- SPEECH

Lessons from an unusual crisis

Speech by Isabel Schnabel, Member of the Executive Board of the ECB, at the Federal Reserve Bank of New York conference on “Implications of Federal Reserve Actions in Response to the COVID-19 Pandemic”

1 October 2021

Introduction

The economic developments caused by the coronavirus (COVID-19) pandemic have been highly unusual.[1] After the deepest decline in output in the post-war period, the recovery was also much steeper than in other sharp recessions, such as the one after the global financial crisis.[2]

The comparably swift brightening of the economic outlook is in large part due to the decisive policy responses by both fiscal and monetary authorities, which were in many respects as unusual as the crisis itself. Even though the pandemic is not yet over, I would like to use my remarks today as an opportunity to point out in what respect the policy response to the pandemic was indeed unusual, explain how it successfully averted an even more severe economic contraction in the euro area and ask what lessons we can draw for the future.

I will first describe the starting point of the euro area at the outset of the pandemic, which significantly affected the design of our policy response. Subsequently, I will explain how the ECB tailored its monetary policy response to this extraordinarily deep crisis by adapting its toolkit in an innovative way, and how monetary and fiscal policies complemented each other, unlike during previous crises. Finally, I will draw some tentative lessons from the crisis by highlighting three features that were crucial for the success of our response: first, our ability to design and implement forceful measures with the appropriate degree of flexibility based on the pre-existing blueprints of our extensive monetary policy toolkit; second, the complementarity and mutually reinforcing effects of our monetary policy instruments; and finally, the important role of fiscal policy in complementing monetary policy in counteracting the unprecedented economic fallout from the pandemic.

The euro area at the outset of the pandemic

Any policy response must be adapted to the prevailing economic and institutional environment. There are three specific conditions that are important for understanding the euro area policy response.

The first relates to the broad macroeconomic environment. Prior to the outbreak of the pandemic, growth in the euro area had been relatively sluggish and inflation had been stubbornly low for many years. Staff projections suggested that inflation would continue to fall short of our medium-term inflation aim over the projection horizon (Chart 1, left-hand panel).

This macroeconomic environment implied that the ECB’s monetary policy stance was already highly accommodative even before the pandemic struck. The ECB’s deposit facility rate (DFR) – the key anchor for money market rates in the euro area in the present environment of excess liquidity – had been at an all-time low of -0.5 percent since September 2019 (Chart 1, right-hand panel). Hence, the conventional monetary policy space had already been exhausted to a large extent, implying that there was less scope to cut key policy rates than in other advanced economies like the United Kingdom or the United States.

Chart 1

Subdued inflation outlook in the euro area implied highly accommodative monetary policy already before the pandemic

Left-hand panel:

Sources: ECB calculations.

Latest observation: Q2 2021.

Right-hand panel:

Source: Bank for International Settlements (BIS).

Latest observation: August 2021.

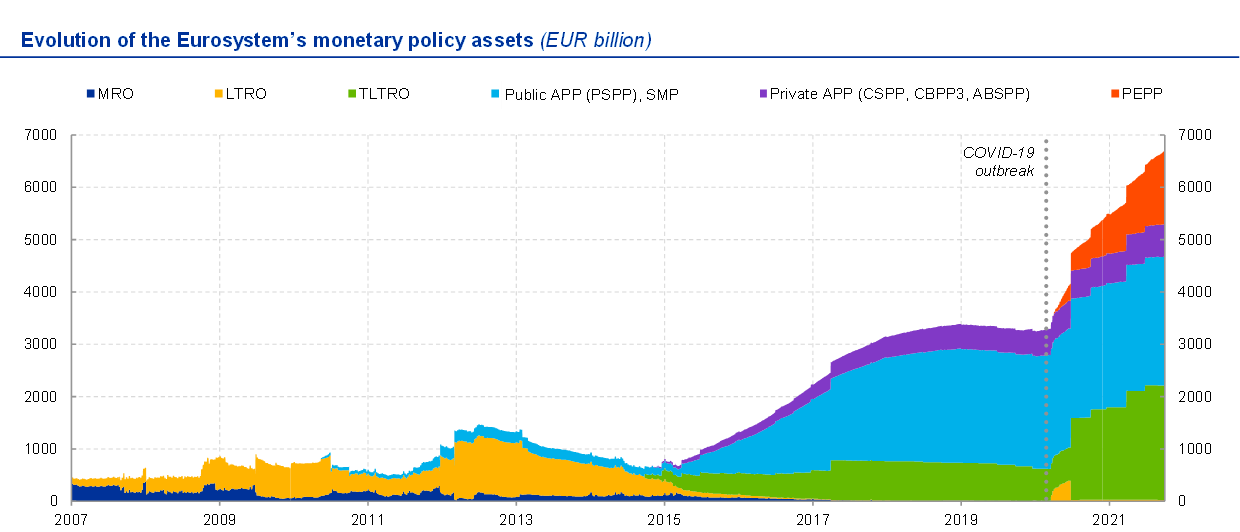

Against this background, the ECB was already running a massive asset purchase programme of both public and private sector securities in order to bring inflation back to its medium-term aim (Chart 2). Only shortly before the pandemic, in September 2019, the ECB decided to restart net asset purchases at a volume of €20 billion per month. At the same time, the ECB also announced more favourable conditions on its targeted longer-term refinancing operations (TLTROs). This offered the advantage that a broad set of instruments was readily available when the crisis hit and could be adapted swiftly.

Chart 2

Eurosystem balance sheet expanded markedly before the pandemic with sharp acceleration due to pandemic crisis measures

Source: ECB, ECB calculations.

Note: The chart shows the consolidated monetary policy assets held by the Eurosystem. It excludes non-monetary policy assets such as gold and gold receivables, claims on non-euro area residents and non-monetary policy securities held under the “Agreement on Net financial Assets” (ANFA).

Latest observation: 29 September 2021.

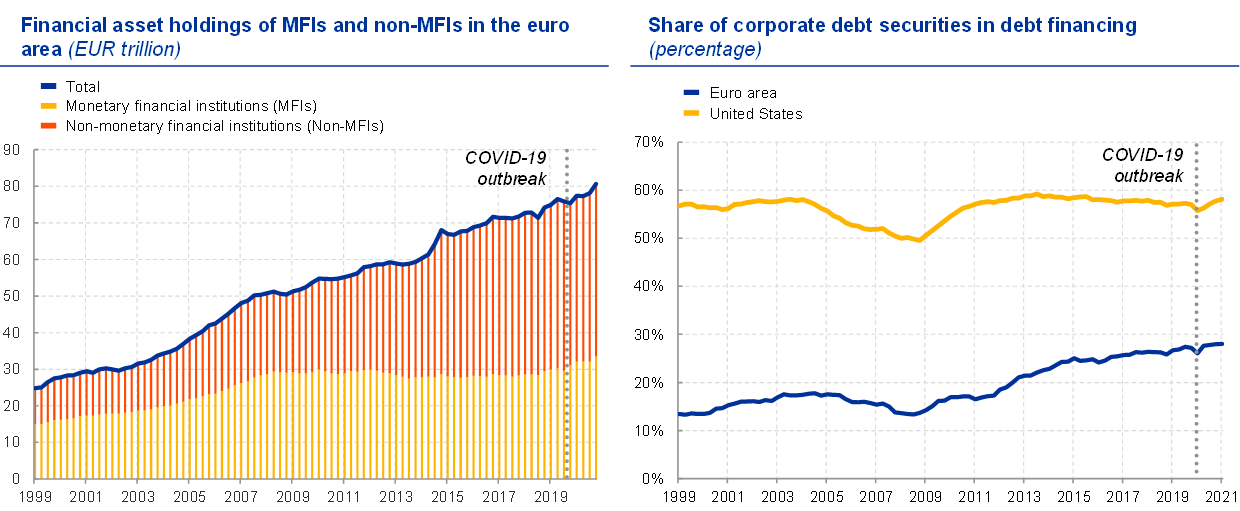

The second specific feature of the euro area relates to the structure of the financial system. In spite of the recent rise in non-bank financial intermediation and market-based finance, bank loans remain the dominant source of debt financing for firms in the euro area economy (Chart 3). Since the global financial crisis, the share of non-financial corporate debt securities in total debt financing has more than doubled. However, the reliance of firms on bond markets remains significantly lower than in the United States, for example.[3] This implies that banks play a much larger role in monetary policy transmission in the euro area, which had to be reflected in our policy response.

Chart 3

Bank-based transmission remains highly relevant in the euro area in spite of the rise of non-banks and bond financing

Left-hand panel:

Source: Euro area accounts.

Note: Non-MFIs include insurance companies and pension funds (ICPFs), investment funds (IFs), and other financial intermediaries (OFIs). MFIs exclude the Eurosystem. Calculations based on market values.

Latest observation: Q1 2021.

Right-hand panel:

Sources: ECB and US Federal Reserve.

Note: The chart shows the volume of debt securities relative to the sum of bank loans and debt securities. Data cover the non-financial corporat (NFC) sector for the euro area and the non-financial business sector for the US series. Data on debt securities and bank loans are outstanding amounts (not seasonally adjusted).

Latest observation: Q1 2021.

A third feature of the euro area is the specific institutional set-up of the currency union: there is a single monetary policy but mainly national fiscal policies. The heterogeneity of the euro area and differences in fiscal space posed a particular challenge at a time when the pandemic threatened to reinforce the divergence among euro area countries, which could also give rise to self-fulfilling price spirals and destabilising flight-to-safety dynamics in sovereign bond markets.

These risks prompted European governments to rethink their approach to fiscal policy in the European Union. In the same vein, the ECB calibrated its monetary policy to avoid market fragmentation and ensure the effective transmission of our single monetary policy to the entire euro area.

An unusual policy response to an unusual crisis

This macroeconomic and institutional context was the backdrop for the policy response to the pandemic crisis. I would like to focus on three aspects that made our policy response unusual: the introduction of dual rates in our TLTROs; the size and flexibility of the pandemic emergency purchase programme (PEPP); and the first broad fiscal response at European level, complementing our monetary policy response.

Dual rates in the TLTROs

Our TLTROs, which were first launched in June 2014, support bank-based transmission and ensure continued credit intermediation through the banking system by offering particularly favourable lending conditions to banks meeting a pre-defined lending threshold.

The third series of TLTROs started in September 2019. The sudden collapse of revenues during the first wave of lockdowns implied a sharp rise in the demand for credit by corporates, making refinancing operations to banks one of our primary responses to the unfolding pandemic. However, given the severity of the impending crisis, it quickly became clear that the pre-pandemic conditions attached to our liquidity-providing operations would not be sufficient to accommodate the unprecedented surge in corporate credit demand.

The ECB therefore embarked on a major innovation in the design of our lending operations: we decided to offer longer-term funding under the TLTROs during the pandemic period at interest rates below the DFR, the rate at which banks can deposit liquidity overnight with the Eurosystem, conditional on participating banks meeting pre-defined lending thresholds. By disconnecting the lending rate from the DFR we were able to effectively reduce the funding costs of those banks that continued to support the real economy, without having to adjust our interest rate corridor, thereby preserving banks’ lending margins and avoiding potential negative side effects from a further rate cut.

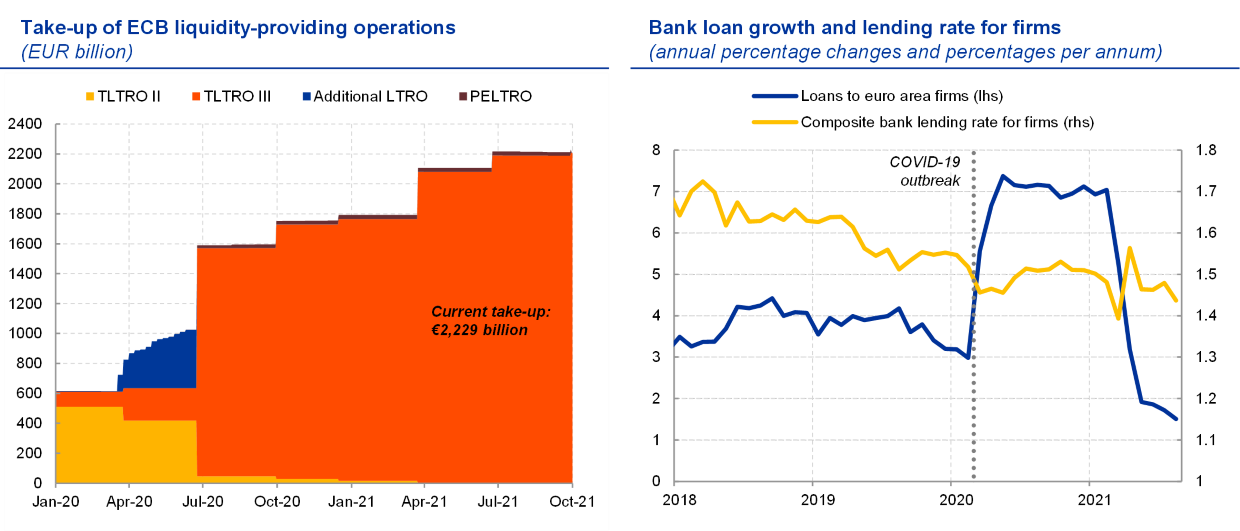

Banks’ participation in these liquidity-providing operations has been substantial (Chart 4, left-hand panel): the overall TLTRO III take-up currently represents around one third of our total monetary policy assets. In comparison, the Federal Reserve’s remaining outstanding loans and net portfolio holdings under the emergency facilities constitute less than two percent of total monetary policy assets.[4]

While the emergency lending facilities in the United States served mainly as a backstop to the market, the TLTROs became an essential source of funding for the European banking system. The sharp increase in lending to corporates at the beginning of the pandemic is testament to the success of the TLTRO in averting a credit crunch and safeguarding the monetary policy transmission mechanism (Chart 4, right-hand panel).

Chart 4

High take-up of TLTROs and sharp rise in bank lending to firms

Left-hand panel:

Source: ECB.

Note: TLTRO III refers to the sum of TLTRO III.1-9.

Latest observation: 1 October 2021.

Right-hand panel:

Source: ECB.

Notes: Loans to non-financial corporations (NFCs) are adjusted for loan sales, securitisation and for notional cash pooling. Composite bank lending rates are calculated by aggregating short and long-term rates using a 24-month moving average of new business volumes.

Latest observation: August 2021.

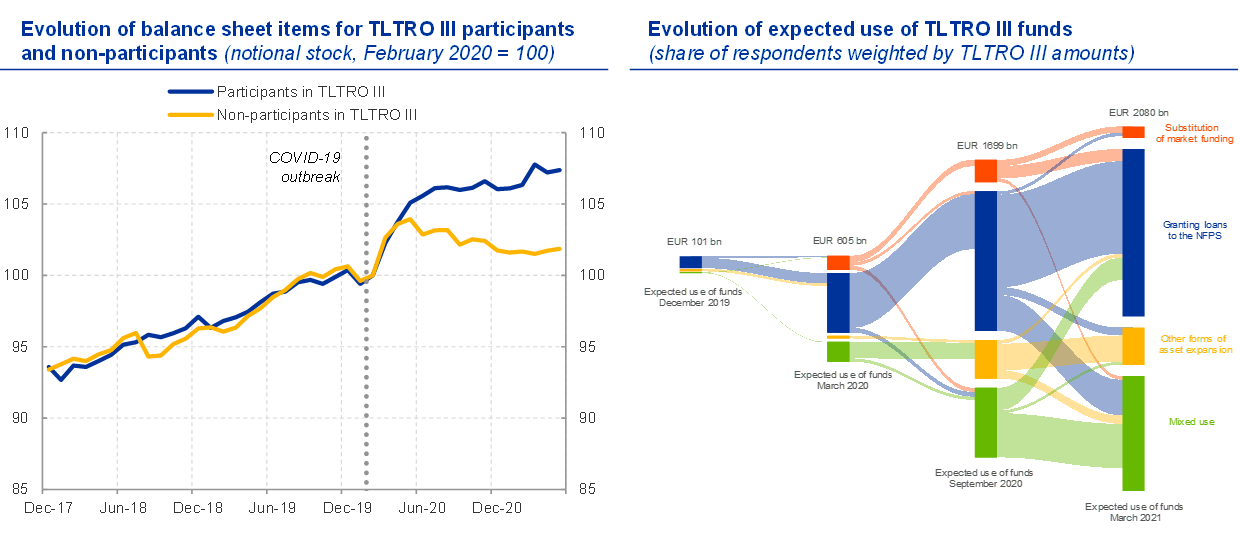

ECB staff analysis confirms that outstanding eligible loans were growing significantly more for banks participating in the TLTROs than for non-participating banks (Chart 5, left-hand panel). And the ECB’s bank lending survey confirms that a substantial part of the TLTRO III funds was expected to be used for lending to the non-financial private sector (Chart 5, right-hand panel).

Chart 5

TLTROs safeguarded bank-based transmission during the pandemic

Left-hand panel:

Sources: ECB and ECB calculations.

Notes: The chart displays the evolution of eligible loans for banks participating (blue line) and banks not participating (yellow line) in TLTRO III until May 2021. For details, see Barbiero et al. (2021), “TLTRO III and bank lending conditions”, Economic Bulletin, Issue 6, ECB.

Right-hand panel:

Source: ECB, euro area bank lending survey (BLS) and ECB calculations.

Notes: Other forms of asset expansion include government securities, cash holdings, financing other financial entities, and others. Shaded areas report take-up of banks that change their expected use of funds between survey waves. NFPS refers to non-financial private sector. For details, see Barbiero et al. (2021), “TLTRO III and bank lending conditions”, Economic Bulletin, Issue 6, ECB.

Latest observation: Q1 2021 (April 2021 BLS).

But the TLTROs were just one element of the monetary policy measures that ensured continued credit intermediation to the real economy. The easing of collateral requirements in lending operations facilitated banks’ strong participation in the TLTROs and supported the provision of bank credit to very small firms that are particularly reliant on bank financing.[5] The ratings freeze implemented as part of the collateral easing measures reduced the risk of a forced liquidation of assets and contributed to rapid market stabilisation.

Moreover, the pandemic emergency longer-term refinancing operations (PELTROs) complemented the TLTRO operations by providing a liquidity backstop at somewhat less favourable conditions but without conditionality with respect to the lending performance. Finally, the granting of swap and repo lines, including through the standing swap line facility with the Federal Reserve and the newly established Eurosystem repo facility for central banks (EUREP), supported the provision of US dollar liquidity for euro area banks and of euro liquidity for non-euro area banks.[6]

Collectively, these liquidity-providing measures ensured that credit provision to the private sector through the euro area’s bank-based financial system never seized up.

The PEPP: large and flexible

The second main policy response was the announcement of additional private and public sector asset purchases.

While the first response to the pandemic on 12 March 2020 included the announcement of an additional envelope of €120 billion under our regular asset purchase programme (APP), it quickly became clear that the APP was not an adequate tool to deal with the sudden and severe dislocations in euro area bond markets when the crisis hit with full force.

Therefore, on 18 March 2020 the ECB’s Governing Council announced a new asset purchase programme of unprecedented size, with an eventual overall envelope of €1,850 billion after two further expansions in June and December of the same year. The huge size of the programme reflected the unprecedented depth of the crisis. But it was not only its size that distinguished the programme from its predecessors, it was also its special design in the light of the dramatic market turbulence of March 2020.

In particular, the sudden divergence in sovereign borrowing rates – which form the basis for financing conditions across the euro area economy more broadly – implied serious risks of fragmentation, which threatened to impair the smooth transmission of our monetary policy stance to the entire euro area. This is why we equipped the PEPP with the flexibility to adjust the volume of purchases over time, across asset classes and among jurisdictions.

In retrospect, it turned out that, after we proved our determination to stabilise financial markets and stave off fragmentation risks at the beginning of the crisis, having the option of flexibility – with the clear commitment to use it as necessary – was largely sufficient to preserve the integrity of the monetary policy transmission mechanism.

The distribution of net purchases across asset classes is a case in point. Under the PEPP, we reduced the minimum maturity of eligible assets and expanded our support to the commercial paper market. This segment of the financial market is a crucial source of short-term funding for firms, which was at risk of freezing up at the height of the crisis as a result of the “dash for cash”, set in motion by redemptions in money market funds. However, the bulk of interventions in this market segment were concentrated in the first two months of the PEPP (Chart 6, left-hand panel). By effectively and quickly restoring market functioning, the purchases gave the regular investor base for commercial paper the confidence to start investing again. Thereafter, the backstop provided by the PEPP’s optionality was sufficient to support the continuous normalisation of market conditions, even in the context of renewed and stringent economic lockdowns.

The same observation applies to the role of flexibility in the distribution of purchases among jurisdictions. While the stock of cumulative net purchases of public sector bonds is guided by the Eurosystem capital key, just as under the public sector purchase programme (PSPP), the PEPP provides more flexibility to deviate from the capital key temporarily.

Chart 6

PEPP flexibility restored market functioning and countered risks of fragmentation

Left-hand panel:

Source: ECB website.

Latest observation: July 2021.

Right-hand panel:

Source: ECB website, ECB calculations.

Notes: Capital key deviations for public sector purchases calculated in bi-monthly stock terms. DE – Germany, ES – Spain, FR – France, IT – Italy.

Latest observation: July 2021.

In response to the tangible risk of fragmentation in financing conditions, we allowed cumulative net asset purchases under the PEPP to deviate from the capital key-implied distribution at the beginning of the pandemic. However, these deviations declined shortly thereafter and have now reached relatively low levels (Chart 6, right-hand panel). Again, the option of flexibility is providing an effective backstop, while the actual capital key deviations self-stabilise when the situation calms down.

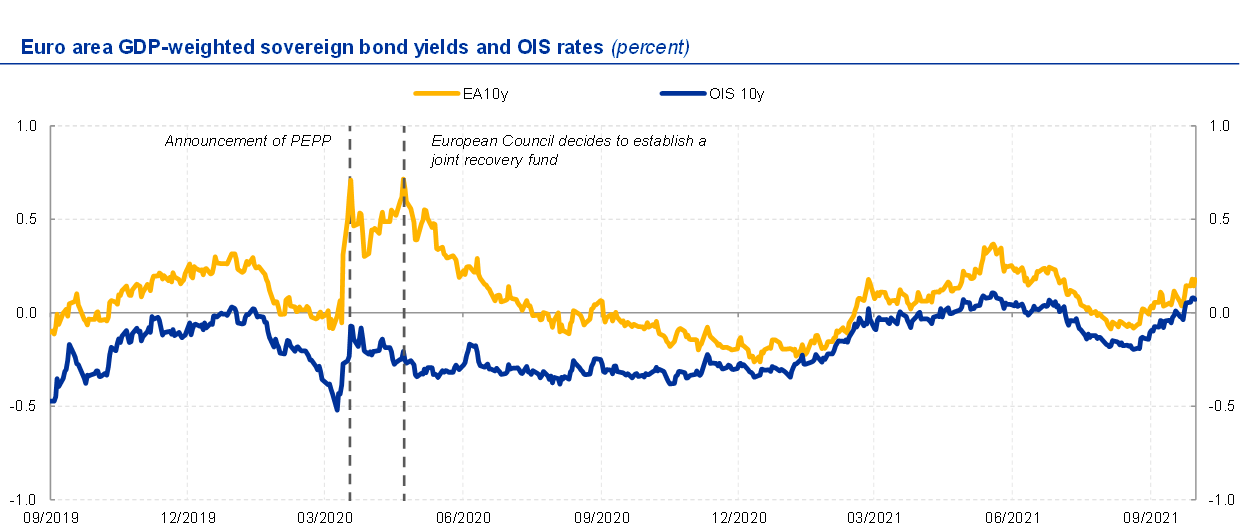

The PEPP’s flexibility probably contributed to lowering the spread of the euro area GDP-weighted yield over risk-free rates quickly after the announcement of the PEPP (Chart 7).

Chart 7

Spread of euro area GDP-weighted sovereign yields over risk-free rates declined after announcement of PEPP and EU recovery fund

Sources: Refinitiv, ECB calculations.

Note: OIS refers to overnight index swap.

Last observation: 30 September 2021.

As financial market turbulence receded gradually over the course of 2020, the PEPP’s market stabilisation function became less relevant.[7] In turn, the PEPP’s contribution to an appropriately calibrated monetary policy stance became more important with a view to countering the downward impact of the pandemic shock on the path of inflation. This shift made the PEPP more similar to our regular asset purchase programme, the APP, under which net asset purchases are likely to continue for some time once net purchases under the PEPP have come to an end.

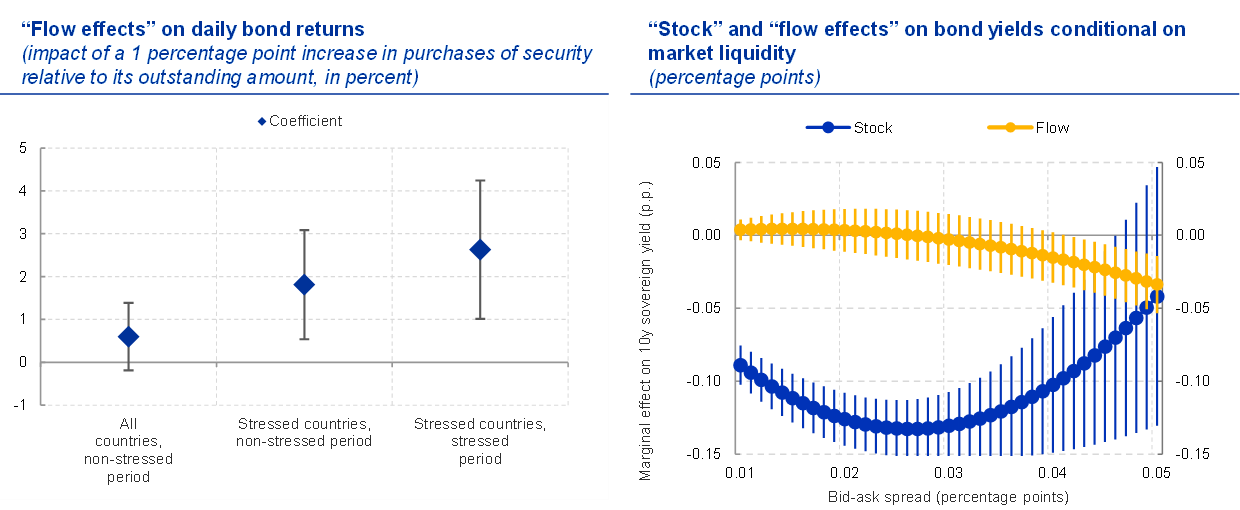

The different ways of how asset purchases work under varying market conditions are also reflected in the relative importance of “flow” and “stock” effects. ECB staff analysis shows that, in stressed or illiquid market conditions, a higher volume of purchases per unit of time – the “flow” effect – was particularly relevant (Chart 8).[8] In contrast, the expected stock of cumulative purchases – the key transmission channel in many theoretical models of central bank asset purchases – is dominant in non-stressed market conditions.[9]

Chart 8

“Flow effect” of asset purchases matters more in stressed market conditions

Left-hand panel:

Source: ECB calculations.

Notes: The impact estimates derive from regressions of daily bond returns of individual central government securities on ECB purchases of these securities, scaled by their outstanding amounts, and a full set of security- and day-fixed effects. Purchase volumes are instrumented via the blackout periods embedded in the PSPP and PEPP design, as detailed in De Santis, R. and Holm‐Hadulla, F. (2020), “Flow Effects of Central Bank Asset Purchases on Sovereign Bond Prices: Evidence from a Natural Experiment”, Journal of Money, Credit and Banking, Vol. 52, No 6, pp. 1467-1491. Diamonds are point estimates, whiskers are 95% confidence intervals.

Right-hand panel:

Source: ECB calculations.

Notes: Estimated marginal effect of stock and flow measures of asset purchases on 10-year bond yields conditional on market illiquidity, measured by bid-ask spreads based on a non-linear regression model. “Stock” is defined as the ratio of survey-implied total expected public sector purchases by the expected end of net asset purchases to total expected outstanding public sector debt. “Flow” is defined as the ratio of realised net purchases of public sector bonds to realised net issuances per month. Monthly frequency over a sample period from January 2015 until July 2021.

Beyond the direct effects, our various crisis measures proved to mutually reinforce each other, thereby also amplifying the overall accommodative impact of our policy response.[10] For example, negative rates strengthen the portfolio rebalancing effect from asset purchases as investors aim to avoid negative interest rates. Asset purchases, in turn, signal the policymaker’s intention to keep short rates low for an extended period of time, strengthening our forward guidance. Moreover, by increasing the relative returns of bank loans, asset purchases also indirectly support the bank loan creation that is further buttressed by the conditionality attached to our TLTROs.

Monetary and fiscal policy going hand in hand

The third, and possibly most important, unusual aspect of the policy response was the complementary action taken by the fiscal and monetary authorities. Our forceful monetary policy response announced in March 2020 was immediately followed by broad fiscal measures at national level, including, in particular, loan guarantee schemes for corporates and job retention schemes for workers. These measures were supported by the activation of the general escape clause of the Stability and Growth Pact. Importantly, the national fiscal response was followed – for the first time – by a broad European fiscal response, including the SURE programme directed at the labour market, as well as the recovery plan for Europe, Next Generation EU (NGEU), providing not only loans but also grants to those EU Member States hit particularly hard by the pandemic.

It is indisputable that this combination of monetary and fiscal policy substantially strengthened the overall beneficial effect on the economy and may be the main factor explaining the surprisingly steep recovery.

Lessons for the future

Even if we are “not completely out of the woods”, as President Lagarde said at the ECB Forum on Central Banking earlier this week, we may start thinking about what lessons we can draw from this unusual crisis for hopefully more usual times.

Overall, the policy response during the pandemic crisis appears to have been very successful. But what does this imply for the future?

First, the ability to successfully counter a rapidly evolving crisis depends on the scope for innovation and flexibility in the monetary policy toolkit. Before the pandemic, a number of observers were questioning whether the ECB still had sufficient “firepower” to address a major economic downturn. The substantial monetary easing that we delivered over the course of the crisis has put such concerns to rest. By adjusting our instruments in previously uncharted directions and by designing a purchase programme with considerable flexibility, the ECB has successfully addressed the specific challenges posed by the pandemic crisis.

Second, the mutually reinforcing effects of our instruments are likely to have strengthened the combined monetary stimulus. In particular, there are important complementarities between negative interest rates, targeted lending operations and asset purchases. Moreover, our recently revised forward guidance allows us to steer interest rate expectations even more effectively, thus reinforcing the impact of our other measures.[11] Importantly, the mutual amplification of our instruments allows us to do less on the intensive margin of any one of our tools. In line with our policy of continuously conducting thorough proportionality assessments, this also mitigates undesirable side effects associated with individual monetary policy instruments.

The final lesson from our policy interventions is that supportive fiscal policy, in particular at the European level, has played an important role in alleviating the pressure on monetary policy to be “the only game in town”. While the announcement of the PEPP was crucial in averting self-reinforcing price spirals in government bond markets and thus a deterioration of financing conditions at the beginning of the crisis, the political agreement relating to a joint recovery fund and the NGEU initiative was instrumental in sustainably calming financial markets (Chart 7). The subsequent easing of financing conditions – and the investment that will be financed under NGEU – will continue to support economic activity in Europe, foster potential growth and ultimately help to bring inflation back towards our medium-term target.

Conclusion

Let me conclude.

As the global economy recovers from the unprecedented contraction caused by the pandemic, the gradual rebound in activity offers an opportune moment to take stock and evaluate the policy interventions that were implemented to mitigate the fallout from the pandemic.

Although it would be premature to claim that we have successfully overcome the crisis, the experience from the pandemic has illustrated the effectiveness of the ECB’s monetary policy toolkit in stabilising financial markets and countering the negative impact of the pandemic on the inflation outlook. Our pre-existing instruments allowed us to swiftly calibrate and implement innovative policy measures that were tailored to the specific circumstances faced by the euro area. This toolkit appeared well suited to deal with the situation at hand and proved to be adaptable to the challenges we were facing. In particular, the flexibility and mutually reinforcing effects of these measures have been crucial in providing sufficient accommodation to counter the impact of the crisis.

Fiscal policymakers have entered new territory by providing a genuinely European response for the first time. While probably falling short of a true “Hamiltonian moment”, this could provide the first step towards greater fiscal integration at European level. Further progress will critically depend on whether these measures will be able to lift countries onto a sustainable growth path. If successful, this could pave the way towards a more countercyclical and more European fiscal framework.

Unusual crises require unusual responses – this is the core of the proportionality principle, which underpins all our policies. This, in turn, implies that we will continue to adapt our tools as appropriate going forward, as the economy enters calmer waters.

Our commitment to act as necessary to fulfil our mandate should never be questioned – neither in crises nor in more usual times.

Thank you.

- I would like to thank Julian Schumacher for his support in preparing this speech.

- Lagarde, C. (2021), “Monetary policy during an atypical recovery,” speech at the ECB Forum on Central Banking “Beyond the pandemic: the future of monetary policy”, September.

- See also Schnabel, I. (2021), The rise of non-bank finance and its implications for monetary policy transmission, remarks given at the Annual Congress of the European Economic Association. The chart shown here displays data from the financial accounts to ensure comparability between the euro area and the US series. The US data encompass a broad category of the non-financial business sector, which also includes unincorporated firms such as sole proprietors, limited partnerships, etc. and, as such, is fairly similar to the definition of non-financial corporates in the euro area financial accounts.

- For the United States, based on the Federal Reserve’s consolidated balance sheet released on 23 September and comprising the share of non-securities holdings relative to all monetary policy assets; for the euro area, based on the consolidated financial statement of the Eurosystem as at 24 September and comprising the share of lending to euro area credit institutions related to monetary policy operations denominated in euro relative to all monetary policy assets.

- See de Guindos, L. and Schnabel, I. (2020), “Improving funding conditions for the real economy during the COVID-19 crisis: the ECB’s collateral easing measures”, The ECB Blog, April.

- See Panetta, F. and Schnabel, I. (2020), “The provision of euro liquidity through the ECB’s swap and repo operations”, The ECB Blog, August.

- See Schnabel, I. (2021), “Asset purchases: from crisis to recovery,” speech at the Annual Conference of Latvijas Banka on "Sustainable Economy in Times of Change," September.

- See also Bailey, A., Bridges, J., Harrison, R., Jones, J. and Mankodi, A. (2020), “The central bank balance sheet as a policy tool: past, present and future,” Bank of England Staff Working Paper, No. 899.

- See, for instance, Vayanos, D. and Vila, J.-L. (2021), “A Preferred-Habitat Model of the Term Structure of Interest Rates”, Econometrica, Vol. 89(1), pp. 77-112; Li, C. and Wei, M. (2013), “Term Structure Modeling with Supply Factors and the Federal Reserve's Large-Scale Asset purchase Programs”, International Journal of Central Banking, Vol. 9(1), pp. 3-39; Eser, F., Lemke, W., Nyholm, K., Radde, S., and Vladu, A. (2019), "Tracing the impact of the ECB’s asset purchase programme on the yield curve", ECB Working Paper Series, No 2293.

- See also Altavilla, C., Lemke, W., Linzert, T., Tapking, J. and von Landesberger, J. (2021), “Assessing the efficacy, efficiency and potential side effects of the ECB’s monetary policy instruments since 2014,” ECB Occasional Paper Series, No 278.

- Our revised forward guidance firmly anchors any policy tightening to inflation reaching two percent well ahead of the end of our projection horizon and durably for the rest of the projection horizon, and to realised progress in underlying inflation being sufficiently advanced to be consistent with inflation stabilising at two percent over the medium term.

Europäische Zentralbank

Generaldirektion Kommunikation

- Sonnemannstraße 20

- 60314 Frankfurt am Main, Deutschland

- +49 69 1344 7455

- media@ecb.europa.eu

Nachdruck nur mit Quellenangabe gestattet.

Ansprechpartner für Medienvertreter-

1 October 2021