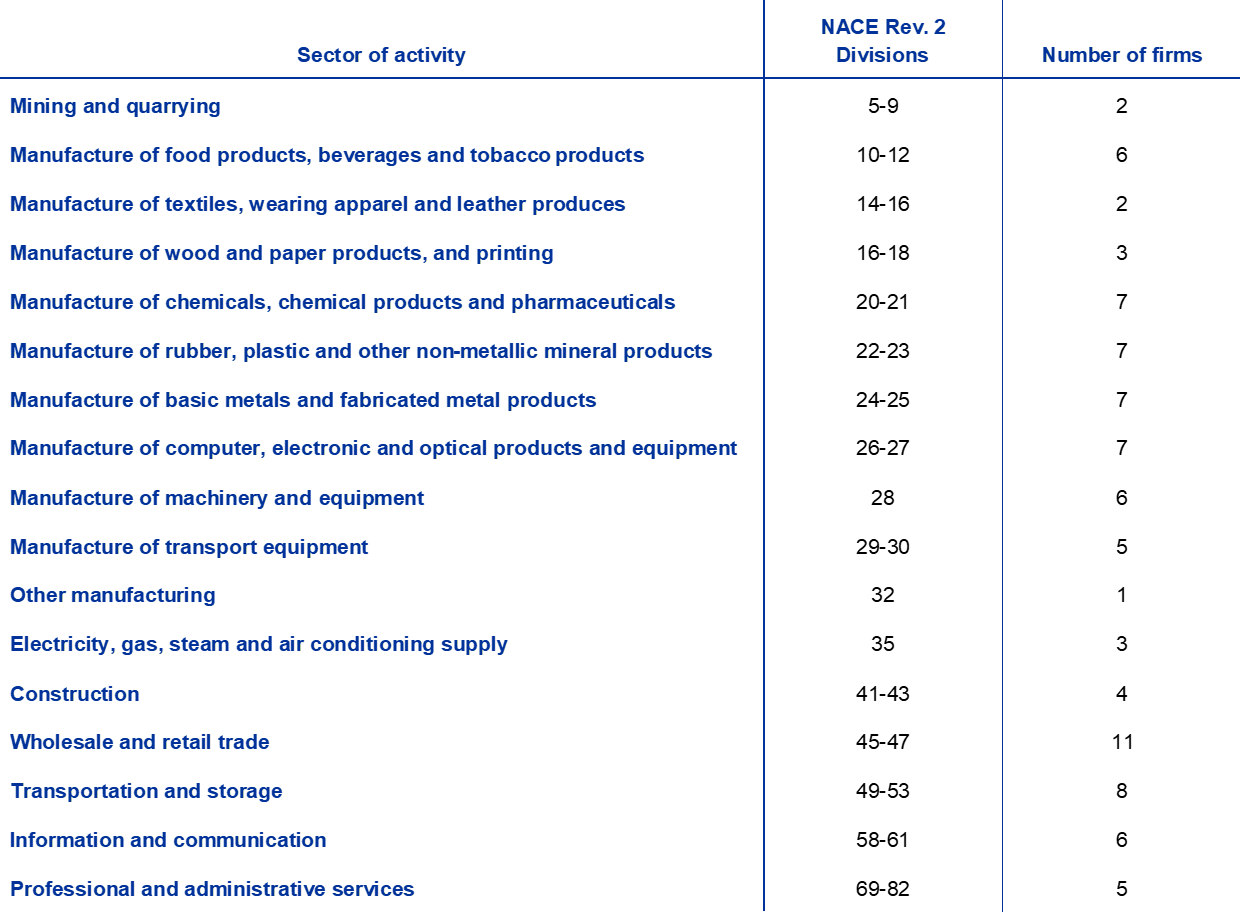

This box summarises the findings from a recent ECB survey of leading firms on the impact of climate change on economic activity and prices. The survey was structured in three parts and covered questions related to the impact on businesses of climate change and related measures and policies. The first part invited firms to identify in their own words (i) the main impact of climate change and related adaptation and mitigation measures on their business, (ii) the main challenges they face in transitioning to a net-zero economy, and (iii) which climate-related policies they expect to have the biggest impact – and which ones could help their company tackle the transition.[1] The second part of the survey asked firms whether they agreed or disagreed with various statements on how climate change and related adaptation and mitigation measures would affect their business. The third part asked them to assess in qualitative terms the impact of climate change on their investment, employment, productivity, costs and prices, distinguishing between the impact “until now” and the impact “during” and “after” the transition to a net-zero economy. The survey was carried out in early 2022, and responses were received from 90 large and mostly multinational companies with which the ECB maintains contact as part of its regular gathering of business intelligence.[2] A breakdown of the survey sample by sector of activity is provided in Table A.

When asked about the main impact of climate change on their business, around two-thirds of respondents described risks associated with the transition to net zero, while half of them also pointed to risks stemming from a changing climate. Transition risks were emphasised particularly by companies operating in high-carbon emission sectors, whether by virtue of their own production, that of their suppliers or the users of their products.[3] Such risks related in particular to the cost and technological challenges inherent in shifting to cleaner modes of production. However, around 40% of respondents also described opportunities that could arise for their business, either because the firms have already invested in alternative, low-carbon products, or because the goods and services they provide help other companies to reduce their emissions. The physical risks mentioned range from risks related to the sourcing of raw materials to the integrity of production facilities, infrastructure, supply chains, logistics and the well-being of employees.[4] Given the potential for damage to physical assets and infrastructure, such physical risks are particularly relevant for firms dependent on or operating in the agricultural sector, firms in the manufacturing sector with potentially vulnerable (global) supply chains, construction companies and businesses in the transport sector.

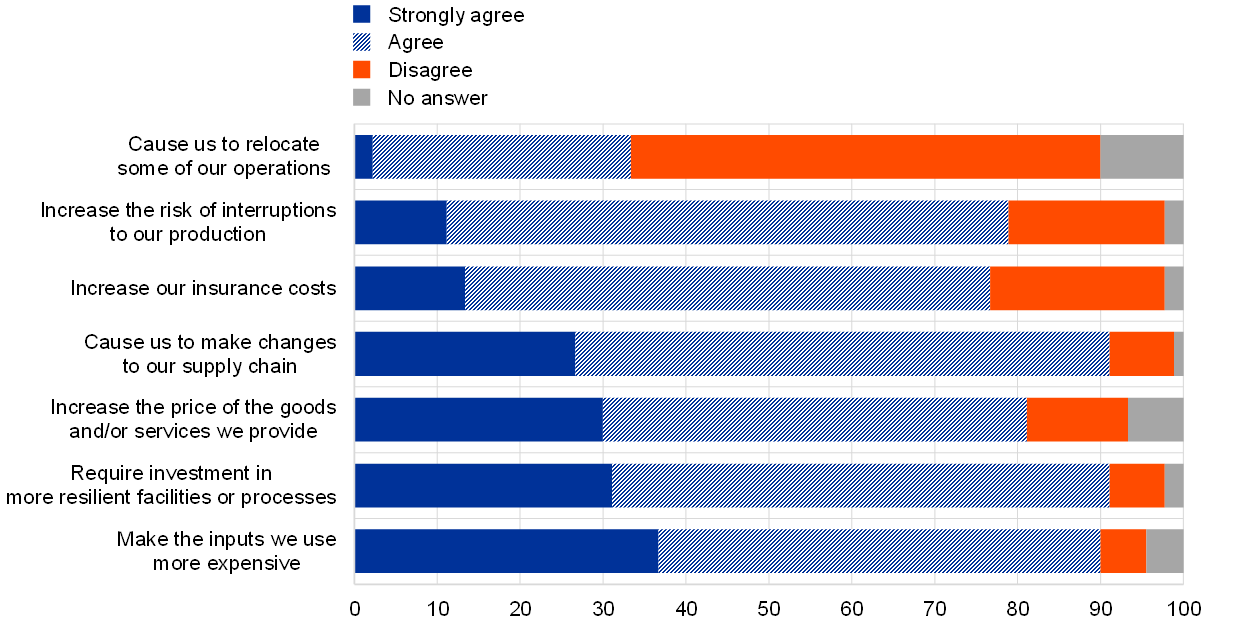

Respondents expect climate change and their firm’s adaptation to it to increase different types of cost pressure (Chart A). The survey tested this using a set of statements with which firms could agree or disagree. More than 90% of respondents agreed that climate change and their firm’s adaptation to it would require investment in new facilities or processes and changes to their supply chain, as well as make inputs more expensive. More than three-quarters of firms agreed that their insurance costs would rise because of climate change and that there was an increased risk of interruptions to production. One-third of the companies in the sample agreed when asked if climate change would cause their firm to relocate some operations.

Chart A

Selected impacts on firms of climate change and related adaptation measures

(percentages of responses)

Source: ECB.

Notes: Firms were asked whether they strongly agreed, agreed or disagreed that “Climate change and/or our adaptation to it will [+ statement]”. “More resilient” facilities or processes means facilities or processes that are less exposed to climate change-related risks, such as extreme weather events.

The main challenges arising from the transition to a net-zero economy mentioned by respondents include the availability of new technologies and inputs, followed by costs. Chart B categorises the issues and challenges mentioned by respondents in relation to the transition. Around 60% cited challenges related to “availability”, stressing in particular the need for large scale deployment of renewable electricity generation, transmission lines and electric vehicle-charging infrastructure. They also mentioned development and innovation needs, for example related to green hydrogen, carbon capture and storage technologies. In addition, many firms saw the sourcing and recycling of raw materials and low-carbon processed materials as a challenge, given increasing demand and still-underdeveloped low-carbon alternatives. A similar number cited challenges related to costs. In this regard, firms frequently highlighted that low-carbon alternatives involve higher costs or are less profitable than their conventional alternatives. The next largest concern related to cost pressures caused by rising prices of raw materials, necessary investment and the purchasing of clean energy. Many respondents also cited challenges related to greening the value chain or measuring emissions across the value chain, regulatory and reporting challenges, global competitiveness concerns, acquiring the necessary workforce skills, the lack of sufficient incentives, and customers’ or employees’ mindset and willingness to transition.

Chart B

Categorisation of the main challenges in transitioning to net zero cited by firms

(shares of total responses in which a challenge falling within each category was mentioned, expressed as percentages)

Source: ECB.

Notes: The categorisation is based on the authors’ interpretation of written responses. The percentage shares of total responses are indicated for all types of challenge mentioned by 10% or more responding firms.

A majority of respondents agreed that transitioning to a net-zero economy would require higher investment, raise costs and increase their firm’s selling prices (Chart C). 80% or more agreed that mitigating climate change would require their firms to adopt technologies that did not yet exist, that substantial investment was needed to make products based on new technologies or materials to meet customers’ needs and that the overall level of investment would increase due to efforts to mitigate climate change. A somewhat lower share, however, thought that climate change would increase the cost of capital or raise the amortisation rate on their company’s assets. 80% or more of respondents agreed that mitigating climate change would make the raw materials and components they use more expensive, carbon prices into a relevant cost component and the energy they use more expensive. Almost as many agreed that this would increase the price of the goods and/or services their company provides.

Views were more mixed regarding the extent to which climate change would be a catalyst for changes to production and market structures (Chart C). Almost all firms said that mitigating climate change required them to renegotiate with suppliers or find new suppliers to decarbonise inputs. Slightly more than half of respondents thought that mitigating climate change would result in a shift to a more local supply chain. Around half said that the transition to net zero would encourage their firm to enter new markets, encourage new entrants and/or increase market concentration in their industry.

Chart C

Selected impacts on firms of the transition to net zero

(percentages of responses)

Source: ECB.

Note: Firms were asked whether they strongly agreed, agreed or disagreed that “Mitigating climate change (transitioning to net zero) will [+ statement]”.

Respondents broadly recognised the importance of the European Union’s climate policies (including the EU Green Deal and Fit for 55), while often raising specific issues related to design and implementation at industry level. Many emphasised the importance of a stable regulatory framework and the need for consistency across sectors and geographic regions. Some expressed concerns that the way in which different regulations interacted could have unintended negative effects. The importance of the proposed EU Carbon Border Adjustment Mechanism was highlighted by a number of respondents, although views were divided on whether it would be sufficient to ensure a level playing field and contain the risk of carbon leakage.[5] Many respondents raised the issue of carbon pricing: some saw a higher carbon price as a cost pressure, while others emphasised the importance of generating appropriate incentives through higher carbon prices.

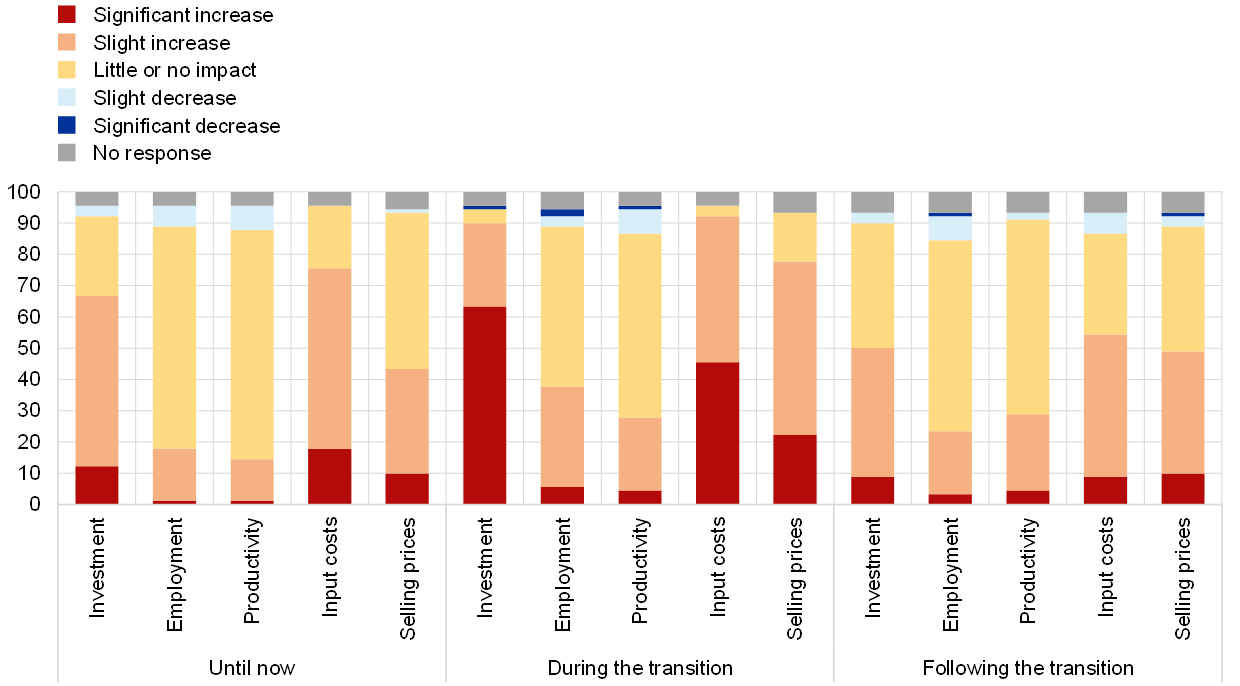

Responses indicate that the overall impact of climate change and related policies will be to increase investment, costs and prices, especially during the transition phase (Chart D). 70% of respondents said that their firm’s investment was already higher than it would have been because of climate change, although only 10% said it was significantly higher. More than 90% anticipated higher investment during the transition phase and more than two-thirds expected the increase to be significant. A similar pattern of responses is observed for input costs and prices. Nearly 80% of respondents said that their input costs had already increased. Nearly half responded that their selling prices had already increased as a result of climate change or climate policies, but only a small proportion said that these increases were already significant. The effect on input costs and selling prices was expected to intensify during the transition.

Chart D

Overall impact of climate change on investment, employment, productivity, costs and prices until now, during and after the transition to net zero

(percentages of responses)

Source: ECB.

Note: Respondents were asked to assess the overall impact of climate change on different aspects against a hypothetical baseline without any climate change or climate-related policies.

Only a small share of respondents expected a significant increase in investment, costs and prices due to climate change after the transition (Chart D). This suggests firms anticipate that much – but not all – of the impact on investment, costs and prices will be limited to the transition period itself. Specifically, more than half of respondents thought that investment, costs and prices would be structurally higher after the transition, but only a small share (around 10%) expected them to be significantly higher. Furthermore, the results suggest that the overall upward impact on investment and costs after the transition is expected, on average, to be slightly lower than it has been until now. By contrast, the upward impact on selling prices is expected to be slightly higher.

Table A

Composition of the survey sample by firms’ main activity

Activities based on NACE Rev. 2 definitions

Source: ECB.

Adaptation measures refer to actions taken by firms to adapt to climate change and its effects. Mitigation measures refer to actions taken to reduce emissions with the aim of containing climate change.

The survey of leading firms took place in the context of the ECB’s dialogue with non-financial companies as a special survey in addition to the regular survey rounds. The regular survey is described in “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, Frankfurt am Main, 2021.

Transition risks refer to risks associated with mitigating climate change, for example through climate policies, technological changes or changes in preferences and behaviour.

Physical risks refer to risks associated with a changing climate, both through gradual changes in climate and an increasing frequency and intensity of extreme events.

Carbon leakage occurs when a strict climate policy aimed at reducing emissions in one country causes firms to relocate production to other countries with less strict climate policies, leading to a corresponding increase in emissions.