20 Years of European Economic and Monetary Union: Selected takeaways from the ECB’s Sintra Forum

2 September 2019

On the occasion of the 20th anniversary of the euro, the experiences with EMU so far and crucial factors for its success going forward were at the core of the European Central Bank’s 2019 Sintra Forum on Central Banking. In this column two of the organisers highlight some of the main points from the discussions, including the diverse progress with economic convergence and how it may relate to the geographic agglomeration of industries, the role of fiscal policies relative to monetary policy for macroeconomic stabilisation in the still incomplete monetary union, and selected key determinants of future growth in the euro area (such as demographic forces). The papers, presentations and video recordings of all sessions can be found on the ECB website.

1 Convergence, agglomeration and growth in the euro area

A widely debated issue relating to the proper functioning of currency unions in general and EMU in particular is the degree of economic convergence among its member countries. For example, the literature on optimum currency areas (see Mongelli 2002 or Dellas and Tavlas 2009 for surveys) highlights the fact that asymmetric shocks make macroeconomic adjustment challenging when monetary policy is unified and can smooth business cycles only at the area-wide level. Building on the growth and economic development literature (see e.g. Barro and Sala-i-Martin 1992 and, for a survey, de la Fuente 1997), convergence of per-capita GDP towards high levels is tantamount to spread the benefits of a monetary union evenly.

Jean Imbs (in Imbs and Pauwels 2019) adopted the conjectural perspective, which is particularly relevant for monetary policy. Over the first 20 years he finds significant sigma-convergence – i.e. cross-country synchronisation treating upturns and downturns equally – in GDP (see also Draghi 2019) and, in particular after 2013, consumption growth between the twelve early EMU member countries. A major contribution of the paper – based on a novel analysis of supply chains as captured in input-output tables – is that the overall “export intensity” of euro area countries is as important as, or even more important than, direct trade in explaining the observed convergence in GDP growth. Note that “export intensity” also includes upstream sectors that provide inputs to export-oriented sectors in the same country but do not trade much across borders themselves. For example, services – such as transportation, hotels or business services – play an important role in these input sectors. Therefore, euro area GDP synchronisation reflects a deep form of integration that is not observed in other regions of the world without a monetary union.

Sebnem Kalemli-Özcan (2019) added in her Sintra discussion the structural perspective on GDP per-capita levels, the so-called beta-convergence that focuses on countries catching up and moving from low to high levels. It recently received a lot of attention, because many of the newer Member States that joined the euro after 2007 exhibit significant convergence towards the euro area average, whereas some initial member countries from southern Europe exhibit protracted diverging tendencies (e.g. Sondermann et al. 2019, Chart 2). Diaz del Hoyo et al. (2017) argue that the main reason for the lack of convergence in the latter countries is a gradual reduction in total factor productivity growth, which began long before they introduced the euro.

As the different trends in different groups of countries offset each other, Kalemli-Özcan finds neither catch-up nor divergence in real per-capita GDP levels across euro area countries once she controls for standard growth determinants such as demographic variables or education. Interestingly, however, the picture changes when countries are broken down in regions. Running the same regressions at the regional level she finds clear evidence that – on average – poorer regions in the euro area catch up with richer regions (Table 1). One caveat remains, however, as a Bruegel paper that was presented to the April 2019 ECOFIN meeting emphasises: regional convergence is quite uneven, with many regions in France, Greece, Italy, Portugal and Spain underperforming (see Demertzis et al. 2019, Figure 4).

Table 1

Catch-up (beta-convergence) of euro area regions with low real per-capita GDP levels

Notes: The table shows the estimation results of different specifications of the following equation for regional beta-convergence and for different periods:

.

is real per-capita GDP in region i at time t and

represents a group of country-level control variables (1/life expectancy (years), log of fertility rate (%), and the share of the population with more than a secondary education (%)), which may be extended by export intensity – taken from Imbs and Pauwels (2019) – or country fixed effects (FE). Y means that variables are included.

Source: Reproduced from Kalemli-Özcan (2019), Table 1.

Looking forward, one important factor influencing future (regional) economic convergence and growth in the euro area is how industrial structures agglomerate geographically. Think, for example, of Silicon Valley in the United States and the start-up and “superstar firms” that determine its productive potential. In joint work with Maggie Chen and Harald Fadinger, Laura Alfaro applied a new continuous index of agglomeration (that measures agglomeration as distinct from market concentration) to a huge plant-level data set (Alfaro et al. 2019). Looking at the manufacturing sector in 2004, they find a hub-and-spoke structure in the geographic distribution of plants, with larger, more productive plants (which are often parts of multinational companies) being the centre towards which other plants gravitate. Importantly, Chart 1 suggests that, in euro area regions, greater manufacturing agglomeration in 2004 was associated with higher average real GDP growth between 2005 and 2017. Quantitatively, an approximately 50% increase in the probability that plants are within 50 km of each other is associated with an increase of the average annual regional growth rate from 1.1 to 1.5 percent (although causality cannot be claimed).

Chart 1

Average real regional GDP growth rates (2005-2017) and industrial agglomeration (2004) in the euro area

Note: The vertical axis shows the average annual real GDP growth rate for the euro area NUTS2 regions between 2005 and 2017. The horizontal axis shows an industry-region level agglomeration index. The agglomeration index for plant i captures the relative probability that other plants (from the same industry) agglomerate around plant i (within a certain distance, in this case 50 km) rather than around other plants in the same country and industry. This plant-level index is then averaged at the industry-region level. A higher agglomeration index implies more agglomeration. The grey line shows the expected (conditional) regional growth for different levels of industry-region agglomeration, based on the following estimation:

where r denotes regions and k industry sectors,

is the industry-region level agglomeration index,

represents a group of regional control variables (the level of per-capita GDP, population density, the fraction of the population with more than a secondary education and R&D expenditures, all measured in 2004) and

is an industry fixed effect.

Source: Reproduced from Alfaro, Chen and Fadinger (2019), Chart 3.

While the discussant, Gianmarco Ottaviano (2019), endorsed the efficiency and growth effects of such agglomeration, he highlighted two related side effects about which must be noted. First, increasingly de-industrialised (“peripheral”) regions are being left behind, with unemployment and declining living standards. Second, voters in the most negatively affected regions turn to populist and right-wing parties that question the current economic and political system. For example, Colantone and Stanig (2018a,b) show causality in this regard for the UK Brexit vote and elections in western European countries, respectively. Overall, these facts are consistent with both Baldwin’s (2016) Great Convergence at the global level (some major emerging market economies catching up with the leading advanced countries) and Moretti’s (2012) Great Divergence at the regional level.

2 Macroeconomic stabilisation policy and the completion of EMU

Given the degree of convergence achieved in the euro area, the next question is the suitability of area-wide and national macroeconomic stabilisation policies. Many speakers mentioned the overall success of the ECB’s monetary policy during its first 20 years (in line with research by Hartmann and Smets 2018), which provided a stable inflation anchor (e.g. Brunnermeier 2019 or Reis 2019) and showed the ECB’s ability to act even in difficult circumstances and be innovative when necessary (e.g. Boone 2019 or Praet 2019), including President Draghi’s leadership in ensuring the ECB’s readiness to do “whatever it takes to preserve the euro” during the European sovereign debt crisis (e.g. Blanchard 2019 or Juncker 2019).

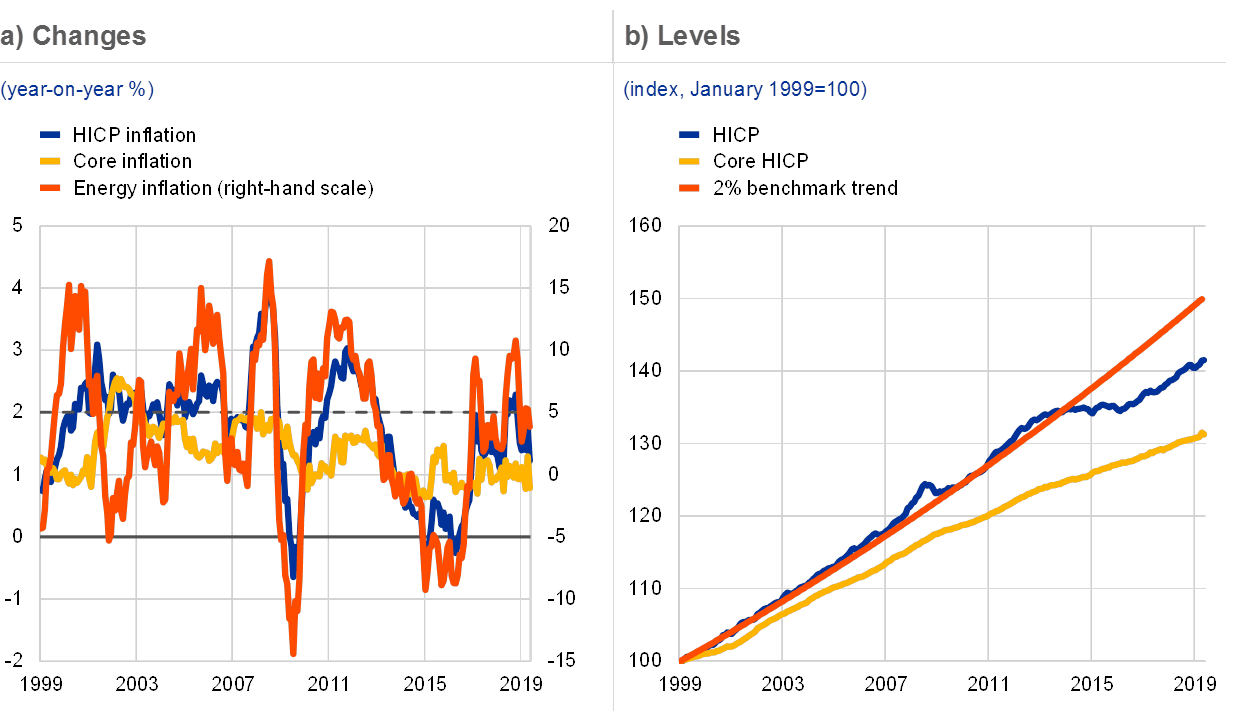

More specifically, Ricardo Reis (2019) and Peter Praet (2019) showed that between 1999 and 2013 the ECB’s preferred headline inflation gauge, based on the Harmonised Index of Consumer Prices in the euro area, moved relatively closely to the ECB’s aim of below but close to two percent (see Chart 2). Thereafter, however, protracted downward deviations set in, as part of a low-inflation recovery following the sovereign debt crisis. Drawing on Rostagno et al. (2019), Mario Draghi (2019) and Peter Praet (2019) also highlighted that core inflation (HICP inflation stripped of volatile components such as energy and food prices) evolved along a lower trend than headline since well before the financial crisis (Chart 2). The stabilisation of headline inflation in the presence of large upward oil price shocks (see the dashed red line in panel a) of Chart 2) would necessarily imply a lower path for core inflation. In addition to the scars from the sovereign debt crisis later, Draghi and Praet argued that this may have contributed to the subsequent low inflation environment. Moreover, in order to further underline the ECB’s symmetric pursuance of its inflation aim Peter Praet suggested revisiting the formulation of below but close to two percent going forward and Mario Draghi (2019) highlighted that after a long spell below the aim inflation would have to be above the aim for some time in the future.

Chart 2

Headline inflation, core inflation and energy price shocks in the euro area

Note: Core inflation is HICP inflation excluding food and energy. Panel a) shows monthly HICP and core inflation on the left y-axis and energy inflation on the right y-axis. Panel b) compares a 2% trend line with the actual HICP and core HICP levels.

Source: Reproduced from Praet, Guilhem and Vidal (2019), Charts 3 and 4.

At the same time, many participants seemed to share the view that macroeconomic stabilisation in the euro area can only function properly when other EMU features and institutions are also designed adequately. This particularly applies to the fiscal arena, which remains a national responsibility in EMU – with some common rules applicable to individual countries – and whose imperfect functioning placed an over-proportional share of the stabilisation burden on ECB monetary policy, notably since the aggravation of the sovereign debt crisis (Draghi 2019, Praet 2019 and Rey 2019). Chart 3 shows an extreme example, among others, when in 2012-2013 a strongly pro-cyclical fiscal tightening occurred, precisely at a time when macroeconomic stimulus was essential (Praet 2019).

Chart 3

Cyclicality of the aggregate of euro area countries’ fiscal policies

(% of potential GDP)

Note: The euro area fiscal stance is calculated as the combination of member countries’ changes in their primary balances in % of potential GDP. (For data availability, cyclically adjusted primary balances are used before 2010 and structural primary balances thereafter.) Observations in the upper-left (upper-right) area indicate a period of pro-cyclical (counter-cyclical) fiscal tightening, while observations in the lower-left (lower-right) area imply a period of counter-cyclical (pro-cyclical) fiscal easing.

Source: Reproduced from Praet, Guilhem and Vidal (2019), Chart 16.

More generally, Laurence Boone (2019), Hélène Rey (2019) and Gita Gopinath (2019) expressed strong support for some central fiscal stabilisation capacity. For example, decentralised fiscal policies imply a focus on domestic situations and a negligence of positive cross-border spillovers (Blanchard 2019 and Boone 2019). Moreover, when countries that lack fiscal space are hit by a negative economic shock, rules focusing on the situations of individual countries may result in insufficient support for the area as a whole. Volker Wieland, however, observed a disconnect between these calls for fiscal centralisation and what citizens in euro area countries seem to vote for. The budgetary instrument for convergence and competitiveness (BICC) that the Eurogroup (2019) agreed in June 2019 does not contain a stabilisation function.

Blanchard (2019), Reis (2019) and Rey (2019) also raised the issue of current account and relative price adjustments when shocks are not uniform across euro area countries. If member countries with stronger growth maintain low inflation and run current account surpluses, it becomes even more difficult for the countries with weaker growth to recover. In their view, macroeconomic stabilisation in the euro area would function better if there was greater fiscal stimulus in the surplus countries with more fiscal space and more flexibility towards higher inflation.

In order to improve the financial and prudential features of EMU, Laurence Boone (2019) and Gita Gopinath (2019) called for further progress with the European capital markets and banking union projects (e.g. a European Deposit Insurance Scheme and a large enough fiscal backstop for the Single Resolution Fund). In order to avoid further “procrastination” in solving Europe’s banking problems; Martin Hellwig (2019) saw the first priority for the banking union to be improving the resolution regime. The necessary political legitimacy of required interventions in national banking systems can, however, only be ensured if sufficient executive and legislative powers are raised to the area-wide level and encourage public discussions that cut across national borders.

3 Demographic change, growth and inflation

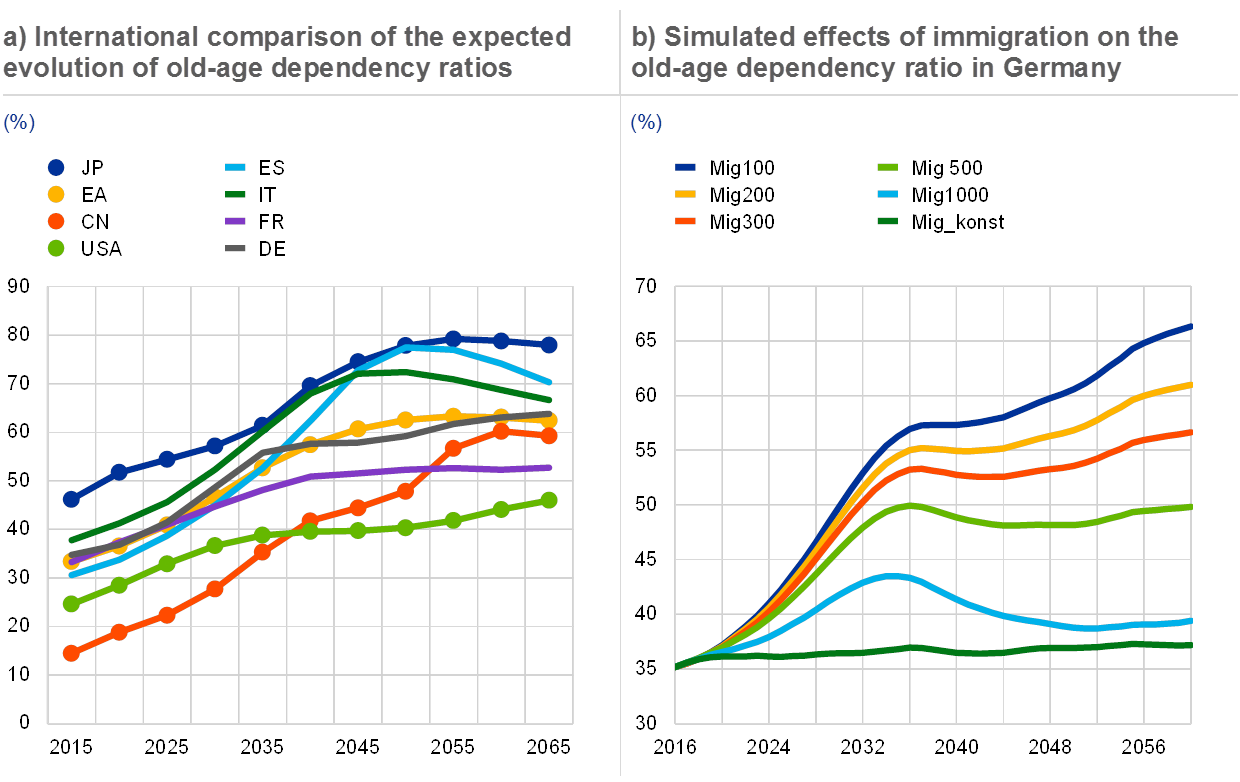

Ultimately, EMU can only be successful if member countries experience strong enough growth and employment. Axel Börsch-Supan addressed one particularly important factor, which is demographic change (Börsch-Supan et al. 2019). Panel a) of Chart 4 shows that there will be significant population ageing in the euro area over the next 30- to 40 years. Importantly, this process will be very diverse across countries. Italy and Spain are predicted to age significantly more than France, for example.

Chart 4

Ageing and migration

Note: The old-age dependency ratio is defined as the number of people aged 65 or above divided by the number of people aged 20-64 (people deemed to be of working age). Abbreviations in panel a): JP=Japan; EA=euro area; CN=China; USA=United States; ES=Spain; IT=Italy; FR=France and DE=Germany. The upper coloured lines in panel b) show the simulated evolution of the German dependency ratio for different annual net immigration figures between 2016 and 2060: Mig100=100,000 immigrants, Mig200=200,000 immigrants and so on. The bottom line (Mig_konst) represents the scenario in which net immigration would keep the old-age dependency ratio roughly constant (e.g. about 1.5 million immigrants per annum between 2016 and 2025).

Source: Reproduced from Börsch-Supan, Leite and Rausch 2019), Charts 1 and 4.

Börsch-Supan et al. (2019) use a general equilibrium overlapping generations (OLG) model to simulate that this ageing process could reduce euro area per-capita GDP (approximated by the aggregate of its three largest economies, France, Germany and Italy) by a cumulative 8.7 percent between 2015 and 2030. However, labour market reforms, pension reforms and international flows of capital, labour and goods and services would moderate this negative effect. For example, implementing reforms that gradually increase the retirement age by two years, decrease the job entry age by two years, increase female labour force participation to 90 percent of the rate for men, and reduce unemployment rates to the non-accelerating inflation rate of unemployment (NAIRU) would almost completely undo the drop in per-capita GDP. Börsch-Supan called on European governments to actively use the necessary pension, labour market and education reforms in a forward-looking manner and to facilitate the capital deepening associated with a reduction in the working age population through adequate investments in digitisation.

In contrast, Börsch-Supan reckoned that the direct impact of plausible streams of (typically relatively young) immigrants is unlikely to offset the ageing of the domestic population. The upper lines in panel b) of Chart 4 show simulations of the effects of net immigration into Germany of between 100,000 and 1,000,000 people on the old-age dependency ratio (roughly the share of retired people relative to the working age population). Only the green line (Mig_konst), which corresponds (on average) to about 1.5 million immigrants per annum over the next 15 years (with a peak of 2.1 million in 2021), would neutralise population ageing. Such numbers are clearly not feasible in the light of the reversal of attitudes in the German population which followed the 2015 peak of 950,000 immigrants during the refugee crisis.

Anna Maria Mayda (2019) added in her discussion, however, that the impact of migration on ageing and its growth implications would be more forceful when indirect effects were also taken into account. First, migrants tend to have higher fertility rates than natives. Second, low-skilled immigration can increase the labour force participation of high-skilled native women, as low-skilled immigrants often take over services in households (e.g. Cortes and Tessada 2011). Third, skilled immigrants have a positive impact on innovation and – as a consequence – on productivity (e.g. Hunt and Gauthier-Loiselle 2010).

Importantly for central banks, population ageing also affects inflation; even though the literature is inconclusive about whether the relationship is generally negative or positive (see e.g. Gajewski 2015 versus Lindh and Malmberg 1998). Simulations by Härtl and Leite (2018) using the computational general equilibrium OLG model suggest that different channels have contributed to disinflationary pressures in both France and Germany since the 1990s (see Chart 23 in Börsch-Supan et al. 2019). As the ageing process is more advanced in Germany than in France (see Chart 4, panel a)), however, the disinflationary tendency is more pronounced in Germany, and will remain so for the next decade. In line with these results, ECB staff recently estimated a positive long-run relationship between the growth rate of the working age population and inflation in the euro area (Bobeica, Lis, Nickel and Sun 2017).

Authors’ note: All views expressed are summarised to the best of our understanding from the various Sintra participants’ Forum contributions and should not be interpreted as the views of the ECB or the Eurosystem.

References

Alfaro, L., Chen, M. and Fadinger, H. (2019), “Superstar firms and spatial agglomeration: An exploration of effects in Europe”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Baldwin, R. (2016), The Great Convergence: Information Technology and the New Globalization, Harvard University Press, Cambridge.

Barro, RJ. and Sala-i-Martin, X. (1992), “Convergence”, Journal of Political Economy, Vol. 100 (2).

Blanchard, O. (2019), “How to strengthen the euro macro-policy architecture?”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Bobeica, E., Lis, E., Nickel, C. and Sun, Y. (2017), “Demographics and inflation”, Working Paper Series, No 2006, ECB, Frankfurt am Main, January.

Boone, L. (2019), “Policy mistakes and architectural deficiencies: A critical assessment of the first 20 years of the single currency”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Börsch-Supan, A., Leite, D. and Rauch, J. (2019), “Demographic changes, migration and economic growth in the euro area”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Brookings Papers on Economic Activity (2018), “Comments and discussion”, The Brookings Institution, Washington, forthcoming in the Fall issue.

Brunnermeier, M. (2019), “The Euro at 20: challenges and solutions”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Colantone, I. and Stanig, P. (2018), “Global competition and Brexit”, American Political Science Review, Vol. 112 (2).

Colantone, I. and Stanig, P. (2018), “The trade origins of economic nationalism: import competition and voting behaviour in Western Europe”, American Journal of Political Science, Vol. 62 (4).

Cortes, P. and Tessada, J. (2011), “Low-skilled immigration and labor supply of highly skilled women”, American Economic Journal: Applied Economics, Vol. 3 (3).

de la Fuente, A. (1997), “The empirics of growth and convergence: a selective review”, Journal of Economic Dynamics and Control, Vol. 21 (1).

Dellas, H. and Tavlas, G.S. (2009), “An optimum-currency-area odyssey”, Journal of International Money and Finance, Vol. 28 (7).

Demertzis, M., Sapir, A. and Wolff, G. (2019), “Promoting sustainable and inclusive growth and convergence in the European Union”, Bruegel Policy Contribution, No. 7, April.

Diaz del Hoyo, J.L., Dorrucci, E., Heinz, F. and Muzikarova, S. (2017), “Real convergence in the euro area: a long-term perspective”, Occasional Paper Series, No 203, ECB, Frankfurt am Main, December.

Draghi, M. (2019), “Twenty years of the ECB’s monetary policy”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Eurogroup (2019), “Term sheet on the Budgetary Instrument for Convergence and Competitiveness”, press release, 14 June.

European Central Bank (2019), 20 Years of European Economic and Monetary Union, Frankfurt am Main, forthcoming.

Fratzscher, M. (2019), “Turning the euro into a global currency should be a high priority for Europe”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Gajewski, P. (2015), “Is ageing deflationary? Some evidence from OECD countries”, Applied Economic Letters, Vol. 22 (11).

General Secretariat of the European Council (2018), “Euro Summit meeting – Statement”, Brussels, 14 December.

Gopinath, G. (2019), “The future of the EMU”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Hartmann, P. and Smets, F. (2018), “The first twenty years of the European Central Bank: monetary policy”, Working Paper Series, No 2219, ECB, Frankfurt am Main, December, forthcoming as “The European Central Bank’s monetary policy during its first 20 years” in The Brookings Papers on Economic Activity, The Brookings Institution, Washington, Fall.

Härtl, K. and Leite, D. (2018), “The aging inflation puzzle: on the interplay between aging, inflation and pension systems”, MEA Discussion Papers, No 06-2018, Munich Center for the Economics of Aging, Munich.

Hunt, J. and Gauthier-Loiselle, M. (2010), “How much does immigration boost innovation”, American Economic Journal: Macroeconomics, Vol. 2 (2).

Imbs, J. and Pauwels, L. (2019), “Real convergence in the EMU”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Juncker, J.-C. (2019), “Building the euro: moments in time, lessons in history”, speech at the European Central Bank Sintra Forum on Central Banking on “20 Years of European Economic and Monetary Union”, Sintra, 19 June.

Kalemli-Özcan, S. (2019), Comment on “Real convergence in the EMU” by J. Imbs and L. Pauwels, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Lindh, T. and Malmberg, B. (1998), “Age structure and inflation – a Wicksellian interpretation of the OECD data”, Journal of Economic Behavior & Organization, Vol. 36 (1).

Mayda, A. (2019), Comment on “Demographic changes, migration and economic growth in the euro area” by A. Börsch-Supan, D. Leite and J. Rauch, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Mongelli, F.P. (2002), “'New' views on the optimum currency area theory: what is EMU telling us?”, Working Paper Series, No 138, ECB, Frankfurt am Main.

Moretti, E. (2012), The New Geography of Jobs, New York: Houghton Mifflin Harcourt.

Ottaviano, G. (2019), Comment on “Superstar firms and spatial agglomeration: an exploration of effects in Europe”, by L. Alfaro, M. Chen and H. Fadinger, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Praet, P., Saint-Guilhem, A. and Vidal, J.-P. (2019), “The single monetary policy: 20 years of experience”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Reis, R. (2019), “The second decade of the euro: old challenges in new clothes”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Rey, H. (2019), “Key issues for the euro area”, forthcoming in 20 Years of European Economic and Monetary Union, ECB, Frankfurt am Main.

Rostagno, M., Altavilla, C., Carboni, G. Lemke, W., Motto, R., Saint Guilhem, A. and Yiangou, J. (2019), unpublished manuscript, ECB.

Sondermann, D. (editor), Consolo, A., Gunnella, V., Koester, G., Lambrias, K., López-Garcia, P., Nerlich, C., Petroulakis, F., Saiz, L. and Serafin, R. (2019), “Economic structures 20 years into the euro”, Occasional Paper Series, No 224, ECB, Frankfurt am Main, June.