ECB announces details of refinancing operations with settlement up to 12 October 2010

In view of economic and financial market developments, the Governing Council of the European Central Bank has today decided to continue the gradual phasing-out of its non-standard operational measures.

Specifically, the Governing Council has decided to continue conducting its main refinancing operations (MROs) as fixed rate tender procedures with full allotment for as long as necessary, and at least until the end of this year’s ninth maintenance period on 12 October 2010. This tender procedure will also remain in use for the Governing Council’s special-term refinancing operations with a maturity of one maintenance period, which will continue to be conducted for as long as needed and at least until the ninth maintenance period of 2010. The fixed rate in these special-term refinancing operations will be the same as the rate used in the respective MRO.

The Governing Council has also decided to return to variable rate tender procedures in the regular 3-month longer-term refinancing operations (LTROs), starting with the operation to be allotted on 28 April 2010. Allotment amounts in these operations will be set with the aim of ensuring smooth conditions in money markets and avoiding any significant spreads between bid rates and the prevailing MRO rate. An indicative allotment amount will be pre-announced for each of the 3-month LTROs at the start of the maintenance period in which the operation is to be conducted. The MRO rate will be used as the minimum bid rate in the 3-month LTROs. This is a technical and transitional measure to avoid allotment rates below the prevailing MRO rate in the presence of ample liquidity.

In order to smooth out the liquidity effect of the 12-month LTRO maturing on 1 July 2010, the Governing Council has decided to carry out an additional six-day fine-tuning operation with announcement, allotment and settlement on 1 July and maturity on 7 July, the latter date coinciding with the settlement day of the next MRO. The fixed rate tender procedure with full allotment will be used also in this operation, the fixed rate being the same as the prevailing MRO rate.

Furthermore, the Governing Council has also decided, in line with its decision on the 12-month LTRO of 16 December 2009, to fix the rate in the 6-month LTRO to be allotted on 31 March 2010 at the average minimum bid rate of the MROs over the life of this operation(1).

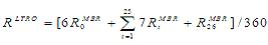

(1)Only one interest payment will be made. This interest payment will be made on the maturity date (30 September 2010) and be calculated as the allotted amount multiplied by

Here,

is the minimum bid rate of the MRO settled on 31 March 2010 and

are the minimum bid rates of the 26 subsequent MROs. The operation will have a maturity of 182 days.

Europäische Zentralbank

Generaldirektion Kommunikation

- Sonnemannstraße 20

- 60314 Frankfurt am Main, Deutschland

- +49 69 1344 7455

- media@ecb.europa.eu

Nachdruck nur mit Quellenangabe gestattet.

Ansprechpartner für Medienvertreter