Main findings from the ECB’s recent contacts with non-financial companies

Published as part of the ECB Economic Bulletin, Issue 7/2021.

This box summarises the results of contacts between ECB staff and representatives of 68 leading non-financial companies operating in the euro area. The exchanges mainly took place between 4 and 13 October 2021.[1]

Contacts reported strong growth in activity overall, but many said that supply constraints were increasingly limiting their ability to meet demand. Manufacturers described healthy order books and long delivery times, but shortages of inputs made it difficult for production to keep pace with orders. The acute shortage of semiconductors continued, and the spread of the Delta variant of the coronavirus (COVID-19) in Asia had further affected chip supplies. This resulted in a sharp drop in automotive production and in demand for related intermediate inputs. By contrast, contacts reported growing demand for many non-durable consumer goods and continuing robust demand for household durables, in turn sustaining demand for most intermediate goods. Faced with strong order books, most contacts said that manufacturing activity was being hampered by shortages of materials and components, also related to congestion at container shipping ports. Activity in the construction sector was also hindered by shortages of materials and labour, despite strong or recovering demand for both residential and non-residential investment. Developments in retail and transport services reflected the continued strong demand for manufactured goods. Contacts elsewhere in the services sector generally reported steady or robust growth in activity. Leisure travel, hospitality and recreation services had recovered quite strongly over the summer, but activity in these sectors remained markedly below pre-pandemic levels. Demand for IT and telecommunications services remained solid, while media and advertising services were steadily recovering from pandemic-induced lows.

Looking ahead, most contacts were optimistic about the outlook for activity in the fourth quarter of 2021 and beyond. Strong order books would sustain the output of manufacturers for a number of months or quarters, while the further loosening of travel restrictions would give an added boost to related services industries. The recent rise in energy prices was, however, creating additional uncertainty regarding production in energy-intensive industries. Moreover, higher inflation could subdue real disposable income and final consumer demand. Supply chain disruption was likely to persist for several months before gradually easing in the course of 2022, while more substantial capacity investments would take effect in 2023.

Contacts reported growing employment but also an increasing lack of available labour and high attrition, resulting in many unfilled positions. Numerous companies observed a scarcity of applicants, which acutely affected those firms seeking to hire or rehire on a large scale. This was attributed to people moving to jobs in other industries, returning to their home countries (in the case of foreign workers) or adjusting their work-life balance – factors that could persist to varying degrees. There were also structural drivers related to job preferences and ageing. Pent-up demand to change jobs together with reduced geographical limitations (owing to home working) also led to higher attrition rates. Not only were some long-standing shortages (such as of software engineers and lorry drivers) becoming more acute, but shortages were also increasingly observed across a range of professions, albeit to differing degrees across geographical areas.

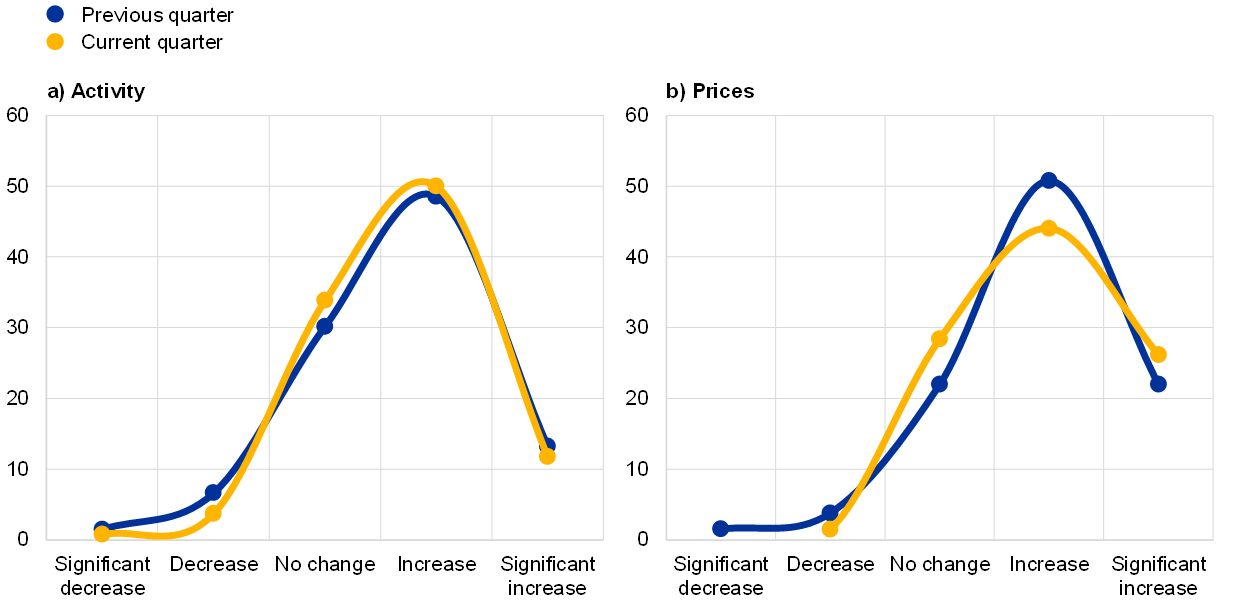

Chart A

Summary of views on developments in and the outlook for activity and prices

(percentage of respondents)

Source: ECB.

Notes: The scores for the previous quarter reflect the ECB staff assessment of what contacts said about developments in activity (sales, production and orders) and prices in the third quarter of 2021. The scores for the current quarter reflect the assessment of what contacts said about the outlook for activity and prices in the fourth quarter of 2021.

Contacts in the industrial sector reported significant increases in selling prices, while price developments in the services sector were less dynamic. This was not dissimilar to the situation described three months earlier, in which many input and selling prices were already rising at the fastest rate seen for many years. However, the persistence of the high or rising input costs, together with the recent surge in energy prices, did lead many contacts to raise their price expectations for next year and to anticipate a stronger pass-through to consumer prices. In particular, most contacts in business-oriented sectors described a favourable environment for passing higher costs on to their customers, given the latter’s focus on securing supply, and many anticipated a significant further pass-through to consumers. At the same time, many of the contacts in more consumer-oriented sectors considered that strong competition among retailers and from online merchants would limit the pass-through to final consumer prices.

Industrial input prices were still expected to ease at some point in 2022, but contacts expected wage inflation to pick up. The prices of some commodities had already peaked towards the middle of this year, and while the prices of others were still increasing, most contacts still expected these to stabilise or ease in the coming quarters. However, the transmission of pipeline pressures through the value chain would persist for some time. If not reversed, the recent surge in gas and electricity prices would further add to costs next year as contracts are rolled over. Most contacts anticipated higher wage increases in upcoming wage negotiations, broadly mirroring the recent pick-up in consumer prices. Besides pressure to sustain real incomes, wage negotiations would reflect improved business profits (in some cases reflected in bonuses rather than wages), a certain degree of catch-up in cases where wages had been restrained during the pandemic, and tighter labour market conditions. However, for some contacts the main concern was not negotiated wage increases but the higher wages that needed to be offered to attract new staff.

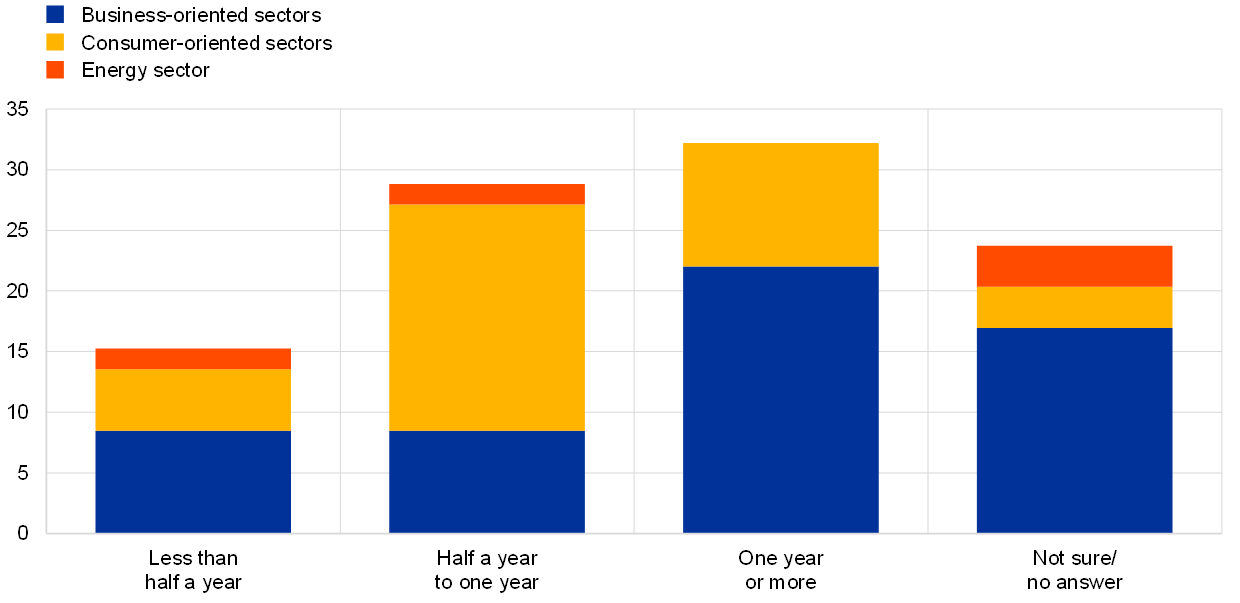

Chart B

Summary of views on the persistence of supply constraints and input price pressures

(percentage of respondents)

Source: ECB.

Notes: The chart presents the ECB staff interpretation of what contacts said about the likely duration of the supply constraints and input price pressures currently faced by their industry, including those related to the scarcity of inputs, transport delays, energy costs and labour shortages. The views are expressed as a percentage of the respondents who said that their firm or industry was experiencing supply constraints and/or input price pressures. Business-oriented sectors comprise intermediate and capital goods, construction, transport and business services. Consumer-oriented sectors comprise consumer goods (including food), retail and consumer services.

Chart C

Summary of views on the extent to which current cost pressures will be passed through to consumer prices

(percentage of respondents)

Source: ECB.

Notes: The chart presents the ECB staff interpretation of what contacts said about the extent to which the unusual cost pressures that they were facing would be passed through to consumer prices. The views are expressed as a percentage of the respondents who said that their firm or industry was experiencing supply constraints and/or input price pressures. Business-oriented sectors comprise intermediate and capital goods, construction, transport and business services. Consumer-oriented sectors comprise consumer goods (including food), retail and consumer services.

- For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.