- RESEARCH BULLETIN NO. 64

- 27 November 2019

Finance and decarbonisation: why equity markets do it better

This article provides evidence that economies receiving more funding from stock markets than credit markets generate less carbon. Increasing the equity financing share to one-half globally would reduce aggregate per capita carbon emissions by about one-quarter of the Paris Agreement commitment. Our findings call for supporting equity-based initiatives rather than policies aimed at decarbonising the European economy through the banking sector.

Financial markets and global warming

The 2015 Paris Climate Conference firmly put at the heart of the debate on environmental degradation a sector of the economy that may surprise some readers: finance. Accordingly, the leaders of the G20 stated their intention to fund low-carbon infrastructure and other climate solutions by scaling up so-called green finance initiatives. Key examples are the burgeoning market for green bonds, whose issuance reached USD 48 billion in the first quarter of 2019[2], and the creation of a green credit department by the largest financial institution in the world, the Industrial and Commercial Bank of China.

Somewhat paradoxically, the interest in green finance has also laid bare our limited understanding of the relationship between traditional finance and the environment. Yet it is important for us to understand that relationship, because most of the global transition to a low-carbon economy will need to be funded by the private financial sector if international climate goals are to be met on time (UNEP, 2011). Are expanding financial markets detrimental to the environment? Do they cause harm, for instance, by fuelling economic growth and the concomitant emission of pollutants? Or, do they steer economies towards sustainable growth by favouring green sectors over so-called brown ones? And is there a difference in this regard between credit markets and equity markets? Do they have the same impact on environmental degradation, or does it make economic sense to stimulate one segment of the financial system at the expense of the other?

We explore those questions in this article, which is based on a recent ECB working paper (De Haas and Popov, 2019). Here, as in the working paper, we present novel evidence that, when it comes to addressing climate change, not all financial markets are created equal. As it turns out, stock markets are superior to banks in decarbonising the economy. As we show, for a given level of economic development, financial development, and environmental protection, economies generate fewer carbon emissions per capita if they receive relatively more of their funding from stock markets than from credit markets.

Financial markets over time: size and structure

To determine whether or not financial intermediation has an effect on carbon emissions, we focused on the two main characteristics of a country’s financial markets: their overall size and their structure. We define the size of financial markets, or the extent of overall financial development (FD), as the sum of total private credit and total stock market capitalisation, divided by GDP. Financial structure (FS) is defined as total stock market capitalisation divided by the sum of total private credit and total stock market capitalisation.[3]

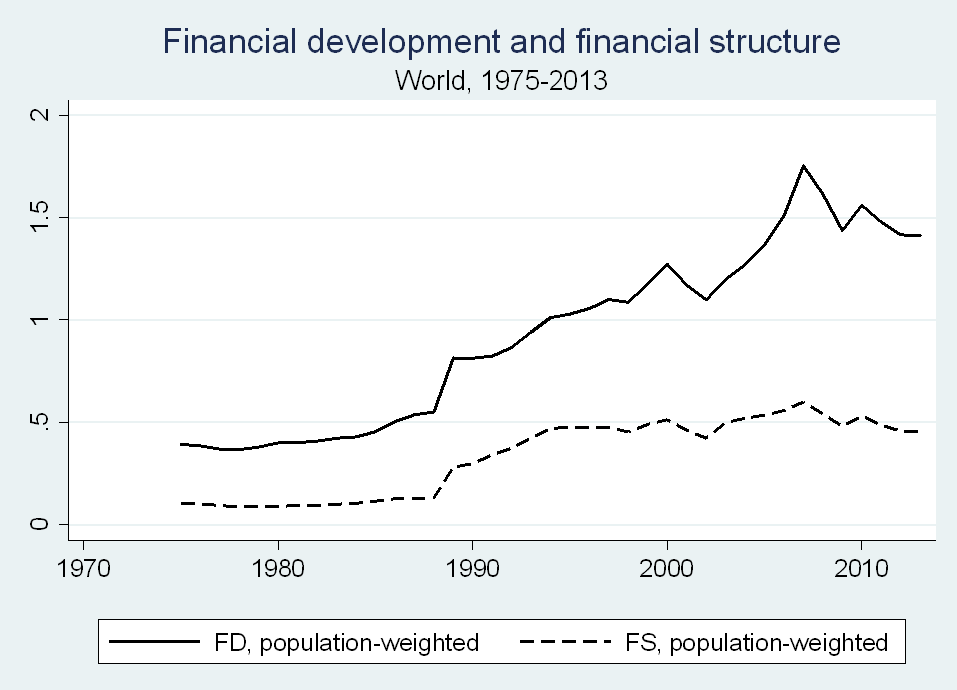

Chart 1 plots the annual sample average of FD and FS between 1974 and 2013. During these four decades, the overall size of financial systems more than tripled (relative to GDP). In addition, the relative importance of stock markets more than doubled during this period. That is, stock markets tend to catch up with credit markets at later stages of economic development.[4]

Chart 1

Global financial development and structure over time

Note: The chart plots population-weighted global financial development and population-weighted financial structure between 1975 and 2013.

The debt-equity mix and carbon emissions

Our working paper contains four findings that we want to highlight here. Taken together, the findings suggest that if a country wants to decarbonise its economy, it should not only promote green finance initiatives such as green bonds, but also develop its equity markets. Let us discuss each finding in turn.

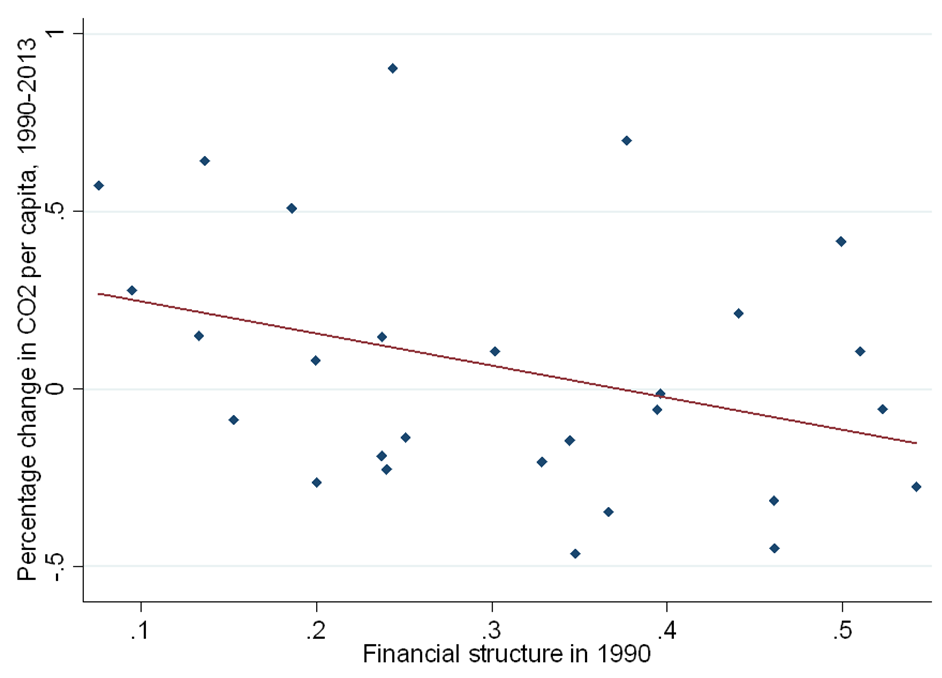

Our first finding is that economies that receive relatively more of their funding from stock markets than from credit markets generate fewer carbon emissions per capita. In other words, financial structure matters. By contrast, financial development does not: the overall size of financial markets does not appear to play a role in the environmental performance of the economy. Chart 2 illustrates this result: between 1990 and 2013, per capita carbon emissions declined further in countries where stock markets were relatively more important in 1990.

Chart 2

Financial structure and carbon emissions

Note: “Financial structure in 1990” is defined as total stock market capitalisation divided by the sum of total private credit and total stock market capitalisation, for each country, in 1990.

Numerically, our estimates suggest that increasing the share of equity financing by 1 percentage point, while holding the size of the financial system constant, reduces aggregate per capita carbon emissions by 0.024 metric tonnes. What are the aggregate implications of this? We note that for a number of countries with large banking sectors, such as Australia, Canada, Finland, and the Netherlands, FS is approximately 0.5 throughout the sample period. Suppose that we take all countries below this threshold and lift them to FS=0.5, and we leave every country with FS>0.5 unchanged. For about 80% of the countries in the data set, this would imply an average increase in FS of 0.2 (from an average of around 0.3). This hypothetical shift in the global financial structure would lower aggregate emissions by 11.5%, or one-quarter of the 40% reduction in emissions that EU countries committed to achieve by 2030 in the context of the Paris Agreement.

The faster decline in aggregate emissions per capita in countries with more equity-based financial systems is mirrored by a faster decline in sector-level per capita carbon emissions. This is especially true in sectors that are more carbon-intensive for technological purposes (e.g. water transportation or energy production), and is driven by two separate mechanisms. First, holding sector-specific technologies constant, stock markets are better than banks at reallocating investment towards greener sectors.[5] Second, holding the industrial composition constant, a more equity-based economy experiences a faster reduction in carbon emissions per unit of output in carbon-intensive sectors. Why? In fact, deeper stock markets are associated with more green patenting in traditionally carbon-intensive industries. This effect is strongest for patented inventions whose goal is to increase the energy efficiency of the production and processing of goods. The effect of equity markets on energy efficiency is strengthened when we account for private equity, confirming the important role that investors such as venture capitalists play in innovation and technological adoption (Kortum and Lerner, 2000).

Third, we show that there is a positive link between equity funding and lower carbon emissions at the firm level, too. Consider what happened in Belgium. In 2006, Belgium introduced a notional interest deduction for corporate equity, mainly to reduce a tax advantage for companies issuing debt rather than equity. This policy shock provides an arguably exogenous source of variation in the cost of equity financing. Matched data from Orbis and from the EU Emissions Trading System suggest that the reform caused Belgian non-financial firms to increase their equity ratio by about 5% of the sample mean, an adjustment similar to that of Belgian banks (Schepens, 2016). Subsequently, these same firms reduced the carbon intensity of their production, both overall and in comparison to similar firms in the same sector in neighbouring countries.

Finally, the reduction in emissions by carbon-intensive sectors due to domestic stock market development is accompanied by an increase in carbon emissions embedded in imports of final and intermediary goods of the same sector. This effect is stronger for sectors that can easily outsource part of their production structure abroad. This may sound undesirable: if all equity investors do is push firms to export carbon‑intensive production processes abroad, the aggregate effect – from the point of view of planet Earth – will be zero. However, the domestic greening effect dominates the pollution outsourcing effect by a factor of ten. Stock markets thus have a genuine cleansing effect on polluting industries and do not simply help such industries to shift carbon-intensive activities to “pollution havens”; a finding consistent with the negligible role played by outsourcing in the clean-up of US manufacturing (Levinson, 2009).

Why is equity superior to debt in decarbonising the economy?

Why does an increase in the availability of equity finance over time speed up the decarbonisation of the economy? The first explanation is related to innovation and asset tangibility. Relative to carbon-intensive sectors, energy-efficient sectors tend to be more innovative and less rich in tangible assets. But it is precisely innovative sectors (i.e. R&D intensive ones) that grow faster in countries with deeper stock markets, while sectors rich in tangible assets expand faster in economies that rely more on bank financing (Kim and Weisbach, 2008; Brown et al., 2017).

The second explanation is that equity investors see green firms as less likely to suffer environmental disasters – and hence less likely to be involved in litigation (Klassen and McLaughlin, 1996). Large-scale ecological accidents, such as the Bhopal gas tragedy or the Exxon Valdez oil spill, are associated with extremely high litigation risk (Salinger, 1992). The technological greening of carbon-intensive sectors as stock markets develop is, to a large degree, explained by equity investors pushing such sectors to adopt and develop greener technologies because they are concerned about future litigation costs.

At the same time, litigation risk does not fully explain away the positive effect that equity investment has on the reduction in carbon emissions per unit of output in carbon-intensive sectors. Our results thus allow for the possibility that alternative mechanisms are also at work, such as individual investors having different social objectives than banks, although this is difficult to test.

Concluding remarks

Our results suggest countries with bank-based financial systems that aim to decarbonise their economy should not only promote green finance initiatives such as green bonds, but also consider stimulating the development of equity markets. Equity investment can play an important role in the transition to low-carbon economies, in particular by stimulating innovation that leads to the adoption of greener technologies. One simple measure in this regard is to reduce or eliminate tax benefits that favour debt over equity, a reform that is already on the table in the context of the European Commission’s Capital Markets Union.

In parallel, countries can take measures to counterbalance the tendency of credit markets to finance relatively carbon-intensive sectors and firms – banks could be asked to disclose information about the environmental performance of the firms they fund, for example. Or, countries could introduce green credit guidelines, as China and Brazil have recently done, to encourage banks to improve their environmental performance and to lend more to firms that are part of the low‑carbon economy.

References

Beck, T. and Levine, R. (2002), “Industry Growth and Capital Allocation: Does Having a Market- or Bank-Based System Matter?”, Journal of Financial Economics, Vol. 64, pp. 147-180.

Brown, J., Martinsson, G. and Petersen, B. (2017), “Stock Markets, Credit Markets, and Technology-led Growth”, Journal of Financial Intermediation, Vol. 32, pp. 45–59.

De Haas, R. and Popov, A. (2019), “Finance and Carbon Emissions,” ECB Working Paper Series, No 2318.

Hsu, P.-H., Tian, X. and Xu, Y. (2014), “Financial Development and Innovation: Cross-Country Evidence”, Journal of Financial Economics, Vol. 112, pp. 116-135.

Kim, W. and Weisbach, M. (2008), “Motivations for Public Equity Offers: An International Perspective”, Journal of Financial Economics, Vol. 87, pp. 281-307.

Klassen, R. and McLaughlin, C. (1996), “The Impact of Environmental Management on Firm Performance”, Management Science, Vol. 8, pp. 1199-1214.

Kortum, S. and Lerner, J. (2000), “Assessing the Contribution of Venture Capital to Innovation”, RAND Journal of Economics, Vol. 31, pp. 674-692.

Levinson, A. (2009), “Technology, International Trade, and Pollution from US Manufacturing”, American Economic Review, Vol. 99, pp. 2177-2192.

Salinger, M. (1992), “Value Event Studies”, Review of Economics and Statistics, Vol. 74, pp. 671-677.

Schepens, G. (2016), “Taxes and Bank Capital Structure”, Journal of Financial Economics, Vol. 120, pp. 585-600.

United Nations Environment Programme (UNEP) (2011), “Towards a Green Economy: Pathways to Sustainable Development and Poverty Eradication”, New York.

Wurgler, J. (2000), “Financial Markets and the Allocation of Capital”, Journal of Financial Economics, Vol. 58, pp. 187-214.

- Disclaimer: This article was written by Ralph De Haas (European Bank for Reconstruction and Development) and Alexander Popov (Principal Economist, Directorate General Research, Financial Research Division). It is based on ECB Working Paper 2318 “Finance and carbon emissions”. The authors gratefully acknowledge the comments of Paul Dudenhefer, Alberto Martin, Agatha Doorley and Zoë Sprokel. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

- See https://www.climatebonds.net/files/reports/global_q1_2019_highlights_0.pdf.

- These definitions are in line with prior studies on the link between financial development, financial structure, and growth (e.g. Beck and Levine, 2002; Hsu et al., 2014). Note that we ignore funding through corporate bond markets. We do so for two practical reasons. First, comprehensive data on corporate bond financing are missing for many of the countries in the dataset. Second, in the vast majority of countries for which we have data, corporate bonds account for a negligible share of overall financial intermediation compared with credit markets and stock markets.

- One issue is that both data series are patchy before 1990, especially for Central and Eastern European countries. We have therefore omitted this data, so that our final data set comprises 48 countries observed between 1990 and 2013.

- This mechanism is reminiscent of Wurgler (2000).