The impact of the COVID-19 pandemic on labour productivity growth

Published as part of the ECB Economic Bulletin, Issue 7/2021.

The growth of euro area labour productivity, measured by real GDP per hour worked, increased at the onset of the coronavirus (COVID-19) pandemic before declining in the course of the subsequent economic recovery. [2] This contradicts the general notion of productivity being procyclical and reflects the unique nature of this crisis.[3] This box discusses the recent patterns in labour productivity and considers the extent to which some of these developments might fade or consolidate after the crisis.

Between the last quarter of 2019 and the first quarter of 2021, euro area labour productivity growth remained positive and even accelerated compared with the period prior to the pandemic (Chart A). Average growth in annual real GDP per hour worked rose to 1.7% during this period, more than twice the average pre-pandemic (2014-19) rate, while real GDP and total hours worked declined by annual averages of 5.7% and 7.4% respectively. The fall in employment was much smaller, due mainly to the different job retention schemes set up in various euro area countries – on average, employment fell by an annual 1.6% over the same period. In the second quarter of 2021, however, these developments reversed, with hours worked and employment rebounding sharply, causing productivity growth to slow. Nevertheless, productivity is now more than 2% higher than the pre-pandemic level seen in the fourth quarter of 2019.

Chart A

Real GDP per hour worked in the euro area

(year-on-year percentage changes)

Sources: Eurostat and ECB staff calculations

The pandemic and the associated containment measures have affected aggregate labour productivity growth in many different ways. The discussion in this box is organised by grouping the different channels into those with an impact on within-firm productivity growth and those with an impact on the reallocation of resources across firms within and across sectors of activity. Within-firm productivity growth depends on input quality, managerial practices, innovation and technology adoption. Resource reallocation results from the expansion or contraction of firms and from the process of creative destruction whereby new, productive firms displace obsolete ones. Reallocation can take place across sectors or within sectors.

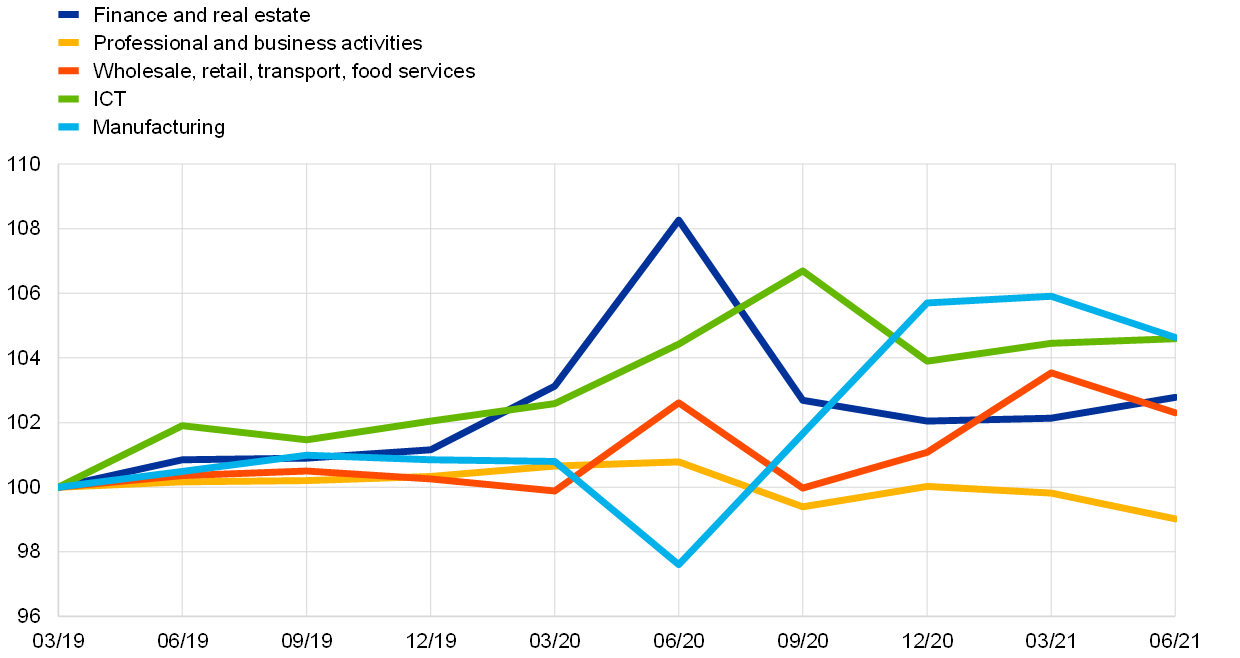

Within-firm productivity growth is benefiting from the acceleration in digital uptake brought about by the pandemic. Containment measures obliged firms to adjust quickly to remote working and establish new channels for sales and customer contact, which had an impact on their working and business arrangements. It can therefore be said that the pandemic has accelerated the trend for digitalisation that had already started well before the crisis. Chart B shows how productivity, measured as sector value added per hour worked, increased soon after the first wave of lockdowns in sectors such as information and communication (ICT) and finance, where staff could work remotely and firms could take advantage of new digital solutions. Some of those productivity gains were retained after the economies started to re-open. This was reinforced by events in manufacturing and in the wholesale, retail and accommodation sectors, where productivity gains started later but remained strong well into 2021. Survey-based evidence suggests that these sector-specific developments reflect rapid productivity gains from digital adoption, particularly in those firms and sectors that are relatively less technology-intensive.[4] Although part of the shift to remote working might reverse over time, some is likely to persist, at least in some areas, and could potentially open the door to substantial gains in terms of productivity and employee well-being.[5]

Chart B

Real value added per hour worked, different sectors

(Q1 2019=100)

Sources: Eurostat and ECB staff calculations

Note: The latest observation is for the second quarter of 2021.

Looking ahead, the pandemic might, however, also have a negative impact on within-firm productivity growth. An increase in firm exits as supporting policies are withdrawn could lead to the destruction of jobs, which could potentially lead to a deterioration of skills if the reallocation of displaced workers to other firms is slow. Human capital accumulation might also be affected by lockdown-induced interruptions to education and training. Supply chain disruption might persist, and firms might need to find new suppliers, new transport routes or new production locations. In addition, it will be important for favourable financial conditions to be maintained to make new productivity-enhancing projects viable and to prevent corporate debt overhangs, together with high uncertainty, weakening investment going forward.

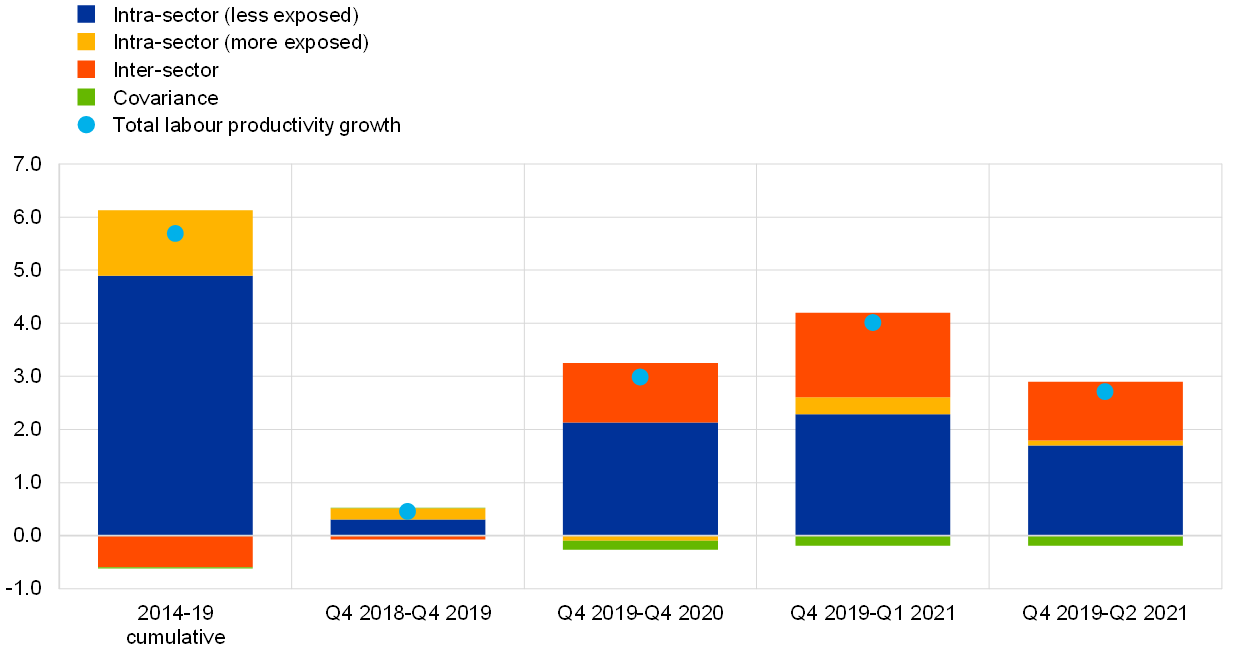

The impact of the shock has been asymmetric, which has triggered a productivity-enhancing reallocation of resources across sectors, at least in the short run. The containment measures have had a major impact on service sectors relying on face-to-face interactions. These are, on average, relatively less productive than other less hard-hit sectors like manufacturing or technology-intensive sectors that have even benefited from the increased demand for online solutions. This redistribution of activity across sectors of varying productivity might serve to enhance productivity. A shift-share analysis using quarterly euro area data confirms that during the pandemic, the reallocation of resources across sectors has contributed between 30 and 40% of aggregate productivity growth (Chart C, panel a).[6] This development contrasts sharply with the pre-crisis period when sector reallocation contributed little – and negatively – to aggregate productivity growth. Intra-sector developments in the areas least affected by the shock explain the rest of aggregate productivity growth. There are, however, two possible caveats looking ahead. First, it is not clear to what extent the contribution of sector reallocation will persist over time – the impact already seems to be declining in the second quarter of 2021, and this may accelerate as containment measures are gradually removed.[7] And second, reallocating jobs and capital across sectors is always harder, and takes longer, than within sectors, which might weigh on the recovery.

There are also signs that the creative destruction process could be productivity-enhancing. The exit of low-productivity firms is regarded as a silver lining in crises.[8] However, the exogenous and horizontal nature of this shock – affecting all firms in a given sector – was no guarantee that productivity-enhancing creative destruction would take place. Evidence shows that compared with other crises, exits have been muted as a result of the different policies supporting corporates enacted by governments.[9] But ECB simulations show that the firms most likely to exit as a result of the pandemic are less productive than other, more resilient firms within their sectors (Chart C, panel b).[10],[11] Regarding firm entry, recent data show that firm entry declined at the onset of the crisis but recovered thereafter, to a higher level than before the crisis in some euro area countries, as well as in the United Kingdom and the United States.[12]

Chart C

Impact of the COVID-19 pandemic on resource reallocation and productivity

a) Contribution of inter- and intra-sector developments to aggregate productivity growth

(percentage points)

b) Productivity of firms at risk of exit and of healthy firms in the same country and sector according to ECB simulations

(EUR thousands)

Sources: Panel a: own calculations based on Eurostat data; panel b: ORBIS-iBACH and ECB staff calculations.

Notes: Panel a: sector labour productivity measured as real value added per hour worked. The intra-sector contribution is divided into the sectors least and most affected by the pandemic. The more exposed sectors are arts and entertainment, accommodation and food, transport and retail and wholesale trade. Panel b: productivity defined at the firm level as real value added per employee. Based on simulation of firm-level imbalances reflecting firms’ financial conditions before the crisis and sector value added dynamics according to the Eurosystem staff projections for the euro area dated December 2020. The numbers refer to the quarter with the maximum number of firms at risk according to the simulations. Firms at risk of exit are defined as those with negative working capital and at the top 25% of the leverage distribution within their country-sector.

Looking ahead, productivity growth will depend heavily on the consolidation of widespread digital uptake and the design of the exit strategies from policy support. The accompanying article on productivity trends in this issue of the Economic Bulletin highlights a slowdown in the spread of innovation and technology in the euro area. Seen in this light, the observed acceleration in digital uptake could be a positive outcome from the crisis. However, the long-term productivity trend will depend heavily on institutions, infrastructure, skills and methods of production and management developing and digitising in tandem. Furthermore, digital adoption needs to be widespread, across sectors and firms. And finally, the massive policy support granted to the corporate sector has been crucial in mitigating the initial impact of the shock. Once the recovery takes hold on a sustainable basis, however, policy support needs to be lifted gradually to avoid impairing the efficient reallocation of resources by setting wrong incentives. Accordingly, the design and timing of the exit strategies will determine how far aggregate productivity growth will be impacted by further after-effects from the shock.

- We would like to thank ECB colleagues Vasco Botelho, Rodrigo Barrela, Paul Reims and Charles Hoffreumon for their input.

- Total factor productivity (TFP) is another measure of productivity. Developments in TFP growth outside the euro area are discussed in Box 1.

- A paper by Basu and Fernald, for instance, starts with the sentence: “Productivity rises in booms and falls in recessions.” See Basu, S. and Fernald, J., “Why Is Productivity Procyclical? Why Do We Care?”, NBER Working Paper Series, No 7940, October 2000.

- See Box 6 entitled “The long-term effects of the pandemic: insights from a survey of leading companies”, Economic Bulletin, Issue 8, ECB, 2020.

- The COVID-19 pandemic could also exacerbate the inequality between firms if only the most productive and largest companies adopt the latest digital technologies. The reason is that digital technologies are characterised by scalability, large fixed costs and low marginal costs, and benefit from network effects. See Haskel, J. and Westlake, S., Capitalism without Capital: The Rise of the Intangible Economy, Princeton University Press, Princeton, NJ, November 2017.

- A shift-share analysis decomposes labour productivity growth into three terms: (i) intra-sector productivity growth, holding the economic weight of sectors constant (intra-sector contribution); (ii) change in sector economic weights holding sector productivity constant (inter-sector contribution); and (iii) the interaction between a change in sector economic weights and labour productivity growth (interaction or covariance).

- See Bloom, N., Bunn, P., Mizen, P., Smietanka, P. and Thwaites, G., “The Impact of Covid-19 on Productivity”, NBER Working Paper Series, No 28233, December 2020.

- While the crisis might increase the exit of low-productivity firms and thereby support productivity growth, they might also undermine it depending on the nature of the shock and market distortions. See Foster, L., Grim, C. and Haltiwanger, J., “Reallocation in the Great Recession: Cleansing or Not?”, Journal of Labor Economics, Vol. 34, No S1, 2016, pp. S293-S331.

- See Criscuolo, C., “Productivity and Business Dynamics through the lens of COVID-19: the shock, risks and opportunities”, working paper presented at the ECB Forum on Central Banking 2021.

- This claim is based on a simulation of firm-level imbalances reflecting firms’ financial conditions before the crisis and sector value added dynamics according to the Eurosystem staff projections for the euro area dated December 2020. Firms at risk are defined as those with negative working capital and at the top 25% of the leverage distribution within their country-sector.

- These results are confirmed by survey data matched with administrative data for Spain (Fernández-Cerezo, A., González, B., Izquierdo, M. and Moral-Benito, E., “Firm-level heterogeneity in the impact of the COVID-19 pandemic”, Working Papers, No 2120, Banco de España, May 2021) and in a multi-country framework by Criscuolo, C., op. cit.

- See Criscuolo, C., op. cit.