- PRESS RELEASE

International use of the euro was resilient in 2022

21 June 2023

- Euro remains second most widely used currency, amid geopolitical risks and high inflation

- Euro’s share at around 20% across various indicators of international currency use

- Euro’s global appeal linked to stronger Economic and Monetary Union

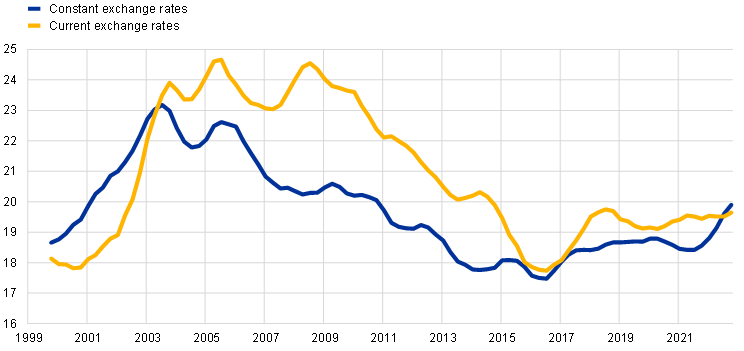

The international role of the euro was resilient in 2022, with its share across various indicators of international currency use averaging close to 20%. This was one of the main findings in the annual review of the international role of the euro, published today by the European Central Bank (ECB).

Last year was marked by the onset of Russia’s war in Ukraine and heightened geopolitical risks, in a context of rising inflationary pressures. Against that backdrop, the euro remained the second most important currency globally.

“Despite a succession of new shocks, the international role of the euro remained resilient in 2022. This resilience was noteworthy”, said ECB President Christine Lagarde. “However, international currency status should not be taken for granted. This new landscape increases the onus on European policy makers to create the conditions for the euro to thrive”.

The share of the euro in global official holdings of foreign exchange reserves increased by 0.5 percentage points to 20.5% in 2022, when measured at constant exchange rates. The share of the euro increased across most other market segments, such as in foreign exchange settlements and in the outstanding stocks of international debt securities, loans and deposits. The international role of the euro in foreign currency-denominated bond issuance, including international green bonds, as well as in invoicing of extra-euro area imports and exports, remained stable.

Looking ahead, the international role of the euro will be primarily supported by a deeper and more complete Economic and Monetary Union, including advancing the capital markets union, in the context of the pursuit of sound economic policies. The Eurosystem supports these policies and emphasises the need for further efforts to complete Economic and Monetary Union.

“Further European economic and financial integration will be pivotal in increasing the resilience of the international role of the euro in a potentially more fragmented world economy,” said Executive Board member Fabio Panetta.

This year’s interim edition of the report includes three special features. The first sheds light on the future of the international monetary system in the context of Russia’s war in Ukraine. It notes that evidence of potential fragmentation of the international monetary system in the wake of Russia’s invasion is not indicative of broader trends.

The second special feature reviews the evidence on the way in which one leading international currency can be replaced by another, drawing on new ECB staff research into invoicing currency patterns among countries neighbouring the euro area. The third feature looks at the role international currencies play in global finance, and provides insights into determinants of currency choice in cross-border bank lending.

For media queries, please contact Alexandrine Bouilhet, tel.: +49 172 174 93 66.

Chart 1

Composite index of the international role of the euro

(percentages; at current and Q4 2022 exchange rates; four-quarter moving averages)

Source: 2023 review of The international role of the euro, p. 3.

Europäische Zentralbank

Generaldirektion Kommunikation

- Sonnemannstraße 20

- 60314 Frankfurt am Main, Deutschland

- +49 69 1344 7455

- media@ecb.europa.eu

Nachdruck nur mit Quellenangabe gestattet.

Ansprechpartner für Medienvertreter