The viral effects of foreign trade and supply networks in the euro area

Published as part of the ECB Economic Bulletin, Issue 6/2020.

Adverse shocks induced by containment measures introduced in response to the coronavirus (COVID-19) are not limited to the originating country; while not the sole propagation mechanism, foreign trade transmits these shocks across economies. In the euro area, the deep integration of firms within regional supply chains – as well as strong demand ties – acts as a magnifying mechanism. This article quantifies the propagation and impact of adverse shocks originating in the euro area on euro area GDP, foreign trade and trade balances. It concludes that the transmission to the rest of the euro area of a shock originating in one of the five largest Member States ranges between 15% and 28% of the original shock’s size. The negative spillover effects are most severe for open countries and those most intertwined in regional production networks.

1 Introduction

In their attempts to limit the spread of the COVID-19 pandemic, all euro area governments introduced lockdowns and containment measures, spurring a blend of supply and demand shocks which adversely affected their economies in addition to the economic consequences of the disease itself. As the pandemic unfolded across the globe, many other countries adopted similar measures, thus putting the euro area under further strain, as commercial and business activities were closed, movement permitted only for necessities, and travel limited to essential business or where force majeure made it necessary. The severe repercussions at national level on the spending capability, consumption and investment preferences of economic agents have spread across the globe, with their intensity depending on the degree of economic and industrial interconnectedness.

This article employs multi-regional input-output tables to evaluate the transmission via foreign trade of adverse shocks generated by lockdowns and containment measures across the euro area.[1] This methodology offers several benefits. Opting for a full representation of country-sector production and demand linkages allows us to evaluate the spillover and the spillback effects of any idiosyncratic shock on output, value added, and domestic and foreign trade of any other country and sector within a single overarching framework. The methodology enables us to obtain a breakdown of the full shock-transmission mechanism into direct effects on trading partners and spillover effects on third countries via trading partners and on industries. The latter are only indirectly affected as a result of effects on the inputs of the sector directly affected by suppression measures. Our methodology accommodates the analysis of a variety of shocks, in particular, single country, multi-country, sector specific and foreign trade specific shocks. The abovementioned properties are particularly relevant given the strong interdependence of euro area economies and this article’s focus on shocks originating in the euro area. In this context, analyses based on methodologies that fail to consider euro area interconnectedness are likely to underestimate the effective impact of the COVID-19 shock.

The remainder of this article is structured as follows. The methodological framework, scenarios and related assumptions are described in Section 2. Section 3 describes the channels of transmission and Section 4 discusses the effects on the euro area economy of lockdowns and containment measures implemented in its five largest economies. It also delves into the mitigation effects expected to result from the policies designed by governments to support citizens’ income and business activity in times of pandemic. Section 5 concludes by reviewing the main takeaways from our analysis and discusses the potential structural economic changes triggered by COVID-19.

2 Data and methodology

The article takes data from the Multi-Regional Input-Output (MRIO) database of the Asian Development Bank (ADB) that reconstructs national and international flows between country-sector pairs and sectoral final demand. The database encompasses all euro area economies and a broad set of other countries. Compared with alternative sources, it also provides more recent information up to 2018 (see Box 1 for a detailed description of the database and our methodology).[2]

The analysis uses a static representation of the economic linkages across sectors and countries to evaluate the economic effects on individual industries of virus-suppression policies. Different sectors are affected to varying degrees by supply disruptions and lockdown measures. The entire manufacturing industry, except for food, beverages, tobacco and pharmaceuticals, has been significantly affected by COVID-19 containment measures. Repercussions on agriculture and aquaculture have been less severe, as is the case for certain services that can be provided remotely, such as telecommunications (which may even have received a boost as a result of the changing behaviour of economic agents during the pandemic). We account for this through the careful differentiation of production shocks in Section 4. Conversely, other areas, namely transport, tourism and accommodation, are assumed to have experienced the severest adverse hits.

Box 1 A working tool: the inter-country input-output tables

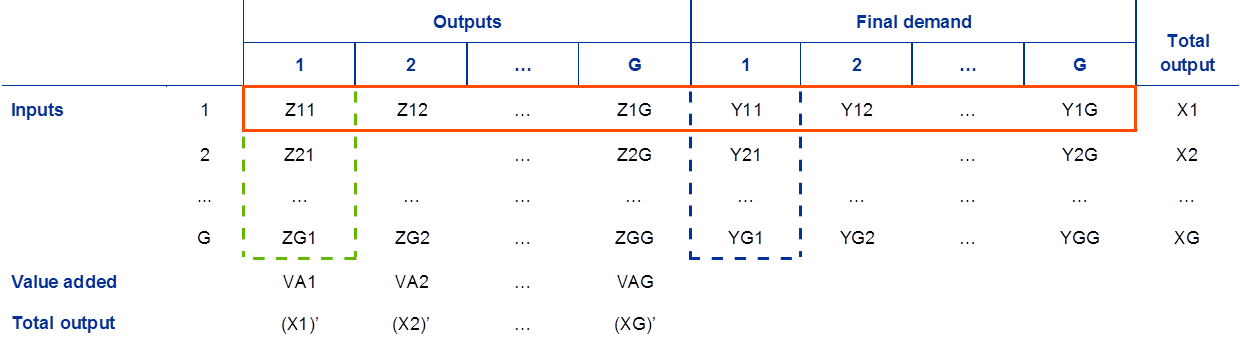

This box describes the structure of the inter-country input-output tables (ICIOTs) and how different types of shocks can be applied to them. An ICIOT (see Table A) is structured around two main matrices: the international market for intermediates, Z, and the international market for final goods, Y. The rows of Z are producing country-sectors and the columns are consuming country-sectors. The columns of Y are pairs of countries and final demand sectors (such as private consumption and investment), only one of which is depicted in the simplified illustration below. Both Y and Z consist of G times G submatrices that contain the bilateral sectoral supply linkages between all country pairs.

Table A

Structure of inter-country input-output table with G countries and N sectors

Note: Zij is the NxN matrix of intermediate inputs produced in country i ∈ {1,…,G} and consumed in country j ∈ {1,…,G}, VAi is the 1xN vector of value generated in country i ∈ {1,…,G}, Xi is the Nx1 vector of gross output produced in country i ∈ {1,…,G} and Yij is the Nx1 vector of final goods and services completed in country i and absorbed in country j ∈ {1,…,G}.

A number of aggregate and more granular descriptive statistics can be obtained from the ICIOTs. This is illustrated below by some examples. Let denote the elements of the respective matrices, where s, t ∈ {1,…,N} denote the exporting and the importing sector respectively. The sectoral value added for country 1 is then calculated for each sector as total output minus intermediate input,

(1) .

Sectoral exports of country 1 equal total sectoral output minus sectoral output consumed on the domestic intermediate and final market,

(2) ,

while sectoral imports equal total intermediate inputs plus final demand produced by the sector minus intermediate and final consumption originating from domestic sectoral production,

(3) .

The sum across sectors of (1), (2) and (3) yields, respectively, the GDP, total export values and total import values of country 1.

We apply sectoral supply shocks to rows and demand shocks to columns. Shocks are calibrated based on internal and external analyses of the repercussions of countries’ containment measures.[3] In Table A, the matrices affected by a single-country production shock are represented by a red solid line, an intermediate demand shock by a green dashed line and a final demand shock by a blue dotted line. Depending on the scenario, a shock ( can be single-country or multi-country and model production disruptions or final demand shocks. The ICIOT (Z* Y*) including the production shock is obtained by multiplying the rows of the affected matrices by the Nx1 shock vector s ( , where ⊗ is the Hadamard product) and the ICIOT including the demand shock by multiplying the columns of the affected matrices by the transposed shock vector ( ). The impact of each shock on euro area activity and foreign trade is the difference between the values obtained from the pre-shock ICIOT and the post-shock ICIOT.[4] In a second stage, indirect shocks are applied to model the supply chain adjustment to the shock in the first stage. Their calibration is a function of the initial shock, the WIOT structure and the assumption on the elasticity of output with respect to intermediates, which is discussed below. The economic mechanism is explained in Section 3.

There is, however, a caveat to this approach, which concerns the treatment of shock vector intersections. Take, for instance, a single-country shock to economy c affecting all sectors differently. The linkage , i.e. the intermediate inputs of country c sector 1 to country c sector 2, could be reduced either by the production shock in sector 1 or by the intermediate demand shock of sector 2. In these situations, we assume that equilibrium is determined by supply, which means that the production shocks are the initial triggers and do not account for further fallout on the activity of sector 1 due to lower intermediate demand from sector 2.[5]

An important simplifying assumption made in our approach is that a production shock in one country-sector pair triggers an equivalent intermediate demand shock and vice versa. Our strict proportionality assumption is akin to assuming that the base reproduction number (r0) is equal to unity and constant over time, hence each additional shock will always have a similar effect on the economy.[6] This is nevertheless a simplification since, in this rapidly changing reality, the dynamics of propagation of a shock through foreign trade are similar to those of the spread of a virus and the contagion rate in the economic “epidemic” process rises rapidly in the early stages when few sectors and economies are infected. In the very short run, key components and crucial services that suddenly cannot be delivered anymore can paralyse entire production chains, but contagion progressively flattens and abates as more and more economies are hit.

In our framework, as long as the relative magnitude of sectoral innovations is preserved, the final effects of a given shock are proportional to the original shock. Because of the linearity of our model, shock effects on macroeconomic variables can be scaled up or down if the sectoral distribution (in a single-country shock) or inter-country relative distribution (in a multi-country shock) remains the same. In this way, our assessments can be adapted to analyse the effects of milder or more severe trajectories that the pandemic might take. Sectoral shocks are reported as percentages of the largest shock. Thus, the industry experiencing the sharpest contraction in production takes the value of 100 and shocks in other sectors are indexed to it. We calibrate the shocks based on sectoral information available on the effects of suppression measures and on analyses from internal experts as well as external sources. For example, the shock to weighted aggregate activity in each country is set equal to the GDP contraction projected in the June 2020 Broad Macroeconomic Projection Exercise (BMPE).

The analyses rest on some key assumptions and have certain limitations, such as:

- they strip out the price effects of implemented policies;

- they provide no information on the implications of and interaction with significant monetary policy measures, although the effects of implemented fiscal and monetary policies indirectly influence the exercises to the extent that they modify the forecasts of aggregate output developments in 2020;

- moreover, since they are static, the assessments ignore potential permanent changes in the structure of economies that may ensue from reshoring or the diversification of essential production processes and changes in lifestyle, time allocation across activities, consumption preferences and daily needs.

Possible trade diversion effects are ignored as their appearance may be delayed and our analysis focuses on 2020. The assumption of non-substitutability of supply and demand (lower exports by a country will not be replaced by other countries’ exports) across origins and destinations is strong,[7] drawing on the idea that, as with viruses, immunisation from shocks disrupting global value chains (GVCs) requires time. It may entail, for instance, starting new lines of production or diverting demand to other suppliers, which may prove to be imperfect substitutes as a result of limited supply capacity or other factors.

3 Transmission channels

There are several contributions in the literature on GVCs showing that production networks propagate idiosyncratic shocks and can be a source of aggregate fluctuations.[8] In this section, we discuss the various channels that are at play when this occurs and how shocks originate in country-sectors and spill over to the rest of the world, amplified by foreign trade.

Domestic production shocks applied to the ICIOT are transmitted to upstream and downstream trading partners and further up and down the chain to partners of trading partners via export and import channels. Intuitively, by halting domestic production, lockdown measures are conducive to shortages of intermediate goods produced domestically that enter foreign production processes via trading partners (known as the export channel). These shortages generate negative supply shocks for companies located downstream in the chain. At the same time, they reduce the demand for foreign intermediates entering domestic production processes (known as the import channel). The closure of businesses also results in a negative demand shock for companies located upstream in the production process relative to the original locked-down businesses. To the extent that intermediates cannot be substituted, the entire foreign production line is hampered and, consequently, purchases of intermediates from any other country are reduced proportionately. The operation of the export channel propagates initial supply shocks further down the chain. Likewise, lower import demand for foreign intermediates has a negative effect not only on their production in partner economies, but also in other countries that supply inputs for the same processes. The import channel hence has an indirect impact on all companies upstream. Besides intermediate-production linkages, lockdown measures also reduce exports of final products, hence constraining consumption possibilities and potentially generating unintended and temporary extra savings.

Final demand shocks in the ICIOT are only transmitted up the value chain and therefore have a more limited direct impact on foreign countries. Negative demand shocks have a direct negative impact on imports, leading to a reduction in the production in other countries, unless firms replace them with exports to other destinations; this in turn leads to a decrease in their demand for intermediates. This process could be reiterated several times up the value chain. We, however, only model the first two steps, the reduction in imports and foreign production and the foreign intermediates demand shock. This is to account for the time lag that production adjustment needs, but also because the magnitude of indirect effects shrinks with each iteration.

To illustrate the transmission mechanism, let us consider shop closures and, more specifically, look at the case of a bar forced to lock down. Intuitively, if hypothetically the output of food and entertainment services goes down by 10% and these services account for 10% of GDP; such measures will have a direct negative effect on GDP of 1%. However, the bar will reduce its purchases of beer, which will have an impact on the revenues of beer producers which is equal to their share of the total costs of bars. If we assume this to be 20%, then an additional contraction of 0.2% in GDP will ensue. Looking further upstream in the beer production process, when beer sales wane, producers order and purchase fewer hops by an amount proportional to the share of hops in total costs. If this ingredient accounts for 25% of beer production costs, a further 0.05% is shaved off the GDP. The overall effect on the country GDP will be equal to -1.25% if the production chain is entirely domestic, while the negative impact is shared internationally if foreign companies are part of the supply chain. Our analysis of spillover effects stops at hops although it encompasses all the economic ties that the bar and the beer producers maintain with other sectors and economies.

4 Euro area-wide repercussions of containment measures in the five largest economies

COVID-19 migrated from China across the euro area before spreading to the rest of the western hemisphere, hence containment measures outside of China were first enforced in Europe.[9] Using the transmission channels explained above, we assess spillovers from the lockdowns, temporary closures, restrictions on movement and other containment measures adopted by the five largest euro area economies (Germany, France, Italy, Spain and the Netherlands) since early March 2020.

The sectoral distribution of production shocks reflects the expected differential impact of containment measures across industries. The distribution by major NACE[10] category is presented in Table 1. As expected, trade, transport, accommodation and food services are among the hardest hit in all countries, while for other sectors, particularly manufacturing, there are significant differences. The initial aggregate GDP shocks to the five largest euro area economies in 2020 correspond to the projections for euro area economies in the June 2020 BMPE.[11] However, as mentioned above, the overall magnitude of the shock does not matter for the computation of shock transmission in this framework, since the results can be scaled up.

Table 1

Shock calibration: indices of sectoral output shocks due to containment measures by main sector of activity

Source: ECB staff calculations.

Note: The shock in the most severely hit sector resulting from containment measures is indexed to 100, shocks in the other sectors are a percentage of this. Private services include several activities: information and communication, financial and insurance activities, real estate activities and professional, scientific, administrative and technical activities

There is very substantial transmission of domestic shocks in the five largest euro area economies to aggregate activity in the rest of the area. Aggregate results are reported in Chart 1. Based on the current structure of euro area countries and their interdependencies, our assumptions and the sectoral calibration above, the impact of a shock similar to the COVID-19 suppression measures applied to the five largest euro area economies would be amplified by 15-28%. This happens in two steps. First, in this scenario, a GDP loss of €100 in Germany causes a loss of €13.50 in the rest of the euro area through supply linkages (see blue bars in Chart 1). Lost output results in a reduction in income if the original shock is not countered through policy measures. The income shock then triggers an identical demand shock that is distributed homogeneously across expenditure components, domestic and foreign production, leading to a contraction in euro area GDP of a further €8.60 (see yellow bars in Chart 1). The main finding of this exercise is that the degree of interconnectedness influences the amplification of the initial shocks.

Chart 1

Transmission of single-country shocks to the five largest euro area economies through supply and demand linkages

(left-hand scale: percentage; right-hand scale: multiples)

Source: WIOD, MRIO database of the ADB, ECB staff calculations

Notes: Shocks are indexed to the smallest shock in terms of euro area GDP (the Netherlands), which is set to 1; the other aggregate shocks are multiples of it. For instance, the initial shock to Germany takes on the value of five because it has five times more weighting in euro area GDP.

Euro area foreign trade contracts by more than aggregate activity and lockdown measures lead to GVC retrenchments. The box entitled “The fall in manufacturing and services activity in the euro area: foreign versus domestic shocks” in the April edition of the Economic Bulletin discusses the euro area regional production network, focusing on how it has changed since the global financial crisis (GFC).

COVID-19-induced shocks have caused a deterioration in the net trade positions of euro area Member States. Net trade has contracted in all of the five largest euro area economies, substantially contributing to the transmission of the initial domestic shock to GDP. We find that the deterioration is greatest for the most open countries, those running large trade surpluses and for economies (the Netherlands and Germany) that are most intertwined with those experiencing the shocks. Based on monthly trade data for April and May, partial indications on changes to the euro area trade balance in the second quarter of 2020 support our conclusion of a deterioration in the euro area’s external position.

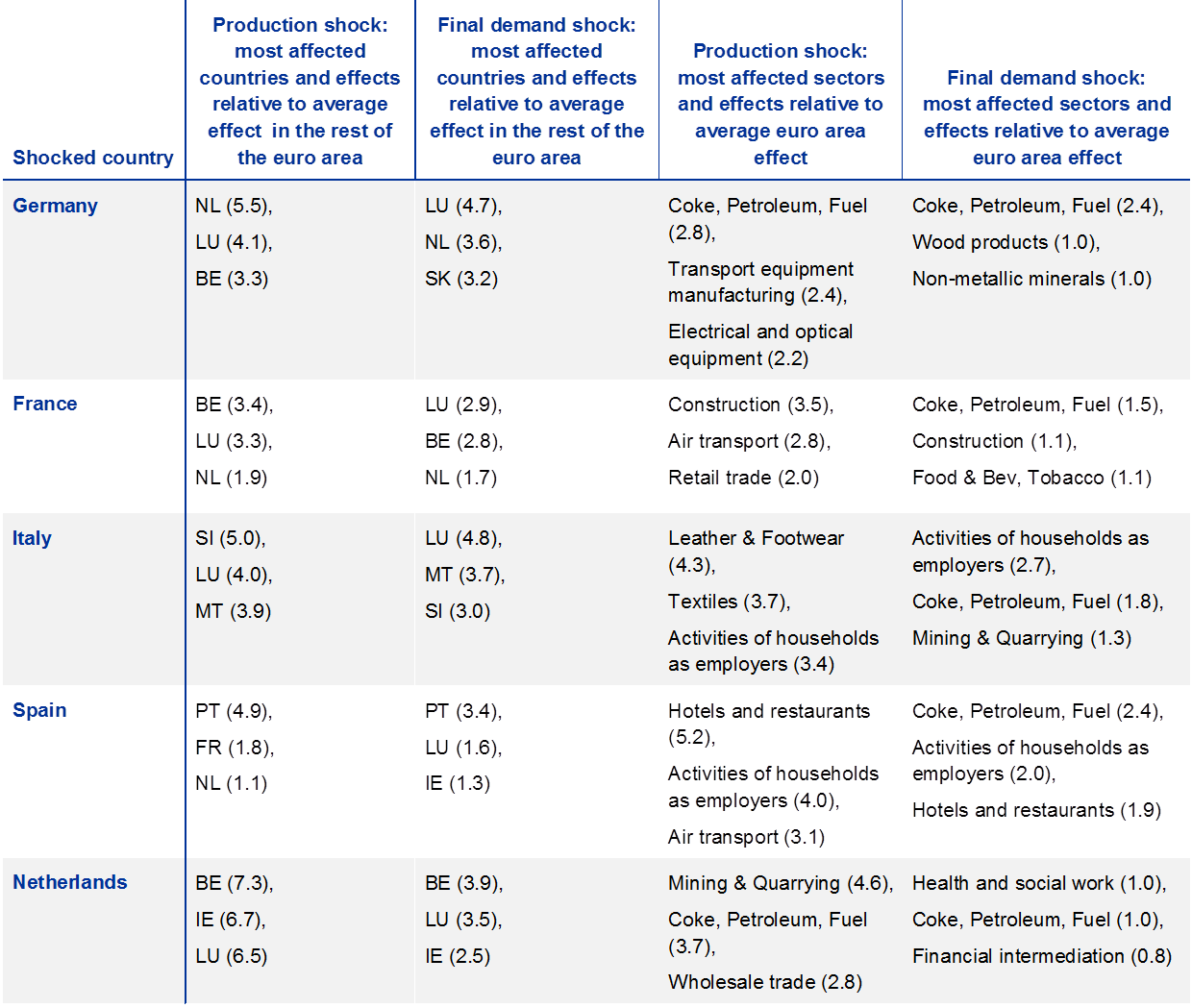

Table 2

Most affected countries and sectors in the euro area

Source: ECB staff calculations.

Note: The numbers in brackets denote multiples of average effect, i.e. how much bigger the effect on the respective country or sector is compared to the average effect on the euro area excluding the shocked country (countries) or compared to the average effect on the euro area (sectors).

Box 2 The euro area regional production network

The euro area is a unique example of a regional production network. GVC linkages in the region reflect an intricate supply web with more than one hub, comprising production, shipping and financial centres. Intermediates travelling across several borders in such networks form the majority of euro area trade, while disruptions are transmitted across the region either because inputs from another euro area country become unavailable (forward linkages) or because as firms in the rest of the euro area reduce their output, foreign demand for domestic intermediates wanes (backward linkages). In this context, demand and supply shocks blend and reinforce each other as they propagate among member states.

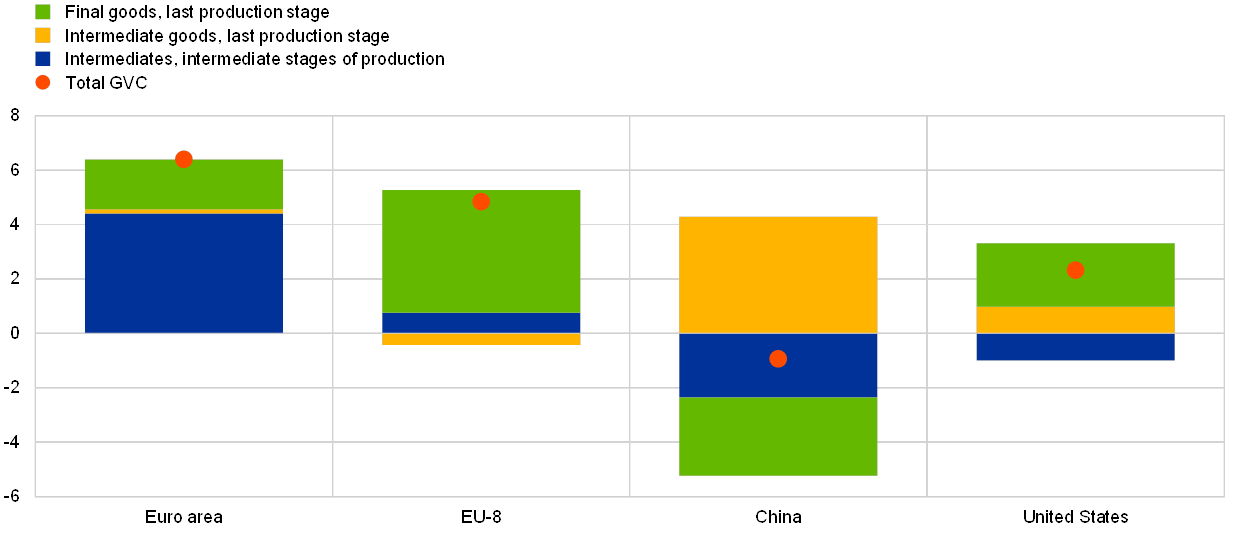

This box describes the euro area production network and discusses how it has changed, focusing in particular on the period after the GFC. Intra-euro area GVC trade is compared with trade with other main trading partners/regions (the eight non-euro area economies in the European Union, China, the United States and the rest of the world). The analysis uses a refined definition of GVC trade that distinguishes between shallow and deep GVC linkages. In particular, GVC trade is defined in the literature as the share of exports and imports that crosses at least two borders (concerning three economies) before reaching the final destination.[12] We further separate it into deep and shallow GVC trade. The former is the share of exported and imported intermediates entering intermediate stages of production in the importing-exporting country (blue bars in Chart A) while shallow GVC trade occurs when the goods and services produced in a global network are traded directly with the final absorbing partner (yellow bars in Chart A). This distinction is key when disentangling trade within a production network from GVC trade with other production networks.

Chart A

GVC exports by main euro area trading partner/region

(as a percentage of total bilateral exports)

Source: WIOD, MRIO database of the ADB, ECB staff calculations.

Notes: The sum of blue and yellow bars represents GVC exports, i.e. the share of total exports that crosses at least two borders before reaching the final destination. The chart breaks down total GVC trade into shallow GVC linkages, that is the share reaching the final transforming economy (yellow bars), and deep GVC exports, that is intermediates processed and then re-exported for further processing (blue bars).

The European production network remains the engine behind aggregate activity in the euro area. In 2018, three-quarters of the intermediates exported by euro area countries within the European Union were destined for further processing and re-exporting; two-thirds reached another euro area member. The share of GVC trade in intermediates exported at intermediate stages of production (of total intra-euro area trade) is three times as large as that with China (33% versus 11%, see blue bars in Chart A) and four times as great as that with the United States (8%). Indeed, the bulk of GVC trade with other regions occurs at the final stages of production, i.e. it concerns intermediates directly embedded in finished goods (see yellow bars in Chart A).

Supply chains in the euro area continued to develop amid a decline in GVCs’ share of total global exports since before the GFC. While the global trade slowdown did not spare euro area trade, the euro area actually strengthened its position as a leader in GVCs relative to other regions after the GFC. More than half of total exports consist of production that is processed across several borders, a share far greater than in China or the United States (both around 30%).

Since the GFC, the euro area has reorganised its internal production network, further deepening its regional core and expanding its influence on the rest of the EU.[13] Chart B breaks down the change in GVC exports that occurred between 2008 and 2018 within the euro area and with its main foreign trading partners (the United States, China and non-euro area economies in the EU), highlighting shallow GVC exports (green and yellow bars) and deep GVC exports (blue bars). From a euro area perspective, the global shortening of value chains was counterbalanced by further integration within the regional network in the euro area and with the rest of the EU (6 percentage points and almost 5 percentage points respectively, see red dots in Chart B). Such progress is in contrast to the decline with China and the significant slowdown with the United States. Moreover, the core of euro area supply chains deepened further (blue bars in Chart B) whereas GVC trade with other regions mainly concerned shallow linkages (green or yellow).

Chart B

Change in euro area GVC exports, shallow and deep linkages (2018-2008)

(as a percentage of total bilateral exports)

Source: WIOD, MRIO database of the ADB, ECB staff calculations.

Notes: The chart breaks down the total change in GVC exports (the share of trade that crosses at least two borders before reaching the final destination, red dots) between 2008 and 2018 into three main components: the share that consists of intermediates embedded in finished production (yellow), the share of exports in final goods that were produced in a supply chain (green) and the share of intermediates that are processed by the importer and then re-exported for further processing (blue).

Integration within the euro area is clustered around a few economies (Germany and the Netherlands in particular). Based on the bilateral flows in intermediates crossing at least two borders, the five largest euro area economies are primarily integrated with the Netherlands, which acts as the euro area delivery and arrival point for exports and imports from the rest of the world. Germany is the manufacturing hub but Italy also appears to have a more central position compared with France and Spain. Other members of the European Union share a dense matrix of bilateral GVC trade with the euro area, especially with Germany, Austria and Italy.

Eastern enlargement of the euro area and improvements in stressed countries explain the success of its regional supply chains after the GFC. Our analysis indicates that, despite less favourable global conditions, rising protectionist measures and a globalisation reset in other regions, supply networks in the euro area were boosted by the greater integration of new members (Lithuania, Slovakia and Estonia) with the core.[14] These countries not only strengthened their position in the regional network as both an origin and destination for parts and components, but some of them attracted a growing share of production from other regions (the United States and China) that they embedded in their processes.[15] A significant contribution also comes from countries like Spain, Portugal and Greece that improved their participation in regional GVCs relative to their pre-GFC values.[16]

Since 2008, imports of intermediates from the rest of the world that are further processed in the euro area have expanded substantially as other emerging economies have gained traction in terms of participation in GVCs.[17] While too early to draw a conclusion, the role of the heterogeneous group of countries composing the “Rest of the World”, which encompasses commodities exporters as well as Vietnam, Turkey and the Philippines, is growing steadily in terms of GVC participation. A benign interpretation of this evidence from a global perspective is that GVCs may not be falling apart but rather changing to accommodate a diversified set of players, leading to a less concentrated global production network.

5 Conclusion

This article analyses how domestic adverse shocks generated by containment measures are transmitted and magnified within the euro area. International country-sector interconnectedness and openness determine the strength of the propagation of shocks via foreign trade, but our analysis has shown that the amplification effects and the transmission channels vary depending on the type of shock.

Shocks propagate strongly in the euro area because the region is a typical example of a regional production network in which final demand linkages are also very important. Transmission to the rest of the euro area of a shock originating in one of the five largest Member States ranges from 15% to 28% when supply and demand channels are taken into account. A common or coordinated response through targeted fiscal measures can help forestall such amplification effects. In addition, these effects need to be taken into account when assessing the impact on real GDP and inflation and when deciding on the appropriate monetary policy response.

The complex chain structure of the production model can be improved. International cooperation could be strengthened with a view to avoiding shortages of essential products, such as medicines or medical appliances, by reducing the excessive concentration of the production of key components in single factories and allowing for greater geographical diversification. While economies of scale will continue to work in favour of the concentration of production, the balance of costs and benefits goes beyond the purely short-term outlook and economic convenience. As highlighted by COVID-19, non-economic considerations regarding critical situations are also factors to be taken into account.

At the same time, production networks can represent a safety net for participating companies in times of crisis. During a crisis, the weakest links in the network may be rescued, merged or acquired and the financial holdings of large groups can provide liquidity to avoid credit crunches. Financing difficulties can also be eased by temporarily relying on more favourable payment conditions from suppliers in the network. Lastly, in cases of production curtailments, firms inside the network will receive preferential treatment over those outside it and will be the last to experience shortages of intermediate supplies. However, the safety net mainly helps overcome temporary setbacks but will not protect companies under strain in the medium term; it therefore remains the duty of governments to avoid long-term scarring effects from the pandemic.

The analysis presented abstracts from new trends in the way people and economies will interact in the future. COVID-19 accelerated transformations that were already underway. Remote working, teleconferencing, fewer meetings held in public or at the workplace, a reduction in the use of public transport, more controlled tourism and a reduction in movement and travel – all are likely to remain prominent for a considerable time. At the same time, significant changes are occurring in our lifestyles and how we spend our work and leisure time. This is likely to have lasting implications for how economies and their production systems are structured.

- The literature on the macroeconomic effects of COVID-19 has been rapidly expanding, touching also upon the effects of lockdowns and containment measures on GDP and trade of partner economies. See Barrot, J.-N., Grassi, B. and Sauvagnat, J., “Sectoral Effects of Social Distancing”, HEC Paris Research Paper No FIN-2020-1371, 2 April 2020, Navaretti, G.B., Calzolari, G., Dossena, A., Lanza, A. and Pozzolo, A.F., “In and out of lockdowns: Identifying the centrality of economic activities”, Covid Economics, Vetted and Real-Time Papers, No 17, Centre for Economic Policy Research, 13 May 2020, Bonadio, B., Huo, Z., Levchenko, A.A. and Pandalai-Nayar, N., “Global Supply Chains in the Pandemic”, Working Paper, No 27224, National Bureau of Economic Research, Cambridge, Massachusetts, May 2020, Bodenstein, M., Corsetti, G. and Guerrieri, L., “Social Distancing and Supply Disruptions in a Pandemic”, Finance and Economics Discussion Series 2020-031, Board of Governors of the Federal Reserve System, Washington, 16 April 2020, and Baqaee, D. and Farhi, E., “Nonlinear Production Networks with an Application to the Covid-19 Crisis”, Working Paper, No 27281, National Bureau of Economic Research, Cambridge, Massachusetts, May 2020.

- The conclusions of our empirical assessments have been cross-checked using the world input-output tables (WIOT) in the World Input-Output Database (WIOD), an alternative source of inter-country sector linkages that includes 45 countries and spans 56 sectors, but contains outdated information (the latest data are from 2014). The WIOD is a project covering the years 2000-2014 financed by the European Commission and developed by a consortium of universities and research institutes. The MRIO database expands on the WIOD along two main dimensions – it extends the tables to include more recent data (the latest are from 2018) and several additional Asian economies. However, it features a more limited number of sectors (35 versus 56 in the WIOD) as service activities are less finely defined. The MRIO database has been extensively used in the literature.

- These assessments consider the effects of fiscal and monetary measures on sectors’ activity and countries’ GDP. Therefore, while we do not explicitly evaluate the effects of policy measures, we indirectly take their effects into account in the shock calibration.

- Pre- and post-shock values of economic statistics were obtained through ICIO, a built-in tool in Stata; see Belotti, F., Borin, A. and Mancini, M., “icio: Economic Analysis with Inter-Country Input-Output Tables in Stata”, Policy Research Working Paper No 9156, World Bank, Washington DC, February 2020.

- As a result, the production shock is not exactly equal to the value-added shock; according to our computations, such discrepancies are of a two-decimal order of magnitude. Moreover, this concerns sector spillover effects in the domestic market whereas the article focuses on the international transmission of idiosyncratic shocks, which is not affected.

- In the extreme scenario, when no substitution across inputs, sources or final destinations is possible in the production process, the entire supply network is already disrupted by the first shock; in a situation of this kind, r0 goes to infinite but then falls rapidly to zero for any subsequent shock.

- This is a reasonable assumption in the short to medium run for some highly specialised services and manufacturing, where alternative suppliers for specific parts and components are difficult to find, especially during global shocks.

- See Acemoglu, D., Akcigit, U. and Kerr, W., “Networks and the Macroeconomy: An Empirical Exploration”, NBER Macroeconomics Annual 2015, Vol. 30, National Bureau of Economic Research, University of Chicago Press, June 2016, pp. 273-335, Acemoglu, D., Carvalho, V.M., Ozdaglar, A. and Tahbaz-Salehi, A., “The Network Origins of Aggregate Fluctuations”, Econometrica, Vol. 80, No 5, September 2012, pp. 1977-2016 and Gabaix, X., “The Granular Origins of Aggregate Fluctuations”, Econometrica, Vol. 79, No 3, May 2011, pp. 733-772.

- COVID-19 initially concerned China before migrating to Europe and spreading globally to become a true pandemic. This article studies its effects in the euro area, i.e. focusing on the period in which contagion spread mainly across Europe. However, since suppression measures were adopted around the globe, additional analyses have been conducted to quantify their impact on the euro area economy. We find that the euro area would experience a 2% GDP contraction % when the GDP weighted aggregate demand in the rest of the world falls by 9.7%. The direct effects on euro area economies are a result of lower exports of final products to the rest of the world. Output in the euro area adjusts to lower exports and the demand for intermediates by euro area producers, both from within and outside the region, also contracts. Therefore, the proper supply chain transmission mechanism is triggered in a second stage and contributes about a quarter to the propagation of the foreign demand shock within the euro area (0.5 percentage points).

- . The “Statistical classification of economic activities in the European Community” (derived from the French Nomenclature statistique des activités économiques dans la Communauté européenne).

- See the box entitled “Alternative scenarios for the impact of the COVID-19 pandemic on economic activity in the euro area”, Economic Bulletin, Issue 3, ECB, 2020.

- Borin A. and Mancini, M., “Measuring What Matters in Global Value Chains and Value-Added Trade”, World Bank Policy Research Working Paper No 8804, World Development Report 2020, 4 April 2019.

- The rest of the EU is composed of Bulgaria, Czech Republic, Denmark, Croatia, Hungary, Poland, Romania, and Sweden.

- For Latvia, empirical evidence is less strong; the country’s importance as a producer of intermediates has grown but it has not attracted more GVC exports into its borders.

- Euro area integration with the United States was broadly stable after the GFC. However, the aggregate data conceals Germany’s decline as a destination, which was offset by an increase in the trade of parts and components from the United States to new Member States.

- Euro area GVC integration with other regions remains shallow. 60% of exports to China and the United States consist of domestic production for direct final absorption; this compares with just 40% of domestic production exported by one Member State directly to another euro area absorbing Member State. Similarly, almost 50% of the intermediates exported to Asia and America are directly delivered to the final destination which deals only with the transformation into final goods and absorbs them domestically. When intermediates originating in the euro area are further traded by Asian and American firms, they are mostly re-exported within the region. See also Li, X., Meng, B. and Wang, Z., “Recent patterns of global production and GVC participation”, Global Value Chain Development Report 2019: Technological Innovation, Supply Chain Trade, and Workers in a Globalized World, World Trade Organization, 13 April 2017, pp. 9-43.

- The expansion of intra-euro area supply chains did not entail a retrenchment of its trade integration with the rest of the world. Although they were initially set back, exports and imports from the rest of the world progressed at a pace comparable to global activity in the aftermath of the GFC. Trade integration with China has taken a new path as demand for euro area production has grown steadily, making China a top destination for European firms’ output. Indeed, the domestic production content of euro area exports to China expanded after the GFC; intermediates, parts and components delivered elsewhere, however, experienced a decline. A possible interpretation of this evidence is that euro area companies moved gradually to local production, i.e. trade has been replaced with foreign direct investments. Nonetheless, the Chinese production content of euro area imports did not decline but remained stable.