The effects of tariff hikes in a world of global value chains

Published as part of the ECB Economic Bulletin, Issue 8/2019.

In the context of the trade conflict between the United States and China, global value chains (GVCs) are a potential factor amplifying the impact of higher tariffs on economic activity. Raising tariffs in a globalised world with international supply chains can have significant negative repercussions on economic activity. In general, global sourcing by firms implies that higher tariffs, usually imposed to protect a domestic industry, can lead to higher input costs for domestic producers. In addition, the effects of higher tariffs may be magnified by GVCs, especially in the case of multistage production processes, where goods move in a sequential manner from upstream to downstream with value added at each stage.[1] Against this background, this box provides some evidence of the adverse effects of tariffs on economic activity in the context of global sourcing and GVCs.

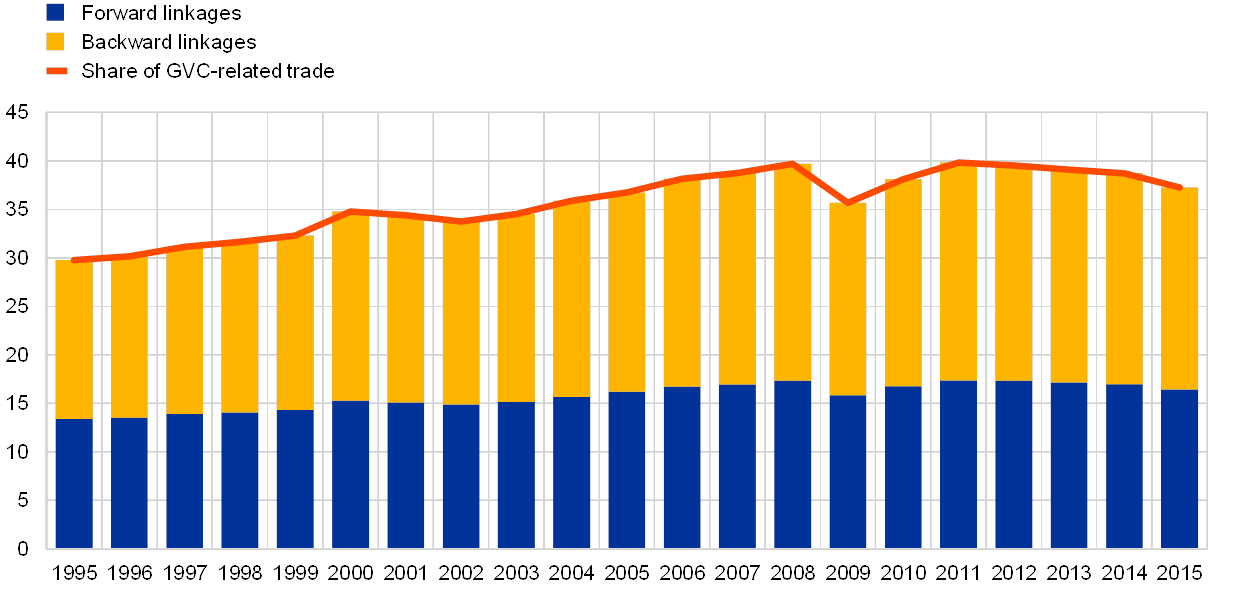

GVC-related trade, defined here as those traded items that cross at least two international borders, expanded over the decade preceding the financial crisis (as a share of total trade), plateaued thereafter and declined during the most recent years with available data (see Chart A).[2] GVC-related trade can be decomposed into the so-called backward and forward linkages. Forward linkages trade refers to a country’s value-added exports that are not absorbed in the final demand of that country’s direct trade partners, but (usually after some processing) are further exported to third markets. Backward linkages trade, on the other hand, comprises the foreign content used to produce a country’s exports.[3] Industries further upstream in the supply chain (e.g. mining, product development) typically have a larger share of forward linkages, while more downstream sectors, such as many manufacturing industries, tend to rely more on backward linkages. Such considerations are of relevance in the context of the magnification effects of higher tariffs due to GVCs, since these depend, among other things, on the share of foreign value added in exports.

Chart A

Evolution of GVC-related trade between 1995 and 2015

(global share of GVC-related exports in total (gross) exports, in %)

Sources: OECD inter-country input-output (ICIO) tables and ECB calculations based on Borin and Mancini (2019).

Note: GVC-related trade includes all traded items that cross at least two international borders. The chart presents the weighted average of the indicators across 64 countries.

Intermediate goods trade can magnify the impact of tariffs on the economy, even more so if there is international multistage production. International trade models which include sectoral linkages and intermediate goods trade suggest higher welfare gains from trade liberalisation than models which do not include these features. This is related to the fact that – when allowing for global sourcing – reductions in trade frictions not only lower the price of final goods but also the input costs faced by firms.[4] Accounting – in addition to this – for a global multistage production structure, where production stages are organised sequentially across borders, may magnify the effects of tariffs.[5] First, as goods cross borders multiple times in international multistage production processes, they may be taxed each time a border is crossed. Second, tariffs are commonly levied on a good’s total (gross) import value, instead of the value added in the most recent production stage. As a result, the smaller the value added in the last production process (relative to its gross value), the larger the effective tariff rate applied to this production stage.

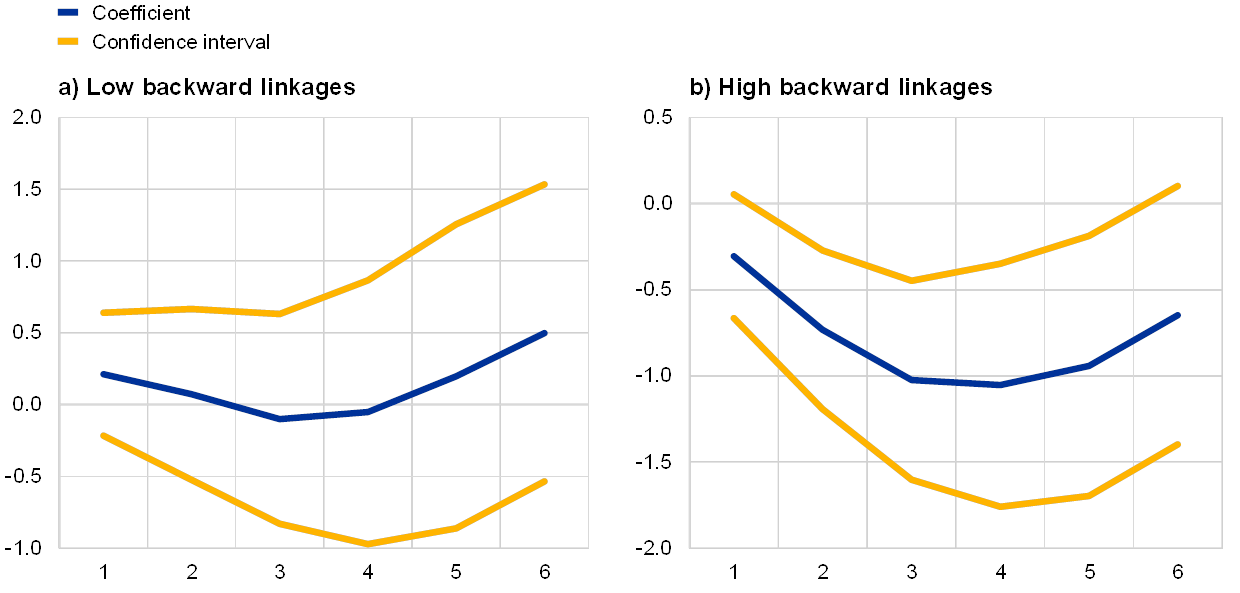

Empirical analysis suggests that tariff hikes can, over the medium term, significantly dampen the economic activity of industries which rely on foreign inputs. Global sourcing activities of firms mean that tariffs meant to protect specific sectors of the economy may at the same time hurt domestic producers in other industries by raising their input costs. Moreover, international multistage production implies that input costs are not only affected by a country’s own tariff schedule, but also by the tariffs applied to production stages further upstream. For example, a tariff imposed by the United States on Chinese exports may hurt Mexican firms downstream if they use US inputs with Chinese content. Consequently, the impact of tariffs on economic activity depends on a country-industry’s position in the supply chain. Chart B presents impulse responses of real industrial production to an increase by one standard deviation of a variable measuring “upstream tariffs” for country-industries with low and high backward linkages, respectively.[6] While an increase in “upstream tariffs” does not significantly affect the real activity of industries with low backward linkages, significant negative effects are found for industries downstream in the value chain (i.e. with high backward linkages), which seems intuitive since their production process relies on foreign inputs.[7] For such industries, a one standard deviation rise in upstream tariffs is associated with a decrease in industrial production by one percentage point after three years. This effect becomes statistically insignificant after six years.

Chart B

Impulse responses of real industrial production to an increase in upstream (input) tariffs over a horizon of six years

(responses in pp and 90% confidence intervals)

Sources: UNIDO, OECD, WITS, BACI, ECB calculations.

Notes: Impulse responses refer to a tariff shock of one standard deviation. Country-industries with high (low) backward linkages are country-industries at the 80th (20th) percentile of the distribution of the variable. Backward linkages measure the foreign content in a country-industry’s exports and are computed using the approach of Borin and Mancini (2019). More details about the data and the estimation approach are presented in footnote 7.

The magnification effects of tariffs due to international multistage production mean that trade flows associated with downstream sectors are especially sensitive to tariffs, which is consistent with estimation results obtained from a gravity model. Since the value of output accumulates along the value chain, ad valorem trade costs (like tariffs) are higher in absolute terms for downstream producers. Moreover, international multistage production implies that the cost savings derived from relocation apply only to the value added of the particular production stage being relocated, while ad valorem trade costs are levied on the stage’s full value of output. Both aspects suggest that downstream sectors can be expected to be especially sensitive to tariffs, which would be consistent with tariff magnification effects due to multistage production.[8] This can be tested empirically by employing an empirical gravity framework with tariffs, where bilateral industry-level exports are regressed on time-varying bilateral industry-level tariff rates and a battery of fixed effects to control for other trade cost components.[9] The tariff coefficient is here allowed to vary with the degree of foreign content in bilateral exports in order to investigate whether a larger foreign content share (i.e. more backward) is associated with higher trade cost sensitivity. Empirical results indeed suggest that the sensitivity of trade to tariffs increases sharply with the foreign content in bilateral trade flows (see Chart C). While sectors with low backward linkages have a tariff elasticity of close to -0.8, it amounts to around -1.4 for sectors with a medium degree of foreign content, and it jumps to -2.1 for trade flows with high backward linkages.[10] These findings are therefore consistent with significant magnification effects of tariffs in the presence of sequentially organised international supply chains.

Chart C

Sensitivity of exports to tariffs by backward linkages

(estimated coefficients and 95% confidence intervals)

Sources: OECD, WITS, BACI, ECB calculations.

Notes: Low, medium-low, medium-high and high backward linkages refer to the four quartiles of the distribution of the backward linkages variable. Backward linkages measure the foreign content in a country-industry’s exports and are computed using the approach of Borin and Mancini (2019). The dependent variable refers to bilateral industry-level exports, which are regressed on bilateral industry-specific tariff rates, controlling for other factors affecting exports with appropriate fixed effects. More details about the data and the estimation approach are presented in footnote 9.

In the light of the above, GVCs are often thought to play a role in the current trade conflict between the United States and China by amplifying the effects of tariff hikes. On the one hand, previous results suggest that tariffs that raise input costs can significantly dampen the output of sectors whose production processes rely on foreign intermediate goods. Since the tariffs imposed by the United States against China targeted a large number of intermediate goods, this channel may indeed be of relevance in the current trade dispute.[11] On the other hand, the importance of magnification effects due to global multistage production are less clear and depend on the predominance of GVC-related trade in bilateral trade relations. OECD data for 2015 suggest that, overall, around 25% of the trade between the United States and China takes place in the context of GVC linkages (non-blue bars in Charts D).[12] For both countries, this is below the total share of GVC-related trade in total exports as well as the (weighted) average share of GVC-related trade in global trade (Chart A), which in turn may be explained by the large distance between the two countries. Moreover, for US exports to China, forward linkages (yellow bars in Chart D) are relatively more relevant indicating that US exports to China are rather upstream in the value chain.[13] By contrast, for Chinese exports to the United States, the share of backward linkages is larger (green and orange bars in Chart D), thus rendering these trade flows potentially more sensitive to the tariff hikes’ magnification effects linked to the multistage organisation of production discussed earlier.[14]

Chart D

Decomposition of bilateral exports between China and the United States in 2015

(In USD billion)

Sources: OECD inter-country input-output (ICIO) tables and ECB calculations based on Borin and Mancini (2019).

Notes: The blue bars comprise both intermediate and final goods. GVCfw and GVCbw refer to forward and backward linkages. Exports include goods and services.

- Such sequentially organised value chains are also referred to as “snakes”. This is in contrast to supply chains sometimes labelled as “spiders”, where multiple limbs (i.e. parts) come together to form a body (i.e. assembly) without a particular sequencing. Baldwin, R. and Venables, A.J., “Spiders and snakes: Offshoring and agglomeration in the global economy”, Journal of International Economics, 90, Elsevier, Amsterdam, 2013, pp. 245-254.

- GVC-related traded items are, therefore, re-exported at least once before being absorbed in final demand (Borin and Mancini, 2019). Such trade flows can be computed on the basis of inter-country input-output (ICIO) tables. This box uses ICIO tables published by the OECD. Note that the level of GVC-related trade may depend on the source of the ICIO tables (e.g. OECD data versus World Input Output Tables), while the displayed dynamics over time (Chart A) tend to be quite similar. Two releases of the OECD ICIO tables are here aligned over time in order to extend the sample period. Borin, A., and Mancini, M., “Measuring What Matters in Global Value Chains and Value-Added Trade”, Policy Research working paper, WPS 8804, World Bank, 2019.

- Backward linkages also include domestic added value that is double-counted in the gross export decomposition. These double-counted terms are usually small.

- See for example Caliendo, L. and Parro, F., “Estimates of the Trade and Welfare Effects of NAFTA”, The Review of Economic Studies, 82(1), 2015, pp. 1-44. See also Jones, C.I., “Intermediate goods and weak links in the theory of economic development”, American Economic Journal: Macroeconomics, 3(2), 2011, pp. 1-28, which discusses more generally how intermediate goods create linkages between firms that can give rise to multiplier effects.

- The quantitative importance of these magnification effects is usually investigated in general equilibrium trade models with mixed results. For example, Yi as well as Antràs and de Gortari find that such magnification effects of multistage production can be sizeable, while Johnson and Moxnes suggest that these effects are of limited importance when compared to a model which allows for global sourcing. See Yi, K.M., “Can Vertical Specialization Explain the Growth of World Trade?”, Journal of Political Economy, 111(1), 2003, pp. 52-102; Yi, K.M., “Can multistage production explain the home bias in trade?”, American Economic Review, 100, 2010, pp. 364-393; Antràs, P., and de Gortari, A., “On the Geography of Global Value Chains”, mimeo, Harvard University, 2019; Johnson, R.C. and Moxnes, A., “GVCs and trade elasticities with multistage production”, NBER Working Paper, No 26108, 2019.

- Upstream tariffs are computed as the weighted average of tariffs applied to intermediate goods used by a country-industry, with weights referring to the share of inputs in a country-industry’s total output. The measure is extended to also include tariffs imposed by countries further upstream in the supply chain by following insights on cumulative tariffs presented by Rouzet and Miroudot using the OECD ICIO tables. The tariff data are sourced at detailed product level from TRAINS and the WTO using the World Bank’s World Integrated Trade Solution (WITS) tool and aggregated to the industry level using constant trade shares derived from CEPII’s BACI data set. Note that tariffs imposed downstream in the value chain could also affect the output of upstream industries, which is not investigated in this box. Rouzet, D. & S. Miroudot, The cumulative impact of trade barriers along the value chain, June 2013 Conference Paper, GTAP resource No 4184, 2013.

- The impulse responses are obtained by using Jorda’s local projections with standard errors clustered at the country-industry level. The observational unit is a country-industry in a given year. The outcome variable of interest is real industrial production (sourced from the UNIDO) which varies at the 2-digit ISIC industry level. Local projections imply that the change of this variable is regressed on the changes in tariffs and a vector of control variables which includes two lags (of each) of changes in the dependent variable, variables for input and protective tariffs, and nominal value added growth. The model further contains country-industry, industry-time and country-time fixed effects to control for various other types of factors that may drive industrial activity. The tariff variables are interacted with a country-industry measure of backward linkages computed from the OECD ICIO table for the year 2005, which is in the middle of the sample period. The sample covers the period from 1995 to 2017 and includes 54 countries and 22 industries. The focus on upstream tariffs may mitigate endogeneity concerns regarding the tariff variable, while it should be noted that the analysis does not necessarily present causal effects. Jorda, O., “Estimation and inference of impulse responses by local projections”, American Economic Review, 95(1), 2005, pp. 161-182.

- For more details, please refer to Johnson, R.C. and Moxnes, A., “GVCs and trade elasticities with multistage production”, NBER Working Paper, No 26108, 2019.

- The applied empirical setup is similar to Bergstrand et al., who discuss estimation approaches for structural gravity models. For instance, the model contains exporter-industry-time and importer-industry-time fixed effects as well as exporter-importer-industry fixed effects. The model is estimated on sectorial trade and production data derived from the OECD’s ICIO tables for the period from 1995 to 2015, covering 62 countries and 18 manufacturing industries. Tariff data are sourced from WITS. Standard errors are clustered at the bilateral industry level. The results presented in Chart C refer to a model estimated by OLS. Estimating the model by Poisson Pseudo Maximum Likelihood leads to qualitatively similar results, while the elasticity estimates are generally larger. See Bergstrand, J. H., Larch, M., and Yotov, Y.V., “Economic integration agreements, border effects, and distance elasticities in the gravity equation”, European Economic Review, 78, 2015, pp. 307-327.

- The gravity model features a long-run perspective. An elasticity of -1 suggests that a 10% increase in bilateral tariffs would lower bilateral exports by 10%.

- Intermediate goods account for more than half of the value of the products affected by the tariffs that the United States imposed on imports from China (worth USD 250 billion) in the course of the third quarter of 2018. See, for example, Bown, C. P., Jung, E. and Lu, Z., “Trump and China formalize tariffs on $260 billion of imports and look ahead to next phase”, Peterson Institute for International Economics Trade and Investment Policy Watch, September 20 2018.

- Note that Chinese and US value added absorbed by the importer (i.e. blue bars in Chart D) comprise intermediate and final goods.

- Such forward linkages can imply that the tariff costs are passed on to third markets downstream in the value chain. See, for example, Mao, H. & H. Görg (2019), Friends like this: The Impact of the US – China Trade War on Global Value Chains. Kiel Center for Globalization Working Paper No. 17.

- In terms of sectoral breakdown of gross bilateral trade, according to OECD data for 2015, 90% of Chinese total (i.e. goods and services) exports to the United States originate from the manufacturing sector, while less than 10% come from services and the role of the agriculture sector is negligible. By contrast, roughly 50% of US total exports to China originate from the manufacturing sector, while around 7% stem from agriculture and the rest is mainly related to service activities. Focussing only on trade in goods, almost 55% of Chinese gross exports to the United States are consumer goods (including personal phones, personal computers, and passenger cars), while intermediate and capital goods account for around 30% and 15%, respectively. US goods exports to China are mainly intermediate goods (more than 55%), while capital and consumer goods account for roughly 15% each (and another approximately15% relates to miscellaneous products).